What’s going on?

The Pluto protocol is the first of its kind and the optimal parameters it should work with have yet to be figured out. The protocol was initially launched with crazy onboarding APYs to draw community attention to this mechanic and find out whether sell pressure it leads to is moderate enough. Now we are glad to see that anyone aware of Pluto is also aware of how to issue Pluto. But we realize that selling of onboarding rewards limits the growth of the market price and the protocol as a whole.

Why does this happen?

Onboarding makes backed price go up and improves sustainability of the protocol — this is why it is manyfold more beneficial compared to staking. But the flip side of Onboarding is that it is yielding only while lock-up. This makes a part of participants sell their rewards in order to reinvest the gains back into onboarding. Let’s name this kind of sell pressure the Onboarding price impact.

Anyone willing to invest in Pluto has to choose between buying PLUTO from the market to stake it and onboarding. Now we can tell that the share of buyers is not large enough to compensate for the Onboarding price impact.

And what’s next?

We are considering to make staking and onboarding APYs closer to each other:

- Increase maximum staking emission from 60% to 80% per year to make staking more lucrative.

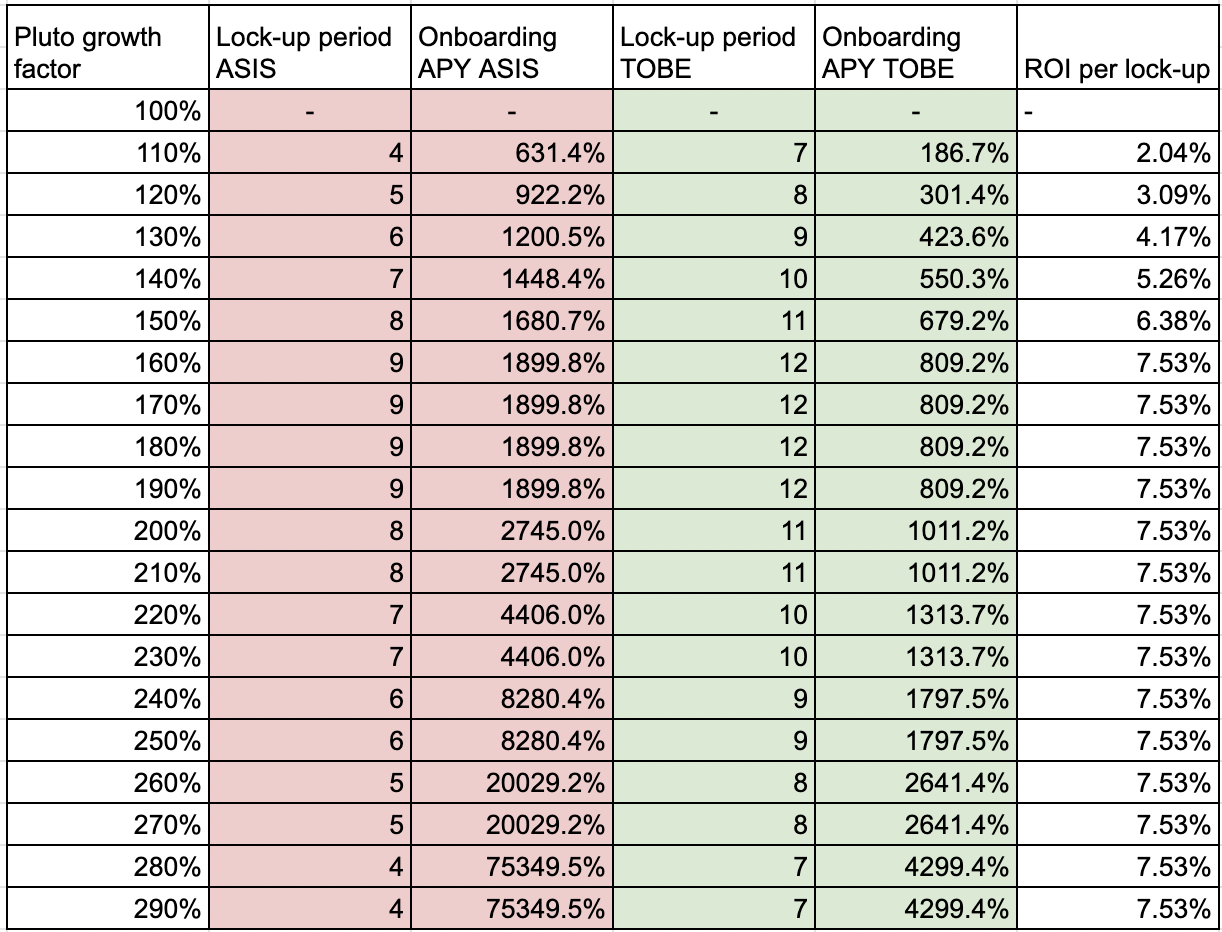

- Increase lock-up period by 3 days keeping onboarding ROI. This means that participants get the same PLUTO amounts, but have to wait longer to unlock:

This should make the buy-and-stake option relatively more attractive to participants. In this case a participant gets the equally valued choice:

- Buying PLUTO from the market to stake it in order to get, say, 350% APY keeping full control of their funds.

- Investing in onboarding to get, say, 1010% APY, which implies a downside risk that they can’t address until the lock-up is over.

What should it lead to?

We expect the proposal implementation will lead to an increase in the market price of PLUTO. On the one hand, it will increase the share of participants who prefer the buy-and-stake option and thus increase buying pressure. On the other hand, it will reduce the Onboarding price impact and extend the cycle of selling rewards, which means less selling pressure. Therefore, the price equilibrium should be higher than before.

Finally, this proposal will affect the Treasury and backedPrice. Due to the reduced share of onboarders the treasury will have a lower degree of growth, still due to higher market price and plutoGrowthFactor each onboarded token will increase backed price more intensively.

Join the discussion on the proposal

The new parameters are just the beginning of searching for the optimum and these are not final. We look forward to getting your feedback on the proposal in our telegram community chat:

Stay tuned!