NFT traders generally hate having to pay fees regardless of their nature because it cuts into their profit margins. For everyone else involved, fees represent a direct and simple way of collecting on the value they have brought into the space either by creating the item itself or by maintaining a core piece of infrastructure.

The recent increase in popularity and usage for marketplaces that allow their users to evade some of these fees started a debate on whether fees should be paid, when and what for. Although this is for market participants to decide together, it is important to first understand what kind of revenue fees generate and how that plays into the trading activity.

The OpenSea marketplace on Ethereum is subject to three fees paid by buyers and sellers when a trade is executed:

-

Gas fee / network fee: Paid to the Ethereum blockchain to process the transaction and add it to the blockchain. The amount varies based on how busy the network is. Paid by the buyer on top of the price.

-

Platform fee: A flat 2.5% fee on the amount paid for any item sold on OpenSea. Deducted from the price of the item.

-

Creator fee / royalties: Each project is able to set a unique creator fee percentage on collections listed. Deducted from the price of the item.

In this report we will look at the fees generated by trading on OpenSea over the last 6 months. The data can be explored more closely using the live dashboard below 👇:

☝️ The dashboard can be updated on-demand by pressing the refresh button 🔄 in the top right corner of the page.

I. Overview

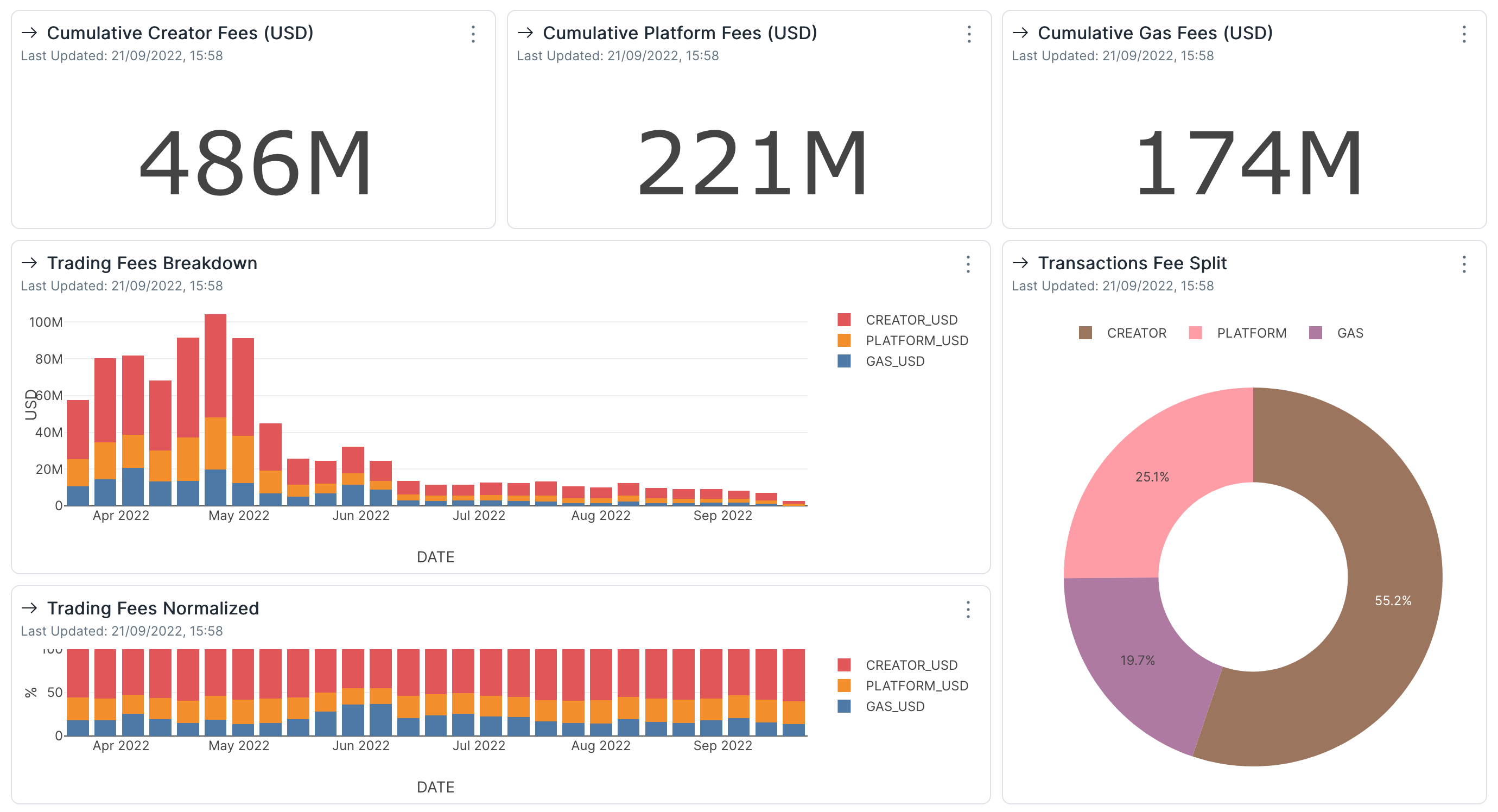

The three fees enumerated above are bundled under the general term Trading Fees. With OpenSea having a total of 8.99M transactions with a sales volume of $8.8B over the last 6 months, they have generated $881M in trading fees going to the blockchain miners (now validators 🐼), to the platform itself and to the creators.

Although traders often like to say that fees represent liquidity being drained from the NFT projects, this is actually a large income stream going to the people making the blockchain run, offering users a place to trade and most importantly, create the items they trade.

Regarding the stability and predictability of fees, we can see their volume substantially decrease since their peak in April although the number of transactions remained in a similar range. For this reason, both marketplaces and creators might be motivated to maintain slightly larger fees to account for periods like these.

II. Fees Breakdown

The largest share of the fees total is represented by creator fees, making up over half of the total sum and amounting to $486M. The 2.5% flat fee of the marketplace represents a quarter of all the fees on trades, amounting to $221M.

Gas fees represent the smallest share of the pie with just under 20% of the total, amounting to $174M USD for the observed period. This is surprising in the case of Ethereum trading which used to be notorious for its prohibitively high gas fees and users often complain about having to account for it when making any transaction. As it turns out, gas (for the most part) should be the least of their worries.

Looking once again at the volume of fees paid over time, all of them had a sharp decrease from their peak in May, but we can see that all of the amounts decreased in proportional amounts and the daily share of each continues to be in the same tight ranges. This indicates that the change is not due to any particular change in the fees structure, but rather caused by the overall slowdown of the market that pushed prices down. While the gas fee is not linked in any way to the value of the items being traded, the lower blockchain activity also significantly lowered the gas fees required when making a trade.

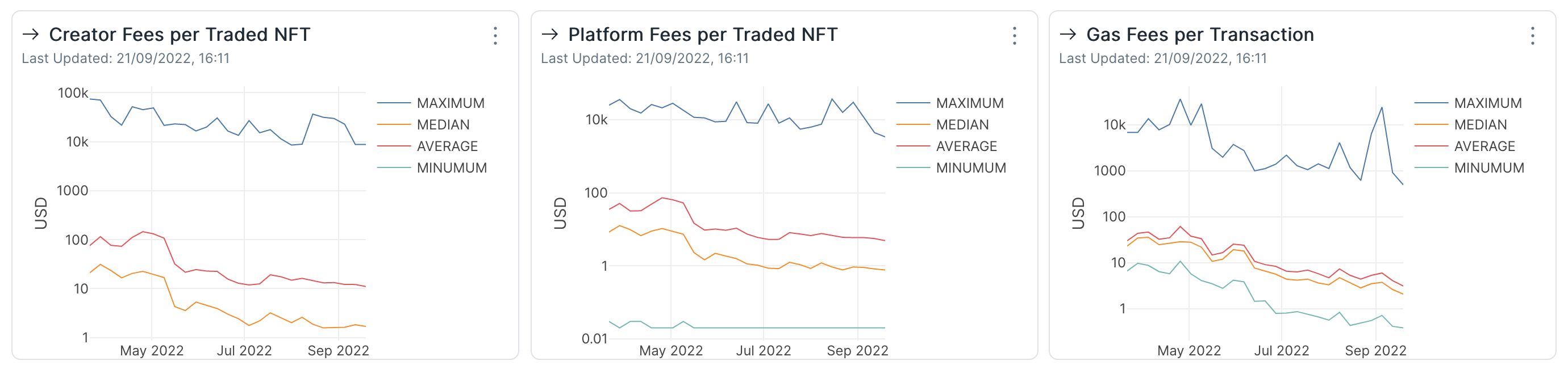

Below we can see how the amount of fees paid per transaction changed over time. In all cases we’re confirmed that the amounts had a continuous decrease over time, accounting for the overall low fees we’re seeing in recent weeks.

But although these values seem to continue on their downward trend, maximum values continue to spike occasionally. This means that while values seem to be going down for the moment, the trading environment as a whole is still very sensible to both network activity and closely linked to the value of the items being traded.

While this tandem can seem like a burden at times, it actually means that all of the involved parties have a common interest in increasing the value of the ecosystem and not choke traders with excessive fees.

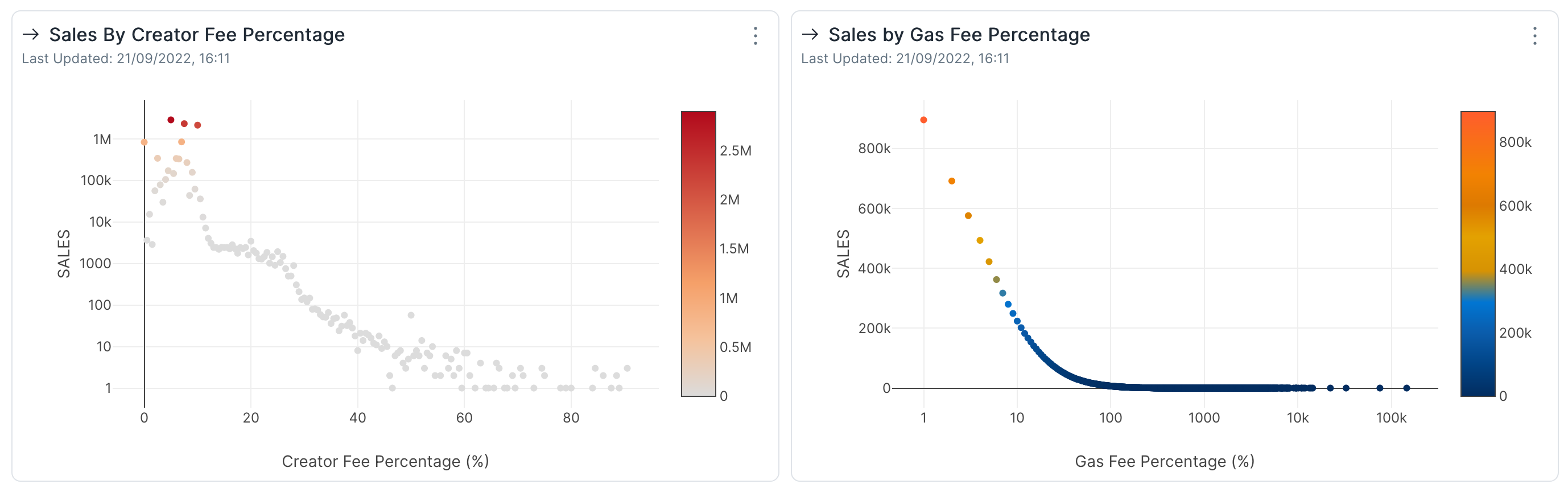

If we look at how sales change by the amount of fees being paid on trades, we start to see some bounds to what traders are willing to pay. (We are going to exclude the platform fee because it is always the same).

First up, creator fees. There seems to be a sweet spot of creator fees between 5% and 10%, but naturally sales are doing very well for lower fees as well. However, once the creator fee goes past 10%, the number of sales has a sharp decrease where it finds a small stable area where sales are still somewhat commonly made when fees are up to 20%. This quick decrease might be because sellers need to increase the price from their purchase price in increments too large to make it attractive to new buyers and therefore have to spend a longer time before making a sale, exposing them to a higher risk of just being stuck with an unwanted item.

Then there are gas fees. Because they cannot be controlled by any of the involved parties, traders are more likely to pay any kind of fees if there is urgency involved or if the potential upside is expected to compensate the costs. Even so, traders are generally willing to pay when the gas fee is worth up to 10% of the price of the item being purchased.

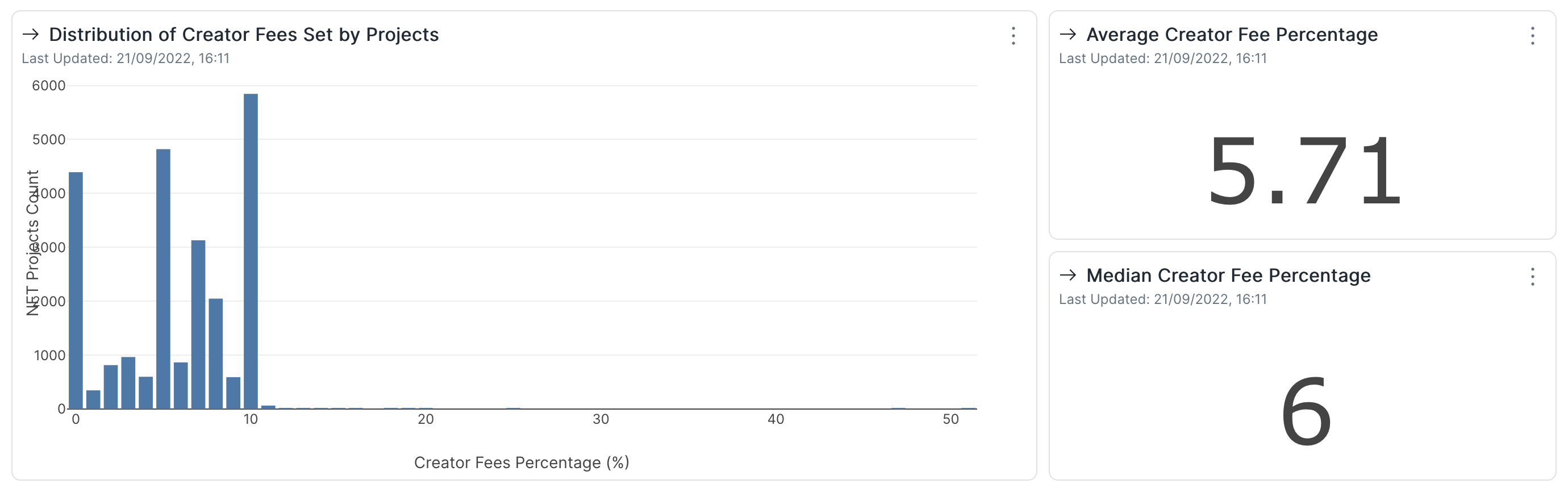

The creators fee amount seems to be commonly acknowledged by most projects to have an acceptable value between 0% and 10% and we can only see a tiny amount of the projects traded over the last 6 months to go above that.

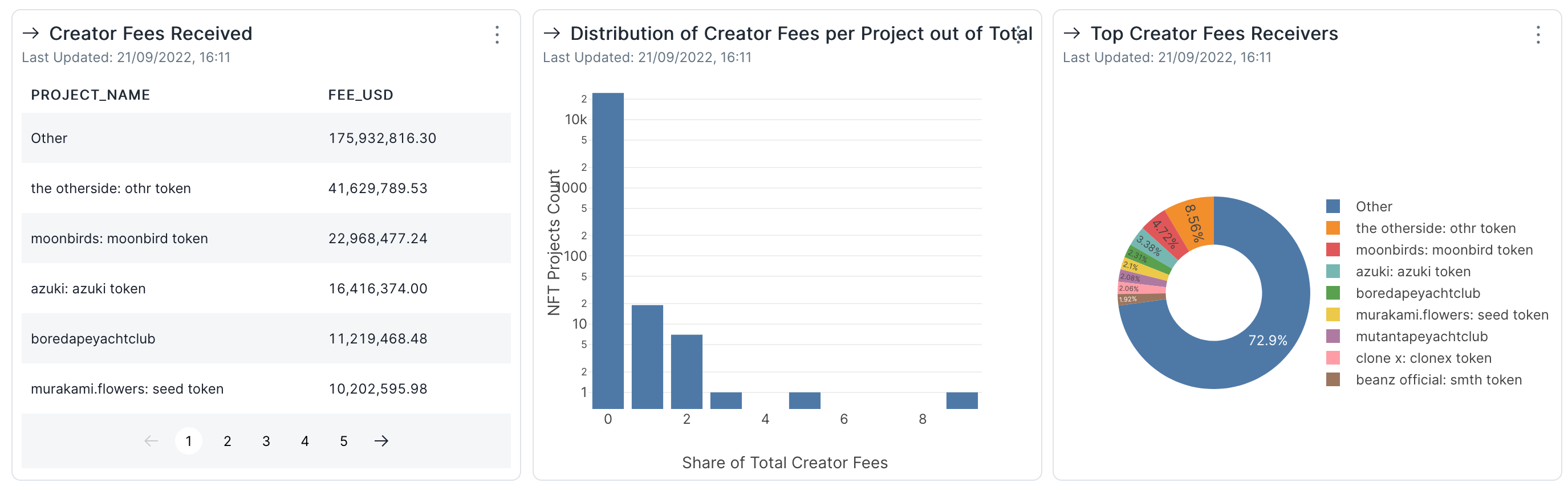

But as expected, not every project generates the same amount of sales volume and thus receive varying shares of the total creator fees we’ve seen. Out of the 24.5k projects that had sales over the observed period, 7 projects collected a quarter of all the creator fees, with the most going to the Otherside collection and followed by Moonbirds.

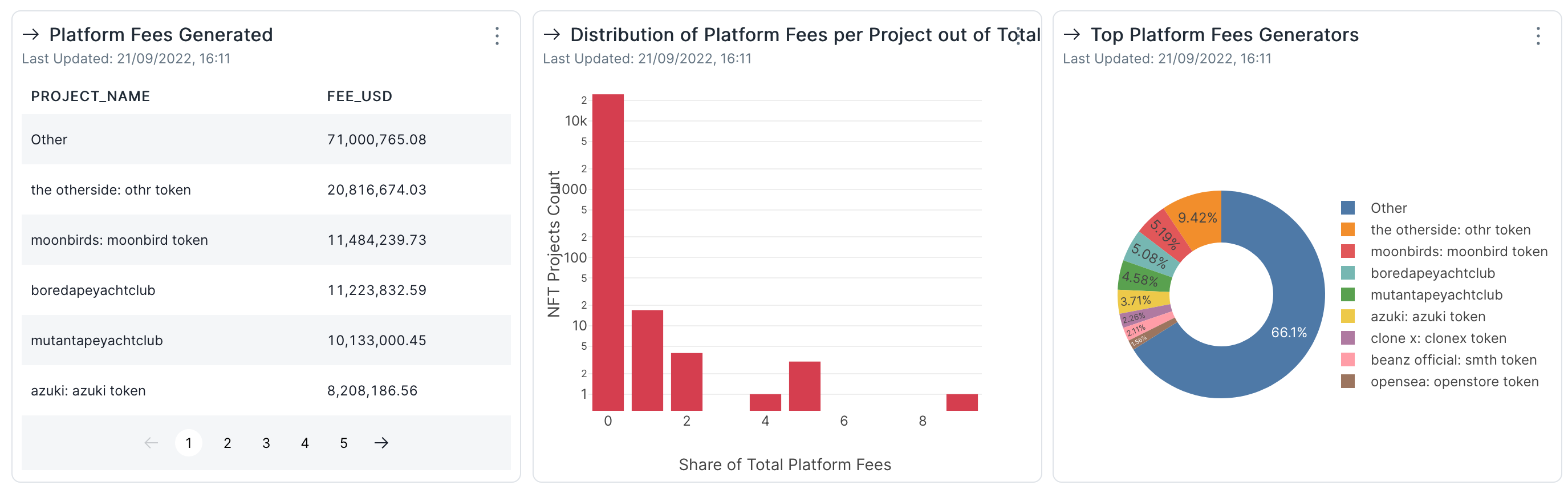

The sales volume of projects also make them have a strong relationship with the marketplace they’re being traded on as they’re responsible for attracting a considerable amount of fees and inevitably onboard more people onto the marketplace in the process.

Conclusions

-

Trading fees continue to be a large income stream to all parties involved despite the considerable decrease in volume over the past few months.

-

Creator fees represent the largest share of the fees generated from OpenSea trading.

-

Because the income from streams can vary by a lot and is unpredictable, fee recipients might be more inclined to maintain higher fees to account for periods of low activity.

-

Not only did the value of traded items decrease over the last few months, but so did the gas fees due to lower activity on the blockchain.

-

The amount of fees does influence the buying decision of traders as well as their ability to make a sale. When creator fees are higher than 10%, the quick increase in price needed to turn a profit might turn buyers away. Similarly, buyers are less likely to make a purchase if the gas fees add more than 10% to the price of the item.

-

Projects are generally aware of these limits and most of them have creator fees set at 10% or below.

-

Creators and the marketplace are in a close relationship in which they strive to create the best experience for their audiences which ultimately rewards both sides in the form of fees. However, because of their large share of the generated fees, a handful of projects have a lot of leverage and the marketplace would be more inclined to satisfy them first over the rest.