When FTX and Alameda collapsed, many worried about the fate of the Solana blockchain and how the event might impact the DeFi ecosystem, and indeed the general mayhem that ensued during that week pushed everything to the limit.

One of such cases is Marinade Finance which saw its instant unstake pool drained during the week of November 08-14, with any new liquidity being immediately sucked back out over the course of a few days. While this didn’t put the protocol itself at risk, it did offer an extreme case study of how their own liquidity pool behaves in periods of stress and high demand.

In this report we will look at how the instant unstake pool of Marinade Finance got drained and how the current pool parameters compare to the rest of the market.

All of the staked SOL can be redeemed from Marinade by burning mSOL and waiting for one or more epochs to end depending on the unstake volume. For those who can’t (or won’t) wait that long, they can opt to instantly unstake, which in practical terms is simply a swap of mSOL to SOL. Marinade Finance has its own liquidity pool to enable instant unstaking, but as with any pool, swapping assets comes at a cost.

The pool parameters are set to charge a flat fee of 0.03% while the SOL liquidity is above a current liquidity target of 100k. When liquidity drops below that, the fee will linearly increase to a maximum fee of 3%. More info on pool mechanics in the docs.

The counterparty to Marinade’s pool in this report will be made up of all the other mSOL-SOL pools aggregated from the swap transactions over the same period.

Assuming that the Marinade pool uses the true value of mSOL based on the accrued staking rewards of the underlying staked SOL, that will be the price used as a reference to calculate unstake premiums on both the Marinade pool and all others.

All of the data can be further inspected and interacted with using the live dashboard:

☝️ The dashboard can be updated on-demand by pressing the refresh button 🔄 in the top right corner of the page.

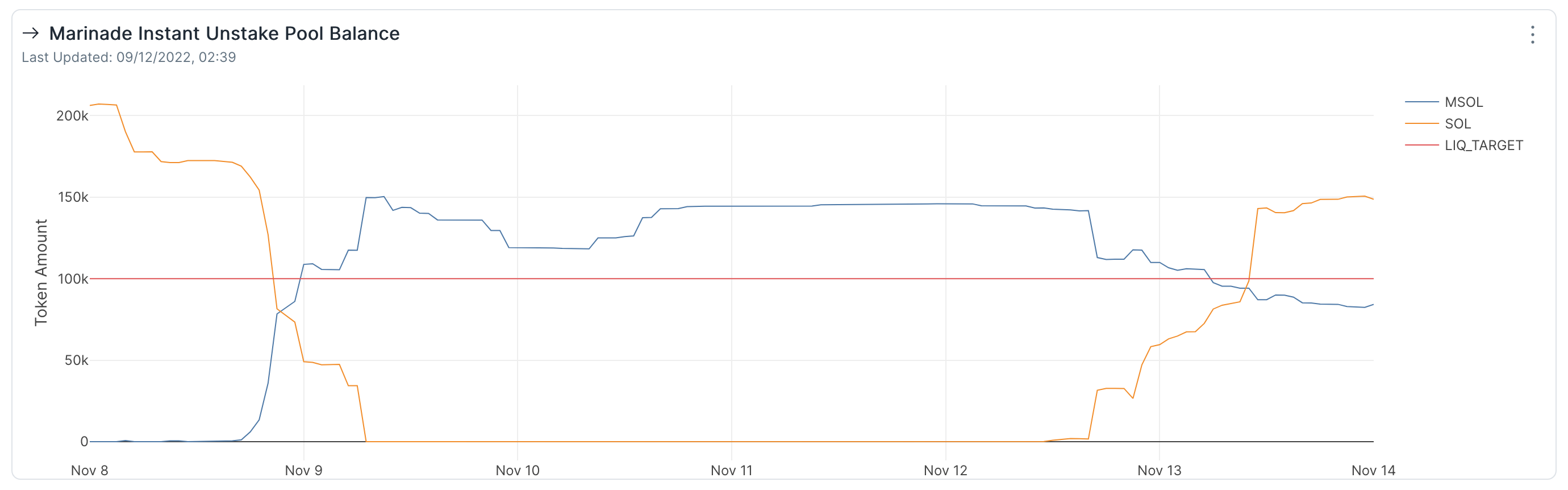

I. Pool Liquidity Balance

Because the pool parameters take a more unusual approach by placing a hard cap at 3%, it can end up in a situation where it can be depleted at much lower costs than alternative pools, making it difficult to be replenished during periods of high demand.

When this happened right after the FTX and Alameda collapsed, the Marinade pool quickly lost most of its SOL liquidity and was left at virtually 0 for several days.

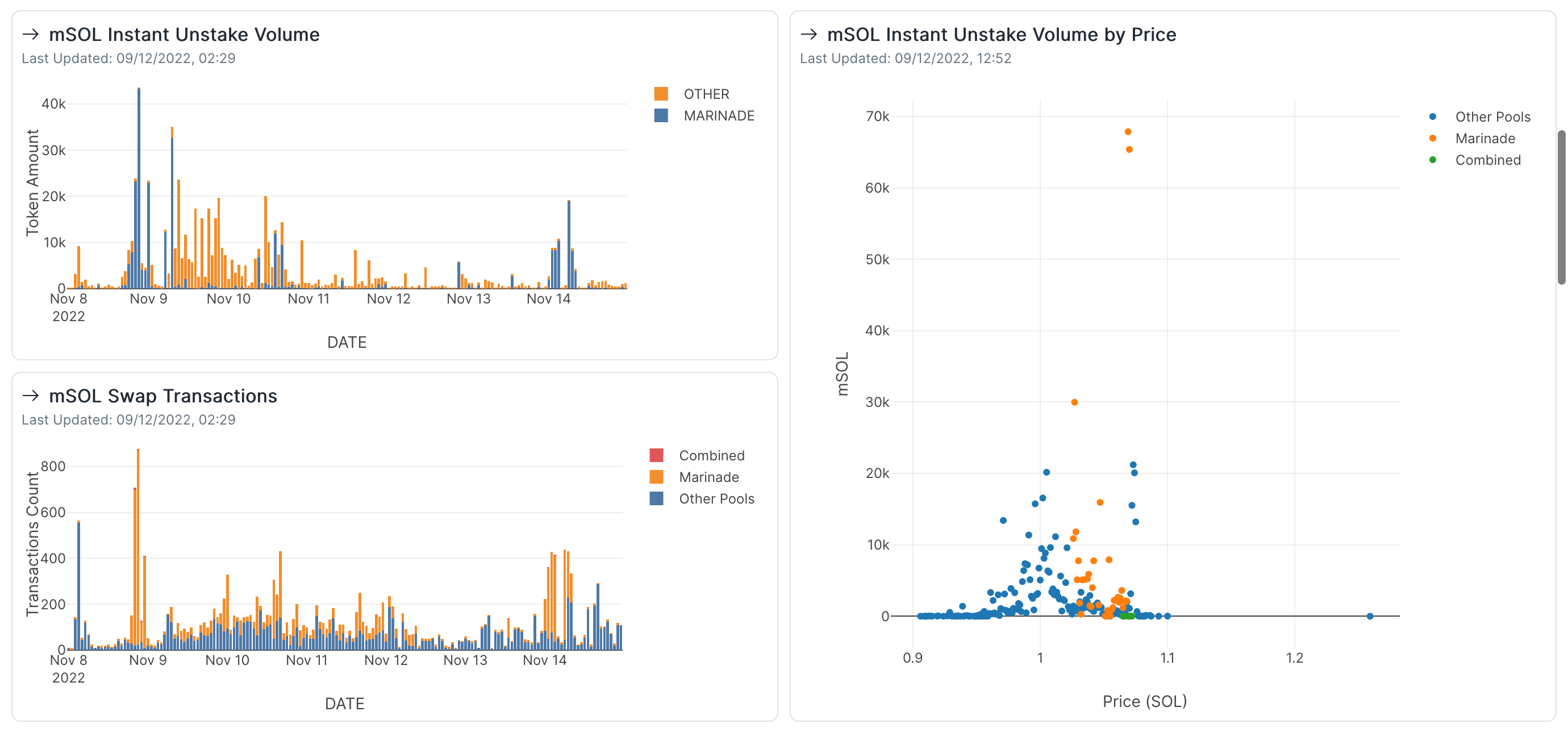

We can see that right before being emptied, most of the unstake volume was coming through the Marinade pool, allowing it to capture swap fees that are split between liquidity providers and the Treasury.

But just because Marinade didn’t have any more liquidity to service users, it does not mean trades did not continue elsewhere. Over the following two days, on November 9 and 10, we can see high unstaking that has no other option but to use the other liquidity pools that offer in many cases a much lower price.

II. Liquidity Crunch

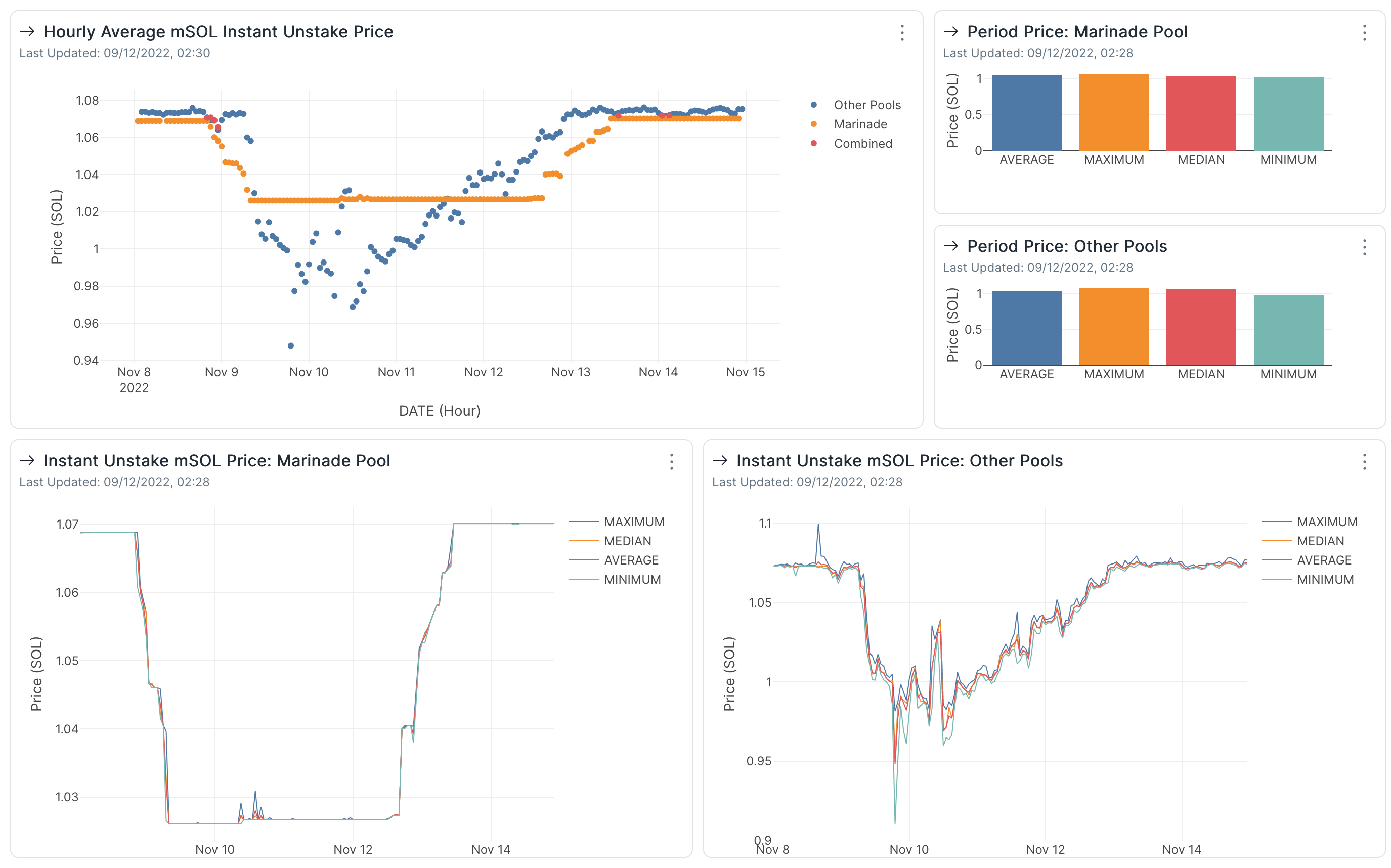

Below we can see how the pool parameters kick into action as liquidity sharply decreases. The liquidity crunch is visibly present in the other available pools as well and we see a price action similar in size and timing. As a result, the price of mSOL drops in comparison to SOL for those wanting to instantly unstake and users have to effectively pay a premium to do so.

For the Marinade pool, it is a straight journey to the bottom set by the maximum fee, where for the most part it remains until Nov 12 when new liquidity can start to build up in the pool. Up until that point, the much more attractive price in comparison to the rest of the market leads to every drop of liquidity to be quickly gobbled up the moment it got added.

But while this seems like a very dramatic event, on the weekly scale it did not have have a strong impact in the average prices due to the significantly lower volumes traded during that period.

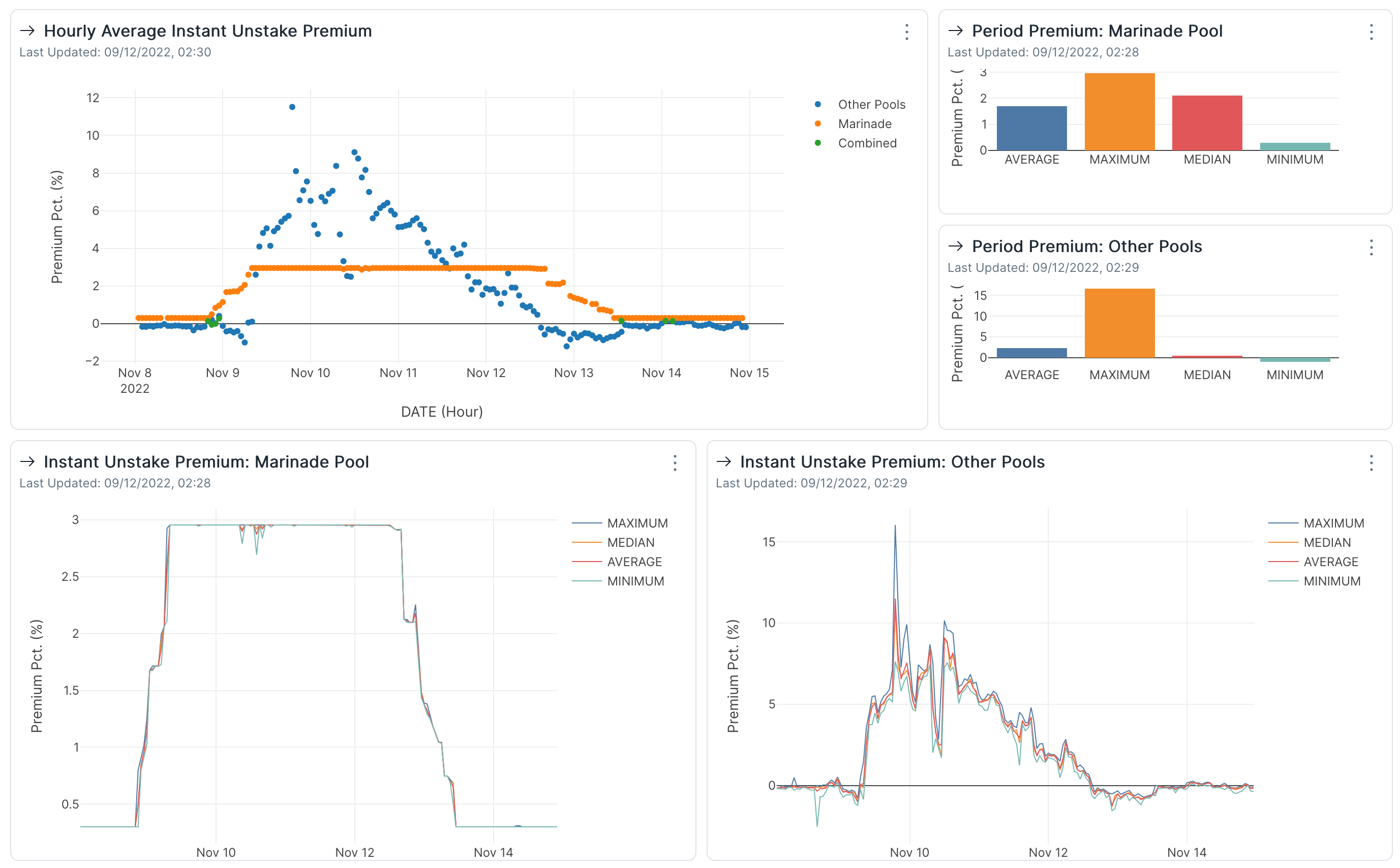

The price change induced by the dwindling liquidity, while the underlying value remains unchanged, can be translated as a premium paid by those who want to immediately trade mSOL to SOL.

While Marinade has that premium capped at 3%, we see the market comfortably going much higher and paying double. In extreme cases, the premium goes as high as 16% on a trade and around 12% as an hourly average.

Interestingly, between November 12 and 13, liquidity providers earn less on the other pools, yet liquidity is slow to return back to Marinade, where the maximum fee is maintained for almost a day longer.

Conclusion

Undoubtedly the events highlighted how the Marinade owned liquidity pool for instant unstaking can be depleted and leave one of the main value propositions of the protocol in the hands of the open market, all the while missing out on additional fees for the Treasury.

Considering these events, Marinade Governance proposed and successfully passed a proposal to adjust the parameters of their pool. Following the implementation of the proposal, the liquidity target will be set at 150k and the maximum fee increased to 9%.

This change is expected to make the pool more reactive and resistant in times of great demand, as well as more attractive for liquidity providers. At the same time however, this increases the burden of maintaining a positive loop of sufficient liquidity to attract users and sufficient trading activity to make liquidity stay.