1/11 首先科普一下清算价值,奥派经济学家米塞斯在几十年前就提出为了反映银行所承担的特殊合同义务的真实性,所有资产均应以清算价值入账,即在必要时清算某些资产,进行变现的时候最后能够到手的价值。

2/11基于清算价值的假设,USD及USD等价物显然是具备较稳定的清算价值的,BTC/ETH足够去中心化且有足够的价值认同度,因此也可以被认为具备比较稳定的清算价值。但其他加密货币真正发生大规模清算时,价值会发生严重偏离,因此以账面价值进行计价显然是不合理。

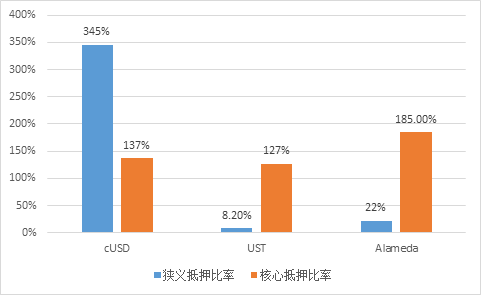

3/11基于此,我们提出了狭义抵押比率和核心抵押比率,其区别在于狭义抵押比率认可资产的账面价值,而核心抵押比率考虑了清算价值假设,会将不具备足够流动性的资产清算价值设为0,以反映极端情况下的价值偏离。

4/11在之前的分析中,我们发现Alameda的核心抵押比率仅有22%,远低于Celo、MakerDAO等协议,与UST处于相近的水平线。事实上,Alameda和UST背后的问题都是狭义抵押比率的合理性掩盖了核心抵押比率的不合理性。

5/11接下来我们将用这种分析框架尝试对USDD进行分析。依据TDR数据进行计算,USDD的核心抵押比率为182%,处于正常区间,而核心抵押比率为93.5%,略微偏离正常值。外界传言的“50%抵押率”未把BTC的价值计算在内,其计算方式是不合理的,即使按照最严格的清算价值计算,USDD也有93.5%的抵押比率。

6/11这里解释一下,核心抵押比率低于100%是第一道预警线,当核心抵押比率在100%以上时,协议是绝对安全的,即使狭义抵押物(TRX)全部归零,USDD也能得到足额的资产背书。尽管USDD的核心抵押比率低于100%,但和UST的8.2%,Alameda的22%仍然不在一个数量级,不能简单地归为一类。

7/11按照100%和93.5%的差额计算,对应的BTC价值缺口约4700万美元,而BTC价格由19800下跌到16700所带来的抵押物价值差额大约也是4700万美元,这表明USDD核心抵押比率的偏离直接诱因是近期BTC的大幅度下跌。

8/11另一个原因是PSM机制的暂停。在原本的设计中,如果出现数值的偏离,PSM机制将会启动,通过同步减少资产和负债端的头寸来缩小风险敞口,使得核心抵押比率回归到100%以上,但从链上信息来看,PSM并未生效。

9/11关于USDD“脱锚”,Curve数据显示当前USDD价格约为0.98USDT,严格来说这并不算脱锚,因为包括DAI、VAI、USDT、BUSD在内的主流稳定币均多次出现过5%以内的价值偏离,2%的浮动属于短时间内的市场偏离,预计不会持续下去。

10/11总结:通过对USDD的清算价值分析,我们认为USDD的狭义抵押比率远远超过100%,USDD拥有充足的抵押资产,USDD的价格波动也在正常范围以内,不存在长期脱锚的风险。

11/11虽然USDD没有任何实质性安全问题,但PSM机制的失效和BTC的大幅度下跌确实使得核心抵押比率出现了小幅度的偏离。因此我们也呼吁Tron DAO Reserve重视问题,防微杜渐,适当补充抵押物、销毁USDD或者启动PSM机制,进一步增强用户信心。

About X Research DAO

X Research DAO is a community-based research DAO backed by Huobi Research. It aims at being one of the most valuable decentralized blockchain-analysis insitituions in the world. X research DAO focuses on analysing web3 projects, early stage public-chains, gamefis and NFTs.X Research DAO welcomes all web3 enthusiasts, let’s build the best research DAO and learn together!

Join us:

Website:https://www.xresearchdao.xyz

Twitter:https://twitter.com/XResearchDao

Telegramm:https://t.me/xresearchdao

Discord:https://discord.gg/S52jJT9NSp

Youtube:https://www.youtube.com/channel/UCHBeMdxOnoU6zo3mbVd1MKg/featured

Notion:https://bit.ly/3AjGNlq

Mirror:https://mirror.xyz/0x9045237C0248AA32A758635f9E5d8A47f1460702/

Disclaimer

The author of this report and his organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report.

The information and data cited in this report are from compliance channels. The sources of the information and data are considered reliable by the author, and necessary verifications have been made for their authenticity, accuracy and completeness, but the author makes no guarantee for their authenticity, accuracy or completeness.

The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment and other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report, unless clearly stipulated by laws and regulations. Readers should not only make business and investment decisions based on this report, nor should they lose their ability to make independent judgments based on this report.

The information, opinions and inferences contained in this report only reflect the judgments of the researchers on the date of finalizing this report. In the future, based on industry changes and data and information updates, there is the possibility of updates of opinions and judgments.

The copyright of this report is only owned by X Research DAO. If you need to quote the content of this report, please indicate the source. If you need a large amount of references, please inform in advance (see “About X Research DAO” for contact information) and use it within the allowed scope. Under no circumstances shall this report be quoted, deleted or modified contrary to the original intent.