Written by your friends at NeptuneCircle (Stephen, Mike, and Kris)

Subscribe to @neptune_circle for more updates. We will post on Mirror and Twitter.

If you would like to take a sneak peek at our model outputs for June 2022, please follow us on Twitter and send us a message. We’d also love to hear your thoughts and inputs about our method as we are still refining the platform/model.

Table of Content

- A quick summary on our model outputs;

- A survey of existing NFT valuation and luxury brands valuation;

- A look at our model’s methodology; and

- Finally, a look at why NFT valuation is important;

TL;DR - fine, we’ll add one.

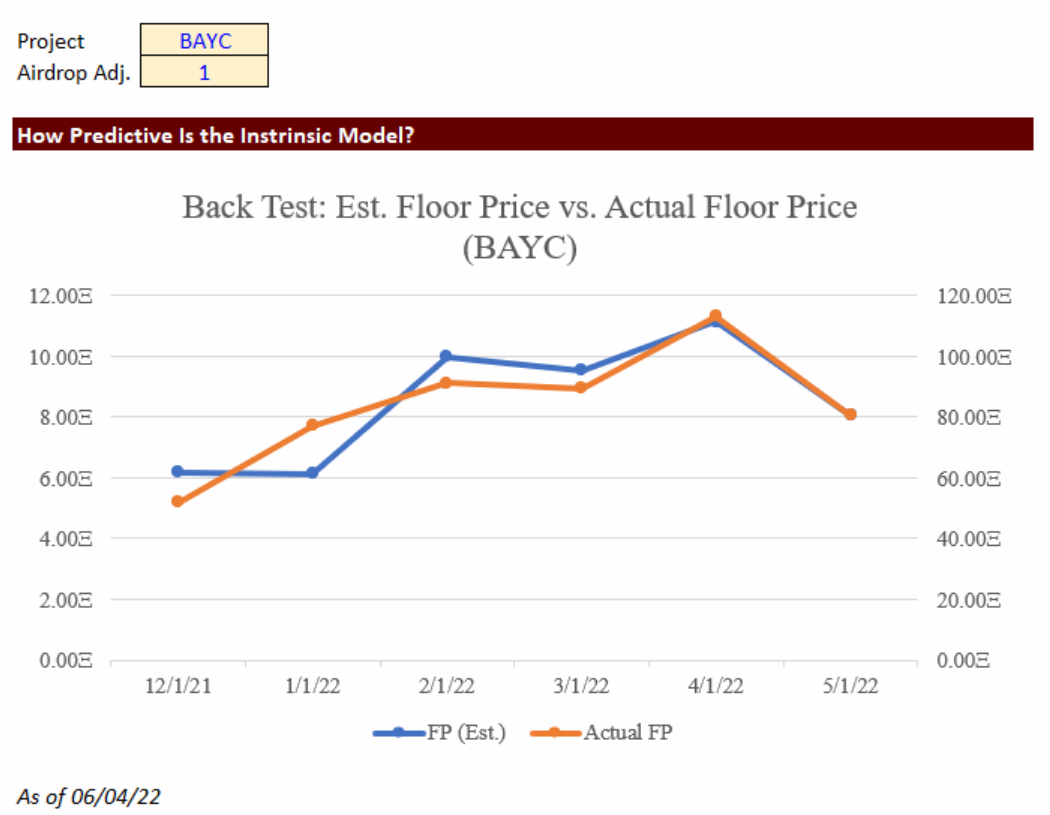

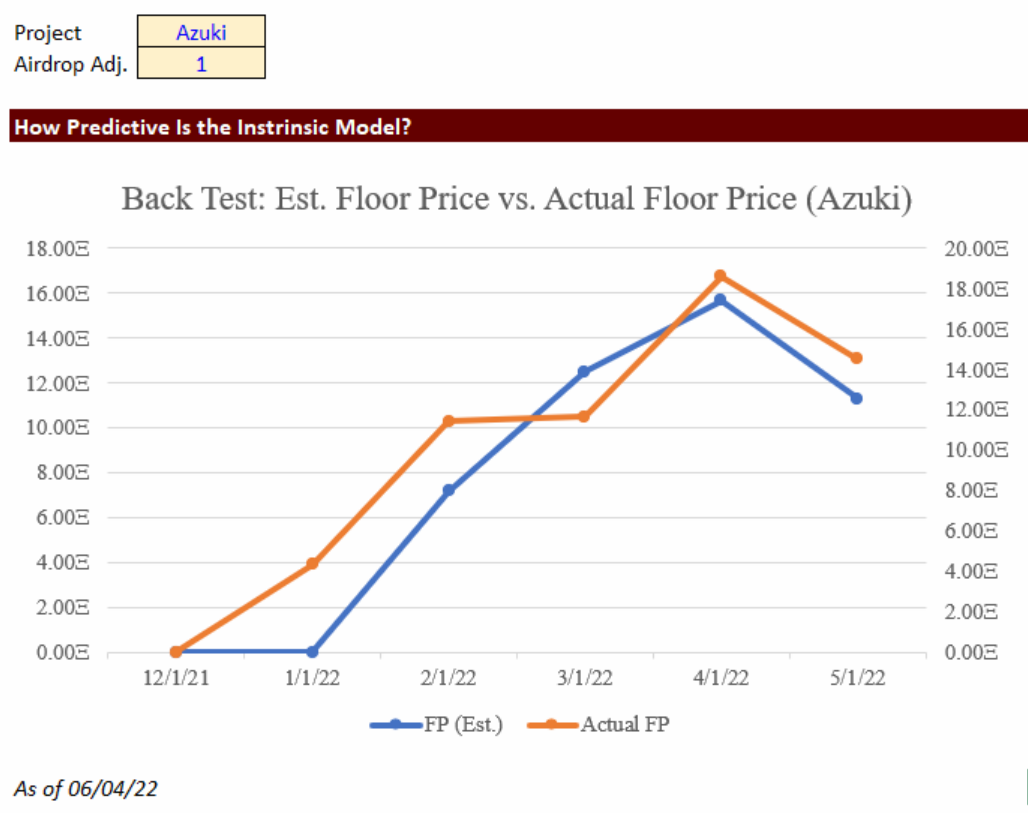

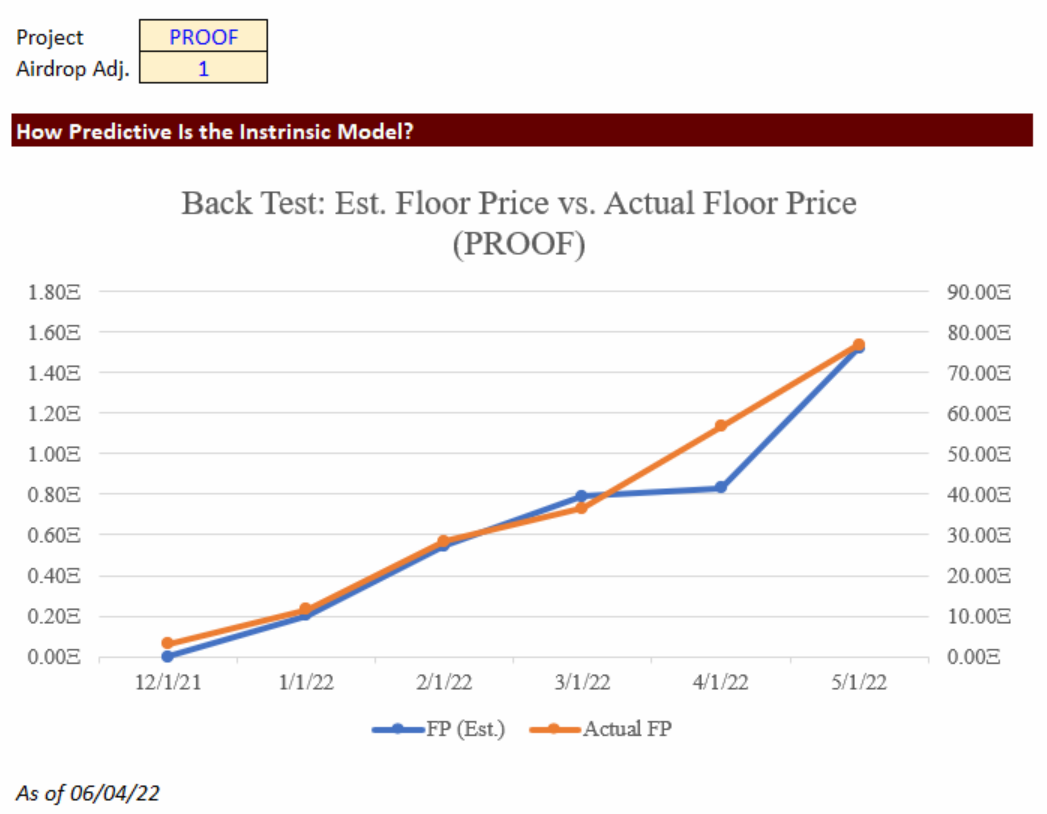

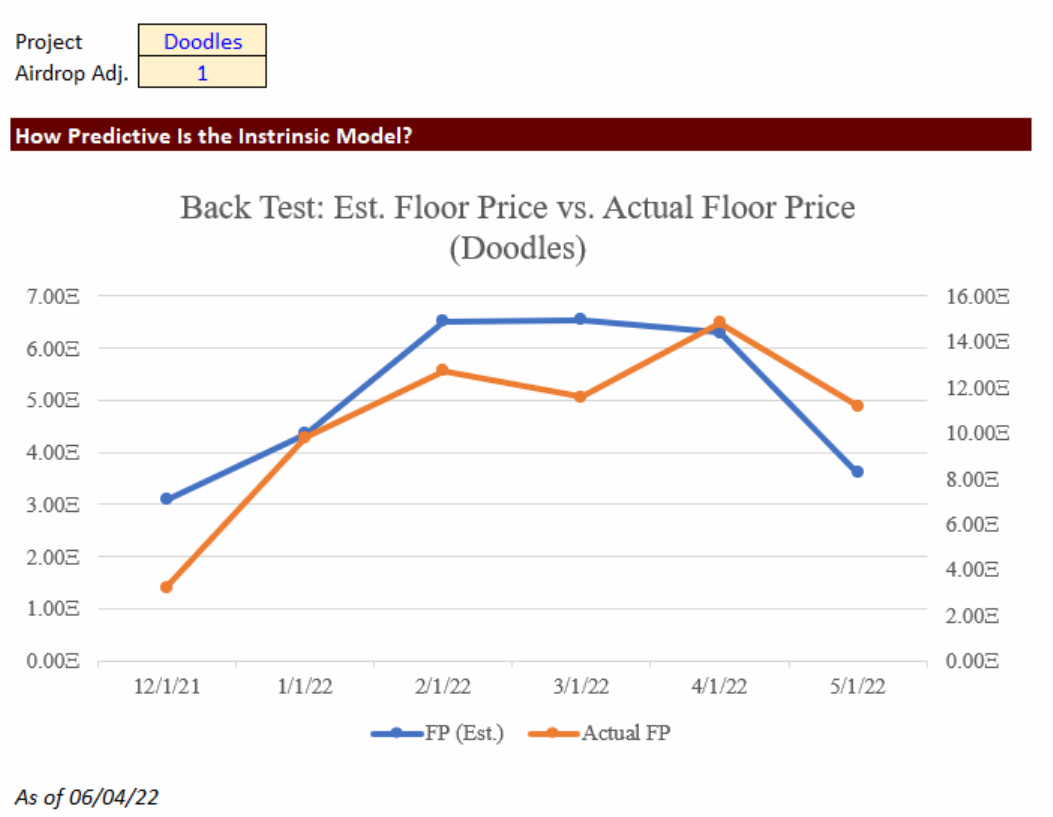

- In Section 1, we put down some of our model output and one could see that the research model yields accurate results in terms of predicting each NFT collections’ monthly floor price.

- The rationale behind the model is two-fold: (1) intrinsic value, where we seek to introduce the concept of cashflow (via royalties) into NFT valuation. Beyond that, we have also incorporated the market’s (Stock > ETH > Blue-Chip NFT) expectation for the next few months; and (2) intangible value (continued to be developed), where we hope to explain the floor price movements using some of the idiosyncratic elements of the project.

Section 1: Model Outputs

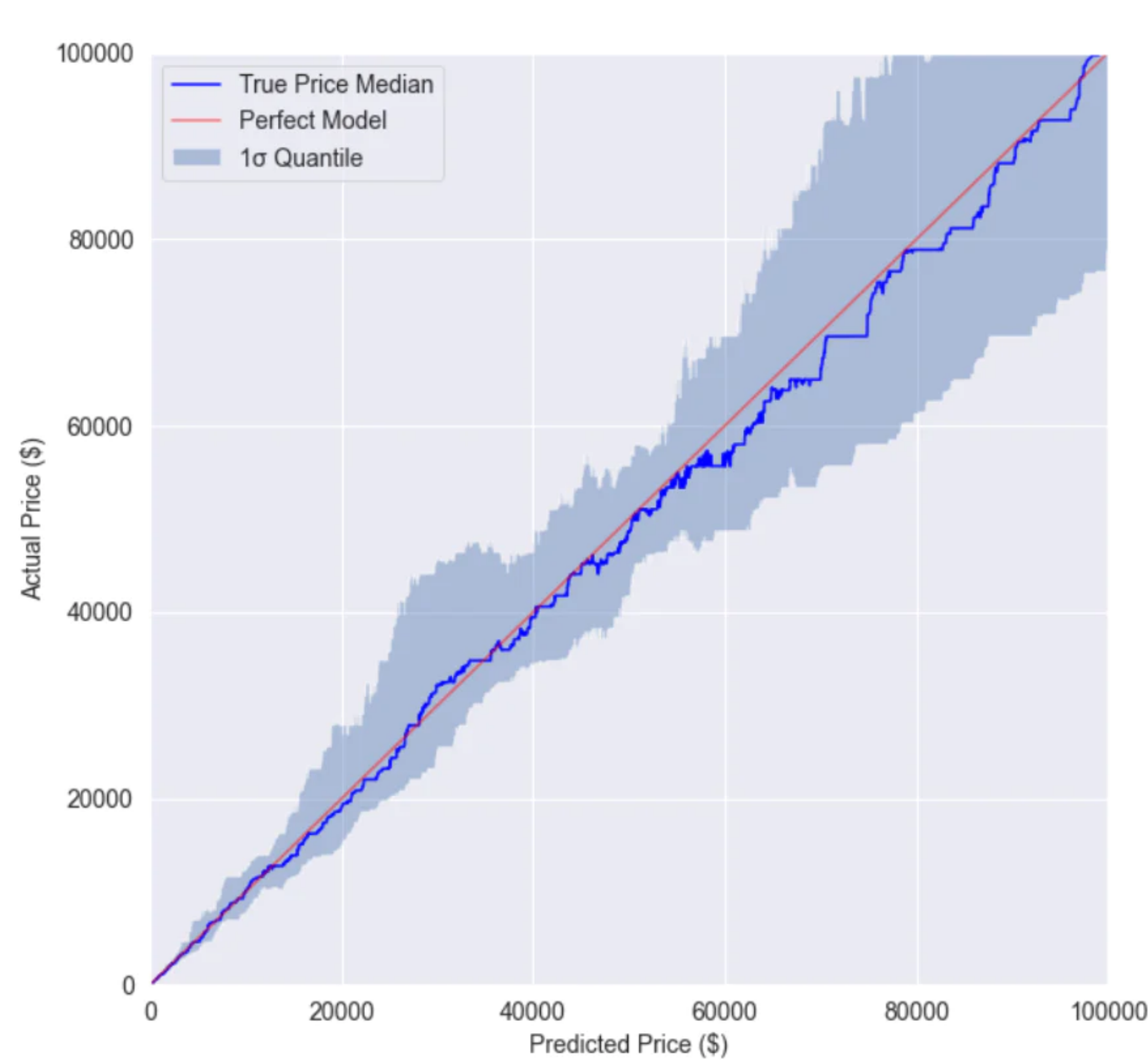

There remains a great mystery of how one value NFTs and have a model that could accurately predict the monthly floor price trend. Guided by numerous materials, we, at NeptuneCircle, have started this process and the below is what we found. In our model output, the blue line details our model’s floor price prediction for that particular month and the orange line notes the actual average floor price. Please pay attention only to the month-to-month trend of the predicted floor price as opposed to the absolute value because those numbers vary by assumptions.

We have also modeled out many other blue-chip NFTs (MAYC, CloneX, Moonbird, WoW, and CryptoPunk), and below are only some selected snapshots of the model output.

The way we back test our model is the following: for example, if the valuation date is 3/1/2022, the model only uses data available on or before 2/28/2022 and reaches a prediction (blue line dots). This datapoint is then compared with the actual floor price (orange line dots, where we use the average floor price for the entire month of March, 2022).

Section 2: NFT and Luxury Brand Valuation

The reason why we talked about NFT valuation and luxury brand valuation at the same time is because many have argued that PFP NFTs are similar to the luxury brand market but with the additional opportunities of (1) airdrops and (2) no second-hand depreciation. We will discuss this topic at a different article but for now, you can take a quick look at the Messari report here.

NFT Valuation

The below introductions are from an article by Matrixport Partners. Right now, the vast majority of the market has 4 ways to analyze NFT values.

The first approach is to acquire on-chain Time Weighted Average Prices (TWAP) on NFT floor prices through Chainlink or Sushiswap. This is commonly used by NFT lending projects that are attempting to build permissionless loan functions.

The second approach is to use statistical methods and machine learning techniques to extrapolate the NFT’s possible valuation range based on past sales data and corresponding NFT traits. Upshot, after pivoting from a peer-appraisal model in November 2021, has been actively exploring and experimenting with the approach, as well as building NFT pricing APIs. Using Shapley Value, a method which measures specific features’ impact on historical data, it is possible to conduct analysis on each individual NFT’s traits and the relationship with its historical sales price.

- Machine Learning allows Upshot to incorporate data that last price and EWMA do not take into consideration, such as pooling the sales histories of NFTs to arrive at a prediction for a single NFT and utilizing a range of NFT metadata (such as CryptoPunk accessories), and then weigh the importance of these features. As a result, ML approaches excel in predicting the prices of NFTs where others fall short, and is why we rely on them to generate our NFT appraisals.

The third approach is a peer appraisal model, where NFT collectors and collector DAOs can participate in either direct appraisal for NFT values, or enter a prediction-market style valuation session where the participants can be rewarded and punished by the session results. It is obvious that aside from a few selected super-rare NFTs that would work well with this method, pricing NFT using the appraisal model would produce less efficient and accurate outcomes.

Lastly, there are financial derivatives-driven primitives such as Abacus Spot. With Abacus Spot, participants can open pools, deposit ETH to speculate on NFT prices and track down NFT owners to activate emission rewards in the form of Abacus’ token. Holders of NFT can demand bribes from liquidity pool traders for an earlier spot in the pool, which in turn will give the traders an advantage to profit in the auction process (you can read more about their First in, First out system here).

Luxury Brand Valuation

In the context of mergers and acquisitions, valuations of luxury brands—and most especially of luxury fashion brands—take into considerable account intangible assets such as brand value and creative leadership.

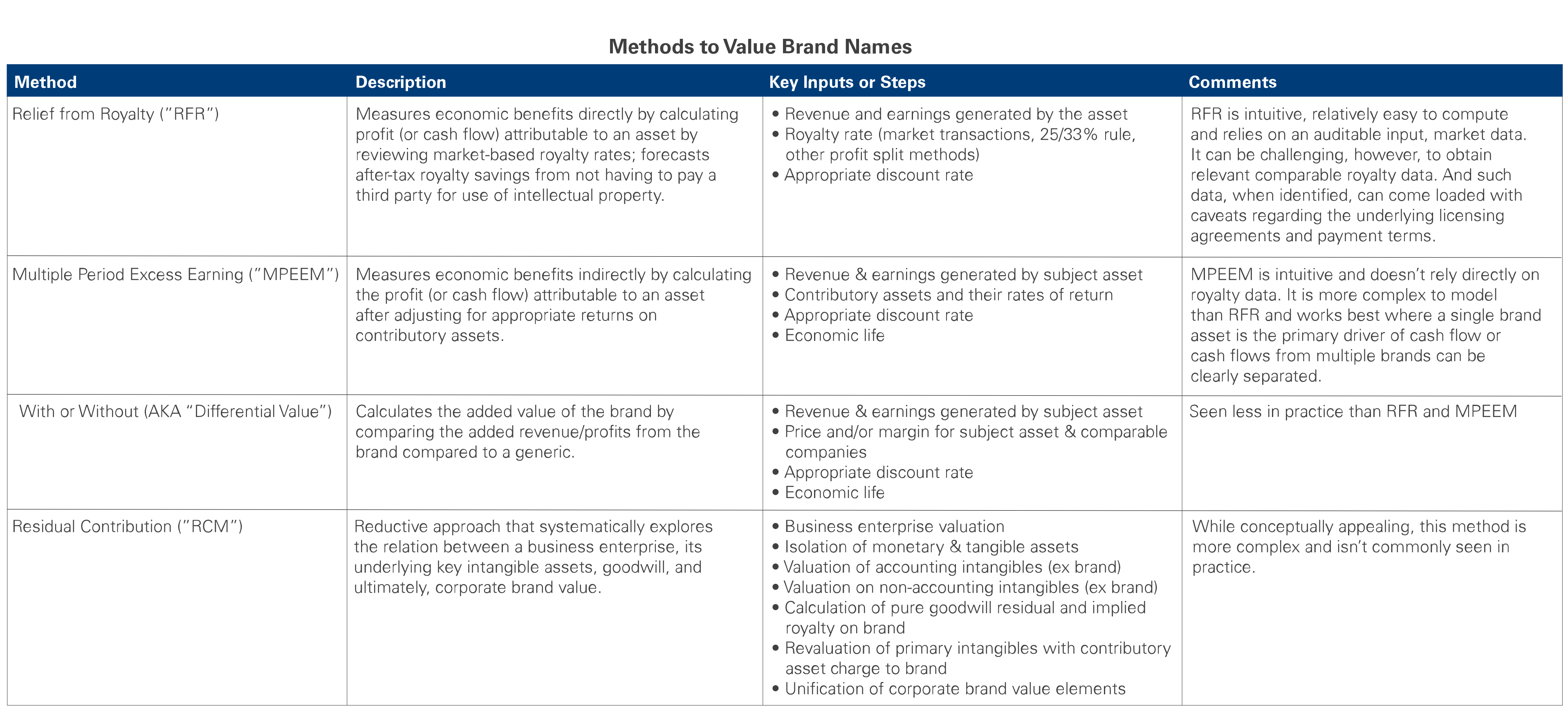

There are three broad approaches to brand valuation—the asset, market or income approach. In current practice, the asset and market approaches are infrequently deployed. In terms of the asset approach, the cost to develop a luxury brand may not be known and typically has little correlation to its value. Meanwhile, because brands are rarely transacted as standalone assets, there is little direct market evidence of value. As a forecast is available in most settings requiring valuation of a brand, an income approach is most common. Additionally, in one variant of the income approach, the Relief from Royalty Method, some aspects of the market approach are incorporated via the use of royalty rates.

The table above provides a description of the four main methods to value brands, their key inputs and some comments on their respective strengths and weaknesses. Given their importance to the business and its earnings, use of the MPEEM is quite common when valuing luxury brands. Alternatively, the With-and-Without Method can provide a meaningful value indication as there are price and margin data for both luxury and non-luxury brands. A key challenge if the analysis is performed from a price, rather than margin perspective, is attribution of the price differential to the brand vs. actual differences in physical quality.

Section 3: Our Methodology

Background of NFT Royalties

NFT royalties are payments that compensate original NFT creators for the use of their. In business, royalties generally pay the creator a percentage of sales or profits. With NFTs, royalties are usually set by the owner during the minting process. NFT royalties are automatic payments to the original NFT owner made on secondary sales of the owner/artist's creation. The NFT royalty is chosen by the original owner in the marketplace, or blockchain platform, during the minting process. The royalties are tracked on the blockchain. NFT royalties come from secondary sales, which are sales that occur in the marketplace after the original sale. To use a stock market comparison, this is similar to stocks trading in the secondary market after first selling in an initial public offering, or IPO.

Intrinsic Value (Cashflow) Perspective

We seek to introduce a cashflow consideration into our NFT valuation. Each NFT collections has it own trading volume and royalty fee percentages - these represents actually cashflow (in ETH) to the artist and studios behind the collection. The important implication is that one could, in essence, use a DCF framework to value the project as a whole. What we hope to incorporate is some of the fundamentals from our familiarities with traditional financial modeling - an old fashion way to look at the NFT collections if you will. This method could similarly be applied to the valuation of NFT studio brands (like BAYC) in general, which could in turn incorporate minting sales and merchandise sales. Now that this new component is introduced, let’s dive right in.

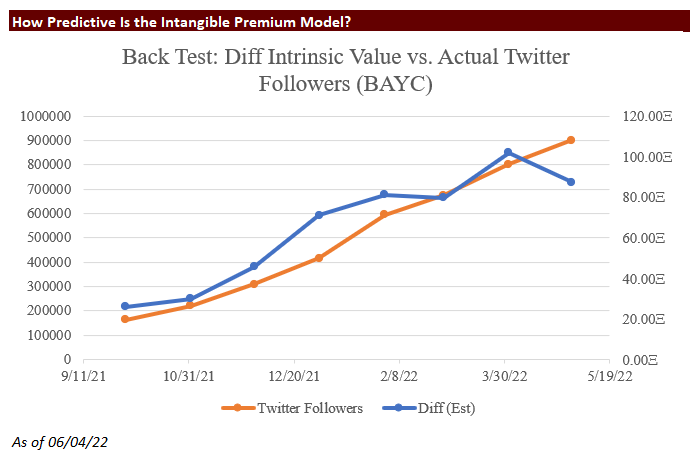

In simple terms, the intrinsic model captures three things: (1) royalties (i.e., cashflow); (2) historical floor price; and (3) market expectation (as opposed to market’s historical performance). The vast majority of models on the market focuses on historical figures, and they do sometimes yield incredible results and have high accuracy rate. However, what is lacking is the expectation regarding the market condition in the coming months. Our research modeled out the expected/future view (as of the valuation date) on the capital market (S&P 500 etc.), crypto market (ETH), and NFT market (blue-chip index). On the one hand, historical market condition is embedded in our discount rate and historical sentiment regarding the project is reflected in royalties and floor price. On the other hand, future expectations flow through our month-to-month growth assumptions. This is why we are able to accurately predict the monthly movement/trend of floor prices. You should also note that our model has taken out the effect of airdrops, which according to our experience, could skew the floor price quite a bit because one collection’s floor price in a month with airdrop expectations could be the sum of two collections (the original one and the airdrop one).

Additional Thoughts on Historical Data: The discussion on airdrops leads naturally to our perspective on historical data: even though market sentiment could be similar to the prior month in some cases, we need some portion of the model to reflect the market sentiments for the future. Nonetheless, the model still takes significant allocations from historical data - inspired by Upshot, where they said:

“One component that helps us achieve this is the limited memory of our models - we consider recent events more than events that happened further in the past.”

here, in our model, our research employed the same approach.

Intangible Value Perspective

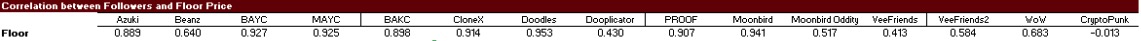

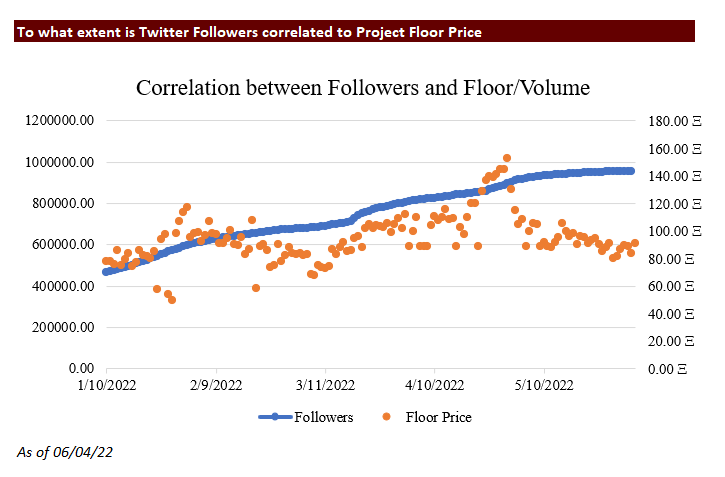

Beyond the intrinsic value method, as we mentioned above, we also need to consider intangible value of NFT such as brand value and creative leadership. As such, we want to introduce Twitter’s popularity consideration into our NFT valuation, especially in the intangible value part. Twitter’s popularity has drawn plenty of attention from NFT collectors/traders. To some extent, growing Twitter's followers of each NFT collection reflects its brand value and NFT collector loyalty. It represents a community built around the NFT collection, which will make NFT collection easier to spread out their culture and form "meme" swiftly. As is well known, an emotional state can influence our decisions, and no double such choice includes an NFT investment decision, which transfers some followers into the collection purchasing power and supports the collection's floor price and trading volume. Twitter followers' growth in each NFT collection gives us a novel way of capturing the community value.

To measure how a collection's Twitter followers could affect its floor price, we use the historical Twitter followers count for each blue-chip NFT collection (BAYC/AZUKI/Doodles/Moonbird/etc.) and investigate against collections' correlation coefficient between followers and the each collection's floor price/trading volumes. We found a highly positive correlation for some blue-chip NFT collections, implying follower is not just paying attention to solid NFT collections but also become actual buyers. This way, such as the "With or Without" method we mentioned, could similarly assess adding a brand's value (community value). It also partially explains the premium between the floor price of a mature NFT collection and its intrinsic value based on the DCF framework we used. Combined with the intrinsic model, this is why we possibly can propose an NFT monthly target floor price upon adjustable monthly assumptions in our upcoming reports.

We’d love to hear your thoughts and inputs about additional variables as we are refining the platform/model.

Section 4: Why NFT Valuation is Important?

Until now, the value held in NFTs has largely remained under-utilized and stagnant. While we found that investors focus more on short-term market sentiment than on a project's organic and sustainable growth, profitability, and long-term fundamentals in this nascent and muddy market, we believe, whether you are Flash boys or Intelligent investors, reasonable NFT pricing at least could help investors make better decisions. Accurate NFT pricing enables exciting new possibilities at the intersection of Defi x NFTs that will unlock the true potential of NFTs as an asset class. We believe improved NFT pricing will increase transparency, reduce information frictions in NFT markets and encourage participation from a broader community of developers - opening the floodgates to a new wave of NFT products and protocols.

For a better understanding of NFT finalization, please refer to the Matrixport article we talked about (Link at the bottom).

Cited Sources

NFT Financialization: Trends and Opportunities by Matrixport [Link]

Taking NFT Pricing to the Next Level with Machine Learning by Upshot [Link]