Angle Protocol was created to make Decentralized Finance accessible to everyone in the world without any financial risk thanks to stablecoins. It is crucial for the success of the protocol to have a decentralized governance.

With more than 24k people on Discord and 16k on Twitter, the Angle community has gained a lot of momentum in the past weeks. This community remains the top priority for the project and we hope that thanks to the ANGLE token it will keep growing in a healthy way!

In this post, we would like to share our plans for the ANGLE governance token distribution and utility across the protocol.

Overview

With a total initial supply of 1 billion, the main purposes of the ANGLE token are to get as many people involved as possible in the governance of the protocol, to help the protocol own and control a portion of its reserves and to incentivize Users, Standard Liquidity Providers and Hedging Agents.

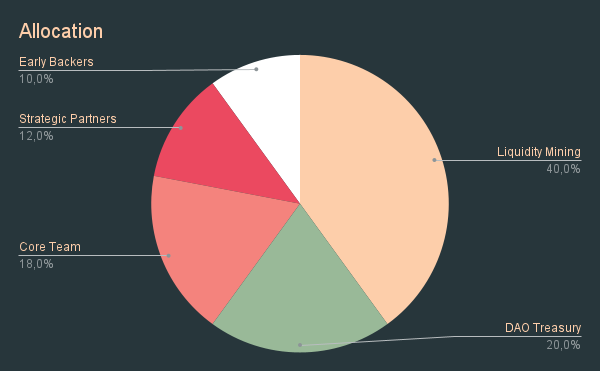

The vision for the ANGLE distribution is that it needs to be multi-year, extended, and sustainable until the protocol reaches ubiquity. With this in mind, the token distribution is broken down as follows:

- 40% To the Community through Angle Liquidity Mining Program

- 20% To the DAO Treasury

- 18% To Angle Core Team

- 12% To Angle’s current and future strategic partners, for grants, advisors of the project and valuable community members

- 10% To Early Backers

ANGLE Token Allocation

Angle Liquidity Mining Program

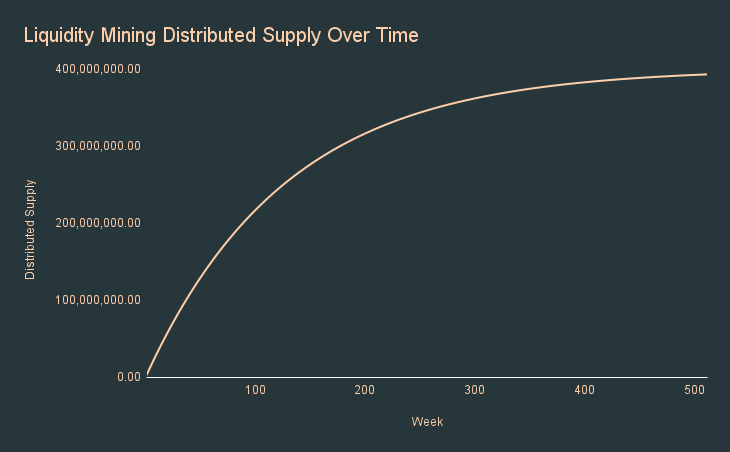

The ANGLE Protocol plans to distribute 40% of its supply through liquidity mining over 10 years.

More specifically, these 400,000,000 ANGLE are going to be distributed through staking contracts for stable holders, SLPs, directly to HAs or even to the LPs of some AMM pools involving tokens of the protocol. These staking contracts were designed to be completely fluid with no lockups or epochs: the longer you stake your tokens, the more ANGLE tokens you accumulate.

Each week an amount of tokens will be distributed to the different contracts with an allocation across the staking contracts set by governance depending on the pools to incentivize.

In the beginning, governance will for instance incentivize owners of agEUR, sanUSDC_EUR and sanDAI_EUR since it is crucial to the success of the protocol.

The ANGLE distribution through this medium has been thought of and modeled after Bitcoin mining, with slight modifications on the halving factor.

As opposed to Bitcoin’s 4 years halving schedule and to other protocols like Curve which updates its weekly distribution amount every year, ANGLE’s distribution will diminish every week.

The idea is to have the weekly distribution of a given week be 1.5 smaller than that 52 weeks prior. Instead of having a 1.5 decrease at the end of each year, distribution will hence diminish by a factor of 1.5^(1/52) = 1.007827 every week.

We have built some simulations to evaluate how supply will evolve over time, you can take a look at this Google Sheet.

The distributed supply through time will then look like:

This design is for the moment based on off-chains mechanisms and is going to be implemented by a multisig held by the Core Team. Governance will however be able to change these parameters and remove the multisig. We still hope that the Community will share this stance with the Angle Core Team.

Everything has been decided to incentivize early users while avoiding short-term mercenary capital and making sure that the protocol will still have ways to attract new participants over the long term.

DAO Treasury

At launch, the DAO will control 20% of the ANGLE tokens. It will be able to vote for how and where to allocate these tokens. Once again, we feel that the Community is the best partner to decide where to allocate ANGLE rewards.

One idea of the Core Team is to sell a big portion of these tokens through a bonding curve against agTokens (Angle’s stablecoins). This would allow the protocol to accumulate some surplus, to deflate the total stablecoin supply (useful in case of black swan scenari like MakerDAO faced in the past) and most of all to take control of a big portion of its reserves.

In the wake of DeFi 2.0, we expect that the bonding curve developed by the Core Team has the potential to revolutionize the way protocols fund themselves and own their liquidity: here instead of selling tokens against another token, the bonding curve proposes to sell governance tokens against a token of the protocol. The DAO will then have full ownership of what to do with the proceeds of the sale which could give rise to interesting initiatives and ideas for the successful development of the protocol.

On a side note, the price of the tokens in the bonding curve is going to be an exponentially increasing function of the number of tokens already sold. This will incentivize people to buy there until the bonding curve token price reaches the market price, helping the protocol grow its reserves. At the same time, this will progressively lock some ANGLE tokens as the price becomes too high.

To optimize for the launch conditions, the Bonding Curve is not going to be activated at the official launch of the protocol on the 3rd of November.

Core Team, Early Backers and Strategic Partners

The tokenomics plans for 18% of the tokens to go to the Core Team. The goal is to keep a meaningfully incentivized but non-controlling core team, while maintaining long term alignement. To this extent, the tokens of the Core Team are subject to a 3-year vesting to make sure that founders and team remain fully committed to the protocol and the community. 2% of these 18% (= 0.0036% of the total supply) will be made available initially, and the remaining tokens will follow a linear vesting schedule.

To fund extensive security audits and recruit top tier talent for the protocol, the Angle Core Team raised funding and distributed 10% of the tokens to early backers. We are fortunate to have a set of world-class partners who are aligned with our vision for Angle Protocol. Yet, we want to clearly demonstrate that we prioritize more the Community and protocol success with this token distribution. To this extent, early partners will remain subject to the same vesting conditions as the team.

Overall, one key thing to note is that liquidity distributed through liquidity mining to the Community will be bigger than that going to team and early backers. This ensures that the Community will remain in control, and that the Core Team and early backers will never have too much influence over the protocol.

Angle Strategic Partners and Community Grants

12% of the initial ANGLE will be held by the Core Team and available for distribution to the Community as grants or bug bounties, to strategic partners like exchanges for listing, but also to the most active and helpful community members as well as to advisors helping the protocol grow.

While the Liquidity Mining program is fair in a proportional way, it still favors users with more capital. We believe that grants and community rewards may be a way to distribute governance into the hands of users in a non-capital dependent way and hence to contribute to creating a robust and incentive-aligned community.

A portion of these tokens may also be distributed back to the DAO Treasury, to the liquidity mining or bonding curve programs if it is believed to become the best way to incentivize the community.

Token Utility

While token distribution is important, it is even more crucial to stress out what this token will be used for. The ANGLE token is the angular stone of the Angle protocol. The token gives the right to participate in governance votes with the Angle DAO. This DAO will be responsible for parameters tuning, deploying new stablecoins, accepting new collateral types for a given stablecoin, and protocol upgrades and integrations.

It is also going to be responsible for the efficient use of the collateral in the protocol. The protocol owns some collateral from users who minted stablecoins, from SLPs and from HAs: the DAO will be the entity handling the strategies earning yield on this collateral and choosing in which proportions to distribute this yield to SLPs.

On top of that, the protocol will naturally accumulates some surplus from transaction fees, yield and collateral appreciation. The DAO will also be responsible for deciding what to do with this surplus.

While a portion should serve as a buffer to continue to absorb collateral volatility and earn yield to grow over time, this surplus could also be allocated to support initiatives around the protocol or for ANGLE buybacks under the form of auctions like is done by Maker DAO. The advantage of buybacks is that they align the incentives of ANGLE holders with the rest of the ANGLE ecosystem. Bought back ANGLE could be either burnt, go back to the DAO Treasury or be distributed through the liquidity mining program.

Summary

The ANGLE token distribution was designed to help the project grow in a healthy way and sustain the vision of the protocol as a tool designed to make Decentralized Finance more inclusive.

There are always tradeoffs when structuring a tokenomics for the short and long-term success of a token and protocol. We tried to make a system that puts community at the front, before team and early backers, with a mix of capital-dependent and non-capital dependent incentives!

As always, we welcome your feedback via Twitter and our Discord and hope that you will share our vision on how to grow the protocol with what we believe to be an efficient tokenomics.

What’s Next: Launch Plans

Angle will be live on the 3rd of November. We will launch agEUR, the first liquid and reliable Euro stablecoin, backed initially by USDC and DAI. The launch of the ANGLE governance token will take place at the same time, with an ETH/ANGLE pool available on SushiSwap for those of you wanting to get immediate liquidity on the token. The available liquidity at launch will therefore be that on the Sushi pool and of the 0.0056% vested by team and early backers. Around 3,000,000 tokens will then be released each week through liquidity mining with a decreasing rate.