Much of the value proposition of smart contract blockchains during the 2021 bull market was based on Decentralized Finance (DeFi) DAPPS, but after a long period of retracing value and several hacks later, that category does not incite as much excitement anymore. Some call DeFi dead. But what’s not dead and actually was born during that market cycle was the need for reliable scaling solutions that would allow users to avoid the frequent gas surges of the Ethereum Mainnet and allow projects to explore use cases that would have been inaccessible otherwise.

The Optimism L2 network is one of the scaling solutions that captured a lot of users and projects from the Mainnet, while succeeding to incubate its own ecosystem of native apps. But if DeFi as a whole is dead, what else is there to do?

In recent weeks, months even, Optimism has been pushing more toward NFTs and experimenting with possible use cases. It ran quests, rewards programs, learn-to-earn campaigns and perhaps the most daring step in this direction, it launched an NFT bridge in collaboration with Quix, the leading NFT marketplace on Optimism.

In this report we will look at the growth of the Optimism network and the role NFTs have played in it over the last month.

The most prominent use of NFTs over the last year has been tying digital assets to them, generally art, but these tokens can be issued to represent much more, such as identity credentials, stake, LP positions and so on. This report will consider interactions with all kinds of non fungible tokens under the label of NFTs.

The default parameters we will e using for the data analyzed in this report are set to months = 3 and date_trunc = week.

All of the data and underlying queries can be further explored and interacted with in the live dashboard:

☝️ The dashboard can be updated on-demand by pressing the refresh button 🔄 in the top right corner of the page.

I. NFT Transactions and Events

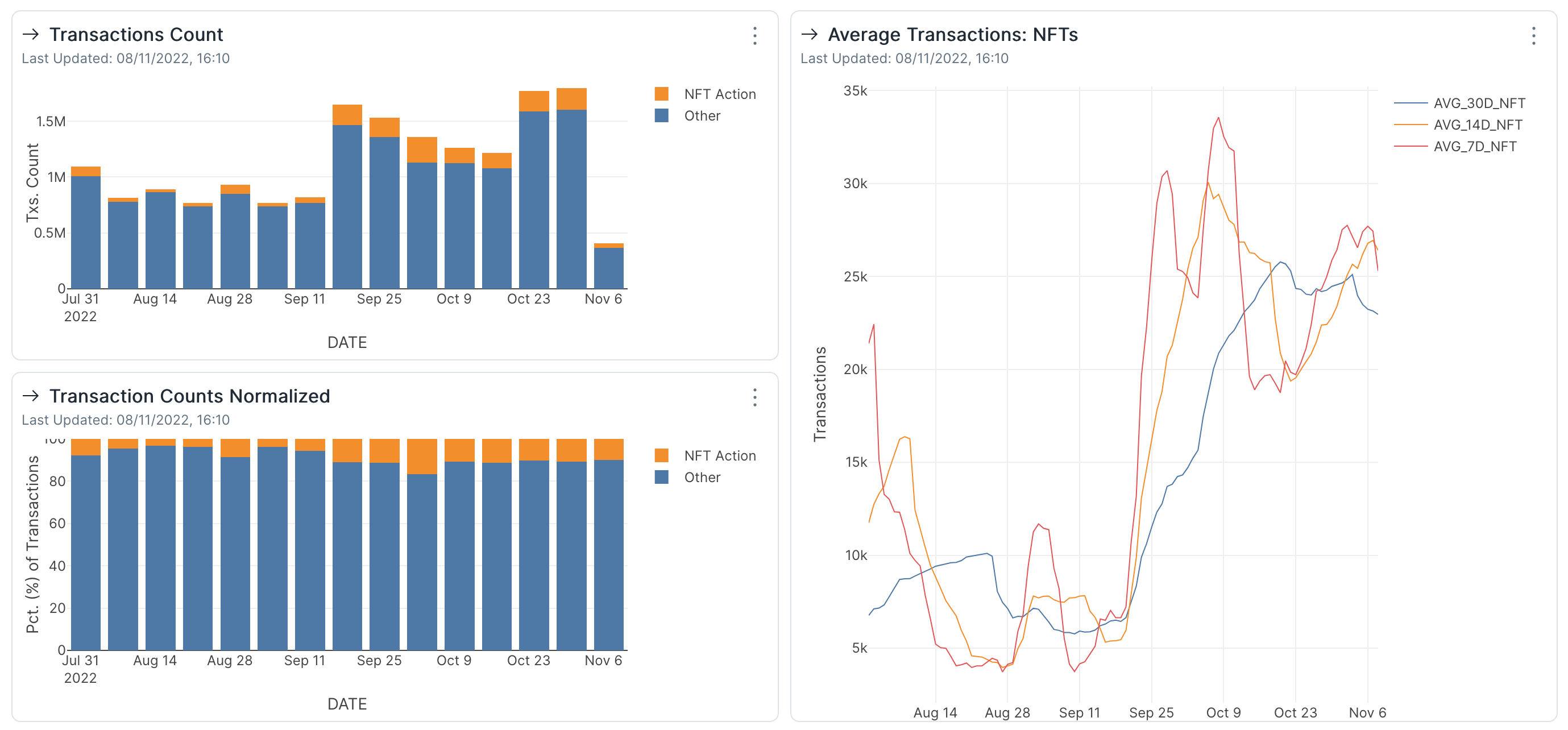

Over the last 3 months, the overall activity on the Optimism network has been on the rise and the weekly transactions have increased by more than 50% compared to the start of the period. However, we can see that during the same period so did the number of transactions where NFTs were involved and they represent an increasing share of the weekly transactions.

It’s also worth noting that even in the case of a hardcore NFT Trader, a lot of transactions will still be made to move funds around, swap tokens etc., so it is expected to have a big difference between the two categories.

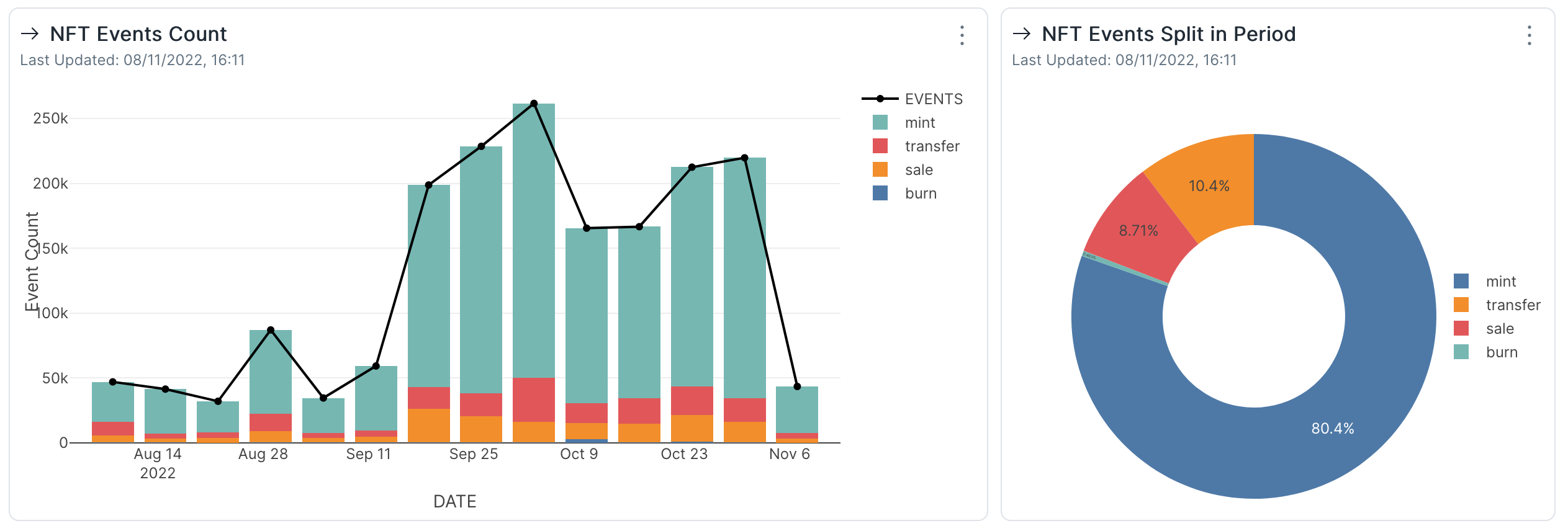

The number of NFT transactions quickly accelerated in mid September, a period when the Optimism Foundation launched the Optimism Quests, a onboarding campaign that would reward participants with an NFT to celebrate their achievement. This is one of the first campaigns where NFTs are used to rewards participants and thanks to its success many other were launched.

Many of the campaigns since have rewarded users with NFTs, so it’s unsurprising that most of the transactions were minting events. Especially because these NFTs are freely distributed and campaigns are running, there is little value for them in the secondary market, so although there is a large number of NFTs in user wallets, this does not and likely will not lead to a lot of sales activity.

But the Optimism Foundation is aware of this and worked to fix it. More on this later.

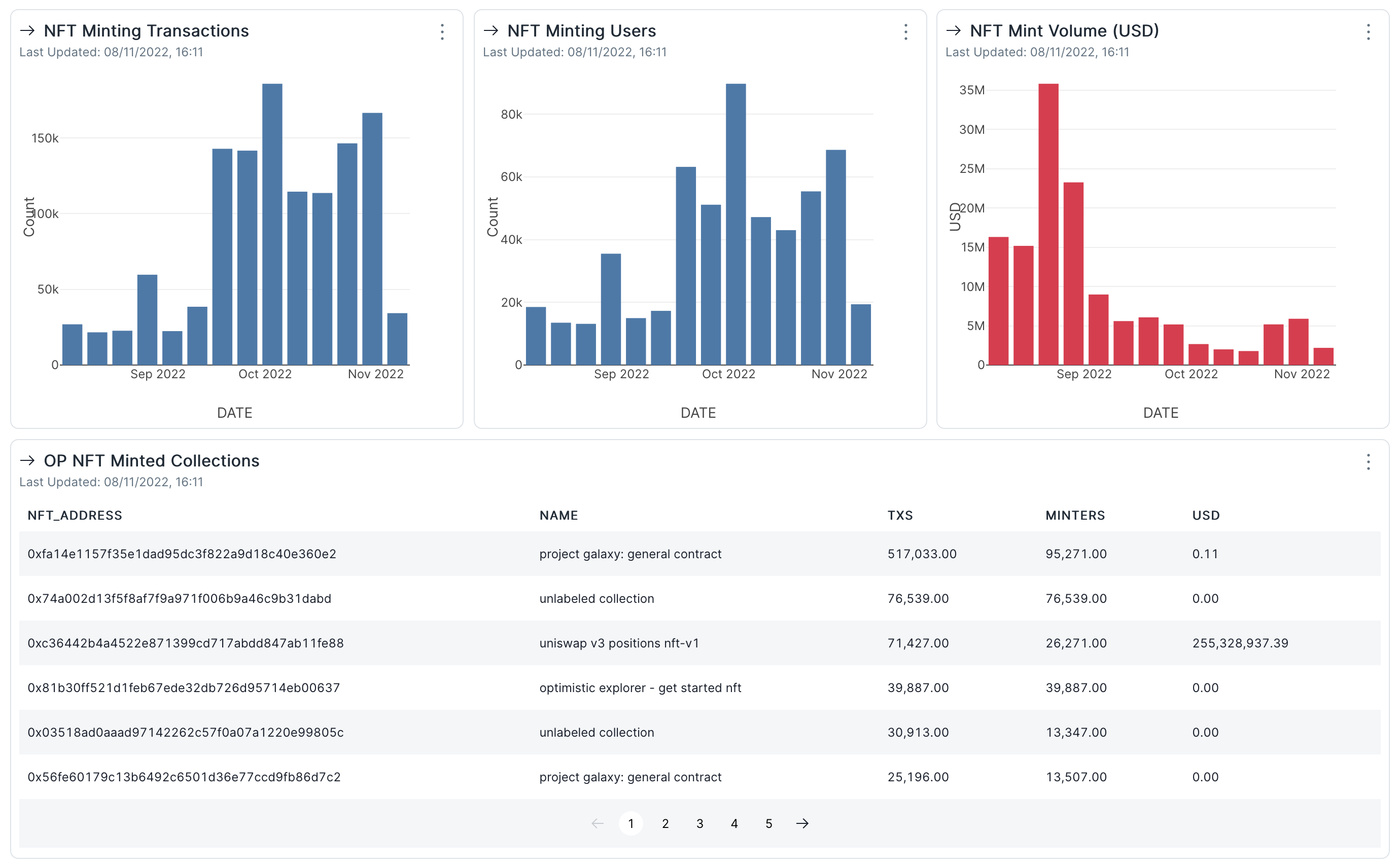

The number of minting transactions skyrocketed in the second half of September and so did the number of users minting NFTs. There are two quick things we can learn about the activity in the last three months from the graphs and table below:

-

Most of the minting activity was centered around rewards programs such as Optimism Quests that are rewarded through Project Galxe, Optimism Explorer and others.

-

Most of the top minted NFTs were free to mint. However, we see a lot of value going into Uniswap v3 positions which are represented through NFTs. Most of that DeFi activity was concentrated in early September and has steadily cooled down ever since.

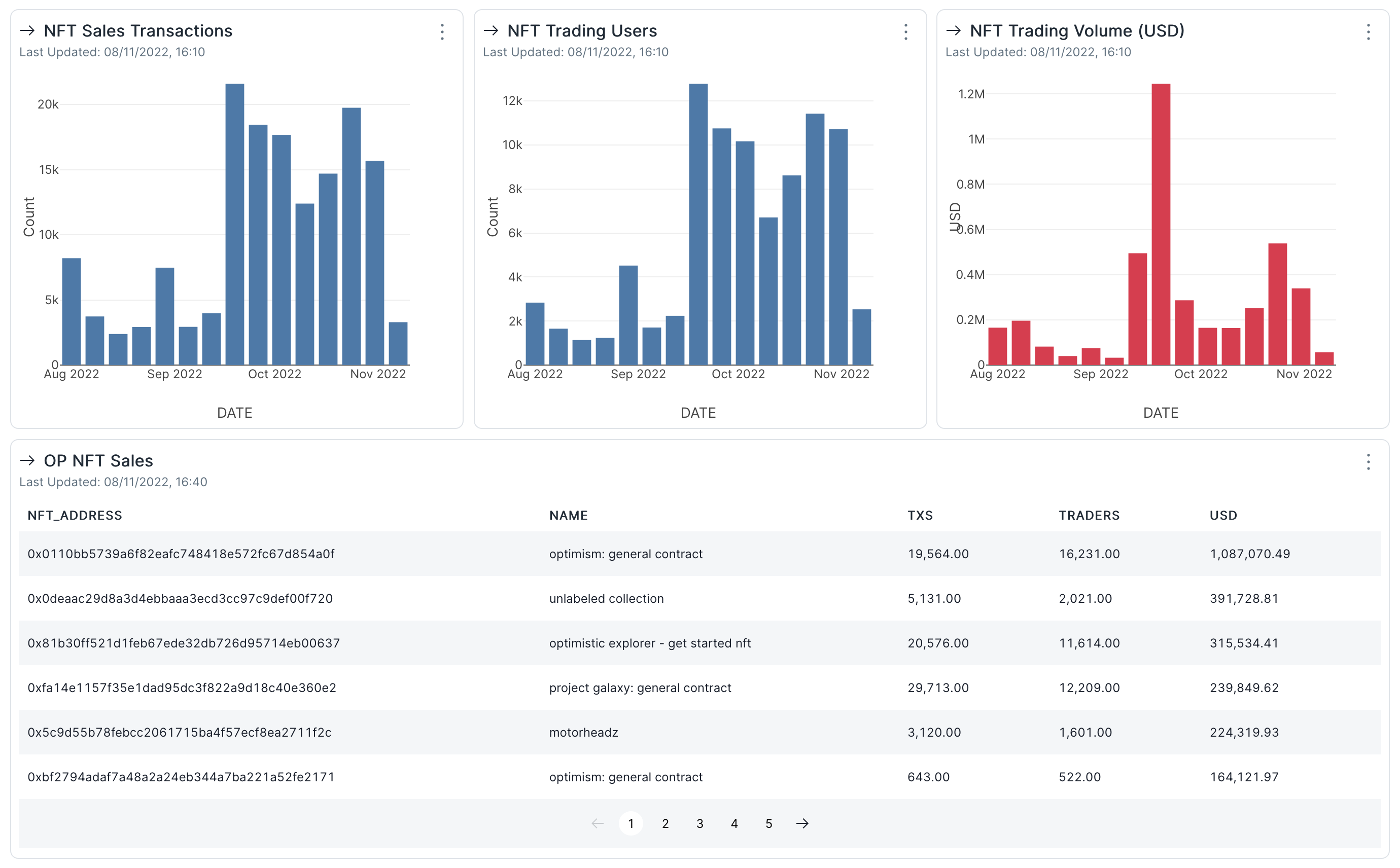

NFT sales had a similar journey by the number of transactions and users, but this time we see a lot more sales volume being made after the busy month of September. This shows that while rewards are free, the onboarded users brought along their capital which they are happy to spend on even more NFT and continue to explore the ecosystem on their own.

Much of the volume can be seen however to go into collections that were free to mint, such as Early Optimists or Optimistic Explorers which might be indicative of users trying to just make some trading volume to earn even more rewards. There are however community projects that were able to make it on the leaderboard, such as Optimistic Ape Yach Club (OAYC), or Motorheadz.

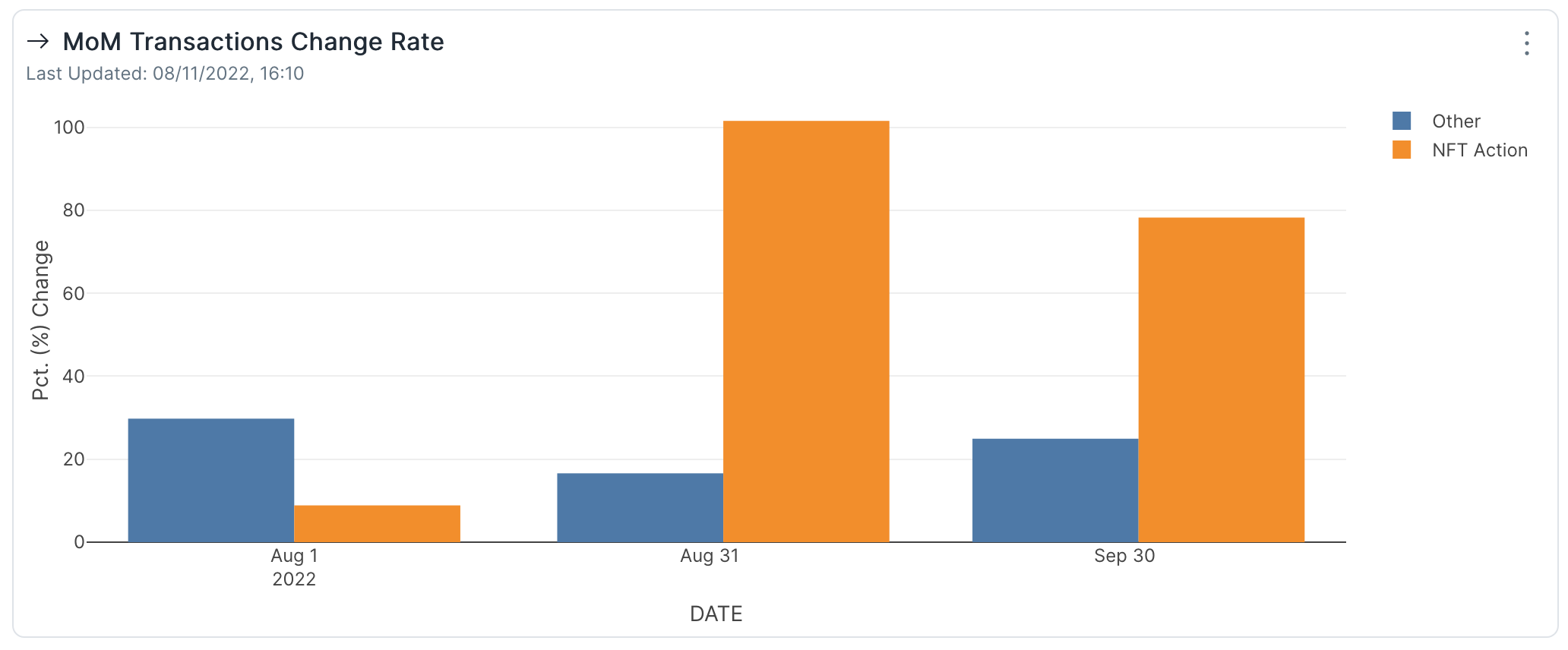

The Month-over-Month change rate of transactions where NFTs were involved has been far greater than other type of transactions. In September, when the Optimism Quests were launched, but also when Opensea landed on the network, there’s been a >100% increase compare to August. Although the month of October did not have the same performance, it’s nonetheless impressive at just under 80% and shows that Optimism had the right intuition to expand their involvement in NFT-related initiatives.

II. Users

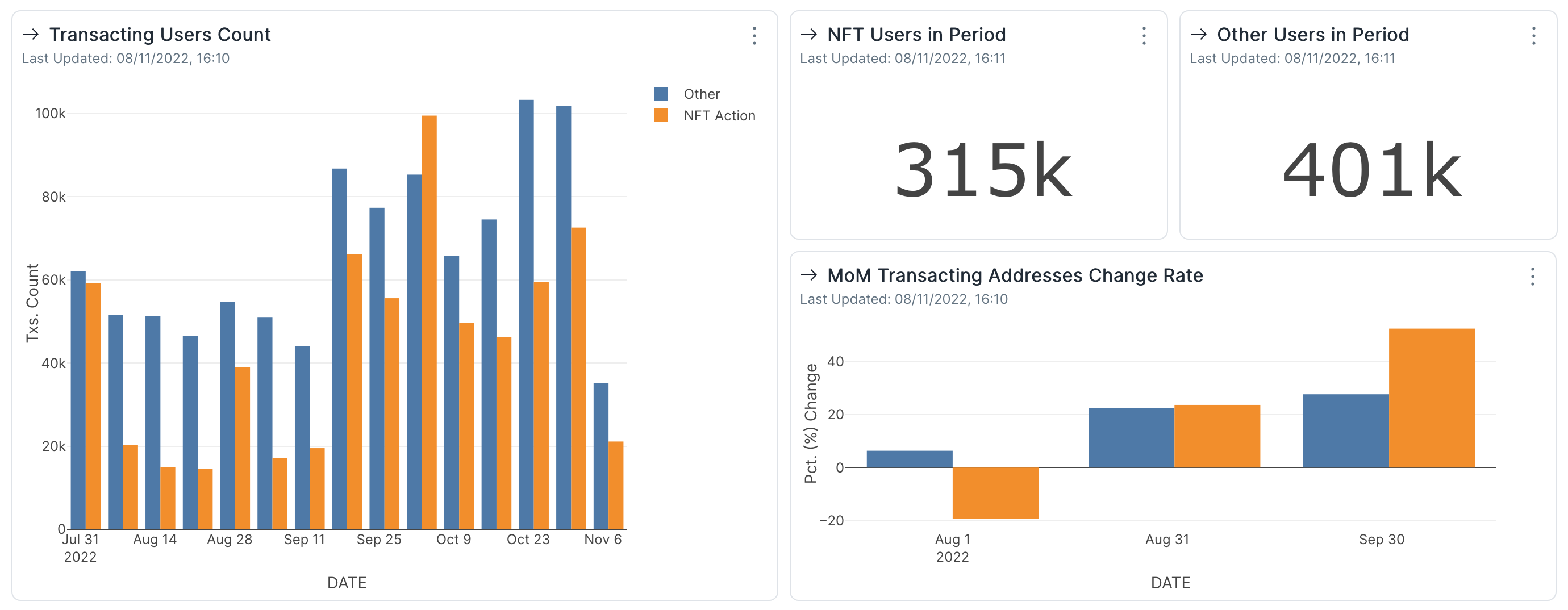

By the number of users interacting with NFTs vs Other transactions types, the difference is much smaller. In fact, there is even one week in early October where there were more users interacting with NFTs than with anything else. Over the last three months, there have been almost as many NFT users as for anything else, once again proving the popularity of digital assets on the Optimism network.

MoM we can see again NFTs increasing in popularity and doing so in a much more accelerated manner than for all other aspects of the L2.

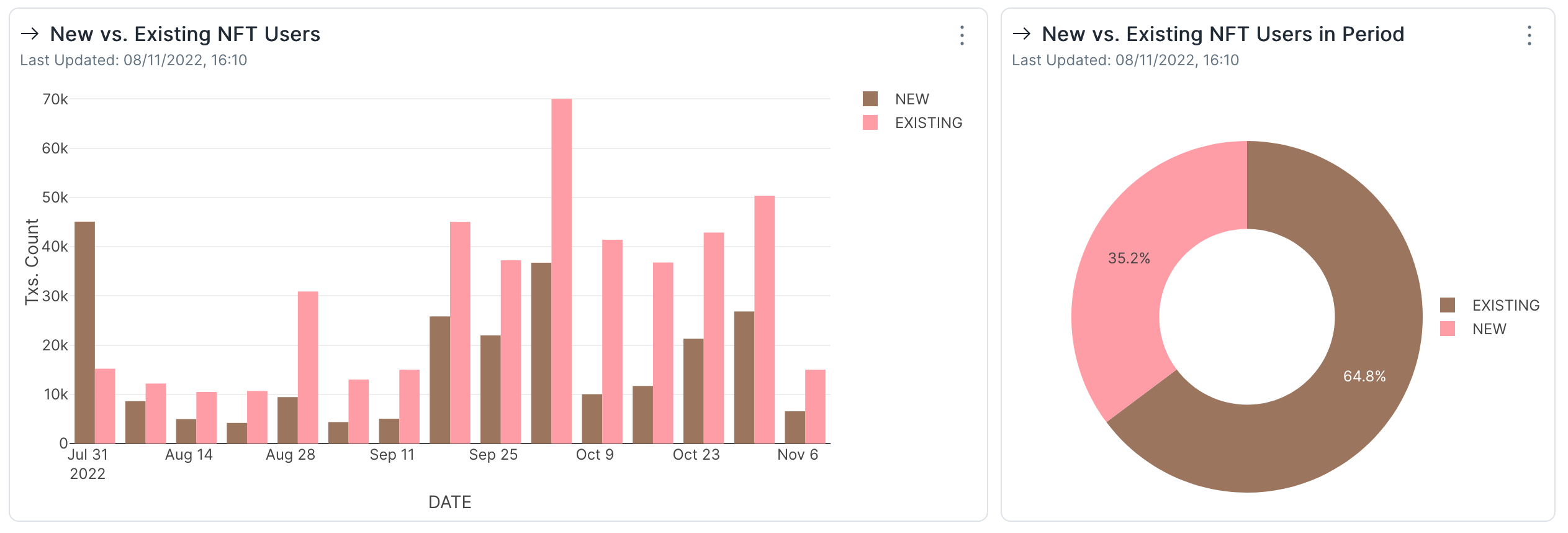

Narrowing things down to just NFT users, we see a healthy amount of new users hopping on the NFT train. Considering the nature of many of the NFT campaigns however, it’s actually good to see that many of the transacting users are actually repeat (existing) users, pointing toward a successful onboarding following their initial interaction with one of the increasing number of NFT projects they can choose from.

III. Bridgooors

Remember what I was saying about free mints that won’t lead to a lot of sales? There are two solutions to that:

-

Community projects native to Optimism

-

Projects from the Ethereum Mainnet

The second option is technically difficult, but that did not stop the Optimism Foundation and Quix to build their own NFT bridge that users can use to send digital assets back and forth Optimism and the Ethereum Mainnet.

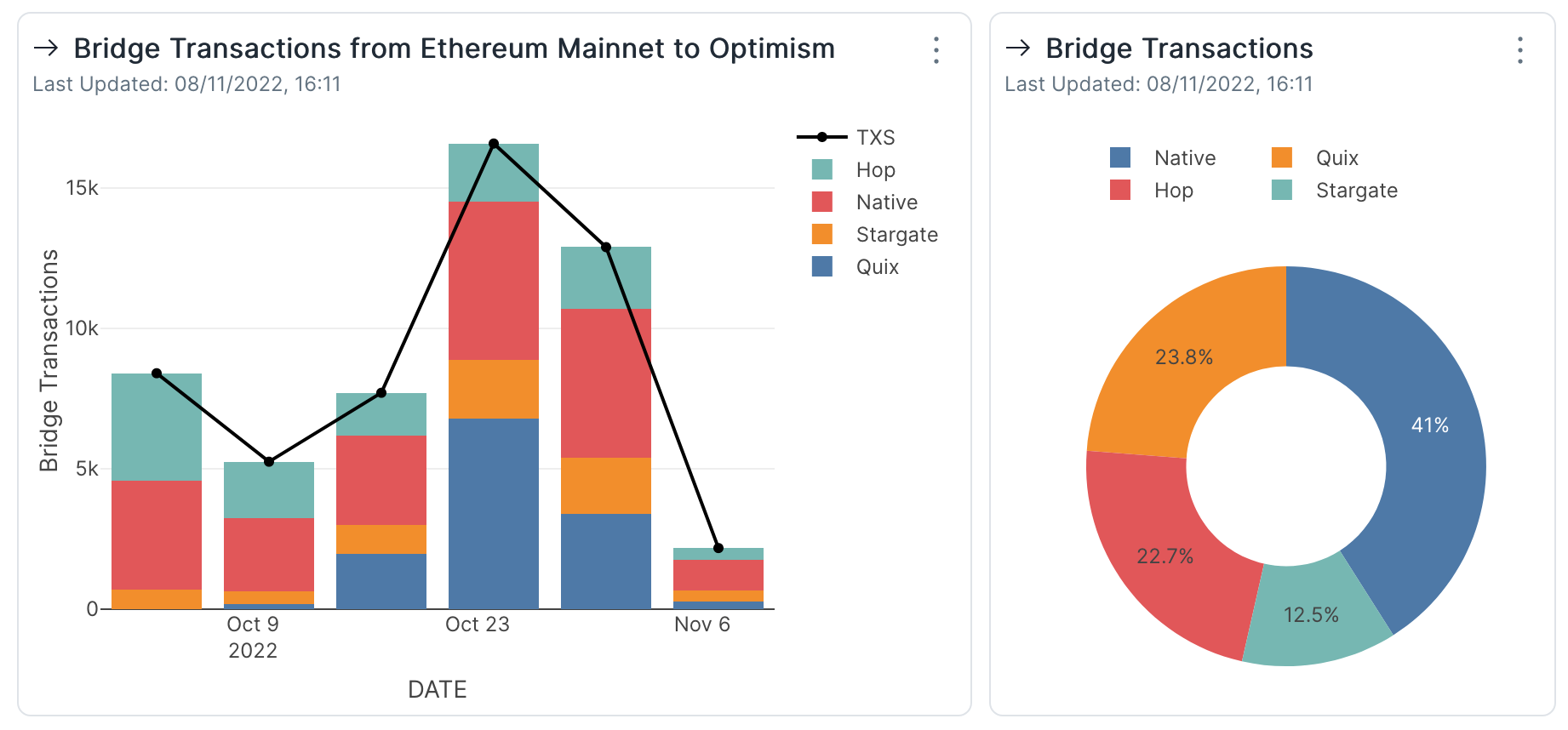

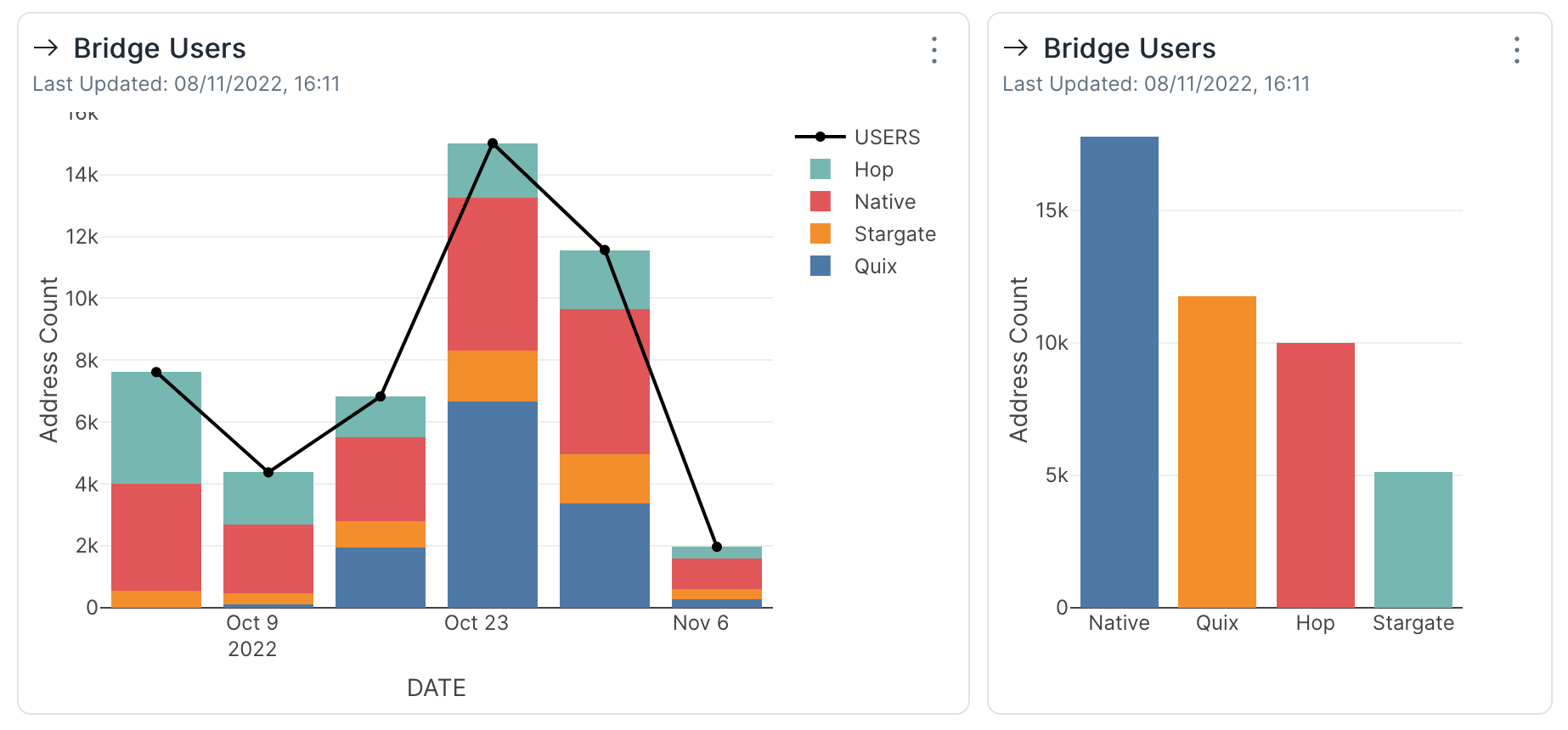

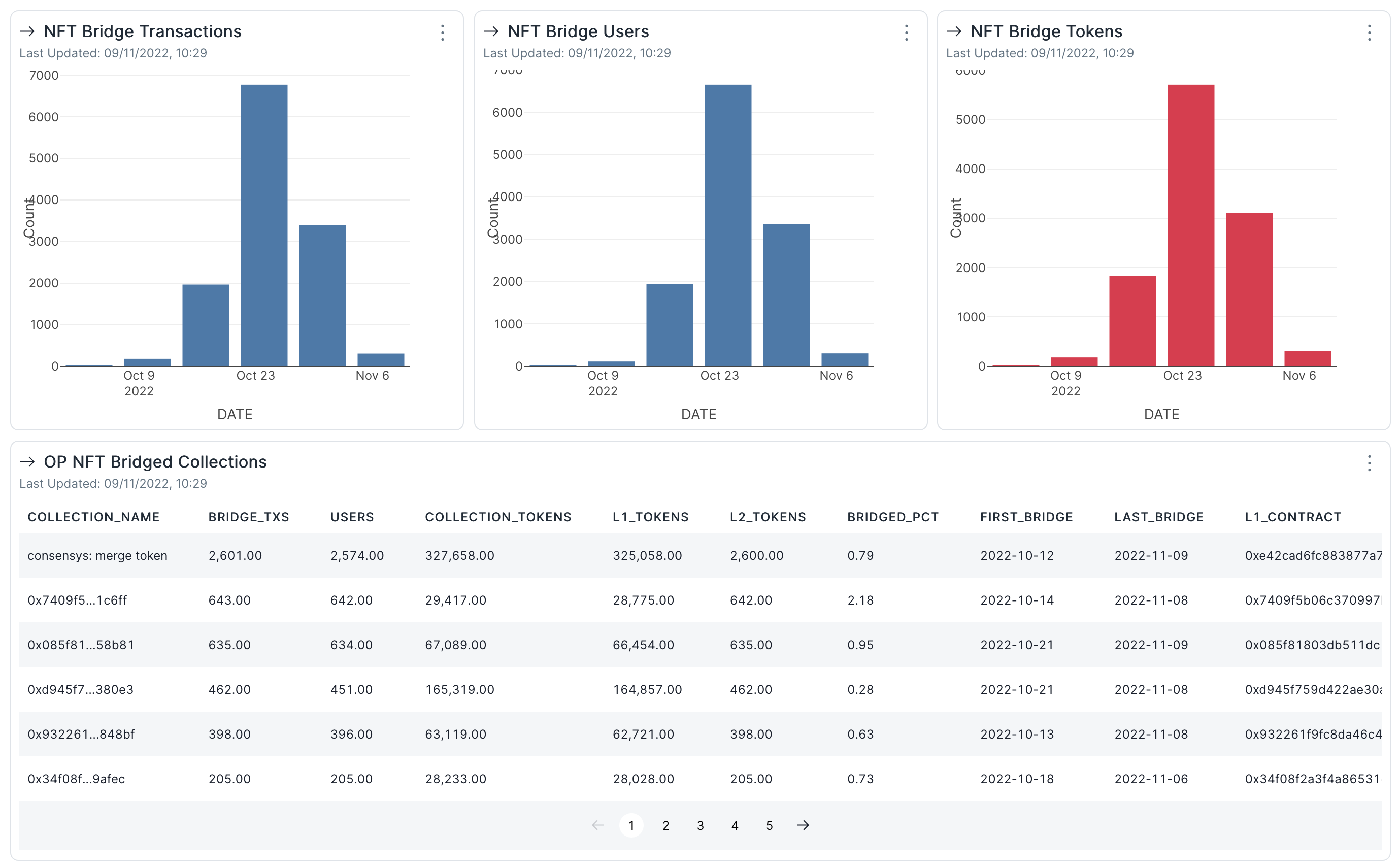

While there have been a lot of bridges functioning between the two networks for as long as the L2 itself, the launch of the NFT bridge proved to be extremely in demand. Over the observed period, we can see the Quix bridge occasionally having as many transactions as the rest of the bridges combined, despite being launched just a little over a month ago, on October 5. Since then, transactions on it represent almost a quarter of all bridge transactions.

And this success is not by the number of transactions either. In fact, it can be said it’s even more successful by the number of users, second only to the Optimism native bridge for this period.

With the bridge still being so new, it’s unsurprising that many of its users are new. However, despite its success, we don’t see a lot of recurrence for bridge users who mostly only bridge one NFT and then rarely come back over the following weeks.

So far there have been a lot of collections bridged from the Mainnet, but only a small percentage of their collection size has hit the L2. At the same time, we can’t yet see any of the largest collections crossing over the bridge and it is somewhat understandable. Bridges have been the victim of many hacks over time and the NFT community of Ethereum, despite the apearances, is not too keen to make any risky moves with their most valued NFTs.

In the limited time we can observe since launch, we see there’s been a lot of initial excitements to test the bridge but that faded off a little over the last week. But as time goes by, the Optimism NFT market develops and the Bridge continues proves its reliability, so we can expect more activity from users looking to prevent getting caught in the gas wars that plagued previous NFT cycles on the Mainnet.

Conclusions

-

NFTs play an increasingly prominent role in the activity of the Optimism network by the number of transactions and users interacting with the tokens. Furthermore, NFT interactions have much greater MoM growth rates than for the rest of the ecosystem.

-

Much of the growth in NFT interactions was fueled by the many onboarding campaigns ran by the Optimism Foundation and its partners that rewarded users with free mints.

-

NFT as artwork, identity and rewards are not the only use cases users interacted with, and we can see a lot of activity around Uniswap v3 LP position NFTs. However, the activity around DeFi NFTs gradually slowed down over the last three months.

-

The free mints system does not lead to a lot of secondary market activity but users continue to explore the ecosystem, leading them to eventually interact with native NFT collections and the rest of the projects that Optimism has to offer.

-

Doubling down on the NFT use case of the network, the Quix NFT bridge proved itself to be an effective way of bringing over users from the Ethereum Mainnet and onboarding them to the L2.

-

Optimism was right in identifying NFTs as an in-demand use case for blockchains that would be a lot more accessible on a fast, inexpensive network and we can expect this sector to continue to fuel growth on the L2 in the following period.