In the world of finance, money is just like any good you buy or sell. But, instead of buyers and sellers, we have borrowers (people who need money) and lenders (people who have money to give).

Since money cannot strictly be bought, the price of money is the price a borrower must pay a unit of money to the lender for a certain period of time. This price is known as the interest rate.In this blog post, we’ll explore into the depths of money markets, and the impact of interest rates during bull markets, and how you can profit from it. Let’s dive right in!

The Role of Borrowers and Lenders

In the money market, borrowers pay lenders for the privilege of using their money for a certain period. Where do lenders get money from?

In traditional finance, banks borrow money from depositors and investors in capital markets. As a result, banks don't keep all the interest earned from loans to themselves as they have to pay their lenders (depositors and investors) too.

In DeFi, a similar principle applies. Lenders collect interests from borrowers but must share a portion with the money market protocols they utilize. This is why, in any money market in DeFi, there are two, not one, main interest rates.

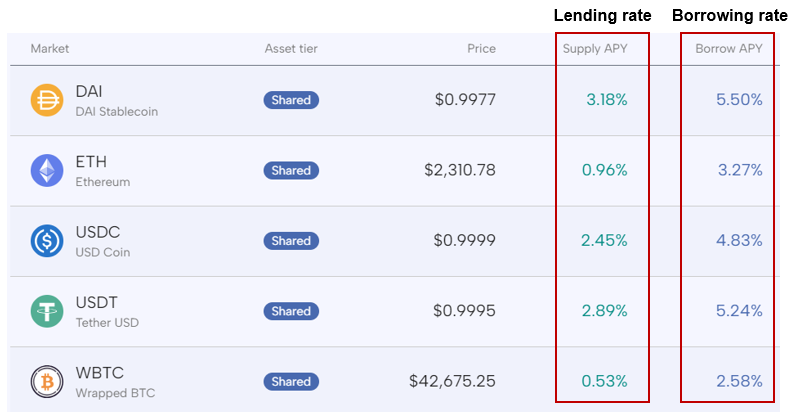

The borrowing rate is the price at which borrowers must pay a unit of cryptocurrency borrowed from lenders. The lending rate is the portion of the borrowing rate retained by lenders. The difference between the borrowing rate and the lending rate is retained by the money market protocol.

You can see these two rates in Nostra as “Borrow APY” (the borrowing rate) and “Supply APY” (the lending rate.

Let’s recall that APY means Annual Percentage Yield, namely the portion of a loan principal paid by a borrower / earned by a lender assuming the loan is outstanding for a year.

How do interest rates fluctuate in Nostra?

Interest rates are, as almost anything in finance, a function of the imbalance between supply (how much lenders are willing to lend) and demand (how much borrowers are willing to borrow) of a certain cryptocurrency in Nostra.

The higher the demand relative to the supply, the higher the interest rate borrowers pay lenders and vice versa.

While we won’t cover the mathematical details of how interest rates are calculated (you can read the official docs for a more thorough explanation), the market dynamics that move interest rates are definitely worth mentioning.

The key concept to master here is “leverage”.

Borrowing in DeFi: A Focus on Leverage

A notable distinction between TradFi and DeFi is the reason for borrowing.

In traditional finance, borrowing money could serve numerous purposes such as buying a house or equipment for a business.

However, in DeFi, the primary motivation for borrowing is to purchase cryptocurrencies. The act of purchasing financial assets with borrowed capital is known as "leverage."

What would you do if you had a high conviction on the BTC price skyrocketing over the next week?

You would definitely buy some using the money you have now. However, your gains are limited by the money you can use to buy BTC now. If you want to increase your potential gains (and losses), you have to increase the capital available for you to buy BTC.

That’s why you might think of borrowing cryptocurrencies (such as stablecoins) to buy BTC.

Leverage becomes particularly significant in bull markets, where cryptocurrency prices are on the rise. Traders, aiming to maximize returns, invest as much as possible. If they don't have enough money, they borrow. It's like getting a boost to buy more crypto

How to Profit during Bull Markets using Interest Rates in Nostra

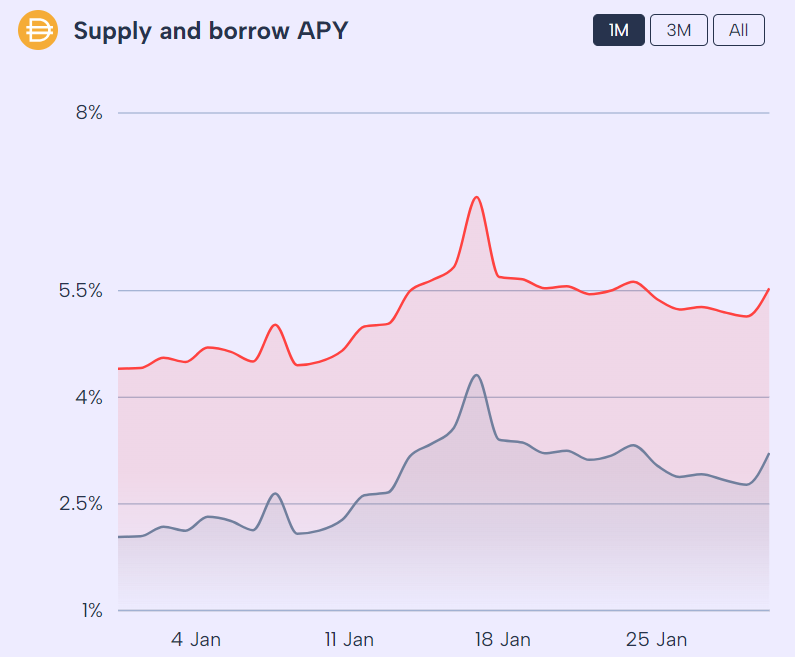

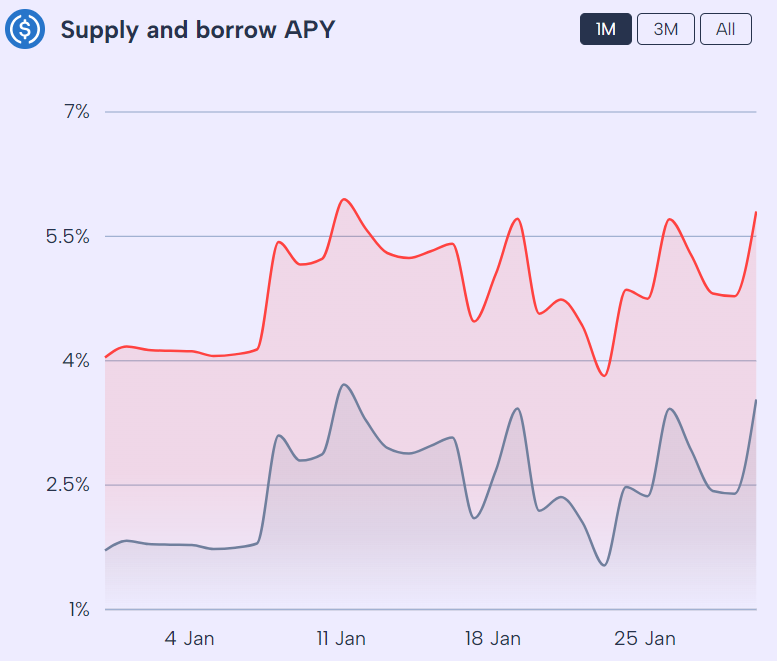

As we have seen before, during bull markets, prices of volatile cryptocurrencies such as BTC and ETH experience an upward trend and traders rush to borrow stablecoins to purchase more and more volatile cryptocurrencies.

The increase in borrowing volume brings the lending APY up, providing more conservative investors an interesting opportunity to profit from a bull market.

Even if you think it's too expensive and risky to buy cryptocurrencies in a bull market, you can lend your stablecoins in Nostra to others who want to buy and still make good money earning a yield on your lent funds.

This is the cool part of financial markets: cautious people can earn by lending money to those who want to take bigger risks and are okay with paying for it.

Interest rates on Nostra are on a tear since the start of 2024, as you can see below for USDC and DAI.

Wrap Up

Understanding interest rates in DeFi is all about seeing money as more than just cash.

You must know why people borrow and lend, and how this is connected to the ups and downs of crypto prices.

Whether you like to play it safe or take chances, DeFi has something for everyone.

Interest rate farming could sound boring at first sight but it is extremely rewarding on the medium/long term.

Nostra provides you with a platform where you can have the best of both words: dopamine rush with maximum leverage as well as slow but steady passive income.Don't just watch the bull run. Join it smartly with Nostra.