Deep dive into the future of interoperability of blockchains

While Bitcoin is king, I don’t subscribe to the notion that it’s the only sheriff in town. With over 110 active public blockchains it is not unreasonable to suggest that the “one-chain-to-rule-them-all” thesis is dead.

CEO of Avalanche Emin Gün Sirer gets it.

Despite what individual tribes believe, the reality is that technology is ephemeral. What is the best technology now may not stay the best forever. This means that the number of these networks will likely continue to increase into the future.

All of these new blockchains (plus Ethereum Layer-2 roll-ups) will need to talk to each other so this necessitates the need for interoperability between these distinct networks. Accordingly, cross-chain bridges attempt to unify this increasingly fragmented landscape by enabling the transfer of tokens, assets, smart contract instructions, or data between blockchains.

Ryan Selkis, CEO and co-founder of Messari Inc, rightly notes that:

”By now, it’s abundantly clear that a multichain world isn’t just the future, it’s the present.”

Speaking of which, Ryan Selkis has written up an excellent crypto theses detailing key trends, people, companies, and projects across the crypto landscape, with predictions for 2022. This report is a must-read for all budding crypto professionals.

I have spent the last 6 days going over it, highlighting things, clicking on links, and above all LEARNING. It is not too late! Do yourself a favour — print it (all 165 pages of it) & read it. Here is a podcast for you if you are more of a listener:

To be sure Ryan Selkis has dedicated a whole section on scaling and interoperability solutions.

As Do Kwon chimes in at the Mainnet conference:

”Maybe it’s a bad idea to stick all the applications into one global computer. Maybe it just makes sense to have a multi-chain future.”

This is well reflected by the fact that we have seen an explosion in blockchain bridges that attempt to unify an increasingly fragmented landscape.

DezentralizedFinance.com lists more than 50 different bridge projects:

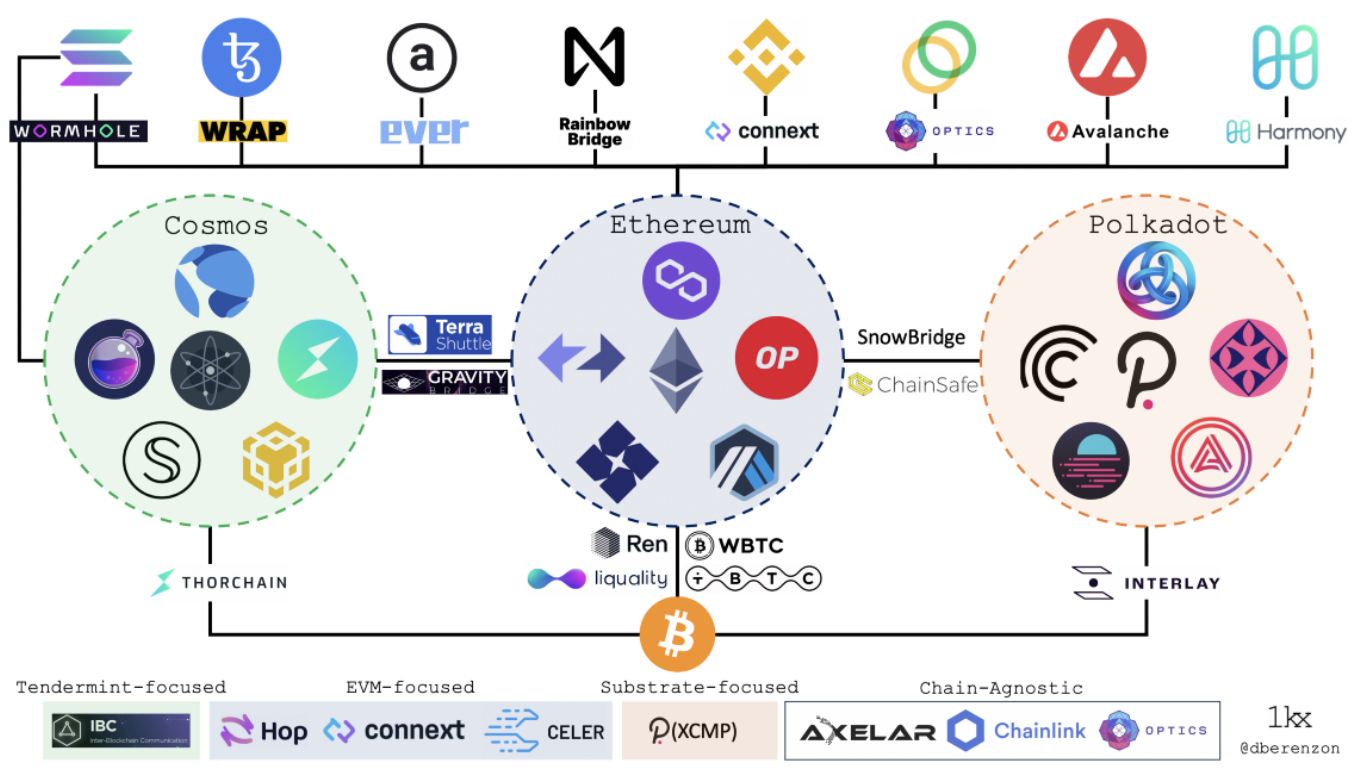

To create a better framework on how to evaluate each bridge design we can draw on Dmitriy Berenzon’s article Blockchain Bridges: Building Networks of Cryptonetworks, which overviews the various approaches to cross-chain bridges.

At an abstract level, Dmitriy Berenzon defines a bridge as a system that transfers information between two or more blockchains. In this context, “information” could refer to assets, contract calls, proofs, or state. He offers a nice visual to conceptualize cross-chain bridges.

To clarify things further Dmitriy Berenzon distinguishes roughly four types of bridges. I believe this separation is very useful for our understanding of bridges.

- Asset-specific: A bridge with the sole purpose of providing access to a specific asset from a foreign chain.

- Chain-specific: A bridge between two blockchains which usually supports simple operations around locking & unlocking tokens on the source chain and minting any wrapped asset on the destination chain.

- Application-specific: An application that provides access to two or more blockchains, but solely for use within that application.

- Generalized: A protocol specifically designed for transferring information across multiple blockchains.

*See article for more details.

Dmitriy Berenzon rightly notes that while an ideal state would have been one homogeneous bridge for everything, it is likely that there is no single “best” bridge design and that different types of bridges will be best fit for specific applications (e.g. asset transfer, contract calls, minting tokens).

Ryan Selkis would certainly agree with this assertion. In fact, he is convinced that it’s inevitable that cross-chain bridges will facilitate an enormous amount of asset and data transfer volume. He goes on to prognosticate that the most popular L1 <> L2 / L1 <> L1 / L2 <>L2 bridge protocols will have higher daily volumes than the most popular centralized exchange within five years.

According to data by Footprint Analytics the four largest cross-chain bridges namely, Avalanche Bridge, Polygon Bridge, Arbitrum Bridge and Fantom Anyswap Bridge, account for 95.61% of the entire cross-chain bridge, with its highest monthly increase of 401.23% last month.

To go through each and every cross-chain bridge is beyond the scope of this post but let’s consider some projects that have caught my eyes.

Hop Protocol

Moving assets between roll-ups and the Layer 1 network is slow and expensive, thereby diminishing the savings users gain by using the roll-up.

The Hop Protocol allows allows users to quickly and easily transfer tokens among blockchains such as Ethereum, Polygon, xDAi, Optimism, and Arbitrum, enabling a composable and interoperable layer-2 ecosystem for Ethereum.

For more details check out this Bankless Podcast interview with CEO and Founder of Hop Protocol Chris Whinfrey:

The Hop Protocol has caught my attention because it is the leading trust-minimized bridge by volume right now and uses bonders and stableswap AMMs to rebalance funds on both sides of the bridge.

Keyword here is trust-minimized bridge!

Richard Chen explains that almost all cross-chain bridges right now are variations of trusted multisigs. The Ethereum to Avalanche bridge, in particular, is an EOA (Externally Owned Account) whose private key is sharded among four trusted Intel SGX signers. And it holds over $6B in users’ funds.

This in and of itself is very worrisome as these bridges are massive honeypots and it is not unreasonable to predict that dredict bridge hacks will be the new CEX and DeFi hacks. For example, the $611M Poly Network hack might just be the tip of the iceberg of what’s to come.

While the focus of bridges to date has been on token transfers, Richard Chen points out that the holy grail and an active area of research right now is on how to do cross-chain message passing trustlessly.

Hop Protocol doesn’t have a token (yet)! So you’d be advised to check out How To Bridge Your Assets Using Hop Protocol for a more practical guide on how to use this technology. This might very well be worth your time! Put simply, use the bridge to get a chance of receiving a potential retroactive airdrop from Hop Protocol!

Loopring

tldr: Loopring is Ethereum’s first and only ZK roll-up DEX.

Loopring is an open-source, audited, and non-custodial decentralized exchange. It hosts a unique approach compared to other Ethereum-based DEXs, implementing ZK roll-ups, which is centred around scalability.

In particular, Loopring allows anyone to build high-throughput, non-custodial, orderbook-based exchanges on Ethereum by leveraging Zero-Knowledge Proofs. If you are not on the ZK roll-ups bandwagon check out my previous article here and here. Suffice to say that ZK roll-ups in particular are poised to be the key scalability solution for Ethereum for the foreseeable future.

The Wolf Of All Streets would certainly agree with this assertion:

With zk Roll-ups, Loopring asserts its exchanges can offer faster settlements for traders. Rather than settling trades on the Ethereum blockchain directly (as other decentralized exchanges do), zk Roll-ups enable Loopring exchanges to complete key computations elsewhere.

The idea is that this can reduce the number of transactions that a Loopring exchange will need to submit to the Ethereum network, thus increasing speed and reducing costs for traders.

Speaking of The Man, The Myth, The Legend — Vitalik Buterin was interviewed today (05.01.2022) by the Bankless duo, in which he specifically mentioned Loopring and the cheap and fast transactions that they are able to offer. Here is the whole two hours of it. Enjoy!

All in all, I love me some ZK roll-ups and therefore by extension I am very intrigued by Loopring. Gas fees are too damn high and this is the reason why I stay away from Uniswap and all other DEXs. Does Loopring fix this?

Be that as it may, Loopring appears to be gaining momentum. Most recently Loopring announced that pTokens BTC is now available on Loopring exchange and can be swapped with USDT. This makes Loopring compatible with BTC and introduces its market liquidity.

There has also been talk about the possibility of a partnership with GameStop. *Not sure if this is bullish. We didn’t have GameStop in New Zealand so I don’t quite get excited about this.

And last but not least I wanted to introduce you to an interoperability startup called LayerZero.

LayerZero

tldr: Interoperability that actually works!

In short, LayerZero is an omnichain interoperability protocol that unites decentralized applications (dapps) across disparate blockchains.

Read Ryan Zarick’s LayerZero- An Omnichain Interoperability Protocol to get into the weeds of this project.

Their whitepaper is an easy read. Notably, it lists all the important players in the cross-chain interaction space, why they fall short of the ideals of trustless valid delivery, and how LayerZero closes that gap i.e. whose lunch they are going to eat! (e.g. Polygon, THORChain, Polkadot, AnySwap, and others beware — LayerZero is coming for your lunch!)

Here is a nifty diagram of the architectural differences between CEXs, DEXs, and a cross-chain bridge built using LayerZero.

The ultimate goal is that LayerZero will connect all chains seamlessly, having users unaware they are even using it. It will enable current and new Decentralized Applications to expand beyond the borders of EVM or Non-EVM, creating the world’s first omnichain applications.

*Please note: It’s a start-up so no token yet!

That certainly sounds mouth watering — *Multicoin Capital (Kyle Samani at it again — his spider webs are everywhere), Binance Labs, Delphi Digital (the experts for the experts), and many other high profile VC’s would certainly agree as they have poured serious initial seed funding into this project. Do Kwon of Luna is also in on the action as an angel investor.

*Zoom over to Multicoin Capital and read their thesis — good stuff! Also follow Kyle Samani on Twitter. He is definitely a nifty operator in this space.

Here is the video that explains LayerZero.

In summary, I believe that the ‘one-chain-to-rule-them-all’ thesis is all but dead. Accordingly, many maxi tribes across the industry might have to swallow the bitter ‘interoperability’ pill and embrace it as fundamental to the industry’s future.

I have zoomed in on the Hop Protocol (airdrop?), Loopering (ZK roll-ups), and LayerZero (novel technology) but there are certainly other projects out there that stand out.

Synapse, dYdX, Ren, THORChain and many other cross-chain bridges equally deserve some love so get your spectacle out and #DYOR.

I will leave you with this little gem by EllioTrades Crypto:

In this video Ellio rightly points out that the crypto market is characterized by microcycles of narratives with bullish 3 month cycles. This makes sense — think of DeFi summer or the crazy NFT craze. As an example, consider Axie Infinity’s price chart:

Put simply, Ellio suggests that the best way to get ahead in crypto is by identifying and surfing the micro narrative cycles and taking profits along the way.

In this post we discussed the cross-chain bridge narrative. My previous post zoomed in on the Music NFTs narrative. What narratives are going to pump in 2022?

Stay sharp and identify and play the narratives!

#WAGMI

Happy bridge’ing ya’ll!

Frei Bier / Twitter: @FreiBIER13

DISCLAIMER: My writings are merely a reflection of my learning journey and my attempt to compartmentalize the cryptoverse. I am learning out loud so feel free to correct me or disagree with me. This is not investment advice but my hope is that you find value in some of my links and ideas.