If you've ventured into the world of DeFi, you've likely encountered the term "liquidation."

It might sound ominous, like a sudden vanishing act for your crypto assets if things go awry.

But fear not; it's not always as dire as it seems, especially when you're on a lending platform that has your back.

That's precisely where Nostra comes into play, transforming the intimidating into the manageable.

Debunking Liquidation Myths

First things first, let's demystify liquidation.

It's merely the result of your borrowed DeFi assets nearing the value of your collateral. Contrary to popular belief, liquidation doesn't always mean losing everything.

Instead, the impact of a liquidation event largely depends on the specific mechanisms of the lending protocol in question.

Protocols designed with the borrower's interests in mind can mitigate the potential fallout, ensuring that liquidation is not the end of the world but a manageable risk.

Nostra's Balanced Approach

Nostra stands out by implementing a liquidation mechanism that strikes a balance between protecting lenders and being fair to borrowers.

This equilibrium is crucial.

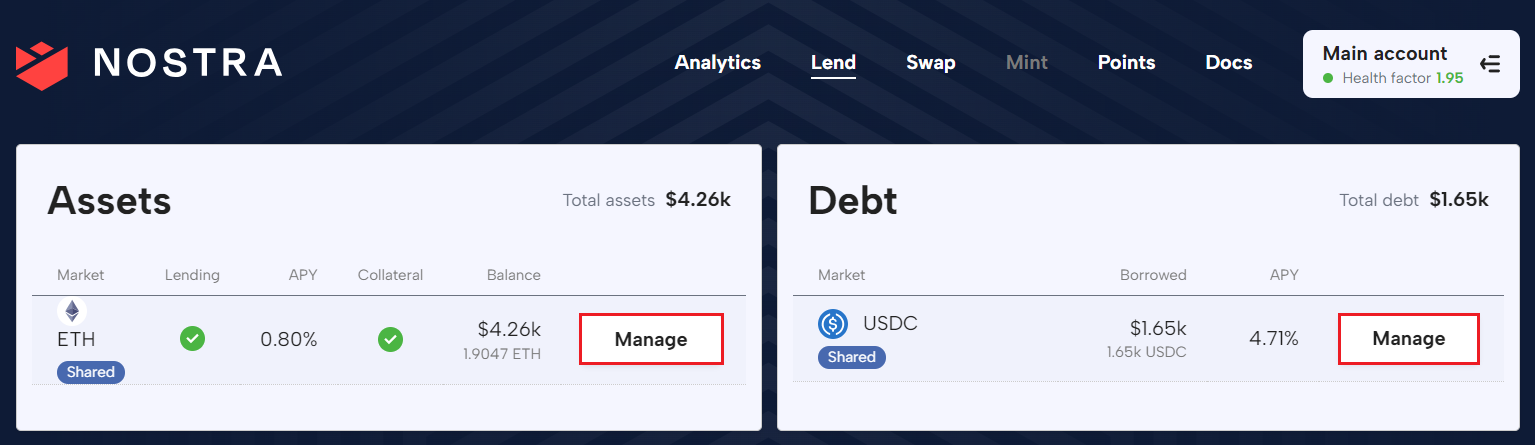

Lenders need safeguarding from excessive risk, while borrowers shouldn't face severe penalties for minor health factor fluctuations (for a deep dive into health factors, check our previous blog post!).

The Close Factor: A Dynamic Solution

At the core of Nostra's innovative approach lies the "dynamic close factor," determining the liquidation extent based on a borrower's health factor.

Instead of some one-size-fits-all rule, Nostra assesses how risky your situation is and takes action accordingly. So, if you're slightly below the liquidation threshold, Nostra won't seize your assets.

The protocol will just do enough to keep everything safe and sound, aiming for a sweet spot that keeps everyone happy.

For instance, in protocols with a fixed close factor of 50%, a borrower could see half of their collateral liquidated for a health factor momentarily dipping below 1 (e.g., 0.995), which can be perceived as excessively punitive.

Nostra's model, by contrast, adjusts the close factor dynamically, allowing only the portion of the borrower's position to be liquidated that is necessary to restore their health factor above a safer threshold, currently 1.2.

Encouraging Responsible Risk-Taking

Nostra understands that DeFi enthusiasts enjoy a bit of risk-taking for potential rewards.

We aim to keep the liquidation process user-friendly, allowing everyone to participate without excessive worry. It's about maintaining a positive atmosphere, ensuring fair risks, and preventing users from feeling unfairly treated.

In the unpredictable realm of DeFi, liquidation can be intimidating. But with Nostra, it's more like a passing rain shower than a thunderstorm.

We’ve found a way to ensure that even during turbulent times, you won't lose everything. It's about fairness and understanding, and enabling everyone to continue playing the game they love.

So, next time you hear "liquidation" and feel uneasy, remember: it's manageable, especially with Nostra by your side.