MSTR公司概述:MicroStrategy(微策略公司)创立于1989年,是一家提供商业智能,移动软件和基于云服务的公司,开发用于分析内部和外部数据的软件,以便作出业务决策和开发移动应用程序。由Michael J.Saylor担任首席执行官兼董事会主席。主要竞争对手有:SAP AG Business Objects,IBM Cognos和Oracle Corporation的BI Platform.

2022年Q3报表: https://www.sec.gov/edgar/browse/?CIK=1050446&owner=exclude

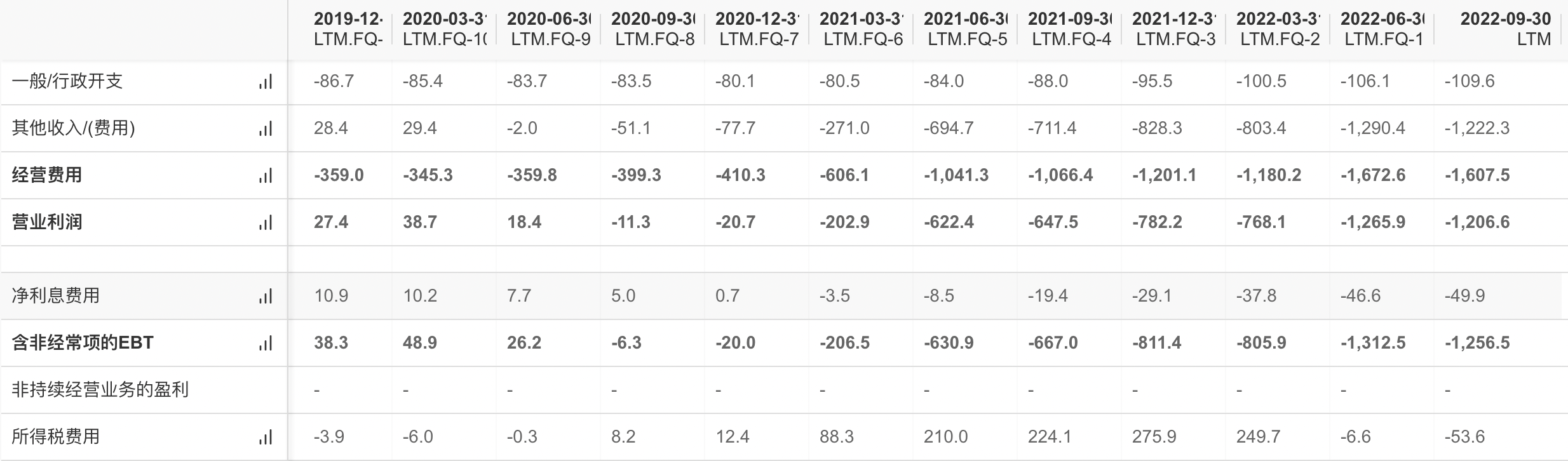

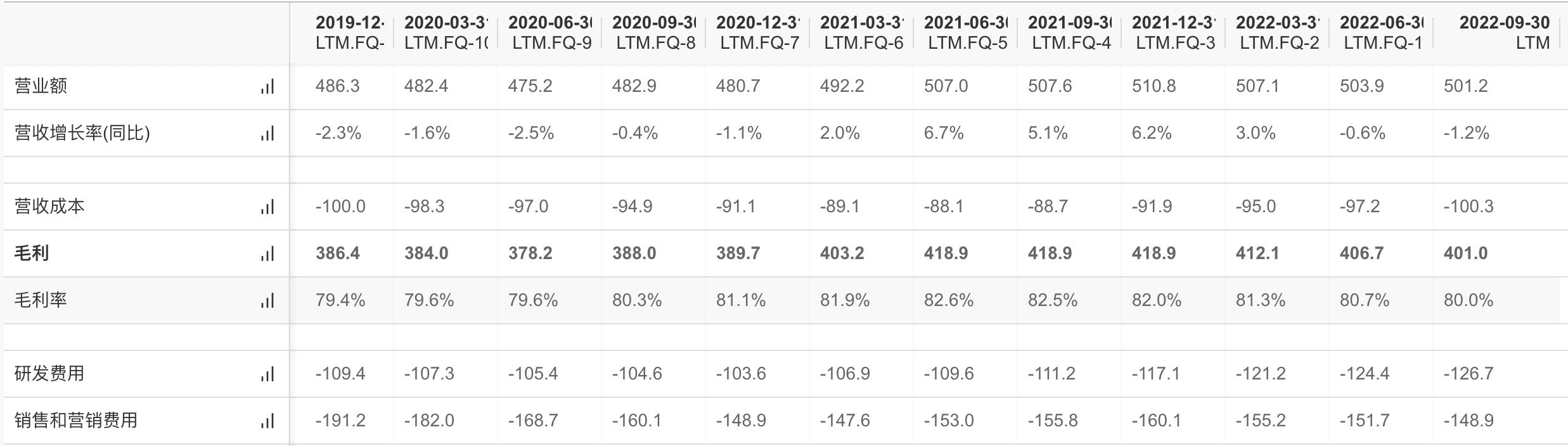

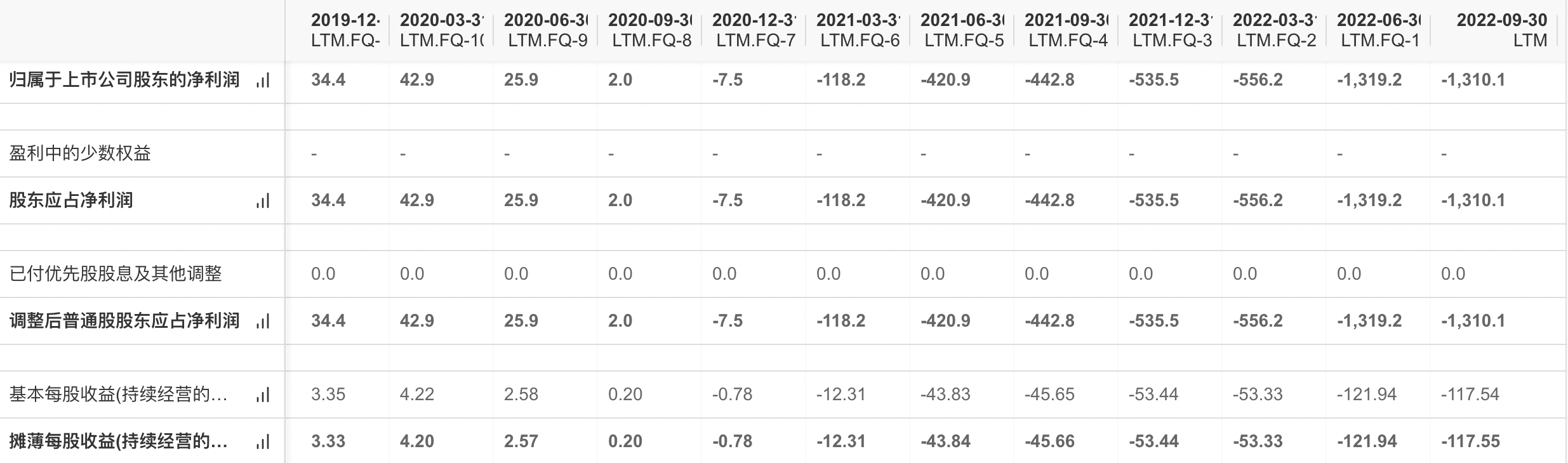

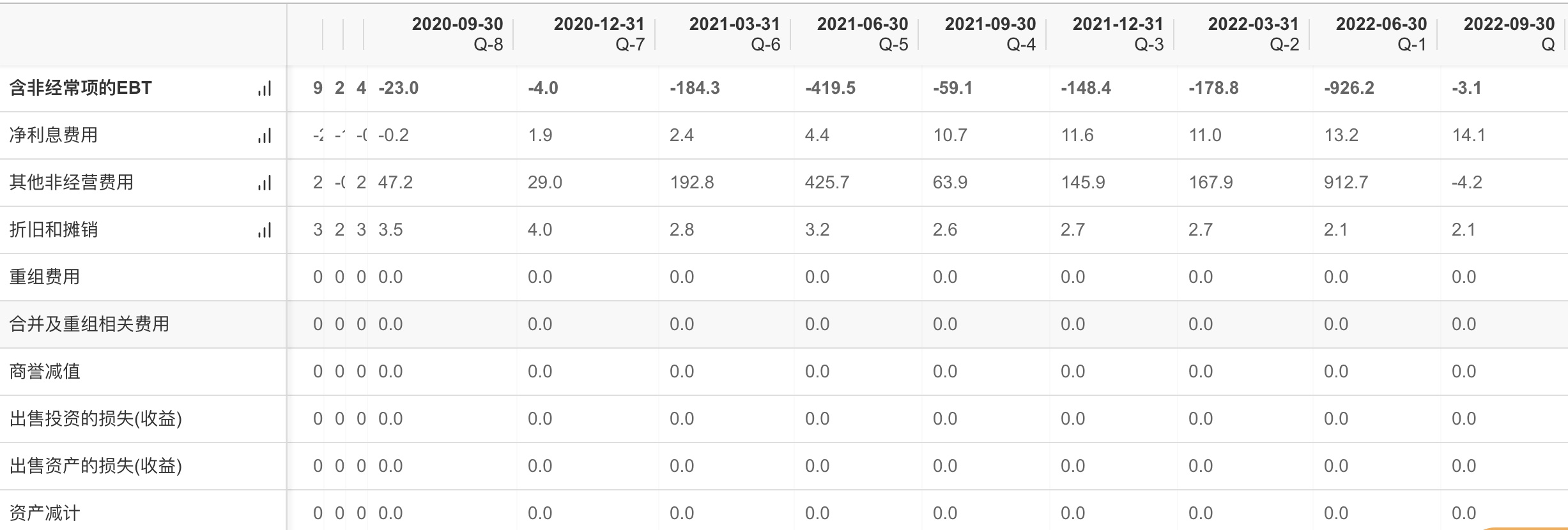

利润表(季度对比)

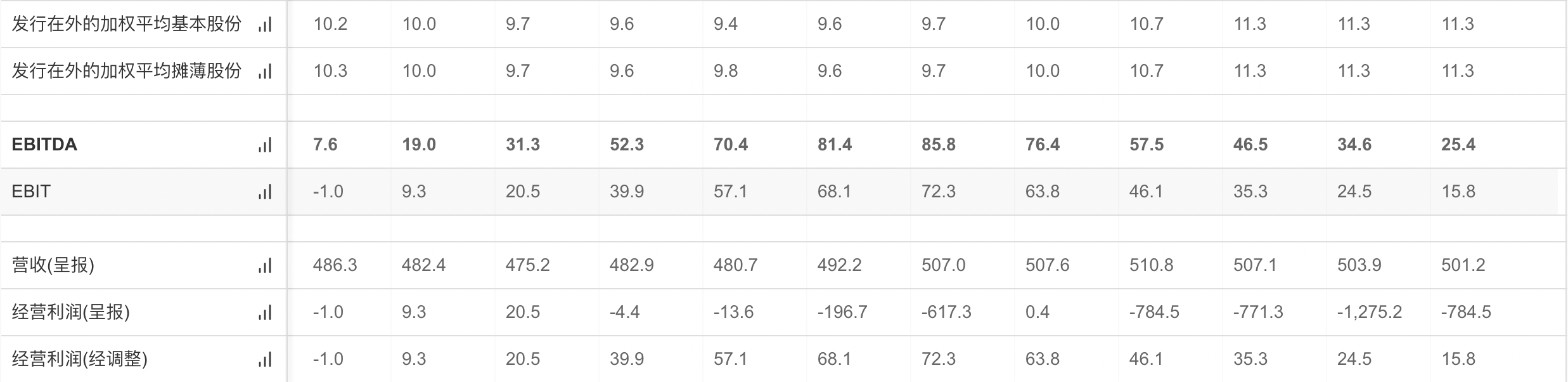

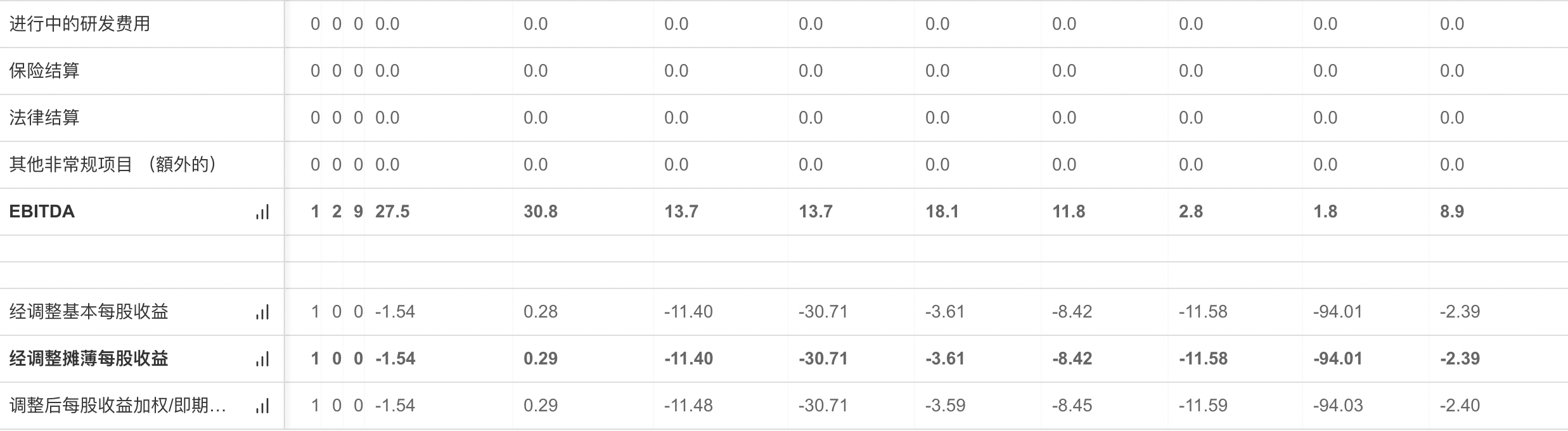

EBITDA

EBITDA:税息折旧及摊销前利润

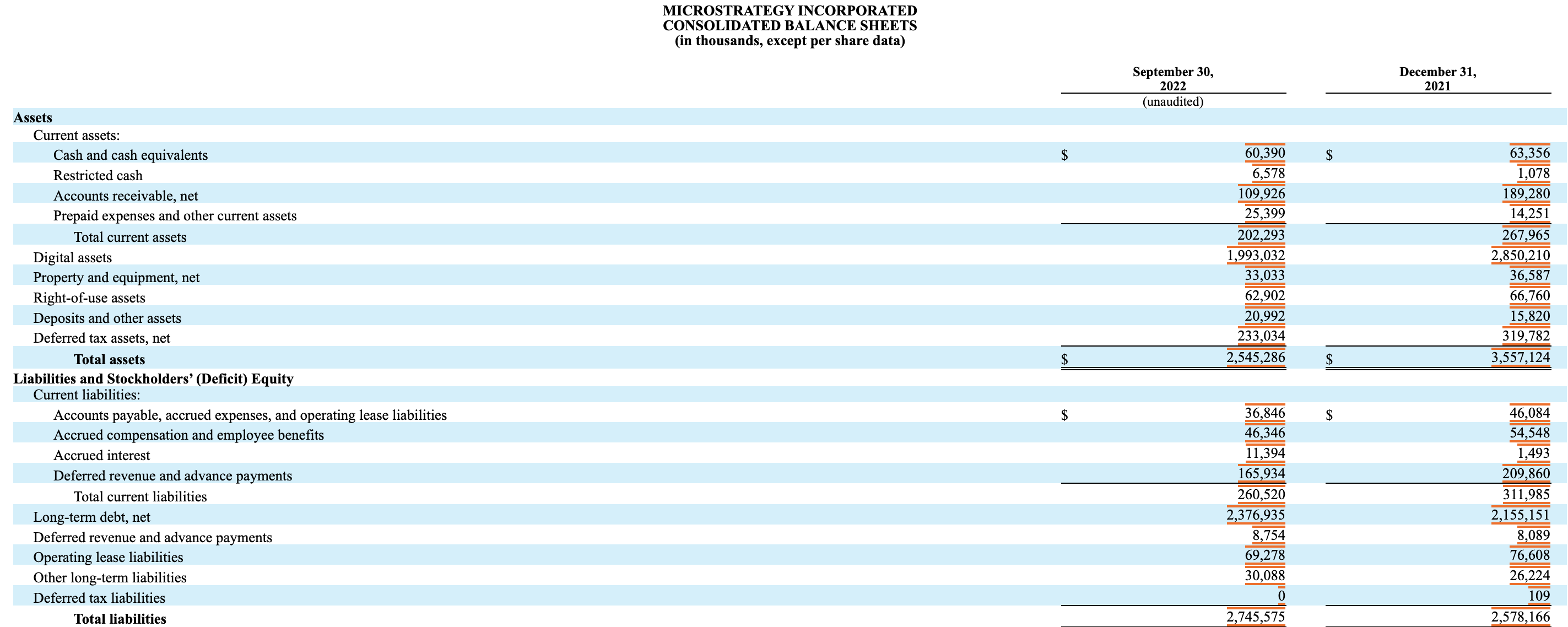

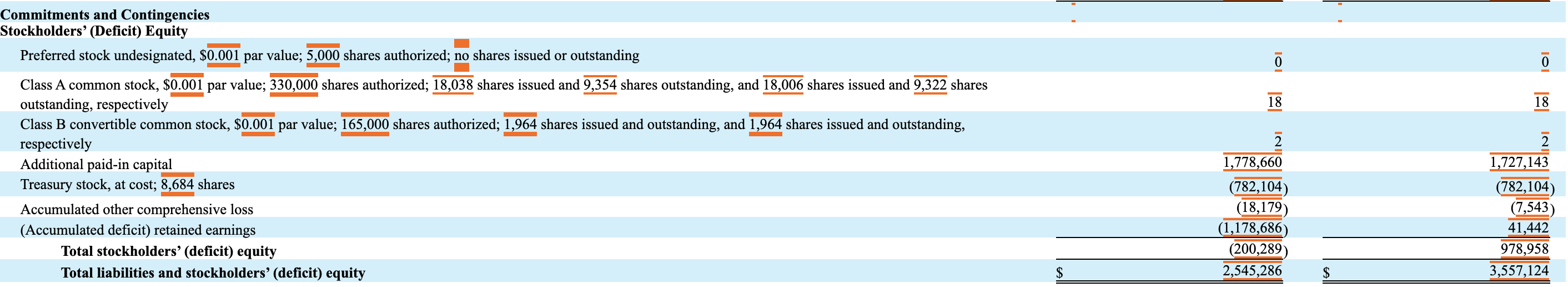

资产负债表(Q3 2022)

2022年三季度:总资产 25.45亿美元,总负债 27.45亿美元。

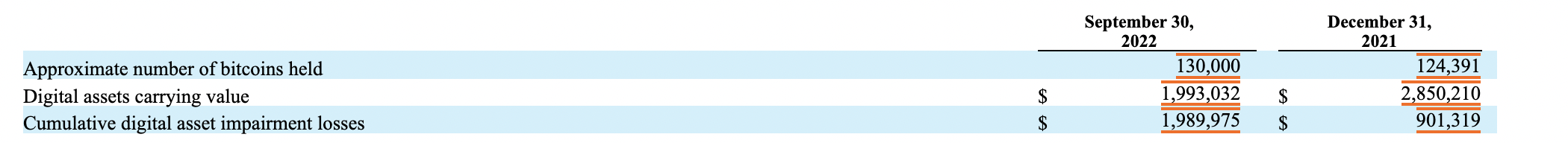

数字资产投资(截止2022.9.30)

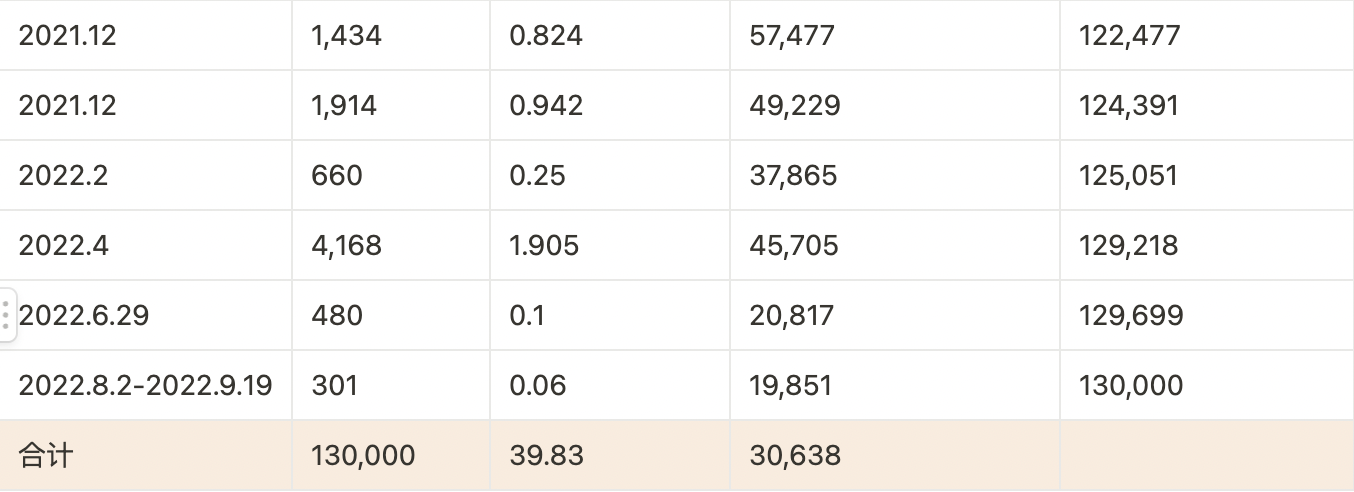

btc买入情况

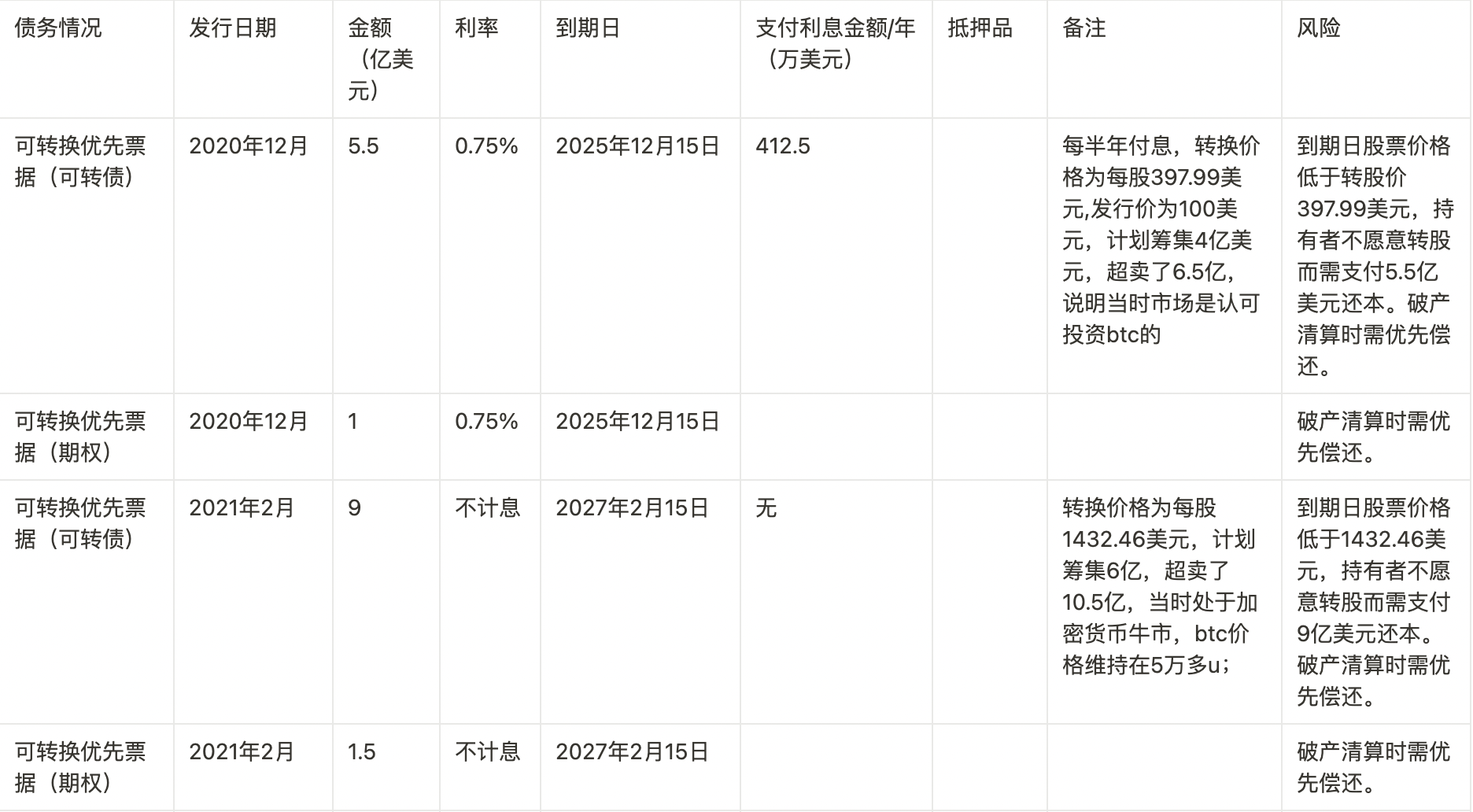

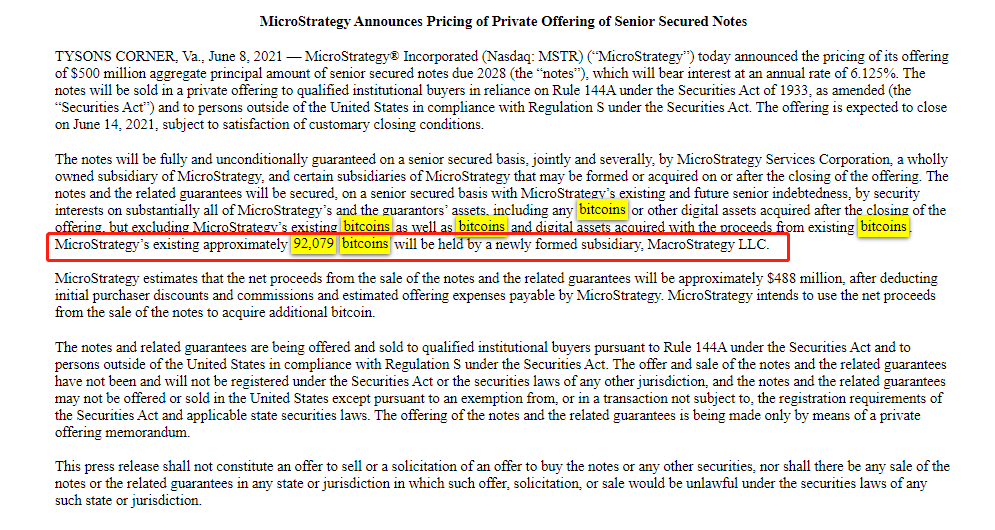

2028年到期的高级担保票据:The 2028 Secured Notes and the related guarantees are secured, on a senior secured basis with the Company’s existing and future senior indebtedness, by a pledge of 65% of the equity interests of the Company’s MicroStrategy International Limited subsidiary and security interests on substantially all of the Company’s and the Subsidiary Guarantors’ assets, including any bitcoins or other digital assets acquired on or after June 14, 2021, but excluding the Company’s bitcoins acquired before June 14, 2021, as well as bitcoins and digital assets acquired with the proceeds from bitcoins acquired before June 14, 2021 and bitcoins acquired from proceeds of debt secured by such bitcoins (the “Collateral”).

As of September 30, 2022, approximately 14,890 of the bitcoins held by the Company serve as part of the collateral for the Company’s 6.125% Senior Secured Notes due 2028 (the “2028 Secured Notes”), as further described in Note 4, Long-term Debt, to the Consolidated Financial Statements and in Note 8, Long-term Debt, to the Consolidated Financial Statements of the Company’s Annual Report on Form 10-K for the year ended December 31, 2021. As of September 30, 2022, approximately 30,051 of the bitcoins held by the Company serve as part of the collateral for a $205.0 million term loan (the “2025 Secured Term Loan”) issued to MacroStrategy LLC (“MacroStrategy”), a wholly-owned subsidiary of the Company, by Silvergate Bank (“Silvergate”), as further described in Note 4, Long-term Debt, to the Consolidated Financial Statements.

-

2028年到期的5亿美金垃圾债情况:

-

条款约定,以公司未来所有的资产作为担保,但是不包含2021年6月14日之前所持有的btc。

-

2021年6月8日发告知,92,079枚btc转入新成立的公司主体,不为该垃圾债做担保。

-

按照该公司三季度总资产25.45亿美金,数字资产价值19.93亿美金计算可得,该公司其他资产共计5.52亿美金。

-

mstr公司所持btc总数量为13万枚,去除转入新公司的92,079枚,剩余37,921枚可以为该债券做担保。

-

按照btc价格16,000美金计算,当前可担保数字货币价值16,000*37,921=6.06亿美金。

-

公司其他资产+数字货币价值=5.52+6.06=11.58亿美金,足够为该债券做担保。

-

该债券当前暂无违约风险。

-

silvergate银行抵押借款情况:

Overnight Financing Rate 30 Day Average as published by the Federal Reserve Bank of New York’s website plus 3.70%, with a floor of 3.75%, and is payable monthly in arrears beginning May 2022. The 2025 Secured Term Loan will mature on March 23, 2025, unless earlier prepaid or repaid in accordance with its terms. The total net proceeds from the 2025 Secured Term Loan, after deducting lender fees and third-party costs, were approximately $204.6 million. The 2025 Secured Term Loan is collateralized by bitcoin held with a third-party custodian and by a $5.0 million cash reserve account with Silvergate Bank. MacroStrategy is required to maintain a Loan to collateral value ratio (“LTV Ratio”) of 50% or less (not including the cash reserve). As of March 31, 2022, approximately 19,466 of the bitcoins held by MacroStrategy serve as part of the collateral for the 2025 Secured Term Loan. As of March 31, 2022 the net carrying value of the 2025 Secured Term Loan was $204.6 million, net of unamortized issuance costs, and was classified as a long-term liability in the “Long-term debt, net” line item in MicroStrategy’s Consolidated Balance Sheets.

In accordance with the terms of the Credit and Security Agreement, the 2025 Secured Term Loan was collateralized at closing by bitcoin with a value of approximately $820.0 million placed in a collateral account with a custodian mutually authorized by Silvergate and MacroStrategy (the “Bitcoin Collateral Account”). While the 2025 Secured Term Loan is outstanding, MacroStrategy is required to maintain a Loan to collateral value ratio (“LTV Ratio”) of 50% or less, which would amount to at least $410.0 million worth of bitcoin being required to be held in such account assuming the full $205.0 million of 2025 Secured Term Loan principal remains outstanding. If the price of bitcoin drops such that the LTV Ratio exceeds 50%, MacroStrategy is required to either deposit additional bitcoin in the Bitcoin Collateral Account or prepay a portion of the 2025 Secured Term Loan such that the LTV Ratio is reduced to 25% or less (or 35% or less, provided that in such case the interest rate on the 2025 Secured Term Loan will be increased by 25 basis points until such time as the LTV Ratio is reduced to 25% or less). If at any time the LTV Ratio is less than 25% as a result of excess collateral in the Bitcoin Collateral Account, MacroStrategy is entitled to a return of such excess collateral so long as the LTV Ratio would not exceed 25% after giving effect to such return.

Separate and apart from the requirements associated with the LTV Ratio, MacroStrategy established a $5.0 million cash reserve account (the “Reserve Account”) with Silvergate to serve as additional collateral for the 2025 Secured Term Loan. MacroStrategy is required to maintain at least $5.0 million in the Reserve Account until the last six months of the 2025 Secured Term Loan term, at which time funds in the Reserve Account may be used to make interest payments on the 2025 Secured Term Loan at MacroStrategy’s request, with the amount required to be held in the Reserve Account correspondingly reduced to the extent such payments are made. The collateral for the 2025 Secured Term Loan does not extend beyond assets in the Bitcoin Collateral Account and the Reserve Account. As of March 31, 2022, the Reserve Account is presented within “Restricted cash” in the Company’s Consolidated Balance Sheet and the Bitcoin Collateral Account is presented within “Digital assets” in the Company’s Consolidated Balance Sheet as further described in Note 2, Digital Assets, to the Consolidated Financial Statements.

2025年到期的Silvergate银行2.05亿美金抵押贷款情况:

-

2022年3月最初质押19,466枚btc,当时价值8.2亿美金,可得出LTV:2.05/8.2=25%。

-

需要维持LTV始终<50%。

-

要求mstr将LTV始终维持在50%及以下,如果币价突然暴跌使得LTV高于50%了,那么mstr需要补充比特币质押物,并且将LTV拉到最初的25%及以下或者偿还一部分债务以确保将LTV拉至25%以下。

-

按照最初19,466枚BTC质押计算:当前LTV:2.05/(19466*16000)=65.82%>50%需要追加保证金

-

三季度财报披露该抵押贷款现btc抵押数量为30,051枚。增加抵押btc数量后计算当前LTV为:2.05/(30051*16000)=42.64%

-

按照该公司可流动抵押btc数量:92,079枚计算,当btc价格低于4,450美金时,所持有的btc将不够补保证金且维持LTV在50%以下。

-

除了比特币的质押物之外,Silvergate银行的现金账户中,mstr需要保持500万美金的现金在该账户中作为抵押品。

Microstrategy当前的风险面和利好面

风险:

-

债券价格下跌风险--2025年和2027年到期的两份债券风险较大,转股价格都较高,2025年到期的债券转股价格为397.99美元/股,2027年到期的为1,432.46美元,当前mstr股价为160美元左右。若股价在2025年12月未能上涨至397.99美元以上,将面临持有者不愿意转股而需偿还6.5亿美金的本金压力。同理2027年到期的10.5亿美金债券,若到期日股价未能上涨至1432.46美元,将需要偿还10.5亿美金的本金。

-

运营者负面消息缠身造成的股价进一步下跌--mstr的实际经营者saylor还面临国税局的起诉,被追缴1亿美金的税金和罚款(包含2500万美元的税款和7500万美金的罚款),目前该公司的库存现金及现金等价物为6039万。并且国税局是不接受加密货币支付的,如果需要补缴这1亿美金的税款,就意味着需要卖出当前所持有的btc筹集资金,或者需要再发行债券去筹集资金,但是按照该公司目前的股票价值走势及加密货币市场目前所处的熊市周期来看,当前再发行新的债券大众不一定还会买账。

-

主营业务萎缩,收入持续下跌不足以覆盖利息支出的风险--营业收入持续下降,当每年的营业收入+可支配现金少于需要偿付的利息5000万美金后,将面临现金流枯竭,需要变卖数字资产的局面。

-

通过数字资产变现的方式来稳定自身现金流--2022年2季度,特斯拉抛售了持有的75%的比特币,增加了9.36亿美元的现金,这一举措有可能会引发多米诺骨牌效应,让持有比特币的上市公司为了财报数据好看而选择抛售比特币变现,特别是在mstr本身现金流短缺的情况下。

利好:

- 当成btc etf投资,以避免市面上其他比特币基金高昂手续费或高门槛的限制。

-

当前美国市场投资btc的方式有:

-

[ ] 直接去交易所购买btc(需要对加密货币行业有一定的认知,且交易中需要支付一定的手续费)

-

[ ] 通过流动基金来投资(例如gbtc,每年管理费为2%,且购买金额需大于5万美金)

-

[ ] 投资ProShares Bitcoin Strategy ETF(proshares 比特币策略主动行etf是第一个获得美国证券交易委员会批准的比特币策略ETF,可在任何特定股票市场上使用,在这里是指纽约证券交易所(NYSE)。 该基金基于对比特币期货合约的管理敞口,作为在交易时间内获得资本增值的一种方式,不直接投资于比特币资产本身。其费用较低,每年只有0.95%,但他投资于比特币期货,并不直接提供所有权。)

以上三种方式都会受到一些限制,而mstr公司市值19.96亿,其中btc价值19.93亿。当前的mstr股票就可以当成一只事实btc etf来看待。其股票走势和btc价格走势的强关联性可以让投资者将其当作btc eff去投资,撰文时btc报价16,760美元,若坚信未来btc可以涨回历史高点60,000美金,对多头来说持有mstr的股票投资回报率将能达到3.6倍。

2. 按照当前EBITDA值来看,2022年Q3,mstr的EBITDA为8,900万美元,而当前该公司每年利息支付费用为5,012.5万美元,EBITDA利息覆盖率为1.7,当前该公司尚且还有足够的现金流来支付利息支出。按照EBIT值来看,过去两年该公司营业利润为4000万美金左右,加上6000多万的现金及现金等价物,也是暂时没有偿还利息的压力的。

参考资料:

-

https://cn.investing.com/equities/microstrategy-inc-financial-summary

-

https://www.sec.gov/ix?doc=/Archives/edgar/data/1050446/000156459022017437/mstr-10q_20220331.htm

-

https://www.sec.gov/ix?doc=/Archives/edgar/data/1050446/000156459022005287/mstr-10k_20211231.htm

-

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001050446/000156459021021949/mstr-10q_20210331.htm