Clone X and MNLTH Case Study

A Brief Introduction to RTFKT

RTFKT (pronounced “Artifact”) is a creator-led and digitized sneaker manufacturer, which uses the latest in-game engines, NFT, and blockchain to build a metaverse-focused brand. According to Benoit Pagotto, one of the co-founders, RTFKT wants to combine fashionable streetwear with the world of gaming. Creating NFTs is a great way to achieve that since they are cultural collectibles by nature. Metajackets, Decentraland wearables, and forging events all aligned with this philosophy and helped build a brand that could help inspire a new generation of creators and designers.

RTFKT released CloneX in November 2021, a new collection of Avatars in collaboration with Daz 3D, a renowned electronic art and software company, and the Japanese contemporary artist Takashi Murakami. The collection was described as a blueprint project, the most ambitious one by RTFKT, mixing everything from anime to sci-fi and streetwear, and setting the ground to an entire RTFKT ecosystem. The avatars give the owner full access to 3D files of the Clone X collectibles.

Market Performance

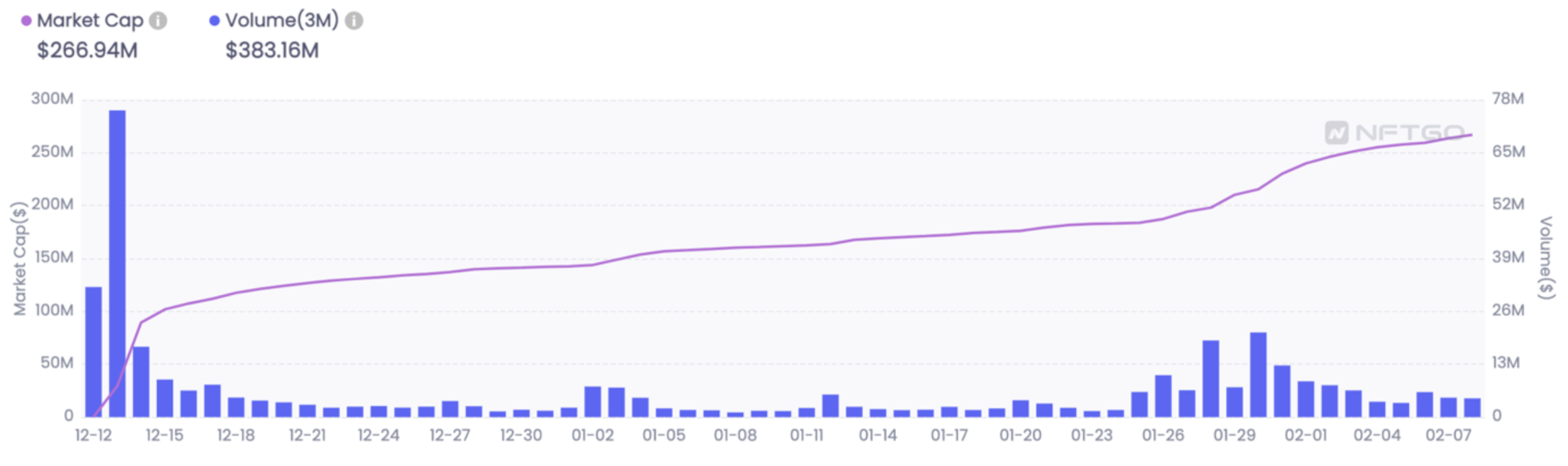

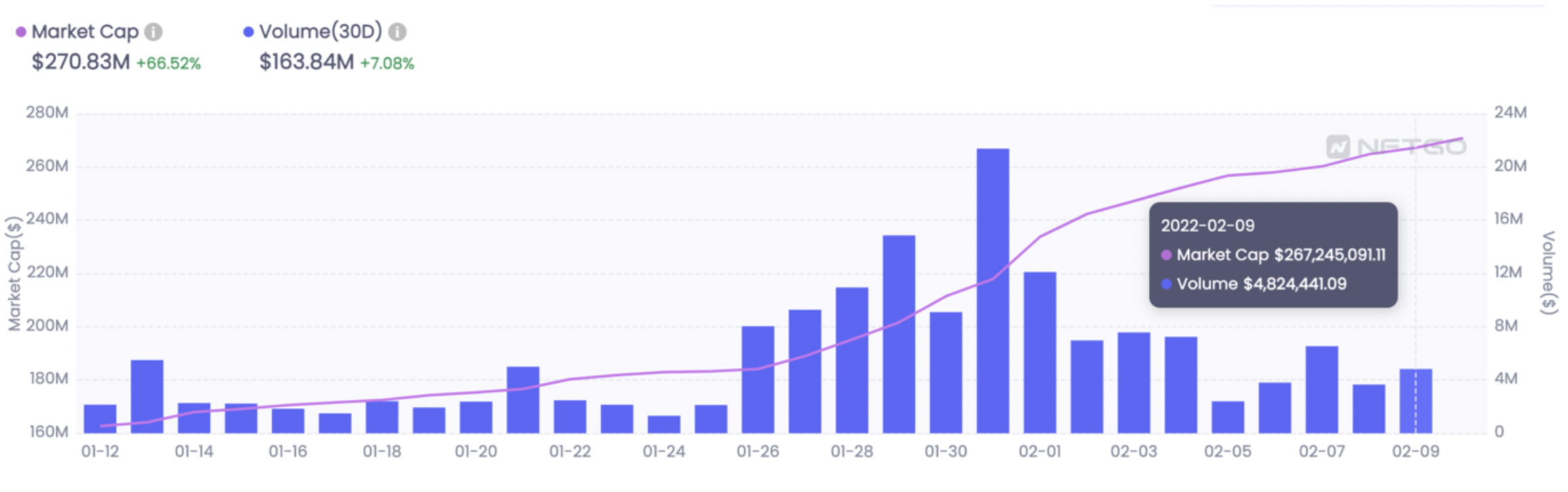

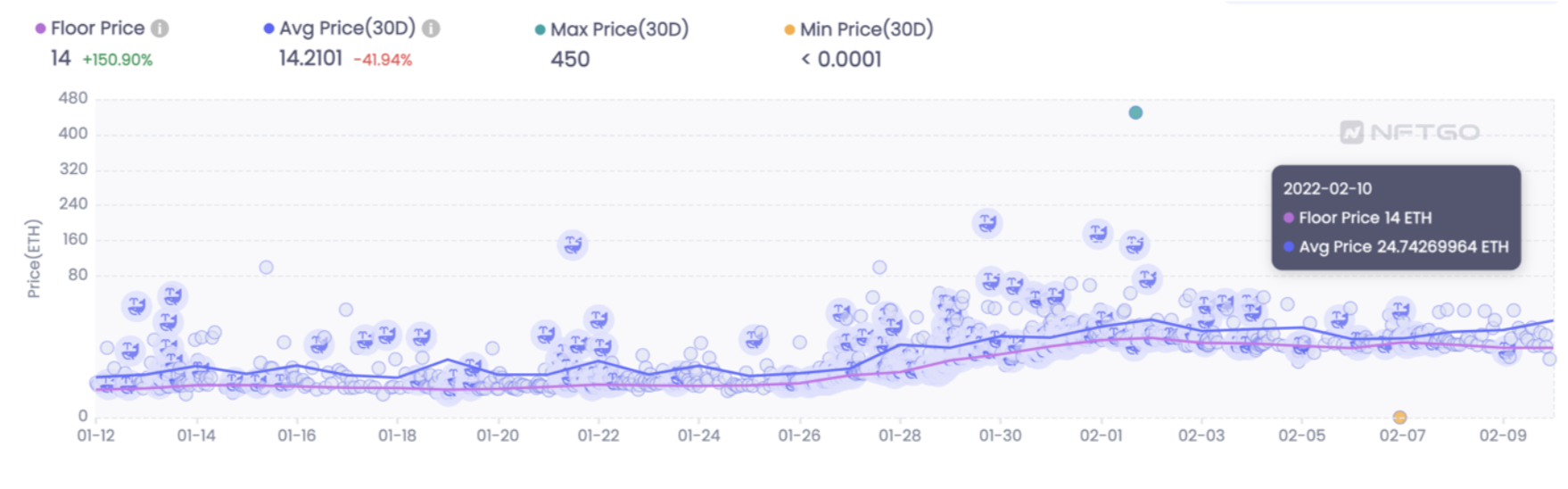

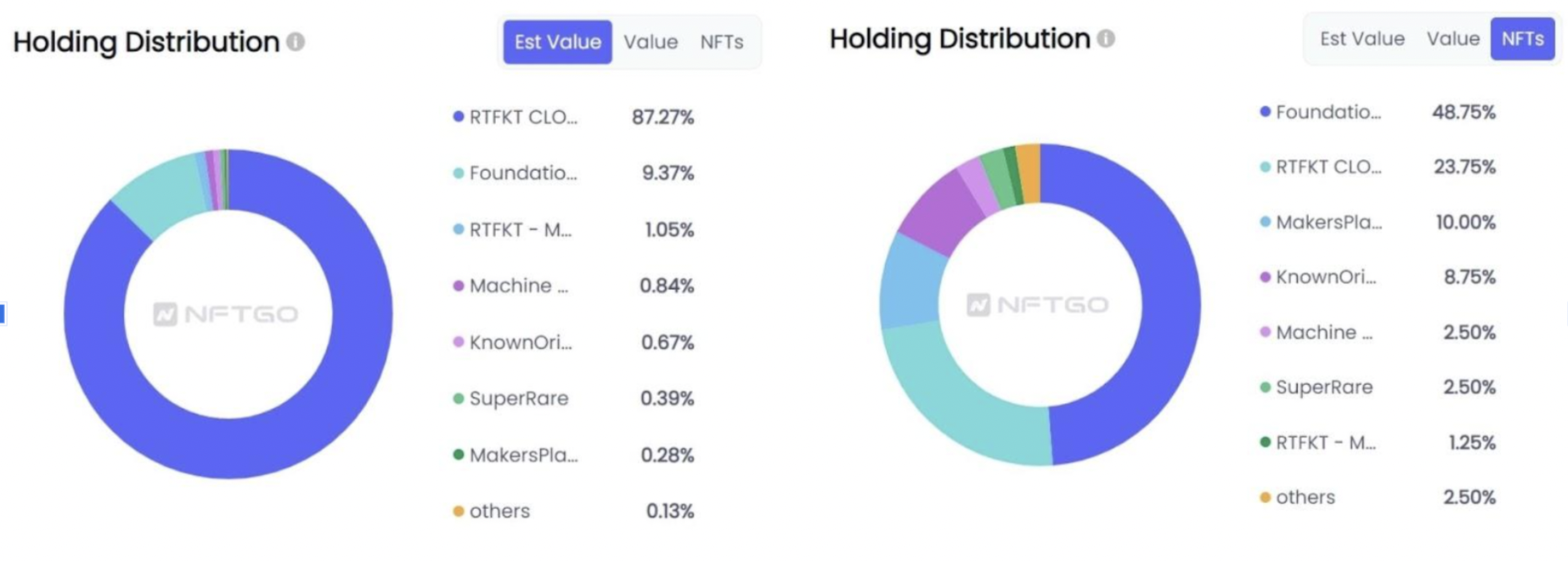

Since its initial drop, the Clone X collection has had a constant market cap growth from mid-December 2021. In late January 2022, a surge in trading volume propelled the market cap from roughly $183 million USD on January 25th to more than $250 million USD on February 4th. Along with this surge in market cap, the floor price of the Clone X collection also increased from less than 6.5 ETH to more than 15 ETH in the same period. The daily trading volume peaked on the 31st of January at more than $21 million USD, its highest since December 13th, 2021. This surge in trading volume is likely due to the project gaining more interest from media and the entrance of many whales.

Market Cap & Trade Volume (3-month/30-day)

The trade volume reached an ATH on the 13th of December, exceeding $75 million USD. The trade volume then decreased rapidly to an average of $2 million USD. The volume increased again at the end of January 2022, peaking on the 30th of January with almost $21 million USD. This pumped the market cap to new highs. As of February 2022, the market cap sits at around $270 million USD.

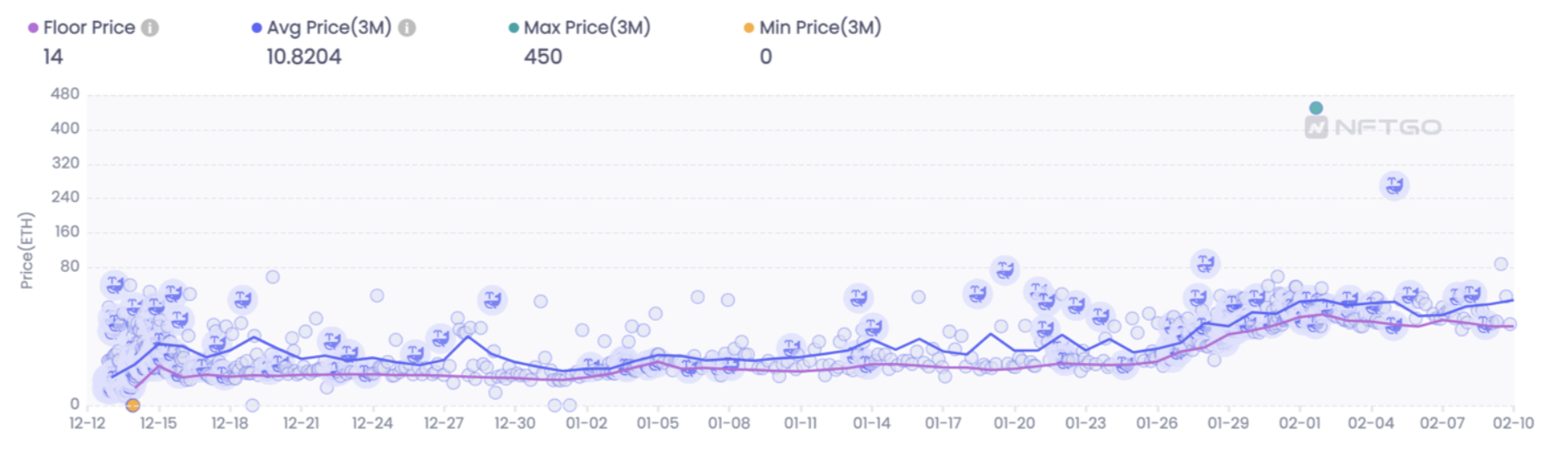

Trading Prices (3-month/30-day)

Trading prices have followed the same pattern as the market cap in the past three months. A clear increase is observed at the end of January 2022.

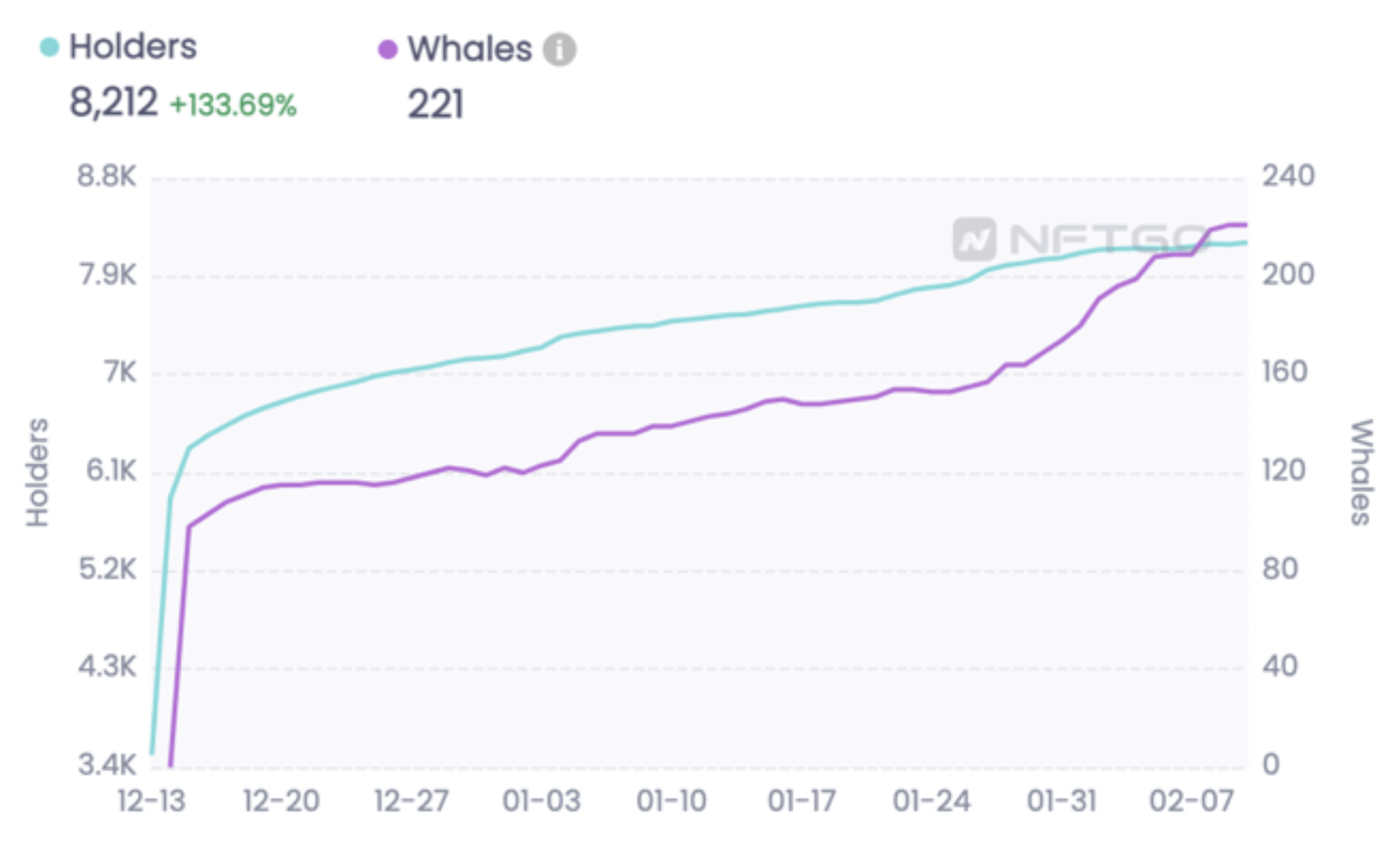

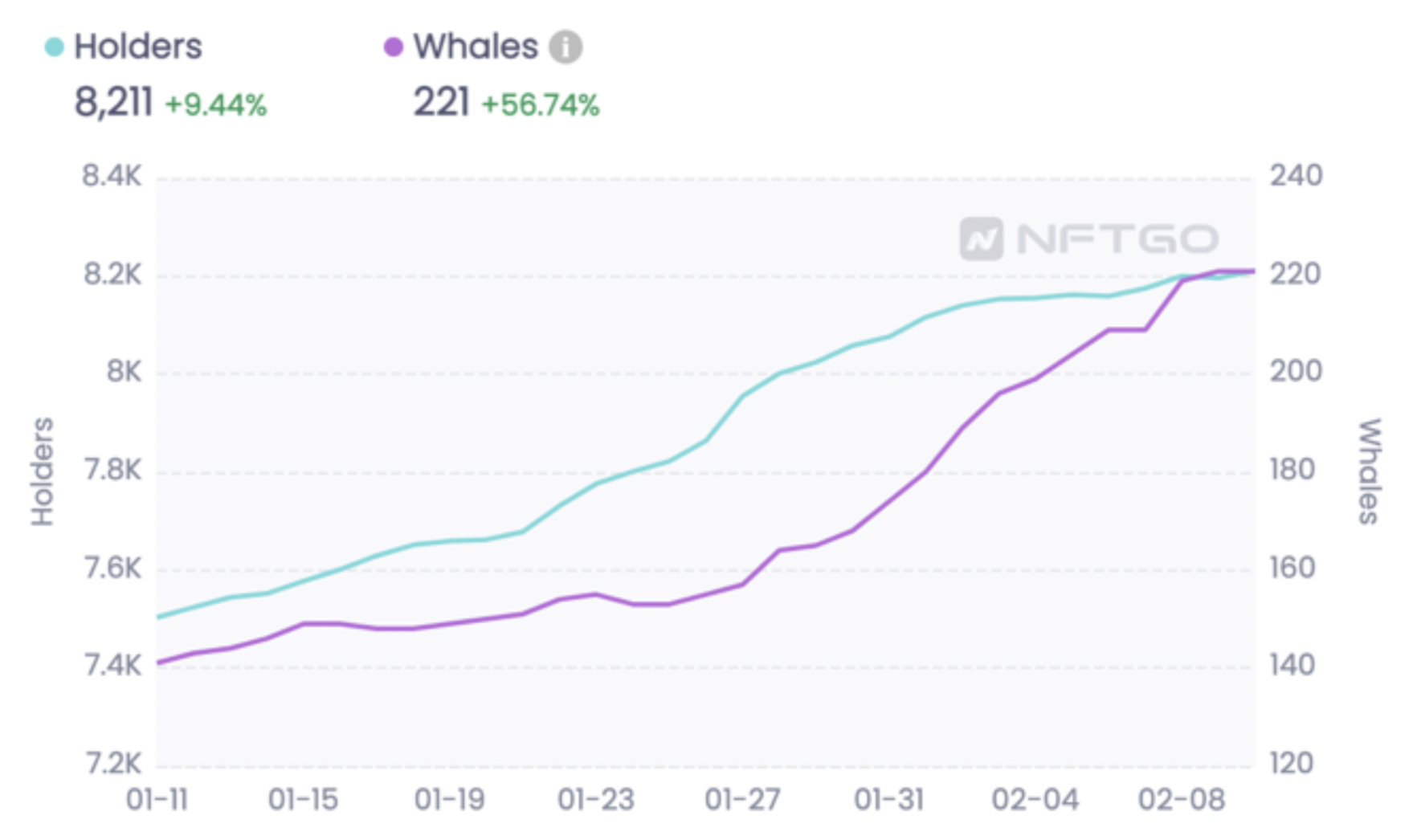

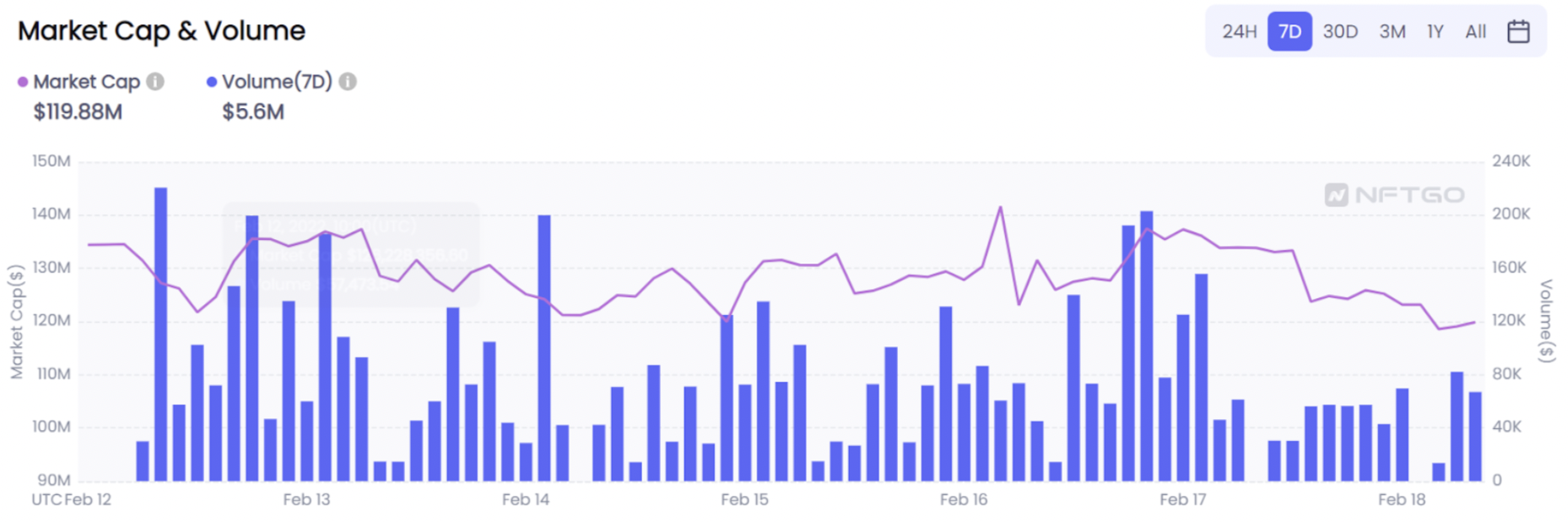

Holder Trends (3-month/30-day)

While the sharp increase in holders does not seem to be driven by whales in particular, the increase in whales in terms of percentage is much more important than the other holders.

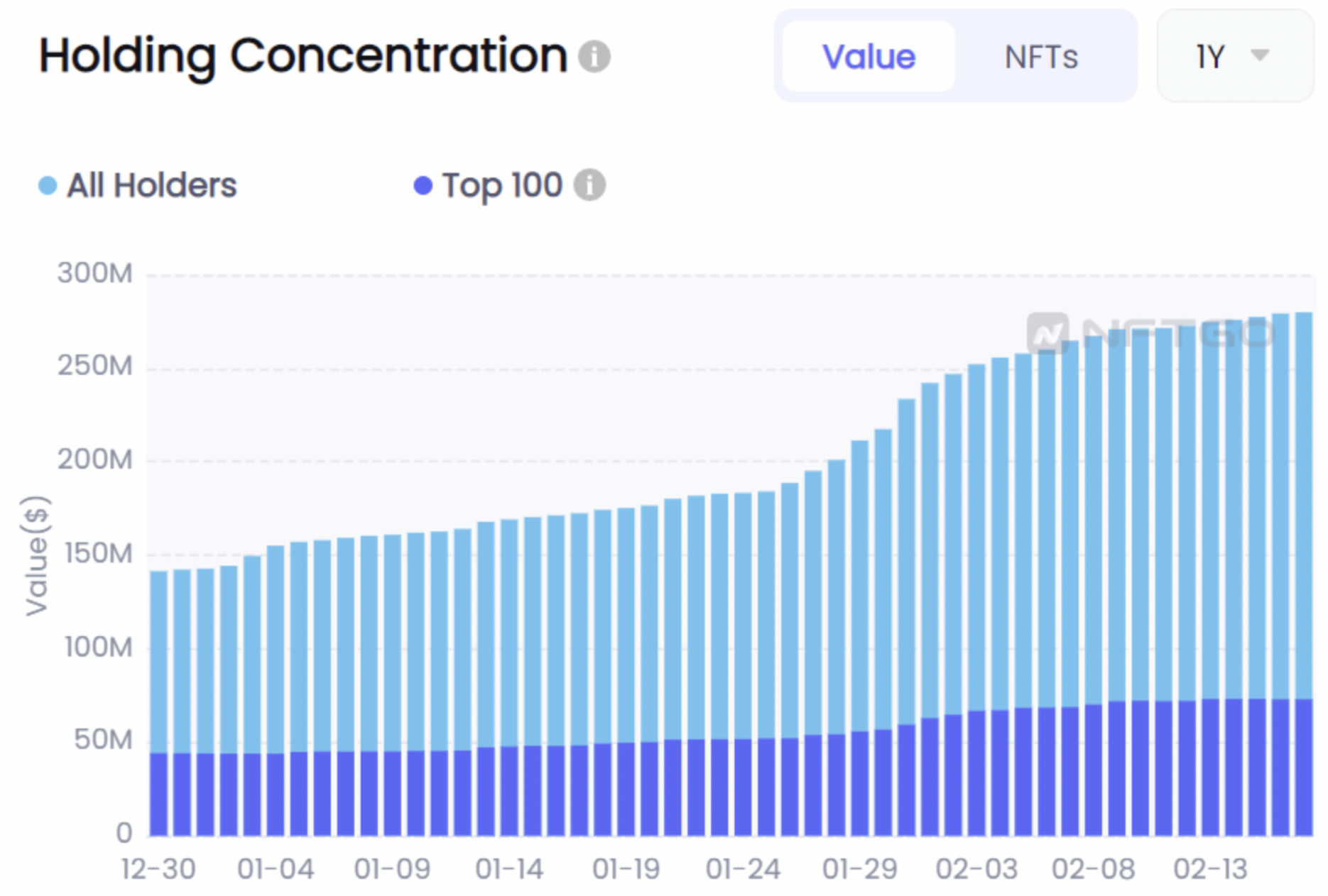

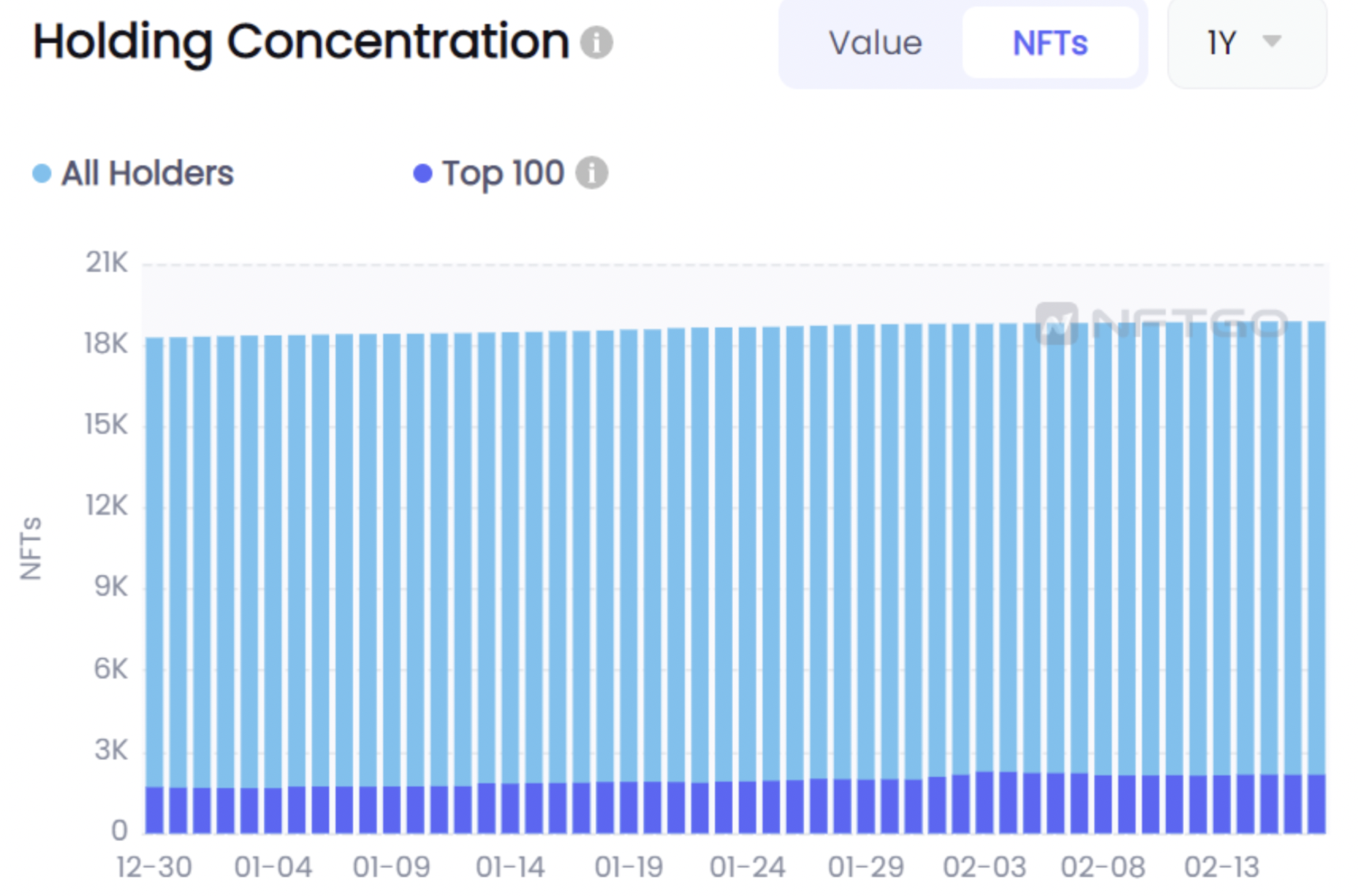

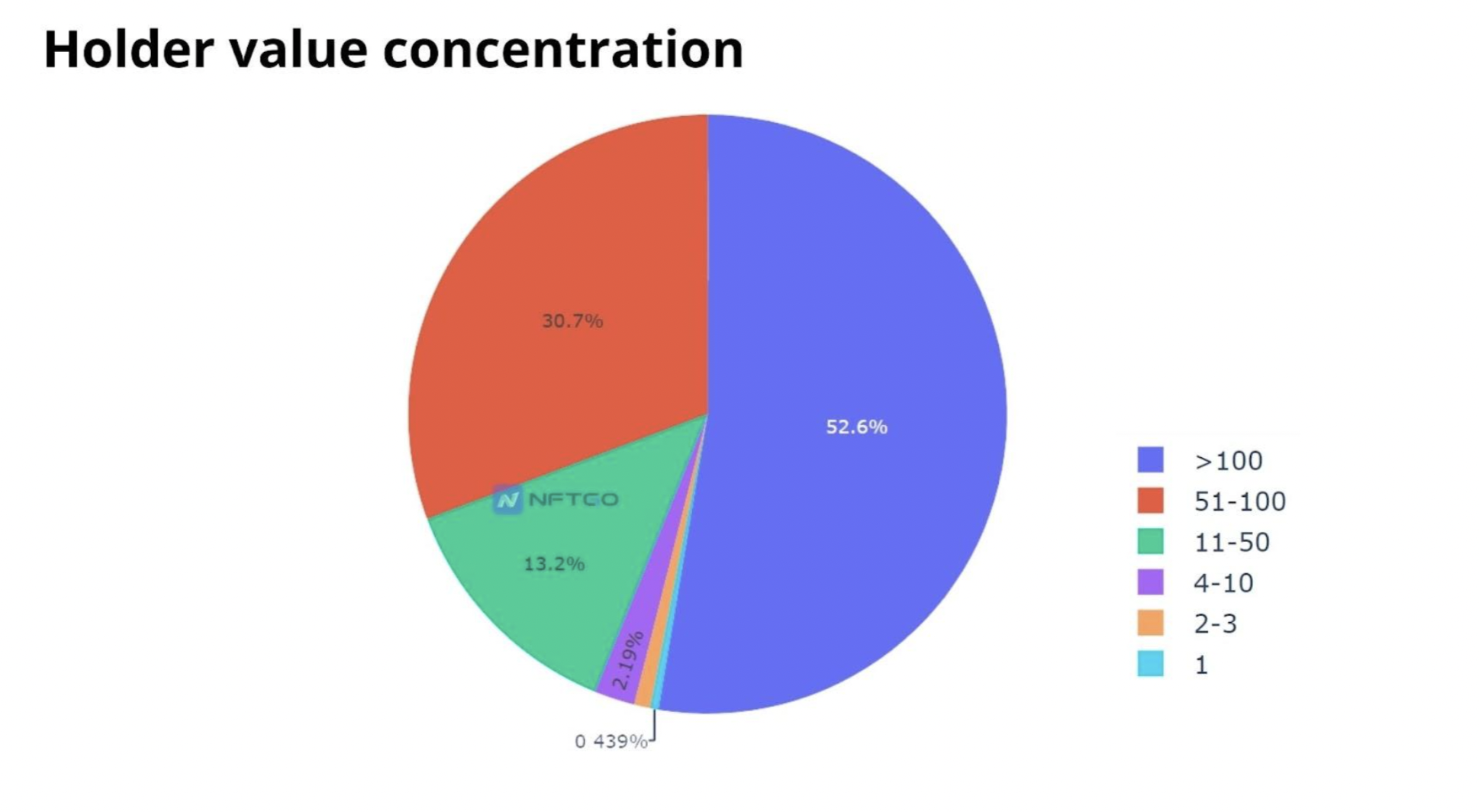

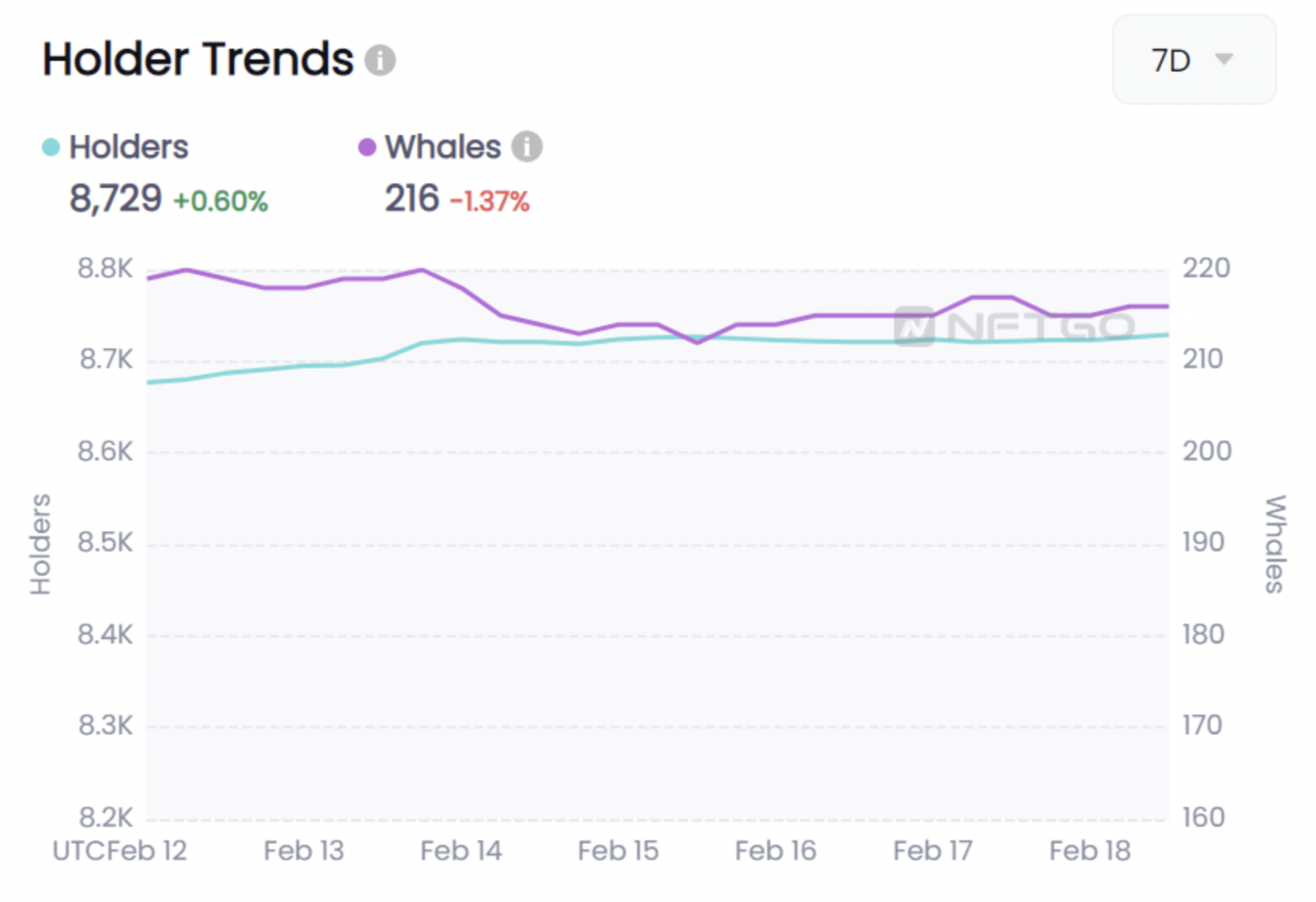

The holding concentration graph indicates the share of the holders in value and number of NFTs. Using this metric, we can see that about 30% of RTFKT’s value is held by 1% of the holders. On the other hand, the 1% group holds approximately 10% of the NFT supply.

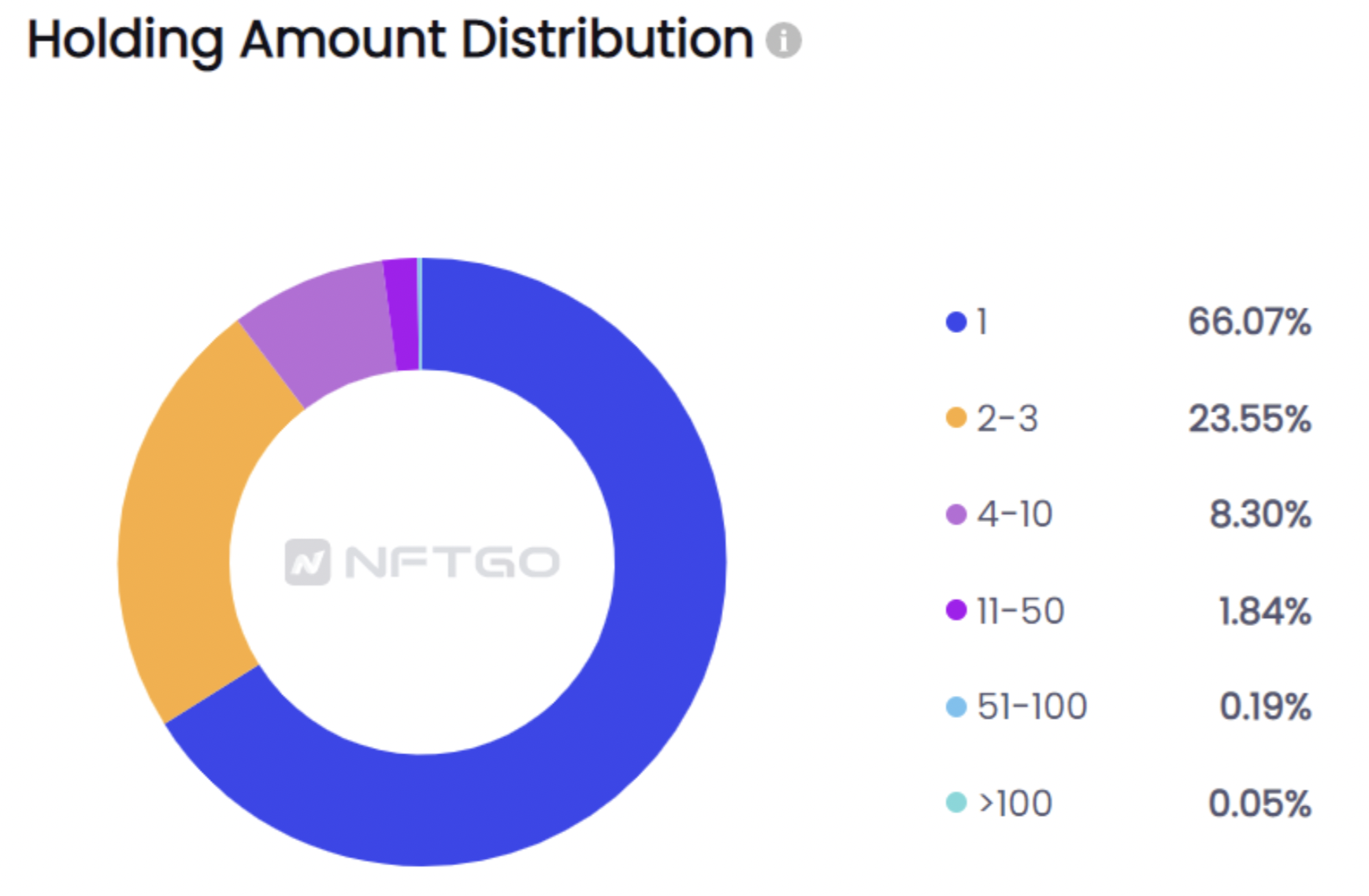

In the RTFKT collection, 8,291 holders own 20,000 NFTs in total. This is a common pattern in NFT projects. Most NFT projects are not distributed equally among participants, rather, depending on the investor’s conviction and faith in the project, they might buy more NFTs from the collection. The RTFKT avatars have utility both in the metaverse and the real world. This makes it an invaluable asset for metaverse enthusiasts. Each cell of the holding amount distribution graph displays the number of NFTs owned by each holder.

The chart above illustrates that 66% of the holders hold just one NFT. The other 34% of the holders have 2 or more NFTs. Holding more NFTs in a successful collection exponentially grows the returns of the investor’s portfolio.

The chart below shows the minimum share in value for each of the holders. One of the important observations from the two charts of holder “count” concentration and holder “value” concentration is that although the 100+ holders occupy only 0.05% of the holders, they hold over half of the collection’s value. In contrast, the highest concentration of the holders are holding only 0.43% of the total value of the collection.

Search Trends

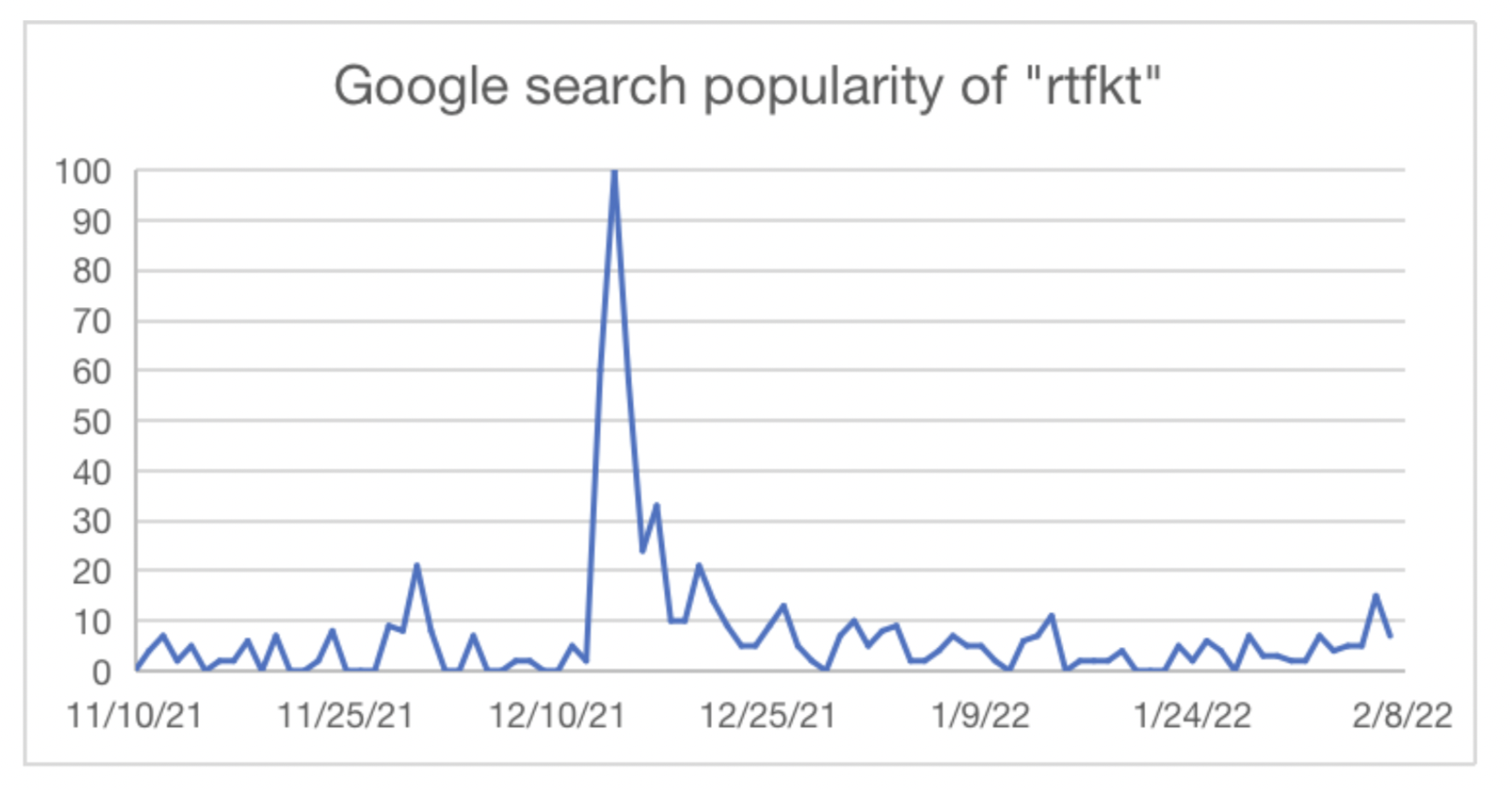

According to Google Trends, the search popularity of “RTFKT” has not seen any noticeable increase in January. This could indicate that the rapid increase in trading volume and price are not strongly related to frenzy or hype, but most people have already been following the collections.

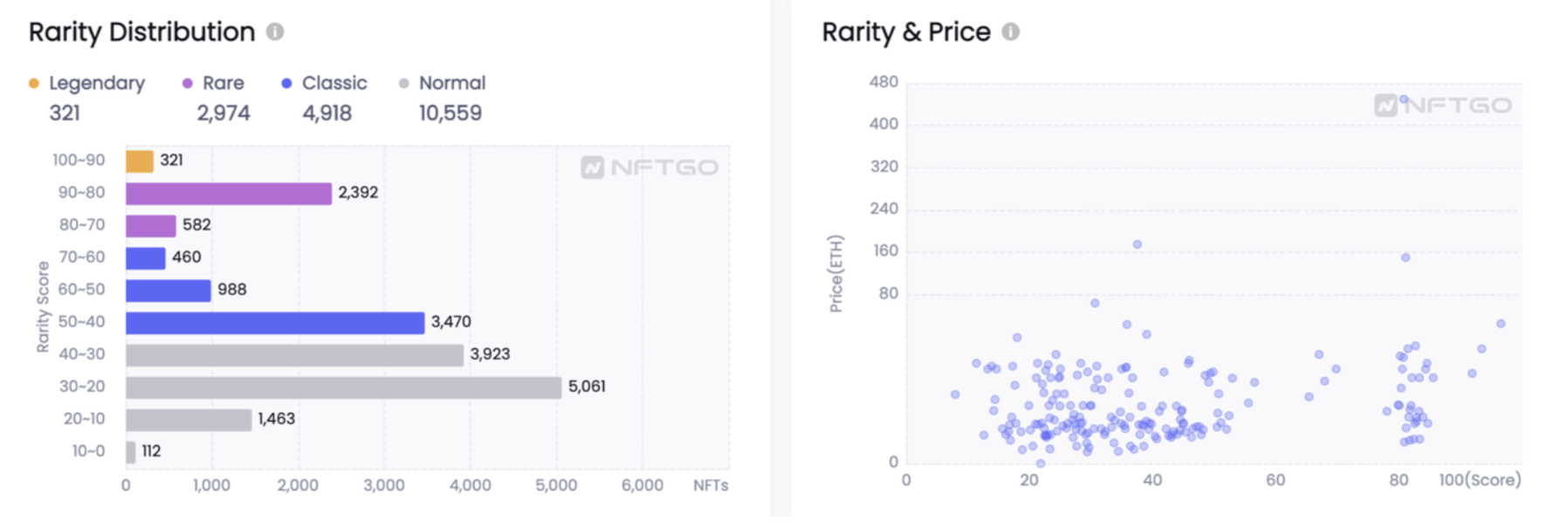

Rarity distribution and rarity/price regression

The Rarity/Price plot of the collection shows that correlation is not strong and there are other factors that have a stronger influence on price than the rarity.

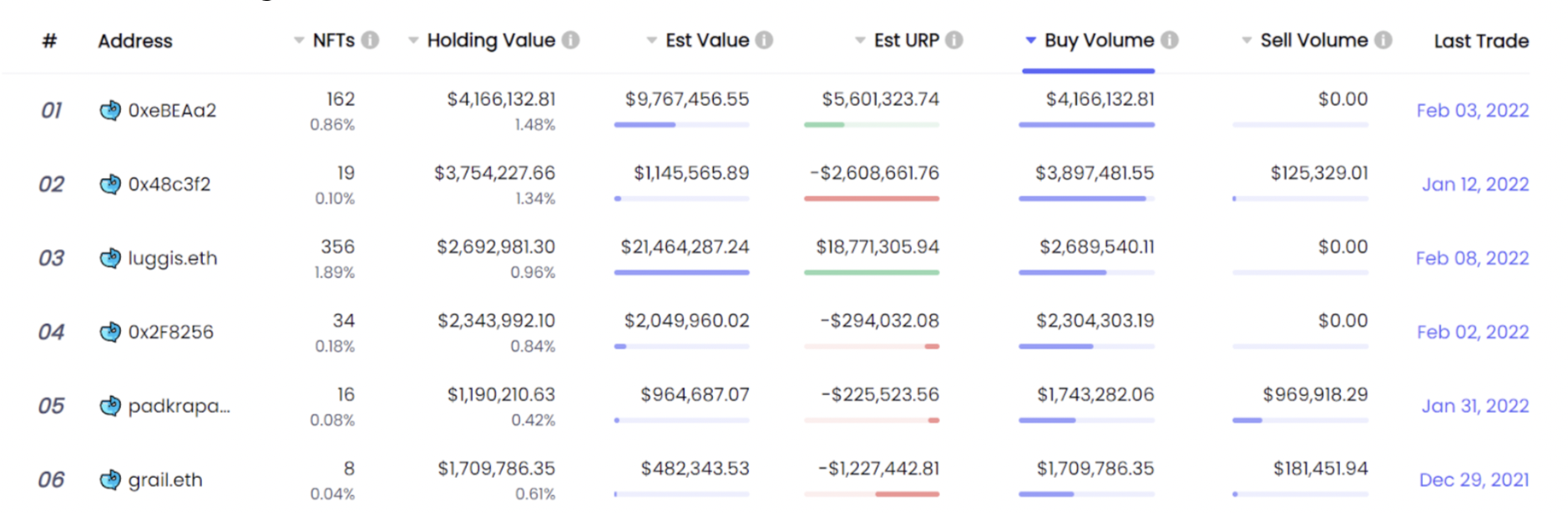

Whale talks

According to NFTGo.io, the number of whales holding CloneX NFTs increased from 153 on January 25th to more than 221 on February 9th. The entry of a large number of whales aligns well with the surge in trading volume, market cap, and floor price of the collection. In a similar fashion to other collections, whales’ activity acts as a signal for surging floor prices and trade volumes.

The Whales holding CloneX NFTs generally have a diversified portfolio with interest in both collectible and Metaverse NFTs. Whales are important actors in the market as they tend to spend much more capital to buy NFTs they have conviction in. The data from NFTGo shows that some Whales have bought millions of dollars worth of NFTs from the RTFKT collection.

For some Whales, these NFTs are invaluable assets that have made up most of their portfolio’s value. Below is an example of a Whale address. Almost all of their portfolio’s value stems from RTFKT, even though the vast majority of their NFT holdings is from Foundation.

What makes it valuable

Collections like CLONE X transform the meaning behind the metaverse from a dot-com buzz world to a real-world, decentralized digital experience. In the days that Meta announces huge investments in the metaverse and Microsoft acquires Metaverse-related companies with billion-dollar valuations, we need a decentralized and permissionless yet immersive digital experience. The founder of RTFKT Benoit Pagotto calls The Metaverse “a natural evolution of playing video games, creating friendships, memorable stories and collecting items for years”. The metaverse transition is unstoppable, but what’s left is how the new digital world will be. There are two folds to the story:

- A censorship-resistant, community-led digital experience

- A centralized experience of the digital world powered by big tech

The value of NFTs comes from the novel technology of blockchain and cryptography. In the world of NFTs, anyone with the capital can buy an NFT and there’s also a trustless way of proving ownership. This transforms the role of the NFT buyer from a “customer” to a “co-creator”. Since there are clear incentives built into the NFT ecosystem, the digital identity of the owners is tied to their NFT. With decentralized governance (ie. DAOs), this can even go further and become DAO voting power. This makes the owners an active participant in the development of the NFT collection’s brand. In the interview with Forbes, Pagotto says:

“ On a brand level, it’s [The Metaverse] also a massive shift, where your community isn’t mere ‘consumers’ anymore, but creators that are active in your ecosystem. It’s the opportunity for everyone to rethink their role, a real shift of power toward the creators. “

Planet Story in Metaverse Era

CLONE X talks about its deep relationship with Metaverse and constructs a big picture about three extraterrestrials who came from the planet Orbitar in the Draco constellation. In the narrative, these interplanetary tourists have come to accelerate our evolution towards an immaterial existence, and plan to transfer all human consciousness into advanced clone forms to create the ultimate Metaverse.

In this advanced civilization, humans no longer reside in an organic form but are instead represented by their digital CloneX avatars. This groundbreaking technology has revolutionized Homo sapiens’s ability to self-express themselves through customizable avatar identities. This development also allows Clones to travel across galaxies and expand our civilization into new galaxies and simulations. This futuristic story drives the concept behind Clone X.

Go Beyond Fashion

Being able to create fashion pieces, and characters to wear, and used as your identity in the metaverse, is a big new step for fashion brands of the future. When asked about the project’s future plans, the founder Benoit Pagotto told Forbes Magazine:

“We’re now entering into the next step with Avatars. Fashion brands in the past were purely focused on fashion items, then recently evolved into lifestyle brands, creating content, exhibitions, and movies. But we think that the Metaverse Era allows for a new way for fashion brands to create not only fashion but a full living ecosystem. ”

The collection’s north star is to combines the futuristic vision of the metaverse with the real world. Through augmented reality and state-of-the-art game engine design, RTFKT aspires to pioneer the creation of the next wave of revolutionary technologies.

Bond with Stronger Brand

On December 13th, NIKE Inc. announced the acquisition of RTFKT, aligning the two companies’ vision on leveraging innovation to merge culture and gaming. According to John Donahoe, President, and CEO of NIKE, Inc., the acquisition is a step to accelerate Nike’s digital transformation and allow the brand to serve athletes and creators that are at the intersection of sport, creativity, gaming, and culture. For Nike, this acquisition will help grow the brand’s digital footprint and capabilities to ramp up virtual wearables without needing outside help or outsourcing. For RTFKT, the acquisition will help the start-up with the funding to explore a much wider set of possibilities within the metaverse, it will also help RTFKT benefit from Nike’s strength and community-building expertise and experience.

Weeks after trademarking the use of its logos and slogans for digital wearables and launching its own virtual NIKE LAND world within the virtual game Roblox, the acquisition of RTFKT is Nike’s next step to get “metaverse-ready”, in a similar fashion as many other big brands, such as Louis Vuitton and Balenciaga, both of which have released their own video games to supplement their real-life catwalk show.

MNLTH Release

A week ago, RTFKT released a new “MNLTH” series featuring Nike and RTFKT co-branding.

The “MNLTH,” which is currently sold on OpenSea, was airdropped to current Clone X holders alongside PodX virtual spaces. RTFKT’s Clone X by Takashi Murakami is currently one of the top traded NFT collections in the world with a total transaction volume of 114,600 ETH (approximately $352 million USD) at the time of writing.

The object features a dark metallic finish with geometric patterns etched and is overlaid on the exteriors with glowing Nike and RTFKT logo cutouts on the laterals. What’s housed within the boxes is being kept a secret. “Like this post, if you’re confused,” RTFKT comments on its own announcement post.

The mysterious black box has been an effective strategy for NFT projects, this strategy spikes up speculation and excitement. The target audience for this collection is everyone inside and outside of crypto interested in Nike and The Metaverse. With Nike’s name on the NFTs, the wave of people that wanted to explore the NFT space for the first time participated in the collection’s launch. The project’s NFTs are still kept secret. This has caused volatility in market cap and volume.

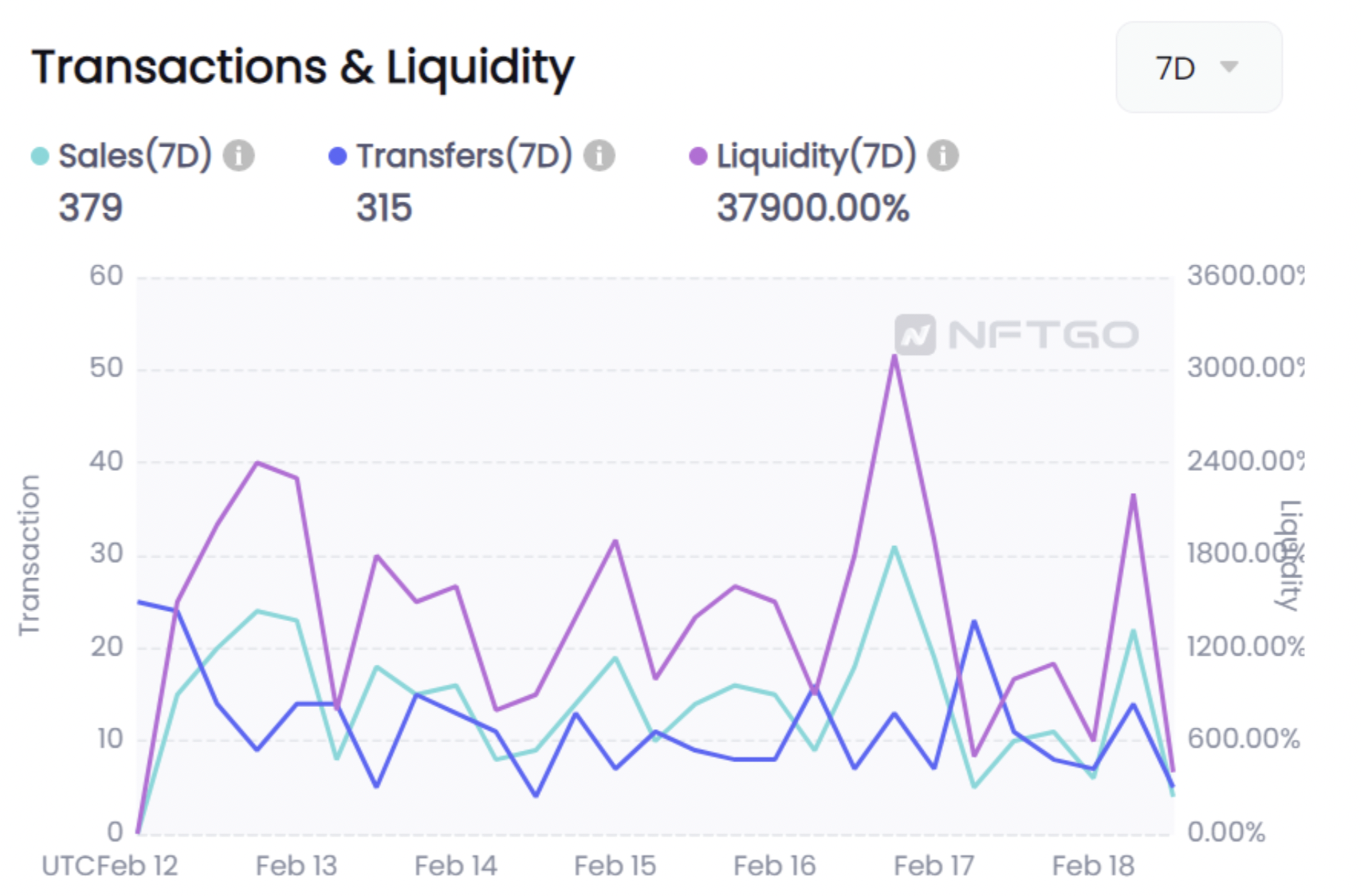

The new MNLTH NFTs are capturing attention from all sorts of demographics. The minor increases and decreases in holder trends reflect the fact that this project has yet potential to shine in holder count. The reason for this trend might be the fact that the project is still vague and as soon as the clouds leave the sky, people will start to give more attention to it.

Nevertheless, the MNLTH project is one of the highest-ranking projects in liquidity. The liquidity of a project reflects the buyers in the market. The more people are willing to exchange capital with the good, that asset is considered to be a liquid asset. On the other hand, the projects with more sellers than buyers often have negative liquidity. Since NFTs are in a rather small market compared with cryptocurrencies, liquidity is a huge factor for investors and traders.

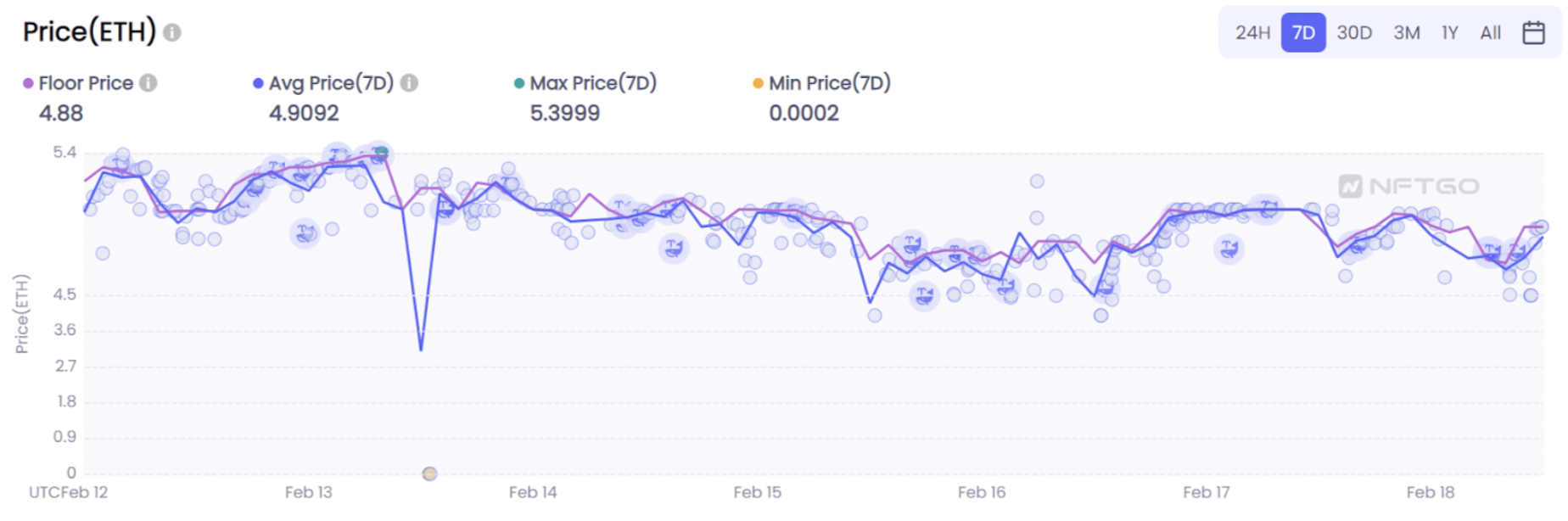

The price time series generally shows subtle ups and downs in price. The speculation for this NFT keeps the price volatile. The graph shows a couple of Whale movements as well.

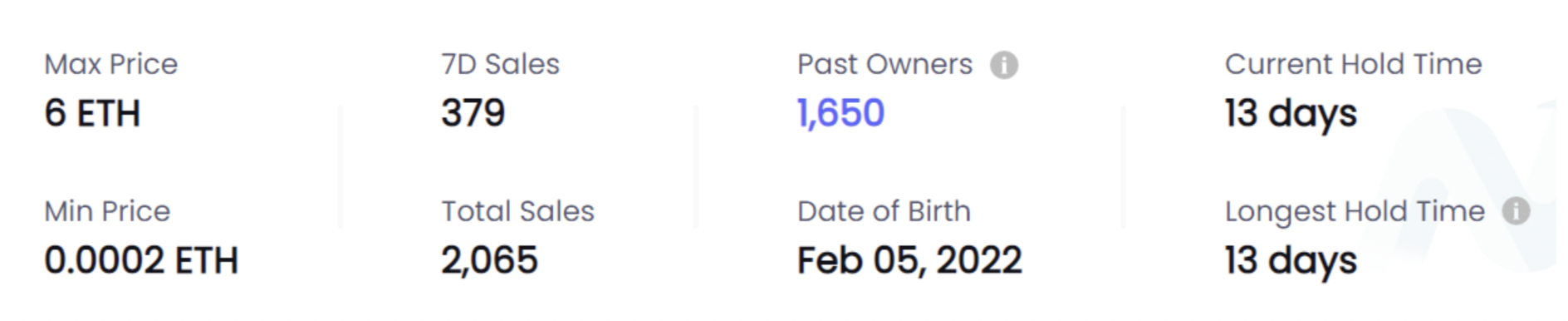

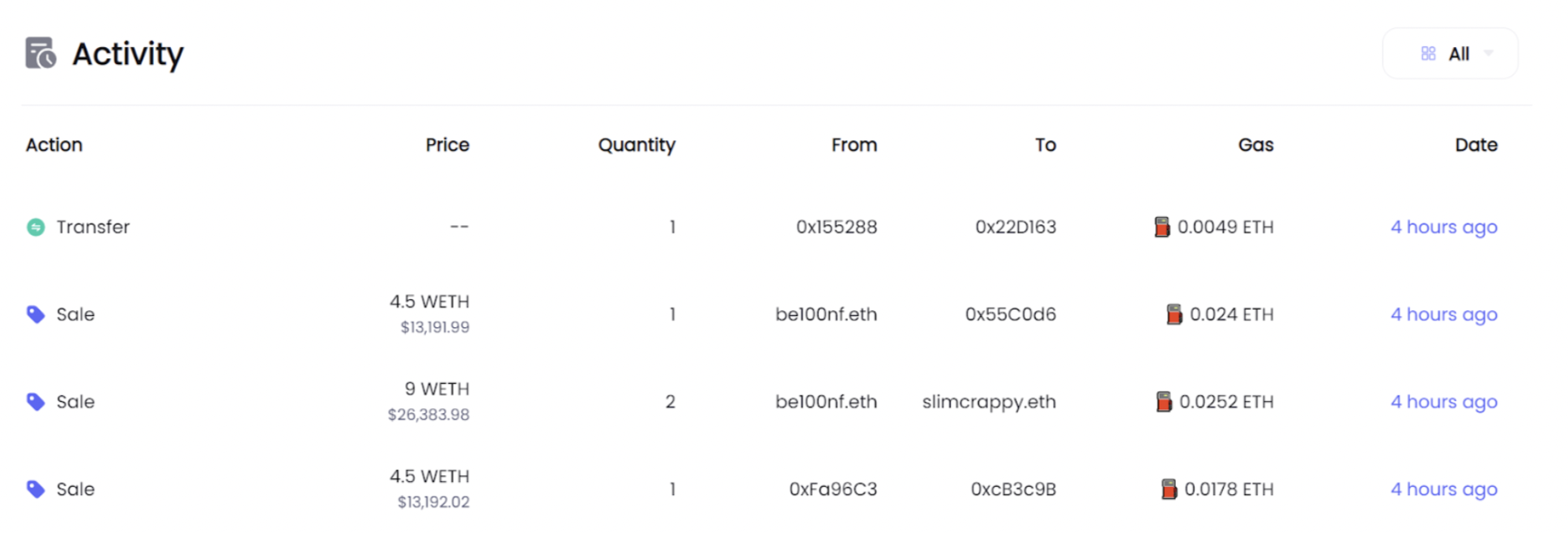

By looking into the details of this mysterious NFT, we can analyze its history in more detail. From the asset’s profile on NFTGo, we can see that the NFT has been traded 1,650 times. The highest sale price for this NFT was 6 ETH. The current holder has listed the item for 4.85 ETH on OpenSea. Looking into the on-chain activity of the NFT, we can observe that the seller had bought the NFT 13 days ago for 4.82 ETH.

Analysis of the on-chain activity of this NFT shows us that just 4 hours ago -as of this writing- one of the holders sold the NFT for less than half of the price.

Collaboration with Murakami

Takashi Murakami is a Japanese contemporary artist that has had a rich history of collaboration in multimedia art. Murakami has been designing pieces of art for over two decades, mixing Japanese and Western culture through a colorful style. In Q1 2021, Murakami partnered with Yoshihisa Hashimoto for his own NFT collection Murakami. Flowers, which was postponed to 2022, for “re-examination of the sales for better understanding of NFT”. The collection by Murakami is to this date highly awaited by NFT enthusiasts.

The collection is Murakami’s signature art. The flowers consist of pixelated digital art with different rarity and traits such as different background images.

Dutch Auction Mode

20,000 avatars were available for the drop, split between presale and a public sale. The CloneX public sale took the form of a dutch auction, where the price started at 3 ETH, decreasing by 0.1 ETH every 30 minutes to a minimum of 1 ETH. This is to avoid gas war peaks and allow NFTs to reflect the value defined by the community, according to Benoit Pagotto.

More Players are Coming In

In November 2021, Nike created NIKELAND, a new place on Roblox for Nike fans to connect, create, share experiences, and compete. This virtual world has the backdrop of its world headquarters, building on its goal to “turn sport and play into a lifestyle”. NIKELAND will allow users to develop interactive custom-made games, dress up characters using a digital showroom.

This is not the first time a brand partners up with Roblox to create a virtual space for its community.

In September 2021, the skateboarding show giant Vans announced their own virtual world on Roblox called Vans World, where players can skate in various environments with customizable apparel.

Earlier in August, Gucci opened its Gucci Garden space on Roblox for two weeks, where digital collectible Gucci accessories could be acquired. Items were hidden in virtual Gucci Garden, in a similar fashion as real-world flagship exhibitions from Gucci. The space has now closed, and 4.5 million items were acquired, sometimes for free, by the users.

Unlike Nike and Vans, the sportswear brand ADIDAS took a very different approach to getting “metaverse-ready”. The brand announced in November it will invite Adidas CONFIRMED members on the POAP platform for distributing limited collectible digital badges.

In January 2022, Nike brought the NIKELAND experience to its New York City store on Fifth Avenue, featuring visual elements and augmented reality features through Snapchat Lenses for interactive games.

Conclusion

The possible implications of an on-chain Metaverse brand include building the on-chain Metaverse infrastructure. Brands like RTFKT are pioneering the transformation of the digital economy. The fashion industry is hundreds of years old and projects like Clone X are introducing new and disruptive business models.

The Metaverse NFT space is leveraging cutting-edge technology to bring blockchain to augmented reality. With the advancements in blockchain scalability and the development of more powerful game engines, the Metaverse can build an immersive digital experience.

The path for RTFKT is stated by the creators as:

“Human development in consciousness has accelerated faster than anticipated. We are here to accelerate our digital future now.”

If you want to know more...

What is a Dutch auction?

Dutch auctions have been extremely popular for NFT public sales in the past year. Not only has it allowed certain NFT collections to reach mind-blowing prices but has also helped build a certain hype around others. One could however wonder why the Dutch auction method is so popular compared to a more traditional English auction method.

The Dutch auction is an auction in which the auctioneer begins with a high asking price and decreases gradually until some participant accepts the price or reaches a predetermined reserve price.

A more traditional English auction, on the other hand, has an ascending price format, where the auctioneer opens the bidding at a floor price and collectors outbid with higher prices until there is no counterbidding.

As such, for a Dutch auction, the participating collectors are informed ahead of time and have the chance to bid prior to the event. The auctioneer can then consider all bids before setting the ceiling price of the auctioned item. Once the auction starts at the ceiling price, there is a gradual decrease in price at a fixed pace.

Advantage of Dutch Auctions

A Dutch auction allows sellers to sell collections very fast while encouraging smaller investors to participate. As such, proceeds can be directed to the developers or artists rather than pay high gas fees for the process.

Gas wars remain the primary reason for auctioneers to prefer Dutch auctions. Gas wars refer to spikes in blockchain gas fees that occur when a very high volume of transactions takes place at the same time on a low transaction throughput blockchain (such as Ethereum blockchain).

During a public sale on the Ethereum network, high transaction fees are required to add new blocks to the blockchain. This results in the miners receiving most of the price paid by buyers. Gas fees can easily exceed the NFT price considering the low floor price of certain collections. A Dutch auction rebalances the sales flow as people are less in a hurry to purchase at launch, the excess minting fee is redirected from miners to the artists. Collectors are willing to buy above the asking price to avoid excessive gas fees and to make sure the collection is not sold out.

An example of a Dutch auction for NFTs is Fragments of an Infinite Field by Monica Rizzoli, where a collection of 1000 pieces was auctioned with a ceiling price of 10 ETH, decreasing every 5 minutes (see graph below for pricing tiers) until the collection sells out. Most of the NFTs sold between 2 and 3 ETH, with an average sale price of 2.4145 ETH.

Overall, the Dutch auction method aligns well with the general promise of NFTs to redistribute wealth and by reducing gas fees, ensures that creators are rewarded fully for their works. As of now, Dutch auctions on the Ethereum network are a preferred way to conduct a public sale but the emergence of new blockchains like Polygon, which offers very cheap minting services, is an alternative method that is gaining more and more popularity and could very well become mainstream in the near future.