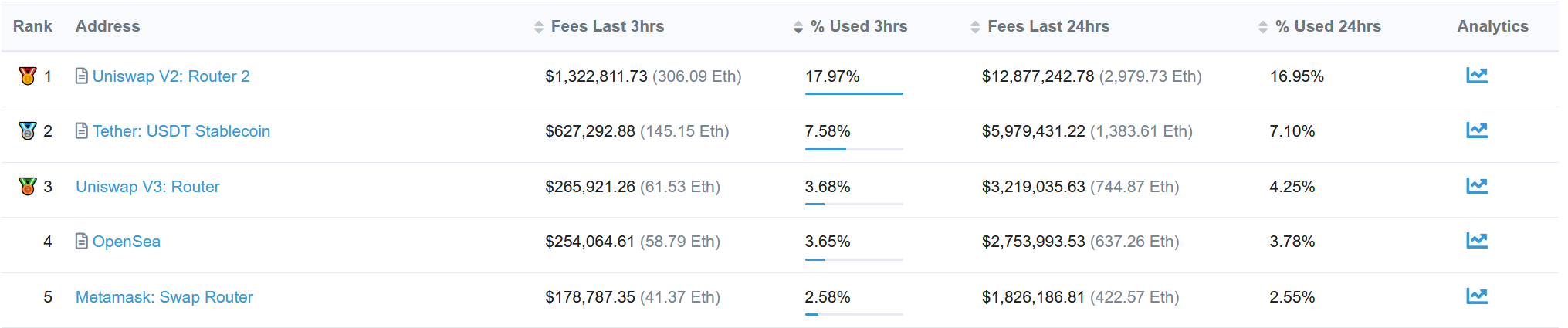

Hello everyone, glad to be back for the next edition of Future Friday where we discuss the upcoming week in the metaverse. Normally my focus is on NFTs, but my research for this upcoming week was unfortunately very fruitless - it seems that NFTs are currently in a coma and waiting for volume to leave the memecoin environment and start flowing back towards the NFT world. As you can see below, over the last few weeks volume has been steadily declining with a massive -60% drop in just the last 24 hours alone. This, coupled with the massive rise in gas fees for SHIB and Uniswap indicates that retail frenzy is driving most of the volume towards shitcoins, causing ETH gas prices to surge to over $200 per ERC transaction. This is probably one of the larger contributing factors towards the massive decline in NFT transactions lately, as fewer people are willing to gamble on mints when gas is so expensive.

Additionally, my research on upcoming projects didn’t yield me many results on things worth discussing, leading me to believe that over-saturation is another headwind in NFT land, and we’ll probably see more contraction and consolidation around proven, quality projects over the next few weeks. Therefore, this week’s Future Friday post will focus on DeFi instead of NFTs.

For those that know me, my true professional expertise actually lies with DeFi and DAOs whereas NFTs are more of an interest of mine that I’ve been writing about for fun. This, combined with the fact that we’re seeing some massive growth in new forms of DeFi protocols (a.k.a. DeFi 2.0) leads me to want to share with you some cool interesting protocols that might be worth investigating. If you want an introduction into DeFi 2.0, see my previous post linked below.

Assuming you’re already aware of DeFi 2.0 (or that you’ve read the above article), I’d like to talk a bit about several new developments in the DeFi universe. First and foremost, it’s important to note that Ethereum is still the undisputed king of decentralized finance - over 95% of total value locked (TVL) in pools, farms, and various protocols is in the Ethereum ecosystem. However, this doesn’t mean that it’s the only viable option. There are many other promising blockchain ecosystems that have a burgeoning DeFi scene, and this is primarily what we’re going to discuss today. In order to fully appreciate the topics at hand, I recommend you become familiar with the following concepts if you aren’t already, as they won’t be covered in this post:

- Bridging from Ethereum to another blockchain

- Staking funds and earning liquidity provider (LP) tokens

- Layer 1 vs. Layer 2 vs. Layer 0

- Bonding and protocol-owned liquidity

If you’re familiar with all of the above, then let’s dive into a few of the cool upcoming projects I’ve been looking at. Remember, none of this is financial advice - the purpose of this post is purely educational. Do your own research and do not invest more than you can comfortably afford to lose.

Secret Network (SCRT)

The Secret Network (SCRT) is a blockchain that has actually been in development for over 3 years, but has been low on the radar profile until very recently when the price of their proprietary token started surging in October. The Secret Network is a smart contract-capable blockchain that utilizes the Tendermint protocol (the same as Cosmos) to achieve higher scalability and throughput than currently available on Ethereum. However, scalability isn’t the primary selling point here. As the name suggests, the Secret Network is a privacy-preserving dApps platform that allows for fully private transactions and smart contracts that are provably secure and entirely private.

One of the major draws of permissionless blockchain ecosystems is their public auditability, so why is Secret such a big deal? Well, the community can easily audit smart contracts deployed to the blockchain and ensure their safety, but the contents of transactions are (optionally) entirely private. The Secret Network achieves this via its decentralized network of specialized hardware nodes that create secure computation environments called Trusted Execution Environments (TEE’s) that not even the node operators cannot access. The data is computed securely off-chain in these contained nodes, and then securely broadcast to the network without ever revealing their contents.

This enables fully privatized decentralized finance, which of course is going to be a major step forward for secure and discreet transactions. I must admit that the lack of transparency might attract bad actors to the chain as it will become trivial to disguise the movement of capital throughout the network, but private DeFi was always an inevitability and the Secret team has created a very polished and high-quality product.

There are a few places to visit once on the Secret Network, but the first is Sienna. Sienna (and their SIENNA token) is the premier DEX for the Secret Network. By changing your SCRT tokens into sSCRT (secret Secret) you can initiate fully privatized swaps and stake your tokens in secret pools where no prying eyes can see the details of your wallet or transaction. The SIENNA token has been growing rapidly in the last few weeks, and is poised to become a significant player in the Secret ecosystem. The SIENNA token hasn’t dramatically pumped yet, but is on a steady and consistent grind upwards and I am very optimistic about its future.

Avalanche (AVAX)

The Avalanche (AVAX) network is an alternative blockchain to Ethereum that uses its proprietary Avalanche Consensus (Proof of Stake) mechanism to secure the protocol. It boasts the fastest time to transaction finality in the industry with a roughly 2.5s time to finality, as compared with 3-5s with Solana and 10-60s or more with Ethereum. Avalanche is fast, and not only is bridging easy, it’s cheap. The average transaction on Avalanche costs between $0.10 to $0.60, meaning lightning-fast swaps into and out of any project you want. The first place you should stop when on the Avalanche chain is Trader Joe. From here you can transfer your AVAX into any token you like, just like with every other major DEX, and the first two I recommend are listed below:

- $JOE, the token for the Trader Joe DEX, has been on a moon mission lately that experienced a meteoric rise from below $0.05 at launch to over $4.00. Of course, most moon missions such as this are unsustainable, but JOE has retested supports around $2.00 and has held consistently well with strong volume (see chart below)

-

Wonderland ($TIME) is the first major OlympusDAO fork and is the biggest DeFi project on Avalanche by far. With over $800m in assets and an eye-watering 67700% APY, staking TIME is one of the easiest plays of the year. TIME has a strong and active community behind it, similar to the OlympusDAO, and is affiliated with Daniele Sesta who is a proven code-writing machine. Daniele is the creator of (or a major contributor to) numerous major DeFi projects including TIME, SPELL, MIM, and ICE. A character to follow on Twitter, his ability to pump out complex smart contracts and build strong communities around robust protocols is encouraging for anybody that is looking to get involved in the next generation of DeFi.

Going back to Wonderland, there’s not a huge difference between the mechanics of Olympus (OHM) and Wonderland (TIME), but TIME is being built specifically to cross blockchain ecosystems with a vision for an inter-chain staking, lending and bonding protocol to provide sustainable liquidity for DeFi apps across various ecosystems. Remember from my previous post that OHM (and by extension TIME) is backed by a basket of assets, where the price of TIME cannot fall below the value of this basket. Unlike other DeFi protocols that rent their liquidity from anonymous stakers, TIME owns all of its liquidity and therefore does not suffer from the problems that plague other DeFi protocols. (Be sure to read the “What is DeFi 2.0” article above if you want more information.

Either way, with TIME’s huge APY rewards (you currently double your staked tokens roughly every 30 days) it’s an excellent way to make passive money while also profiting from the hype as the token price continues to soar. Visit app.wonderland.money after bridging to AVAX and buying TIME on TraderJoe to stake.

Harmony (ONE)

The last ecosystem we will look at today is Harmony (ONE). Many of you should be familiar with Harmony, as it’s a fast and cheap protocol that has a smaller market cap than its main competitors, including Avalanche and Fantom. Harmony is EVM compatible, meaning that Ethereum smart contracts are fully compatible in the Harmony ecosystem, but it’s actually based on a fork of the Binance Smart Chain - meaning it’s also directly compatible with BSC projects.

However, my focus isn’t on Harmony itself, but on one of the most promising DeFi projects I’ve seen to date.

DeFi Kingdoms

DeFi Kingdoms (from here on out referred to as DFK, though their token is called $JEWEL) is a decentralized exchange, liquidity pool, and an NFT marketplace all wrapped up in a shiny RPG game in your browser. In this app you can swap coins at the Marketplace (DEX), stake your coins at the Bank, plant your LP tokens in the Garden for extra rewards, and hire or summon playable NFT heroes that allow you to complete quests, earn tokens, and summon new heroes through the Portal from beyond the ether!

DFK has turned DeFi into a playable experience where not only are you earning money for providing liquidity for users on the Harmony blockchain, you’re also able to earn rewards for putting more effort into the game. The primary token is $JEWEL, which can be earned via staking or via playing the game. There exists a secondary currency in-game called Tears, which are earned by actually playing the game and are used to summon and empower your heroes.

Your heroes are playable NFTs that can be bought or sold on DeFi kingdom’s own marketplace (located in the Tavern). These heroes are similar to heroes you find in other video games, which have their own stats (strength, wisdom, endurance, etc.) and professions (right now you can be a miner, fisher, gardener, or forager) which provide bonuses when completing in-game quests and bounties.

The game is currently in a nascent stage, but buying some $JEWEL on Harmony and staking in the bank alongside some $ONE and coming back in 6 months is probably a very solid moonshot strategy. The token is brand new and has tremendous upside potential, and is growing quickly. This game still has plenty of room to grow, but has complex documentation that you can read in order to learn more on how to play the game. I will be doing a deeper dive specifically into DFK in the near future, but until then you can find my Wizard Warrior lurking about in the kingdom somewhere!

That’s it for the Future Friday post. I could write a novel about each of these protocols, but luckily for me that’s what the documentation is for. If you are interested in any of these projects, visit their linked websites and be sure to dive into their documentation before making a decision. I wouldn’t vouch for these if I didn’t already do so myself, and it should also be made known that I personally have money in all 3 of these projects. Do your own research, never spend more than you can afford to lose, and always feel free to ask me more questions!

Until next time!