Two of the biggest tech buzzwords are in that title — cloud and blockchain. Apologies, I don’t mean to start the piece off with a lame hook, but while people have drawn comparisons between the two in the past, I am of the opinion that some potentially strong parallels have yet to be explored. Cloud infrastructure, as a simplistic concept that entails a lot of complexities beneath it, has been instrumental to taking software, technology, and the economy to where we are today. Even with the immense progress witnessed, and perhaps manifested by the stock prices of the big 3 (Amazon, Microsoft, Google), I believe we still have quite a way to go in this technological era.

So, first of all, what is cloud infrastructure? Leveraging VMware’s glossary,

Cloud computing infrastructure is the collection of hardware and software elements needed to enable cloud computing. It includes computing power, networking, and storage, as well as an interface for users to access their virtualized resources. The virtual resources mirror a physical infrastructure, with components like servers, network switches, memory and storage clusters. (Link)

Taking from this and watering it down even more, you have a bundle of computing power, networking, and storage packaged in a virtual format that replicates all these components a business would (both physically and virtually) need to run most its tech infrastructure. Sounds very similar to the watered-down version of the services we describe blockchains like Ethereum providing — trustless (financial) networking, storage, and computing (powering dApps and services). With these general purpose technologies having similar abstract bases, there could be some fascinating portability from the cloud’s evolution to the future of blockchain.

In this post, I articulate a four-legged thesis on the potential shaping of the blockchain world based off the current evolution of the cloud.

Primo

What exactly does cloud infrastructure do for business? Well, there are several facets to answering that question and I’ll only mention a couple of the more important ones. Firstly, the cloud, and accompanying SaaS tools that immensely leveraged it, reduced the barriers to starting a business. Before true compute and storage outsourcing, internet-enabled companies had to have all sorts of hardware, systems, and large IT departments to scale. Capital, time, and human resources were all needed to keep a business online. This has changed significantly; although, server crashes and IT barriers still occur with the cloud, yet not nearly to the same extent as before. Today, businesses can scale much more efficiently, rapidly, and with less CAPEX (switches costs from a BS item to an IS item).

Shifting gears, let’s look at blockchain. Ethereum and the likes allow for scaling financial primitives, in-app economies / ecosystems, and communities in a much more efficient manner. While we may be in the early days of crypto, there have been glimpses of what the power of smart contracts and trustless ledgers mean for scalability. Look no further at DeFi, which can manage billions in a streamlined way with little overhead and a small group of developers. There is also the future of gaming — an in-game economy built on blockchain technology integrated seamlessly with payments and asset interoperability. And, finally, what about the potential to take business further by enabling micro-payments, rewards systems, and portable social graphs?

Both cloud infrastructure and blockchain enable scalability. Today, when you build an application, you don’t need to know much about infrastructure, hardware, and network protocols. Tomorrow, when you build an application, you won’t need to know much about financial systems, monetization, asset flows, and more.

Secondo

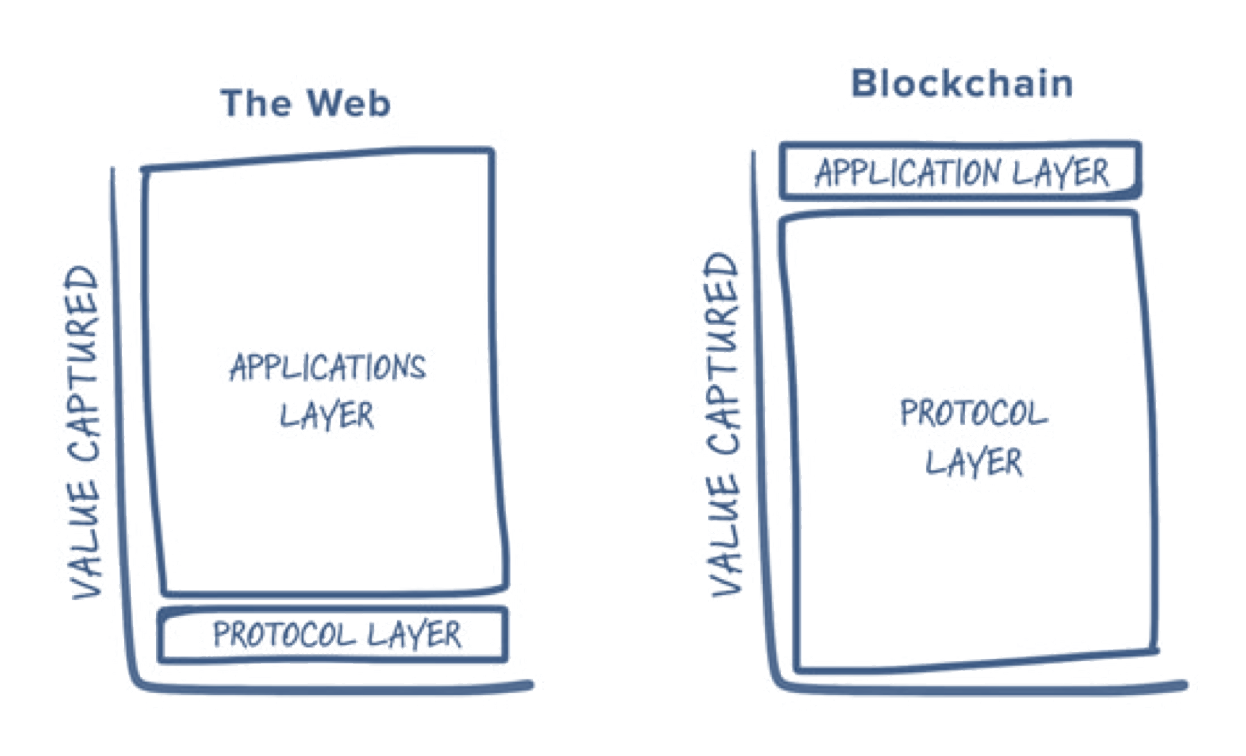

Time to reintroduce the Fat Protocol thesis, which I have mentioned in a couple of prior posts. Popularized by Joel Monegro and the USV crypto team, this thesis reasoned that in a blockchain world, protocols and not applications would accrue most of the value. In the internet stack, key protocols (HTTP, SMTP, TCP / IP) generated immense amounts of value which was mostly captured and aggregated in the application layer (i.e. Facebook, Netflix, Google’s search engine). However, in the blockchain stack, the thesis argues that the protocols should accrue most of the value generated due to the benefits of a shared data layer and native token flywheel effects.

When I look at a cloud-enabled stack, I see it as an exception to the internet stack described by USV above. While I generally think their framework applies to the best internet businesses, many businesses residing on top of the cloud actually have pretty poor value accrual mechanics compared to the cloud companies below. Thus, I believe that the public cloud stack sees similar value accrual mechanics to a fat protocol world.

Prior to the SaaS era, software would be developed and physically shipped (if you are not that young, you may recall buying software in boxes at stores) with gross margins standing very high (75%+). COGS were pretty minimal and there was this fascinating J-curve associated with the fixed cost nature of software development but low-cost nature of its replication. This does still apply to many top-notch SaaS companies today, however, this fails to be the case for all the others. According to Martin Casado (GP at a16z and digital infrastructure investor), several companies out there have product lines with 0% margins “because all of the money goes back to the cloud services [they’re] hosted on” (link). He says it best: these companies are just “reselling a thin layer” on top of the cloud layer. Does ‘thin layer’ sound familiar?

Not only do cloud providers exhibit a value accruing nature, but (partially because of it) they also exhibit an oligopolistic market structure. They’re exposed to so many elements that go into building moats and virtuous cycles that it makes a lot of sense: economies of scale, cross-product subsidization, knowledge moats and knowledge compounding, brand moats, and so on.

Thinking about L1 blockchains (Bitcoin aside, looking more at Ethereum, EVMs and Alt-L1s), I’d reason that a similar market structure could evolve for serving general purpose economic needs. These blockchains benefit from network effects, knowledge / capabilities compounding, security moats, and other virtuous cycle elements which should shape a concentrated market.

Now, does that mean there will only be a couple of blockchains? No, I think there is some interesting logic to say otherwise.

Terzo

Enter the app-specific chains. In late June, dydx, a leading DeFi exchange protocol, announced that its v4 would be developed as a standalone chain in the Cosmos ecosystem. While there have been other instances of this in the past, this one really brought the app-specific chain vs. generalized blockchain discussion to light.

Why would it make sense for dydx to make this move? At a high level, it revolves around optimization and enhanced use of blocks. With its own chain secured by the DYDX token, all blocks will be for the purpose of the exchange and certain parameters and functionalities can be designed in order to significantly enhance the trading experience (vs a DEX on a generalized blockchain).

Shifting to the cloud landscape, there is a general view that all the big firms are on one of the three main cloud platforms. That is actually not the case. Bringing back Mr. Casado, he discussed this on a podcast with investor Patrick O’Shaughnessy, using Dropbox as a focal example. Dropbox, one of the leading file sharing and storage software solutions, used to use AWS S3 for its core operations. However, after some time, it transitioned several key workloads over to its own internal infrastructure. This infrastructure was directly optimized for their use case, and the benefits of the optimization along with the saved S3 costs more than covered the capital needed to invest in and maintain their internal infrastructure. Casado further elaborates on moves such as these while laying out his Vertical Cloud thesis in this blog post (suggest a read). From large, centralized clouds, Casado sees several workloads being shifted over to specialized clouds. The paragraph that captures it all is the following:

And so, in many ways, we’re entering a new and incredibly exciting era of infrastructure, in which any infrastructure service (and really any common sub-component of an application) is fair game to build a company around as a verticalized cloud. The better you are at building the infrastructure, the better the service will be. And because the market is large enough to sustain this, the large central clouds are structurally disadvantaged to compete. The primary question to startups in infrastructure has ironically shifted from “what if AWS/GCP/Azure decides to compete with you?” to “why aren’t you competing more directly with AWS/GCP/Azure?”

Does every business, SaaS company, website need its own cloud? No, and thus, the main cloud providers are not going anywhere. It just doesn’t make sense for everyone. Shifting back to crypto, I ask the same question and sense the same answer. Not every DeFi protocol, NFT tool, social dApp needs its own chain. However, for some lower-stack protocols with heavy blockchain interaction and specialized needs, it could make a lot of sense.

Quarto

Looking at the future of blockchains and crypto, I see a world somewhat mapping the evolution of cloud infrastructure. Firstly, blockchains will add significant infrastructure-driven capabilities and enable scalability improvements. Secondly, core blockchain native tokens should accrue a notable portion of the value generated relative to the ecosystems on top. Thirdly, and somewhat importantly, the future will be occupied by multiple blockchains — some large, secure, and generalized, while others will be specialized and app-specific. I struggle with maximalism making sense. The blockchain future will be much more dynamic.

Conclusion

As always, it is prudent to add a dose of skepticism and continuously stress test one’s theses. Could network effects prove too strong with L1s? What about app-specific L2s or L3s (a la fractal scaling)? Will the fat protocol thesis fall short?

I’ll end this post by saying that trends in infrastructure all have their own profiles, however, when it comes to general purpose technology infrastructure (i.e., the electrical grid, cloud, blockchain) I wonder if Mark Twain’s phrase on history rhyming carries more weight than usual.

Disclosure:* This blog series is strictly personal/ educational and is not investment advice nor a solicitation to buy or sell any assets. It does not represent any views from where the author is working — all views, opinions, and arguments are the author’s. Please always do your own research.*