Despite the summer approaching, and northern countries scheduling their summer vacation, one thing is sure is that the Aladdin DAO never stops shipping. The past month didn’t lie to this statement and we are happy to cover all the latest news, products updates, podcasts related to the Aladdin DAO ecosystem.

Topics of this newsletter :

📈 Protocols Metrics

🏛 Governance Updates

🧠 Protocol F(x): Shields Up!

🕵️♂️ Leveraging Concentrator

🧞 Defi Nuts and Bolts: Oracles

🎤 Podcasts of the month

Nothing said in this newsletter is financial advice. Please do your own research and only invest what you’re ready to lose. Good luck in your Defi adventures!

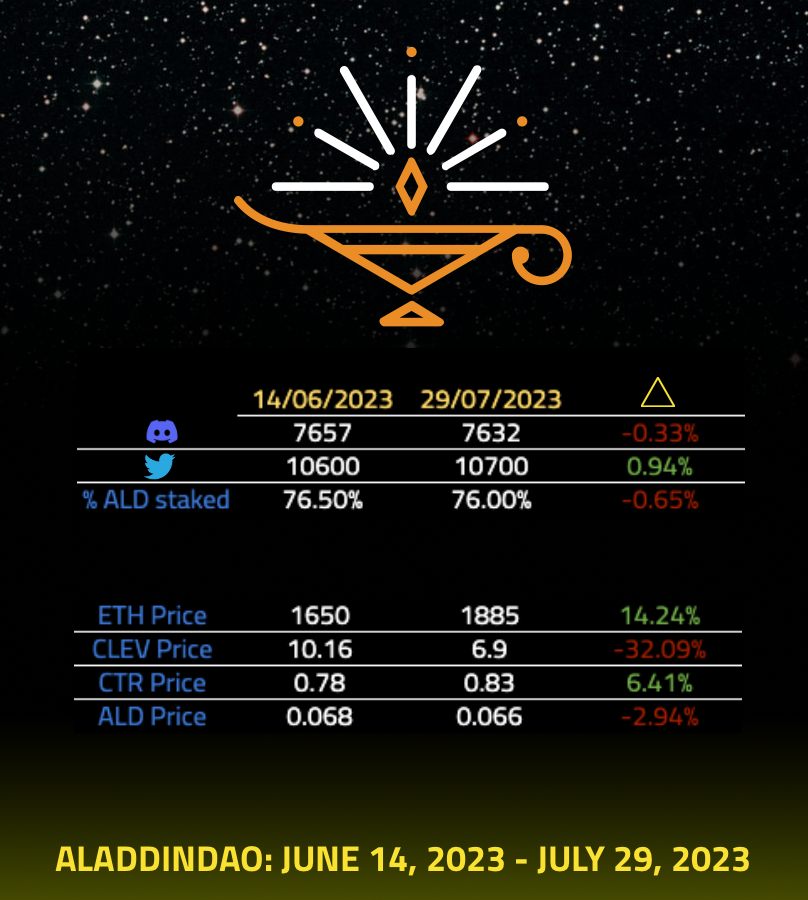

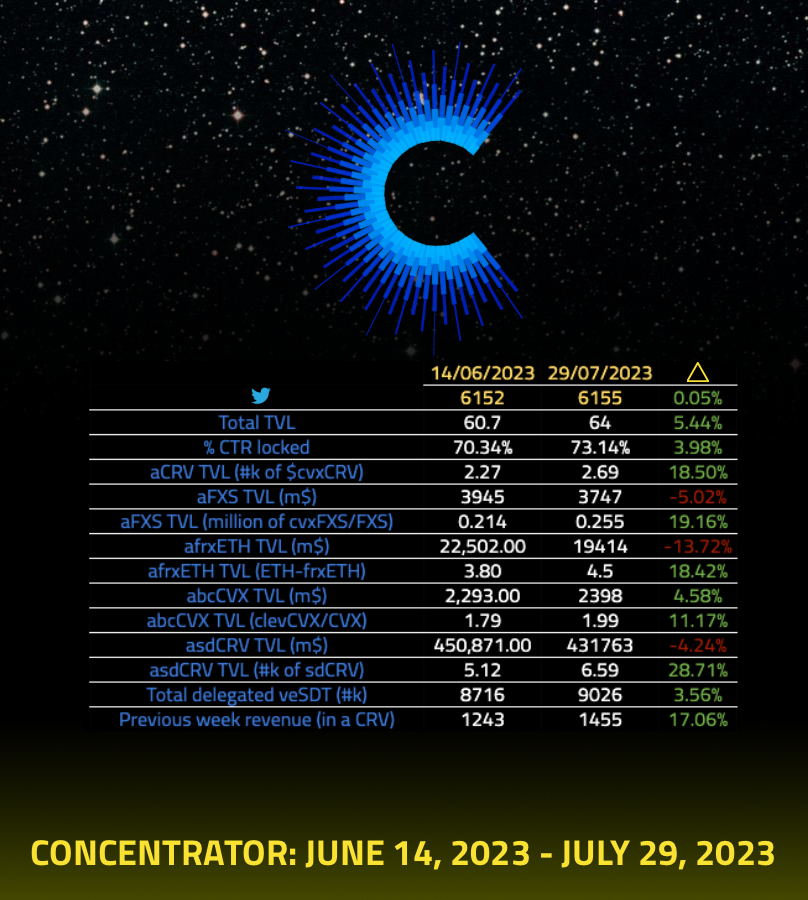

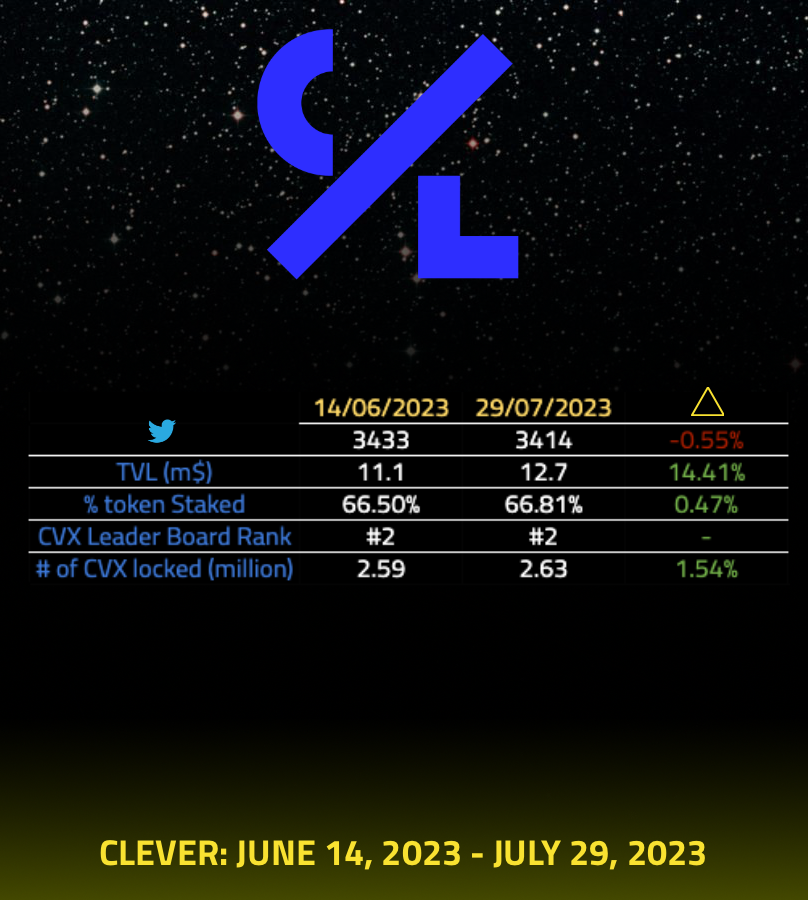

📈 Protocol Metrics

🏛 Governance / Product Updates

Aladdin DAO

- Gov update:

🧐Proposal to change allocation of Aladdin DAO treasury: A new proposal has been released on the forum by Tao, already at the initiative for the new ALD tokenomics. This proposal aims at increasing governance power of Aladdin DAO by acquiring CRV & CVX through bonding of ALD tokens.

As Clever, Concentrator & Fx Protocol are all closely ties-in to the Curve Ecosystem, it makes sense to increase the governance power to pull the best out of these 3 projects, in a more economic way. While CRV & CVX holding increase, voting incentives in CLEV & CTR tokens will as well reduce or even stop on the CLEV/ETH & CTR/ETH LPs.

Please don’t hesitate to interact with the proposal here on the Aladdin DAO Forum.

Concentrator

Gov update:

⌚Concentrator Revenue Sharing Program (xALD): Concentrator is looking to onboard more DAOs and this proposal is here to start spinning a flywheel where both Concentrator lockers & DAO will win together. Concentrator revenue distribution is currently set as-is:

- 50% veCTR holders / 50% Treasury

The proposal will set the revenue sharing as:

-

veCTR holders: 33.3%

-

Concentrator treasury: 33.3%

-

Collaborative DAOs: 33.3% (tips: DAO will earn protocol fees based on the allocated TVL. Any excess of 33.3% revenue sharing will go back to veCTR & Concentrator treasury 50:50)

Vote is currently undergoing here.

👂 A RFC (Request For Comment) has been released on Abracadabra forum to whiteliste Harvester Vaults & Compounders into Abracadabra dAPP. With an impressive 212m$ TVL, Abracadabra is #5 in CDP protocols according to DefiLlama. If you want to have a look at the RFC, follow this link.

For more insights on why this move of Aladdin DAO, we invite you to read our article in this newsletter (Leveraging Concentrator).

✅Compounder aFXS has been changed from FXS-cvxFXS LP to single staking cvxFXS resulting in a high yield for this vault.

- Product update:

1️⃣aCRV on Polygon: Multichain hack or exploit or rug…who knows… resulted in the impossibility to bring back aCRV liquidity from polygon to Mainnet. While the team removes POL on time, there were still aCRV from users. If you hold aCRV on Polygon, proceed before 1-August-2023 following team’s instructions you can find on Aladdin DAO discord. Channel is here.

Clever

- Gov update:

✅CLIP-03: Boosting CLever CVX Growth with Emission Reduction and Revenue Adjustment

After around 15months of operation, Clever is now well seated #2 as CVX holders according to daocvx.com. One of the main reason to use CLEVER is to leverage your CVX position without the risk of being liquidated. To do so, users deposit CVX, borrow clevCVX & swap for more CVX into the clevCVX/CVX LP on Curve. However, this process tends to reduce as the clevCVX discount increases, resulting in buying CVX at a premium. To counter this, more CVX must come into the LP, and how do you attract more TVL? Simply by increasing incentives. So Aladdin DAO team proposes:

-

Aladdin will allocate some of its available treasury to CVX which will be used to vote for clevCVX/CVX LP emissions

-

Using savings from (1), CLEV emissions each bribe epoch will be reduced by 500

-

veCLEV revenue sharing should be reduced from 75% of total revenue to 50% of total revenue

-

By allocating all of CLever’s non-shared revenue (50% of total) to bribing in the clevCVX/CVX LP, we can reduce CLEV emissions by a further 840 per bribe epoch

- Product update:

1️⃣ Not a product update, but an awesome initiative by our Booster fren MetaCVX, well known for his amazing meme design. Wen Merchs? Now anon!

Fx Protocol

-

Gov update: None at the moment ☺️

-

Product update:

1️⃣FX protocol V2 has been migrating to Phalcom testnet so that users can test the new rebalancing pool with stETH.

2️⃣New audit has been released by Secbit. You can read it here.

3️⃣But this is by far the most bullish news so far, prior to 2nd round of IDO & Mainnet launch:

4️⃣IDO Round 2 this week on 8/2 at 13:00 UTC:

🧠Protocol f(x): Shields up!

Part 1: A Space Station Built for Safety…and Profit!

As many of you know, I, your good buddy Kmets, enjoy writing about defi protocols within the Curve ecosystem. Previously I have written articles on the space opera that is the tight confluence between Curve, Convex, and Frax. Now it is time to turn our attention to the most revolutionary new protocol in defi and how it will operate within our space opera’s universe And so it is with great excitement that I bring to you the story of a space station called “f(x)” and why it must, at all times, do everything in its power to have its SHIELDS UP!

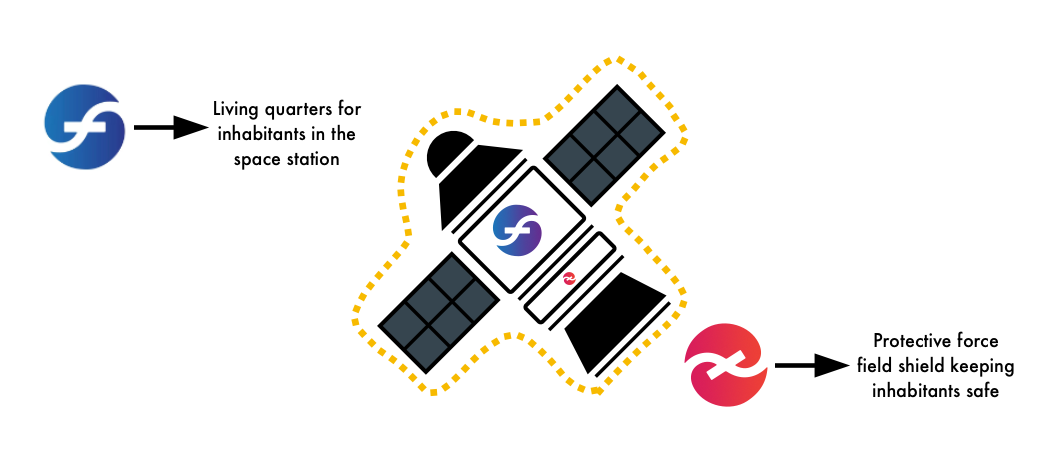

So let’s get right down to brass tacks: why is f(x) Protocol a space station? Well because it’s a lovely place for folks to live and work in the defi galaxy! You see, our space station has two functions:

-

Keep the inhabitants of the space station alive and in a very stable environment.

-

Keep the protective shields up at all times to make sure the space station stays intact and that the inhabitants are never exposed to the extreme environment of space!

So how does this space station function? Well essentially it’s fairly simple:

-

Folks from around the galaxy arrive at the space station and dock their own space ships, which are powered by solar panels and a fuel called stETH.

-

All of the docked space ships then transfer their infrastructure (stETH fuel and solar panels) over to the space station.

-

Once the space ships are docked and their power sources are hooked into the space stations systems, the inhabitants (known as “fETH”) are free to go out into the galaxy and participate in all sorts of defi adventures!

-

Now then, for the docked ships and inhabitants of the space station, it’s extremely important to keep them all safe should they ever want to leave the space station. So a protective shield is powered up to protect the space station…this shield is known as the xETH shield!

-

xETH protects the space station and its inhabitants from the extreme environment of space. The temperature on board only fluctuates at 1/10th of the variations experienced outside of the xETH shields.

-

The xETH shield is powered by ships that were sent to the space station with no inhabitants on board. These ships have no need for life support systems, and so are exposed to the volatile temperatures of space. They are essentially just there to contribute their stETH fuel to power the xETH force fields. The great news is that just a few of these empty ships and their fuel are enough to protect the entire space station!

Let’s dive into why defi space adventurers would want to dock their ships with the space station f(x):

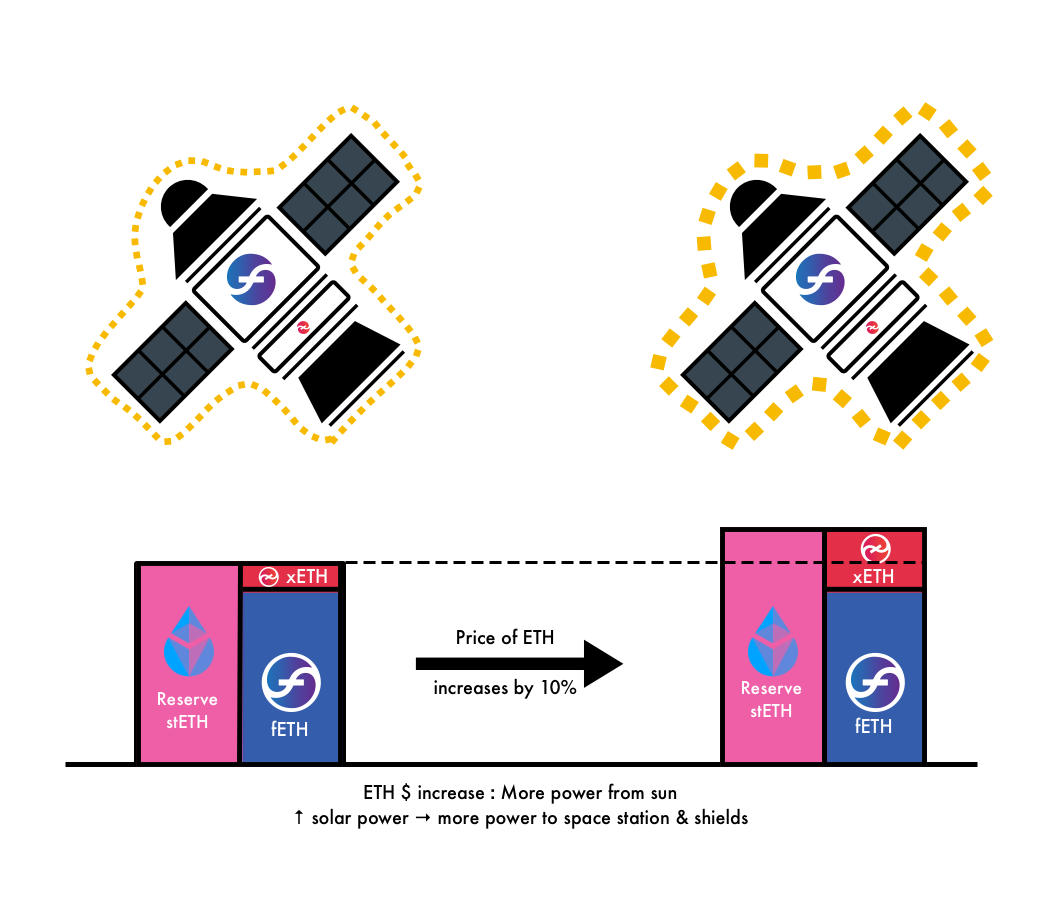

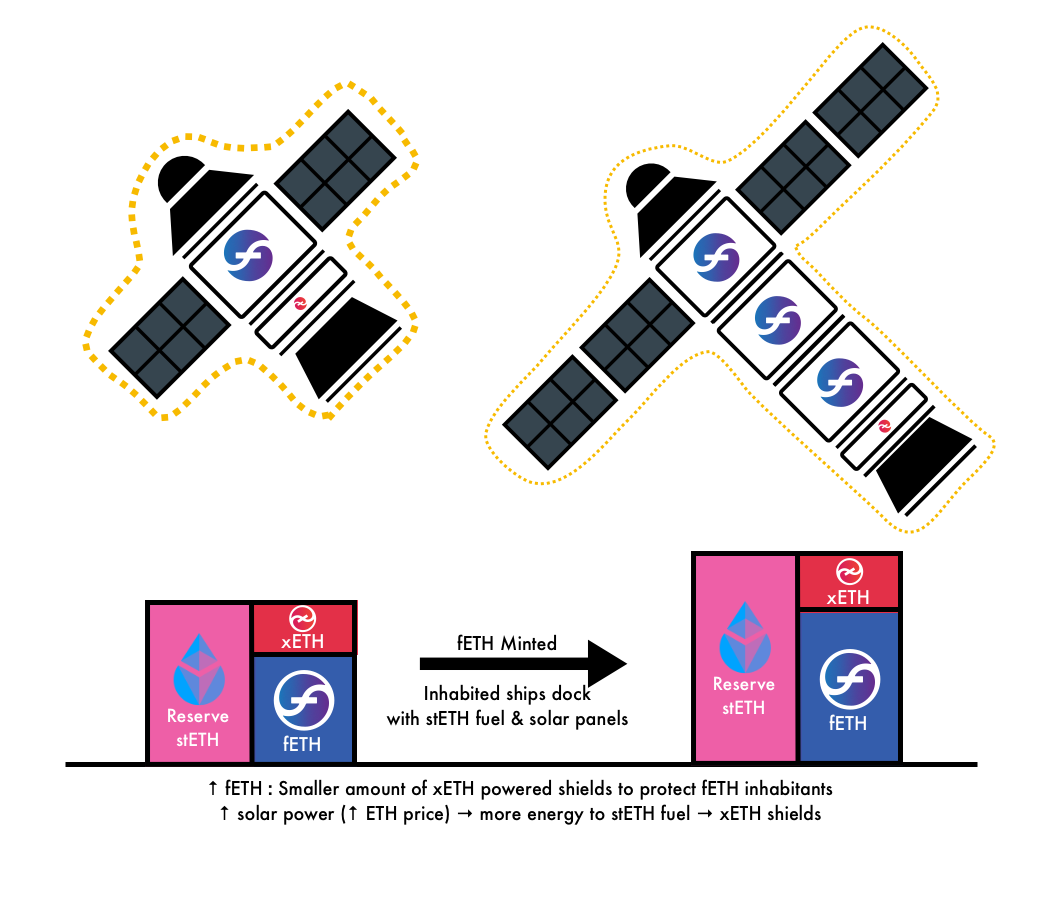

For space explorers, one of the most important things while traveling in the defi galaxy is the ability to find a low volatility, safe environment in which to rest. While it’s fine to have your own small ship powered by stETH and solar panels, you are still exposed to the dangerous and volatile elements of interstellar space. Without having force field shields to protect you and your ship, you could get blown away by a wayward asteroid (smart contract risk), lose a huge amount of solar power from a dust storm (price drop in ETH), or just lose fuel from making a bad dock with another ship (impermanent loss). There’s lots of reasons to dock with the fx space station and just sit nice and cozy in a stable, low volatility, well protected environment. The trade off is that your ship’s stETH energy reserves just stay as they were when you docked…any excess energy that the stations solar panels absorb goes to the empty ships to power up their on- board stETH fuel.

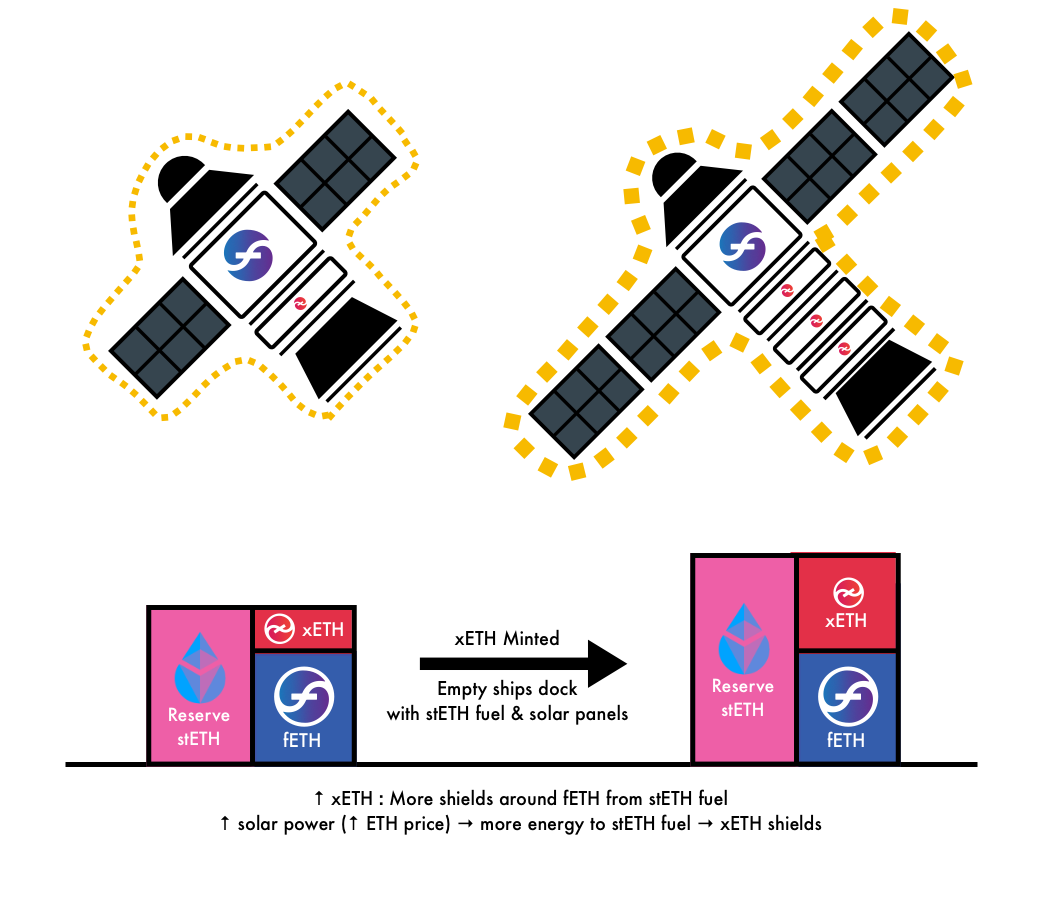

So why would anyone send an empty ship full of stETH fuel to the space station to power up the shields? Quite simply, because the power received from the sun can be utilized to generate extraordinarily energy dense ETH! You see, stETH is similar to a nuclear fuel, like plutonium. And when we add solar energy to it (an increase from ETH’s price), we can make that stETH even more powerful, containing much more joule’s per cubic centimeter than we could on our own! Typically, space traders have to pay big bucks in order to create super dense fuel (aka leveraged ETH). But because of space station f(x)’s configuration, the creation of super dense fuel is free! So trader’s are incentivized to dock ships just chock full of stETH to the station just to get that extra dense fuel and then later trade with it in the future. So these empty ships don’t have a need for life support, so they don’t have any need for the safety of the fETH quarters…they have total exposure to the solar radiation and temperature swings of space (price volatility of ETH). The one caveat is that all of the xETH ships have to split all of that absorbed solar energy amongst themselves proportionally…meaning the more empty ships docked to the space station, the less effect that added energy has on making super stETH fuel.

Alright so now we know why space explorers want to dock their ships at f(x): for safety and rest. And we also know why space traders want to dock empty ships full of fuel at f(x): to get super powered energy dense fuel for trading.

But…what happens to all of the stETH emissions that are produced? Ah dear readers, this is where we shall dive into the safety systems of the space station and why the space station has a giant reserve of living quarters ready to jettison off at a moments notice (aka the Rebalancing Pool). But alas, that will have to wait until next month when we will share part 2 of our series! Until then: FULL STOP! RED ALERT! SHIELDS UP!

🕵️♂️Leveraging Concentrator

What mummy always told you? Never use Leverage if you want to live a long time trader life. But what are you going to do? Ape x100 on you next X_Coin…you terrible kids.

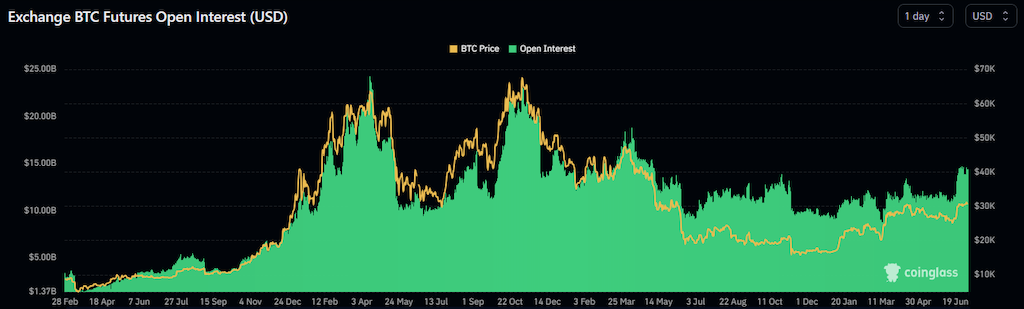

But, as always, leverage has always been one of the most used financial products ever, and the rules also apply to Crypto. As you can see on the below chart, Open Interest (figures measuring the Notional Volume of all traders on several CEXes) on BTC surges by +25% after Blackrock announced applying for a spot ETF.

In Crypto, you can find different type of protocols to leverage a position:

-

Lending/Borrowing protocol: Deposit whitelisted Collateral (ERC-20 token) & Mint whitelisted borrow Assets. This type of platforms are used to take a long or short position on one asset. Typically, the borrowed asset is the one you short, the collateral the one you long.

- AAVE, Compound

-

CDP or Collateral Debt Position: Deposit whitelisted Collateral & Mint synthetic asset. This type of protocols are mainly used to leverage your exposure on your collateral.

- Synthetix, Abracadabra, Qi DAO

-

Leverage Yield Farming: Deposit whitelisted collateral (LP position) and leverage it.

- Impermax, Alpaca, Tarot

Which assets to leverage on Concentrator ?

Concentrator has 2 assets:

-

Harvester vaults: Same as Convex LP

-

Compounder vaults: aCRV, aFXS, asdCRV, etc…

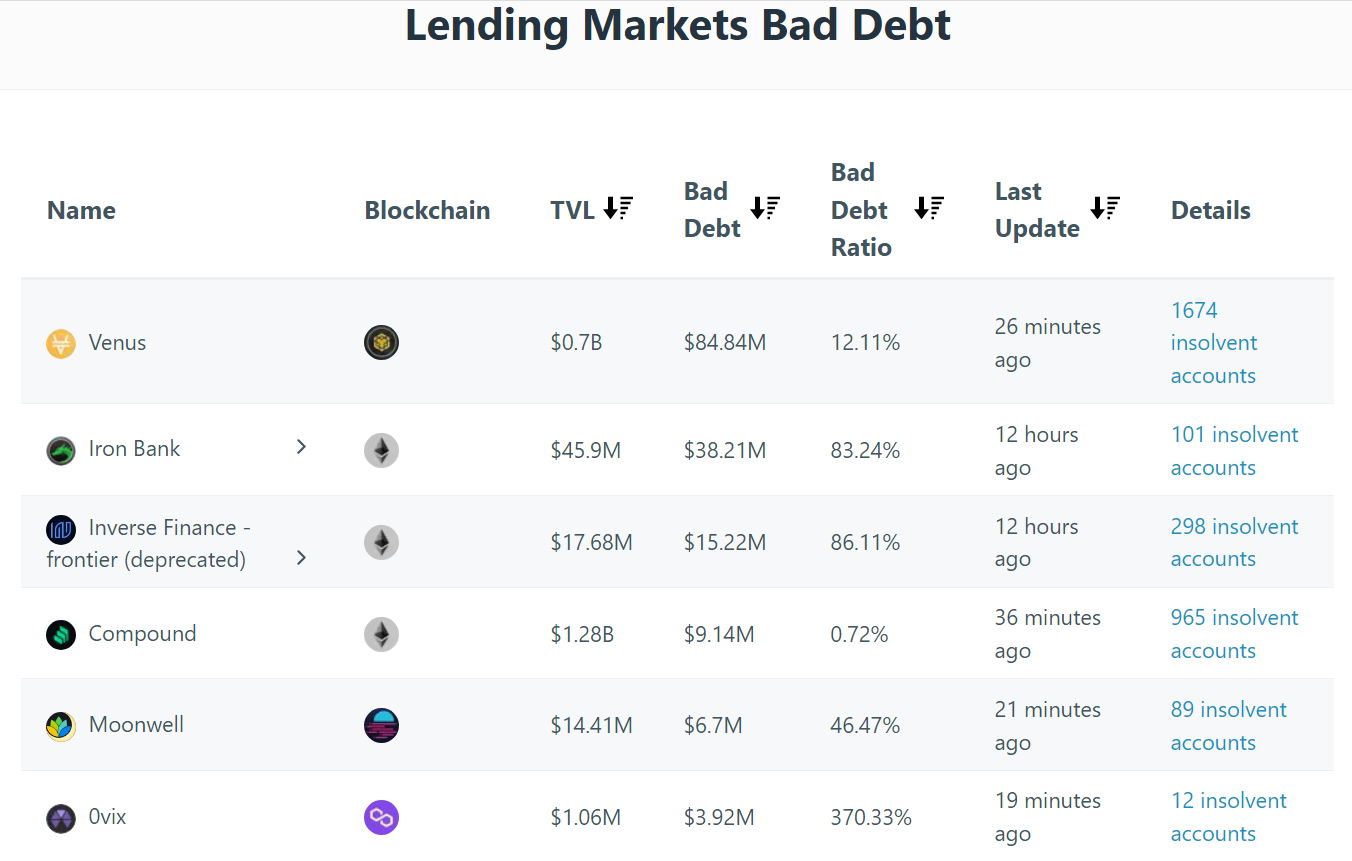

Both types of assets will need their own risk assessment to be whitelisted on Lending market. There are 2 main criteria:1- Liquidity: You need sufficient liquidity to be able to liquidate the position and thus avoid what we call “Bad Debt” being a debt that cannot be covered by the protocol, but by the lenders. A nice website to see those protocols who are still under bad debt state is bad-rekt.riskdao.rog

2- Price feed: To be able to asses if a position is healthy, the price of your collateral needs to be compared to the price of your loan. How do you estimate the price of the collateral?

-

With a ChainLink price feed: Requirements to obtain such price feed is very high. For example, cvxCRV doesn’t have this price feed, while being the largest CRV wrapper.

-

Price feed coming from CEXes: cvxCRV not listed on centralized exchange

-

TWAP (Time-Weighted Averaged Price): Asset price is calculated over a period of time from 30min to few hours to avoid price manipulation, based on a selected Liquidity Pool. However, and don’t ask me why, but this cannot be used with the existing Curve Pools. This is one of the main reason that Curve is deploying New Generation (NG) pool (check previous newsletter for more info).

Why Leveraging Concentrator?

1st, this has been a request from the Aladdin DAO community. As of now, options for leveraging your Curve farming positions is as thick as your work office white paper.

Abracadabra, with their own MIM stablecoin, allows to borrow CRV, 3 CVX LPs, and few Yearn vaults. cvxCRV is not existing, the largest TVL LP from Curve are also not whitelisted on Abracadabra. This leaves a gap that Aladdin DAO wants to fill.

Concentrator is providing most of the time better rewards than Convex, so having Concentrator vaults whitelisted will definitively attract more users on those partners lending markets, and also on Concentrator.

When leveraging Concentrator?

Leverage is the Bull Market SIN. During downtrend and sideline, traders tend to hedge their position & avoid taking too many risks. While, when uptrend picks up, traders, gamblers & money hunters feel excitement and click more easily the “x100 Long Position” button.

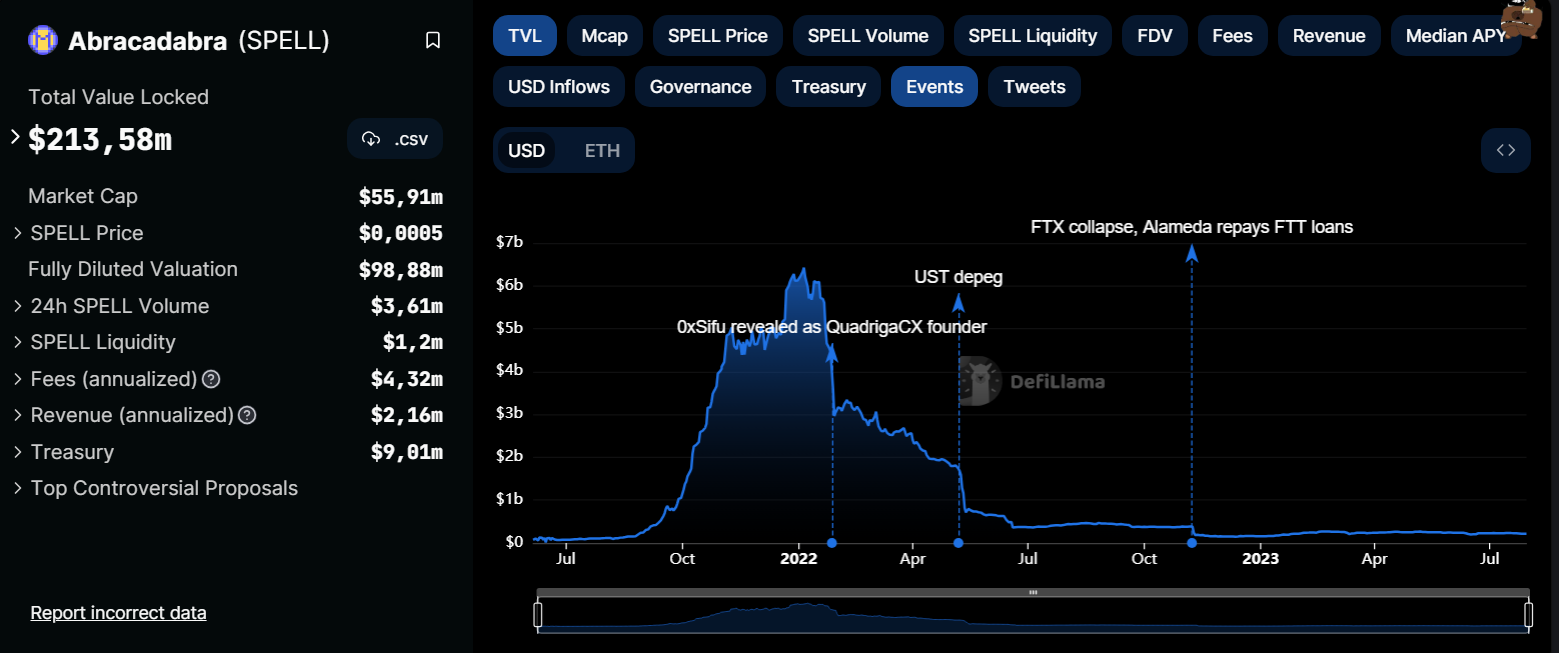

If you look for example at Abracadabra TVL, you can see there is a x30 between today TVL and previous TVL ATH, while the total DEFI TVL is sitting 1/4 from previous ATH.

As we are getting closer & closer to the end of this bear market, and as Concentrator can be now considered as a mature product, it’s time to leverage Concentrator Liquidity Providers.

At first, Aladdin DAO core contributors deposited a first Request for Comment on Abracadabra website, to make a temperature check and check if the 2 types of vaults fulfill the whitelisting criteria from the lending protocol.

This 1st attempt at whitelisting Concentrator assets will obviously followed by others, with the aim to expand Concentrator vaults to the most famous & with proven track records in terms of Safety. Feel free to engage on this forum post if you wish to, the more noise we make the more chance we will see “Leveraging Concentrator” takes effect.

🧞 DeFi Nuts and Bolts: Oracles

In our lovely world of defi, oracles play a critical role in connecting the blockchain-based smart contracts with external real-world data. They act as a way for on-chain DeFi applications and the off-chain real-world data sources to shake hands and play nicely together.

As you all are plainly aware by now, defi applications are powered by smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. These smart contracts run on blockchain networks, which are isolated and cannot access data from the outside world directly. As weird as it may seem, Ethereum clients only know about what is going on with their smart contract info and who is validating. They have no idea what the weather is like in Texas (it is stupidly hot) or what the price of BTC is doing (sometimes ignorance is bliss?). This limitation presents a challenge for DeFi applications that require real-time and accurate information, such as asset prices, exchange rates, weather data, stock prices, and more.

Here's where oracles come in:

-

External Data Feeds: Oracles are responsible for fetching data from external sources, such as financial market data providers, APIs, weather services, etc. They aggregate this data, ensuring it is reliable and accurate.

-

Data Verification: Oracles also play a crucial role in verifying the authenticity of the data they collect. This verification is essential to maintain the integrity and security of the DeFi ecosystem. It prevents the manipulation of data that could lead to fraudulent activities or attacks on smart contracts.

-

Data Transmission: After collecting and verifying the data, oracles transmit it back to the blockchain and make it available to the smart contracts. This allows the DeFi applications to access and utilize the external data in their operations and calculations.

-

Triggering Smart Contract Execution: Many DeFi protocols use oracles to trigger specific actions or execute smart contracts based on predefined conditions. For example, a decentralized lending platform, like AAVE or Liquity, might require an oracle to monitor the value of collateral assets and initiate liquidation if the collateral value drops below a certain threshold.

-

Price Feeds: Price oracles are one of the most common use cases in DeFi. They provide up-to-date price information (usually a 30-minute TWAP) for various assets, enabling DeFi platforms to calculate exchange rates, asset valuations, and execute trades with accurate pricing data.

-

Insurance and Derivatives: Oracles are crucial for DeFi insurance and derivatives markets. They help in determining the occurrence of events (e.g., a flight delay for travel insurance or a certain price movement for a financial derivative) and settling contracts accordingly.

It's also important to note that oracles are a potential point of failure and vulnerability in the DeFi ecosystem. An unreliable or compromised oracle can lead to incorrect data being fed into smart contracts, resulting in financial losses or other undesirable consequences. As a result, DeFi builders pay significant attention to oracle security and decentralization to mitigate these risks. If an oracle is compromised, it could provide false data to a smart contract, which could lead to losses for users. Additionally, oracles are often centralized, which means that they are a single point of attack for hackers. Here are some of the risks associated with oracles in DeFi protocols:

-

Data tampering: An attacker could tamper with the data that an oracle provides to a smart contract, which could lead to losses for users.

-

Single point of failure: Oracles are often centralized, which means that they are a single point of attack for hackers. If an attacker were to compromise an oracle, they could potentially steal funds from users or cause other problems.

-

Frontrunning: Frontrunning is a type of attack where an attacker can see the data that an oracle is going to provide to a smart contract before it is actually provided. This allows the attacker to front-run the smart contract and make trades before the smart contract has a chance to execute.

-

Measuring bias: It can be difficult to measure the bias of an oracle, which means that it is possible for an oracle to provide biased data to a smart contract. This could lead to losses for users or other problems.

Oracle risks can be mitigated in DeFi by using multiple oracles, diversifying the data sources, and using a decentralized oracle network (like Chainlink).

Using multiple oracles helps to reduce the risk of a single oracle providing incorrect data. Liquity, for example, uses two Oracle networks for it’s pricing of collateral: Chainlink and Tellor. Chainlink is used as the primary source of data, and Tellor is utilized as a back-up set of oracles in the event something were to happen to Chainlink. Diversifying the data sources helps to ensure that the data is accurate and reliable. Using a decentralized oracle network helps to further reduce the risk of data manipulation or outages.

Here are some additional ways to mitigate oracle risks in DeFi:

-

Use oracles that are well-audited and have a good track record of accuracy.

-

Use oracles that are transparent about their data sources and methods.

-

Utilize oracles that are decentralized and have multiple independent parties contributing data.

-

Monitor oracle data closely for signs of manipulation or outages.

-

Utilize oracles in conjunction with other risk mitigation strategies, such as smart contracts that are designed to be resistant to fraud.

-

Ensure a 30-minute TWAP is utilized instead of up-to-the minute pricing (mitigates for flash loan attacks)

The most well known and widely utilized decentralized oracle network is Chainlink. The Chainlink oracle protocol works by using a network of decentralized nodes to fetch data from external sources and deliver it to smart contracts on the Ethereum blockchain. The nodes are incentivized to provide accurate data by being paid in LINK tokens. The Chainlink oracle protocol is designed to be secure and reliable. The nodes are randomly selected to provide data, and the data is verified by multiple nodes before it is delivered to smart contracts. This helps to ensure that the data is accurate and reliable.

The following components of the Chainlink protocol are as follows:

-

Oracles: These are nodes that connect to external data sources and provide data to smart contracts.

-

Aggregators: These are nodes that aggregate data from multiple oracles and provide a single, reliable source of data to smart contracts.

-

Smart contracts: These are programs that run on the Ethereum blockchain and can access data from oracles.

-

Chainlink node operators: These are nodes that run the Chainlink software and provide data to oracles and aggregators.

The image above shows how these components interact with each other to provide data to smart contracts. The oracles connect to external data sources and provide data to the aggregators. The aggregators aggregate the data from multiple oracles and provide a single, reliable source of data to the smart contracts. The smart contracts can then use this data to make decisions or perform actions.

Recently, some notable defi protocols have begun to incorporate their own oracles into their protocols for the sake of security and pricing accuracy. Curve has integrated oracles into their new tricrypto pools to be utilized in their new lending service, and Frax has done the same as well with their pools in the Fraxlend protocol. We can expect to see more and more defi protocols integrate oracles into their infrastructure as a way to make accurate pricing and safer products for use in external (or internal) defi protocols. Oracles are complex pieces of infrastructure within defi, but they are necessary in order to create a fully decentralized and permissionless financial system. Cheers to oracles!

Here are a few sources for this article that are recommended to more familiarize yourself with blockchain oracles and how they operate: https://cointelegraph.com/learn/what-is-a-blockchain-oracle-and-how-does-it-work https://chain.link/education-hub/oracle-problem

🎤 Podcasts of the month

1️⃣Captain Rational with A-Team: Defi, Macro & More:

2️⃣The A-Team monthly catch-up:

3️⃣Discovery: Welcome to Convergence

4️⃣Aladdin DAO space with Tokenbrice, Kmets & DefiAdvisoor:

Official Project accounts:

Twitter: Aladdin DAO / Concentrator / Clever / f(x) Protocol

Discord: https://discord.com/invite/fQYBrHeqK9

Website: Aladdin DAO / Concentrator / Clever / FX protocol (Coming soon…)