Although anyone can quickly be onboarded to Optimism using a CEX or a credit card, the main road to the Ethereum scaling solution is over a bridge. After all, the reason for it to exists is for Mainnet users to access a faster and less expensive network while maintaining a familiar experience and therefore their main audience are people already on the blockchain. But once they get to Optimism, where do they go?

In this report we’re having a look at the first destination of users crossing over the bridge from Ethereum to Optimism and track how that has changed over time.

There are many bridges now that can be used to make the journey, but we will only include 4 of the most active: the Optimism native bridge, Hop, Stargate and the Quix NFT bridge. The first destination of users is determined by the first transaction executed by the same user following their successful bridge from the Ethereum Mainnet.

The primary time frame used for the analysis is 1 month wide, from the end of September to the end of October using a daily granularity. These two parameters can be adjusted in the dashboard using the month and date_trunc fields at the top of the page.

All of the visualizations and tables, as well as the underlying data and queries can be further explored and interacted with in the live dashboard:

☝️ The dashboard can be updated on-demand by pressing the refresh button 🔄 in the top right corner of the page.

I. Bridge Inflow to Optimism

Before we can dive into the destination of users, we should first have a quick look at what the bridging activity looks like.

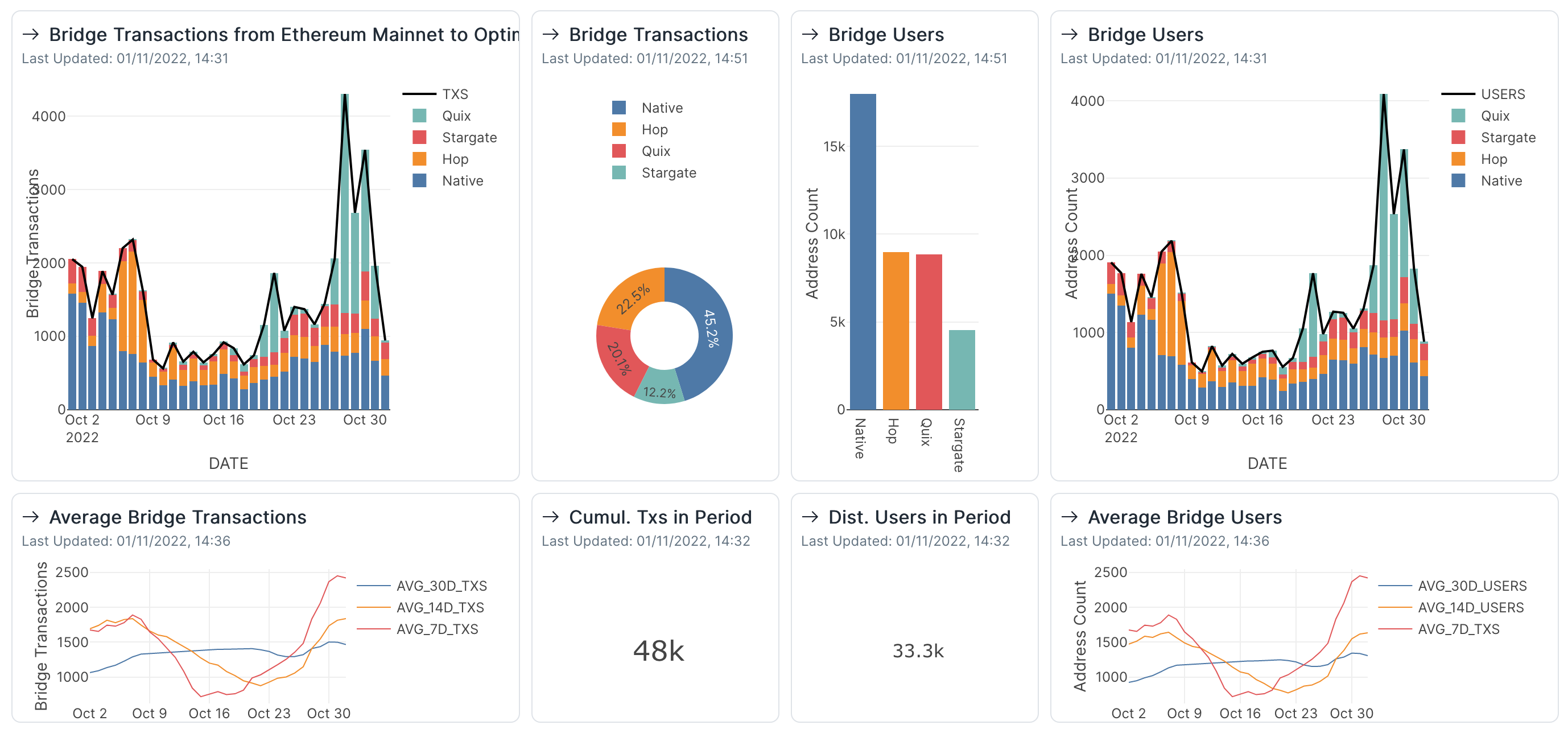

The number of daily users and the transaction count have very close values, indicating that most users only cross the bridge once a day as we might have expected. Over the last month, those values started strong at around 2k a day, followed by a quick decrease to around 600 for a couple of weeks, but they both rose back up and hit over 4k on Oct 28.

Although all bridges have recovered some of their activity, most of the rebound can be attributed to the newest of them, the Quix NFT bridge. On some occasions, its volume is more than half of the daily bridging activity despite only being launched on Oct 10.

II. First Destination of Bridge Users

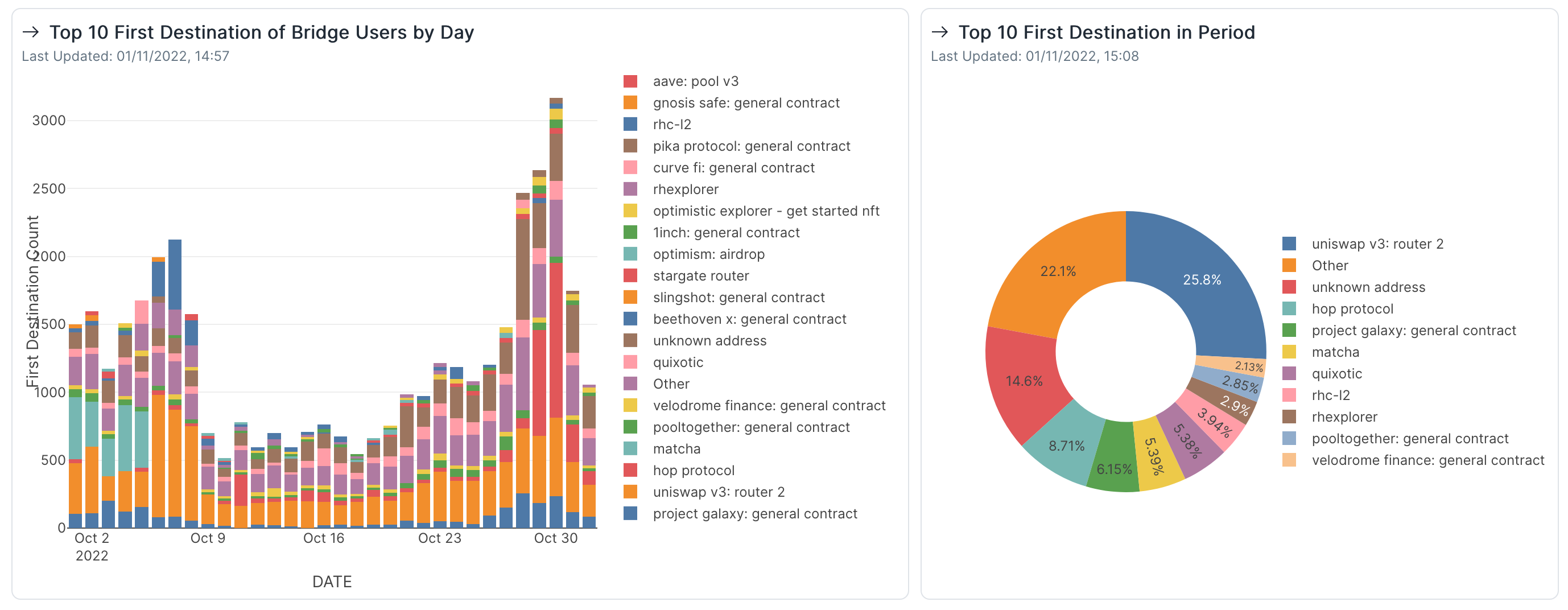

The identity of users destination relies on the dim_labels tables of FlipsideCrypto, which although very comprehensive, still lack labels on around 14% of the first destinations of the last month. Apart from that, we can see that just a handful of protocols are responsible for most of the first destination transactions, with varying shares of the daily activity over time.

Over the last month we can see a lot of protocols coming in and out of the top 10 daily destinations, while others constantly draw first interactions. The most successful protocol is by far Uniswap v3, with its router attracting close to a third of the first interactions of bridge users over the last month. However, it is not the only exchange people go to and we can spot others such as Matcha and Velodrome, as well as Slingshot and Curve occasionally.

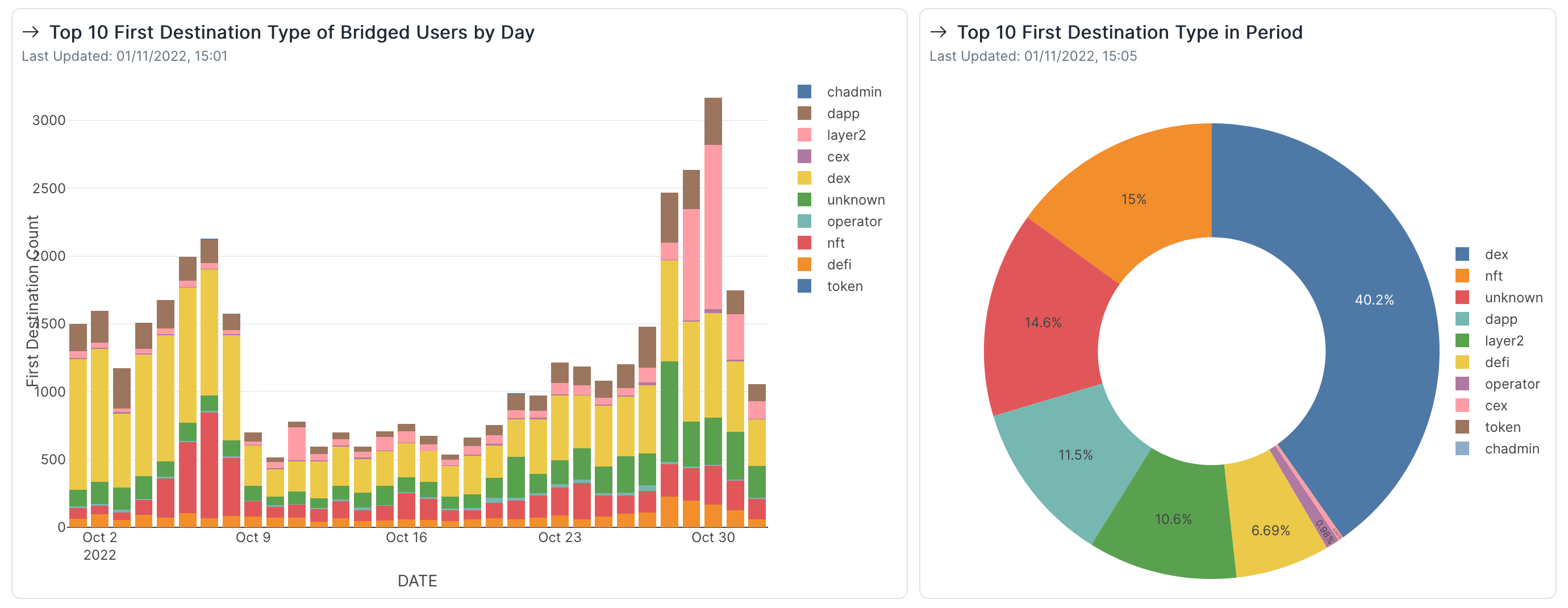

The MoM change rate of many of the top destinations of the last month had considerable transactions increase compared to the previous month. In the case of Uniswap v3, it had 45% more first transactions than the month before, simply continuing an amazing growth streak that peaked a month ago with a 156% change rate compared to August.

One thing we can quickly spot from the chart is that many of the top attractions in October had their worst performance 3 months ago in July. For Hop, there were 86% less first transactions in that month compare to June.

While many of the top destinations have been active long enough to go through the bad and the good, some have only just been created a few months ago. One platform attracting a lot of first interactions is RabbitHole with two of its NFTs issued to its earn-and-learn community.

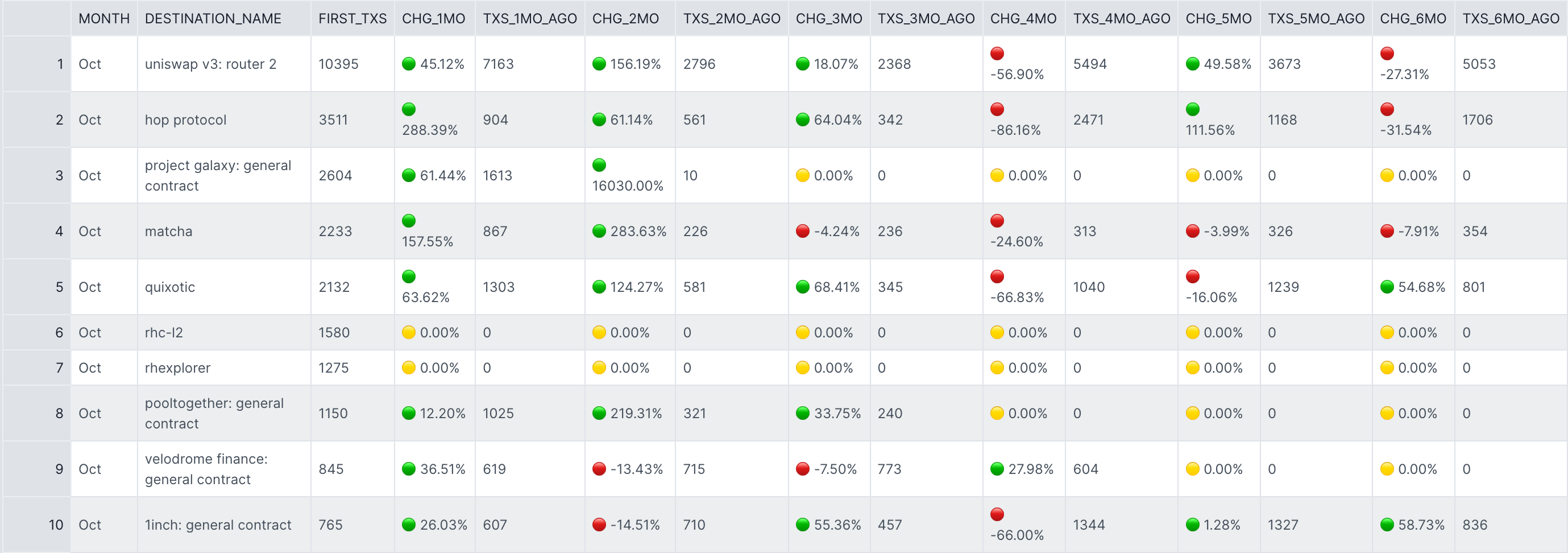

Just as we could conclude from the previous section, DEX protocols make up a large portion of the first destinations over the last month, with the rest of the pie being split between NFTs (category includes NFT contracts and NFT protocols such as marketplaces), DAPPs, DeFi and other Layer2 protocols like Ren, Synapse and ChainHop that connect the L2 to other networks.

When interpreting this type breakdown it is important to remember that there is a thin line between the types and they can change buckets based on their use cases. Furthermore, current categorization is dependent on the accuracy of labels which is not yet as reliable and comprehensive as for other chains with more resources dedicated in this direction such as the Ethereum Mainnet.

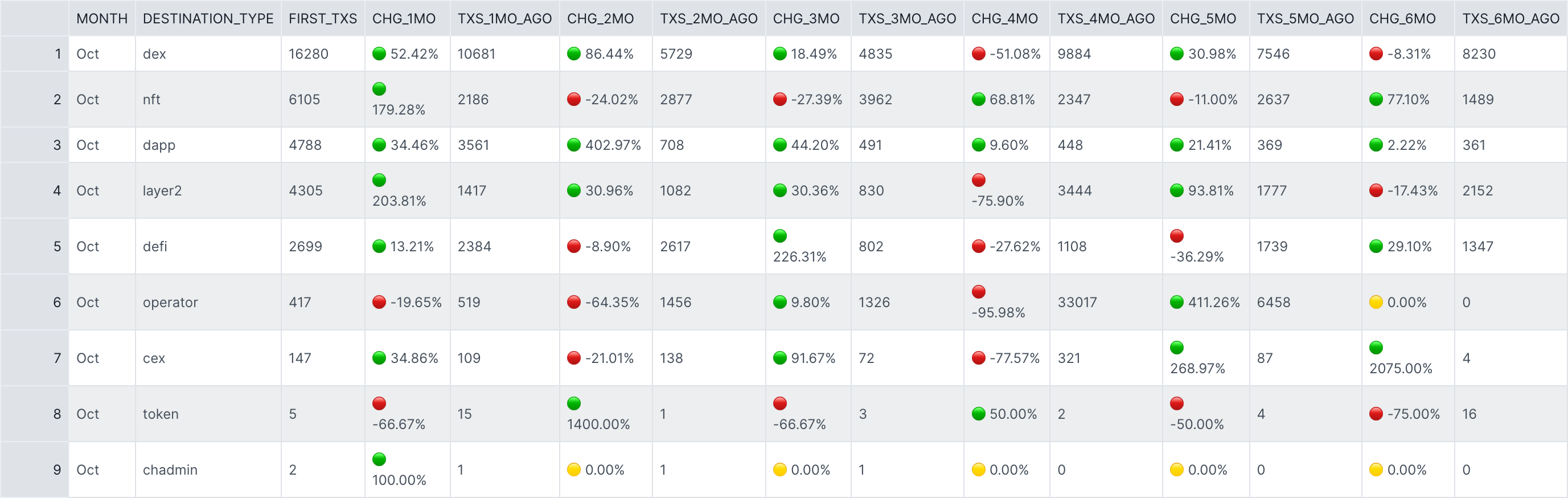

In the last month we can see the DEX, NFT and DAPP categories making large strides and growing the number of first transactions coming their way. Even at its current share and top positions for most of the time, the DEX category increased its first transaction count by 52%.

However, the greatest increase for the last month has been the NFT category with a 179% increase compared to October, where projects such as RabbitHole, Optimism Quests and Galxe leverage the fast and inexpensive minting process of the network to reward and engage users. Furthermore, the NFT sector is boosted by the efforts of Quix to bring over more collections and their communities to Optimism using its own NFT bridge.

Conclusions

-

After a mid October slump, the bridging activity from Ethereum to Optimism partially recovered but it also got a big activity boost from the newly launched Quix NFT bridge.

-

For most of the month DEXs were the main first destination for the majority of users, with the category representing around 40% of first transactions over the last month.

-

Out of all DEXs, Uniswap v3 is by far the most popular. In October it continued to increase its popularity as a first destination and had 45% more first transactions than in September.

-

Some of the most popular destinations in October were protocols centered around issuing NFTs to their members such as RabbitHole, Galxe and Optimism quests.

-

The NFT category had the greatest MoM growth with 6k first transactions, a 179% increase compared to September.