Imo mental agility is the primary ingredient of top investors.

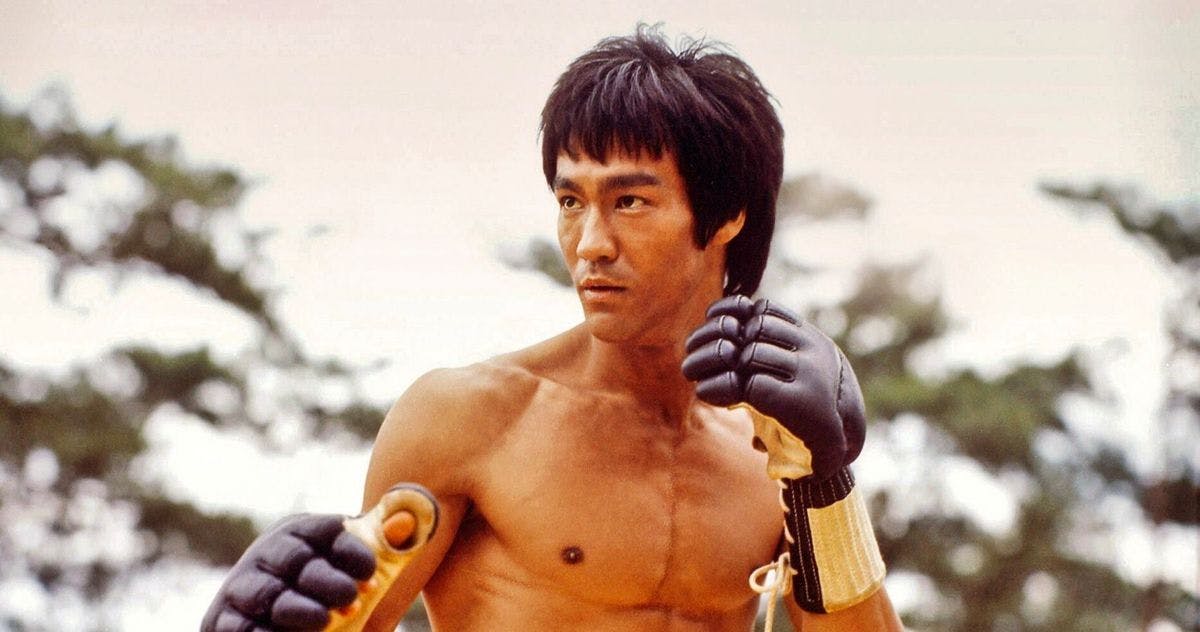

I recently stumbled on an obscure book recommended by Naval. after he made a comment that intrigued me: “Oddly enough, Bruce Lee wrote some great philosophy and Striking Thoughts is a good summary of some of his philosophy.” I was curious to see what it was like to be in the head of a master martial artist.

This hidden gem of a book made me consider closely how I approach investing. It got me thinking about the internal operating system I developed, using a series of mental models, values, principles and tactics. I realized I am not able to really categorize my investing approach. I just hope to learn from anyone and any situation.

“Use only that which works, and take it from any place you can find it.” - Bruce Lee.

Because investing is an infinite game, its very purpose is to keep on playing. There are endless ways to “win” since the winning/losing is not zero sum in infinite games. Buffet does value investing, Soros does macro investing and Jim Simmons does quant investing, and so on. They all have a superior track record. What else do these legends have in common? They escaped competition through authenticity (also a Naval quote). They became the most authentic expression of their own selves. They aimed to be the best version of themselves. They learned non-stop in a way that facilitates their goal. Self-actualization machines. For those who seek to become their authentic selves, investing becomes an excuse to apply deep curiosity and learn to adapt to situations with incomplete information.

I’d argue that great thinkers have unusual mental agility.

They have a comprehensive range of skills and knowledge in their mental toolbox. They internalize key concepts so they become second nature. Then they let the situation dictate which concept is most appropriate. They apply correct judgment on which tool to use and when.They remain flexible and adaptive (while also being more-than-average right). Markets are complex adaptative systems. By definition the rules of the game adapt over time.

As example: the structure of the economy is changing fast. Manufacturing and distribution corporations have been eclipsed by intellectual property giants. Copy-pasting the same investment tactics from one decade to the next has given poor results for traditional value investors.

While tactics have a shelf life, principles should by definition stand the test of time. They provide a structure through which new knowledge and new situations can be organized in meaningful insights.

“All fixed set patterns are incapable of adaptability or pliability. The truth is outside of all fixed patterns”. - Bruce Lee

By not labelling myself into a specific style, I get to pick the best parts of any approach and test rigorously what actually works for me. Value investing principles helped me build an authentic approach that feels right to me. The main ones for me are:

- Focus on fundamentals and inherent value. While technology stock or cryptocurrencies is generally not considered value-style investment, to say that these investments have zero value is not correct. The way to assess their fundamental value is different. The general principles of looking for good fundamentals, relative to what you pay for them, still applies.

- Play the long game. Humans are not good at thinking in exponential terms. They tend to think in linear terms, and overvalue the short term and undervalue the long term. Both venture capitalists and value investors are super long term focused. I try and make sure that I invest in a space I want to learn for the rest of my career and hopefully can hold assets for 25+ years. There is immense advantage in being able to take a very long view and tuning out the short term noise. Good investing is not so much about timing the market as much as time-in-the-market. So it makes sense to exploit a human bias.

- Avoid stupidity. On the whole, most of the alpha I can hope for is likely to come from avoiding avoidable mistakes. When making a decision, I assume I am probably going to be wrong. I poke at it. I ask myself “how will I handle being wrong?“ The surest way to underperform the market is to assume I am smarter than the average. The reverse is true, the best way to do well is to assume I am dumber than the average. Overconfidence is a self-inflicted mistake and keeping an eye on my confidence level (among other mental pitfalls) is crucial.

So… wtf does Bruce Lee have to do with any of this?

Fair question.

Bruce Lee was a true master at his own craft, martial arts. He became great because he internalized the fundamentals of his discipline to a degree that they became second nature.

During a fight, Bruce Lee was completely present and ready to apply principles and tactics that best served the fight strategy at hand. He was not trying to apply frameworks, he simply emptied his mind and let the the right ones come to him.

That was mental agility in action.

“Obey the principles without being bound by them.” - Bruce Lee

I am not surprised that Bruce Lee eventually wrote some great philosophy. He was able to deeply absorb principles from martial arts and find new applications for them in broader aspects of life.

Bruce Lee inspired me internalize core principles. To aspire to empty my mind, and let the right tools and actions come to me in the moment. After I’ve forgotten everything I have learned.

Bruce Lee quotes

“Be like water making its way through cracks. Do not be assertive, but adjust to the object, and you shall find a way round or through it. If nothing within you stays rigid, outward things will disclose themselves. Empty your mind, be formless. Shapeless, like water. If you put water into a cup, it becomes the cup. You put water into a bottle and it becomes the bottle. You put it in a teapot it becomes the teapot. Now, water can flow or it can crash. Be water, my friend”.

“Empty your cup so that it may be filled; become devoid to gain totality”.

“The knowledge and skills you have achieved are meant to be forgotten so you can float comfortably in emptiness, without obstruction”.

“Do not be tense, just be ready, not thinking but not dreaming, not being set but being flexible. It is being “wholly” and quietly alive, aware and alert, ready for whatever may come”.

“Be self aware, rather than a repetitious robot”.

“The great mistake is to anticipate the outcome of the engagement; you ought not to be thinking of whether it ends in victory or defeat. Let nature take its course, and your tools will strike at the right moment”.