tldr:

-

Yei introduces Clovis: the Cross-Chain Clearing, Execution, and Settlement Layer for DeFi.

-

Clovis is the infrastructure that unifies fragmented liquidity across chains. Today, lending markets, DEXs, and bridges operate in silos, splitting liquidity across hundreds of deployments and leaving capital underutilized. Clovis solves this by introducing a clearing and settlement architecture: a Clearing Layer on the hub chain executes global logic, while lightweight vaults on connected chains handle custody and settlement locally. This creates one shared pool of liquidity that can be offered as lending, swapping, and bridging to any chain, turning every deposit into stacked yield across multiple products.

-

Clovis builds on the foundation of Yei Finance, which reached $300M+ TVL and generated $5.5M in protocol revenue over the past year. Yei pioneered the first lending boosted DEX on Sei, where YeiSwap compounds YeiLend yields to drive $230M+ in monthly trading volume and $147M in bridge flow. Clovis now expands this proven model across chains, positioning itself as the cross-chain prime brokerage layer for DeFi.

The Changing DeFi Landscape:

Lending:

Money markets have remained one of the core primitives that the rest of DeFi exists upon, with the ability to become collateral the main goal above all else for any asset issuer. However despite how fundamental a place they take within the ecosystem, lending has still underwent countless and innovations to improve value accrual, capital efficiency and user experience.

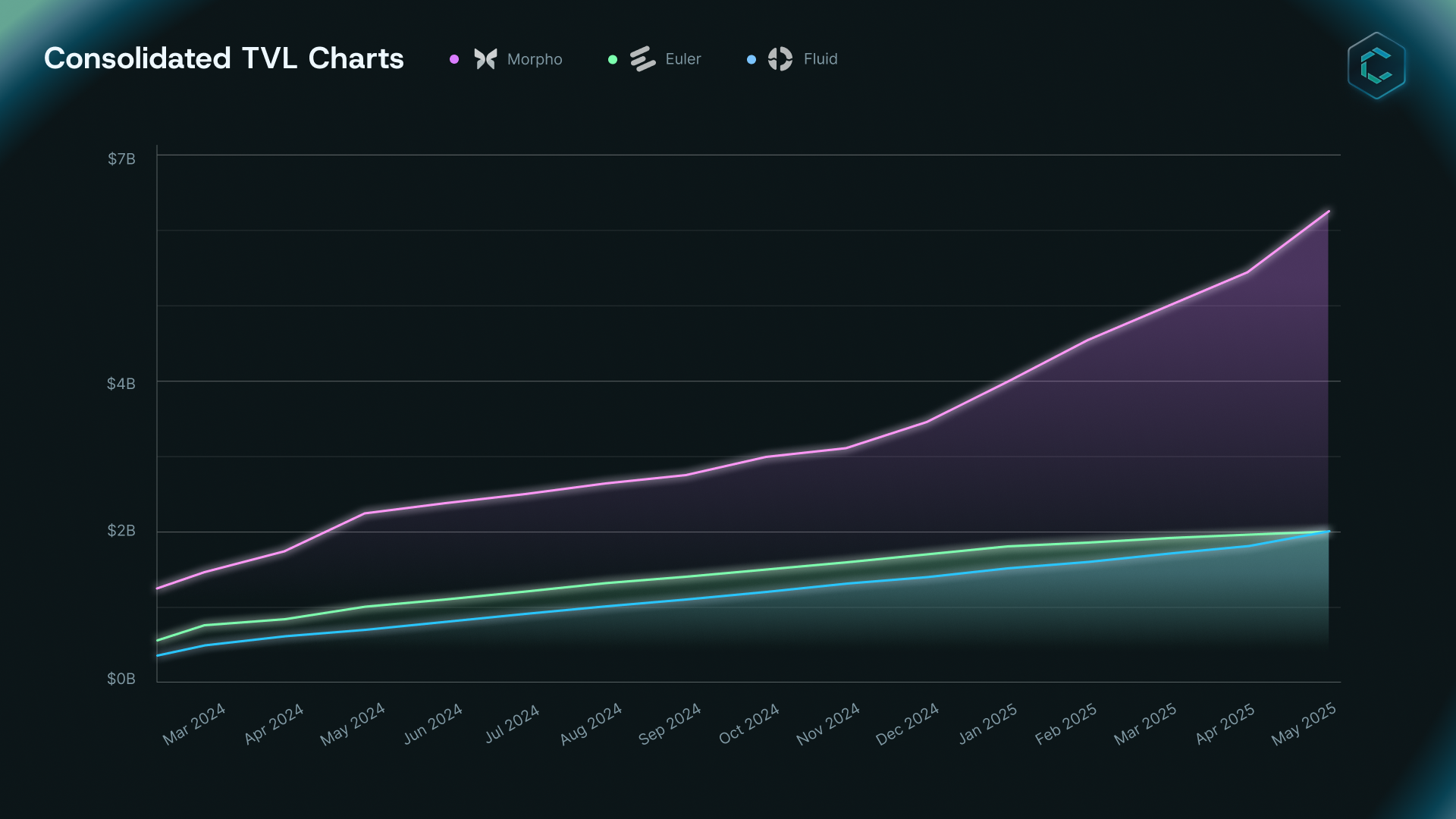

While Aave still remains the defacto standard for DeFi lending, players such as Fluid, which spun out of Instadapp and sought to unify lending and trading, and Morpho which started as a lending aggregator before developing into it’s own standalone market, have seen a historic rise in usage and TVL alike.

However something that none of these existing and new lending markets have been able to resolve is liquidity fragmentation, and by extension - a broken user experience with different depths of liquidity, yield and rates. Despite advertising a consolidated TVL across all supported chains, a user can only interact with a single chain’s liquidity, assets, and of course subject to the yield and interest rates for markets specific to the chain in question.

This contributes to the lack of unified lending UX, and indirectly driving borrowers to where liquidity is better, and by extension has better rates, which then attracts lenders to supply accordingly, causing a negative flywheel and reinforcing the top-heavy liquidity distribution.

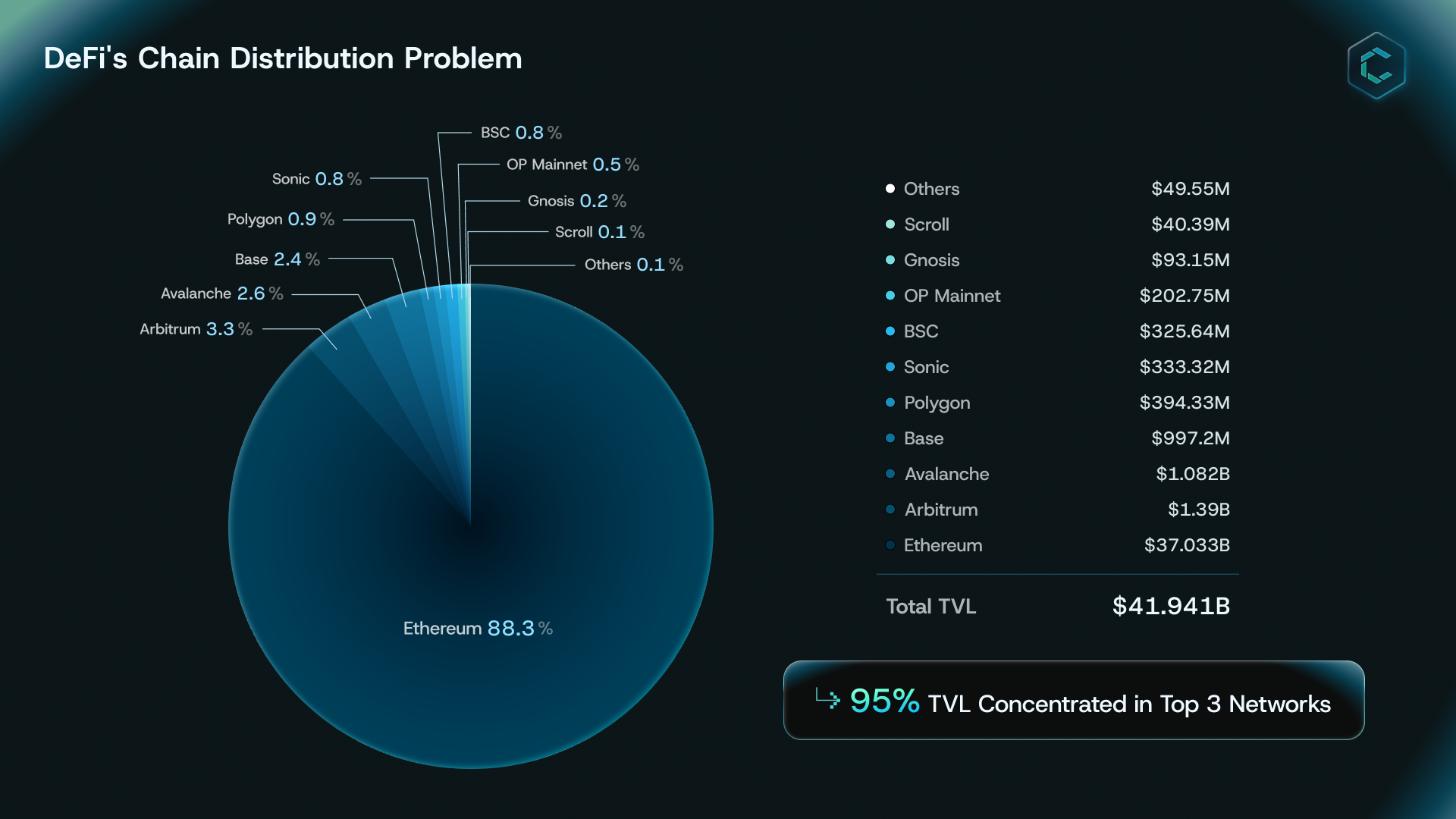

A great example of this is of course, Aave which boasts over $40B in TVL as a protocol across 17 chains, however $37B of which exists solely on Ethereum. Continued further, Aave has almost 95% of it’s entire TVL concentrated within the top 3 chains, making the liquidity available on the remaining 14 chains quite minimal in comparison. When investigating other protocols like Euler, Fluid, Morpho and others, this same distribution occurs and while logical (most liquidity and TVL exists on Ethereum), this phenomenon merely is a symptom of a highly fragmented ecosystem without any priority on improving the already disjointed UX that is modern-day DeFi.

Even just looking at ubiquitous asset like USDC, borrow rates vary dramatically on Aave with the lowest APR available on Sonic, at only 1.08%, whereas on Polygon it costs borrowers a whopping 8.06% - a delta of 6.98%! Then when you take into account the fact that native USDC is available on both chains, meaning transferring between chains via CCTP is free - it makes this discrepancy even more ridiculous.

Decentralized Exchanges:

When it comes to the other fundamental DeFi protocol, DEX’s have also shown a great deal of innovation from overall AMM design such as between Curve and Uniswap, incentivization models such as (3,3) that started within Fantom but was mastered on Base and novel mechanisms for LPs to manage positions like with Maverick Finance. Adding to this, as we a whole slew of protocols built ontop of the underlying DEX’s, all as a means to improve capital efficiency and maximize fees such as automated LP management protocols like Arrakis or Bunni, as well as incentivization of pools via protocols like Aura or Convex.

Now while there have been many ways that builders have tried to improve how AMM DEX’s function as well as generate fees and value for LPs and holders alike, there have been two key innovations recently that have put an emphasis on improving capital efficiency and both involve lending as a core component.

The first of which was Balancer with their boosted pools whereby a portion of the underlying LP was deposited into Aave, and then maintain a minority of the pool as raw assets to actually facilitate swaps - however quotes derived from the aggregate amount of assets. While great in practice and sees a meaningful amount of volume, it suffers from a couple of downsides:

-

Not all the assets within the pool are yield generating by design - Balancer optimizes for 20% raw asset, 80% deposited into Aave which while not a huge deal, still means that a decent chunk of the LP isn’t earning interest.

-

Secondly, as an offshoot of the former, because each of the boosted pools only exist on the chain upon which the assets are deposited, if there is volatility and more liquidity is needed, withdrawing assets from Aave can be quite gas intensive especially on Ethereum which lessens the value and only really shines in times of stable volume.

-

Reliance on Aave is also a drawback as of course these pools can only be deployed on chains where Aave is live, and for assets that have markets on said chains. Furthermore, there is considerable value leakage due to having another third party like Aave involved which isn’t ideal.

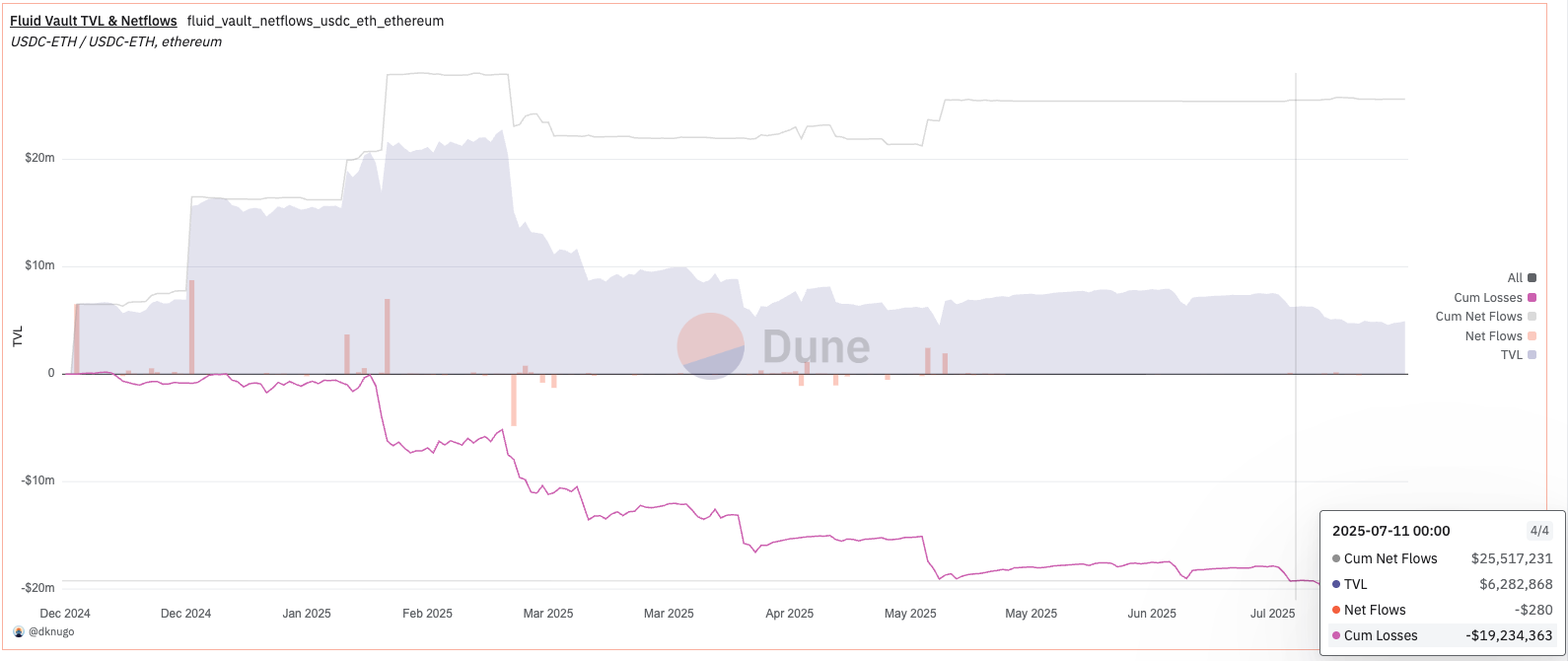

The next protocol that has made a lot of inroads into this dilemma is Fluid, which combines a lending market and a DEX into a single protocol - alleviating the value leakage to a third party like Aave, however introduces a great deal of complexity with the concepts of smart collateral and smart debt. Fluid attempted to combine the simplicity of Uniswap V2 with automated rebalancing built into the pools as well as the concentration of Uniswap V3 to maximize yield. However the problems with this were also extremely apparent:

-

A confusing user experience made it quite difficult for the average LP to onboard into Fluid which gatekept the protocol to advanced users who had no problems managing their debt, collateral and DEX positions in a dynamic fashion.

-

Inherent lack of multichain functionality was also another dilemma with liquidity and the ability to facilitate trading only taking place on 4 chains, with only the Ethereum deployment being meaningful enough to attract volume.

-

Finally, the recent event with LPs on ETH/USDC losing $19M due to automated rebalancing due to the pool trying to maintain a 50/50 optimal ratio of the assets resulted in a negative loop of the pool buying ETH when it’s price collapsed and continued to do so. However, when the price of ETH recovered, the pool was then selling the ETH within the pool to buy USDC which resulted in it constantly buying ETH high and selling low. This exposed a very clear issue that while the design was effective in generating yield in stable environments on volatile asset pairs, the moment that price action became volatile, the pool was unable to maintain it’s delta-neutral portfolio.

Introducing Clovis:

The Yei team was constantly monitoring the ecosystem for innovations in both lending and exchanges, and it became clear that while work was being done to improve on the two primitives, there was something lacking from all of them that was either very inefficient or flawed when tested in the market.

As such, the team focused on simplicity and built Clovis - a protocol that combines a money market, with a DEX that sources its liquidity directly from deposit receipts from the underlying lending market. Built using Aave and Uniswap V3 as the fundamental architectures, the focus was not on reinventing the wheel, but rather, fitting tried and tested protocols together in a way that would result in better capital efficiency, yield, and functionality, seamlessly across multiple chains.

The Four Pillars of Clovis

Clovis is built on three composable DeFi primitives that share liquidity and execution across chains:

-

Clovis Market (Lending) – Aggregates liquidity from all connected chains to provide universal lending and borrowing rates, creating a shared base for capital reuse across lending, trading, and bridging.

-

Clovis Exchange (DEX) – Combines a hub-chain DEX aggregator with Clovis-owned AMMs to deliver universal pricing and multi-yield opportunities for LPs, using lending deposit receipts as LP assets.

-

Clovis Transport (Bridge) – A fast-finality bridge that enables instant cross-chain transfers by settling from local liquidity buffers in the settlement layer, reducing the need for constant asset movement between chains.

-

Clovis Vaults (Asset Management) – Deploys idle capital from assets in the liquidity spokes into external yield opportunities that align with the tranche’s risk profile, generating additional returns without fragmenting liquidity or reducing asset availability for lending, trading, or bridging.

Clovis’s liquidity structure is designed to support additional primitives beyond these, including prediction markets, yield-trading protocols, and perpetuals. This expansion builds on the liquidity network already established and increases both the product surface area and the protocol’s fee-generating flows.

Clovis Market (Cross-Chain Lending)

Here's an example: imagine supplying $SEI as collateral on the Sei Network, borrowing $HYPE on Hyperliquid’s EVM, staking it to receive $kHYPE, and then depositing it as collateral in order to borrow $SOL on Solana. All without needing to bridge or leaving the Yei dApp.

Yei is developing a universal liquidity layer that will span chains and ecosystems alike, simplifying the multichain DeFi experience and expanding the horizons of what is possible with your assets.

By doing this, not only will capital be far more efficient, but yields will be generated in more interesting and creative ways, which will expand the scope of DeFi lending and the utility of the assets used in these applications.

Furthermore, for assets that exist on multiple chains, such as $USDC and $USDT, Clovis enables universal interest rates across the entirety of the lending market.

Users will be able to access their assets regardless of what chain they use, which prevents arbitrage-based inefficiencies. Additionally, since the rates are consistent, the user does not have to worry about where they borrow or repay their position from.

How would cross-chain lending on Clovis work?

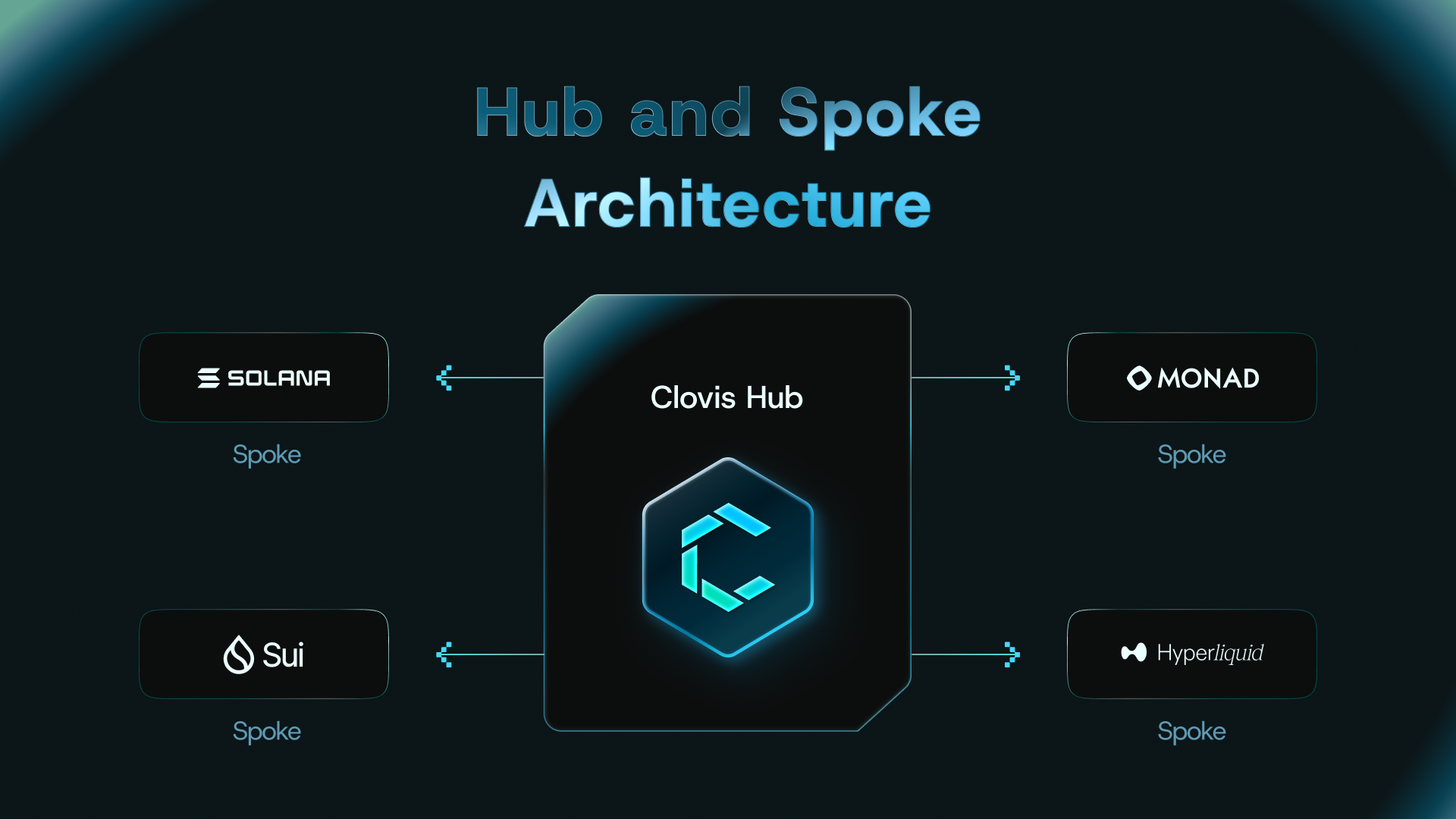

Each chain, regardless of the ecosystem, will be home to a “spoke” deployment of Clovis - where all deposits, borrows, swaps and transfers are initiated (for that chain).

Whenever a transaction is initiated on a spoke, a message will be relayed to the “hub” deployment on Sei - which serves as the central processing center for all accounting and smart contract logic.

This message will be sent using an interoperability provider and allows the hub to maintain universal accounting of all the assets available across all of Clovis’s spokes, as well as user collateral deposits and outstanding debts.

When a user wishes to borrow on a spoke, the hub on Sei that determines the amount the user can borrow based on the collateral they have provided (on any spoke). The hub is constantly updating the spokes every time a cross-chain transaction is initiated (which encompasses nearly every transaction that occurs on Clovis).

The deployment on Sei will continue to be supported, and this will function just like any other spoke, for users who want to deposit or borrow on the Sei Network itself.

Clovis Exchange (Cross chain DEX)

While lending and borrowing have been our primary focus, the Clovis vision embraces other fundamentals, namely the most crucial one - a decentralized exchange.

Clovis Exchange will be built directly on top of Clovis Market, and instead of holding native assets within its liquidity pools, it will instead use deposits from assets within the lending market.

How this works is by using deposit receipts a user gets when they deposit into Clovis Market, and pairing them against each other in simple AMM liquidity pools.

The DEX then combines lending returns with trading fees, while aggregating liquidity into a singular pool on the Hub Chain. Clovis Exchange abstracts Clovis Market’s underlying lending mechanics, allowing traders to execute swaps with native assets (e.g., USDC, ETH, SEI) via a streamlined interface automates background processes by handling lending deposits, withdrawals, and yield optimization.

This greatly increases the capital efficiency of both protocols, and allows the contained liquidity to generate yield from two avenues: interest from borrows and fees generated from trading volume.

How would Clovis Exchange work?

Instead of the LP pool using SEI/USDC as liquidity, Clovis Exchange would use cloSEI, which is a wrapped version of SEI. Users can receive cloSEI by depositing SEI into the lending market. By extension, the USDC in the pool would exist as cloUSDC.

Here’s how Clovis Exchange would facilitate a trade between two assets:

Example: A user wants to swap $SEI for $USDC

-

At the time of the swap, the user's $SEI is deposited into Clovis’s lending market.

-

This action mints $cloSEI, the receipt token for depositing $SEI.

-

Next, the user's $cloSEI is deposited into the cloSEI/cloUSDC liquidity pool.

-

The appropriate amount of $cloUSDC is then released from the pool

-

This $cloUSDC is then redeemed from the lending contract, which outputs the appropriate amount of $USDC.

-

The user now has their $USDC balance and the swap is complete.

This architecture eliminates manual token wrapping or direct interaction with Clovis Market’s interfaces, while supporting cross-chain swap quoting, solver auctions for efficient order execution, and LP strategies layered atop lending positions. Clovis Exchange design ensures rapid settlement through solver auctions even under constrained cross-chain liquidity, and leverages arbitrage bot activity to optimize protocol revenue during market volatility.

Clovis Transport (Bridge)

Clovis Transport revolutionizes cross-chain bridging by instantly settling transactions, maintaining net asset balance across chains, and leveraging Settlement layer liquidity reserves for fast transfers, while seamlessly integrating with deposits, repayments, and swaps for internal rebalancing—giving Clovis a strategic edge over Relayer or Solver bridges by eliminating reliance on external liquidity providers, reusing existing liquidity flows, and enabling native DeFi settlement across chains

Clovis Vaults

Clovis Vaults are the asset management layer of the protocol, designed to generate additional yield from idle capital sitting in the liquidity spokes. Assets in lending markets, bridging pools, or other primitives often have periods where they are not actively borrowed or used for settlement. Rather than leaving these assets idle, Clovis Vaults deploy them into external yield opportunities that match the tranche’s risk profile.

The vault system is fully integrated with the hub and spoke architecture. Idle capital on a spoke chain can be routed to vault strategies either locally or via the hub, ensuring that funds remain available for withdrawal or reallocation when market demand changes. Vault strategies can include deposits into bluechip lending protocols, low-risk liquidity pools, or newer high-yield opportunities depending on the tranche configuration.

This design allows the protocol to capture asset management yields without fragmenting liquidity or impacting the availability of funds for lending and trading. In the base tranche, vault allocations focus on highly liquid, battle-tested protocols to minimise risk. Higher risk tranches can allocate to more aggressive strategies with higher return potential. By dynamically recycling idle capital, Clovis Vaults increase the total return profile of each market while maintaining the flexibility to meet user withdrawals and market shifts.

Summary

Clovis transforms fragmented DeFi liquidity into a unified, yield-generating network. By combining lending, trading, bridging, and asset management under a single clearing and settlement architecture, Clovis turns idle capital into stacked yield opportunities while delivering instant, universal access across chains. Our hub-and-spoke design with liquidity buffers and netting minimizes cost, improves execution, and scales composability beyond individual networks.

With a proven foundation from Yei Finance’s $300M+ TVL and deep integrations with leading wallets and ecosystems, Clovis is positioned to become the default liquidity layer for multichain DeFi. As more chains and partners join, the network grows stronger, rates and prices converge, and users benefit from deeper markets, faster settlement, and higher capital efficiency. This is the infrastructure layer where DeFi’s next phase of growth will be built.