Abstract

To solve liquidity issues in the NFT market, financial applications and tools for NFT-based lending and financing have emerged. In the previous article, we briefly introduced four segments of NFTfi, which are 1) NFT lending and borrowing, 2) NFT aggregators, 3) NFT pricing mechanisms, and 4) NFT financial derivatives. We looked at areas such as the current market, the tradeoffs involved, and upcoming developments. A few typical projects and their mechanisms were also analyzed.

Check it out here: https://research.huobi.com/#/ArticleDetails?id=306

In this article, we analyze the NFT lending and borrowing protocols in terms of the counterparties, LTV, interest rate derivation, liquidation, and supported collections etc. In addition, we also examine in greater detail a new NFT lending and borrowing protocol OpenSky with its innovative time-based liquidation mechanism.

The table below summarizes the characteristics of the main NFT lending and borrowing protocols. Before we proceed further, we would like to revisit the current NFT lending protocol scene, for the benefit of the uninitiated.

1.Types of NFT Lending and Borrowing

One of the main differences between NFT lending and borrowing protocols is the counterparty for the users. Going along this train of thought, NFT lending protocols can then be classified into peer to peer(P2P), peer to pool(P2POOL) and collateralized debt positions (CDPs) protocols.

1.1 P2P

Characteristics and Use Case Scenarios

P2P, as the name suggests, is the mechanism in which users transact directly with each other. Once both sides agree to the terms, the deal is done. In P2P transactions, users can make deals on a large number of NFT series. Protocols like NFTfi and Arcade support more than 200 NFT collections. Niche NFT assets or long-tail assets usually opt to list on such protocols. In P2P mode, loans are highly customizable. For each NFT listed on the platform, potential borrowers can set the terms of the loan such as the loan amount, duration, LTV, APR etc., collateralized with their non-fungible tokens. Lenders then decide whether to lend based on the offered terms.

In other words, P2P lending is more suitable for long-tail assets with low liquidity. ETH lenders tend to prefer lower LTVs and shorter lending periods, for fear of a drastic drop in NFT prices.

Representative Project — — NFTfi

NFTfi has been live since May 2020, even before the recent NFT bull market. It quickly dominated the NFT borrowing and lending scene and became the most popular P2P protocol in the NFT lending and borrowing space.

NFTfi divides lenders into three categories: those who lend for profit; lend to acquire; and lend safely to friends. The first type is the most obvious: lending to others to make a financial return. Lenders may think of it as a competitive alternative to liquidity providers on Uniswap. Most loans on NFTfi have been set in the 40%-100% APR range. The second approach has been used by a few collectors to acquire NFTs in an extremely cost-effective manner over time. In this approach, users have a strategic advantage over pure financial lenders. They are happy to accept a lower APR in return for an option to foreclose on the asset should the borrower default. Following this strategy, users may want to offer more competitive interest rates (10%-40% APY) in order to win the bids on loans collateralized by valuable pieces. In the third situation, lenders lend to friends in a transparent and traceable way to avoid unforeseen, and probably unfortunate, circumstances.

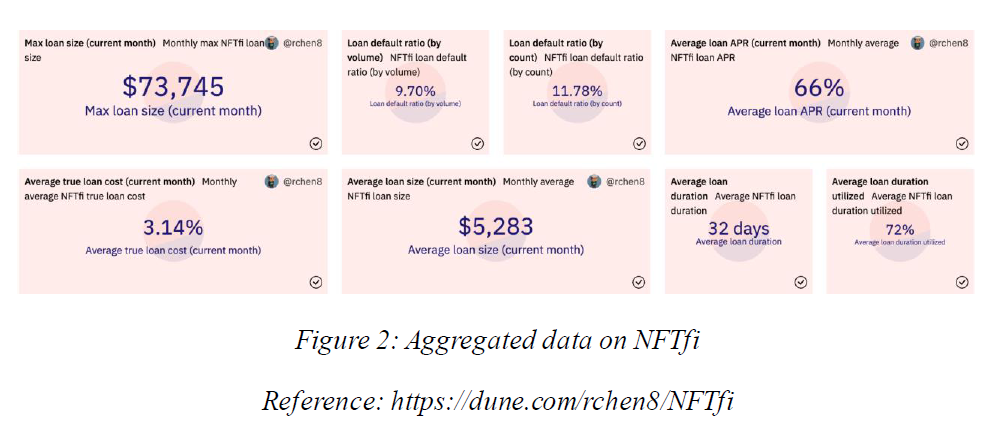

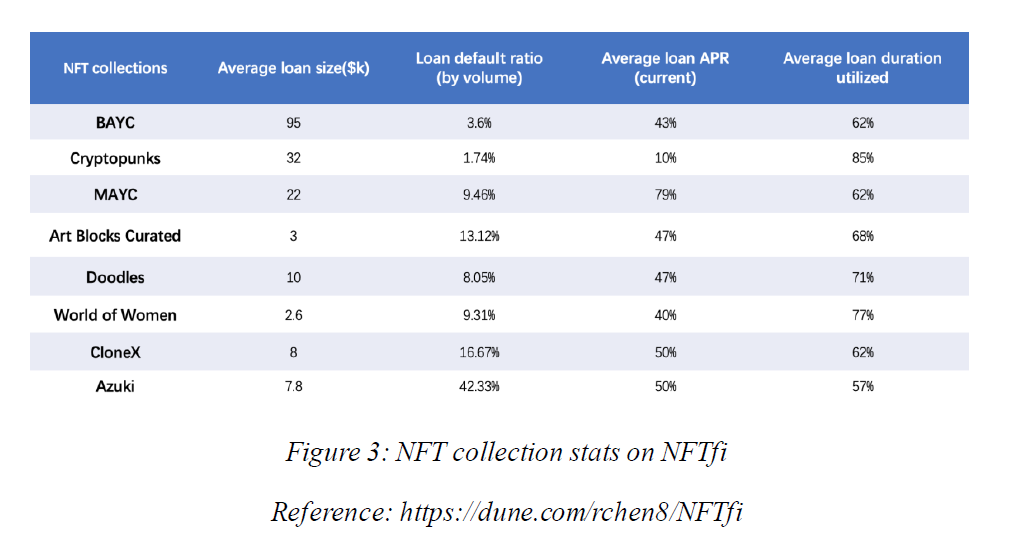

Data on NFTfi shows that the people tend to hold on to their blue-chip NFTs rather than default on their loans. The average loan default ratio on NFTfi protocols is just around 9.7%. NFT collections with large loan sizes: BAYC and CryptoPunks have the lowest loan default ratios of 3.6% and 1.7% respectively. Azuki, which has the large price volatility among the blue-chips, has a loan default rate of 42%.

Average loan APY and loan duration utilized also explain the differences in value preservation between different blue-chip NFT collections. CryptoPunks has the lowest loan APR of around 10%, while BAYC has an APR of 43%. Loan duration utilization data suggests that the holders for some series value their NFTs more than others do, but without any clear relationship to floor prices. Loan duration utilized represents actual repayment time/stipulated repayment time. In this case, CryptoPunks lenders tend to repay their loans faster than other lenders.

Assessment of the P2P Model

As mentioned above, the P2P model is suitable for illiquid assets. Intuitively, the longer the duration, the higher the risk for lenders. Therefore, it should come as no surprise that lenders tend to prefer shorter-term loans with low LTV.

An obvious shortcoming of NFTfi is its low capital and time efficiency. ETH providers spend too much time competing for P2P loans (an offer is valid for 7 days) but only one bidder can ultimately fund a loan while all other bidders earn nothing. Similarly, potential borrowers have to wait until they get an acceptable offer before receiving the needed funds. The long waiting time and the low success rate are a drain of value for both lenders and borrowers.

1.2 P2POOL

Characteristics and Use Case Scenarios

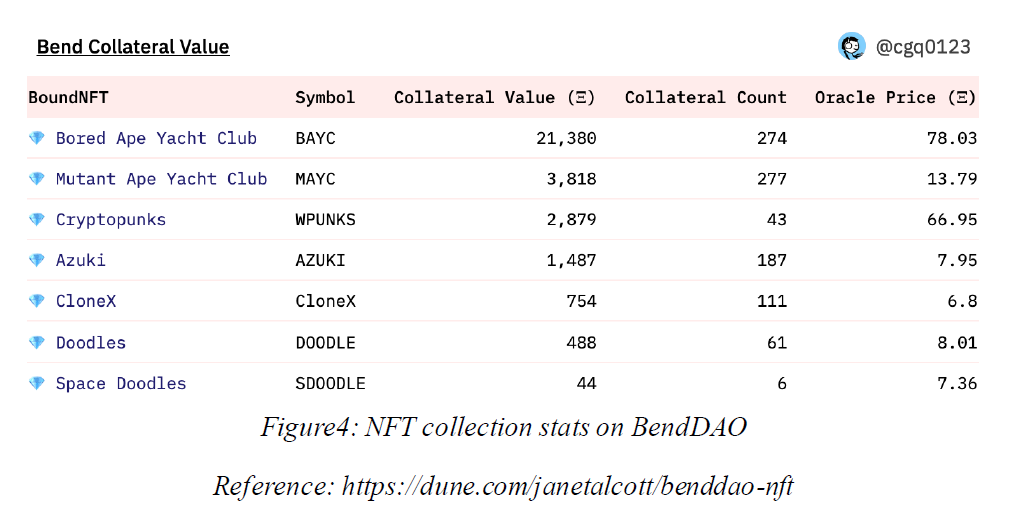

For P2POOL, borrowers borrow from a fund pool, whereas lenders stake tokens into the pool and receive financial returns. P2POOL lending and borrowing are suitable for blue-chip NFTs with high liquidity. BendDAO supports 7 collections (namely BAYC. MAYC, CryptoPunks, CloneX, Doodles, Space Doodles, Azuki); DROPS supports 10+ collections.

Assessment of the P2P Model

Compared with the P2P model, P2POOL lending and borrowing protocols are friendlier to lenders. They usually help lenders diversify risks and lower their entry barriers. Those who hold NFTs close to floor prices are also more willing to choose P2POOL lending and borrowing protocols.

However, P2POOL lending and borrowing protocols usually face two main problems. The first one is capital inefficiency. Lending pools tend to hold idle capital since interest income only comes from borrowers on the platform and funds are seldom fully utilized. The second is the risk of cascading liquidation. Should a heavily collateralised NFT series on a lending protocol face a significant fall in its floor price, liquidations and consequent further drops in floor price are likely to be self-reinforcing.

Representative Project — — BendDAO

Depositors can offer ETH in BendDAO to gain financial profits. Holders can pledge NFTs from 7 collections as collateral to lend ETH through the lending pools at a rate of around 30%-40%. Both lenders and borrowers also receive $BEND as a reward. From the buyers’ perspective, they can also use BendDAO to buy NFTs from other NFT marketplaces, such as OpenSea, using installments with a minimum down payment of 60%.

Despite the obvious benefits, BendDAO also suffers from several problems, the most obvious of which is the potential for cascading liquidation, as illustrated recently when there was no bidder for more than a day on the liquidation auctions for BAYC pieces that lost significant value.

● BendDAO’s Potential Cascading Liquidation

The mechanism behind BendDAO’s potential cascading liquidation can be illustrated by the following vicious circle:

-

A significant fall in NFT floor price results in a wave of liquidations.

-

Liquidators bid on the auctioned NFTs and resell them at the floor price; bidders at NFT platforms like OpenSea get spooked and lower their bid prices, either way the floor price falls further.

-

The fall in the floor price triggers a new wave of liquidations.

We should note that the impact of cascading liquidations is not limited to any specific NFT lending platform, but a systemic risk that would affect all NFT lending platforms with a price-based liquidation mechanism.

● What is BIP#9

BendDAO’s proposed solution to the problem of cascading liquidation came recently in the form of BIP#9. While it has solved some of the initial problems related to cascading liquidation and illiquidity, it appears to have created new problems in the process.

The liquidation-specific portion of BIP#9 can be summarized as follows:

-

Eventually adjust the liquidation threshold to 70%

-

Adjust the auction period to 4 hours

-

Remove the first bid limitation of 95% of floor price

-

Adjust the interest base rate to 20%

On (1), the lowering of the liquidation threshold is a tradeoff between the frequency of potential catastrophes and the magnitude of the catastrophes when they happen. A lower threshold lowers the occurrences of liquidations and the probability of cascading liquidation. However, it also allows the market value of the NFTs to fall much further before liquidation does occur, potentially amplifying the market impact and market fear during liquidation periods since the loans would be backed by less value than if the liquidation threshold were higher.

On (2), the adjustment of the auction period to 4 hours has its own set of tradeoffs too. On the one hand, it reduces the psychological overhang on the market from a two-day auction period, allowing crises to pass quickly. On the other hand, it could turn out to be a really poor user experience for borrowers since users might have to choose between 1) sacrificing sleep and compromising their lifestyle to constantly monitor the floor price and 2) running the risk of a liquidation whenever they are not actively monitoring.

On (3), this is probably the most unequivocal aspect of BIP#9. Like daily price limits in tradfi markets, a limit on the first bid price reduces reported volatility. It does this by stopping a transaction from occurring, compromising some users’ interests just to make things look better than they actually are. By removing artificial barriers to price discovery, users can transact faster and more easily. Nonetheless, one could argue that it could potentially amplify fears in down-trending markets through transparency of the true market state.

On (4), while high interest rates encourage borrowers to pay back the loan, a high floor price (as it is used in economics and finance, not the NFT space) distorts the market at the expense of borrowers. Users are thus likely to derive less value from using the protocol. More on this below when interest rates and spreads are discussed.

Although BIP#9 and the recapitalization of thousands of WETH restored ETH lenders’ confidence, the risk of cascading liquidation and other structural weaknesses have not been sufficiently resolved. Like commercial banks receiving central bank rescue packages, the can has probably just been kicked down the road.

1.3 P2P+P2POOL

About a year ago, DeFi lending giant Aave announced that it planned to enter the NFT marketplace as a collateralized lending platform. Recently, we found that Aave gave a grant to a new kid on the block — — OpenSky Finance — — which we think is trying to fix some problems in the NFT lending market.

OpenSky Finance’s P2P+P2POOL Innovation

OpenSky represents the innovative combination of the P2P and P2POOL models using the composability principle of DeFi. It builds on top of aave.com and incorporates time-based liquidation into the P2POOL model, which offers a significant user experience to borrowers (e.g., no longer have to worry about price-based liquidation). To further clarify, the P2P model typically does not require a liquidation mechanism because the pledged NFT is simply transferred by the smart contract to the lender if the borrower does not repay the loan on time. The P2POOL product deposits all idle funds with Aave, enabling lenders to earn both Aave income and interest from borrowers. The P2P product is then built on top of the P2POOL layer where lenders can use their pool deposits to fund bespoke loans to earn more with 100% capital efficiency. Bespoke loans are repaid directly to the lending pool so that lenders earn continuously and passively without any further action.

Comparison of NFT Lending Protocols

● Capital Efficiency

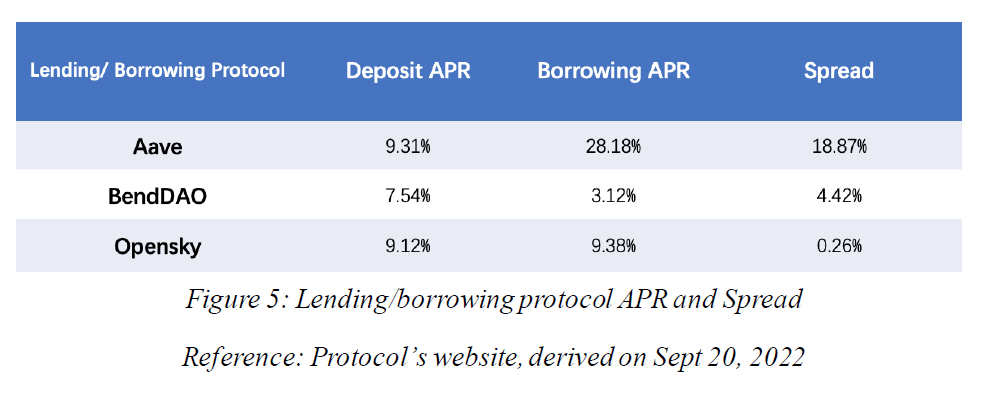

Through depositing all idle funds with Aave, Opensky allows 100% capital efficiency for all deposited funds. This is best demonstrated by comparing the deposit/borrow spread between OpenSky and BendDAO, one of the most established NFT lending protocols. OpenSky has a lower deposit/borrow APR than BendDAO. OpenSky’s spread is currently 0.26% while BendDAO’s spread is at 4.42%, a 4% difference. This implies that the average user will probably capture more value using OpenSky than BendDAO.

● Interest Rate Mechanism

OpenSky carries a fixed APR within a lending period, compared with floating interest rates in BendDAO and negotiated APRs in P2P lending protocols. The fixed interest rates would probably provide a better user experience by offering greater predictability to both borrowers and lenders. The greater predictability arises from the absence of volatility in interest rates. Lenders no longer have to worry about a fall in interest rates during the lending period, which would result in expected returns falling short. Borrowers are also spared the anxiety and the nightmarish scenario of sudden triple-digit spikes in rates.

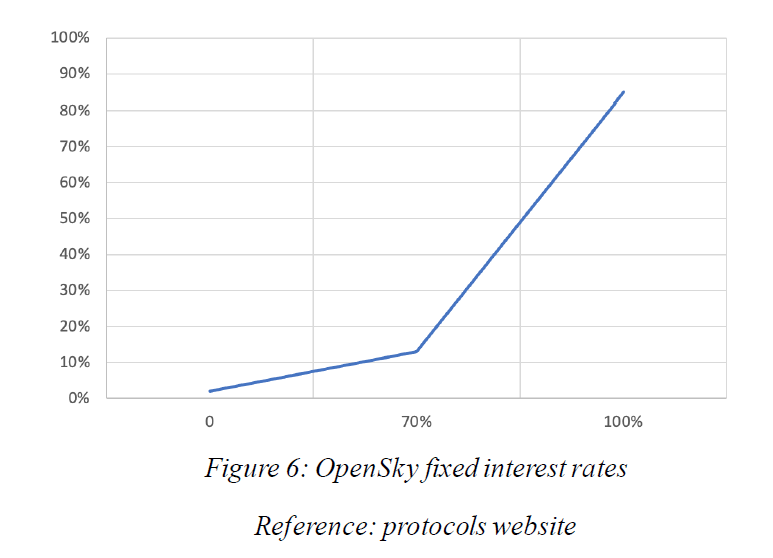

The graph below shows OpenSky’s lending rates at the corresponding levels of capital utilization. The X-axis represents capital utilization rate while the Y-axis shows the borrowing APR. When capital utilization is below 70%, the APR is between 0–13%. When capital utilization is between 70%-100%, the APR is between 13%-85%, in order to discourage drains of the ETH liquidity pool.

Summary

To sum up, OpenSky 1) improves capital efficiency by depositing all idle funds with Aave, 2) uses fixed interest rates to avoid rising repayments due to sudden increases in variable rates, and 3) offers an attractive borrow APR, at least for the moment.

However, OpenSky went live on Ethereum only recently, with a small user base and relatively low but growing TVL. However, it has not launched its SKY governance token to incentivize users to engage in borrowing and lending activities. The token should help them gain market share in the promising niche of NFT Finance.

2. Time-based Liquidation and Price-based Liquidation

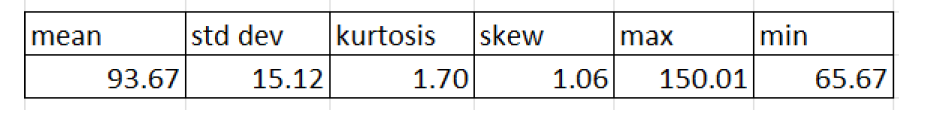

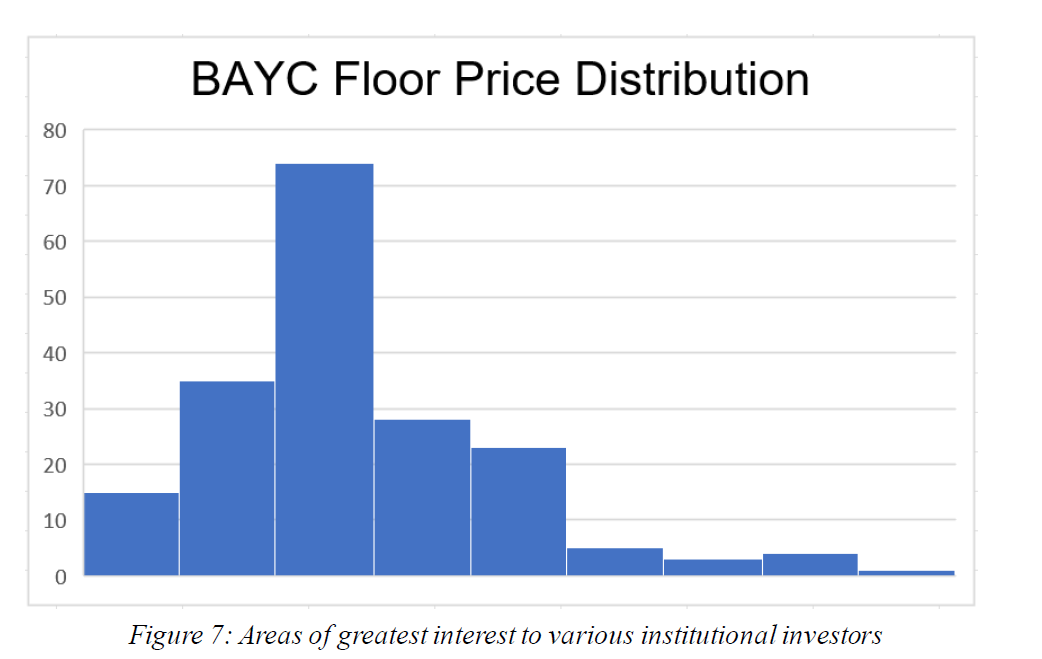

To better appreciate the differences between the price-based liquidation mechanism employed by most NFT lending protocols, and the time-based liquidation mechanism introduced by OpenSky, it would be instructive to look at the statistical distribution of the floor price for BAYC. The data from February 21, 2022 to August 27, 2022 suggests that the distribution is pretty close to that of a normal distribution, with a skew of 1.06 and a kurtosis of 1.7.

Assuming that the future will look pretty much look like the past, the data suggests that surprises are equally likely on both sides of the market, while the observations are mostly closer to the mean than would have been with a perfect normal distribution.

To illustrate with an example, assume the following:

-

That a user borrowed 40% of the floor price of 150 ETH i.e. 60 ETH

-

A borrowing APY of 5%

-

The user in question does not pay back any interest

-

A liquidation threshold of 90%

In this case, the calculation after a year is as follows:

Assuming a normal probability distribution,

(Roughly 5% of the observations should fall outside of 2 standard deviations from the mean)

2 standard deviations = 30.24 ~ 30 ETH

Given a mean price of around 93 ETH, there is a 2.5% chance that the floor price could fall to 63 ETH or below (93–30)

Health factor

= 63 * 90% / (60 ETH + interests)

= 63 ETH / 63 ETH

= 1

Which is the liquidation threshold!

Source: BendDAO

Based on the characteristics of the normal distribution, there is roughly a 2.5% chance that the user could get liquidated in a year after borrowing 60 ETH, based on an initial floor price of 150 ETH.

In comparison, a time-based liquidation does not take into account the price movements after the user borrows, based on the initial floor price of 150 ETH. As long as the user pays back his loan on time (or within the grace period of 48 hours), no liquidation occurs and the user gets to keep his BAYC NFT. The unwieldy mechanics of price-based NFT liquidation is thus easily circumvented.

●Weaknesses

OpenSky’s time-based liquidation mechanism is not perfect either. It is susceptible to manipulation and its stability comes at the expense of the lenders.

● Manipulation

The manipulation argument should be relatively straightforward. A whale or a syndicate holding enough NFTs within the series can corner the market by buying the pending orders on the NFT series on OpenSea and LooksRare to manipulate the floor price feeds from oracles. This cornering operation would raise the floor price, thus allowing the whale or syndicate to use the higher floor price to borrow more, probably without the intention of returning the loan. This is not a problem unique to OpenSky though.

● Risk of Untimely Liquidation and Permanent Loss of Value

The notion that the protocol’s stability comes at the expense of the lenders is simple to grasp too. A time-based liquidation mechanism deprives the lender or the lending pool of the opportunity to liquidate an NFT on a potential defaulter, while the market is still willing to make the lender whole. OpenSky is aware of this potential disadvantage to lenders, and is working on separating the lending and liquidation process. It is establishing a LiquidationDAO to pre-fund potential liquidations and hold acquired NFTs in the DAO’s treasury, with future asset sales decided by DAO votes. In the event of a crash or an event leading to significant permanent loss in value, the lender would forego a timely liquidation especially if the borrower is almost guaranteed to default.

3. Outlook

Two main problems plague the NFT lending sector — low loan-to-value ratio (LTV) and low confidence in oracle accuracy. In fact, the two problems are interlinked. The low LTV is a result of the low confidence that users and protocols have in the NFT pricing accuracy of oracles. The only exception to the rule would be the rising class of debt NFTs, which can be easily valued using some form of discounted cash flow model, like their tradfi counterparts.

Non-fungibility

The low pricing accuracy of the oracles lie mainly in the very nature of the things that give NFTs their value — their non-fungibility. Unlike their fungible brethrens, an NFT is unique and differentiated from every other NFT, even within the same series. Hence, the easy solution of using the last traded price or the floor price within the series is at best just a compromise.

Lack of Data

The lack of data is two-fold, in traded data for immediate price discovery and training data to train the oracle models. For the former, the frequency of trades even in a blue-chip NFT series like BAYC is abysmally low, averaging about 20 per day and sometimes not clocking any trade for several days in a row, resulting in stale quotes. For the latter, the total number of trades and the distribution of trades for most NFT collections barely qualify for statistical significance.

Increasing Data Points

The increased prevalence of NFTs and the addition of NFT trades into compliant databases should improve the effectiveness of NFT price oracles over time. However, given the uniqueness of every individual NFT, additional data points can probably only improve the approximation of prices at any point in time to a very rough degree. The precision would probably never rival that of fungible tokens, but better approximation, coupled with innovative mechanisms such as time-based liquidation, should help improve the efficacy of NFT lending protocols. In the words of the great market philosopher John Maynard Keynes, “It is better to be roughly right than precisely wrong.”

4. Reference

1. https://nftfi.medium.com/3-lending-strategies-on-nftfi-com-dad12c757c5d

2. https://dune.com/rchen8/NFTfi

3. https://openskyfinance.medium.com/opensky-finance-is-live-on-ethereum-47bd7efcc7b9

About X Research DAO

X Research DAO is a community-based research DAO backed by Huobi Research. It aims at being one of the most valuable decentralized blockchain-analysis insitituions in the world. X research DAO focuses on analysing web3 projects, early stage public-chains, gamefis and NFTs.X Research DAO welcomes all web3 enthusiasts, let’s build the best research DAO and learn together!

Join us:

Website:https://www.xresearchdao.xyz

Twitter:https://twitter.com/XResearchDao

Telegramm:https://t.me/xresearchdao

Discord:https://discord.gg/S52jJT9NSp

Youtube:https://www.youtube.com/channel/UCHBeMdxOnoU6zo3mbVd1MKg/featured

Notion:https://bit.ly/3AjGNlq

Mirror:https://mirror.xyz/0x9045237C0248AA32A758635f9E5d8A47f1460702/

Disclaimer

-

The author of this report and his organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report.

-

The information and data cited in this report are from compliance channels. The sources of the information and data are considered reliable by the author, and necessary verifications have been made for their authenticity, accuracy and completeness, but the author makes no guarantee for their authenticity, accuracy or completeness.

-

The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment and other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report, unless clearly stipulated by laws and regulations. Readers should not only make business and investment decisions based on this report, nor should they lose their ability to make independent judgments based on this report.

-

The information, opinions and inferences contained in this report only reflect the judgments of the researchers on the date of finalizing this report. In the future, based on industry changes and data and information updates, there is the possibility of updates of opinions and judgments.

-

The copyright of this report is only owned by X Research DAO. If you need to quote the content of this report, please indicate the source. If you need a large amount of references, please inform in advance (see “About X Research DAO” for contact information) and use it within the allowed scope. Under no circumstances shall this report be quoted, deleted or modified contrary to the original intent.