One of the backbones of any DeFi ecosystem is having a place where you can quickly access liquidity and exchange assets in a trustless, decentralized way. In other words, any smart contract blockchain needs a Decentralized Exchange. In this report we will have a look at three of the largest DEXs on the Optimism Layer 2 network and compare their performance over the last month.

The dashboard below contains all the graphs included in the report which can be further interacted with and explored. The default parameter values used are months = 1 and date_trunc = day but they can all be adjusted and experimented with using the parameter fields at the top of the dashboard.

☝️ The dashboard can be updated on-demand by pressing the refresh button 🔄 in the top right corner of the page.

I. Transactions & Volume

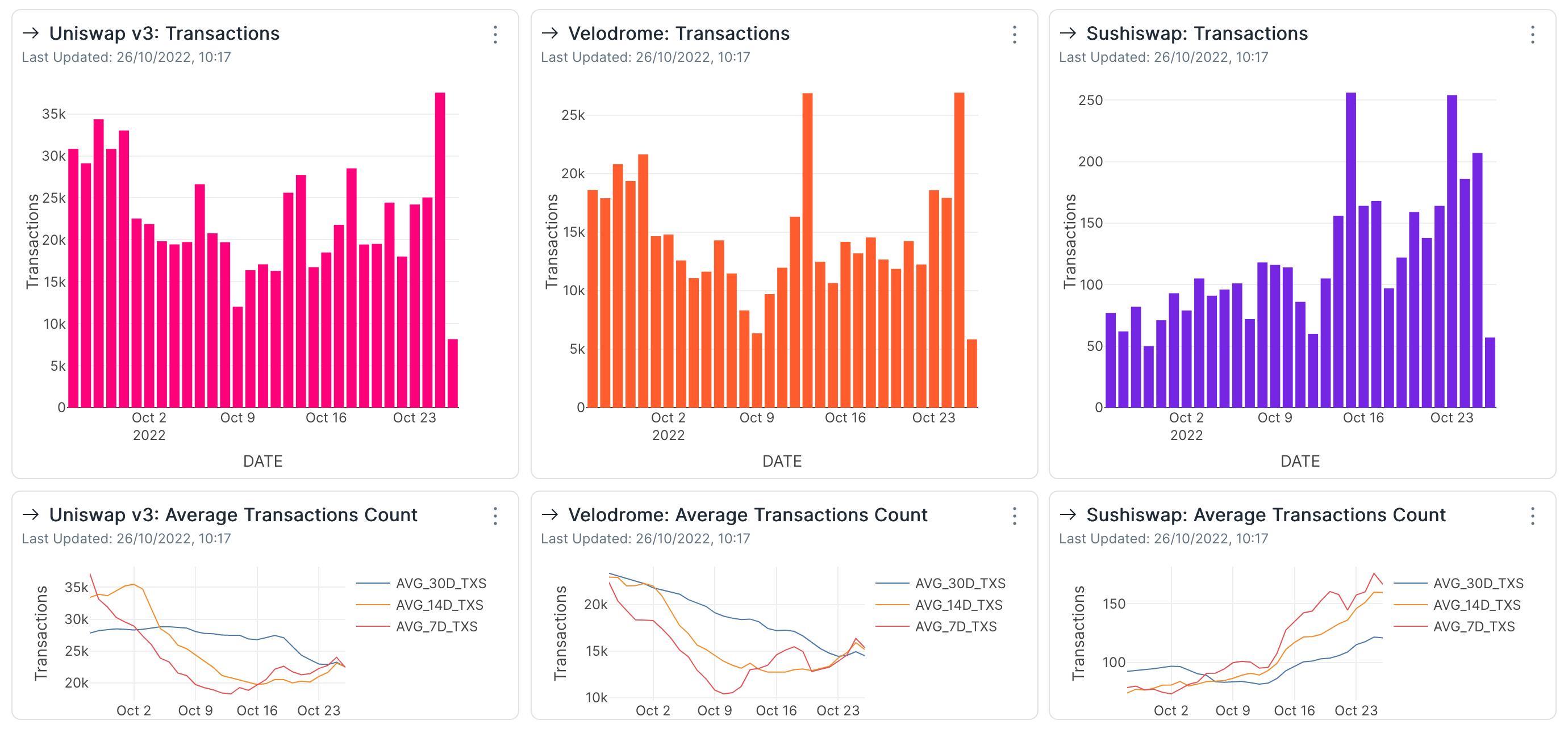

Over the last month we can see that out of the three DEXs, Uniswap and Velodrome operate on a similar scale, while Sushiswap has considerably less activity.

Uniswap v3 and Velodrome closely resemble each other both by transaction counts and the overall trend they’re following. We can see the two having a decline in transactions in the middle of the observed period, but that quickly recovered and they both currently have activity levels similar to the start of the period. In total, Uniswap executed 700k transactions and Velodrome 454k over the last month.

Although Sushiswap seems like it is just getting started (it is also the last of the three to move to Optimism), this past month looks promising. It went from and average of 70-80 daily transactions to now over 160-170, doubling its activity, and continues to push even further on a well sustained uptrend. In total, Sushiswap executed 3.7k transactions in the last month.

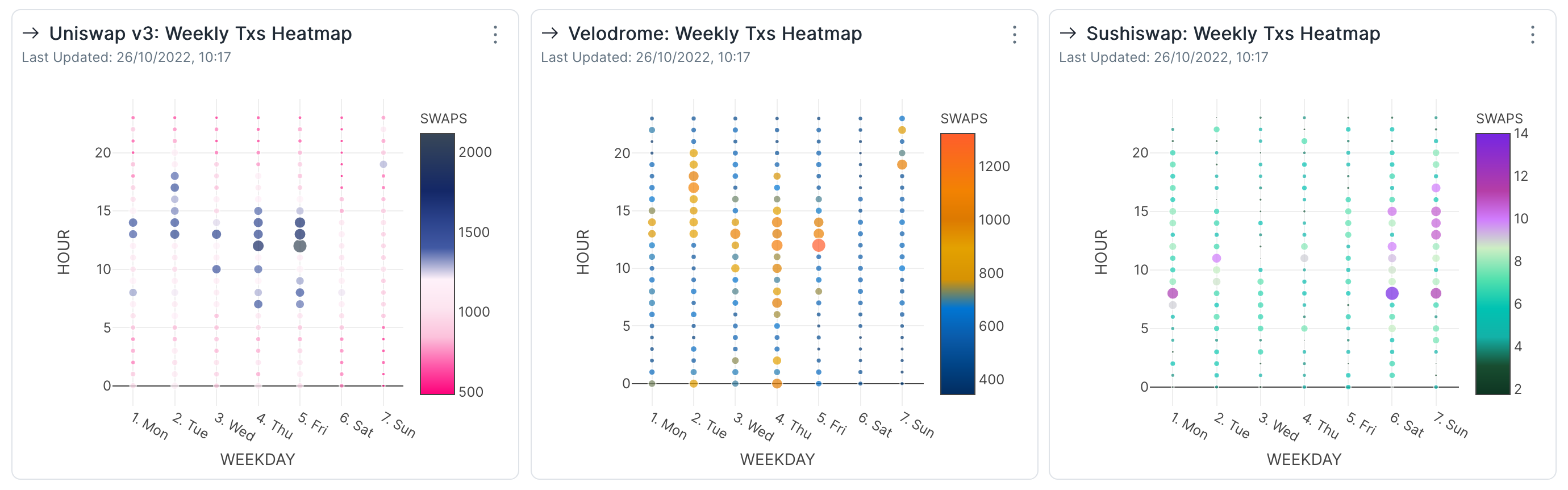

On a weekly basis, we see Uniswap and Velodrome having the most activity at similar time intervals, mainly during weekdays, but not within regular hours. In the case of Sushiswap we see quite the opposite, having most of the activity on weekends.

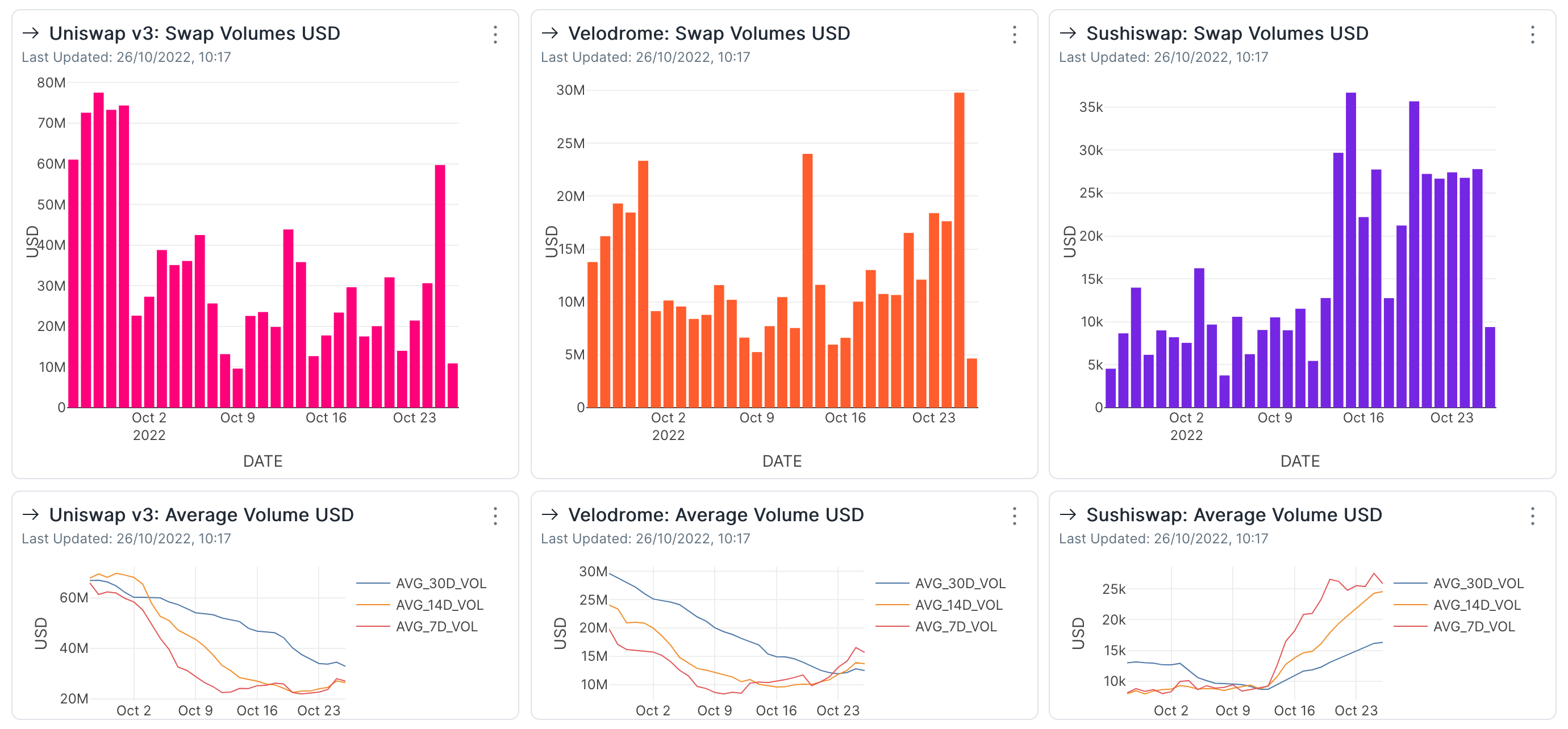

Looking at swap volumes, we’re being told a similar story about their activity over the last month. However, while we’ve seen Velodrome not far behind Uniswap in terms of transactions, by volume they’re operating at completely different scales. On most days Uniswap has double the swap volume of Velodrome. In total, Uniswap had a volume of $650M and Velodrome just over half of that at $356M.

Sushiswap shows in this case as well that it continues its ascension, having started a strong upward trend in volume in the first half of October. Its daily average volume increased from just $8k to around $25k. Over the last month it had a swap volume of 494k.

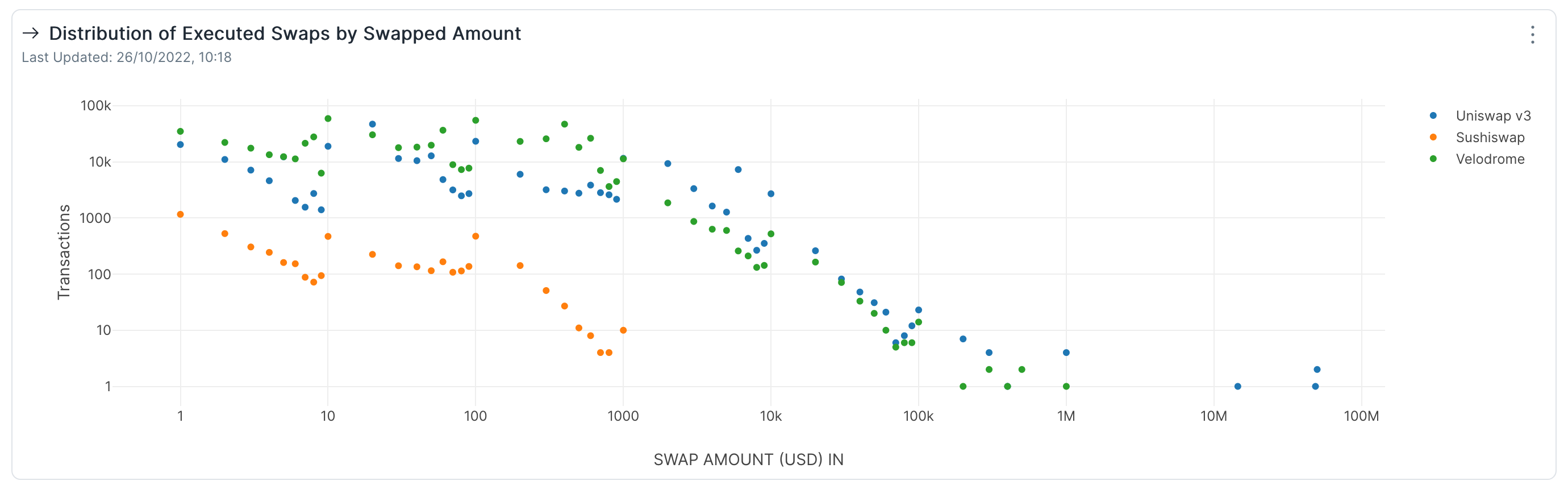

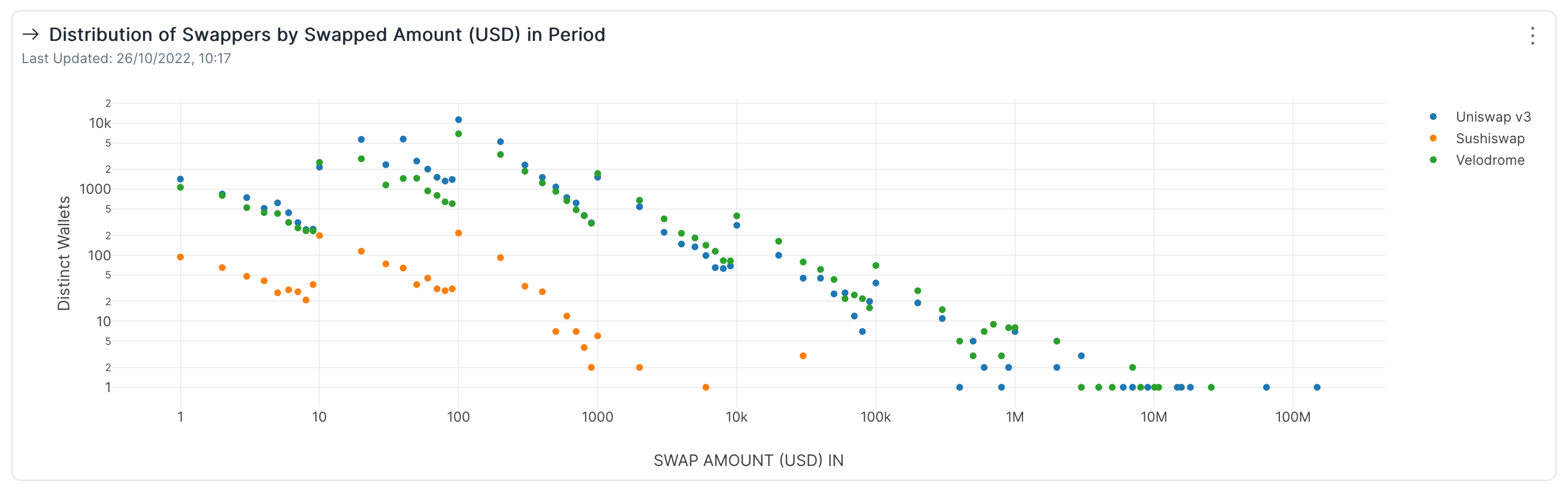

All the differences in transactions and volume can once again be spotted by plotting the two dimensions in the scatter plot below, but we also gain a new perspective over the strong point of each.

Velodrome and Uniswap have had a very similar activity, but we see Velodrome executing more transactions in the <$1k range. From that point on, Uniswap stands out as the leader, which also helps to explain the difference in volume we’ve seen despite the similar transactions count.

Sushiswap finds itself in a difficult spot, competing for the <$1k range, but it’s still quite early to judge whether it will be squashed by a defeated competitor of the >$1k range or if its way will be cleared up by the other two pushing on to increase trade sized they can acommodate on their platforms.

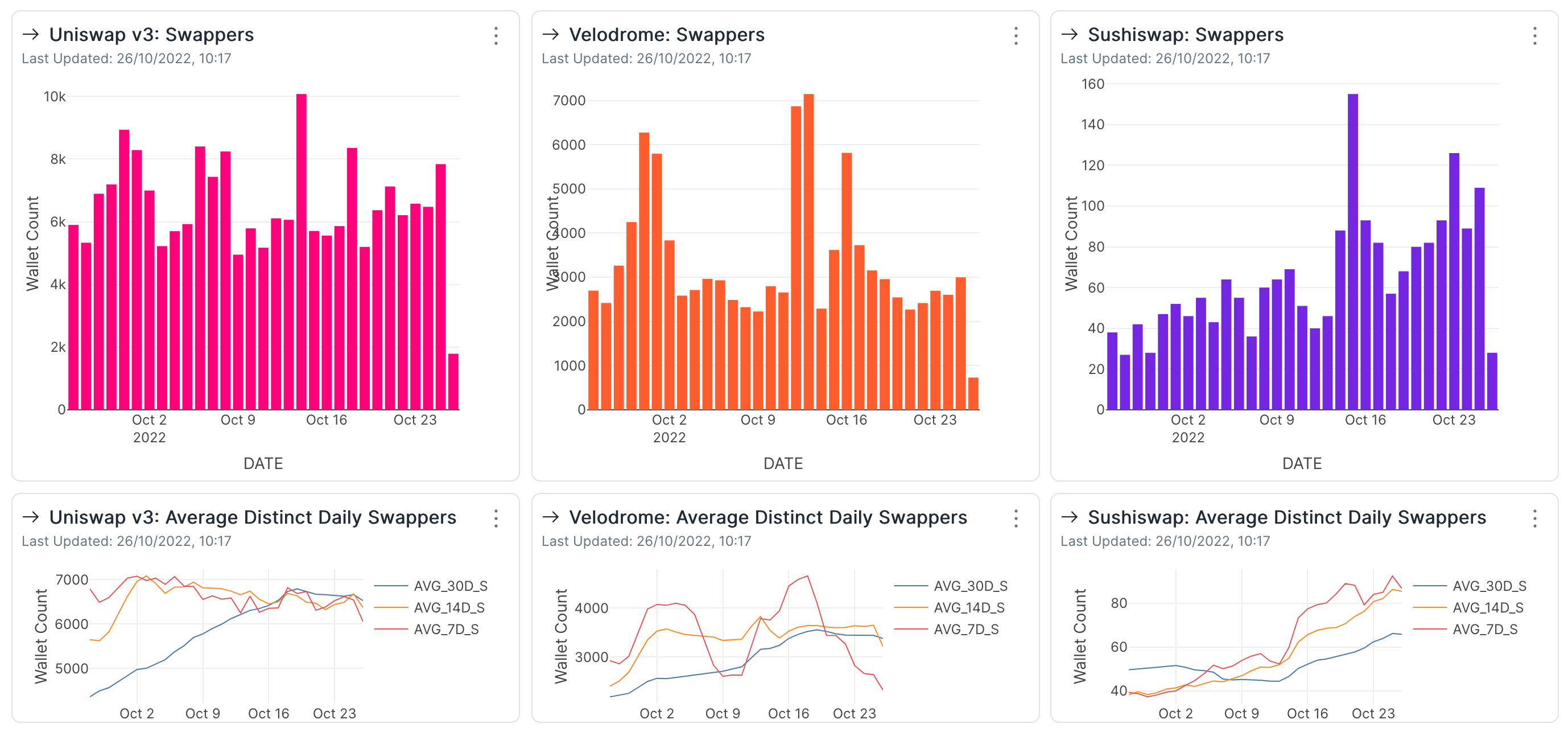

II. Swappers

This is yet again a segment where Uniswap shows it’s been able to gain the most traction, constantly having swapper counts much higher than Velodrome and Sushiswap. However, we can see that this constant high level of swappers is something that’s only started to shape up during the observed month, with the 30d moving average at the start of the period sitting at much lower at about 4.5k. Nonetheless this is an impressive performance. Over 82k distinct users swapped on Uniswap in the last month.

Velodrome occasionally has swapper spikes hitting over 6k daily users, but that is a lot more inconsistent and oftentimes swapper counts sit under 3k. Over 40k distinct users swapped on Velodrome in the last month.

The increase in usage we’ve seen for Sushiswap in previous sections seems to be fueled by a steady increase in the number of users over the last month. This means that the growth it had in this period is not an overstretch of an existing user base, but a sustainable increase across the board.

Uniswap is very successful with users that swapped <$1k in the last month but it’s in very close competition with Velodrome for larger users.

Sushiswap on the other hand has not yet had users trading more than 30k during the observed period but it’s building itself up as a worthy competitor in the <$100 range.

III. Tokens & Pairs

Although all three DEXs have a very diverse list of tokens listed, in all cases it is just a handful of tokens driving almost all of the volume. Those tokens are mainly WETH, OP, USDC, DAI and USDC. Naturally, the pairs with the most volumes are combinations of these tokens.

It’s only on Velodrome where we see volumes being a bit more balanced between the top tokens, as opposed to Uniswap and Sushiswap where just WETH and USDC make up around 90% of the swap volumes. This means that although Uniswap seems to be in the lead by many aspects, it’s current success relies on just two or three assets, whereas Velodrome has a stronger footing across many projects, prepping the exchange for success whenever the Optimism ecosystem takes off.

Conclusions

-

Uniswap v3 had the most transactions, volume and swappers over the last month. In many cases, its activity was double that of its closest competitor.

-

Velodrome is setting itself up to challenge the supremacy of Uniswap and already is extremely competitive by the number of transactions that go through the platform, as well as the size of the users on the platform.

-

Sushiswap although in its early days and far behind the other two, has had an extremely successful last month during which it more than doubled it transaction counts, swapping volumes and number of daily swappers.

-

On all three exchanges most of the volume is driven by just a handful of tokens and pairs. The only one with a slightly more diversified and balanced split of volume is Velodrome, which puts it in a position to become the market leader on Optimism when more of the projects traded on it take off.