Many residents in a lively city of Aba, Abia State, face significant challenges in accessing financial services. This issues of financial services have been a daily headache for all in my community for years.

Have you ever been in that cringe-worthy situation at a restaurant where the old-school centralized system leaves you stranded? You're ready to pay, but oops, the owner doesn’t accept crypto. No biggie, right? You whip out your ATM card... declined 💔. You try a bank transfer...and, surprise, it fails too. Welcome to the Web2 payment struggle, where your money is in the bank, but apparently, you can’t access it. Frustrating doesn’t even cover it.😤

Imagine that you're at the market, shopping for all your essentials. You fill up your cart, but when it’s time to pay, you realize you don’t have any cash. No worries, a bank transfer will do...until the network decides to crash. Now you're left staring at the vendor, who’s looking at you like you’re about to pull a fast one. Awkward. You wish you could disappear.

Let’s not forget the vacation booking nightmare! You've compared all the hotels built around your community, read their reviews, and found the best deal. You’re finally ready to book...but boom! Your payment gets stuck in some financial glitch, leaving you wondering if your personal info is now just floating around in cyberspace for anyone to steal 🥹.

I can recall what happened during the election season of early 2023, when Nigeria’s current president, Bola Tinubu, was contesting, financial services collapsed due to people like Bola Tinubu controls the financial system. Point of Service (P.O.S) businesses in Aba started charging exorbitantly high fees, and nearly 75% of businesses went down due to a lack of access to cash. Despite this challenges Banking services were very low, bad and most times not available. Transportation services were similarly impacted. The struggles faced during that period were a stark reminder of how vulnerable centralized systems can leave entire communities.

Picture a vibrant marketplace filled with traders showcasing their goods, while nearby small business owners struggle with financial exclusion. For years, Aba has been hindered by the constraints of traditional banking, including high fees, limited branch availability, and slow processing times, all of which have stifled economic growth. For the everyday artisan in Aba, getting access to capital is a nightmare. Imagine a talented tailor or a mechanic who dreams of expanding their business but can’t access the needed funds. The endless paperwork, long wait times, and hidden fees not only crush their aspirations but also harm the local economy. Many people in rural areas, like Aba, rely on informal lending circles, but those are neither stable nor reliable.

For the everyday artisan in Aba, getting access to capital is a nightmare. Imagine a talented tailor or a mechanic who dreams of expanding their business but can’t access the needed funds. The endless paperwork, long wait times, and hidden fees not only crush their aspirations but also harm the local economy. Many people in rural areas, like Aba, rely on informal lending circles, but those are neither stable nor reliable.

Centralized banks often charge high fees that hit rural people the hardest. With few branches and outdated technology, most people resort to risky cash transactions which never reflect after been debited and the bank pays less attention to them. At times unnecessary charges and debit with no reference is seen and banks gives no answers to such irregular debits such as the issues faced last year when banks debited people over 15,000Naria with no reference. The system, unfortunately, is designed to prioritize profit over people, leaving communities in a cycle of poverty and limited opportunity. Despite the FinTechs such as Opay, Palmpay, Kuda bank and their kind which we thought could help us solve some of the financial issues ended up failing while some folded because of interference and manipulation by the Central Authorities. Most a times transactions gets hanged and your money never gets refund and no one to complain to because they hardly own a branch of contact.

But what if there was a way to break this cycle? A decentralized finance (DeFi) like Coinbase.

WTF is Defi? Decentralized finance (DeFi) refers to a financial ecosystem built on blockchain technology that operates without traditional intermediaries like banks or brokers. DeFi platforms allow users to engage in various financial activities, such as lending, borrowing, trading, and earning interest directly with one another through smart contracts. This system aims to enhance accessibility, reduce costs, and increase transparency in financial transactions.

DeFi has the potential to reshape how people in Aba access financial services. Base technology, for example, unlocks a world where loans, savings, and investments can happen without the need for traditional banks.

Take Coinbase Wallet, which runs on Base, as an example; residents of Aba could use the wallet for easy transactions. It would allow them to send or receive money, access loans, and make investments without worrying about the high fees imposed by traditional banks challenges.

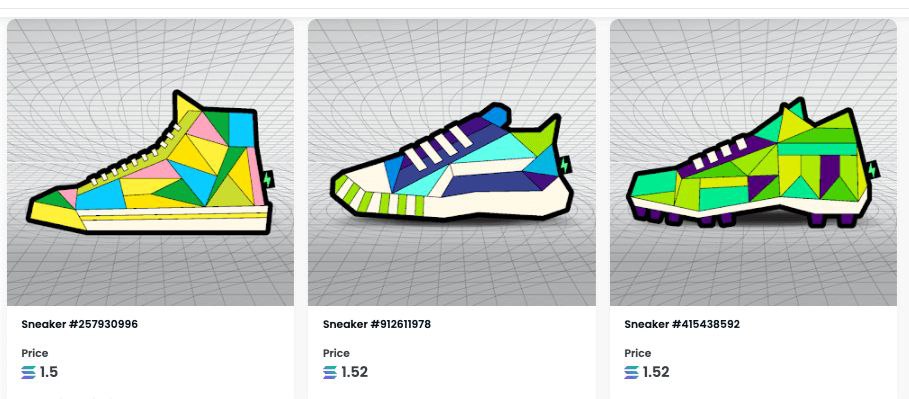

In Aba, imagine where business owners and artisans excel in creating unique, handmade products, NFTs offer an exciting opportunity to bring their crafts to the digital world. By transforming their physical creations into NFTs (Non-Fungible Tokens), these business owners can showcase their work on a global stage, opening up new revenue streams and attracting customers far beyond the borders of the city.

Let's say a local shoemaker crafts a beautifully designed pair of shoes. Traditionally, their reach is limited to the customers who physically visit their shop. But with NFTs, this shoemaker can mint a digital version of their design on a decentralized marketplace.

For Example:

The NFT could serve as proof of ownership or even as a collectible tied to the physical product. This way, the shoemaker could sell the NFT to a buyer who not only owns a unique digital representation but can also claim the physical product. This adds value and creates a sense of exclusivity around the craft.

Similarly, fashion designers, sculptors, or painters in Aba can mint NFTs representing their designs or artworks. By doing this, they can tap into global digital markets like OpenSea or Rarible, showcasing their talent to international buyers. This helps bridge the gap between local craftsmanship and the wider digital economy, allowing business owners to earn revenue not just from the sale of their physical goods but from their digital counterparts as well.

NFTs also allow these business owners to certify the authenticity of their products, building trust with their customers. By offering exclusive, limited-edition NFTs, they can create a unique connection with their buyers, further elevating the value of their work and expanding their business beyond traditional boundaries and all through a decentralized platform where they reach a global audience, bypassing intermediaries.

A decentralized application (DApp) on the Base network could connect Aba’s residents directly to lenders through smart contracts. Instead of waiting days or weeks for a loan, they could secure funds instantly with lower fees. This shift would give individuals more control over their finances, allowing them to grow their businesses and improve their lives without the bottlenecks of traditional banking.

The Power of On-Chain Transactions

On-chain transactions are at the heart of decentralized finance, providing transparency, immutability, security, and trust. Building a POS business that runs on base technology, POS business people will start using Coinbase wallet to accept and send crypto, anyone that's what to withdraw cash can have send crypto to a POS person, once he/she receives it, they will release the cash to the person. Through that, we are building the network of human which is an easy process to onboard community onchain. Each transaction is recorded and verifiable on the blockchain, ensuring users have confidence in the system. For the people of Aba, this translates into a system that works for them, not against them.

Let's still Consider a local farmer who needs immediate funding to purchase seeds. With DeFi, they could access microloans without the burdensome collateral requirements of banks. This isn't just about moving money, it's about building a culture of trust, inclusivity, and empowerment within the community.

Breaking Down Barriers

DeFi will provide savings and investment opportunities previously out of reach for many in Aba. With low transaction fees and the potential to earn interest on savings through liquidity pools, residents can start building wealth in ways that traditional banks have failed to offer.

Educational programs on blockchain like PronounsDAO and decentralized finance could become a core part of community initiatives, helping residents understand and take full advantage of these new tools. This would ensure that the people of Aba don’t just participate in this new financial revolution but lead it, driving their community toward a more inclusive and equitable future.

Conclusion: A Future Reimagined

The potential of decentralized finance in Aba is not just theoretical; it’s a tangible pathway to economic empowerment. The barriers that have long-limited access to financial services can be dismantled by leveraging Base technology and blockchain solutions. A future where financial transactions are more transparent, secure, and affordable is within reach.

It’s time for Aba to embrace decentralized finance and bring its people on-chain, into the new era of the internet. Together, we can build a future where financial services are accessible to all, transforming dreams into reality—one transaction at a time.

contributors: Godexcy | Miky_harris