Not financial advice; this article is intended for research/educational purposes only.

Footnotes are available at the end of the article.

TL;DR

Earn yield in market neutral positions

Introduction

Overlay Protocol allows users to long/short any data stream or any market without someone taking the other side of the position. One of the mechanisms that allows Overlay to do this is the basis position / funding arbitrage mechanism built into the protocol. This allows the protocol to stay within certain risk parameters and enables users to earn a yield in a low-risk manner with minimal market exposure. If this works ideally, users make yield while helping the protocol function properly and adding to the overall decentralization of the protocol.

Funding rates on Overlay

Overlay enables users to take the basis position (or the funding arbitrage) i.e. earn funding rates while taking little to no market exposure. If open interest¹ (OI) of the long side is greater than the open interest of the short side in a particular market, one can earn funding by opening a short position (or vice versa)². Such a position can earn funding while the user is hedged by taking spot exposure on the other side of the position. This is visualized below.

When OI(shorts) > OI(longs), users on Overlay get paid funding to be long; this position may be hedged by shorting the asset simultaneously.³

When OI(longs) > OI(shorts), users on Overlay get paid funding to be short; this position may be hedged by longing the asset simultaneously.⁴

These basis position and/or funding arbitrage strategies (and how to execute them on Overlay) are covered in greater detail below.

Executing the Basis Position/Funding Arbitrage on Overlay Protocol

The basis position⁵ and/or funding arbitrage may be executed on Overlay in a market neutral⁶ manner.

Discussed below are scenarios in which users could earn funding on Overlay by structuring positions in a certain manner.

1. and 2. below describe scenarios in which a user denominating their position in ETH could earn funding, while 3. and 4) describe scenarios in which a user denominating their position in OVL could earn funding. Users are able to earn funding while having positioned themselves in the asset of their choice in a hedged manner.

1. When OI(shorts) > OI(longs) for the ETH/OVL market (and the overall position is denominated in ETH)

In this scenario, funding will be paid to long positions on Overlay. To earn funding on Overlay in a market neutral manner when OI(shorts) > OI(longs) for the ETH/OVL market, one must:

-

Swap spot ETH for spot OVL

-

Deposit the OVL on Overlay to open a position

-

Long the ETH/OVL market with 1x leverage on Overlay

This strategy creates a market neutral position that will keep earning funding on Overlay as long as OI(shorts) > OI(longs). Let’s visualize this position with an example.

The example assumes that 1 ETH = 10 OVL when the position was opened, and 1 ETH is being deployed toward the position. 1 ETH is swapped for 10 OVL and 10 OVL is deposited into Overlay. Subsequently, a long of 10 OVL is opened on the ETH/OVL market.

The table below provides a summary of how the overall position would be affected in case of changes in the ETH/OVL price.

The price of ETH/OVL can go up, go down, or remain constant. In any scenario, this position will earn funding while remaining market neutral (i.e. maintaining the amount of ETH committed when the position was taken).

2. When OI(longs) > OI(shorts) for the ETH/OVL market (and the overall position is denominated in ETH)

In this scenario, funding will be paid to short positions on Overlay. To earn funding on Overlay in a market neutral manner when OI(longs) > OI(shorts) for the ETH/OVL market, one must:

-

Borrow OVL by depositing ETH as collateral on a lending protocol

-

Swap half the borrowed OVL for ETH

-

Deposit remaining OVL on Overlay to open a position

-

Short ETH/OVL with 1x leverage on Overlay

This creates a market neutral position that will keep earning funding on Overlay as long as OI(longs) > OI(shorts). We can visualize this strategy with an example.

Assumptions for the example:

-

1 ETH = 10 OVL when the position is opened

-

1 ETH is being deployed towards the position (position size is 1 ETH)

-

Loan to Value (LTV) Ratio⁷ of the lending platform for borrowing OVL is 60%, and the liquidation threshold is at 70%

-

The amount of OVL borrowed is 5 OVL, i.e. 50% of the total collateral value (1 ETH). This is to maintain a buffer from the liquidation threshold (70%) in case the value of ETH falls.

Based on the above, to execute the strategy, 1 ETH is deposited on a lending platform to borrow 5 OVL. 2.5 OVL out of the 5 OVL borrowed is swapped for 0.25 ETH, 2.5 OVL is deposited on Overlay, and a short position of 2.5 OVL is opened on the ETH/OVL market on Overlay.

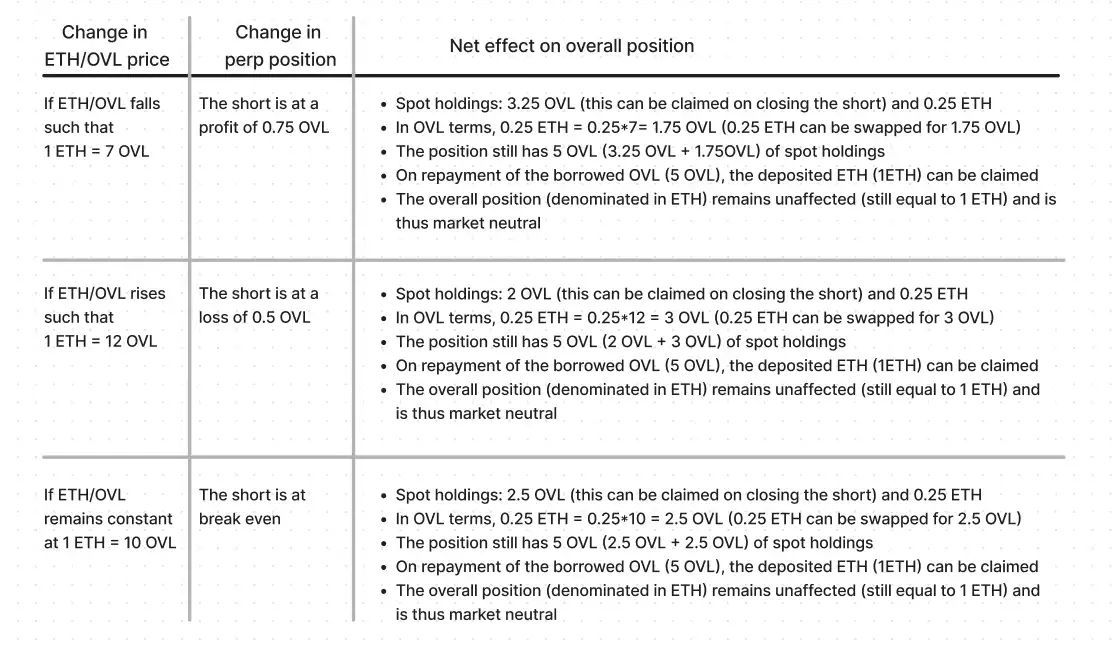

The table below provides a summary of how the overall position would be affected in case of changes in the ETH/OVL price.

The price of ETH/OVL can go up, go down, or remain constant. In any scenario, this position will earn funding while remaining market neutral (i.e. maintaining the amount of ETH committed when the position was taken).

3. When OI(shorts) > OI(longs) for the ETH/OVL market (and the position is denominated in OVL)

In this scenario, funding will be paid to long positions on Overlay. To earn funding on Overlay in a market neutral manner when OI(shorts) > OI(longs) for the ETH/OVL market, one must:

-

Borrow ETH by depositing OVL as collateral on a lending protocol

-

Swap the borrowed ETH for OVL

-

Deposit the OVL on Overlay to open a position

-

Long ETH/OVL with 1x leverage on Overlay

This creates a market neutral position that will keep earning funding on Overlay as long as OI(shorts) > OI(longs). We can visualize this strategy with an example.

Assumptions for the example:

-

1 ETH = 10 OVL when the position is opened

-

10 OVL is being deployed towards the position (position size is 10 OVL)

-

Loan to Value (LTV) Ratio of the lending platform for borrowing ETH is 60%, and the liquidation threshold is at 70%

-

The amount of ETH borrowed is 0.5 ETH, i.e. 50% of the total collateral value (10 OVL). This is to maintain a buffer from the liquidation threshold (70%) in case the value of collateral (OVL) falls.

Based on the above, to execute the strategy, 10 OVL is deposited on a lending platform to borrow 0.5 ETH. This 0.5 ETH is swapped for 5 OVL, 5 OVL is deposited into Overlay, and a long position of 5 OVL is opened on the ETH/OVL market on Overlay.

The table below provides a summary of how the overall position would be affected in case of changes in the ETH/OVL price.

The price of ETH/OVL can go up, go down, or remain constant. In any scenario, this position will earn funding while remaining market neutral (i.e. maintaining the amount of OVL committed when the position was taken).

4. When OI(longs) > OI(shorts) for the ETH/OVL market (and the overall position is denominated in OVL)

In this scenario, funding will be paid to short positions on Overlay. To earn funding on Overlay in a market neutral manner when OI(longs) > OI(shorts) for the ETH/OVL market, one must:

-

Swap half of the spot OVL for spot ETH

-

Deposit the remaining OVL on Overlay to open a position

-

Short the ETH/OVL market with 1x leverage on Overlay

This strategy creates a market neutral position that will keep earning funding on Overlay as long as OI(longs) > OI(shorts). Let’s visualize this position with an example.

The example assumes that 1 ETH = 10 OVL when the position was opened, and 10 OVL is being deployed toward the position. 5 OVL is swapped for 0.5 ETH, and the remaining 5 OVL is deposited into Overlay. Subsequently, a short of 5 OVL is opened on the ETH/OVL market. The table below provides a summary of how the overall position would be affected in case of changes in the ETH/OVL price.

The price of ETH/OVL can go up, go down, or remain constant. In any scenario, this position will earn funding while remaining market neutral (i.e. maintaining the amount of OVL committed when the position was taken).

Footnotes

[1] The asset may be shorted by i) borrowing it on a lending protocol and selling it instantly, or ii) a derivatives position on another trading platform if the fees to maintain that position is less than the fees earned on Overlay.

[2] The asset may be longed by i) spot buying the asset on a centralized or decentralized exchange, or ii) a derivatives position on another trading platform if the fees to maintain that position is less than the fees earned on Overlay.

[3] This example does not take into account ‘carry costs’, ‘funding rates’, or ‘premiums’ to be paid to hold the spot and derivative positions. Generally, to be profitable, the carry costs, in addition to the premium or funding must be less than the basis. Funding rates in crypto will be discussed in greater detail below.

[4] Typically paid every 8 hours.

[5] Overlay data streams are designed in a manner that there would ideally exist no basis between spot price and the price of the perp on Overlay. However, price of assets on both decentralized and centralized exchanges vary from exchange to exchange. So, a basis might still technically exist while executing the basis position/funding arbitrage on Overlay.

[6] The position assumes only basis risk.

[7] The LTV is defined as the ratio of the collateral and the borrowed amount. Platforms generally have a set LTV at the time of taking out a loan. After the loan is taken, if the collateral value falls and the LTV reaches the liquidation threshold, the collateral is liquidated to pay off the borrowed amount, as the loan becomes risky for the platform.