As the FTX situation was unraveling, the Solana community quickly realized that a core piece of infrastructure might be at risk. Despite Serum being run by its own DAO, the program update key was actually in the hands of someone connected to FTX, but no one knew who that was. Even more concerning is that on Nov 13, FTX itself was the subject of an apparent exploit, casting even more doubt over the security of the protocol, which could put at risk everyone interacting with Serum.

At this point, the community had two options to choose from: kill it or give it a new life. In a grand display of coordination and solidarity, a few smaller teams joined forces to deploy a functioning fork of the Serum v3 DEX program during the same day, now named OpenBook.

In this report we will have a closer look at the activity and liquidity accumulated in the two weeks that have passed since its launch.

We are going to mainly focus on only two aspects, key to an order book protocol:

-

New orders

-

Markets liquidity

Note: New orders can be placed directly through the supported UIs or through an aggregator. When aggregated, the process of deposit > order > match > withdraw is automated, but otherwise users must settle funds or can keep on trading them on the platform.

All the charts, data and queries can be further inspected and interacted with through the live dashboard below:

☝️ The dashboard can be updated on-demand by pressing the refresh button 🔄 in the top right corner of the page.

I. Program Activity and New Orders

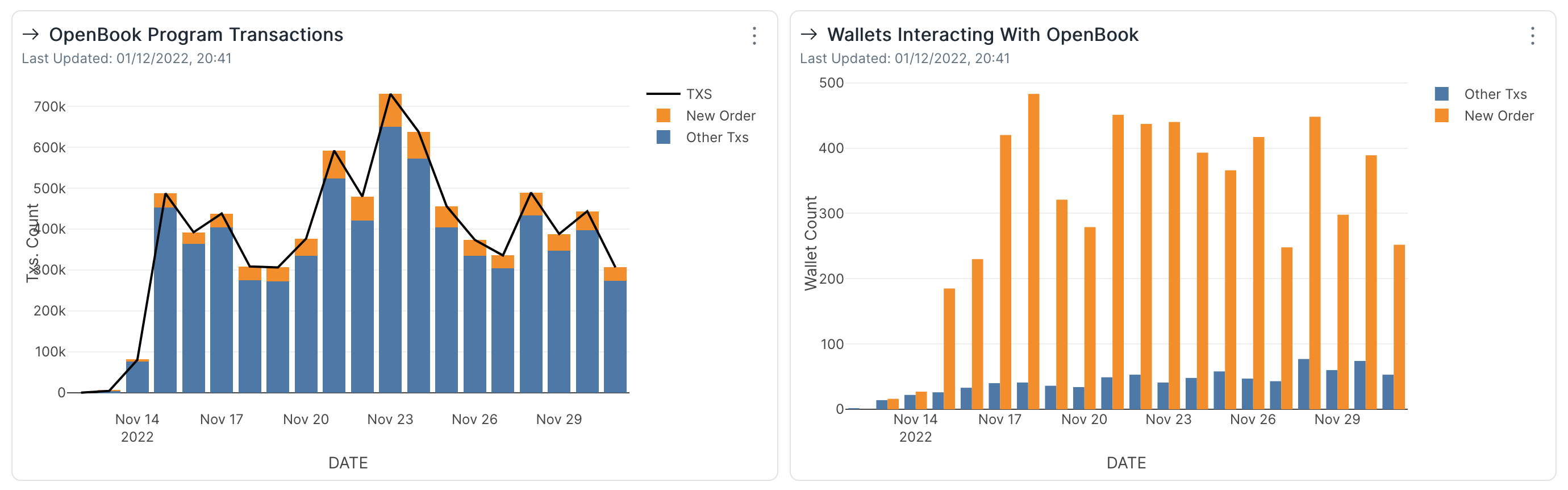

We can see activity starting to roll in immediately after deployment and then shoot up as its release became public. Somewhat cyclical so far, the number of daily transactions peaked at over 730k on Nov 23, but for most of the time the count stays in a range of 300k - 500k.

Out of all transactions, we see that only a small proportion of them are actually New Orders being placed, where a positive net amount of tokens is being added to the order book. Unsurprisingly, there are a lot of other transactions being made on the side of that as many other components have to work together to make sure the book is kept in good order, create new markets, manage accounts and so on.

On the upside, we see that there are a lot more wallets using the protocol for what it is and place new orders to the book. The two categories do not mean a wallet exclusively does one action or the other, and the addresses might overlap.

The number of wallets placing orders peaked early on Nov 18, but daily counts have remained in a stable range, although slightly downward trending over the last week. Given the circumstances of its launch, in the wake of the FTX collapse, from the ashes of a potentially compromised protocol and with a backdrop of a year-long crypto winter, it’s a rather encouraging user base. Although still a young deplaoyment, it received a lot of support from the wider ecosystem that had it integrated with protocols such as the Jupiter aggregator and Raydium, which are responsible for most of the transacting wallets the protocol had so far.

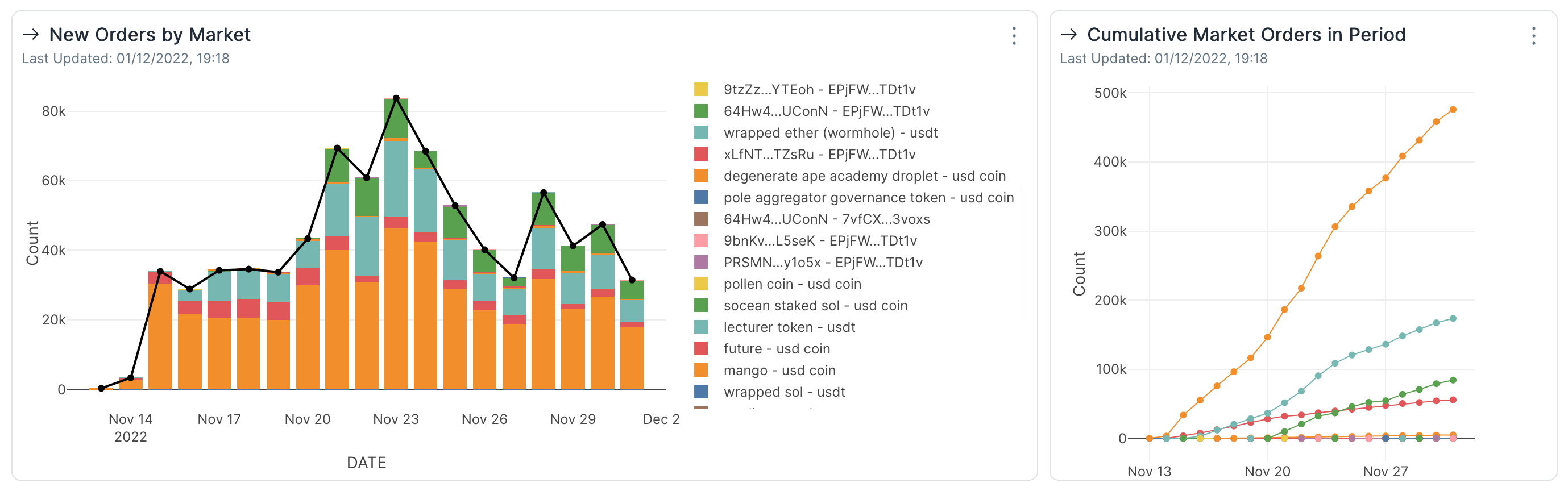

Out of the 37 markets currently open, we can see just a handful of them bringing in most of the new orders. Unsurprisingly, even out of that small group, the most orders by far are being made on the wSOL-USDC market, one of the quintessential pairs of the ecosystem. Since launch, it accumulated over 470k new orders, with over 790M USDC (quote asset amount) and 33M SOL (base asset amount) flowing in through orders.

By the number of orders placed in the period, the market is followed by mSOL-USDC with 174k, scnSOL-USDC with 84k and wETH-USDC with 56k.

Although the new orders activity started out strong, it’s starting to slow down as the order books get filled and many of the listed pairs are currently trading in a more stable range.

A full list of markets and the orders placed during the period can be found in the full dashboard. A transaction can place both a SELL and a BUY order at the same time, so one transaction does not always equal one order.

II. Markets Liquidity

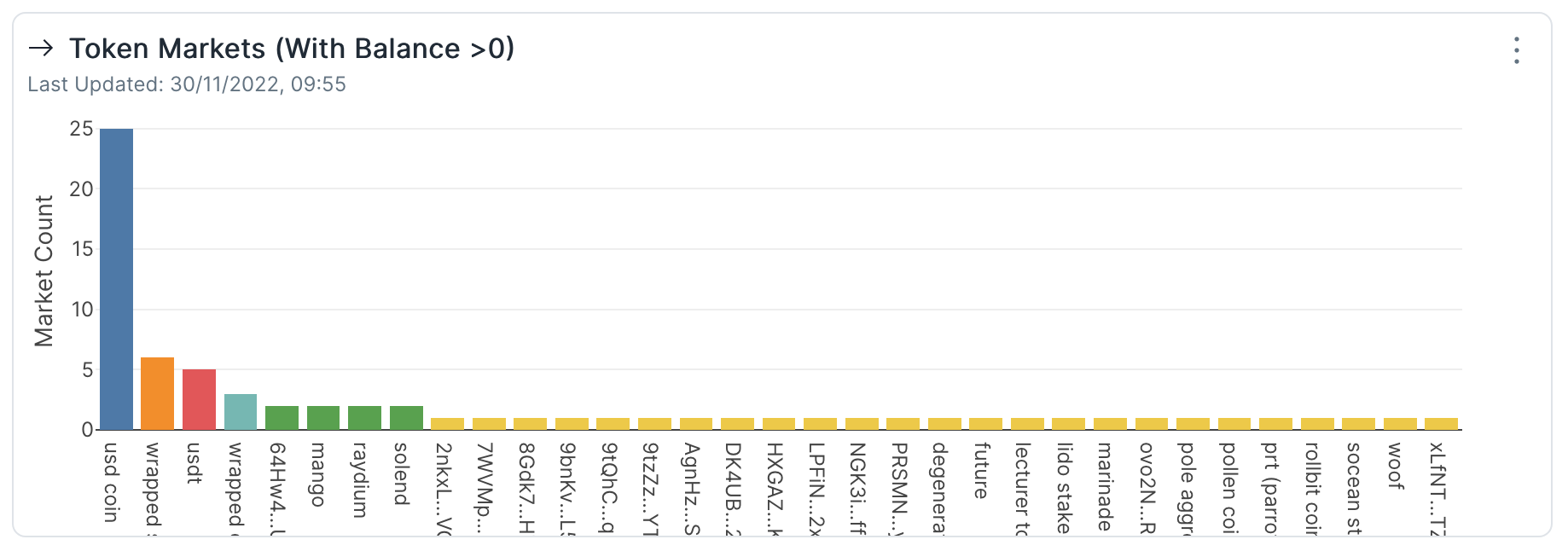

The asset being paired the most on OpenBook is USDC with 25 markets currently open, followed by wSOL and USDT. As we’ve also seen in the previous section, these are the tokens with the most orders across their markets as well so we will focus on the liquidity accumulated on the order book by these assets.

The liquidity overview will be split into two categories: one for stablecoins and one for SOL and its derivative tokens such as mSOL and stSOL.

*Note: The liquidity represents the total token amount balance of each OpenBook vault of the selected asset. They include open orders and unsettled funds.

SOL & Derivatives

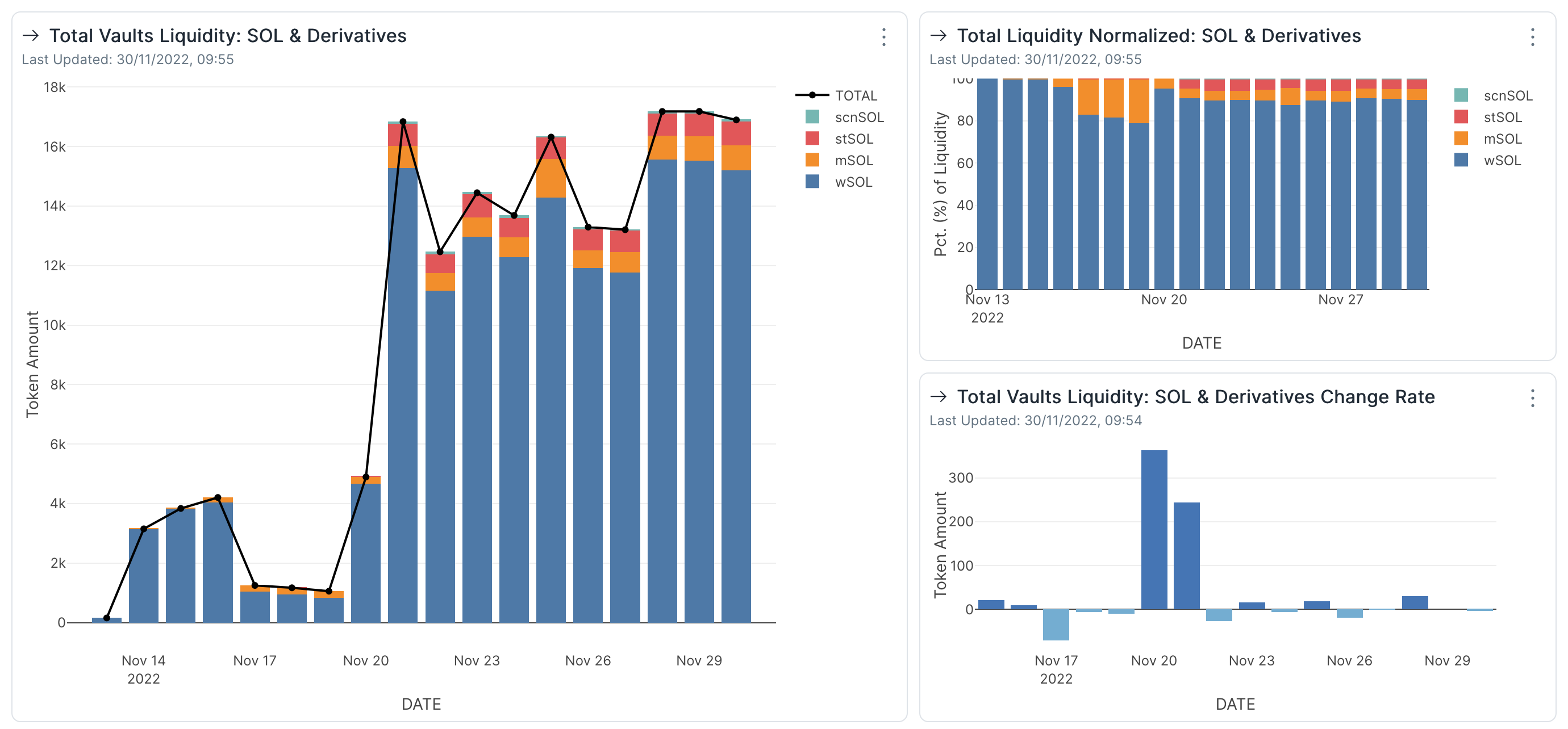

In the beginning there was only wSOL, and it pretty much stayed that way for the first few days. Then we can see mSOL being added and making up ~20% of the liquidity in this token category for a short period. Soon after stSOL and scnSOL were also introduced to the order book, but throughout the observed period wSOL remained the dominant asset.

The total token amount had modest beginning and during the first few days it peaked at only a few thousand SOL, after which it fell down to a little over 1k. The reluctance or hesitation to add a large amount of funds to a protocol that went live just a few days before is understandable, but market makers were quick to get past that as OpenBook proved to run efficiently received more support from the Solana DeFi ecosystem.

The token amount in this category reached a peak of over 17k tokens and has maintained a somewhat stable range between 13k and 17k over the last week.

Stablecoins

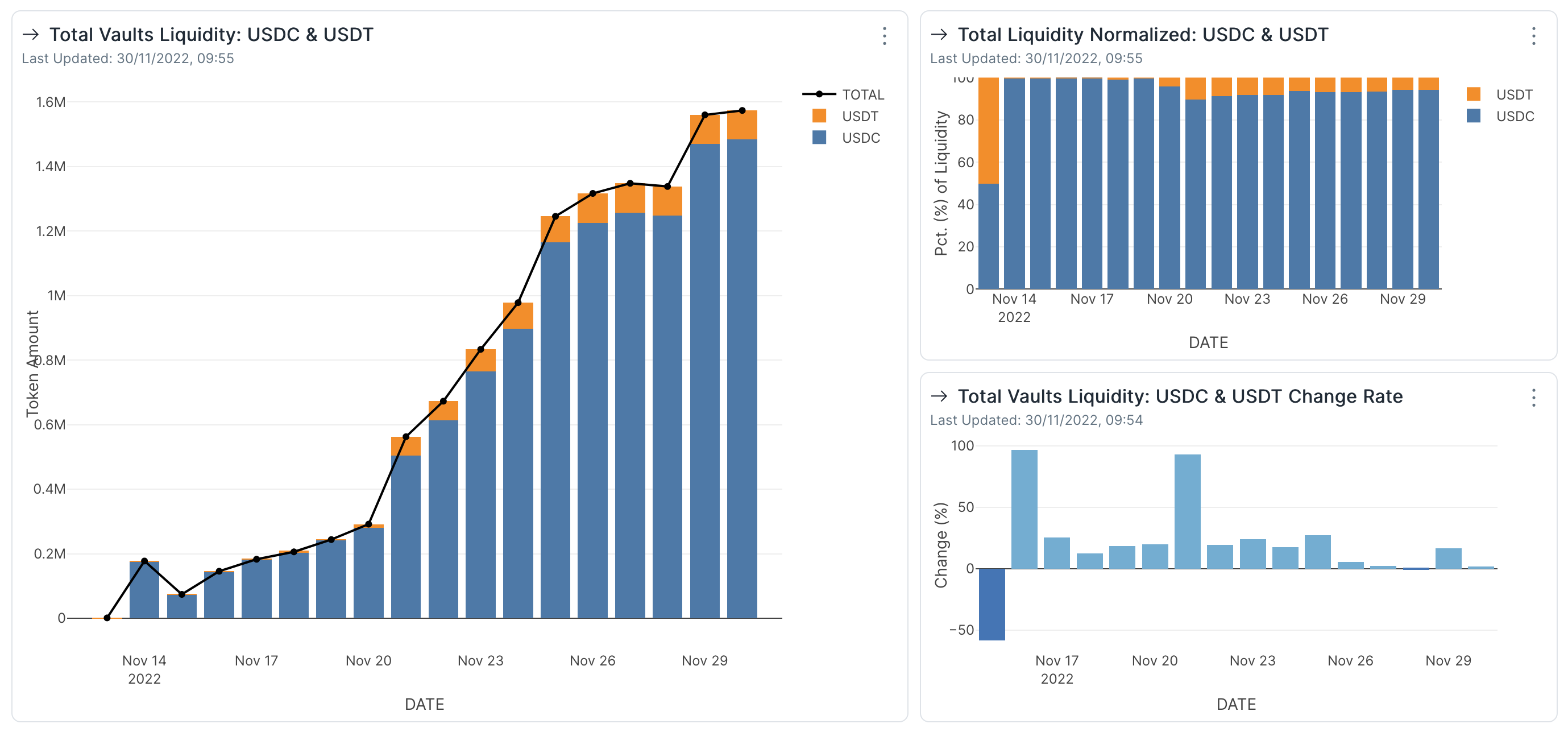

In the case of stablecoins, we can see again a precautious start but followed by a more gradual and sustained increase to the current level of over 1.57M tokens. With the exception of the first day when both tokens had a total balance of a little over 1k, USDC has represented the dominant stablecoin on the order book.

We see for this category that the amount of tokens stored in OpenBook vaults is still on a positive DoD Change Rate streak, but slowing down over the last week.

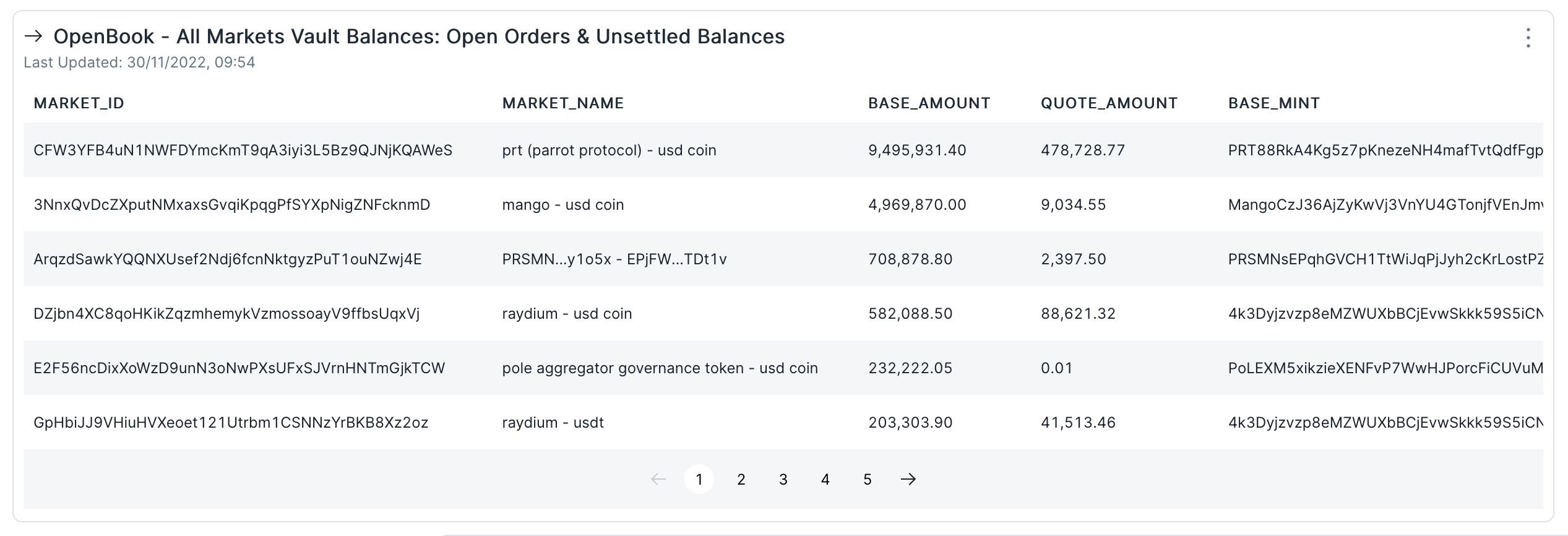

A complete table of all the other markets and current vault assets can be found in the live dashboard:

Conclusions

-

Following the successful fork and deployment of the Serum v3 DEX into OpenBook, we can see activity quickly building up, although only a small share of transactions are actual orders but only as a side effect of how the protocol is built.

-

When filtering for user actions, we see many of the transacting wallets actually placing orders and making real use of the protocol, but the overall count is rather small. In its defense however, it is a protocol being launched in the wake of the FTX collapse, from the ashes of a potentially compromised protocol and with a backdrop of a year-long crypto winter.

-

As one might expect, most of the orders so far were made on wSOL and stablecoin-paired markets, coinciding with the largest count of currently open markets by asset.

-

There are over 16k SOL and SOL derivative tokens being held in OpenBook market vaults as open orders and unsettled balances, a level within a relatively tight range that was maintained over the last week.

-

In the case of stablecoins, there are over 1.5M USDC and USDT tokens sitting in vaults, with the asset category being on an upward trend since the begining, albeit one that’s been slowing down over the last week.

-

Current activity on OpenBook, although modest at first sight, already puts it in the top 5 Solana DEXs based on recent activity according to DeFiLlama. As more of the ecosystem pitches in to shape the future of the protocol and integrate it into their own products, OpenBook is likely to earn a permanent spot among the top sources of liquidity on Solana.