Alameda, the sister company of the FTX crypto exchange, was an early investor into Solana and held around $1B worth of $SOL, although around 80% of it is supposedly locked one way or another, as well as a variety of other tokens of projects built on the blockchain. This week however, as rumors about FTX and Alameda having serious financial issues transformed into more than just rumors, the Solana ecosystem braced for impact.

The network had plenty of time to develop a diverse ecosystem of applications, but as a whole, Solana can only fallback on one asset, the native $SOL token used for transaction fees, network security through staking and of course, the trading currency of NFTs. The survival of the network depends on the survival of the token itself.

In this report we will have a closer look at the on-chain actions following the Nov 6 events and track the flow of value to/from the $SOL token.

-

The price of $SOL used throughout this report is calculated using the on-chain swap activity, which might differ to the prices reported on centralized exchanges over the same period. The general labeling of the token in the FlipsideCrypto tables used for this is

WSOLreferring to the wrapped version of the token, and this is the label that will be present throughout the charts. -

Transfers between a Centralized Exchange’s own wallets or between CEXs will be excluded from the inflow/outflow analysis as these funds never actually leave a centralized entity, thus they don’t represent funds that join or leave the blockchain.

-

On the same topic of CEX transfers, it is entirely possible that many transfers and reserves are not being included in the dashboard as this relies entirely on the accuracy and completeness of the FlisideCrypto

solana.core.dim_labelstable. Furthermore, CEX wallets that had no token movements in the last 4 months will also not have their balances included in the reserves calculations. However, upon close inspection of wallets in this situation, they are often rotated by exchanges and emptied out before being abandoned, and only sometimes they still contain extremely small amounts of $SOL. Because of this there is a reasonable expectation that dormant wallets will not make a significant difference in the CEX reserves if being left out. -

The time frame used in this report starts on November 6 and ends on the date of writing, November 11. The default time frame of the live dashboard is set to a value of

3but can be adjusted using thedaysparameter.

All of the data and underlying queries can be found in the live dashboard below where all charts and tables can be further explored and interacted with:

☝️ The dashboard can be updated on-demand by pressing the refresh button 🔄 in the top right corner of the page.

I. SOL Price

After an excellent performance in the week before, we can see the price of $SOL starting a slow descent for about a day and a half, after which the price becomes much more volatile. After a bit of indecisiveness in the market through Nov 7, while FTX and Alameda were still trying to play things cool, the price started a steady descent from a price range of $30 down to $10 (and a bit lower even for a short while).

Right now the price has gone up since by a little, currently sitting in a price range above $15, but the fallout of the recently announced FTX bankruptcy might just be starting to manifest.

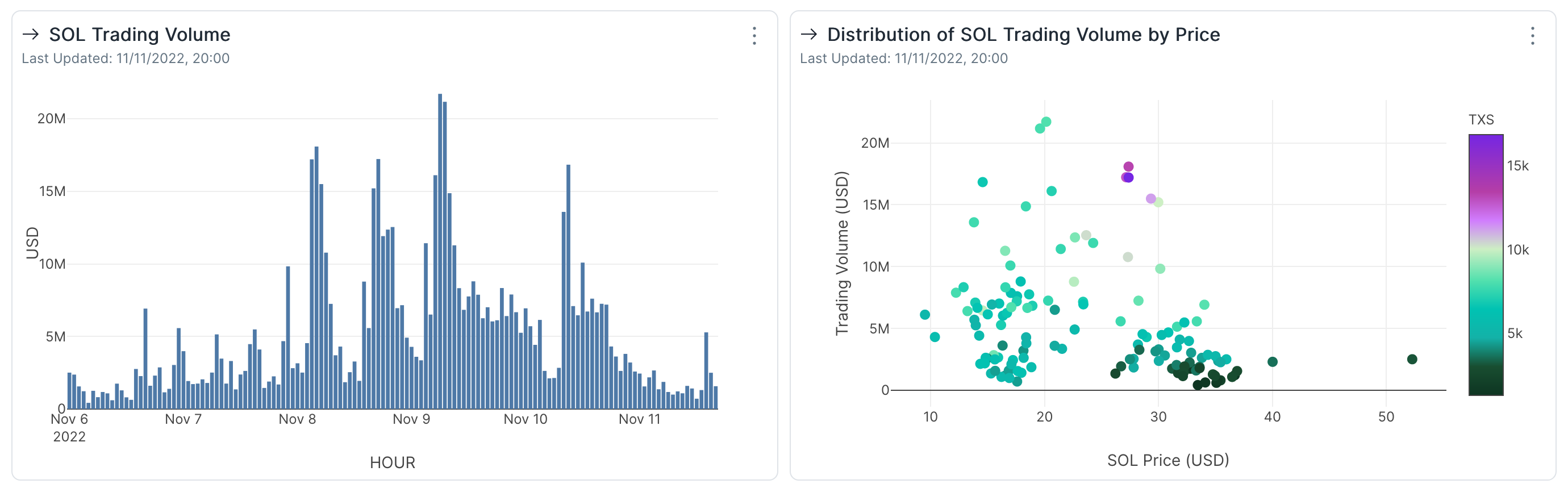

We can see the on-chain trading volume frequently spiking after Nov 8, when it became clear that FTX and Alameda were insolvent and that will most likely result in a liquidation of their assets, and most importantly, of $SOL.

Between Nov 8 and Nov 10 we see a lot of trading volume that is in line with the rapidly changing price of the token and shows how people were rushing to be more than just innocent bystanders in the middle of this all. We can see a lot of transactions (purple) being made just under the $30 price, as people were starting to grasp that they’re not going to have just a small correction. A lot of the volume is not being concentrated in the $15-$20 price range as the market tries to figure out which way to go next.

II. SOL Swap Activity

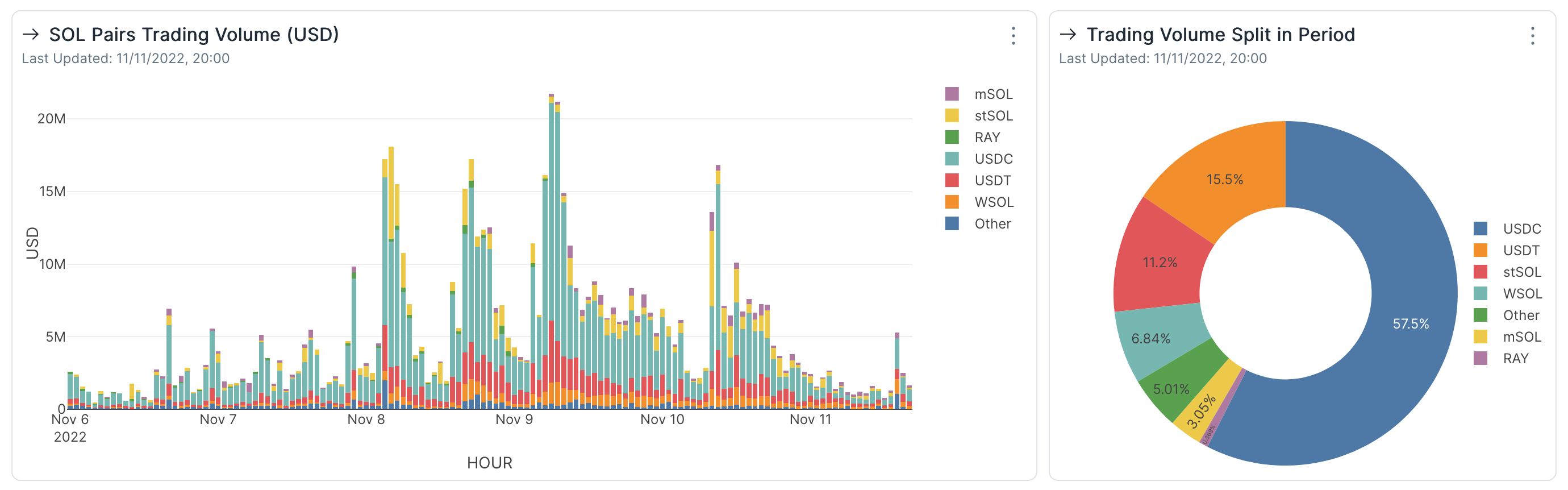

Unsurprisingly, much of the trading volume throughout this period has been between $SOL and stablecoins. Out of the stablecoins available to traders, close to 60% of the trading volume was made using the long-time favorite stablecoin of the Solana blockchain, $USDC.

Besides stablecoins, we can see a lot of volume between $SOL and liquid staked $SOL such as $mSOL of Marinade Finance, or $stSOL of Lido.

*Swaps can be executed with many intermediary steps and between multiple liquidity pools. For this reason, some swaps will start and end with the same token, in a form of arbitrage. Hence, one of the tokens swapped to/for sol visible in the chart below is WSOL.

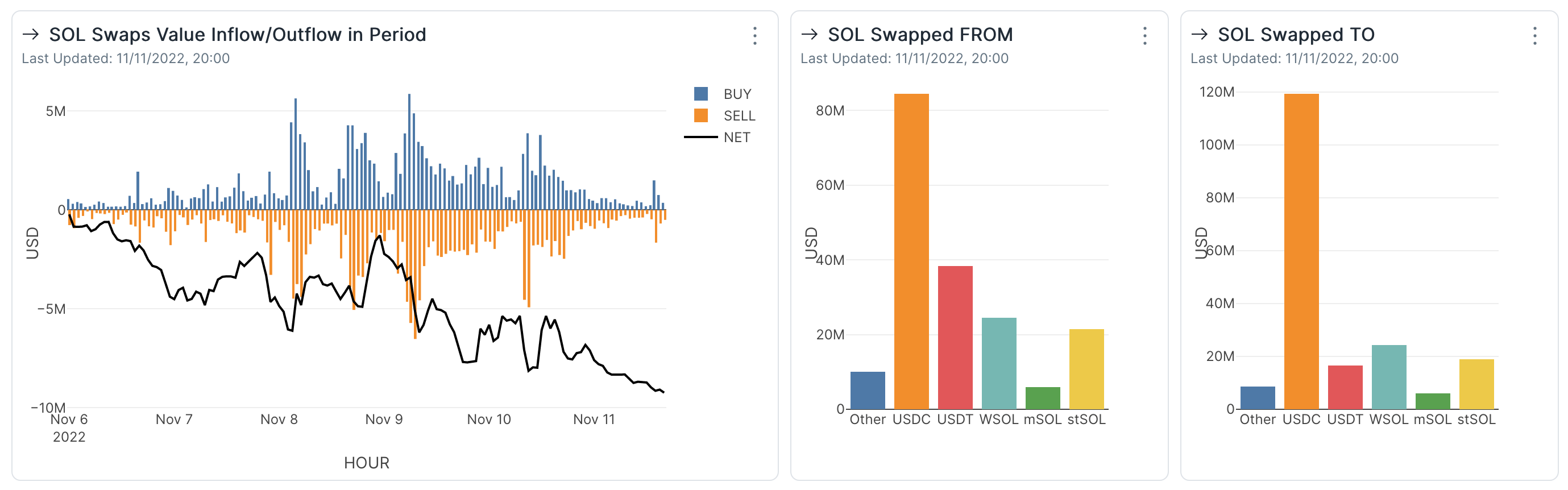

Since Nov 6, a net amount of more than $6M went out of the token through on-chain swaps. With the exception of $USDC, most other token pairs have a negative swap balance to $SOL, telling us two things:

-

$SOL holders and traders overwhelmingly swapped their tokens to an asset they perceive as safe and reliable.

-

All the other tokens, including $USDT, were funneled to $USDC through $SOL. As things were rapidly evolving and CEX deposits/withdrawals were under question, users flocked to one of the most reputable and reliable stablecoins in the space.

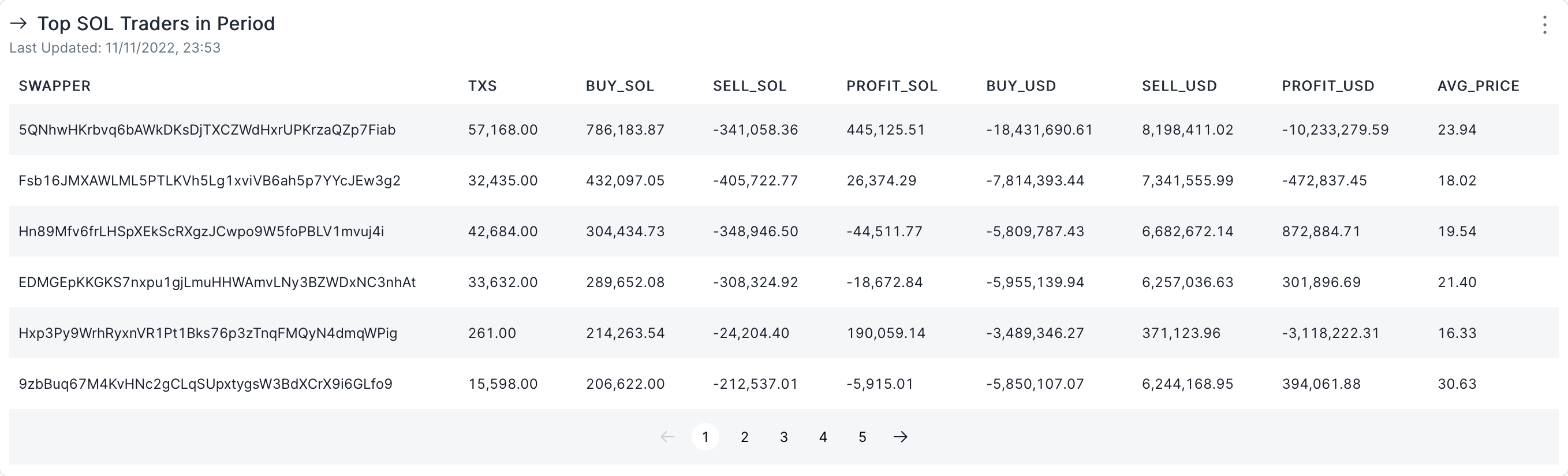

But while this has been a difficult period and a lot of people certainly lost some money, massive price action also opens up a lot of opportunity for skilled traders (or their bots). The most active traders swapped lots of $SOL, many of them at average prices under $20.

However, there isn’t a consensus on the direction of the trade and both buyers and sellers are still betting big, which we can see by the profit they’ve made in $SOL and in $USD (the $USD profit is based on the value of the sold tokens at the time of the transaction). Some of them chose to sell their tokens for an immediate dollar profit, while other continued to stack $SOL and wait for greater price increases.

*It is important to remember that the above section only follows the on-chain trading activity of these accounts, while on closer inspection we can see some of these addresses transferring their assets to other accounts, making CEX deposits and even bridging out of Solana.

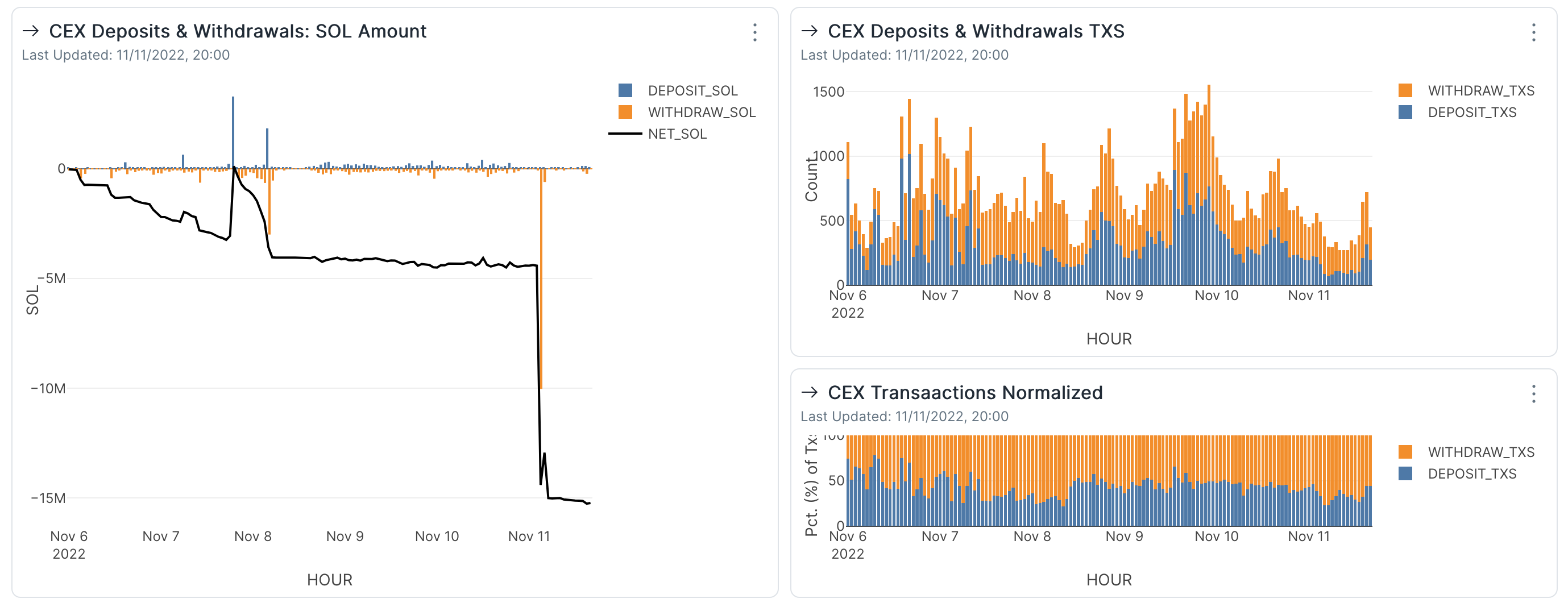

III. CEX Inflow/Outflow

In light of recent events users have a difficult choice to make if they want to move their funds between blockchains, deposit/withdraw from/to fiat etc. Still, one of the easiest, fastest and most liquid ways of doing so is through a Centralized Exchange (quite ironic). On the other hand, because of the same events, users might feel the need to withdraw their funds from CEXs to make sure they still own their assets. Not your keys, not your coins amirite?

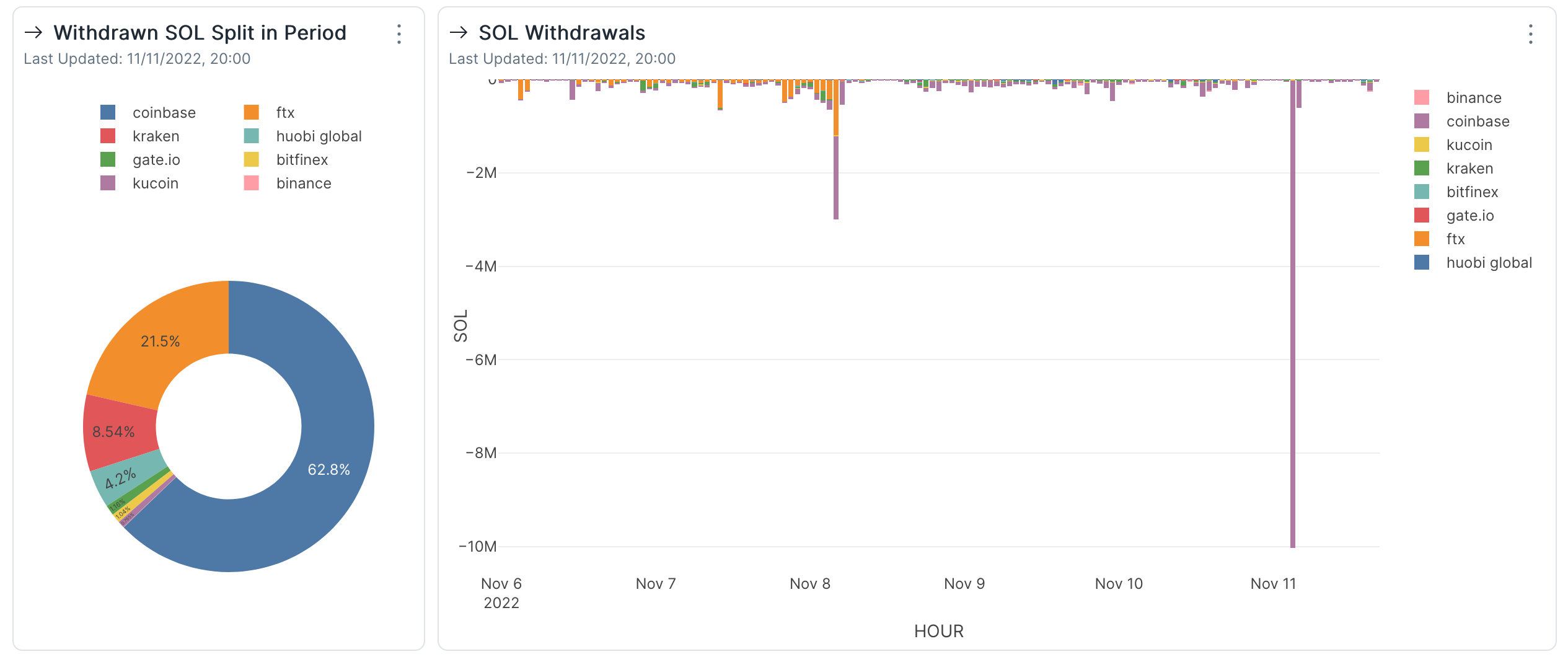

It seems however that this time people have massively withdrawn their funds from CEXs, perhaps realizing the little transparency they actually offer in regards to not only their reserves, but also in regards to their financial situation and/or what their deposits are being used for. Overall, it’s been a moment of awakening for Solana users.

It is also worth noting that users could just as easily sold their tokens and withdraw to any other blockchain, but they still have sufficient trust in Solana. Over this period, a net amount of more than 15M $SOL was brought back home from CEXs.

Up until Nov 8, we can see a lot of withdrawals coming from FTX, just as we would expect, but on that same day withdrawals were halted. Because users were simply unable to withdraw anything from the exchange, we see it being responsible for just a little over 21% of the total $SOL withdrawn in this period, whereas we would expect a lot more volume otherwise.

Even so, withdrawals did not stop, and we can actually see a lot more tokens coming out of Coinbase, with the largest withdrawals being made just recently, on Nov 11.

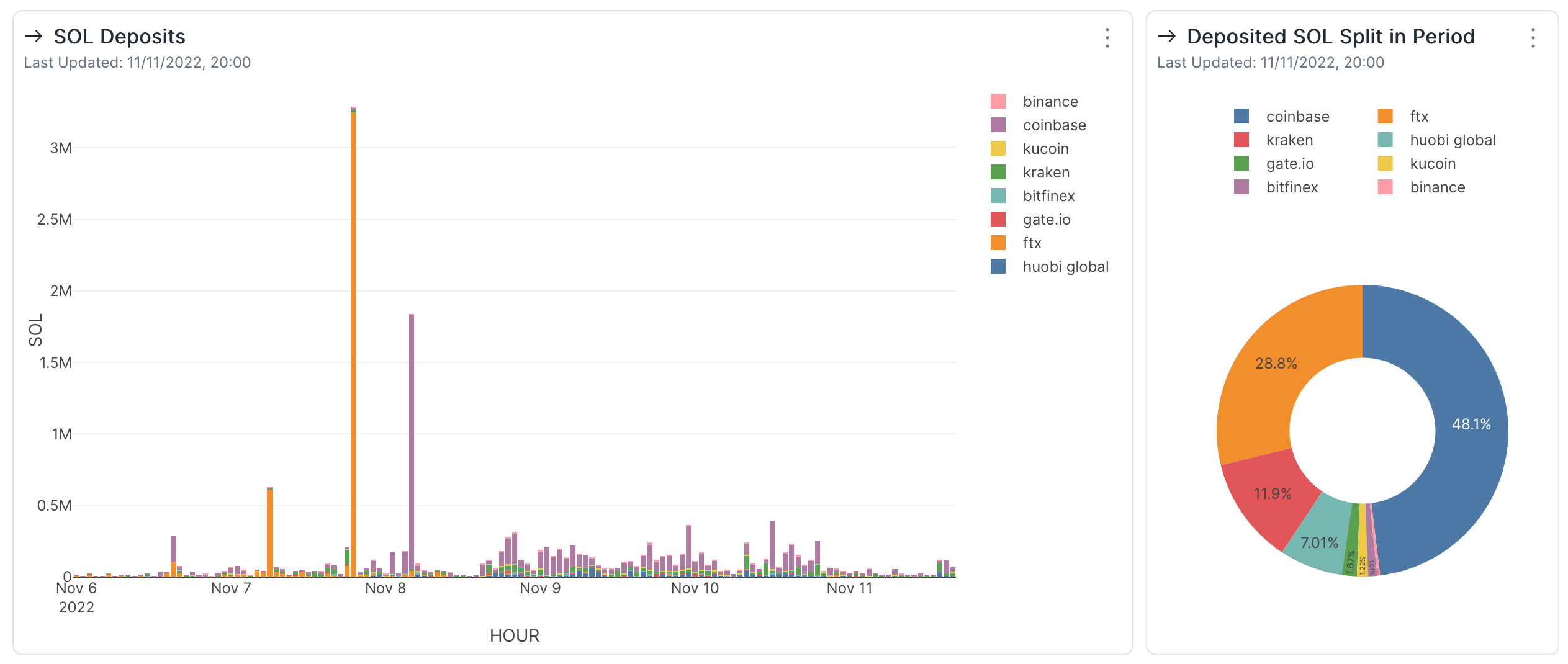

What is slightly insane to observe before Nov 8 is the amount of $SOL still being deposited to FTX, in spite of all the news coming out about it. However, some of the largest deposits in that period were coming from wallets identified as being owned by Alameda (which would seem obvious), but they also stop after Nov 8.

A few other large deposits were made since to various CEXs, but $CEXs are really flooded by new $SOL. But given our previous findings about it being primarily swapped to $USDC, it’s very likely that users changed their behavior to first make their actions on the blockchain and then use the CEX just as a way of withdrawing to fiat.

At the moment, Kraken seems to be holding the greatest token reserves of 3.2M $SOL worth around $56.6M, significantly more than any other of the exchanges included.

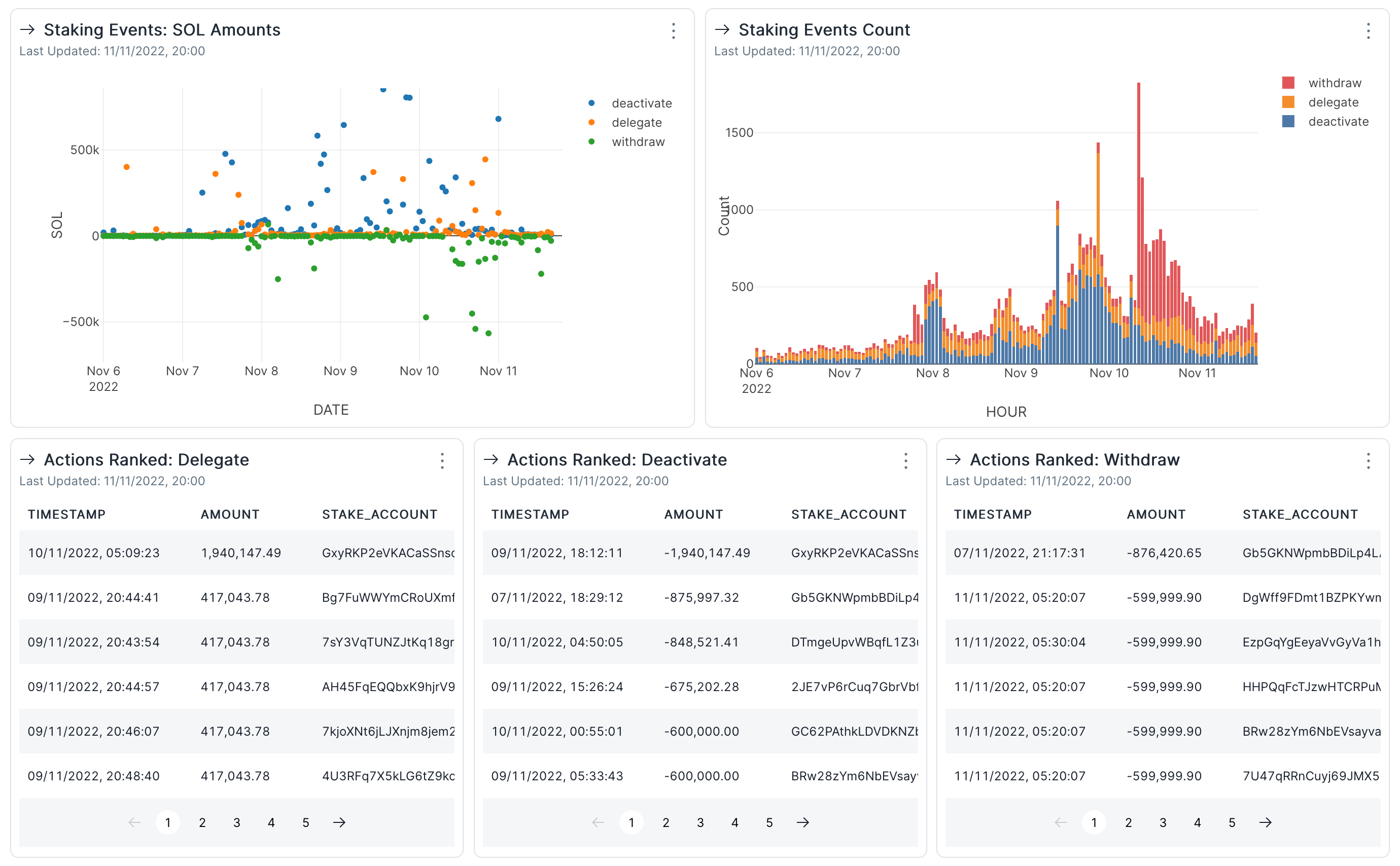

IV. Staked SOL

The $SOL token plays a vital role for the Solana blockchain as it is the stake in its Proof of Stake consensus mechanism. Therefore, the price of the token is important not just for speculative reasons, but also because lower prices mean a lower cost to attack the network, making it less secure. This is doubled by the fact that a depreciating $SOL token makes existing stakers more likely to unstake, again impacting the overall security of the network.

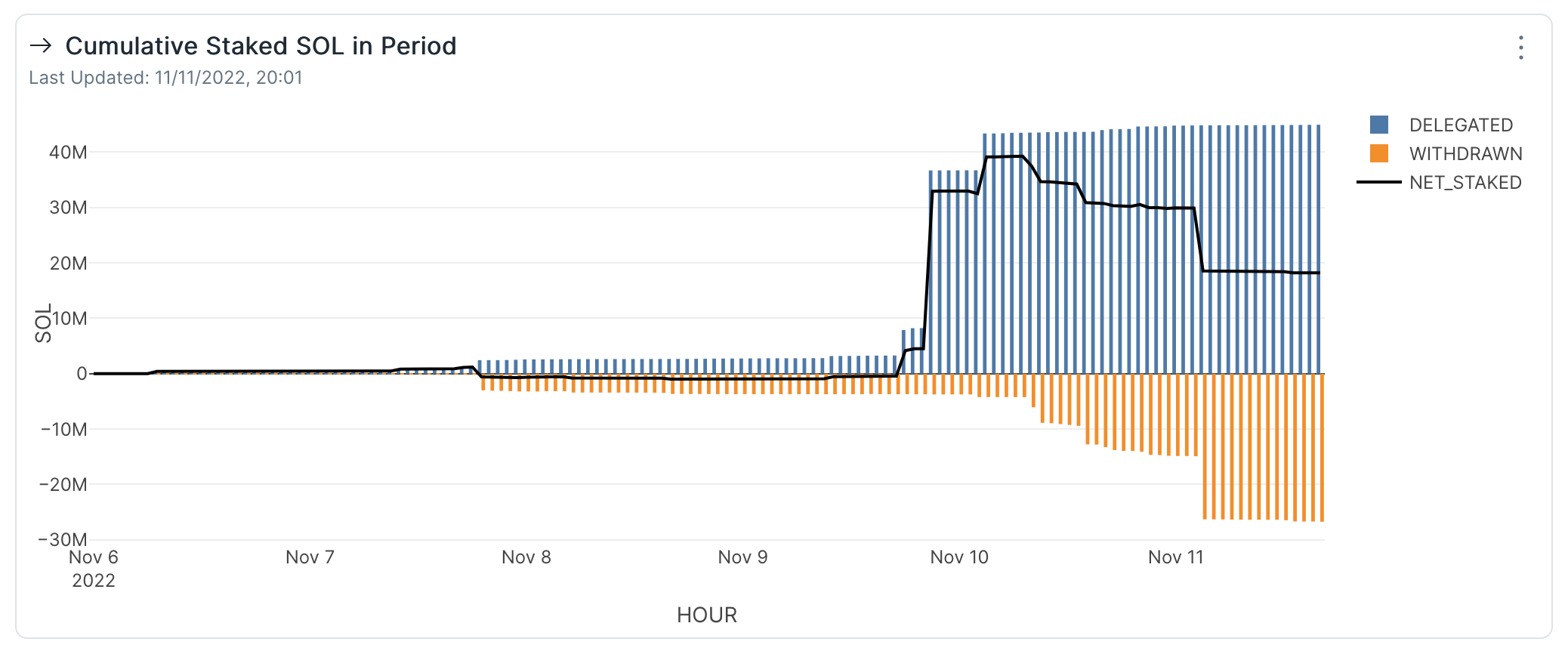

Generally there isn’t too much going on around staking at this stage of Solana’s existence, at that remains the case pre Nov 8 as well. However, as soon as people realised that the possibility of a lot of $SOL hitting the market in the near term, activity spiked.

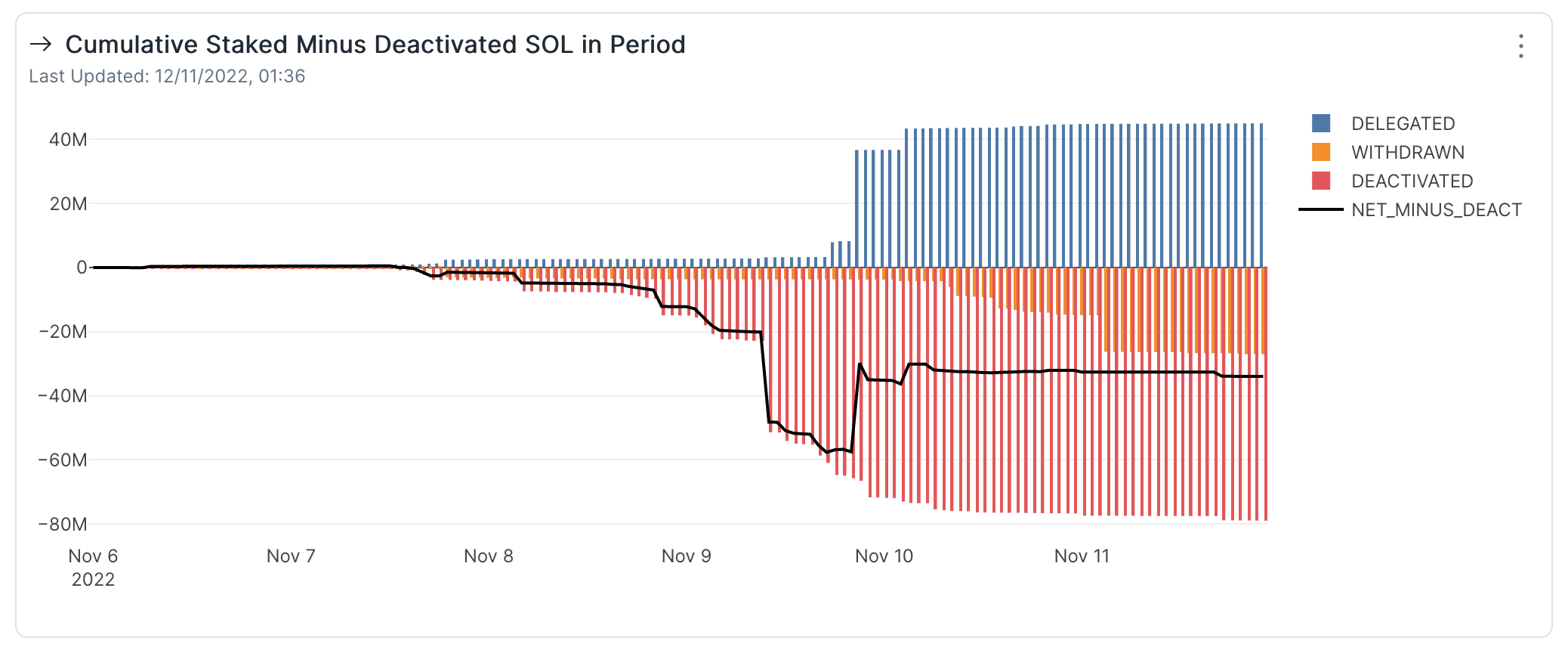

Delegations continue at regular levels, but things substantially increase in the opposite direction. Once a stake is deactivated, the stake account owner can withdraw the tokens at the end of the Epoch.

The amount of $SOL being deactivated continues to ramp up after Nov 8 and peaks on Nov 10, awaiting the end of the Epoch, when users were finally able to withdraw. Over the same period, the almost 60M tokens of deactivated stake stirred a lot of speculation and controversy. Almost half of the amount included tokens delegated by the Solana Foundation, which redelegated the tokens and postponed withdrawal to avoid any further speculation.

Until now, the net amount of $SOL staked has increased by over 17M tokens when considering the amounts being delegated and withdrawn.

However, this is not the end of the story and the net amount changes if we consider the amount of tokens deactivated that can be withdrawn or have already been withdrawn at the end of the last epoch. This time the staked $SOL amount turns negative, and the PoS network can lose up to 33M tokens, representing around 10% of the staked $SOL.

V. Bridge Activity (Wormhole)

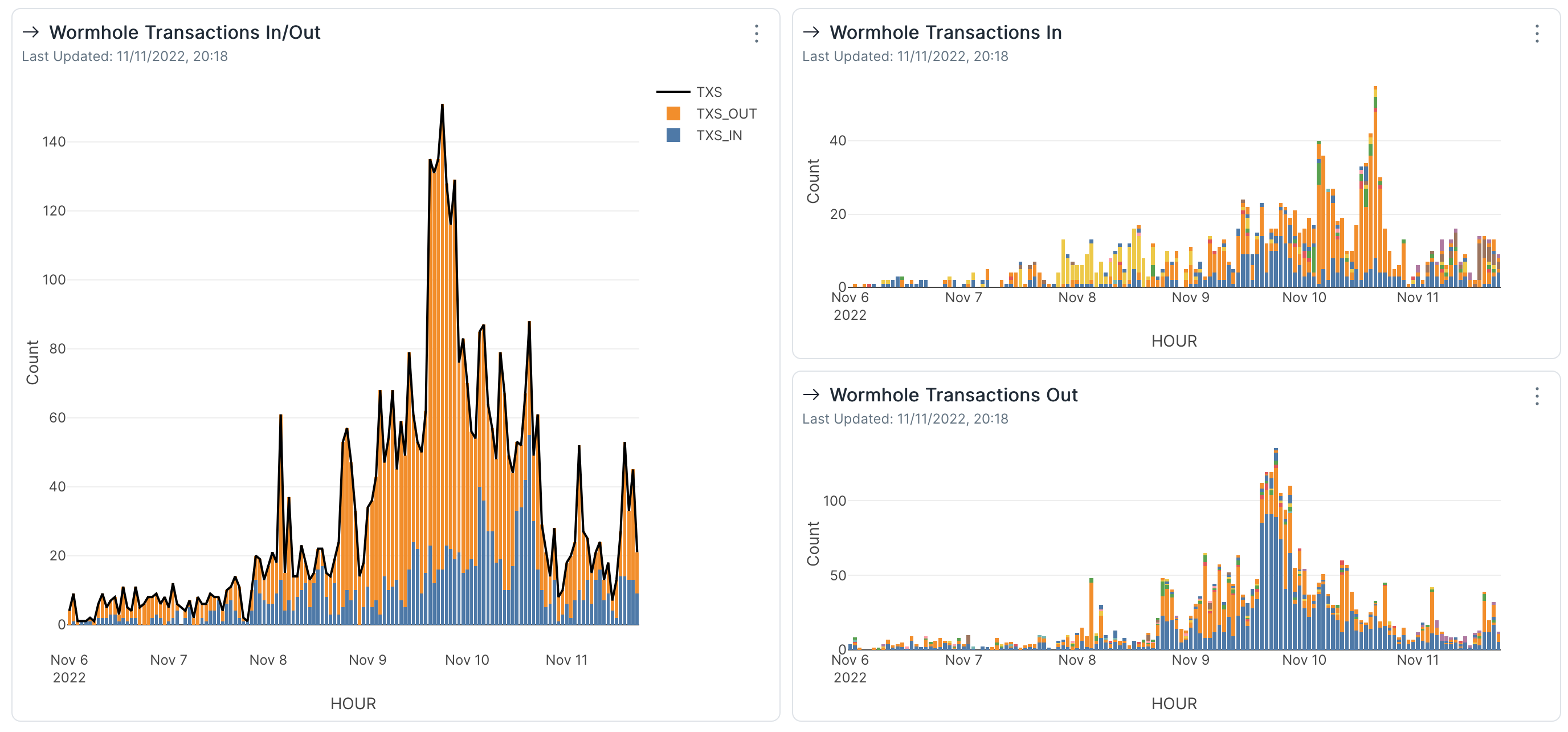

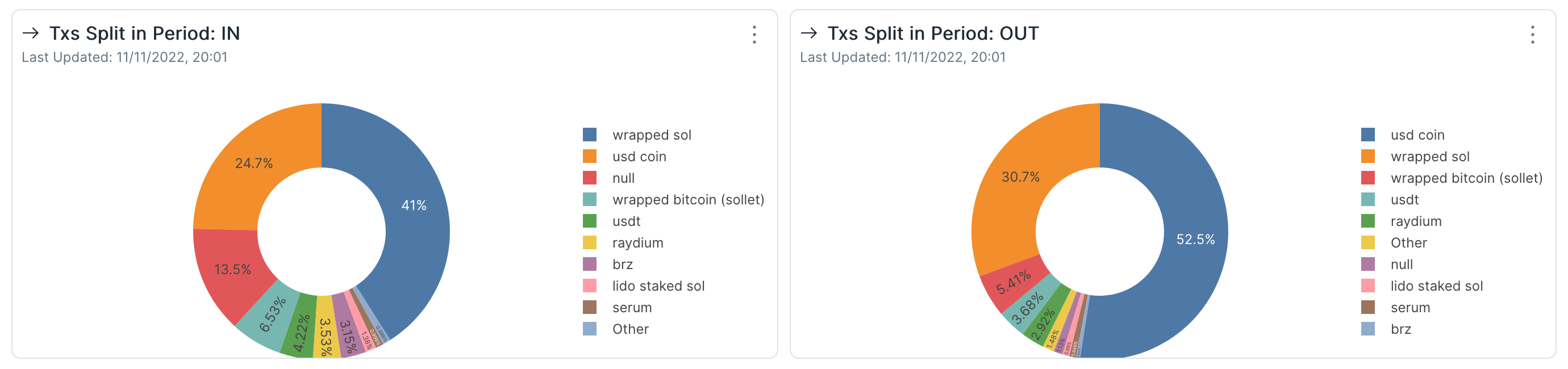

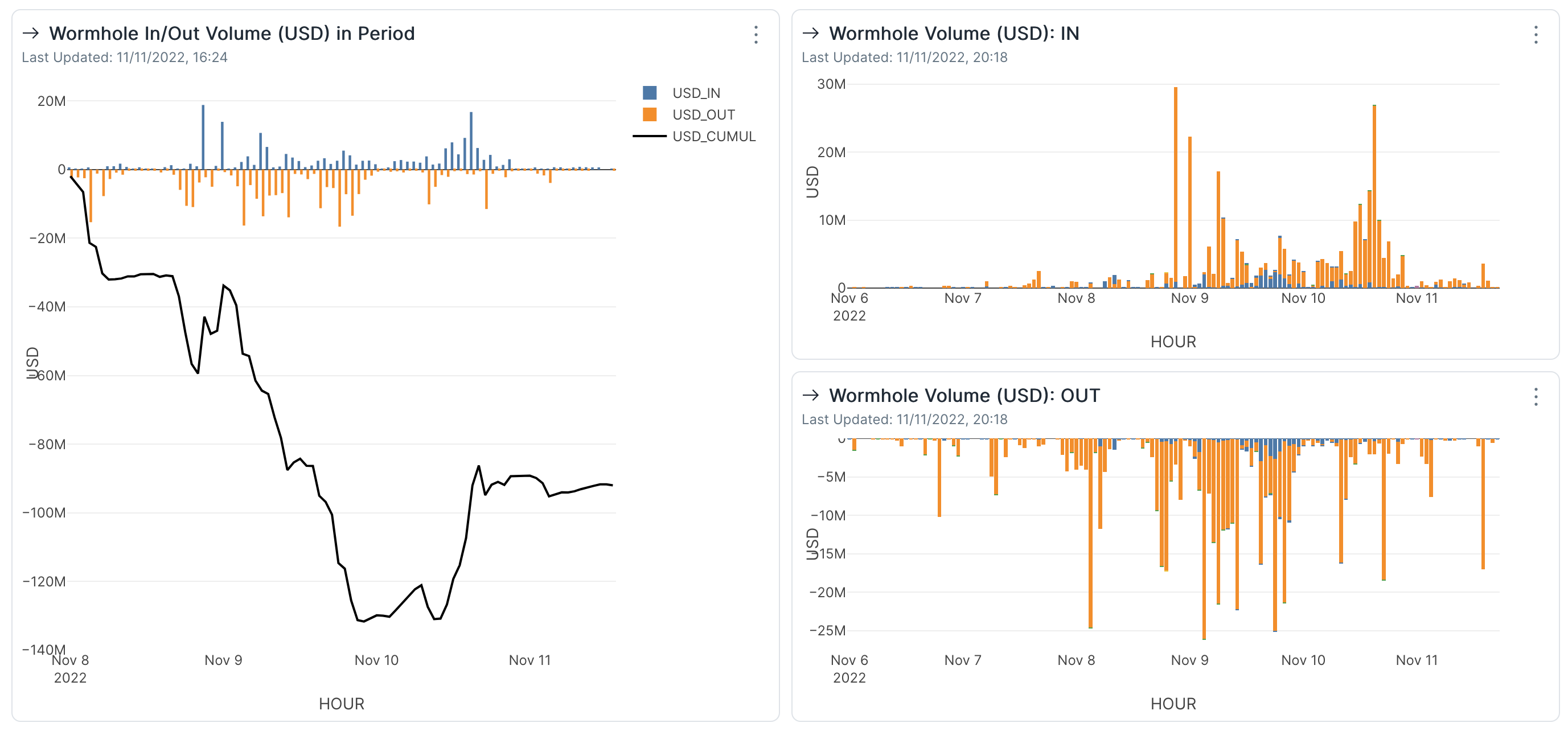

So if not through CEX, how else is value going to escape the imminent threat of FTX and Alameda being liquidated? Through the Wormhole, of course. As many of the target chains don’t support native $SOL or wrapped versions, users of the platform are compelled to use other assets to bridge in/out. Therefore, in this section all bridged assets are included.

Just as in most other charts we looked at until now, bridge activity spikes after Nov 8. Even at its peak, the number of transactions is not extremely high, with only up to 150 transfers in+out per hour. There is however an interesting shift in direction as time passes. First, transactions are mostly outgoing, starting on Nov 8 and up to Nov 10. After that date, transactions start to shift to incoming transfers, signaling that people have felt reassured by how the handled its first sell-off wave.

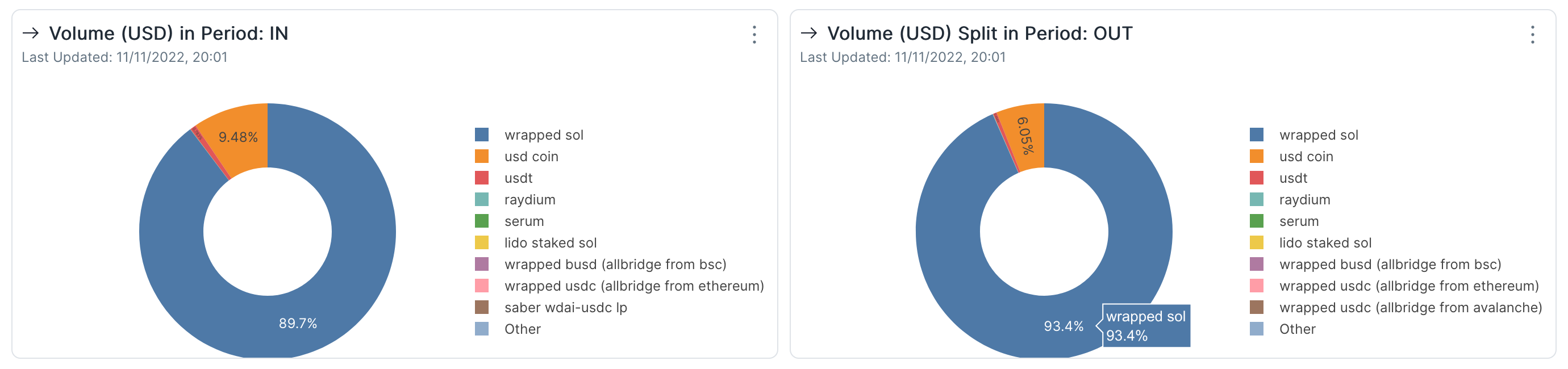

Most transactions were made with $USDC which plays a dominant role on both directions thanks to its reputation and popularity as a stablecoin, as well as its widespread availability across blockchains.

In terms of value, we can see a similar story as the one told by the number of transactions. However, we can now see another layer of all those transactions and assess how much value was bridged away.

Over the observed period, a net amount of assets worth over $90M has left the blockchain through the wormhole, although it’s recovered a little over the last day.

While many of the transactions were made with $USDC, most of the value crossing the bridge is in $SOL, regardless of direction. All the other tokens were bridged in insignificant amounts, and even $USDC only represents around 10% of the overall volume.

Conclusion

-

The Solana blockchain is facing a difficult situation where one of the partners with a lot of stake and connections in the ecosystem will have to be liquidated, putting a lot of pressure on the $SOL token, vital to the existence of the network itself.

-

As more information came to light about the liquidation risk of FTX and Alameda, people have tried to take shelter on-chain by swapping away from $SOL to other assets, withdrawing their stake and bridging away.

-

Notably, this time people were not too keen to deposit their $SOL to a CEX and instead there have been massive token amounts withdrawn to the blockchain.

-

A large amount of tokens has been deactivated, which if fully withdrawn can reduce the stake of the network by up to 10%. Luckily this number is very dynamic and new $SOL is being added back to validators.

-

Bridge activity has spiked after the events of Nov 8, with a lot of back and forth transactions, first away from Solana, and more recently mostly back to it.

-

There is still a lot of uncertainty as to how things will develop in over the following days, but on-chain usage, swap volumes, staking activity and bridging activity all indicate that users feel slightly more confident about the likelihood of Solana surviving this incident and they return to pick things back up.