Epoch 1 will end on September 1st, when Epoch 2 starts. Ahead of this change, we’re releasing details for epoch 2. Remember that Frontier is designed for long term users - continued participation is needed to unlock its full potential.

Epoch 1 Recap

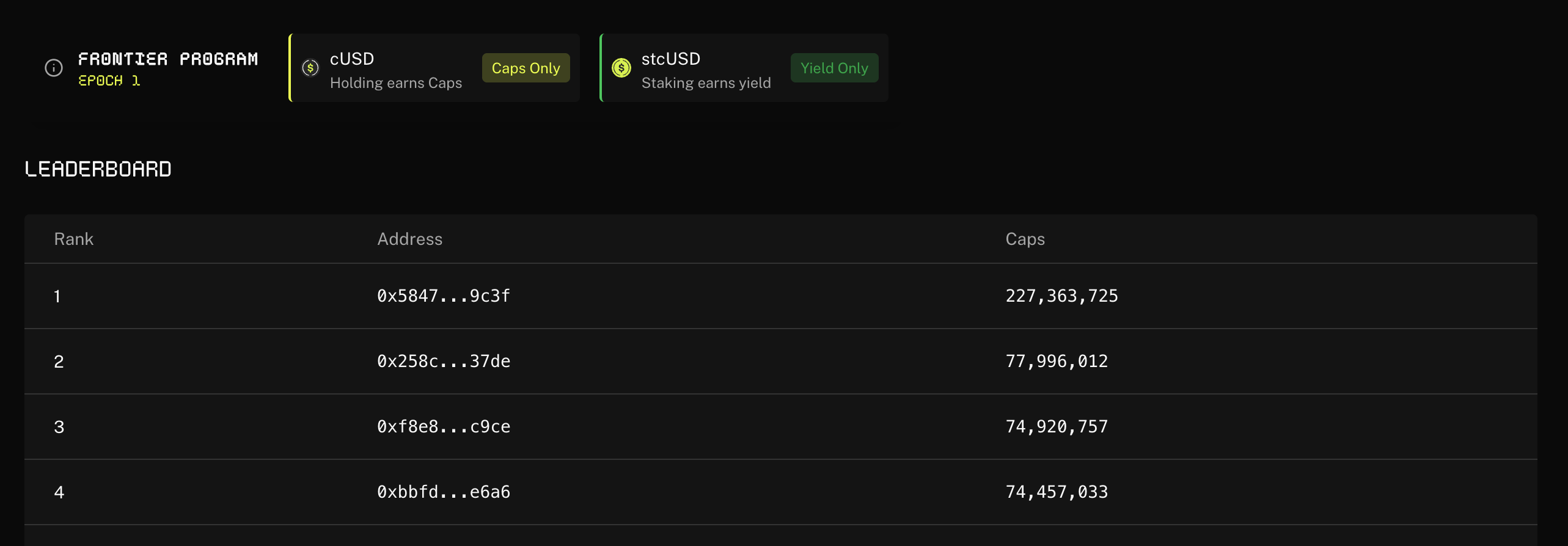

Epoch 1 of Cap’s Frontier Program was simple, bootstrap cUSD’s reserve with USDC. The market reception was tremendous, with over $65M in user deposits from a distributed set of users. Blue chip projects have already integrated cUSD and stcUSD. Pendle listed an stcUSD market within days of launch. Redstone built an oracle for cUSD on Ethereum. These coveted integrations are just the start of a long list of planned integrations for Cap assets.

Based on user demand, the team set up a dashboard for users to track Caps. For any questions or suggestions, visit our community Discord or Telegram channels.

Yield engine start: with the bootstrapping of cUSD’s reserve complete, Cap will slowly begin to turn on its yield engine. Delegators have already begun to create their Symbiotic vaults to delegate to Cap operators. This process will take a few weeks given the need to wait for Symbiotic delegation epochs.

Epoch 2 Activities

Cap users are encouraged to participate in activities throughout Frontier. Continual participation in activities prevents caps inflation from hurting initial depositors.

cUSD asset holders

Starting September 1st, cUSD holders will continue to receive Caps for the next 6 weeks. The rate of Caps will be 10x caps per cUSD.

Pendle

cUSD and stcUSD holders can earn additional Caps on top of their normal rates by using Pendle. YT-cUSD holders will earn the same rate of Caps as cUSD holders and also an additional rate on top. YT-stcUSD holders will earn Caps as well. Below are these aggregated rates:

-

Total YT-cUSD rate = 20x

-

Total YT-stcUSD rate = 5x

-

Total LP-cUSD rate = 20x

-

Total LP-stcUSD rate = 5x

Lending markets

Lenders to Cap assets - those providing stablecoin liquidity for Cap asset holders to borrow - will earn Caps.

PT-cUSD, PT-stcUSD, and stcUSD will be integrated on lending markets. Lenders to these assets will earn the same rate as in the previous epoch. Information on these lending markets will be posted as listings occur.

Product Highlights

As a reminder, Cap’s two flagship products are:

cUSD = cUSD is Cap’s digital dollar asset. It is redeemable for available collateral assets, such as blue chip stablecoins and regulated money market funds.

stcUSD = stcUSD is the yield-bearing version of cUSD. It earns yield from both the base strategies of cUSD’s collateral assets, as well as yield from Cap’s allocations to institutional yield operators.

Note: All loans/allocations to operators from Cap’s reserve are overcollateralized by ETH and BTC derivatives via EigenLayer and Symbiotic.