1.1 What is launch tactic

In the crypto world, we often see some projects hold initial DEX offerings (IDO) through CEX or launchpad, conduct LBP (Liquidity Bootstrapping Pools) by Copper, or directly airdrop to their early participants. IDO, LBP and airdrop are different types of launch tactics.

So what is a launch tactic? It refers to the strategy adopted by crypto projects to enter the market, which is not only an important part of tokenomics, but also determines the success or failure of a project to a certain extent. What kind of launch tactic to adopt, when to launch, and how to combine launch tactic with tokenomics design are things that crypto enthusiasts have been exploring. We are still at an early stage of development for these activities.

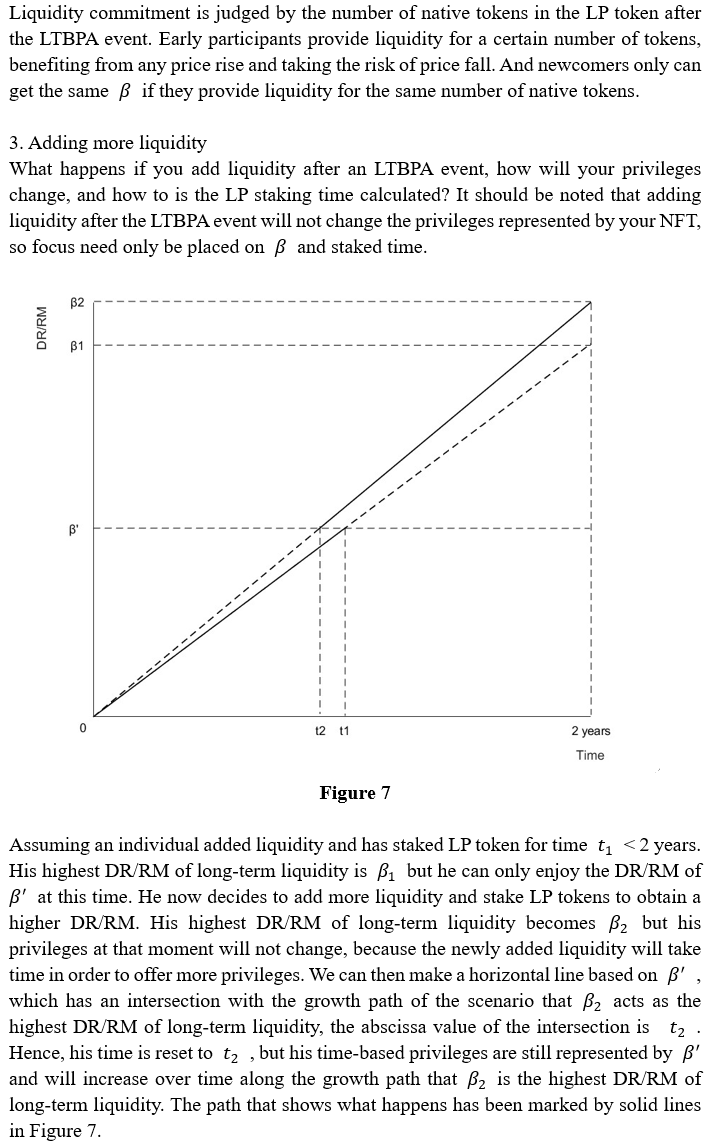

1.2 Why launch tactic matters

For many projects, the main purpose of launch is to raise funds from the public — not only for R&D (research and development), operation and maintenance, but also to build liquidity for their own tokens.

Raising funds for R&D and operations is no longer the main purpose of launch for some high-quality projects, due to regulations and the increase in venture capitalists and angel investors. This funding is enough to support the launch of their products.

Another important goal is to give community members or early participants fair access to tokens. In addition, the projects will also opt to launch as a means of balancing governance rights and show how much they value the community.

The target groups for launch tactics are usually early participants and community members, but they typically have little power and knowledge to determine the launch tactic. It is therefore the responsibility of the builders to figure out which groups should be distributed (early participants, community members or the public), whether there are tiers or ranks, at what cost they will pay and the token release schedule.

If the team and core contributors make mistakes in the choice of launch tactic, it may take some time for the market to eliminate price bias caused by their design. This may not sound like a serious issue. However, a serious error or unfair launch can result in the loss of community members as well as a sustained drop in price, as previous buyers may cancel their positions to cut loss and not buy again.

One possible outcome of these problems is that although the product is good, once community members or token buyers lose faith the popularity will plummet, gradually pulling down the transaction volume and number of users. The Fully Diluted Valuation (FDV) will continue to shrink. So there are no winners, buyers lose money, and investors and teams waste their capital and time.

Some digressions: We can see a large number of many projects claiming to value the community, but in fact they have been undermining the interests of community members through their published unlock schemes. Examples include such as very high purchase costs even at launch, low circulation rates of token to boost false FDV, ultra-short lock-up period of team and VCs, as well as leveraging native tokens to encourage people to add liquidity so they can dump their cheap coins into the pool. There is enough on these things to commission a whole new series.

1.3 Common launch tactics and their features

ICO: An initial coin offering is a launch method in the cryptocurrency industry equivalent to an initial public offering (IPO). Interested investors can buy into an initial coin offering to receive a new cryptocurrency token issued by the company. It’s now generally considered a security sale and legally risky, but you can still see this on private sale and donation. The most successful ICO was Filecoin, which raised US$257 million between August and September 2017.

SAFT: A simple agreement for future tokens is an investment contract offered to accredited investors by cryptocurrency developers. It is a promise for future tokens. The main difference is that the tokens are not delivered immediately, like in most ICOs. Intangible Labs raised US$125 million through a SAFT from 225 investors in March and April 2018. This is to fund Basis, a stablecoin.

IEO: An initial exchange offering is the process of digital asset (e.g. coins or tokens) procurement through an established exchange for the purpose of raising capital for start-up companies. Exchanges act as a middleman between investors and the startup, profiting from fees generated by services rendered during the due diligence process and funding phase. The first use of an IEO by a major exchange was in January 2019, with the launch of Binance’s platform Binance Launchpad. The first use of the platform was with BitTorrent Tokens (BTT) which raised US$7.1 million in less than 18 minutes.

IDO: Initial DEX offering means a project launches its token through a decentralized liquidity exchange (DEX). As a high-quality IDO platform, DAO Maker has released many high-profile and high-quality products such as Gamefi, Numbers protocol and Cere Network.

Airdrop: An airdrop is the active distribution of cryptocurrency to people for free, such as early participants, supporters, contributors, and community members. Ethereum Naming Service ($ENS) took the world by storm in November 2021, with an incredibly successful airdrop — users who had already registered an address using the ENS protocol received free governance tokens by virtue of being early backers of the project.

Dutch Auction: In a Dutch auction, the seller sets an initial price per token, and units are then sold beginning from the highest bidder downward until the auction “clears.” Participants place bids for the number of tokens they would like to purchase and the maximum price per token that they are willing to pay. As the auction price declines, bids placed at a price above the current auction price will be accepted in the order that they were received until (a) current demand meets or exceeds supply or (b) the reserve price is met, and the auction clears. CoinList first introduced the Dutch auction mechanism in 2019.

Stakedrop: Stakedrop refers to staking other tokens, usually stablecoins or ETH, to obtain newly issued tokens. The stablecoins or ETH will be staked for a period of time, but the ownership will not be transferred. Oasis Network held a Rose Garden Event with the help of the CoinList platform at launch. In the first stage, members can stake USDT/USDC to get $ROSE. In the second stage, members can stake $ROSE to maintain network stability and security, and get $ROSE as a reward. Currently, Cosmos Network ecosystem projects most commonly leverage the stakedrop as the launch method.

Incentivized Liquidity: Incentivized liquidity usually rewards the behavior of adding liquidity on the projects (usually measured by LP tokens) to incentivize people to provide liquidity. Most of the time, the reward will be native tokens. This is usually not conducive to project development, because this method attracts plenty of mercenary money. However, the mercenary money will eventually leave and loyal users will suffer as the price falls. The pool2s of Defi dapps serve to incentivize liquidity.

Liquidity Bonding: Liquidity bonding means offering native tokens at a slight discount to people in exchange for some of their liquidity position (LP token). Instead of constantly paying people your tokens just to maintain the same amount of liquidity, they trade their liquidity position with you for more tokens. Olympus popularized the liquidity bonds, and projects can use their service “Olympus Pro” to collect liquidity by liquidity bonding.

The English Auction: An English auction starts from a very low price which is incremented upwards until only one willing bidder remains, at which point that bidder pays the amount they bid. Very few projects use this method. On the one hand, it enables the whales to jump the gun, and on the other hand, it is very unfriendly to latecomers. Neos Credits used this method to sell their tokens $NCR during the hottest hype period of gamefi and metaverse, which cost the latecomers a lot.

Donation: Donation means people donate their ETH or stablecoins at the launch period and receive native tokens as a gift. JPEG’d raised $70 million through donations in February and March 2022, with 30% of its native tokens being distributed as rewards. Of course, this “gift” was pre-declared before the start of the “donation event”.

Community Sales: Community sales is a method for the fair launch of tokens to community members, which usually requires registration and KYC, as well as a specific centralized platform. Near Protocol’s token sale took place on Coinlist, and 1500 registrants bought 100 million tokens within two hours. However, this created much unhappiness and opposition in the community. As a result, the team reopened the community sale for 6000 registrants later for 7 days, which ensured community members no longer needed to worry about congestion and server issues.

Usage Rewards: Usage rewards start by rewarding early adopters of the dApp. Rewarding users is a part of the Web3 spirit, but we can also find people who just engage for rewards and sell the token once they get them, and never use the dApp again. ApolloX and STEPN both chose usage rewards when launching.

LBP: Liquidity bootstrapping pools are configurable rights pools or smart pools to conduct quasi-Dutch auctions by dynamically changing token weights. LBP helps with price discovery and also realizes fair launch. LBP often starts with intentionally high prices. This strongly disincentivizes whales and bots from snatching up much of the pool’s liquidity at the get-go. Apart from that, projects only need to kickstart the liquidity of their token with minimal starting capital by LBP. Balancer and Copper are where teams use LBP the most.

Lockdrop + LBA: This is a launch tactic incubated by Delphi Digital, which consists of two phases. This method was first adopted on Astroport. During the Lockdrop phase, there will be a 7-day period during which anyone can pre-commit to being users of the protocol for a given amount of time. In the case of Astroport, this means LPing, locking up LP shares for up to 1 year and then getting the $ASTRO. During the Liquidity Bootstrap Auction phase, there will be another 7-day period during which lockdrop participants can deposit their tokens into one side of a stablecoin pair liquidity pool i.e. ASTRO-UST. Others can then come in and commit stablecoins into this LP, buying ASTRO from Phase 1 participants. Finally, auction participants receive LP shares pro-rated to their deposits.

1.4 Service DAO

A DAO, or “Decentralized Autonomous Organization,” is a community-led entity with no central authority. With the bull market of cryptocurrencies, DAOs also experienced explosive growth in 2020. Constitution DAO shows the world the power and influence of a decentralized community by participating in the auction of a first-edition copy of the U.S. constitution. In the development process, DAOs also diverged based on their functions and goals, such as Protocol DAOs, Social DAOs, Media DAOs, Investment DAOs, Collector DAOs and Service DAO. Figure 1 shows the DAO landscape.

Due to the bear market, some Service DAOs have been less active or even halted operations, but there are still some that continue to promote DAO development and ecosystem construction while community members remain active. Here are some service DAOs that are still running smoothly.

1. YGG is a play-to-earn gaming guild, bringing players together to earn via blockchain-based economies.

2. Raid Guild is a very well-known Service DAO that provides design and development services (paid services) for the Web3 ecosystem projects through a high-caliber team of designers and developers.

3. DAOhaus is a no-code platform for creating and managing a DAO.

4. DXdao is a Service DAO that develops, governs, and grows DeFi products.

5. AladdinDAO is a DAO to shift crypto investments from venture capitalists to the wisdom of crowds through collective value discovery. AladdinDAO members vote to identify, analyze and provide high-quality DeFi projects to community members.

6. MetaFactory is an experimental brand. A community-owned culture factory focused on the creation of digi-physical goods that celebrate Web3 and decentralized innovation.

These Service DAOs are organizations that have already provided or which intend to provide services and get paid. They fit very well with this paper’s analysis framework and are the DAOs that this paper is intended for.

2. Locked Time-Based Privilege Auction

Here, the author proposes a new launch tactic, named Locked Time-Based Privilege Auction (LTBPA), for Service DAO that is different from the methods mentioned above. For Service DAO, if the core team does not intend to spend a lot of money to initiate liquidity, and collected liquidity from community members is not enough, what can they do? And if Service DAOs want clients and contributors to be tied to them, what can they do?

It is recommended that Service DAOs attract liquidity by promising services and rewards in advance, keeping low inflation and achieving protocol-controlled value (PCV). By incentivizing pioneers with privileges, people are more likely to provide liquidity and participate in DAO building, which will guarantee their interests and rights. Additionally, the large initial token release and low inflation will reduce dilution of the native token and disperse the selling pressure. Further, the control of a wide range of liquidity can avoid hyped-up prices or low sell-off prices. It prevents mercenary money and speculators from increasing the costs for the project’s latecomers, and a price dump that may cause community members to leave. The combination of PCV and low inflation limits the risk of the token falling, but leaves more room for the upside.

Besides, Service DAOs can introduce capital, project leaders or whales, put their rights and interests ahead, and bind their interests with Service DAO, which will bring a lot of resources and tools as well as a stable source of income to Service DAO. At the same time, by increasing the opportunity cost, we also encourage the long-term commitment of community members to provide liquidity, contribute to the community and receive higher rewards.

You may wonder: because Service DAOs’ situations may differ, does this method work for all? We’ll discuss this later, but first let’s see how it works:

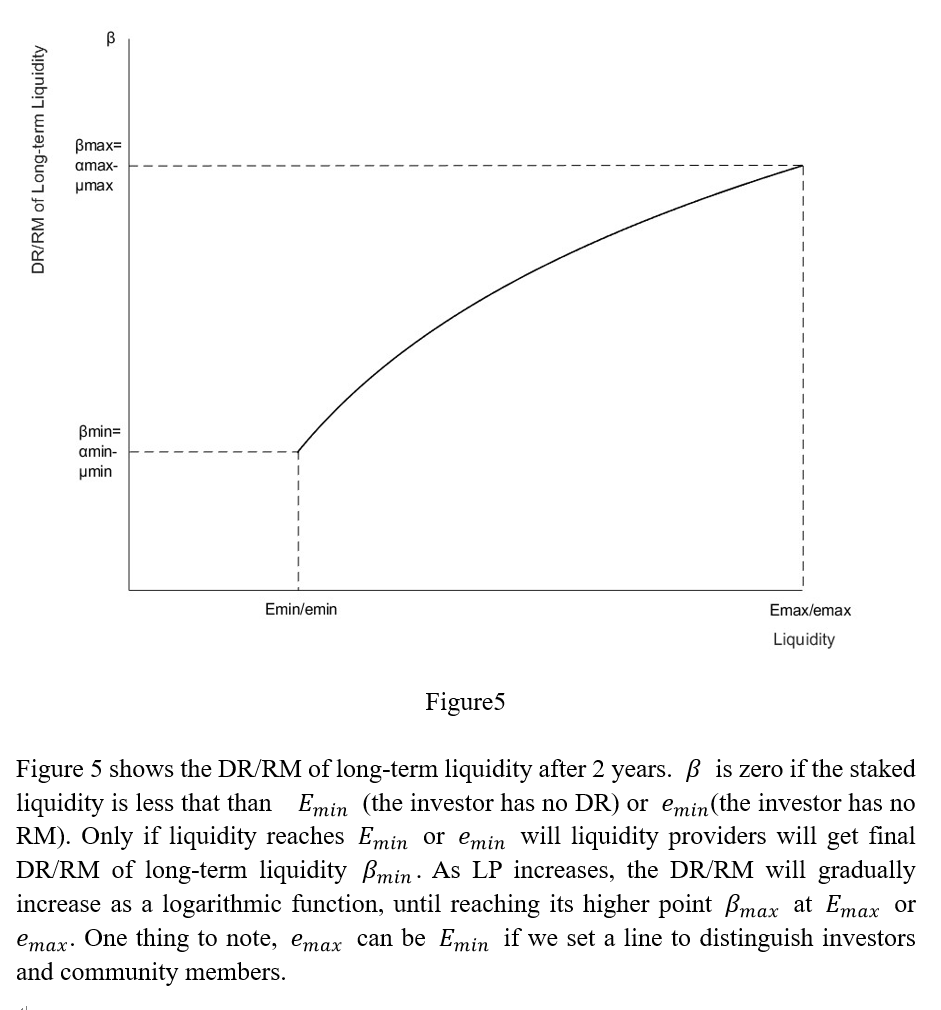

①At launch, participants are allowed to provide ETH to add liquidity to native tokens. Half of the LP is owned by Service DAOs, and the other half is owned by the liquidity providers. The LP tokens are immediately staked and can be unlocked after two years. The specific ratio of native token and ETH is determined by the market.

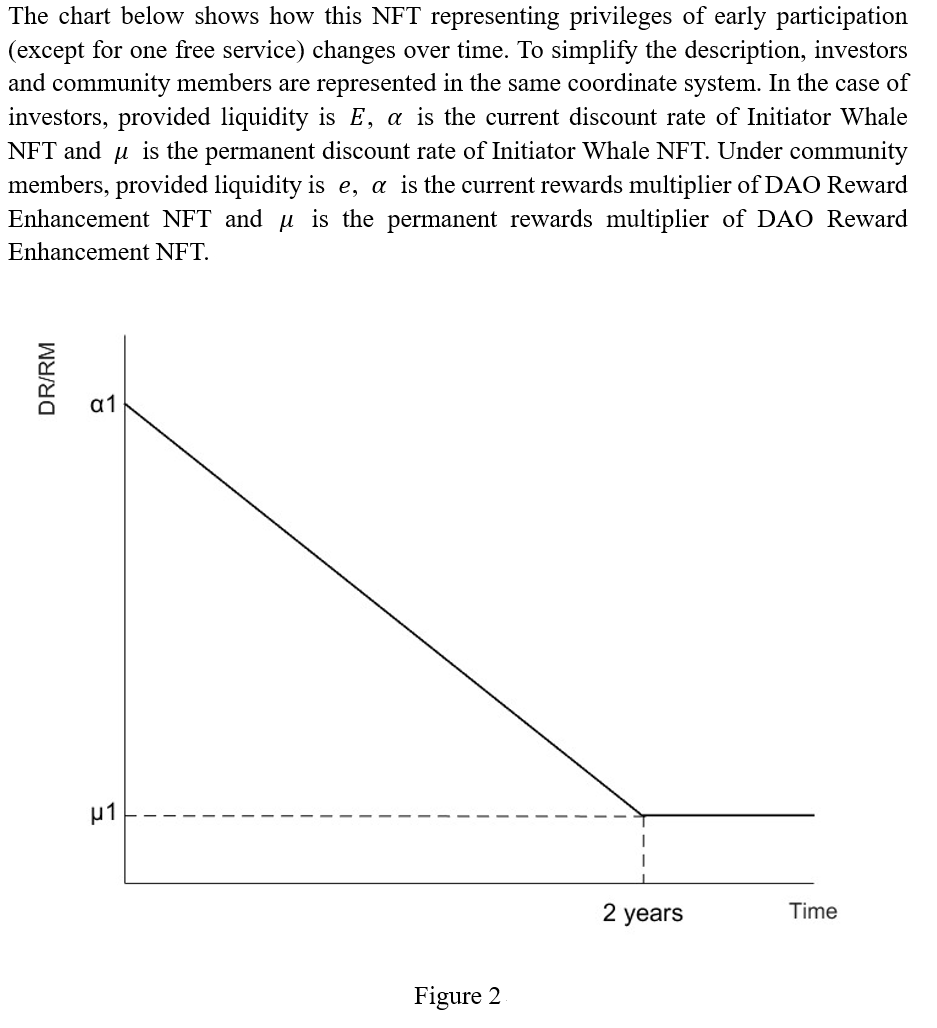

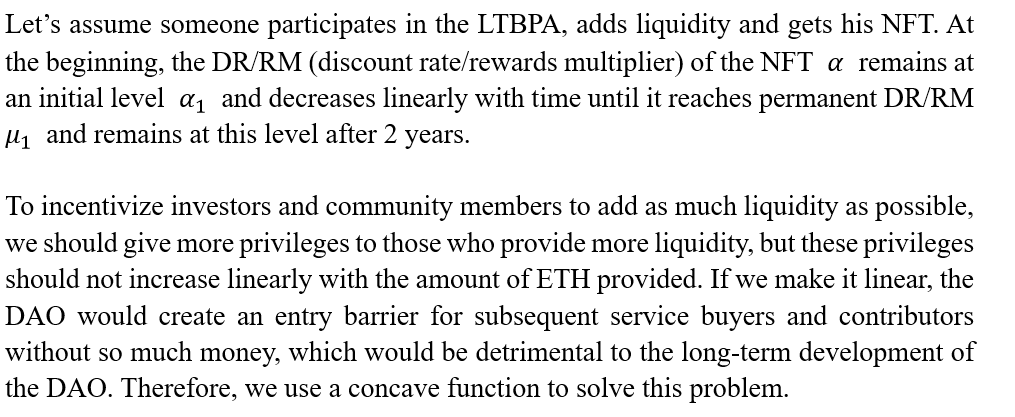

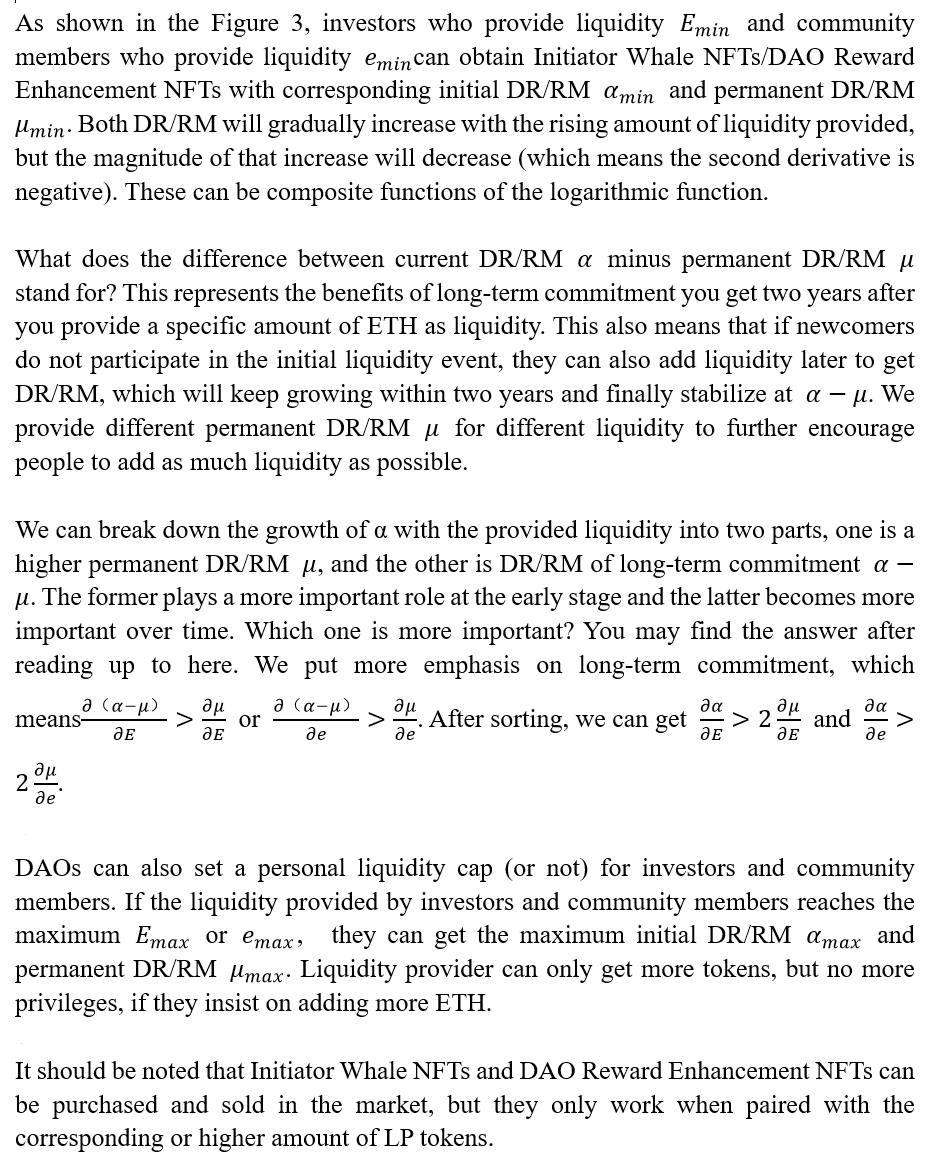

②Those who provide ETH exceeding a certain threshold will be given an Initiator Whale NFT, which will be empowered. Those who own the Initiator Whale NFT can enjoy free service once and discounts for subsequent services. Other participants will be given a DAO Reward Enhancement NFT. When they contribute to the DAO, they will receive additional rewards, and the more liquidity they add, the more rewards they can get. The benefits of both NFTs will decrease over time.

③The newcomers can also buy native tokens, add liquidity and stake LP. Based on the amount and time of LP staked, newcomers can also enjoy a certain level of discounts when they obtain services or contribute to get higher rewards. The longer they stake, the more discounts or rewards they get, and once they unstake they no longer have the privilege. NFTs will be empowered only when they lock the liquidity.

2.1 Token shares of LTBPA

Maybe you need liquidity in the millions or tens of millions of dollars. Of course people believe that the higher the liquidity the better, but this is not up to the team and the community. What the team and community can decide is how many tokens to initially release, and how to incentivize people to add and retain liquidity. (Actually, the most important thing is to enhance the value of DAO itself.)

The initial release of this launch tactic will be a considerable amount, which should be equivalent to the whole shares of investors, private sale, public sale and liquidity incentives. It can also include part of the share of the ecosystem and treasury, because this model itself motivates the ecosystem and stabilizes the token price. According to the report from Lauren Stephanian, the proportion of these shares is about 25% — 40%. It’s just a rough range, and different DAOs should adjust this proportion according to their own situation. LTBPA not only solves the contradiction between high circulation and liquidity requirement, but also solves the problem of fair launch. Investors and community members can obtain tokens at the same price which reshape a healthy relationship between investors, DAOs and community members.

2.2 Why and how to empower the NFT

Why do we empower the NFT for early LPs? Because providing initial liquidity is their contribution and commitment to the community, the empowered NFT represents their privileges (discount rate/rewards multiplier) for coming in early, which also shows the rights that DAOs give to pioneers.

However, as time goes by, the impact of early participation on Service DAO will gradually decrease, and the persistent commitment (providing liquidity) to Service DAO will become more important as the project develops. It is crucial to distinguish between these two things. Although the impact of early participation is getting smaller as time goes by, this impact will always exist. Therefore, base privilege should be set for pioneers.

2.3 Time-based tokenomics

When designing rights for newcomers, the author did not use the ve token model pioneered by Curve, but time-based tokenomics. 0xKepler once mentioned in his article that although the ve token has many advantages, it also has the disadvantage of discouraging, including lower-than-expected incentive alignment, building a community of bagholders and governance halt. Compared to ve tokens, which consider a staker’s commitment into the future in the form of lockups (forward-looking), time-based tokenomics are backward-looking (how long a user is already staking).

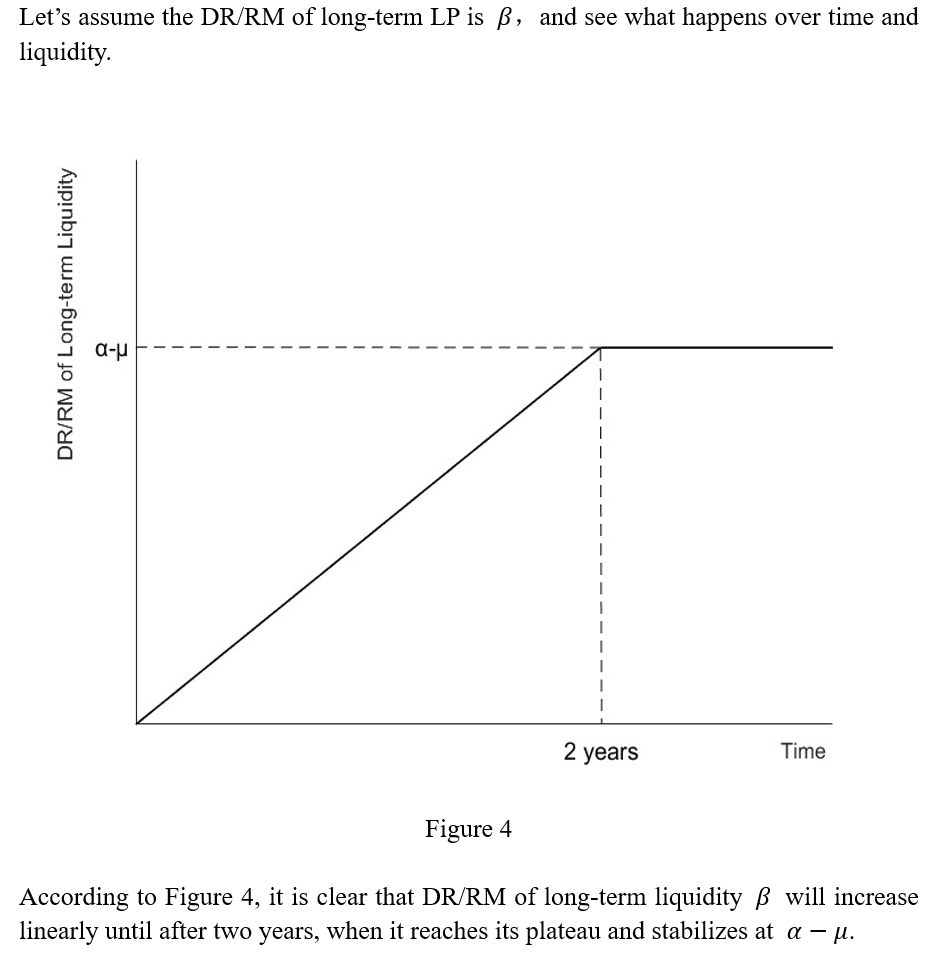

This design brings us three benefits. First of all, we increase the opportunity cost of withdrawing liquidity for investors and contributors through time-based tokenomics. If your project is worthless, they could easily leave as the opportunity cost of unstaking is very small. This is reasonable, as we should give investors and contributors the right to leave, especially for projects with poor prospects. Second, time-based tokenomics encourages newcomers to make long-term commitments, and the gap in privileges between newcomers and early participants will become smaller over time. Finally, the existence of opportunity cost makes it very unlikely for investors and contributors to unstake the LP token and give up their privileges just because of short-term price fluctuations, which improves price stability in the market.

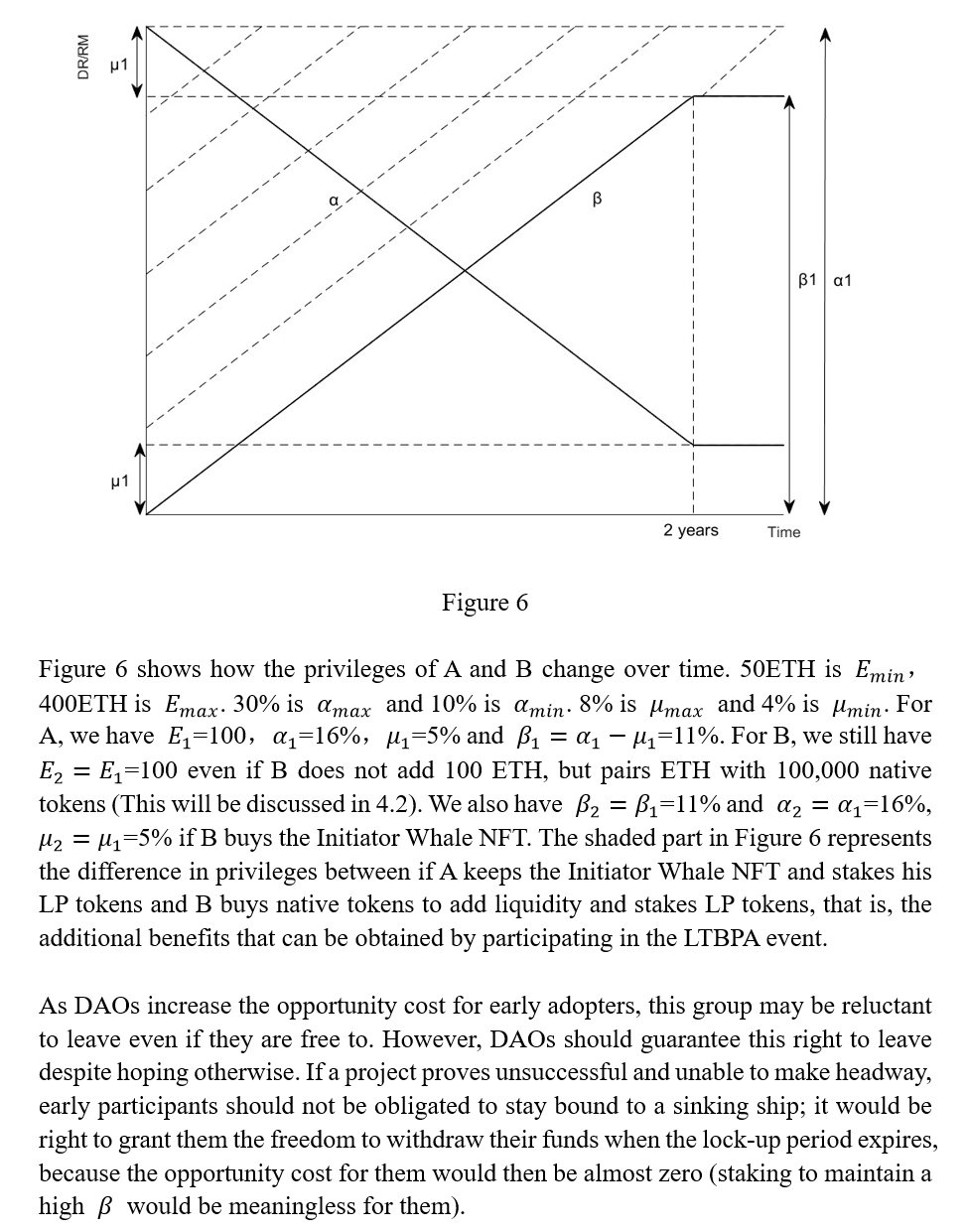

The examples below better illustrate this concept. Here, a Service DAO project decides to launch their token by LTBPA. They have set an investment range of 50–400ETH for investors. The corresponding highest initial discount rate of Initiator Whale NFT is 30% and the lowest one is 10% while the highest permanent discount rate of Initiator Whale NFT is 8% and the lowest one is 4%.

Assume A is a man working in a crypto investment institution and plans to join the LTBPA event on behalf of his company. He added 100 ETH to pair with 100,000 native tokens, the LP token was locked, and he claimed the NFT immediately after this event. His initial discount rate was 16% with 5% of the permanent discount rate. In these two years, he enjoyed one free service and a continuous discount rate of 16% for further service. After two years, the current discount rate of his Initiator Whale NFT has been reduced to the permanent discount rate, but his discount rate of the long-term commitment has gradually increased to 11%. This means that if he sells his Initiator Whale NFT at a good price at this time, he can still purchase follow-up services at a discount of 11%. But if he un-stakes his LP token, he no longer enjoys the discount even though he owns the Initiator Whale NFT.

B is a project leader, who discovered this Service DAO and thought that the services they provided were what he needed for developing his project. He hence decided to invest in this Service DAO to reduce the cost of obtaining services. However, the LTBPA event is just over (the time interval between A and B is negligible), he can only buy 100,000 native tokens from the market and pair them with ETH (perhaps not 100ETH) to add liquidity and stake, then get a higher discount rate over time and obtain the discount rate of 11% after two years. Apart from that, he believes that the frequency of using the service is high, so it would be a good choice to buy the Initiator Whale NFT sold by A in the market. If B adds liquidity and stakes LP tokens right after the LTBPA event, he will continue to receive a 16% discount after two years if buying A’s Initiator Whale NFT at any time. If B buys the Initiator Whale NFT of A from the market one year after the LTBPA event ends, then he will get 10.5% discount within the first year and the discount rate will gradually increase to 16% in the second year.

3. Scope and Flexibility

3.1 Application conditions

No launch strategy is perfect and all are subject to limitations. Only Service DAOs that meet certain conditions can enjoy the benefits of this launch tactic.

Firstly, the Service DAO has to survive the initial phase on its own, which is easier compared to other projects with a long-term development roadmap. Once Service DAO has the ability to provide services, it will start to earn income, which would not require that services in all the areas that Service DAO plans to be involved in are fully developed. Self-sufficiency at the initial stage is easier to achieve when the demand for specialized service providers currently outstrips the supply. The reason why the strategy can’t be used in the initial stage is also simple — Investors are unlikely to recognize or even hear about your project, and it is difficult for community members to withdraw ETH from their wallet for liquidity. There is a high probability that the project will be unsuccessful. On the one hand, community members and core contributors cannot be properly motivated because the pool is too small. On the other hand, the premature issuance of coins will cause the team to be influenced by the price of coins and hence ignore long-term interests in favor of short-term benefits, which means the team’s decision-making process will be distorted.

Secondly, the services provided by Service DAO must be continuous and not a one-shot deal. The services provided can be focused on areas where customers are not adept in or areas where they seek to reduce costs and boost efficiency. If a service is one-off, it means VCs, project leaders and whales would not be incentivized to add liquidity — they would prefer to buy the service at full price instead of adding liquidity to get discounts and privileges while maintaining a long-term cooperation or relationship with Service DAO.

In addition, the Service DAO should have a good reputation in the crypto world, maintain cordial relationships with some investors and project teams, and have stable core contributors. It would be beneficial if the DAO has served blockbuster projects. A good reputation and relationship with VCs and project teams guarantee that your DAO’s tokens will not be sold at a cheap price, and a stable group of core contributors will ensure the quality and efficiency of the services provided by a DAO. If backed by success stories, liquidity and customer acquisition could prove less challenging.

Finally, what constitutes a Service DAO can be viewed broadly. That is, utility projects built by a small group or community members, such as Trader Joe. For these projects, it is not only conditions 1–3 that should be met, but the projects also need to reconsider the privileges provided to investors and whale clients and how best to motivate community members to continue providing professional quality work.

If you the above conditions for projects are not met, then such launch tactics should not be employed. This method is an idea and has not yet been adopted. There might be influencing factors and application conditions within the process that have yet to be discovered.

3.2 Flexibility

Section 2 proposed and analyzed the LTBPA launch tactic, but there are more things to consider for implementation, such as the overall tokenomics design, governance and other practical factors. Different Service DAOs need to combine the launch tactic with their own features when adopting the launch tactic. Below we discuss a few important and commonly used factors that require flexibility.

1. Buyback

Although the initial released share is large in volume and the tokens maintain a low inflation rate, the remaining tokens will still eventually be unlocked. So how can Service DAOs acting in the rights and interests of liquidity providers and token holders withstand market selling pressures (no matter the level) and benefit from the growth of the platform?

Buyback is a more direct tokenomics design that can capture the value of the platform — a Service DAO will buy its native token from the market through the mechanism. The source of funds for buyback can be collected from the transaction fees of LP tokens and a part of the Service DAO’s revenue.

The benefits of buyback are obvious. It is conducive to the healthy and sustainable development of the Service DAO (as opposed to token burning). One the one hand, Service DAOs are encouraged to use the repurchased tokens to further incentivize contribution. On the other hand, the tokens also can be paired with ETH from their incomes to add liquidity into the pool, hence achieving liquidity control.

2. Tier

In practice, it is almost impossible for Service DAOs to provide a unique NFT for each liquidity provider in the LTBPA event. Therefore, it is necessary to adopt classification, that is, to reward the same DR/RM for liquidity providers within a range. A rational person would add as little liquidity as possible under the desired tier, that is, within lower bound of this range.

Why does LTBPA use added ETH rather than the number of native tokens to represent , and also represent the abscissa of liquidity. What happens if we choose the number of native tokens as the measurement of liquidity provided in the LTBPA event? Most will only add liquidity once to reach the desired tier, but they will not know which tier they are in and how many tokens to add until the LTBPA event ends. Therefore, using added ETH as a means of classification can better guarantee the rights and privileges of liquidity providers.

4. Governance

There is no one governance template that suits all DAOs, and different organizations need to build different governance models according to their situation (the veToken model has stagnated many a protocol governance). One important thing in model design is the relationship between proposing rights and voting rights. Below are three key points to handle the relationship.

First of all, accessibility to proposing rights. This is about how to design the governance process to make the proposal more professional while reflecting the interests of the community. Secondly, voting rights distribution. Because this launch tactic design brings too many chips to the hands of investors, it is of great importance to guarantee that the governance process balances the interests of all parties rather than letting whales lead the development of DAO alone. Finally, the voting rights marker. It is necessary to decide what elements can represent voting rights.

It is essential that the combination of governance and tokenomics be conducive to long-term development of the DAO. Simplify the stakeholders of Service DAO into four groups: investors (VCs, project leaders), team, core contributors and community members. And core contributors should also belong to the community.

Unlike other DAOs, Service DAOs cannot survive without investors, because investors provide the general income of Service DAOs. It would be difficult for Service DAOs to leave the team as well because the team has the ability to provide core services for users and knowledge for the community. Therefore, what a reasonable three-party game mechanism needs to be designed to promote the development of the DAO on the premise of decentralization.

Corresponding Solution

1. The limited proposing rights accessibility. Proposals require the provision of a complete set of solutions to problems or guidance for subsequent development rather than simply putting forward an idea for everyone to vote on. The majority of community members usually do not have the ability to propose, and are hence not suitable to directly own proposing rights.

However, community members can be allowed to elect people who have close relationships with the community and have the ability to make proposals (not necessarily core contributors) to propose on behalf of the community. Community representatives can contact investors and teams to design proposals, while investors and teams also have the right to make proposals, and they would better inform community representatives before the proposal is released.

In addition, in order to improve the operational efficiency of a Service DAO, voting should only focus on key issues, such as treasury management, complex parameters setting, rule modification and integration. If the Service DAO has to make many daily decisions, a management layer with optimistic governance should be elected (who may also have other roles in DAO at the same time) to handle routine and less important routine tasks.

2. The tripartite governance of voting rights. The voting rights of Service DAOs should not only focus on the rights of the community, but also focus on the balance of governance among investors, team and community. A good design should take into account the fact that all three parties are entitled to assert their own rights, and the governance process should not conflate their respective claims. Therefore, we propose the following governance: tripartite governance

That means even under the principle that the minority obeys the majority, governance cannot absolutely violate the interests of a certain group. For the second rule, people can set numbers like 0.25 or 0.3 to the right of the equals sign depending on how they define the “absolute violation”.

In order to prevent the sybil attack on the voting rights of the community, the voting rights of LP tokens should be emphasized, which is much greater than twice the governance rights of simply holding native tokens. Time-based design for voting rights and conviction voting (mentioned below) can also be introduced to further significantly increase the cost of sybil attack.

3. Multi voting rights marker. Generally speaking, native tokens represent voting rights. However, in such a case, people are more willing to hold LP tokens, so we should also empower LP token holders to vote. In addition, the contributions of community members should also be rewarded with voting rights, and it has been mentioned in Section 2 that contributions can be rewarded with native tokens. It would be more beneficial to identify contributions without required permission, and governance rights can be obtained independently through an open and quantifiable mechanism without relying on subjective factors.

In addition, there may be other problems that occur in the governance process. The following lists some common problems as well as solutions that have been adopted by 1Hive.

1.Free Rider Problem. In DAOs, all token holders benefit from good governance whether they participate in it (create proposals, vote on proposals) or not, and free riders would be the inactive holders. We also need to classify the kind of contribution in governance — one is creating proposals and another is voting on proposals. Alex Kroeger pointed out that it is necessary to evaluate the difficulty and impact of creating proposals, and give corresponding rewards through bounties, one-off grants, streaming contributor grants, and one-off payments. At the same time, he also suggested leveraging a small number of tokens to incentivize members to vote, and hence publish those that don’t participate in governance with dilution of their stake in the protocol.

2. Conviction Voting. The Conviction Voting (CV) governance module is one Commons Stack component. It allows people to distribute their voting power into different proposals and the voting power will be transferred to conviction. The conviction cannot jump to a different level but will increase or decrease according to a half-life decay curve. When a member joins the community, they will be requested to assert percentages of their preference towards existing proposals, adding up to 100% in total. Conviction Voting not only solves issues like vote buying, plutocracy, sybil attacks and last-minute vote swings, but also helps with on-chain voter apathy.

3. Gardens. Sacha came up with Gardens, a framework for effective on-chain governance based on Conviction Voting. Gardens add Community Covenant and Celeste to clarify rules, protect values and resolve disputes. Community Covenant is a document, stored on IPFS, which explains what the DAO is by a subjective set of rules. It establishes values, rules and customs, and is used to protect the DAO from malicious actors without sacrificing the agency of its members. While Celeste provides a way to resolve subjective disputes, and to peacefully enforce the covenant. More technically, Celeste is a BrightID integrated fork of Aragon Court. Once Celeste is invoked, a decentralized (and randomly selected) group of BrightID verified humans — called keepers — is drafted to rule on the dispute (they are tasked with deciding whether or not the disputed action is compatible with that community’s covenant). By allowing even small token holders to challenge proposals that aren’t in line with the values of the community, Celeste provides a trustless way to uphold a DAO’s core values.

Note: Many people are confused why investors have the right to receive a large number of tokens in LTBPA events, and why investors are given voting rights as one party. In fact, they are clients in addition to being investors. The realization of platform value and the bounty of contributors largely depends on the service purchased by investors. For Service DAOs that rely on clients, there is no reason to refuse to distribute certain voting rights to their clients.

4. Advantages

4.1 For the DAO

From DAOs’ perspective, they need to survive the initial stage by themselves, this special fundraising is realized in the subsequent stage, they no longer get money directly from investors and then use it for development and operation. But contributors and team members can be long-term incentivized via the reward of native tokens according to the schedule and rules of Service DAO. They can them swap these for ETH in the controlled liquidity pool.

From a service perspective, being funded by VCs, project leaders and whales means getting a stable source of income. For client sources, a Service DAOs should be willing to sell its own tokens to investors (in the form of LPs), and provide long-term privileges and benefits for the healthy collaboration. Service DAOs can also build strong relationships with them to expand DAO’s resources and tools, and further develop and improve products based on clients’ needs.

4.2 For VCs, project leaders and whales

Specialization and division of labor are gaining importance in the crypto world. Many small and medium-sized primary market funds, secondary market funds, most project leaders and some whales would be unable to fully complete all the tasks they wish, such as the tokenomics design, community management and activities organization, publishing videos and articles on media, building a frontend application, integrating with applications and even project incubation. Small teams, comprising dozens of members can collaborate to deal with these issues, but hiring extra people for occasional tasks is costly, less efficient and could result poor-quality output. This requires support from more professional institutions. Outsourcing these tasks can reduce extra expenses and improve the quality and efficiency of work. These Service DAOs could also serve as an intermediary for connecting with other resources.

4.3 For community members and contributors

Individuals can obtain tokens at a fair price, unlike in some projects, where the cost for community members to acquire tokens is dozens of times higher than the cost for investors. Community members and contributors who provide initial liquidity for tokens will be continuously incentivized to contribute to the community and DAO for higher rewards. Of course, what is more important is that contributors can work and pay their efforts to get tokens (or even earn income directly) without worrying about sudden drop in price. They can exchange tokens for ETH, keep tokens or further add liquidity to get higher reward multipliers. The positive feedback loop between contributors and DAO is an essential mechanism that guarantees the healthy development of Service DAOs.

Note: Any design should be created to serve the project. Good design can reduce wear and tear during operation and motivate members, while aggressive design will give you higher leverage to access more resources that do not belong to you. However, all designs also come with some negative effects as the value of your project decreases — an over-aggressive design can even destroy the project and reputations. We recommend focusing on enhancing the value the project brings to the crypto world.

References

1 Tokenomics 104: How to Launch a Token (Tactics, Questions, Wen, etc) Nat Eliason

2 Twitter Threads About Tokenomics BowTiedNightOwl

3 Tokens in the attention economy Cobie

4 The Art and Science of Native Token Liquidity Eva Wu

5 Tokenomics Musings: ve tokens and alternatives 0xKepler

6 The Three Tokenomics Problems and a Productivity-Linked Tokenomics Design Jack Chong

7 All for One, or One for All? Krik Hutchison

8 Stop Burning Tokens — Buyback And Make Instead Joel Monegro

9 Optimizing Your Token Distribution Lauren Stephanian

10 Cryptoeconomic Patterns & Application domains Vasily Sumanov

11 To Token or not to Token: Tools for Understanding Blockchain Tokens Oliveira, Luis et.al

12 Thoughts of Governance: Token and DAO(New version — More info about DKP) Typto

13 DAO Treasury/Balance Sheet Management Yuan Han Li

14 How to Retain High-Value Contributors to your DAO? Eliot Couvat

15 Conviction Voting: A Novel Continuous Decision Making Alternative to Governance Jeff Emmett

16 Introducing Gardens: a framework for effective on-chain governance sacha

17 Liquid_Democracy Wiki

18 Liquid Democracy In Context or, An Infrastructuralist Manifesto Anonymous Writer

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as “Huobi Research Institute”) was established in April 2016. Since March 2018, it has been committed to comprehensively expanding the research and exploration of various fields of blockchain. As the research object, the research goal is to accelerate the research and development of blockchain technology, promote the application of the blockchain industry, and promote the ecological optimization of the blockchain industry. The main research content includes industry trends, technology paths, application innovations in the blockchain field, Model exploration, etc. Based on the principles of public welfare, rigor and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms to build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical basis and trend judgments to promote the healthy and sustainable development of the entire blockchain industry.

Contact us:

Website:http://research.huobi.com

Email:research@huobi.com

Twitter:https://twitter.com/Huobi_Research

Telegram:https://t.me/HuobiResearchOfficial

Medium:https://medium.com/huobi-research

About X Research DAO

X Research DAO is a community-based research DAO backed by Huobi Research. It aims at being one of the most valuable decentralized blockchain-analysis insitituions in the world. X research DAO focuses on analysing web3 projects, early stage public-chains, gamefis and NFTs.X Research DAO welcomes all web3 enthusiasts, let’s build the best research DAO and learn together!

Join us:

Website:https://www.xresearchdao.xyz

Twitter:https://twitter.com/XResearchDao

Telegramm:https://t.me/xresearchdao

Discord:https://discord.gg/S52jJT9NSp

Youtube:https://www.youtube.com/channel/UCHBeMdxOnoU6zo3mbVd1MKg/featured

Notion:https://bit.ly/3AjGNlq

Mirror:https://mirror.xyz/0x9045237C0248AA32A758635f9E5d8A47f1460702/

Disclaimer

1. The author of this report and his organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report.

2. The information and data cited in this report are from compliance channels. The sources of the information and data are considered reliable by the author, and necessary verifications have been made for their authenticity, accuracy and completeness, but the author makes no guarantee for their authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment and other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report, unless clearly stipulated by laws and regulations. Readers should not only make business and investment decisions based on this report, nor should they lose their ability to make independent judgments based on this report.

4. The information, opinions and inferences contained in this report only reflect the judgments of the researchers on the date of finalizing this report. In the future, based on industry changes and data and information updates, there is the possibility of updates of opinions and judgments.

5. The copyright of this report is only owned by X Research DAO. If you need to quote the content of this report, please indicate the source. If you need a large amount of references, please inform in advance (see “About X Research DAO” for contact information) and use it within the allowed scope. Under no circumstances shall this report be quoted, deleted or modified contrary to the original intent.