The Near ecosystem continues to grow and with it a longer list of tokens is available for users to swap their $NEAR to. In this report we will have a closer look at the swapping activity using the native token of the blockchain and try to uncover what the outflow of $NEAR is and what other tokens all that value goes to.

The current data set includes swaps executed on two Near DEXs: Ref Finance and Jumbo Swap. As more DEXs are launched and indexed in the FlipsideCrypto tables the dashboard is set up to include them also*.

*Due to an issue with the ez_dex_swaps table at the time of writing, an alternative route of parsing the transaction logs was used which should still capture any new exchange protocols as long as they follow a similar core logic. Alternatively the CTE responsible for the base swaps data can be easily replace with the curated data in the ez tables when a fix becomes available. KUDOS to TheLaughingMan for sharing the base query for extracting swaps data.

The default parameters, and the ones used for this report, are set to date_trunc=day and months=3 but they can be adjusted and applied by the user. All of the data and underlying queries can be further explored and interacted with in the live dashboard:

☝️ The dashboard can be updated on-demand by pressing the refresh button 🔄 in the top right corner of the page.

I. Swap Activity of $NEAR Pairs

Before jumping into the core issue of the report, $NEAR outflows, we should first have a look at the broader picture concerning DEX swaps where tokens are paired with $NEAR.

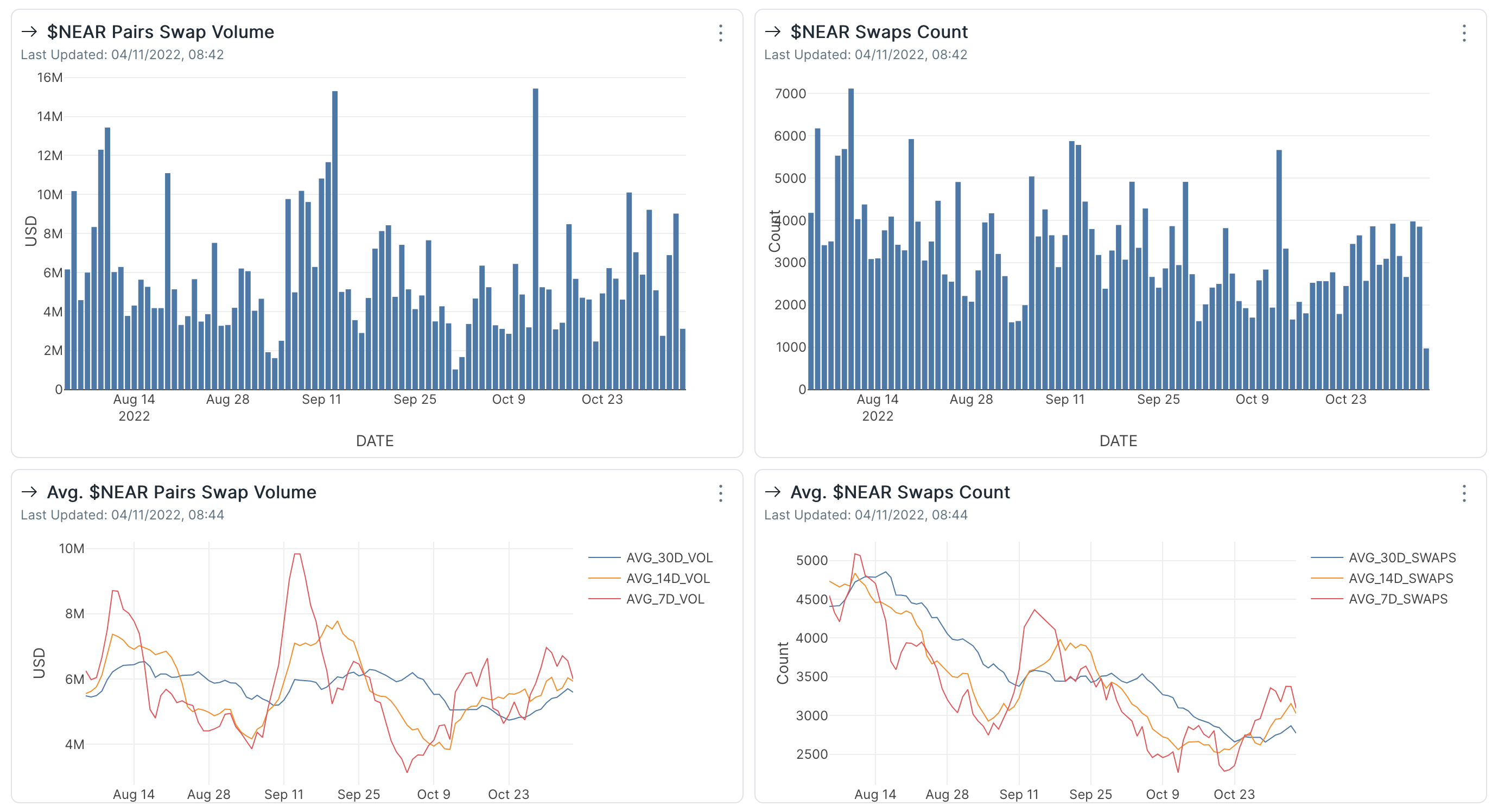

Over the last three months activity slowed down by the number of swaps and volume although there have occasionally been days when activity spiked back up. In total the 312k swaps executed so far generated a swap volume of $536M.

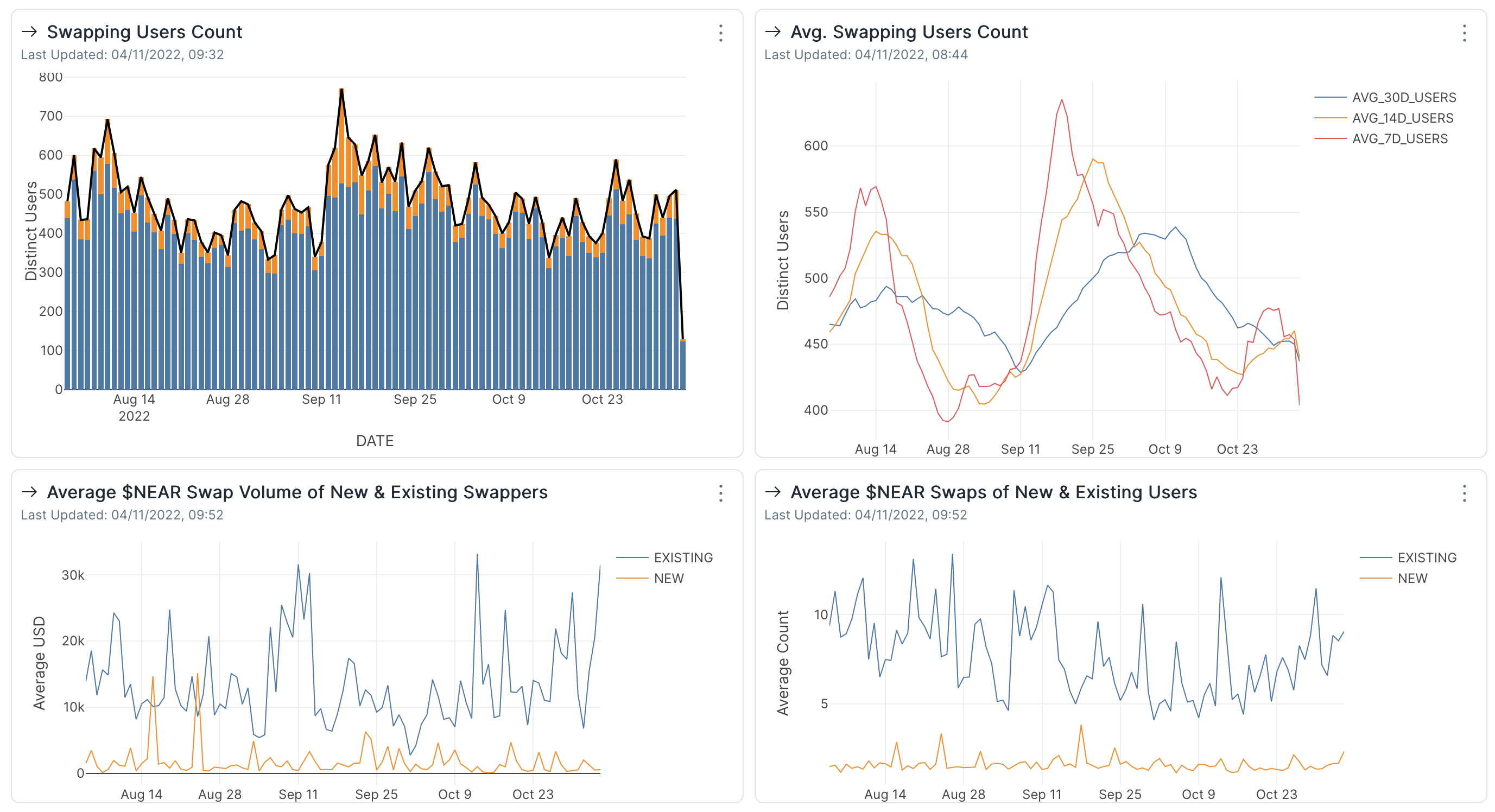

At the same time however the number of users making swaps oscillated more or less in a constant range and ends the observed time frame with daily swapper counts similar to the start of the period. In total, over 12k distinct users made a swap to or from $NEAR.

There was a constant stream of new swapping users over this period but they were only responsible for a tiny percentage of the overall activity. Furthermore, new users make fewer swaps and in lower volumes on average than existing users do. So while the new users certainly help maintain an active swapping activity around the token, much of it is being sustained by the efforts of long time Near swappers which over the long term might lead to a depletion of capital and result in a sharp drop in volume that will also have a negative impact in the value of $NEAR.

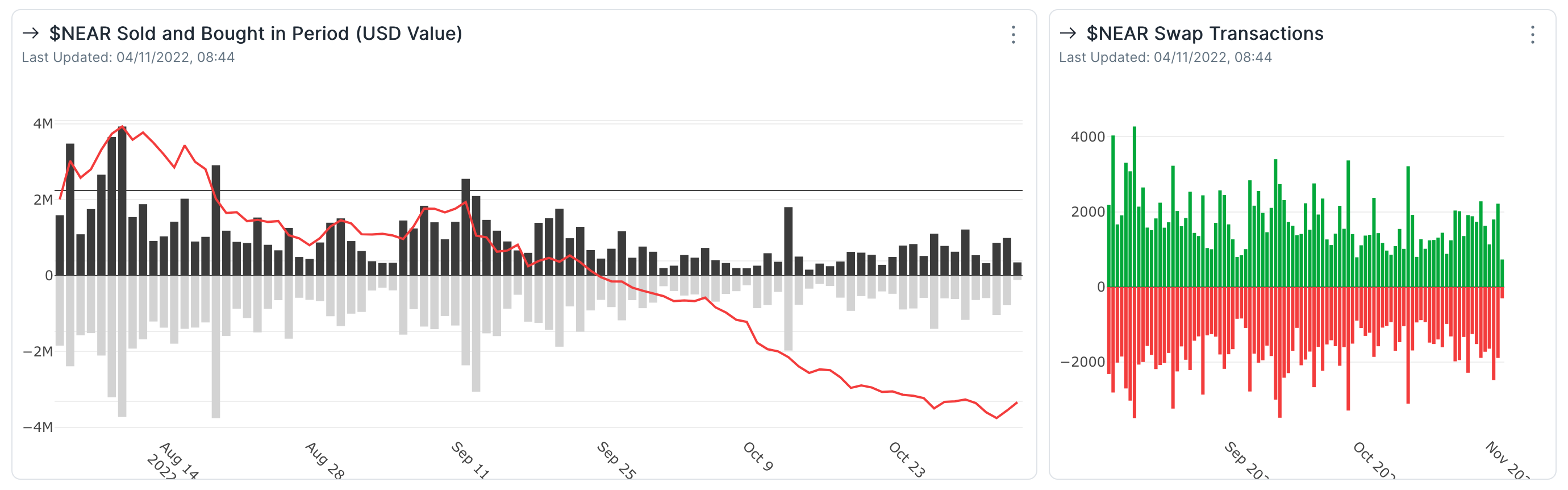

II. $NEAR Sold and Bought

So how much $NEAR is actually being moved back and forth by all this activity? Over 47.5M tokens worth $197M (using their value at the time of the swap). Much of this activity however has been on the sell side, resulting in a net loss of value for the token of $6M in the last 3 months. This isn’t necessarily a loss for the token overall as much of the value went into other tokens of the ecosystem and thus continue to generate more value for the Near ecosystem, which $NEAR’s value is more dependent on.

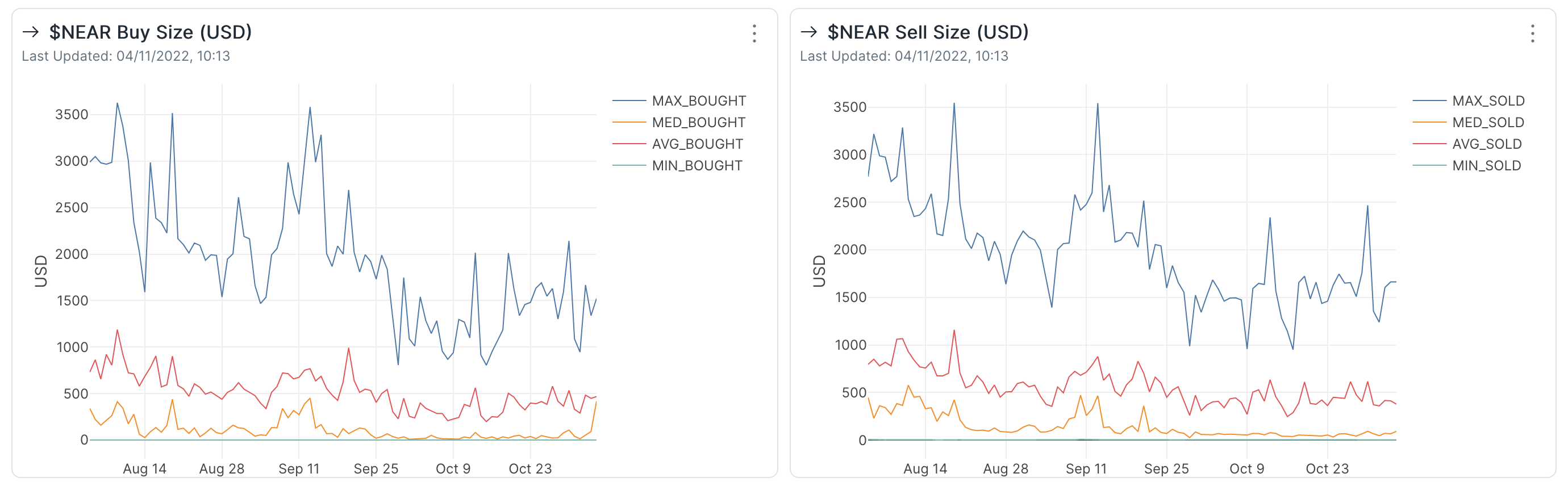

As we might have expected thanks to the data in the previous section, the amount of $NEAR in each swap, regardless of what side it sits on, has significantly decreased compared to what it was in early August at the start of the time frame.

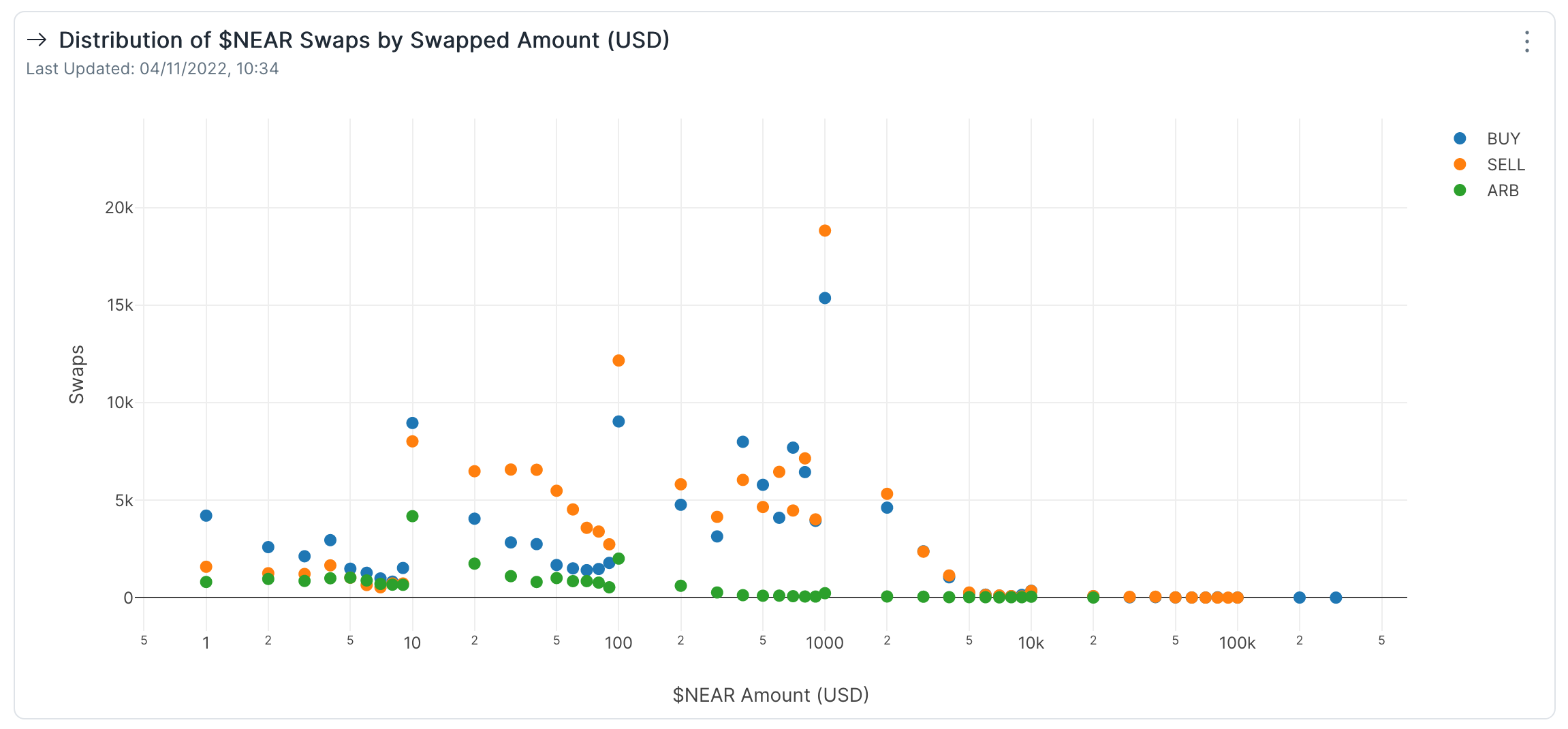

Although amounts have been sliding downward on both sides, we see that actually there’s a bit more pressure on the sell side, where more swaps were made with larger $NEAR token amounts than on the buy side.

As a bonus takeaway, we can see there are also arbitrage swaps going on for the token, where the $NEAR token is being traded back and forth in the same transaction where multiple swaps are being executed inside of the transaction between multiple pools. While they’re not being made with extremely large amounts, they have swaps counts comparable to regular swaps in the <$100 range.

III. $NEAR Outflow

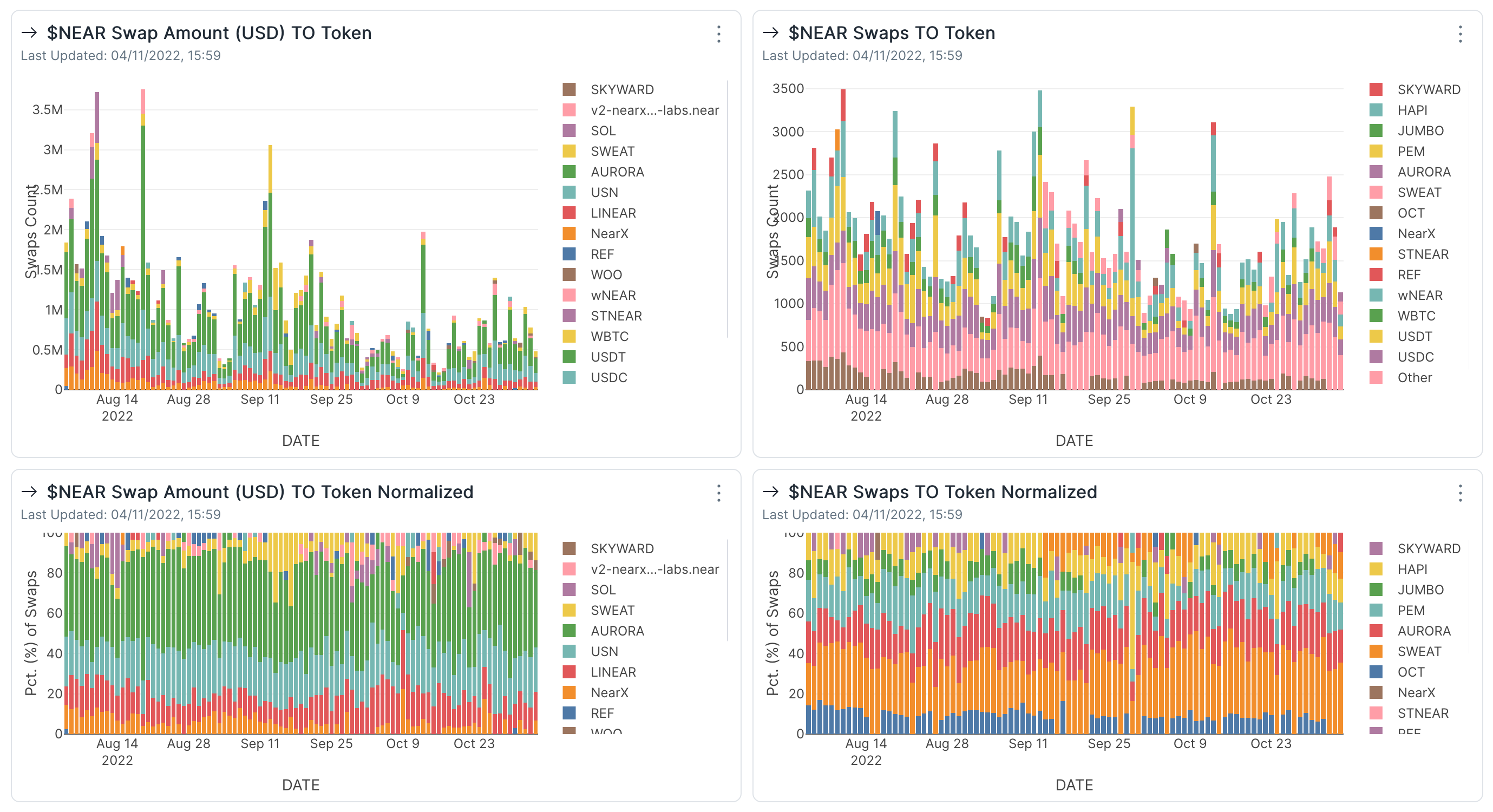

The $NEAR token has been swapped for a long list of tokens over the last three months, but for most of the time we can see just a handful of tokens making up most of the swap volume. Among them we can spot the usual suspects $USDC, $USDT, $USN (the algorithmic stablecoin of Near) and $WBTC. Their share of the daily swap volume has remained more or less constant throughout the observed period.

Next to these projects we can also spot a newcomer that was able to push its way into the top 5 daily tokens swapped TO, and that token is $SWEAT of Sweatcoin. We can see it pop up in the daily rank in early September shortly after its launch on the blockchain and it maintains a significant daily share of volume for the month. Although it still manages to come back up to the daily top 5 after September, that only happens sporadically.

Another token that has lost some of its prominence in the swap volume with $NEAR is $ETH. It’s not only a sign that less funds are being bridged from Ethereum to Near, but also that users would much rather swap their tokens to something that is more related to the Near ecosystem while on the Near blockchain.

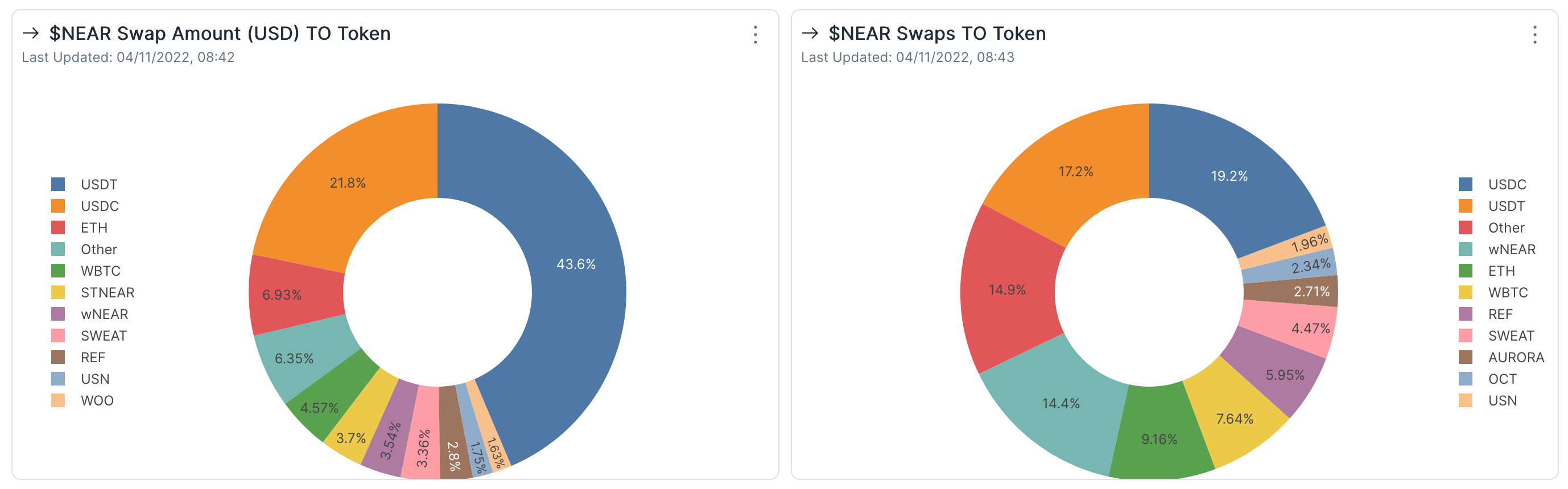

Something that we could spot in the graphs above as well is that there is quite a bit of a difference between what tokens $NEAR is being swapped to when we rank them by swap value and by number of swaps.

Even if for the period there were more swaps from $NEAR to $USDC, around 19% of all swaps, they only make up 21% of the total value of the tokens swapped in this period. Instead, most of the $NEAR tokens were swapped to $USDT in a proportion of 43% of the $NEAR tokens swapped in this period.

Given the market conditions of the last months, it is not very surprising that a lot of the trading volume, even in the case of $NEAR swaps, goes to stablecoins. However, there certainly is sufficient interest for other projects’ tokens as well despite having a lot less volume. Some of the tokens that $NEAR was sold for most often in the last three months are $ETH, $WBTC, $REF, $SWEAT, $AURORA, $OCT and $USN.

Conclusions

-

The number of swaps and swap volume with $NEAR have been declining over the last three months.

-

There are still new users making swaps with the token but not in huge numbers. Furthermore, they swap less often and smaller amounts. The long-term lack of new capital in the market could negatively affect the value of the token.

-

There’s been significantly more value being extracted from the token in the observed time frame resulting in a net loss of value for $NEAR worth $6M.

-

Both by value and swap counts, the $NEAR token has mostly been swapped to a handful of tokens over the last three months. Despite the consistency of what tokens it was being swapped for, $SWEAT was able to break through and be one of the top 5 tokens for most of September.

-

By value, stablecoins represent over 70% of the outflow, with just $USDT being responsible for a little over 43%.

-

By swap count, stablecoins still make up a lot of the outflow but in a much smaller proportion. Instead we see a lot more diversity and interest in other projects native to the blockchain.