Introduction

Trust, liquidity, transparency, security, efficiency, and innovation comes with the birth of blockchain, but the bear market in the crypto industry seems to be struggling finding new growth opportunities; the crypto industry is in desperate need something new as the next narrative. Tokenization of RWA creates a venue between traditional finance and crypto finance, cultivating a multi-trillion-dollar asset market, which can be deemed as the water of life that nourishes the crypto industry across cycles of bulls and bears. Since its inception, voices on tokenization of RWA have always been heard, but none of them have been exemplary impeded by obstacles from technology, regulation, and the market. Recently, the RWA segment has returned to the center of discussions, and many institutions have taken actions. RWA projects have demonstrated characteristics of large varieties, with most of them being DeFi, highly risky with high returns, and it has become more accepted by the public. However, these projects are still somewhat problematic: they are low in liquidity, price discovery is incomplete, and most of them are in an early phase. Whether RWA could become the next superstar depends on the development of infrastructures and completeness of regulations in the next few years. This research report also indicates that token standardization and compliance is inevitable for RWA in further development. Despite the challenges ahead, the industry is constantly moving forward, and innovative projects have not stopped from emerging, especially those based on U.S. bonds and stocks, SME financing, and real assets, which are mainly characterized by: 1. The product of cooperation with traditional financial institutions; 2. optimization of project revenues and token sales; and 3. introduction of more participation of legitimate third-party entities. These features can partially solve the problems on tokenization of RWA caused by regulation, centralization, on-chain and off-chain identity, asset valuation, etc. We expect more projects to spring up and enrich the RWA segment in the future.

1. A brewing narrative

After a year-long bear market, the entire crypto market was like a deflated balloon in terms of market cap: money keeps flowing out, and on-chain activities appeared slumberous. DeFi is no longer appealing by the return, and players reave each other. No one could possibly predict what the fuse would be to kick-start the next bull market. Although an enormous gap remains between the crypto market and traditional financial market, opportunities may lie within by peeking into the incidents that happened during the bear market.

Arguably, the bankruptcies of various large institutions in 2022 were mainly caused by the financing activities of altcoins as well as massive lending and borrowing on them, so that when the price of altcoins plunged, it aggravated the settlement on credit lending, the death spiral was thus activated. It was institutions and credit lending that drove the bull market in 2021, which also conjured the bear market in 2022. In fact, credit lending is the invisible hand that promoted most of the economic development that is worth more than trillions of dollars; it creates huge potential in the market. More and more DeFi protocols started dabbling into traditional financial markets, such as equity and debt financing. While it is increasingly risky, there are no alternatives that could connect traditional financial markets worth over $800 trillion onto the chains. Tokenizing RWA is the ultimate solution to fill up the gap between the crypto market and traditional financial market.

In the first half of this year, the RWA segment has drawn some attention from traditional financial institutions and crypto-native institutions.

To start with, Goldman Sachs announced the launch of its digital asset platform, GS DAP, which has already assisted the European Investment Bank (EIB) in the issue a two-year €100 million digital bond. Shortly after that, Hamilton Lane, a private equity firm with over $100 billion under management, tokenized a portion of its $2.1 billion flagship equity fund for sale to investors on the Polygon network, and electrical engineering giant Siemens offered its first €60 million digital bond on the blockchain. Second, a few government agencies have set foot on RWAs, including the Monetary Authority of Singapore (MAS), which was said to partner with J. P. Morgan Chase and DBS Bank.

In April, Binance announced to be a node operator of the Layer1 blockchain- Polymesh. DeFi protocols such as MakerDAO, Aave and Maple Finance were unprecedently active in the RWA segment, and more crypto investment companies are seeking for RWA projects. Currently, over 50 projects are competing in the RWA segment with emphasis on financial assets, including fixed income, TradFi, and a few in real estate and carbon credit. Recently, RWA tokens have all seen increase in price, some by more than 10 times. Is the momentum accumulated in the first half of 2023 a sign implying that RWA could be leading the crypto narrative in the coming years?

1. History of RWA

The concept of RWA was not born yesterday in the blockchain industry; the earliest RWA project is the “asset-on-chain” BTM chain. Currently, the most successful RWAs are the digital dollar, USDT and USDC, to be more specific, tokenized, and on-chain version of real dollar. Being the cornerstone in the crypto industry, stablecoins have never been more critical and influential.

RWA, known as real world assets- tokenization, is the process of converting the value of ownership (and any associated rights) in tangible or intangible assets into digital tokens. This allows digital ownership to be transferred and stored without a centralized intermediary, and the value of assets is reflected and traded on the blockchain. RWAs can be either tangible or intangible assets.

- Tangible assets include real estate, artwork, precious metals, vehicles, sports clubs, racing horse, etc.

Intangible assets include stocks and bonds, intellectual property, investment funds, synthetic assets, revenue-sharing agreements, cash, and accounts receivables, etc.

2.1 Status quo of the RWA segment

The RWA segment has a wide variety of projects, most of them are DeFi projects. They can be further classified into 3 categories: 1. fixed income projects based on off-chain assets, such as U.S. bonds, stocks, real estate, and artwork; 2. public credit projects based on assets offered and traded on public market; and 3. trading marketplaces based on intangible assets, such as carbon credits. In addition, there are also infrastructure projects, such as sector L1 chains.

-

The fixed income category is based on the U.S. bonds and equity markets, it provides loans to individuals and institutions. Projects in this category differ from other DeFi lending by collateral; it can be real-world assets.

-

The public credit category creates investment funds in crypto for crypto users, following the trace of US bonds and other bonds.

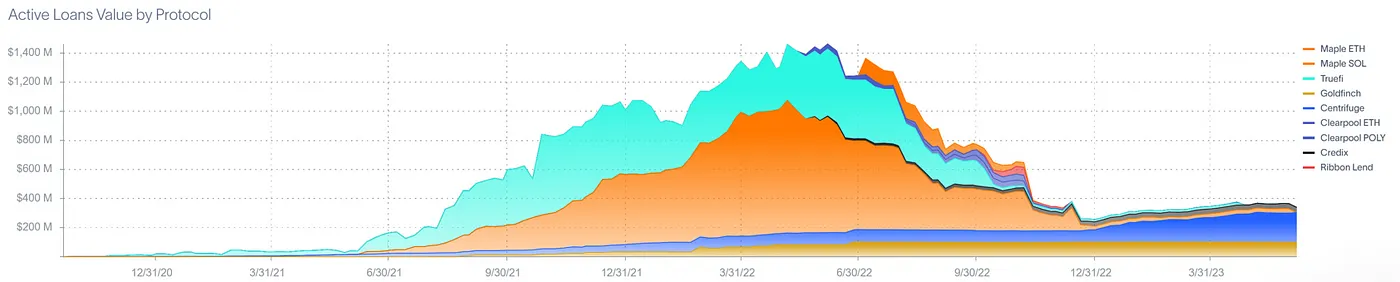

According to RWA.xyz, eight RWA lending protocols, including Centrifuge, Maple, GoldFinch, Credix, Clearpool, TrueFi, and Homecoin, disbursed a total of $4.38b in loans, with an average APR of 10.52% on borrowers’ end, serving mostly users from sub-middle development countries. These credit lending protocols offer higher returns than most DeFi lending, but Maple Finance defaulted on $69.3 million of debt in 2022 during the turmoil of institutions.

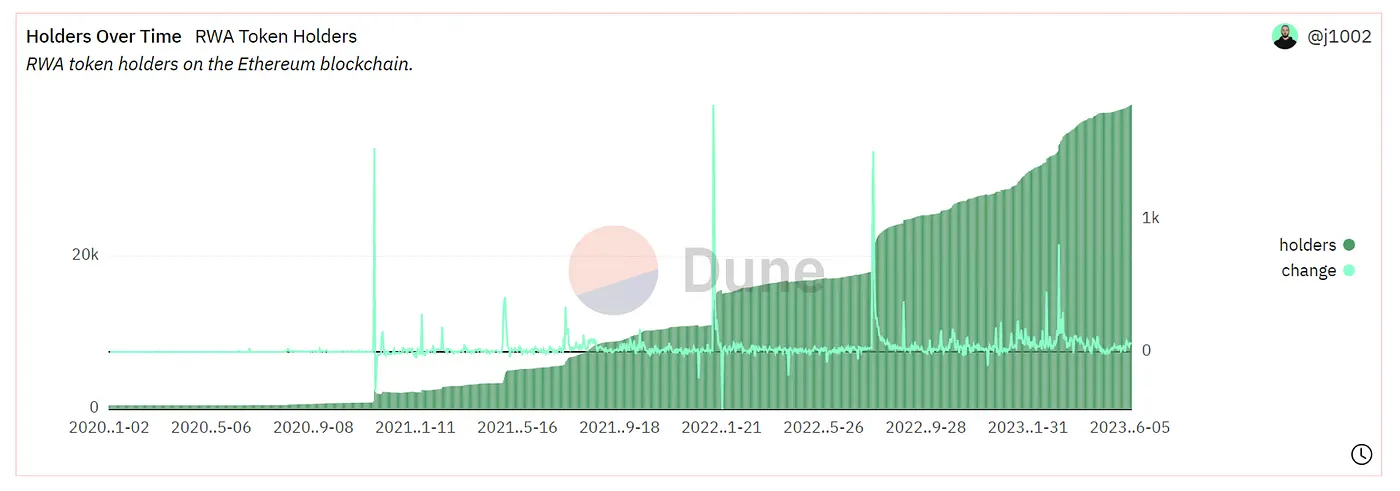

According to the data panel on Dune, the number of RWA holder addresses of $wCFG, $MPL, $GFI, $FACTR, $ONDO, $RIO, $TRADE, $TRU, $BST on Ethereum is also increasing, and it currently reaches 3.9k.

2.2 Advantages of tokenized assets

Ideally, any asset of value is capable of being tokenized. The advantage of asset tokenization is that ecological applications can be built with decentralization and blockchain as the underlying technology, thus solving drawbacks in exiting traditional finance, specifically:

(1) Creating huge potential in the market for investors, including retail investors

As leading financial institutions expect to benefit from the efficiencies and economic possibilities offered by blockchain, tokenization of real-world assets is embraced by institutions, and numerous tokenized products have already been on the market. RWA projects will also boost returns on DeFi.

Through real-world asset tokenization, companies would be able to leverage the DeFi ecosystem, accessing capital in a cost-effective manner and benefiting from lower barriers to entry and new ways to raise capital, especially for emerging markets. At the same time, the DeFi ecosystem can absorb investment returns and access diverse off-chain markets, as well as new opportunities to reach the user base in traditional finance.

(2) Improving the efficiency of capital flows and promoting positive feedback on asset tokenization

Traditional financial trading markets are labor-intensive, while blockchain technology can provide instant settlement, 24-hour trading, etc., reducing operational costs and market access for participants. On top of that, asset tokenization enables illiquid assets to be sliced into small portfolios that represent part of the original piece; no massive workload on paperwork is needed, nor does it require money and time consumption by investors. Therefore, a fairer market is in place, whilst creating new business and social models, such as shared property ownership or shared rights.

In the case of securities, tokenization is a perfect tool for securitization or refinancing of assets from less liquid assets to become more liquid security instruments.

Introducing real-world assets into the on-chain world of DeFi ecosystem brings about unique opportunities of collateral or investment, market efficiencies, and liquidity that is not accessible in traditional markets. The increased capital efficiency will further facilitate the RWA market, cultivating positive feedback.

(3) Lowering the entry barriers for retail investors and increasing liquidity of brick-and-mortar assets

Tokenization removes the barriers that currently impede real-world asset segmentation, empowering most retail investors to access asset classes that are typically limited to a few high-net-worth individuals or institutional investors, especially in the case of brick-and-mortar assets, where retail investors can invest in financial products across borders or collectively invest in a property or a piece of art that has extremely high barriers of entry in traditional finance. Notably, these physical objects may be extremely illiquid in a relatively closed markets; once they are on chain, they will be accessible to investors worldwide. On the one hand, issuers can reach a broader group of investors and invent new asset classes. On the other hand, retail investors could access markets that were previously closed to them and make wiser investment decisions based on transparent and publicly visible data.

(4) RWA transactions are more efficient and secure relying on blockchain

Blockchain ensures transparency of on-chain payment and data flow, solidity of transaction records, traceability, higher efficiency and lower operating costs, more robust risk management, ironclad ownership, as well as more combinability and fairer market condition. In the future, blockchain technology will continue to evolve, L1 chains or layer2 solutions of higher performance, stricter smart contract censorship mechanisms, and privacy protection programs based on ZK are on the way, all of which fertilize the soil to ensure a brighter future of RWA.

3. Prerequisites for a booming RWA market

Creation of asset on-chain is the critical point of the RWA sector. Two pillars are necessary to buttress the implementation: one is the improvement of blockchain infrastructure, and the other is the completeness of regulation, as interoperability, security, and privacy between individual protocols and tokens are highly involved in the world of blockchain, and regulatory statues, on the other hand, judge if off-chain assets and on-chain identity are supported by corresponding laws and regulations. While many issues are being actively discussed, this report explores only the following two: token standards and censorship.

3.1 Diversity of token standards

By on-chain token standard, ERC-721 and ERC-20 are the most seen standards on Ethereum, representing the non-fungible token and fungible token standards, respectively. In traditional finance, there are various asset classes, including tangible assets and intangible assets. When it comes to blockchain, different token standards must be followed according to different attributes of assets. Fungible tokens and non-fungible tokens have the following characteristics:

- Fungible tokens:

i. Exchangeable. Each unit has the same market value and validity, in other words, token holders can exchange assets with each other with the consensus that they are of equal value.

ii. Divisible. Assets can be split into as many decimal places as they are issued, and the value and validity are proportional to a full unit.

- Non-fungible assets cannot be exchanged, and it cannot be replaced because each unit is unique in value, and each contains different information and attributes. Non-fungible tokens are not divisible in most cases, but there are still ways to split the cost of an investment to provide partial ownership, such as in commercial real estate.

Most assets can adopt the standard of fungible tokens, but for some assets, such as bonds and derivatives, non-fungible tokens may be more suitable. Thanks to continuous development of RWA projects, more diverse scenarios will be in the scene, at which point the simple ERC-20 and ERC-721 will no longer be able to meet the needs of RWA tokenization. Many RWA sector L1 chains have foresighted and started to work on RWA tokenization compliant standards, such as Polymesh. Most of current RWA projects are built on Ethereum, which implies that further development on ERC standard is more universal. So far, ERC-3525 is more often discussed; more standards are expected to come out, especially after the storm of BRC-20. In my humble opinion, a perfect token standard for RWA projects must demonstrate the following characteristics:

(1) Outstanding operability and flexibility for RWA token issuers, compatible with both ERC-721 and ERC-20 features.

(2) High degree of privacy that it protects transaction and user information.

3.2 Strict censorship

Security is vital to tokenized real-world assets, especially when they serve as a source of collateral. Due diligence is the top priority for investors to conduct on DeFi protocols to choose technologies or services that are built with high-quality open-source code, which prioritize secured loans and offer closely fitted regulatory compliance. For RWA-related project teams, two solutions are necessary to be provided:

-

Minimizing KYC / AML risks — Conduct KYC (Know Your Customer) or AML (Anti-Money Laundering) checks on users and/or transactions on the platform, and avoid potential user interactions or transactions, directly or indirectly, with OFAC and other sanctioned counterparties or politically exposed persons.

-

Close surveillance — products and services that monitor and detect suspicious activity of DeFi users.

As a result, the program requires a dedicated compliance team to review and approve or deny user access to the platform based on identification, risk assessment, verification, and due diligence. In addition, client activity must be continuously monitored to detect any suspicious activities or behaviors that may be fraudulent or involved in money laundering.

4. Representative Project Analysis

There are several subdivision categories of RWA tracks. This research report analyzes 19 RWA representative projects in detail from multiple dimensions, such as RWA tokenization mechanism, protocol status, token function and performance, protocol advantages and risks. Through the analysis and summary of these projects, we can get a glimpse of the overall development and problems of RWA projects, as well as the future potential.

4.1 Concept of U.S. Debt

(1) MakerDAO

In 2020, MakerDAO formally incorporates RWA into its strategic priorities and publishes guidelines and plans of introducing RWA into the ecosystem. Maker has expanded its collateral offerings beyond ETH to include collateral in the form of tokenized real estate, invoices, and accounts receivable, in addition to issuing the stablecoin DAI. The main source of revenue for the Maker protocol is interest received from lending and penalties from liquidation on stablecoin DAI.

Status quo: Maker is a top 3 DeFi protocol in terms of TVL, ranking behind Lido and AAVE, and it is ranked the first place among CDP (Collateralized Debt Position) protocols. Currently it is deployed on Ethereum only, according to data from defillama retrieved on 2023–06–02, it has a TVL of $6.29b, 30-day protocol revenue of $23.53m, treasury amount of $68.4m. The governance token $MKR has been listed on Coinbase, Binance, Kucoin, Kraken, OKX, Huobi, Bybit. The average 24h trading volume is $13.58m, and the average 30-day trading volume is close to $20m.

Token Function: $MKR, the governance token of MakerDAO, has poor performance in terms of price, mainly because the protocol is weak in value capture, yet it plays an important role in governance. The $MKR token performs the following functions:

-

Governance Rights: $MKR token holders have governance rights for the MakerDAO system. They can participate in voting and make decisions on important subject matters such as calibration of system parameters, risk management and other changes in the protocol. The voting result decides future developments and operations of MakerDAO.

-

Collateral Stabilization: $MKR tokens can be used as collateral in the l MakerDAO system. When users are willing to receive stable coins (e.g., $DAI) by locking up a certain amount of crypto assets (e.g., $ETH), a certain amount of $MKR is required as collateral. This mechanism is designed to ensure the stability and security of the system.

-

System Stability Buyback: $MKR tokens in collateral are also part of the System Stability Buyback mechanism. When the value of the stable coin $DAI in the MakerDAO system drops and deviates from its anchored value with the US dollar, the system will automatically initiate a buyback of MKR tokens and destroy them to stabilize the system.

-

Risk Sharing: $MKR token holders bear the risk in the MakerDAO system. Once the system’s debt cannot be repaid or other problems occur, the value of the $MKR tokens may be affected. This incentivizes holders to participate in and oversee the operation of the system to ensure security and stability.

Protocol advantages: 1. With the help of EVM and L2 ecology, MakerDAO has a more loyal user base, as well as stable and secure network support than other L1 chains; 2. The advantages on governance have been tested through bull and bear cycles, including a strict entry threshold for collateral, not to mention over-collateralization and a nearly-perfect auction system, which guarantees the value of DAI pegged to USD in most cases; in extreme cases, the contingency measures for emergency shutdowns are also in place.

Protocol risks: 1. Governance attacks. Short-term large-scale convergence of $MKR token could lead to excessive concentration of governance power, resulting in a series of governance attacks such as incremental junk collateral, emergency shutdowns, malicious tampering of risk parameters, etc. With appreciation of $MKR, the protocol is competent in dealing with the risks, and it is sufficient to mitigate such risks in most cases; 2. Market price risks. When mainstream tokens are volatile, a series of auction settlements will increase the supply of token on the market, exacerbating the liquidity issue, which happened in the past two years when mainstream tokens experienced massive declines, but the protocol per se did not incur massive losses.

(2) Ondo Finance

Ondo Finance is one of the most trending RWA projects in the first half of this year, which received $20 million in Series A funding led by Founders Fund and Pantera Capital in April. Ondo Finance is a decentralized investment bank that invests mainly in US listed cryptocurrency funds off-chain and conducts on-chain lending business with Flux Finance on stablecoins, including USDC, FRAX, DAI and USDT, with an average lending rate of about 5%. The protocol income comes from the 0.15% annualized management fee.

Users must pass KYC/AML before they can trade any fund tokens and trade in a licensed DeFi protocol. Ondo Finance has launched four tokenized bonds for investors to choose from, including:

-

U.S. Money Market Funds (OMMF): Ondo Money Market Funds, which invest in high credit-rated U.S. government bonds, short-term bonds and other debt instruments with the ultimate goal of capital preservation; currently yielding 4.5%.

-

U.S. Treasury (OUSG): Ondo Short-Term US Government Bond Fund, invested in the U.S. Short-Term Note ETF, currently has an annualized yield of 4.85% with $100.87M in TVL.

-

Short-Term Bond (OSTB): Ondo Short-Term Investment Grade Bond Fund is an actively managed exchange traded fund (ETF) seeks to maximize current income while ensuring capital preservation and liquidity on daily. The ETF invests primarily in short-term investment grade debt securities with an average portfolio duration typically less than one year and a current annualized yield of 5.77%.

-

High Yield Bond (OHYG): Ondo High Yield Corporate Bond Fund, which invests mainly in high yield corporate debt, currently earns 7.9% annualized.

Status quo of the protocol: TVL of $100.5m on ETH, ranked first in the RWA category on Defillama. OUSG has the largest scale, and OUSG holders can also deposit into Flux Finance, a decentralized lending protocol developed by Ondo Finance, for more revenues. Ondo (OUSG) accounts for 61% of the market share, of which 28% is deposited in Flux Finance. The total supply of Flux Finance is now over $40 million and the market cap of OUSG is already over $100 million. The lending protocol FLUX has been sold to Neptune Foundation.

Token functions: The functions of the governance token $ONDO include the following:

-

Paying platform fees: Users may be required to pay certain fees when trading, lending or other financial activities within the platform, and these fees can be paid with $ONDO.

-

Voting rights and governance: Holders of Ondo Finance tokens can participate in the governance and decision-making process of the platform. They can vote on platform upgrades, parameter adjustments, proposal adoption, etc., and express opinions and suggestions on the overall development.

-

Rewards and Incentives: The Ondo Finance platform may issue token rewards and incentives to attract users to participate in the platform’s activities and eco-building. These rewards may be issued in the form of $ONDO.

-

Lending and collateral: On the Ondo Finance platform, users can use $ONDO as collateral to access lending services. Holders of $ONDO are eligible to obtain higher borrowing credits or lower interest rates when using $ONDO as collateral.

Protocol Advantages: Fully compliant with regulations. The products are either low-risk US government related debt instruments or high-risk ETFs, both of which are legitimate products audited by third party accounting disclosures. Also, users are required to pass KYC/AML process.

Protocol Risks: 1. Risk outside the crypto world. Since most of the products are backed by off-chain ETFs, U.S. government debt instruments, etc., although compliance can be guaranteed, it bears more market risk and credit risk outside the crypto world, especially on OHYG and other high-risk corporate credit bonds; 2. Deviating from the spirit of crypto. The project is currently adopting a new operation philosophy of centralized + compliance, and the utility of governance tokens may be stripped and marginalized. Blockchain will serve nothing towards R&D of decentralization but on profit sharing, bookkeeping, and distributing shares, which is opposed to the purpose of most projects in the crypto world.

(3) Maple Finance

Maple Finance has been under development for 3 years, and the main business is lending/institutional credit lending. The on-chain business is to provide USDC, wETH lending services, operated by an independent centralized pool manager; this manager decides lending objects, amount, interest rate, strategy, etc. Some may argue that Maple Finance is not a qualified RWA project, but in April it announced its plan to launch a lending pool for investing in US Treasuries, supporting non-US DAOs, offshore companies, etc. to inject restricted funds into the pool set up by Maple Finance.

Protocol income: Maple Finance’s revenue is derived from the following main sources.

-

Borrowing Fees: Maple Finance charges a borrowing fee for loans. These fees are calculated based on the amount borrowed and the term of the loan; the interest rate is set by the pool.

-

Loan processing fees: Maple Finance, as a platform, charges processing fees related to loan transactions. These processing fees include loan application fees, lending fees, and loan closing fees.

-

Token Mining Rewards: Maple Finance distributes rewards to participants through a token mining mechanism. Maple token holders may be rewarded for providing liquidity or participating in lending pools.

-

Platform Governance Fees: As a manager of lending and borrowing pools, Maple Finance may charge a percentage of platform governance fees. These fees are used to support and maintain the platform’s operations, including developing new features, conducting security audits, and maintaining community governance.

Status quo of the protocol: in terms of TVL, Maple Finance is ranked 145 on defillama, but the first in no-collateral loan protocols, with a total TVL of $48.56m, total debt in transit of $32.22 million, cumulative returns of $45.6m, 18 debt in transit (due to the nature of centralized credit debt, the lending targets are large institutions, and the number is small), 8 cash pools (7 with USDC+1 with ETH, the average 30d return is 7% annualized). In addition, Maple Finance also has a small amount of TVL on Solana, but with the shrinking activeness on Solana, only about $16.4k of TVL is present, and most (99%) of the TVL comes from the ETH mainnet.

Token Features: $MPL tokens are native tokens of the Maple Finance platform with the following features:

-

Paying transaction fees: $MPL tokens can reimburse fees when lending on Maple Finance. $MPL holders may receive discounts or other benefits so that to continuously hold.

-

Community Governance: $MPL holders can participate in the governance decisions of the Maple Finance platform. They can make proposals, vote, and express their opinions on platform governance and decision making.

-

Voting rights: $MPL holders have certain rights in voting on the platform and are eligible to participate in deciding on protocol parameters, protocol upgrades and other important matters.

-

Receive Dividends: $MPL token holders are eligible to share the profits of the lending pool on Maple Finance. These profits, which may come from interest paid by borrowers or other sources of income, are distributed proportionally to $MPL holders.

-

Incentives: Maple Finance may facilitate the growth of its ecosystem by providing incentives to $MPL holders. These incentives may include airdrops, rewards, or other forms of perks to stimulate user participation and support platform growth.

Protocol advantages: Operated with security; the credit risk is managed by the manager of the pool, and a management fee is charged in return. Liquidity providers may enjoy low interest rates and less default risk at the same time.

Protocol risks: 1. Credit risk. Lending pool managers, lending objects are approved by centralized institutions, and the debt mainly relies on credit rather than asset collateral (collateralized assets are from the pool manager). When in the event of a large-scale institutional default, insolvency may occur; 2. High threshold. To maintain a high level of security, the lending threshold is set high, which impedes most users from accessing the services, therefore the community is not a trendy one.

4.2 TradFi

(1) Polytrade

Polytrade is a decentralized trade finance platform designed to provide seamless lending to businesses across multiple industries. The project is currently in the middle of an upgrade from V2 to V3. No debt defaults, and no LPs incur losses since Jan 2022. In V3, it is expected to include functions converting real assets to NFT, and a secondary trading market for NFT in the future.

Status quo of the protocol: The governance token $TRADE has been listed on Kucoin, Gate, MEXC, Bitfinex and other exchanges, with the main marketplace on MEXC. According to defillama, it shows that the project TVL is only $10,984, which is far from the $17.27 million when fully releasing locked tokens, which indicates the risk of overvaluation. On March 30, 2023, the project received funding from Polygon Studios, Matrix, CoinSwitch, Alpha Wave Global and other companies with seed round of $3.8 million.

Token Functions: $TRADE is the governance token that the main function is to vote and make decisions on protocol income and updates; more detailed disclosure of token functions may be disclosed after V3 is released.

Protocol advantages: 1. lower transaction costs of Polygon chain, let alone gas, transaction speed and other natural advantages of EVM; 2. Competitive advantages. Funded by the official Polygon team, it is expected to retain competitive advantage on Polygon EVM.

Protocol risks: 1. credit risk. Although lending happens on the chain, the scrutiny of lending object, business flow, audit and other processes are all off-chain; that is to say, even the project party claims that the transactions are secured by AIG, Mercury and other credible institutions, default risks from off-chain entities cannot be eliminated; 2. technical risk. The project is in the middle of V2 to V3, and current code is not audited by third-party institutions, which may incur bugs on unknown codes.

(2) Defactor

By linking traditional finance with DeFi, Defactor aims to provide businesses with access to financing and liquidity. The project is not yet officially active, and it is in the early stages. According to its roadmap, it is still in the partnership recruiting, staff recruiting, and development phase in the second half of 2023. According to the project’s website, $FACTR is the native token, designed to lower the barrier to access to applications and infrastructure. It coordinates benefits and incentivizes the growth of the ecosystem.

4.3 Borrowing and Lending

(1) Goldfinch

Goldfinch is a decentralized credit protocol for off-chain entities of bonds and fintech, which is similar to Maple Finance. Goldfinch offers zero-collateral credit loans of USDC. Goldfinch is modeled much like a bank in traditional finance, but with a pool of decentralized auditors, lenders and credit analysts. Borrowers can convert USDC into fiat currency and deploy it to end borrowers in their local markets. Before a borrower can apply for a loan, it must be approved by a protocol approved decentralized auditor. Auditors are independent entities that must stake the governance token $GFI in order to receive the privilege to scrutinize borrowers in exchange for rewards.

Protocol income: 10% of all interest payments from Goldfinch are retained in the vault. Also, user redemptions from the Premium Pool will incur a 0.5% fee, which is also deposited in the vault.

Status quo of the protocol: Currently, the total outstanding principal amount of all loans under Goldfinch is $101.34 million, with an aggregate loss ratio of 0% and total principal and interest repaid of $25.1 million. For the last 30 days, the protocol has generated revenue of $101,000. There is no bad debt so far.

Token Features: Goldfinch currently has two ERC20 native tokens, $GFI and $FIDU.

-

$GFI is Goldfinch’s core native token. It can be used for governance voting, auditor staking, auditor voting rewards, community grants, staking supporters, protocol rewards. It can be deposited into the member vault to issue rewards and ensure protocol growth.

-

$FIDU represents the liquidity provider’s deposits in the Premium Pool. The liquidity providers will receive an equal amount of $FIDUs when aided the Premium Pool. $FIDUs can be converted to USDC in the Goldfinch dApp at an exchange rate based on the Net Asset Value of the Premium Pool, less a 0.5% withdrawal fee. Over time, the exchange rate of $FIDU will increase as interest paid increases in the Premium Pool.

Protocol advantages: The mechanism lowers the threshold for borrowing, and to some extent, it helps users with low credit to obtain loans. Goldfinch offers greater user-friendliness than traditional platforms, and the process is essentially handled by smart contracts.

Protocol Risks: The adoption of DeFi is on a global scale, but differences in respective national laws may result in higher costs and issues for Goldfinch operations. Also, Goldfinch senior pools are subject to default risk due to the absence of collateral.

(2) Centrifuge

Launched in 2017, Centrifuge was one of the first DeFi projects to integrate RWAs; it is also the technological solutions provider behind the two headline protocols: MakerDAO and Aave. Similarly, Centrifuge is an on-chain credit ecosystem designed to provide a venue for SME owners to stake their assets on chain in exchange for liquidity.

Centrifuge allows anyone to start an on-chain credit fund and create a pool of mortgages. Borrowers can tokenize physical assets through Tinlake, an open asset pool powered by smart contracts. The physical collateral will be divided into two parts of tokens, $DROP and $TIN, based on risk and return, representing a fixed rate for the prime and a floating rate for the sub-prime, respectively. Investors can choose to invest in either $DROP or $TIN based on risk tolerance and expectations of return. Currently, lending and borrowing on Centrifuge is free of charge.

Status quo: On May 23rd, Centrifuge announced the launch of the new Centrifuge App to replace Tinlake. The new Centrifuge App improved the speed of KYC and flow of investments, added KYB (Know Your Business) automation, and laid the foundation for upcoming multi-chain support. Previous data of Tinlake will be automatically migrated to the new app. From official data, Centrifuge has a TVL of $201 million and total underlying assets of $397 million.

Token Functions: $CFG, native token of Centrifuge, is deemed as an on-chain governance tool that enables $CFG holders to oversee the development of the Centrifuge protocol. $CFG can also be paid as transaction fees.

Advantages: 1. Low barriers of entry for financing, while generating income from assets in the real world. Centrifuge essentially simulates the process of credit lending in traditional finance; 2. Fully committed to compliance. Centrifuge is structured following the law frame of asset securitization in the United States.

Risks: Mainly default risk on loans, according to rwa.xyz, Centrifuge has $10,194,481 in loans outstanding that are more than 90 days past due.

(3) Clearpool

Clearpool is a DeFi lending protocol that provides pure credit loans to institutions. Clearpool has two products: Prime and Permissionless. Clearpool Prime is only available to whitelisted institutions and no collateral is required when borrowing with Prime. Borrowers create pools of funds with specific terms and conditions in a core smart contract. Once the pool is created, the borrower can invite any other whitelisted institutions to fund the pool. The underlying assets are automatically transferred directly to the borrower’s wallet address without custody of Clearpool. Clearpool Permissionless requires the borrower to be a whitelisted institution, and it has no requirements on the loaner.

Protocol Income: 5% of all interest payments collected by Clearpool as fees.

Status quo of the protocol: Clearpool has generated a cumulative $398 million in loans, with outstanding balance of $16.58 million and Permissionless TVL of $20.78 million.

Token Functions: $CPOOL serves as Clearpool’s utility token and governance token. $CPOOL holders are eligible to vote on a whitelist of newly approved borrowers.

Protocol advantages: The advantages of Clearpool are prominent in the fact that loans are granted only through the protocol itself in absence of collaterals, in which case it greatly enhances efficiency.

Protocol risks: No collateral. Once the market is down, the current whitelist and credit rating mechanisms make it difficult to avoid borrower defaults.

4.4 Public fixed income

(1) Swarm Markets

Swarm Markets is a DeFi infrastructure that provides relevant compliance services for RWA token issuance, liquidity provision and trading; it is regulated by German regulatory bodies. Swarm Markets combines an on-chain layer of compliance with regulatory license to tokenize U.S. Treasury bills and equities. By purchasing publicly traded securities with the issuing entity, SwarmX, on-chain tokens are backed by bona-fide assets, which are in possession of institutional custodians.

Protocol Income: Swarm receives 25% of the pool’s exchange fee or 0.1% of the exchanged assets, whichever is greater.

Status quo of the protocol: Swarm currently offers TSLA (Tesla), AAPL (Apple) stocks and TBONDS01 (GOVT iShares U.S. Treasury Bond 0–1 Year ETF), TBONDS13 (GOVT iShares U.S. Treasury Bond 1–3 Year ETF). On April 25, the official Swarm team announced to introduce BLK (Blackrock), COIN (Coinbase), CPNG (Coupang), INTC (Intel), MSFT (Microsoft), MSTR (MicroStrategy), NVDA (Nvidia) tokens for corresponding stocks.

Token Features: $SMT is the native token of Swarm Markets that carries the privilege of trading discounts and rewards. Traders can receive a 50% reduction in agreed fees when they choose to pay with $SMT. $SMT holders are eligible for loyalty rewards, the exact percentage of which will vary depending on the level of rankings, similar to the platform tokens of centralized exchange.

Protocol Advantages and Risks: Swarm offers DeFi users more options, combining crypto and traditional assets by mix and mingle of TradFi and DeFi. However, not many stocks and bonds are currently offered compared to traditional finance, and the trading depth is not commensurate either.

(2) Acquire.Fi

Acquire.Fi is an M&A marketplace of crypto, and it produces income from fractional equity of cryptocurrency companies, traditional businesses, and real-world assets. With Acquire.Fi, equities are converted to NFTs, bought, and sold on the secondary market. Sellers and buyers in the marketplace and investment pool must pass KYC (KYC requirement may be waived for investments under $250).

Protocol Income: Acquire.Fi adopts a tiered structure for commission. Commissions are fixed at 15% of the sales price for deals below $700,000, 8% for deals between $700,000 and $5 million, and 2.5% for deals above $5 million.

Status quo of the protocol: Acquire.Fi marketplace currently offers equity sales in numerous companies, including NFT Marketplace, Metaverse, Media, DAO and other businesses. According to official statistics, over 2000 deals have been completed online.

Token Features: $ACQ is the utility token of Acquire.Fi; when staking $ACQ, users could enjoy an exclusive investment pool, crypto M&A deal flow, LP mining rewards, and other exclusive benefits.

Protocol Advantages: Selling business online with Acquire.Fi does not mandate extra paid services, and there is no need to contact a web hosting provider, while receiving more attention. It’s easier and faster than other platforms.

Protocol Risks: Making deals on Acquire.Fi is highly exposed to legal risks, especially when the buyer and seller are not in the same judicial area.

4.5 Summary of financial products

Lending protocols are the most successful examples of tokenized RWA. On the one hand, the lending model without collateral is appealing to institutional investors in a bull market, but, on the other hand, it ferments the next bear market. In other words, the most worrisome issue for credit lending protocols is default risk. TradFi has relatively fewer projects, and most of the businesses are focused on SME financing.

The institutional credit business has very limited room for growth, where most of the revenues are generated from stablecoins. Moreover, lenders bear default risk, or even bad debts, due to insufficient collateralization. In a bull market, risk-free return on DeFi is also high, which may pose threats to credit lending businesses of institutions.

Treasury bonds or currency funds, such as Ondo’s, may have huge potential in the future. First, these funds are already top choices for investors in traditional finance, and the risk is moderate; second, they offer more options for on-chain users, while lowering the threshold.

Although RWA projects in the financial sector are in a rather early stage, many interesting use cases are already in the place. As the combinability of each protocol is enhanced, many high-yield projects with interesting gameplay may be spotted, and it is indeed a sector worth the attention.

4.6 Real estate type

(1) RealT

RealT is a tokenization platform for real estate founded in 2019 in the US, serving real estate markets in Detroit, Cleveland, Chicago, Toledo, and Florida, where investors could invest in real estate by purchasing RWA tokens. So far, the platform has processed over $52 million and 970 real estates for tokenization.

The protocol has no native tokens; the value exchange within the ecology is completed in $DAI (XDAI/WXDAI), and RealToken is issued and affiliated with each real estate as an equity for receiving rent.

Tokenization process:

-

Off-chain: Ownership of property is confirmed according to the deed by a third-party property manager, and the equity is divided into equal shares; rents are exchanged to U.S. dollars through the property management. Legal Support: RealToken files for a securities exemption under Regulation D and Regulation S of the U.S. Securities Act. RealToken cannot be offered or sold within the United States or for the interest of U.S. citizens.

-

On-chain: Investors need to obtain RealTokens as collateral by depositing or get a loan in $DAI at the price provided by the oracle inside the RMM application (RealT Market Maker). Payments are made daily in $DAI to relevant wallet addresses of the leasing contracts by the amount of 1/30 of the monthly rent.

Protocol Income: No specific revenue model was found; revenues may come from borrowing and lending spreads in the pool of $DAI and commissions on rent received on-chain and off-chain.

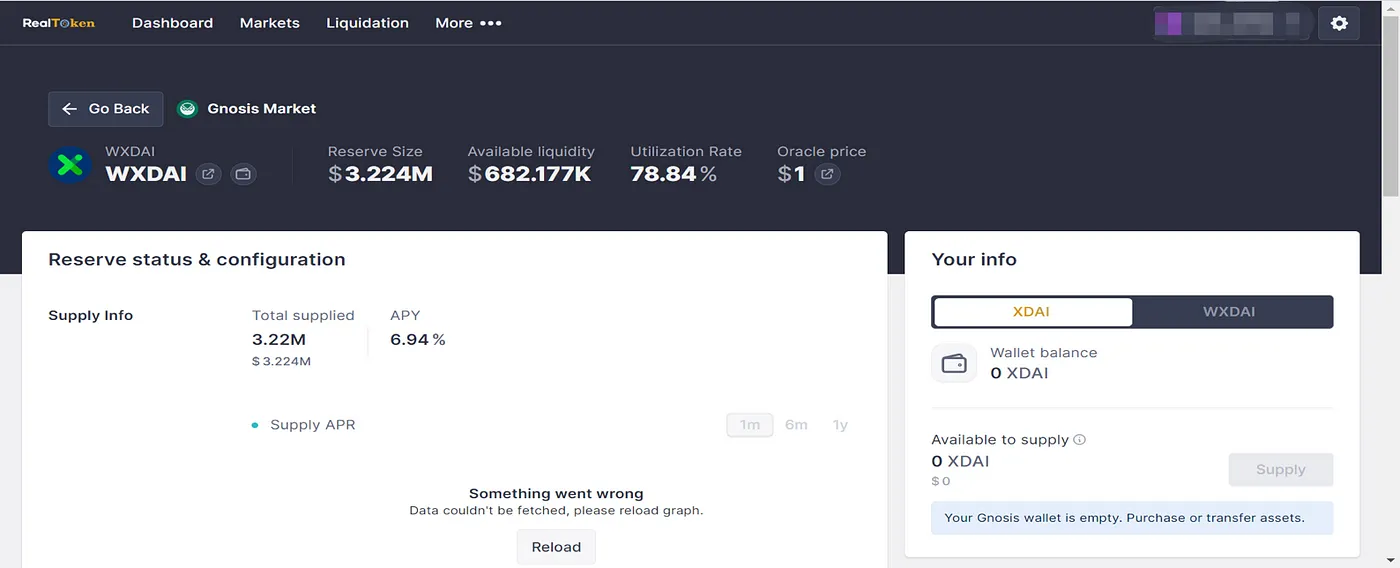

Status quo of the protocol: Current market cap of the protocol is $10.51m; total XDAI supply is $3.224 million with APY 6.94%, and total borrowing is $2.54 million, with APY 9.93%. Over 40 properties are currently available for investment in the protocol.

Status quo of user income: 17 users have weekly rental income over 1000 $DAI, and the highest income is at 6187.83 $DAI/week.

Protocol Advantages: The protocol maintains a multi-million-dollar market size with consistent cash flow since its debut in 2019.

Protocol risks: The expected rental return may differ from actual rent since the real estate rental market is volatile.

(2) Tangible

Tangible is an RWA tokenization project that provides users with solutions of RWA tokenization through the launch of Real USD, a native revenue-bearing stablecoin. RWAs, in this case, include but are not limited to, art pieces, fine wine, antiques, watches, and luxury goods.

Tokenization process:

- Off-chain: There are four categories on the platform: gold, wine, watches, and real estate.

(1) For trading and storage of gold bars, PX Precinox in Switzerland is the service provider.

(2) For wine, the protocol partnered with Bordeaux Index headquartered in London.

(3) For watches, the protocol partnered with BQ Watches based in the UK.

(4) For real estate, Tangible creates native special purpose vehicles (SPV). These are legal entities created for each property, and through SPVs the protocol could manage the properties by finding tenants, collecting rent, or do maintenance. All properties are occupied, and the rental proceeds are paid to TNFT holders in the form of $USDC.

-

Legal support: Each property located in the UK has its own SPV because brick-and-mortar real estate cannot be tokenized, but legal entities can. TNFT holders have ownership of the SPV, which endows them with equity of the real estate. However, legally, the ownership and equity remain in the possession of Tangible’s legal entity (i.e., BTS TNFT Limited, registered in the U.K. Tangible also has a registered entity of the same name in the British Virgin Islands).

-

On-chain: Tangible launches a real estate backed native revenue-bearing stablecoin, Real USD ($USDR), where users can use $TNGBL or $DAI to mint $USDR at a 1:1 ratio. Users can purchase physical goods on Tangible with $USDR, including but not limited to art, fine wine, antiques, watches, and luxury goods. When a user purchases an RWA listed on Tangible, a TNFT (“Tangible non-fungible token”) will be minted, representing that specific item. Tangible deposits the physical item in a physical vault and sends the corresponding TNFT to the buyer’s wallet. TNFT can be transferred and traded.

-

Over-collateralized rate approach & liquidation mechanism:

(1) If the CR of USDR drops below 100%, half of the rent will be retained in the USDR collateral pool. As a result, the daily rebalancing will be reduced by 50%. In other words, USDR holders will earn less interest until the CR returns to 100%.

(2) The vaults, which are compatible with USDR, always hold a diverse portfolio of liquid assets for rapid liquidation (e.g., $DAI, protocol-owned liquidity, and $TNGBL).

(3) If all $DAI and other reserves are depleted, the real estate TNFT will be liquidated. In this case, the user will receive $pDAI instead of the real $DAI. $pDAI is an IOU Token that represents the right to claim on the real $DAI, and it can be cashed out once the liquidation is executed.

Protocol income: TNFT owners are required to pay storage fees. For example, the storage fee for gold bars is 1% per year. Upon redemption, the transportation costs must be paid by the person redeeming the TNFT.

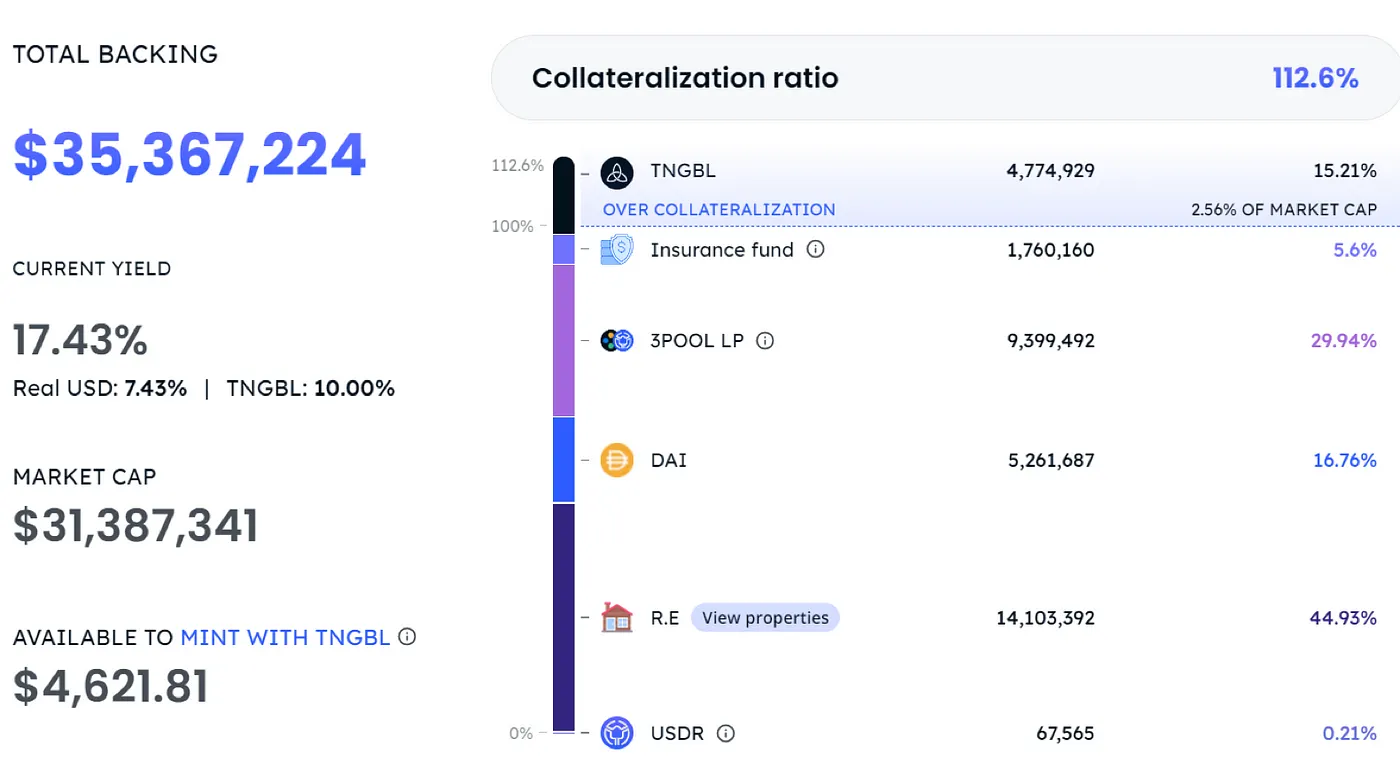

Status quo of the protocol: TVL of the protocol is $33,665,846, with total value of assets in collateral of $35,367,224. According to the USDR Whitepaper, the theoretical collateral distribution should be as follows: 50–80% in tangible real estate; 20–30% in tokens; 20–30% liquidity owned by the protocol; 5–10% insurance funds; 0–10% in $TNGBL. Actual distribution of assets is as follows, which differs significantly from the proposal:

Token functions: $TNGBL locks in passive income of $USDC after minting NFT, serving as reward token to incentivize market circulations and subsidize USDR earnings; it can also be used to mint USDR.

Token performance on secondary market:

-

$TNGBL is only circulating on Uniswap; it is not yet supported by centralized exchanges, which results in poor liquidity. Single-day trading volume is merely several hundred to thousands of dollars, with highest trading volume on a single day of $32,000. The market cap is $110 million, and currently 1,021 addresses are found on chain.

-

The stablecoin USDR was issued at the end of March. The trading volume is considerable; it is circulating on multiple DEXs and compatible with ETH, BSC, polygon, op, and Arbitrum. 30d average daily trading volume is $0.7 million; the price remains above $1, and current price $1.053.

Protocol Advantages: With the creation of TNFT market, many circulating tokens are locked up. Moreover, it also introduces transactions of physical goods, including art, fine wine, antiques, watches, luxury goods, etc.

Protocol risks: De-peg of SDR. The risk is due to centralization; the team is both the TNFT issuer and the custodian of the underlying assets.

(3) LABS Group

LABS Group was originally positioned as a tokenization platform of real estate that allowed homeowners to tokenize their homes to raise capital without an intermediary, and investors can access more liquid real estate tokens through the secondary market. Currently, LABS Group has launched Staynex, a Web3 platform for vacations that offers members annual access to resorts around the world and the ability to earn rewards by holding memberships. Staynex embedded check-in into NFT with the help of blockchain, enabling the creation, design, and mint of timesharing vacation plans of hotels and resorts in the form of NFT, which represents membership and duration of stay.

Because the investment is cross-borders, LABS Group submitted a complete business plan to the government, and it has been approved with a license for retail investments.

Protocol income: LABS Group’s primary platform, secondary exchange, and decentralized lending platform can make various business revenues, such as consulting fee, transaction fee, listing fee, and commission.

Status quo of the protocol: It has rich resources in the vacation industry with over 60 hotels, as well as being the official booking platform for members of Arsenal Football Club. Currently, LABS Group is the best performing RWA project in tokenized real estate. $LABS is currently listed on Kucoin, Gate, Bitmart, etc., receiving massive attention since March 2021. Single day trading volume had once exceeded $35 million at the early stage of listing but declined shortly after. Single day trading volume is less than $100k in the past year. Market capitalization is $1.47 million, FDV is $6.66 million, and the number of addresses on chain is 11,911.

The community is active, with 58k followers on Twitter, 19k followers in Telegram group chat with 511 online.

Token functions: Tokens are mainly serving as rewards, and other functions include governance (voting), and as proof of buyback in destruction mechanism. The destruction is planned at 80%: 50% in the first phase, and 10% of every transaction on the platform will be sent to the liquidity pool for permanent lock. There have also been previous phases of staking activity, such as staking $LABS for soccer match predictions (https://www.support2win.io/, it has ended).

Advantages of the protocol: The timesharing vacation model, where a person has the right to occupy a certain vacation asset for a specific period each year, is embraced in the rising digital nomad culture. In addition, the team is experienced in the vacation industry with access to partnerships of 60 hotels. Also, it is the official booking platform for members of Arsenal Football Club.

Protocol risks: Poor token value capture for $LABS as it was originally designed for rewards; the value resides mostly inside NFT. Timesharing has its own disadvantages: high annual management fees, hard to sell, let alone unethical misconduct and scams.

Summary

The overall market size of real estate type of RWA projects is rather small. Due to the status quo of insufficient liquidity and poor transparency of the mechanism, which requires the intervention of large and centralized entities to endorse and regulate, the acceptance of utility tokens issued by relevant protocols in the crypto market is poor. The reason behind may be that physical assets need to be strictly regulated, and project parties must conduct complex operations on the ownership of assets beforehand.

Tokenization of real estate can potentially solve the following issues: 1. poor liquidity issues of existing real estate market thanks to the cross-territory nature and the ability to complete instant transactions by blockchain; 2. retail investors were not able to invest in real estate globally and receive returns until blockchain made it possible. However, the most difficult problem of real estate tokenization is the deed and valuation; the deed determines the legitimacy of property and valuation determines the price of loans and price for liquidation. Tangible has made bold attempts in these aspects: adopting Chainlink oracle to price RWA tokens, in which the information is filled by the price on hometrack.com. In terms of validation of ownership, Tangible hires third-party auditors to independently verify the ownership. As we can see in these projects, third-party involvement is still mandatory before real estate can be processed on chain, including appraisal, finance, legal and other works, all of which demand compliance in the process with current regulations and laws.

4.7 Carbon credit type

Carbon credits refer to the amount of carbon dioxide emissions reduced or neutralized by a company through the organization’s Verified Carbon Standard (VCS), similar to the “voluntary emission reductions (CCERs)” in China’s carbon trading system.

(1) Toucan

Toucan Protocol is deployed on Polygon with the goal of converting carbon credits into tokens to facilitate the trading of carbon credits in the form of decentralized financial instruments, and ultimately to promote carbon neutrality. (Carbon credits exchanged on Toucan are verified amount on Verra, where Verra is a non-profit organization that records carbon credits.

Tokenization process:

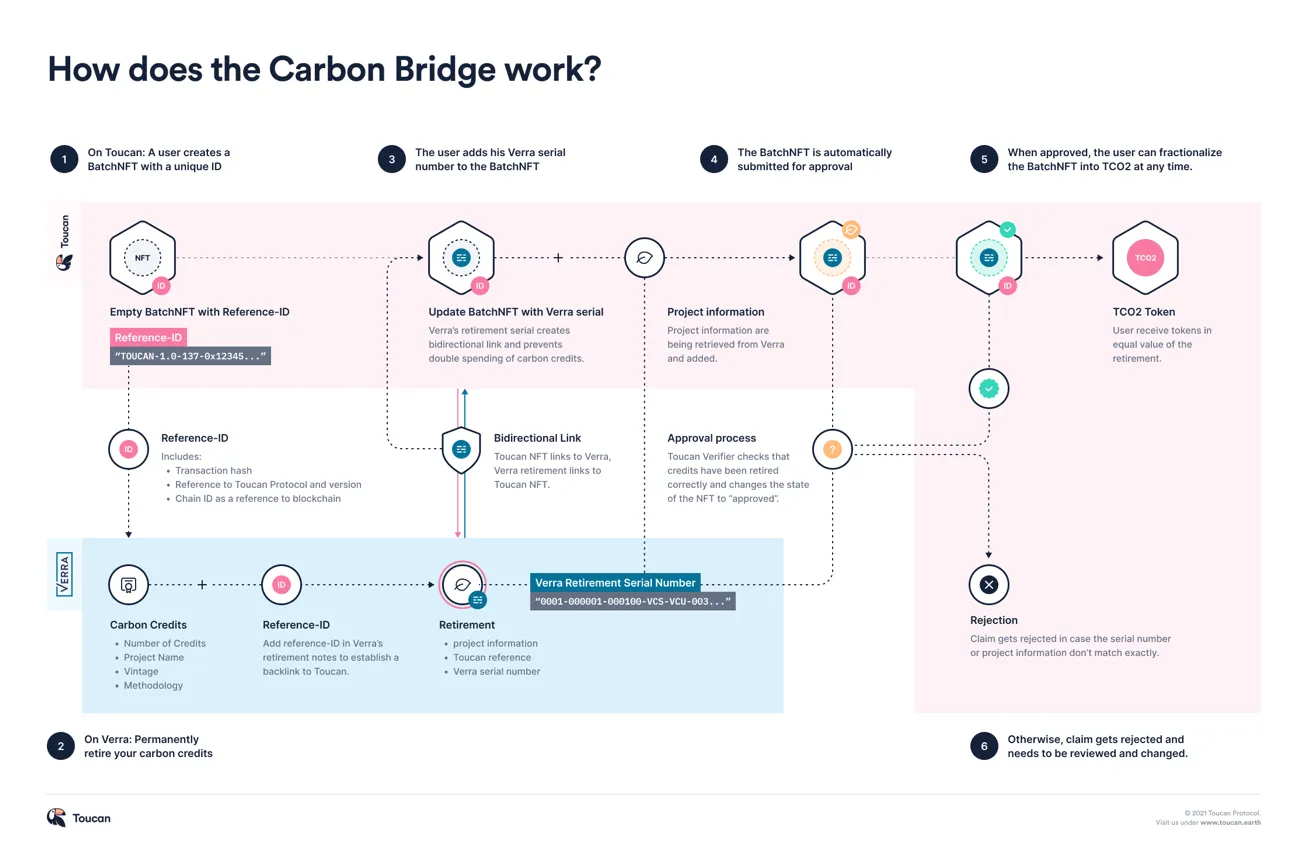

Toucan’s carbon stack consists of three modules: Carbon Bridge, Carbon Pools, and the Toucan Registry.

- Carbon Bridge

Anyone can send their carbon credits onto the chain via Carbon Bridge. Toucan only supports exiting carbon credits on Verra registry, and Carbon Bridge is an irreversible one-way bridge.

(1) An ERC721 compatible NFT, BatchNFT, representing a batch of carbon credits will be minted at the beginning of bridging.

(2) Permanent withdrawal of the tokenized carbon credits from Verra registry and a unique serial number is generated upon tokenization.

(3) Recording the serial number received from Verra, BatchNFT is linked to the exit entry in the original registry.

(4) BatchNFT updates serial numbers and then automatically submits for review.

(5) With final approval by Toucan Verifier, a fully tokenized batch of carbon credits is generated; it could be converted into ERC20 token, TCO2, at any time.

BatchNFT can mint an equivalent amount of fungible ERC20 tokens, TCO2, with 1 TCO2 representing 1 carbon credit with a value of 1 tCO2e.

TCO2 token contract still carries all the attributes and metadata of NFT, fixed at a specific project and year, as voluntary market carbon credits are traded at different prices. TCO2 is the umbrella term for fungible token of carbon credits. When splitting BatchNFT, the ERC20 tokens will be prefixed with TCO2, followed by a name including the registry of origin, project name, year, etc. For example: TCO2-GS-0001–2019.

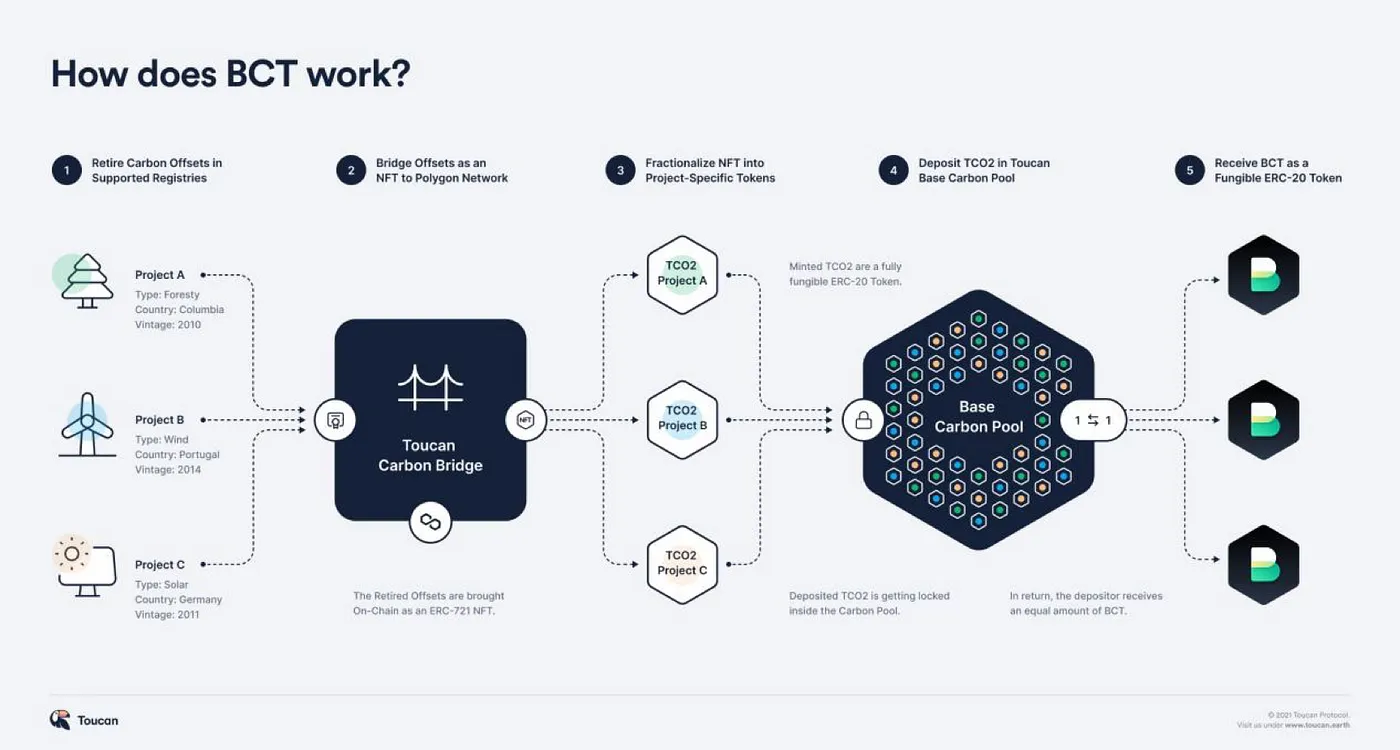

- Carbon Pools

Bundling multiple project-specific tokenized TCO2 tokens into more liquid carbon index tokens enables price discovery for different classes of carbon assets. Each pool has a unique configuration with a specific logic that instructs TCO2 with selection of tokens to deposit.

The Toucan team has partnered with KlimaDAO to deploy the first Carbon Pool, the Base Carbon Tonne (BCT). The requirements for the Base Carbon Tonne pool are: TCO2 tokens must be Verra VCU (Verified Carbon Units), and they must be at least 2008 or after.

TCO2 tokens that pass the logic screening can be deposited in the Carbon Pool, and the person receives the Carbon Pool tokens (e.g., BCT). Users can redeem it at any time. Redemption burns the Carbon Pool tokens and sends the native tokens to the user, and the redemption can be automatic (redeem the lowest ranked TCO2) and selective (pay a fee to redeem the specified TCO2) by user setting.

There are currently 2 Toucan Carbon Pools, BCT (Base Carbon Tonne) and NCT** **(Nature Carbon Tonne)

Protocol income:

- Carbon Pool Token Exchange Fee

When redeeming Carbon Pool tokens with selective option, Toucan Protocol charges a fee, a portion of which is used to burn low-value carbon credits and a portion of which is given to Toucan to establish the protocol, that is 25% for BCT pool redemptions and 10% for NCT pool redemptions.

- Bridging carbon pool fees

This fee is currently set to 0.

Status quo of the protocol: Toucan has been active since October 2021, it currently supports Polygon and Celo with 21,889,951 tons of carbon credits transferred through Carbon Bridge, offsetting 298,173 tCO2e of carbon credits, 19,908,799 of carbon supply (staked in BCT and NCT pools) and $2,946,585 of total liquidity (total BCT and NCT liquidity across exchanges).

Token functions:

-

NCT, short for Nature Carbon Tonne, is a standardized reference token linked to all carbon credits deposited to Nature Carbon Tonne;

-

BCT, short for Base Carbon Tonne, is a standardized reference token linked to all carbon credits deposited to Base Carbon Tonne;

TCO2 tokens that pass the logic screening will be in the carbon pool as collateral to obtain the corresponding tokens; conversely, the two tokens can be exchanged for TCO2.

Protocol advantages: a certain degree of carbon credit tokenization is realized to increase liquidity of carbon credit.

Protocol Risks: Toucan Carbon Bridge is an irreversible one-way bridge that cannot retrieve off-chain credits once the tokenization process begins; Verra Registry does not currently support carbon credit tokenization and prohibits the practice of creating instruments or tokens based on exiting credits, and clearly Toucan’s solution is not the ideal one.

(2) Flowcarbon

Flowcarbon, a blockchain startup founded by WeWork co-founder Adam Neumann, aims to integrate the entire carbon credit lifecycle by providing strategies and solutions from carbon project origination and financing to credit sales and corporate carbon portfolio management. In May, Flow Carbon closed a $70 million funding round led by a16z along with participation from General Catalyst and Samsung Next. Currently, the carbon credit spot market is not yet available. Goddess Nature Token (GNT) will be the first bundled token.

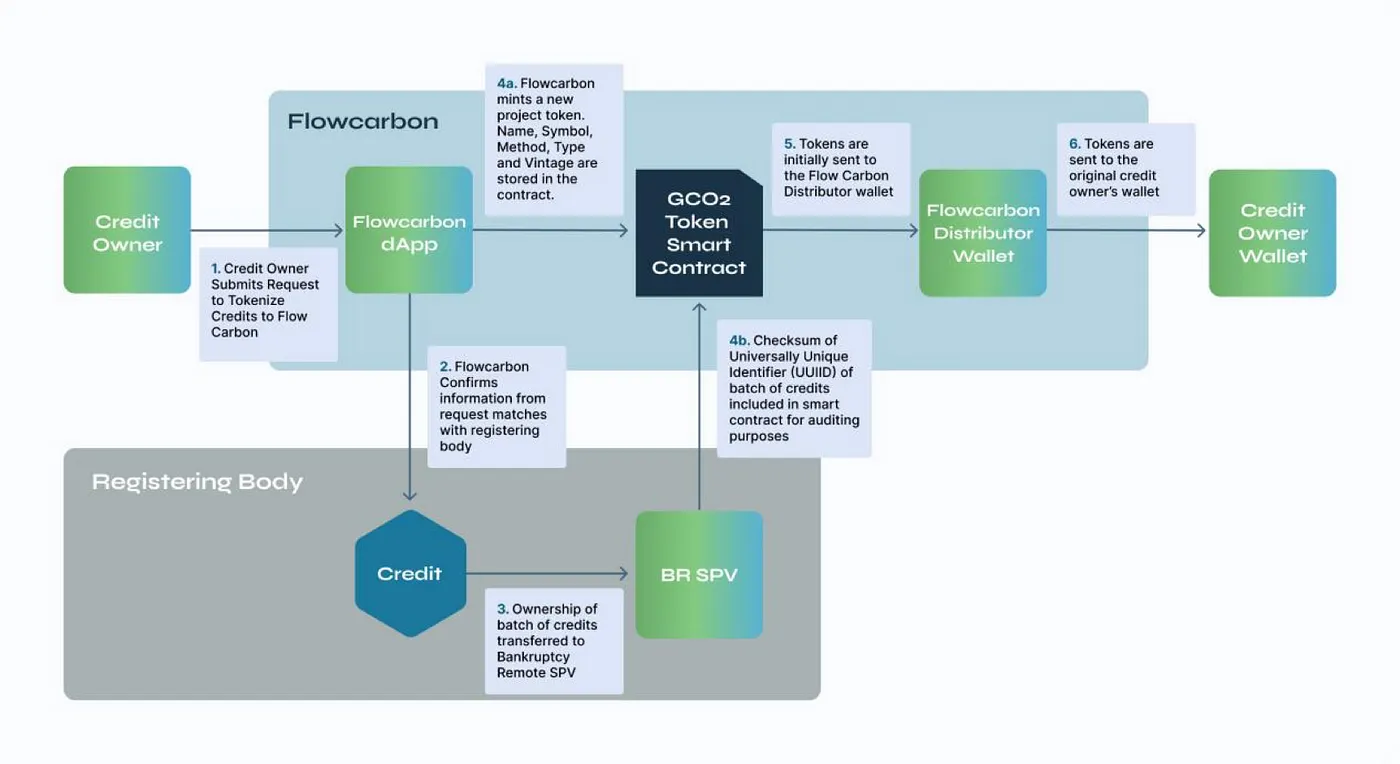

Tokenization process:

- Minting Tokenized Carbon Credits

All requests for tokenization of carbon credits are submitted through a form on the Flowcarbon website. When a tokenization request is submitted, Flowcarbon verifies the information with the designated registrar. Once the ownership of the account, project type and number of credits are confirmed, the carbon credits are transferred to a bankruptcy-isolated special purpose entity (SPV). Once the batch information is verified and the credits are added to the SPV, a new contract is thus created.

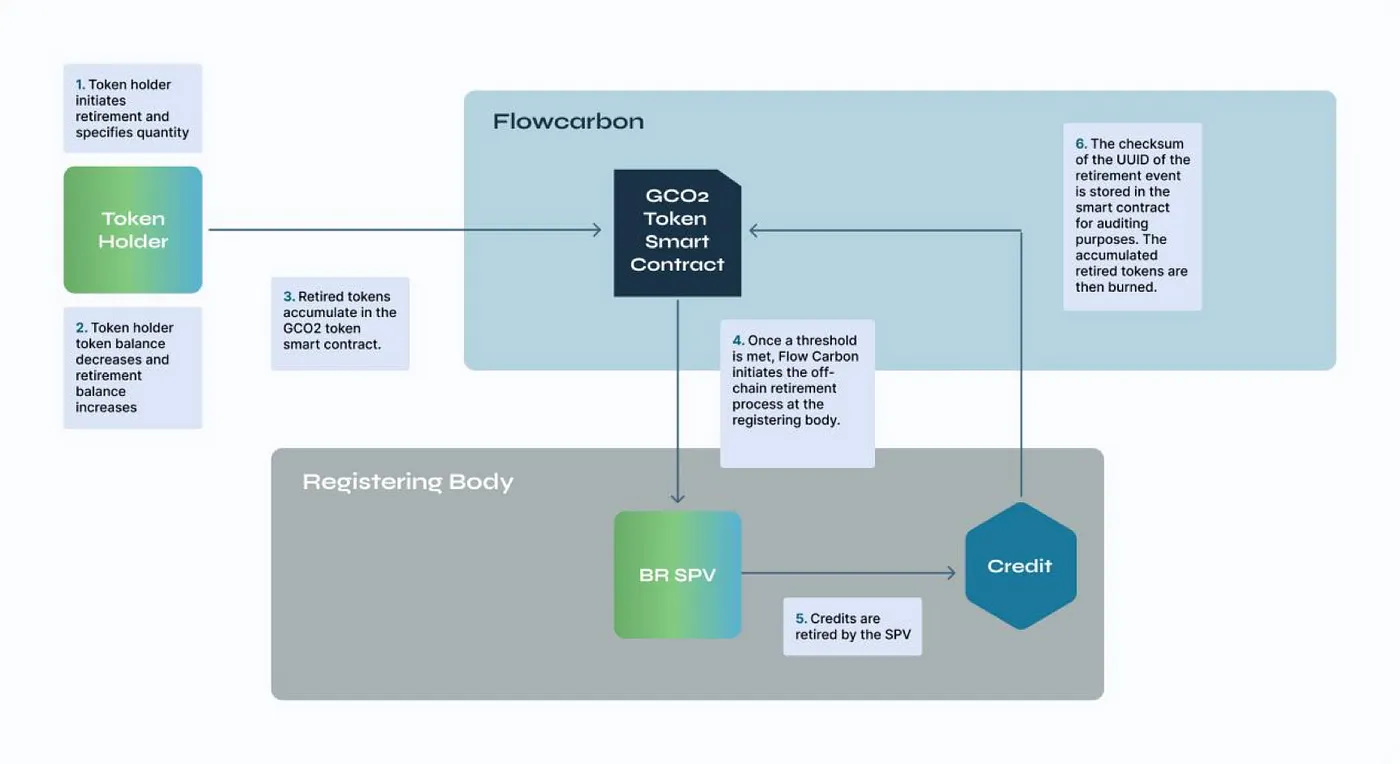

- Exit (Retirement)

A token holder first initiates a token withdrawal on Flowcarbon and specifies the amount to withdraw, which reduces the token holder’s balance and increases the withdrawal amount. Withdrawn tokens accumulate transparently in the contract until they exceed a pending batch size. Once the threshold is reached, the bankruptcy-isolated SPV deletes the carbon credits in the underlying registry.

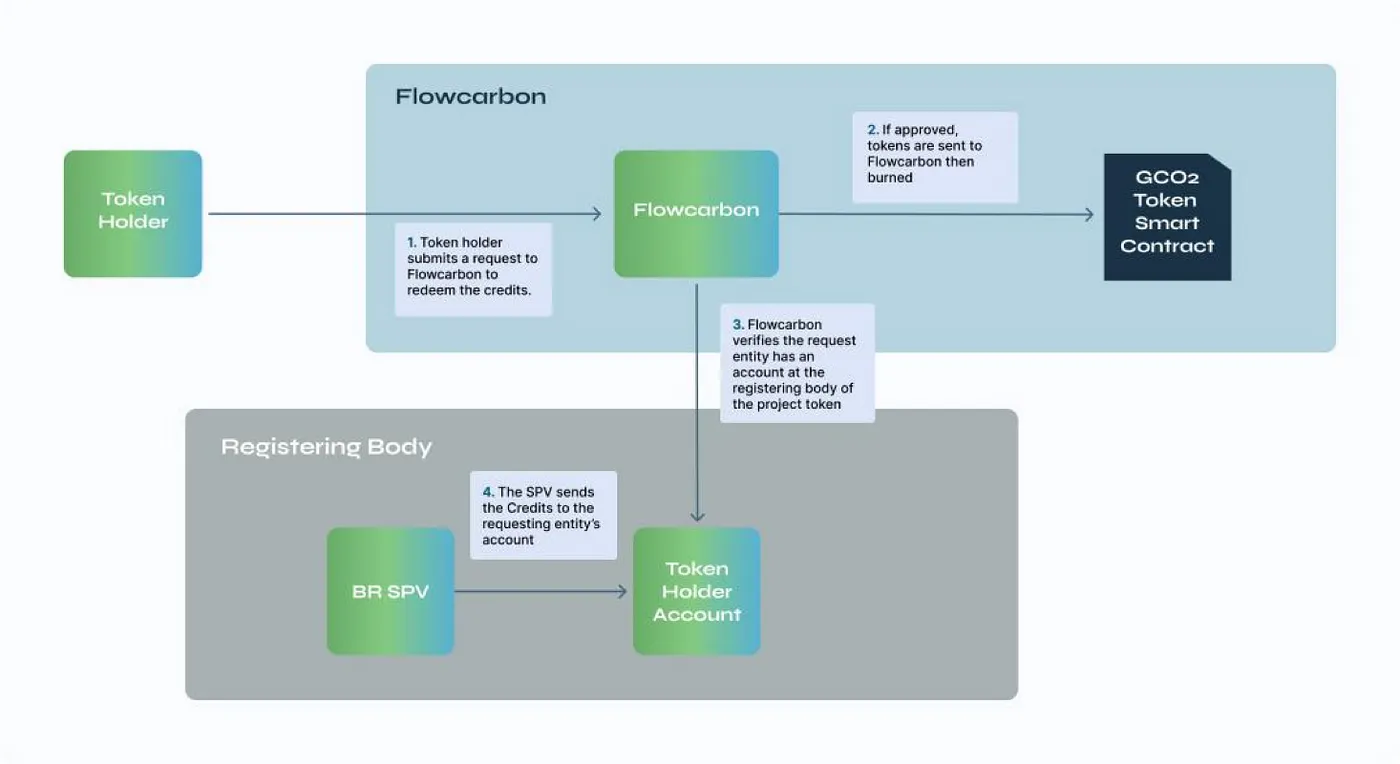

- Redemption

Redemption is the process by which token holders redeem their GCO2 tokens for actual off-chain credits. A token holder initiates the redemption process by submitting a request to Flowcarbon. Once the request is approved, Flowcarbon confirms the account under the applicant’s name with the appropriate registrar. The GCO2 tokens are then destroyed by the GCO2 smart contract, and the actual carbon credits are transferred from the SPV to the designated account.

A standard 2% fee applies on redemptions. If a GCO2 holder requests to redeem 100 GCO2s, 98 off-chain carbon credits will be received.

- Liquidity

GCO2 tokens can be deposited into a designated address in exchange for affiliated tokens in Flowcarbon’s dApp. The affiliated tokens are bundled and issued at 1:1; if 50 GCO2 are deposited into the address, 50 affiliated tokens will be received in return. Affiliated tokens are intended to provide liquidity, and users can purchase the affiliated tokens directly; these tokens are also redeemable and sellable.

Protocol income:

Fees apply dynamically on unbundling, swap, exit and redemption features, and more recent carbon credits are more expensive than the elder ones, which aims to incentivize the withdrawal of older carbon credits. The fees are achieved through a “rake back” contract. When one of these features is activated, the contract performs that feature on behalf of the user account, and the rake back contract determines how much of that fee should be sent back to the user. For example, if the fee cap is 15%, and Sarah requests to unbundle 100 affiliated tokens into 2020 GCO2, the affiliated token contract will automatically charge 15 GCO2 in the fee account, and the rest 85 GCO2 will be sent to the rake-back contract. The rake-back contract contains detailed information about the charge; in this case, 2020 is a relatively new year, and the actual fee rate is 10%. Therefore, the rake-back contract will take 5 GCO2 from the fees and send 90GCO2 back to Sarah.

Protocol Advantages: Flowcarbon provides a “round-trip bridge” that allows GCO2 tokens to be exchanged for underlying carbon credits off-chain.

Protocol Risks: Everything happens off-chain: carbon credits are transferred to SPV instead of on-chain.

(3) PERL.eco

PERL.eco is Perlin’s latest project focused on introducing real-world bio-ecological assets onto blockchain, with one of the first available assets being tokenized carbon credits. The product is not yet officially launched.

Tokenization process:

PERL.eco has partnered with AirCarbon Group, which also manages a fully regulated carbon exchange ACX, and established the PERL.eco Carbon Exchange (PCX), where PFCs (PERL.eco Future Carbon, high-quality carbon projects vetted by PERL.eco and tokenized carbon credits from carbon projects that have not yet been issued) and other high-quality carbon assets and traded at retail on the PCX.

Status quo of the protocol: $PERL is listed on Binance, but attention on social media is low, project progress is slow, and the whitepaper has not been updated for over 1 year. PFC pilot soft launch is planned to happen in Q3 2023 along with early prototype release of PERL.eco Carbon Exchange (PCX); PCX Alpha will be released in Q4 2023, and PCX Beta in 2024.

Token functions:

$PERL is the governance token of PERL.eco. $PERL plays a key role in defining the incentive system, building a broad stakeholder base, and facilitating the flow of economic value in the network. $PERL holders can vote on the fee structure and allocation, as well as making other important decisions. By participating in governance, users are rewarded with carbon credit airdrops that can offset their emissions.

Protocol advantages: Working with a regulated carbon exchange significantly reduces the risk in compliance.

Protocol risks: PERL.eco only acts as a reseller role, increasing the exposure of the subject but not inherently improving liquidity.

Summary

Carbon credit type of Web3 projects provides better liquidity for carbon credit trading through tokenization and establishment of trading pools.

However, Web3 carbon credit projects are constrained by issues of high isolation and low credibility. Furthermore, it is nearly impossible to achieve a truly homogeneous tokenization because carbon credits are influenced by the registry of origin, project and year, and the pricing is not consistent. For example, Toucan, which already has certain trading data, currently supports only two types of carbon credit carbon index tokens, which can be staked only through logical screening. Flowcarbon currently only plans to provide one type of bundled token, which must meet three requirements. In addition, the carbon credit trading process is complex and cannot bypass centralized independent non-government entities, such as Verra and Gold Standard, which have explicitly stated that they do not support carbon credit tokenization at this time. Blockchain technology can change the problems of the traditional carbon credit trading market in many ways, but to improve credibility and enhance the uniformity and liquidity of the market mandates more time and effort.

4.8 Sector L1 chains

It is due to the diversity of real-world assets that the implementation of asset tokenization requires an exclusive L1 chain to meet the needs of institutional users, which includes: 1. higher level of security and privacy; 2. higher degree of user-friendliness, such as the provision of SDKs; 3. diversity and operability of token standards; and 4. an approved chain with permissions from regulatory authorities.

In terms of token standard, from the ERC-20 standard of Ethereum, the issuer is unable to achieve recycle, equity management, identity management, bulk processing, off-chain authorization, and other possible interactions with tokens, which poses more difficulties for asset management. Therefore, existing L1 chains are insufficient for complex operations of asset management in the current financial market. In other words, new L1 chains are needed to build new token standards.

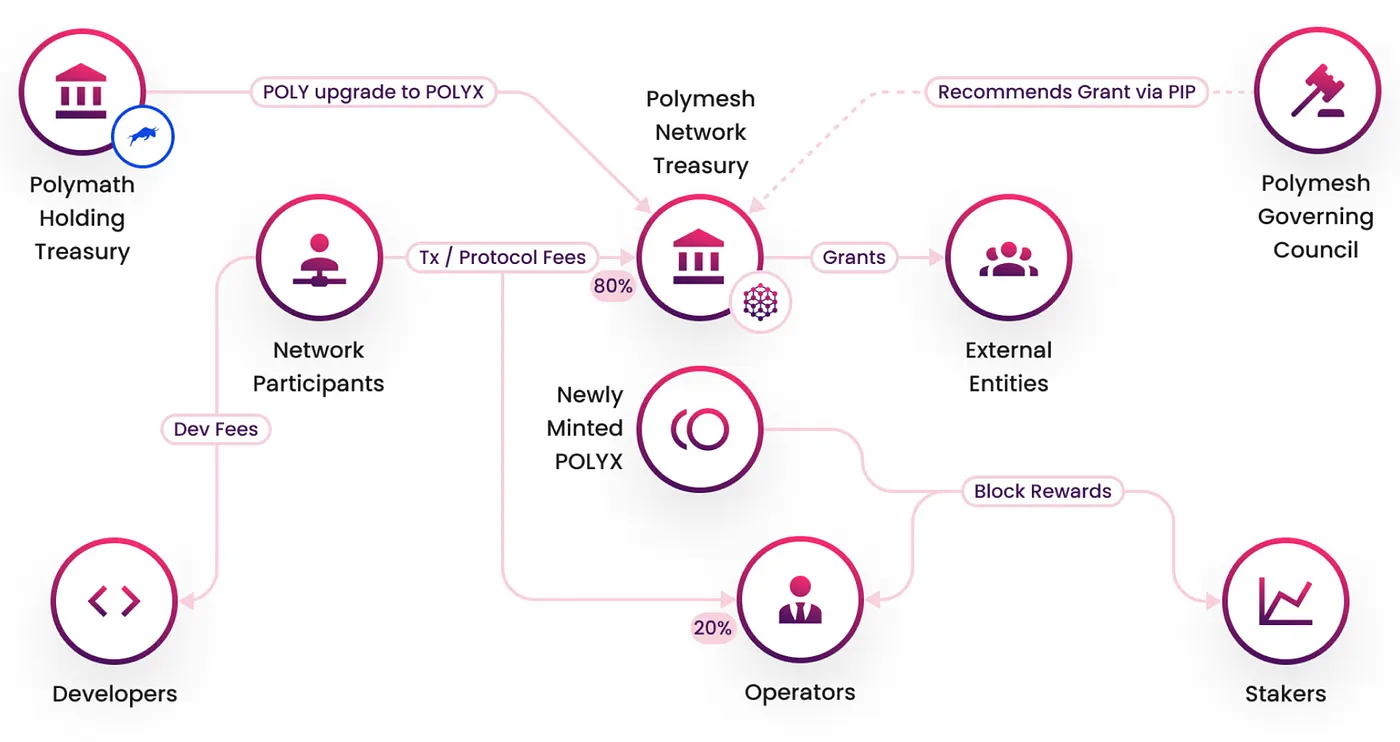

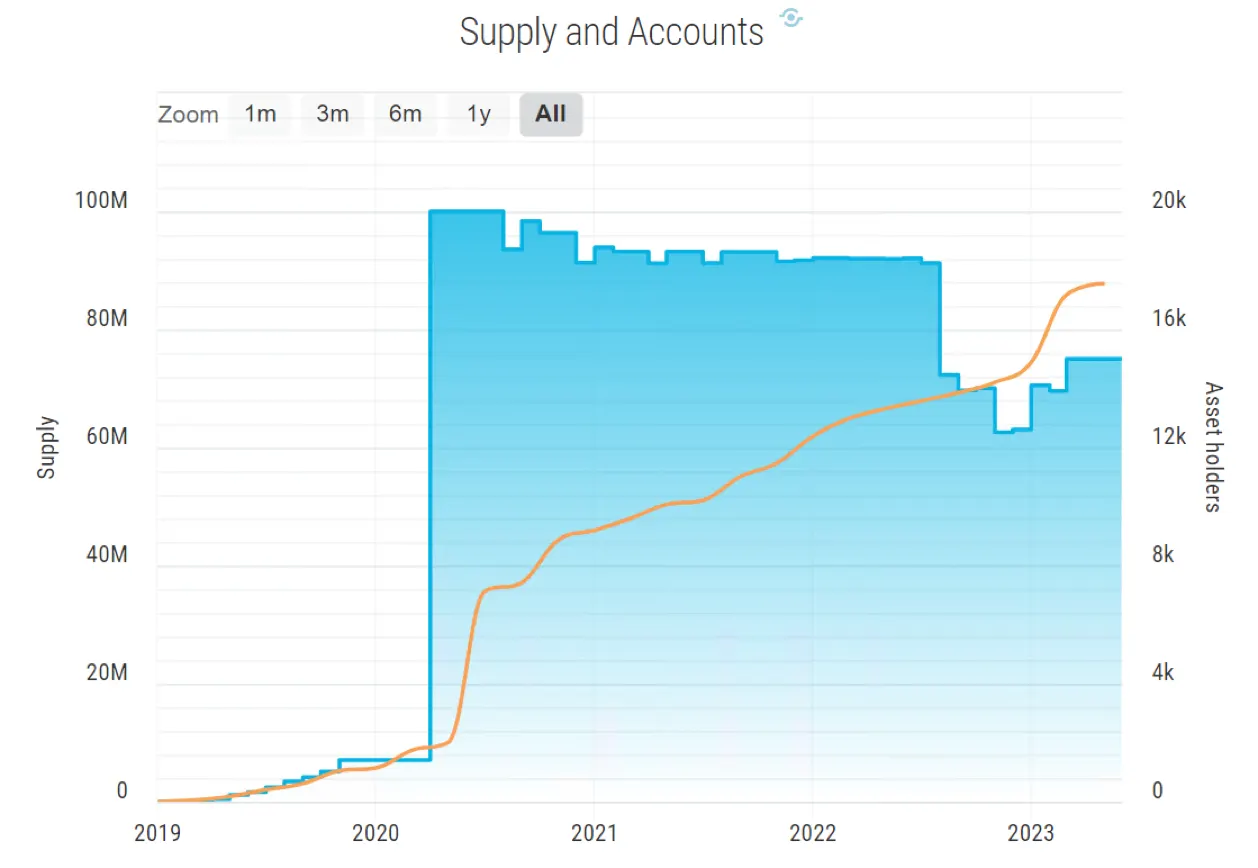

(1) Polymesh

Polymesh is an institutional-grade Layer1 blockchain tailored for regulated assets, such as security-based tokens, with a market capitalization of $90 million in circulation. Polymesh is a publicly permissioned blockchain that employs the Nominated Proof of Stake (NPoS) consensus model developed by Polkadot to clarify the roles, rules, and incentives of the network. Its on-chain token standard is inspired by ERC-1400, reinforcing additional functionality and security to facilitate token issuance and management of on-chain assets.

Polymesh’s core team is expertise in finance, technology, and law; most of them have experience building the first secure token platform and leading the ERC-1400 at Polymath. Information of the team can be found at: https://polymesh.network/team#

Project advantages/features

-

Born for regulation: Un-permissioned L1 chains, such as Ethereum, may have difficulties accommodating transactions of RWA assets due to regulatory and other restrictions. As a result, sector application chains are in place, specifically handling RWAs.

-

Transparency Assurance: All issuers, investors, stakers and node operators, etc. are required to complete KYC, and all customers are subject to the process of due diligence. The node operators must be a licensed and financial entity in practice, to which known real-world entities on-chain interactions can be l traced. All transactions are authorized by licensed entities.

-

Preventing hard-forks: Forked chains can have significant legal and tax implications for physical asset tokens, and POLYX’s industry-led governance model eliminates the possibility of hard-forks.

-

Confidentiality: Polymesh has designed a secure asset management protocol that enables the issuance and transfer of confidential assets, which complies with the requests of real-world market participants on confidentiality of positions and transactions.

-

Instant settlement: Inherited from Polkadot’s GRANDPA finality gadget, combined with the above authentication requirements, compliance verification, and elimination of hard-fork cultivate instant settlement on Polymesh.

Token functions:

$POLYX is the native token of Polymesh. According to the guidance of the Swiss financial regulator FINMA (Swiss Financial Market Supervisory Authority), the token is classified as a utility token in accordance with the laws of the country. $POLYX is utilized for governance, securing the chain through staking, creating and managing security-based tokens.

The inflation rate of the token is 10.12%, which is relatively normal.

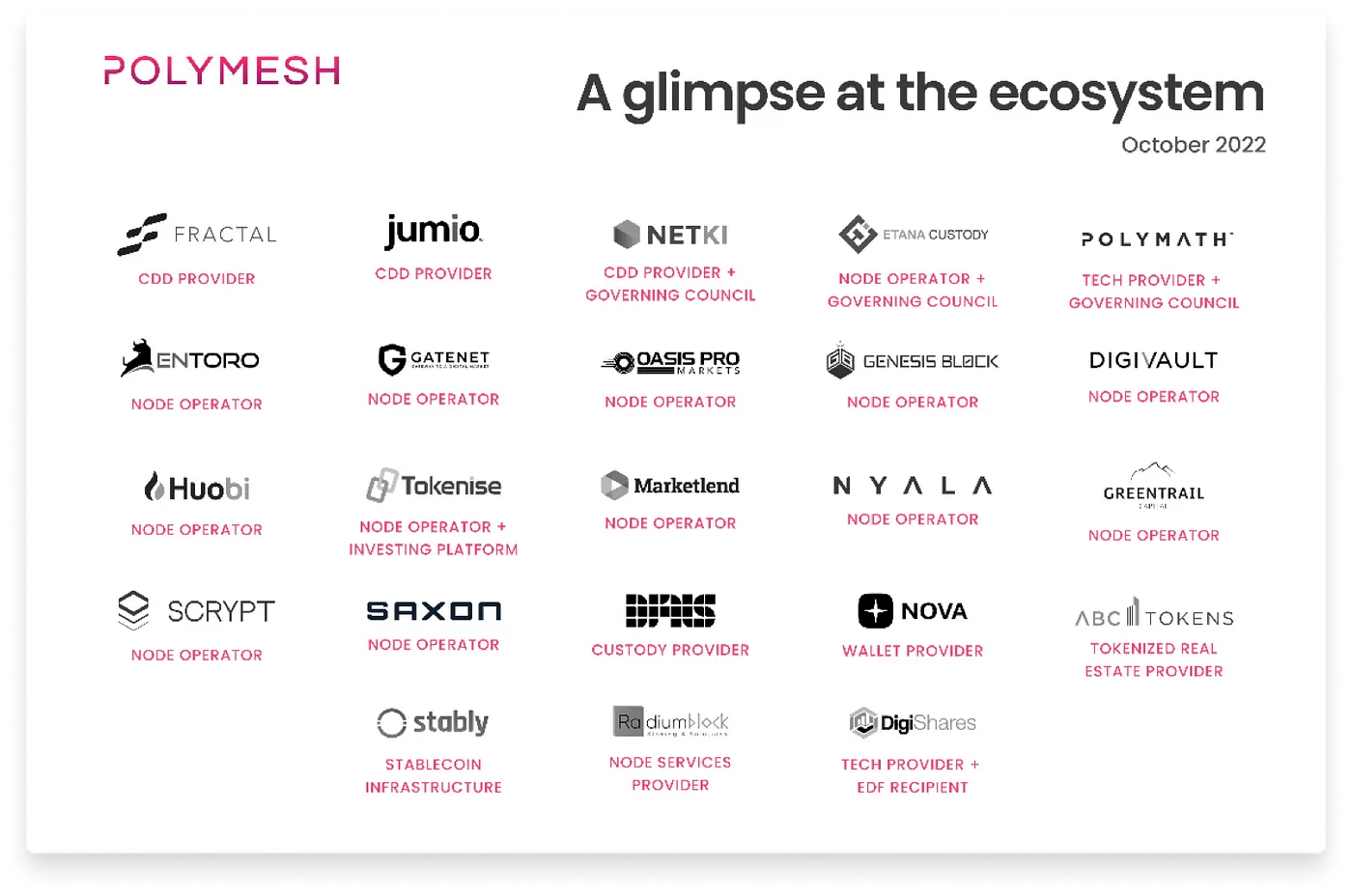

Ecosystem:

Existing participants in the Polymesh ecosystem include exchanges, experts in tokenization (i.e., Polymath), and companies with portfolios of security-based tokens (RedSwan). The Polymesh Association aims to facilitate further development through two programs:

-

The grant program is available to individuals and companies that build open-source features in Polymesh.

-

The Ecosystem Development Fund is available to companies with integrated closed-source technology on Polymesh.

The current major ecologies include:

-

Tokenise — The first CSD, broker and exchange for digital assets. It has chosen to build its infrastructure based on Polymesh; digital assets have been started to be built.

-

DigiShares — A white-label tokenization platform. It became the first recipient of the Polymesh Ecosystem Development Fund with Polymesh integrated.

-

Stably — A regulatory-compliant stablecoin infrastructure provider and creator of the USDS token. It is working to launch first stablecoin on Polymesh.

-

ABC Tokens — A tokenized real estate provider that offers geographically dispersed commercial real estate to investors on Polymesh.

Asset tokenization mechanism:

- Configuring security tokens

Security tokens can be configured on the blockchain to represent physical or digital assets. On Polymesh, tokens are created at the protocol layer, eliminating the need to add smart contracts to each security token at the top of the chain. Tokens can be easily configured by basic programming language and the Polymesh SDK, or on a tokenization platform for issuers who pursue codeless approach.

- Set compliance rules

Polymesh’s compliance engine can set flexible ownership and transfer rules to enforce transfer restrictions so that tokens comply with regulatory requirements, such as KYC/AML requirements, as well as securities regulations.

- Token Distribution

Mint tokens with one click and send them to shareholders, affiliates or reserve accounts while enforcing broader compliance requirements. Set pricing based on meanings of token and (if needed) appoint a qualified custodian to manage the pool in a safe and secure manner.

- Management of company behavior

Execute corporate actions on chain to resolve issues regarding interests, restructuring, capital allocation and voting. The issuer only needs to enter a few details, from where the engine can determine entitlements, schedule record dates, allocate capital (if needed), and update records.

Status quo of the project:

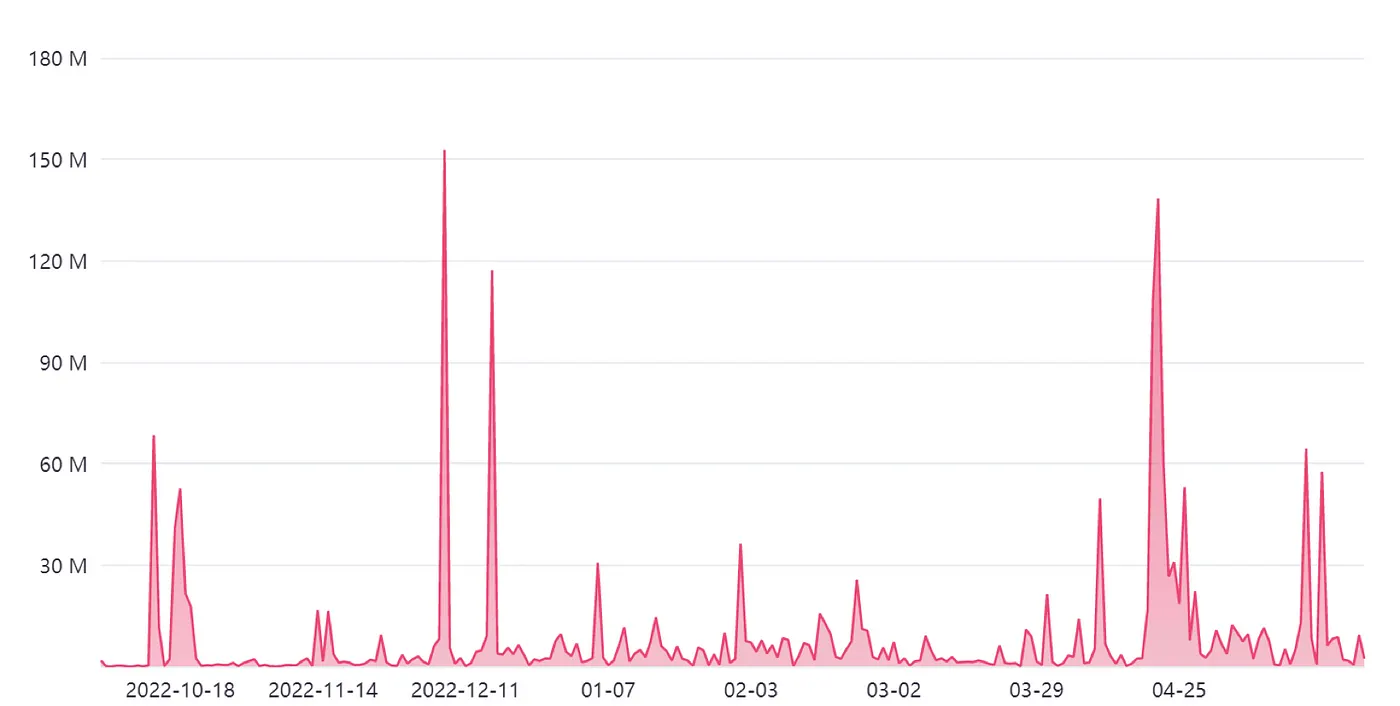

Currently, 38,000 accounts are created with 357M $POLYX tokens in staking, representing 47.7% of the total issuance. 43 node operators are in the network. Daily trading volume on the chain ranges from 2000 to 11 million $POLYX. On April 20, the number of on-chain transfers reached $138 million after the announcement of Binance becoming a node operator.

In the future, Polymesh will integrate smart contract, defi applications, NFT and more functions.

Project review:

Technically, Polymesh leverages Polkadot’s development framework, but it is not a parallel chain. It inherits the security and technical superiority of substract. In terms of ecological development, Polymesh provides the issuance and management tools for RWA tokenization on-chain that can be autonomously executed to meet the end needs of various asset tokenization. It provides an institutional-level solution to RWA tokenization, but there are two risky points: (1) identity verification ensures a certain level of transparency and security, but a plan B is needed in case of emergency; (2) institutional developers are critical to the system, and more partnerships should be established.

(2) MANTRA Chain

MANTRA (formerly MANTRA DAO) was founded in 2020. It is a part of the MANTRA ecosystem, Omniverse, along with MANTRA Nodes and MANTRA Finance. The circulating market cap is $19 million. MANTRA Chain is an L1 blockchain built with the Cosmos SDK that hopes to become a network for enterprise, so that companies and developers could collaborate to build any applications ranging from NFT, games, metaverse, to DEX with compliance. MANTRA Chain can interoperate with other Cosmos ecosystems via IBC, and it is also compatible with EVM chains.

MANTRA carries positive expectations on RWA and Hong Kong, it has only 1 financing event that receives capital investment from LD Capital, Waterdrop Capital, GenBlock Capital.

Project advantages/features:

-

Powerful Identity System: MANTRA Chain has a robust Decentralized Identity (DID) module to meet all KYC and AML requirements, which facilitates the development of products that may cement current functions and ecosystem.

-

A complete ecosystem: With MANTRA Finance being the main line, various nodes, DAOs and L1 chain infrastructures are developed.

Token functions:

$OM is Omniverse’s native token with features including governance, network staking, and DAO token access/airdrop rewards. $AUM, MANTRA Chain’s native token, will be available soon.

Ecosystem and status quo:

The first dApp on MANTRA Chain is MANTRA Finance, which aims to be a globally regulated DeFi platform that transplants the speed and transparency of DeFi to the opaque world of TradFi, empowering the issuance and trade of RWA tokens.

Currently, a few crypto-based interest-bearing DeFi products are launched, which will be followed by the Central Limit Order Book (CLOB) DEX that offers swap functionality and traditional financial products (bonds, equities, and other real-world assets (RWA)). When these products are successfully launched, MANTRA Finance intends to expand the Decentralized Exchange (DEX) by offering derivative products.

Project review:

MANTRA started out in 2020 on Polkadot, but it has not progressed well. The project has undergone several major changes, and the product is overall slow in development, with no relevant RWA product launches or corresponding solutions for enterprise and institutional level in sight.

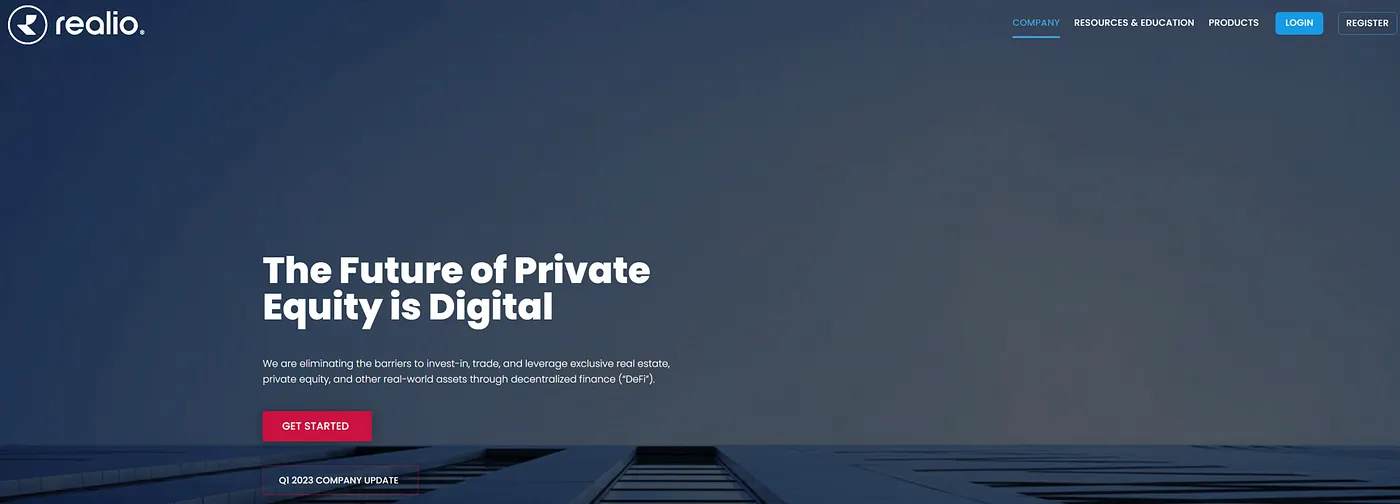

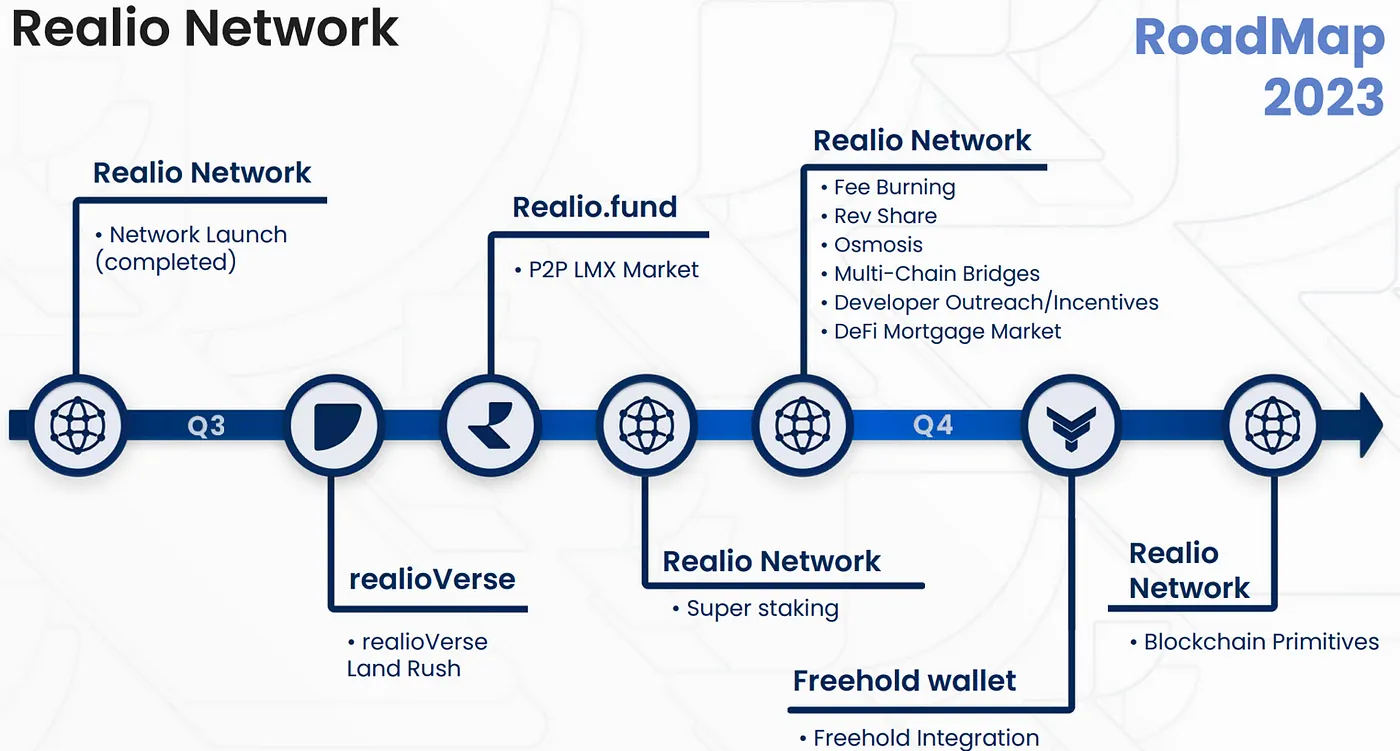

(3) Realio Network

Founded in 2018 in New York, Realio Network is formerly an end-to-end digital asset issuance and P2P trading platform focused on real estate private equity investments. Currently, Realio has built its own L1 blockchain with the Cosmos SDK, and the mainnet was launched in April. The Realio platform utilizes blockchain technology and offers a range of services, including tokenization, digital asset issuance and trading on secondary market. RealioVerse and the coming Freehold wallet are applications that lay foundation for future businesses on securities rather than just real estate.

Realio’s platform also provides tools for KYC/AML compliance, investor authentication and investor management; these tools are also available to aid third-party issuers in digitizing their assets and raising capital within the network. All actions are subject to SEC compliance requirements.

Information of team members is publicly available; multiple advisors are in finance and real estate.

Project advantages/features:

-

Security Assurance: One of Realio’s unique features is a distributed key management system that oversees secure staking validators and principals. By binding $RIO or $RST, shares of block rewards are distributed according to contribution.

-

Compliance: All token offerings must meet SEC compliance requirements.

Ecological development:

Currently, the Realio Network mainnet has just embarked, but Realio’s native tokens $RIO and $RST have long been issued, and the Realio Platform Wallet and Realio.fund have been in the scene.

- Realio Platform Wallet

The Realio wallet is a non-custodial multi-chain wallet that currently supports Bitcoin, ETH, Algorand, Stellar, Raven and Fusion, and any assets on these chains. The storage of private keys and transaction signatures are simplified, and the function to grant access in DeFi is coming soon.

- Realio.fund

A P2P investment platform that offers real-time multi-chain token issuance tools with fully automated compliance process features. Investments can be made in cash or Realio-backed cryptocurrencies.

Token functions:

The network employs a native dual equity model, represented by $RIO and $RST, effective on network staking, governance, key management, and other functions.

$RST is an equity token issued by Realio in partnership with Algorand in 2020; holders are the platform and developers who maintain the platform. $RST is sold as an Algorand Standard Asset (ASA), which has interoperability with other supporting blockchain and platform features, such as RealioX. $RST is sold globally in private following Regulation D Rule 506(c) and Regulation S exemptions. Currently, there is no secondary market for trading. $RST is a hybrid digital security that is eligible both in receiving revenue distribution from the platform and rewards for validators on Realio Network. The maximum supply is 50 million, and mainly sold through pre-sales and the Security Token Offering on realio.fund.

$RIO is Realio Network’s native gas and utility token; it is offered on multiple chains, such as Ethereum, Algorand and Stellar networks. There is no pre-mining; all incremental issuances are via validator’s block rewards and liquidity mining. Maximum supply is 75 million with a circulating market cap of approximately $1 million. $RIO is available on OKX and MEXC, with daily trading volume rising to about 4 million dollars in May compared to 1 million dollars in March.

Status quo of the project:

Currently, the platform is still focused on cryptocurrency trading. Meanwhile, it launched a liquidity mining fund $LMX for the BTC eco, and token holders can also participate in other DeFi programs, which is similar to stETH. 29.7K fans are on Twitter.