Solana has been extremely busy this week trying to contain the mayhem created by the fall of FTX and Alameda, two of the largest entities with a stake in the Solana blockchain and ecosystem. One of the greatest threats posed by a sudden and dramatic decrease in the price of $SOL is that locked tokens will be unstaked and leave the Proof of Stake network a lot less secure and descentralized. But while regularly those staked tokens have to go through a cooldown period until the end of their staking epoch, liquid staked tokens through staking pools can be either unlocked instantly for a fee or swapped on the open market.

In this report we’ll have a look at Solana staking pools and their users activity in response to recent events.

When a user deposits tokens through a liquid staking provider, they receive tokens representative of their stake (mSOL, stSOL etc.) that they can then use as they please. Most providers offer two unstaking options: fast or slow. Usually the fast option instantly unlocks the staked tokens and send them to the user for a fee, while in the slow option has no fee but tokens go through the normal unstaking process through the end of the epoch.

For simplicity, both the fast and slow unstakes will be grouped under the WITHDRAW label as their initiation burns the representative tokens and the stake is no longer part of active stake pending withdrawal.

The time frame used in this report starts on November 6 at the start of the FTX and Alameda downfall and spans to the current_date at the time of writing, November 14. The time frame can be adjusted using the dashboard parameters start_date and end_date.

All of the data and queries can be further explored and interacted with in the live dahsboard below:

☝️ The dashboard can be updated on-demand by pressing the refresh button 🔄 in the top right corner of the page.

I. Staking Pools Activity

For the first couple of days we see just under 300 daily transactions and around 200 users, but starting on November 8, as the financial trouble rumors about FTX and Alameda were turning to more than rumors, users reacted and activity spiked across all liquid staking providers. Following the market share split of providers, most activity can be observed on Marinade and Lido, in almost equal proportions over the observed period.

The daily activity peaked on November 10 and gradually decreased over the following days as people seem to have either exhausted their options or wait to see where the market will go next before they make any other actions.

Unsurprisingly give the current context, most of the activity was the result of users trying to withdraw their staked SOL and presumably reduce their exposure to the asset. Over the observed period only BlazeStake had a net increase of staked tokens, whereas all other protocols had a lot of tokens withdrawn. In the case of Marinade, withdrawals were exceeded deposits by 2.3M SOL, followed by Lido with a similar difference of 1.9M tokens.

Although we’ve see the most activity on November 10, the most $SOL was withdrawn two days before that, on November 8. This shows that larger stakers were quicker to react to the news and positioned themselves accordingly.

We can see however that across the board it’s not been a one sided week, but there have been a lot of deposits as well. Furthermore, we can see that initially both deposits and withdrawals were ramping up, but deposits hit a break on November 10, as the insolvency news of FTX and Alameda discouraging users from staking their tokens.

Over the last few days however we see withdrawals have considerably slowed down and deposits are ramping back up, with Lido leading the charge.

II. Price Reaction

The price activity we can observe above have given $SOL traders and users a huge price range to take action.

We can see a lot of volume being withdrawn just under the $30 price point, most likely shortly after the rumors started to spread, and on November 8 when we could see the most volume. As the price went down and more people became aware and their concerns grew, we see a lot more transactions and volume, especially withdrawals between $12 and $20.

*There are a few withdrawals and deposits made at $40 and $50+ but they are very likely price anomalies as the on-chain $SOL swap price at the time of each transaction is being used as a reference.

Using the distribution of transacting users below, we see that most users only reacted once the price fell below the $20 price from its average price of $36 at the start of the observed period. The over 40% decrease in such a short amount of time seems to have been their trigger to finally withdraw their stake.

Interestingly, the number of depositing users does not change all that much after that point, and we can see a lot of depositing users on the way down, indicating that perhaps many of them saw what was happening as nothing more than news meant to scare the market and quick to blow over. Unfortunately for them, the news proved to be a lot more serious and with higher consequences over the price of $SOL.

III. Swapped Tokens

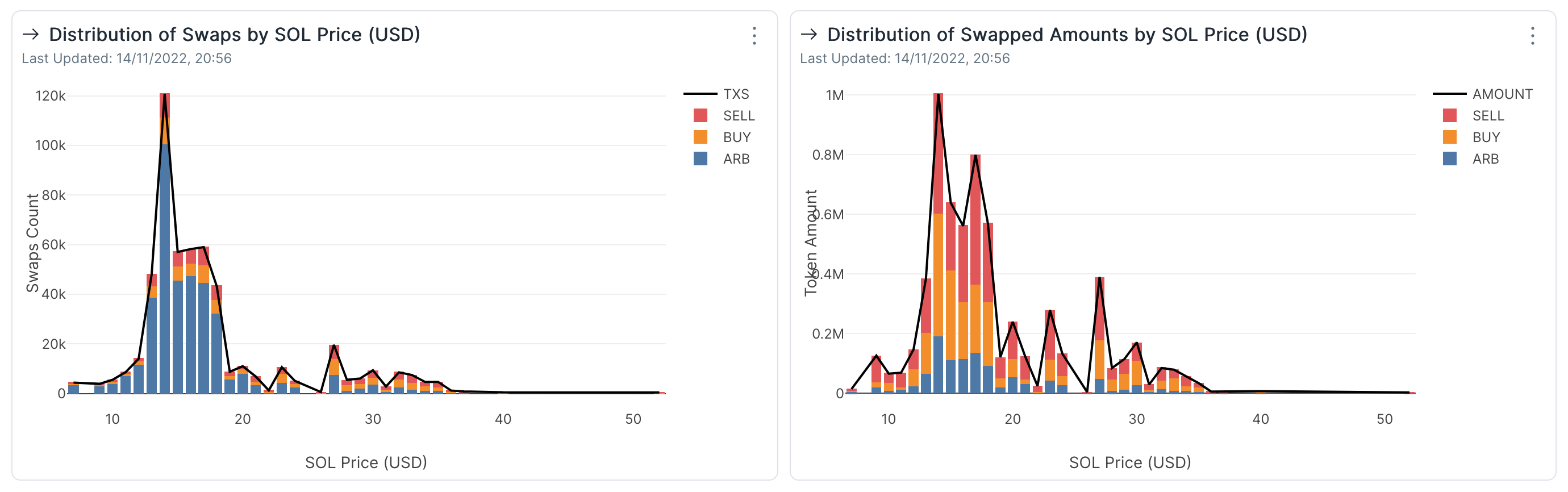

Just as with deposits and withdrawals, we can see swapping activity of liquid staked SOL spiking as the price fell below the $20 price point. By the number of transactions, there has been a lot of arbitrage being made thanks to the large swap volumes we can see on the right, which open a lot of such opportunities across exchanges.

But by volume of tokens (all of them being worth more or less 1 $SOL), arbitrage swaps only represent a small slice of the activity over the observed period. Instead, we can see a lot of regular swaps being made and a surprisingly tight difference between the amounts bought and sold over most of the price range in this period.

The swap activity overwhelmingly went through the Jupiter aggregator as it is one of the most convenient method of finding a good exchange rate and sufficient liquidity, especially as liquidity was spread pretty thin given the sudden surge in demand.

After the gradual ramp-up in transactions from November 6 to November 10, the overall activity decreased by around 40% but remained at a high level. At the same time, volume did follow a similar ascending trend over the first few days, but swap volumes have been considerably lower over the last few day, resembling the activity at the start of the observed period.

The most traded tokens by volume were stSOL and mSOL, the two making up almost the entire volume. Their swaps distribution is similar across the price range of the period.

Similar to what we saw in the case of direct interactions with liquid staking platforms, we see quite a lot of buying activity right under the $30 price, with people probably trying to catch “the dip”. However, as the price of $SOL maintained its downward trend, the amount of tokens being sold substantially increased.

Now that we’ve been in the $13-$16 price range for a few days, we see swap volumes consolidating in that range.

Conclusions

-

Most stake pool users were pretty slow to react to the events that went on after November 6 and overwhelmingly made the decision to withdraw their stake once the price of $SOL decreased more than 40% in a matter of days to under $20.

-

The most withdrawal volume was recorded on November 8, two days before most users took any action. The “smart money” were quick to react to the news and position themselves accordingly.

-

The two largest stake pools, Marinade and Lido had huge withdrawals since November 6, exceeding deposits by 2.3M SOL and 1.9M SOL respectively. Only one out of the 7 providers included in the report, had a net increase in stake over the period with deposits exceeding withdrawals by 5k SOL.

-

After peak withdrawal hysteria on Nov 10, withdrawals slowed down considerably and deposits are increasing again.

-

Swap activity spiked under the $20 price point, progressing to a peak of activity and volume over a similar timeline to direct stake pool interactions.

-

Almost the entire swap volume was made by stSOL and mSOL, which traded in similar ways over time and over the observed price range of the period.

-

Now that the price has been in a more or less stable range for a few days, we see stake pool users regrouping and activity shifting more towards deposits. However, this shift is still modest as many previous users have already suffered losses of up to 40% depending on their entry price and for this reason they will likely be more patient before repositioning and reentering a stake pool.