All funds raised via NFT sales go directly back to our contributors each week. Thank you for supporting community-driven crypto analytics! 🤝

About the editor: Spencer Noon is General Partner at Variant, a first-check crypto VC fund. DMs always open for entrepreneurs.

Click here to subscribe to the newsletter and get issues delivered straight to your inbox each week.

Our Community Is Hiring

DATA SCIENCE

- Dune Analytics is hiring a Crypto Data Specialist

- Edge & Node is hiring a Data Scientist

- 0x is hiring a Product Analytics Data Scientist

ENGINEERING

- Gearbox is hiring for multiple engineering roles

- Phantom is hiring a Senior iOS / React Native Engineer

- Sense is hiring a Senior Front End Engineer and a Senior SC Engineer

BIZ DEV & OPS

- Aleo is hiring a VP of Marketing

- Yield is hiring for a Go To Market Lead

EDITOR’S NOTE

- Don’t see your ideal role? Fill out my talent form and I’ll personally do my best to connect the dots with top projects in our community.

This week our contributor analysts cover NFTs: Axie Infinity, Mirror, and NFT Bots.

① Axie Infinity

👥 Joel John & Jiho

📈 Cumulative Volume On Axie Infinity Crosses $1B

👉 Axie Infinity community on Discord

📌 Sky Mavis job board

🔎 Check out the dashboard

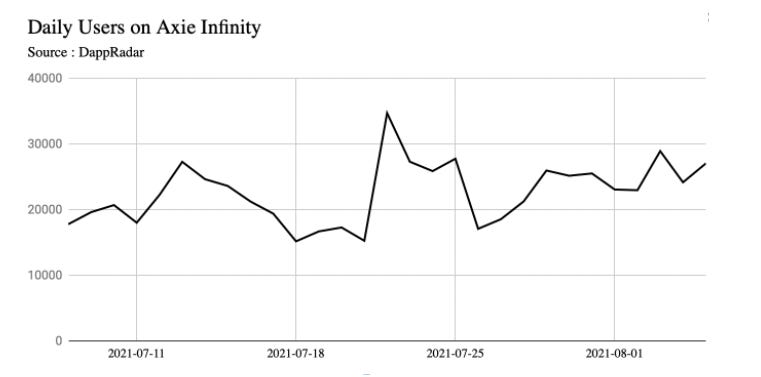

- Axie Infinity has steadily seen around 25,000 daily users with on-chain transactions over the past month. Important to note, these are users who made a transaction through a wallet. The 25,000 figure is fairly higher than the average AMM or DEX, which tends to see around 5,000 users per day day. The team at Axie Infinity claims to have ~1 million DAUs, therefore a ~2.5% user count doing active wallet interactions is a rather healthy indication. (Source: DappRadar)

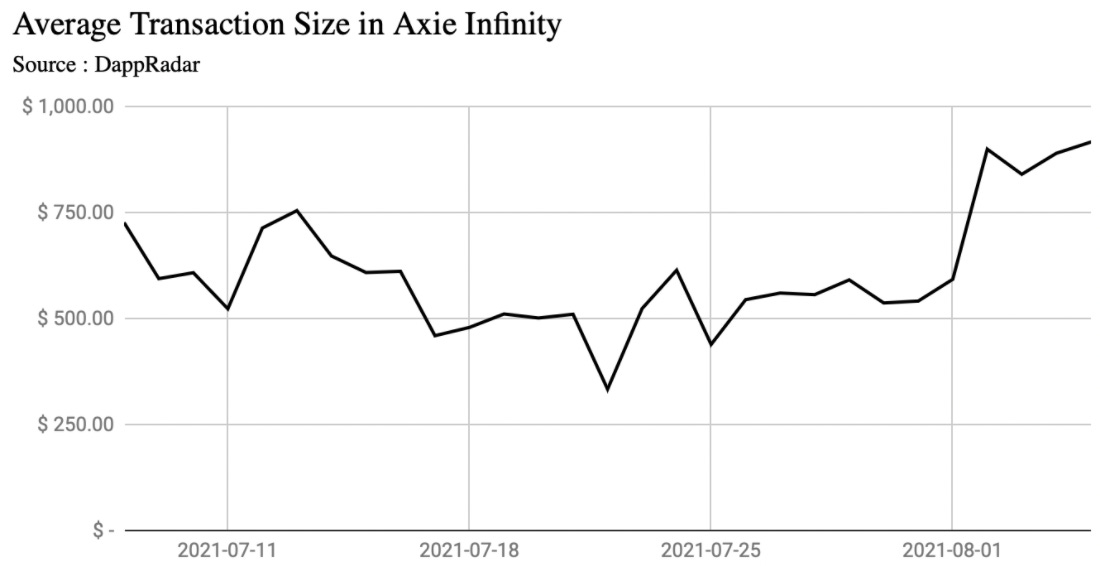

- The average transaction size on Axie Infinity today is north of $500, which shows that spam transactions have not taken over the network just yet. The average user engaging with wallets on Axie Infinity completes 1.4 transactions on a given day. (Source: DappRadar)

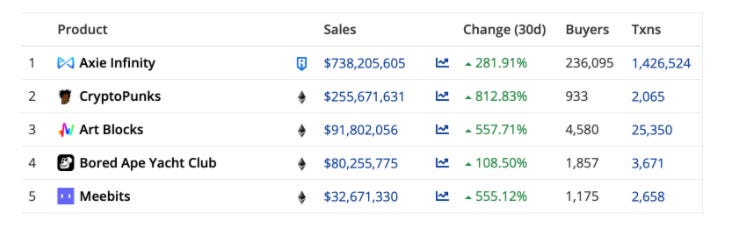

- The data is further supported by the fact that Axie Infinity ranks the highest among NFT sales according to Cryptoslam. At north of $700 million in NFT sales across a quarter million buyers, the project is in a league of its own. (Source: Cryptoslam)

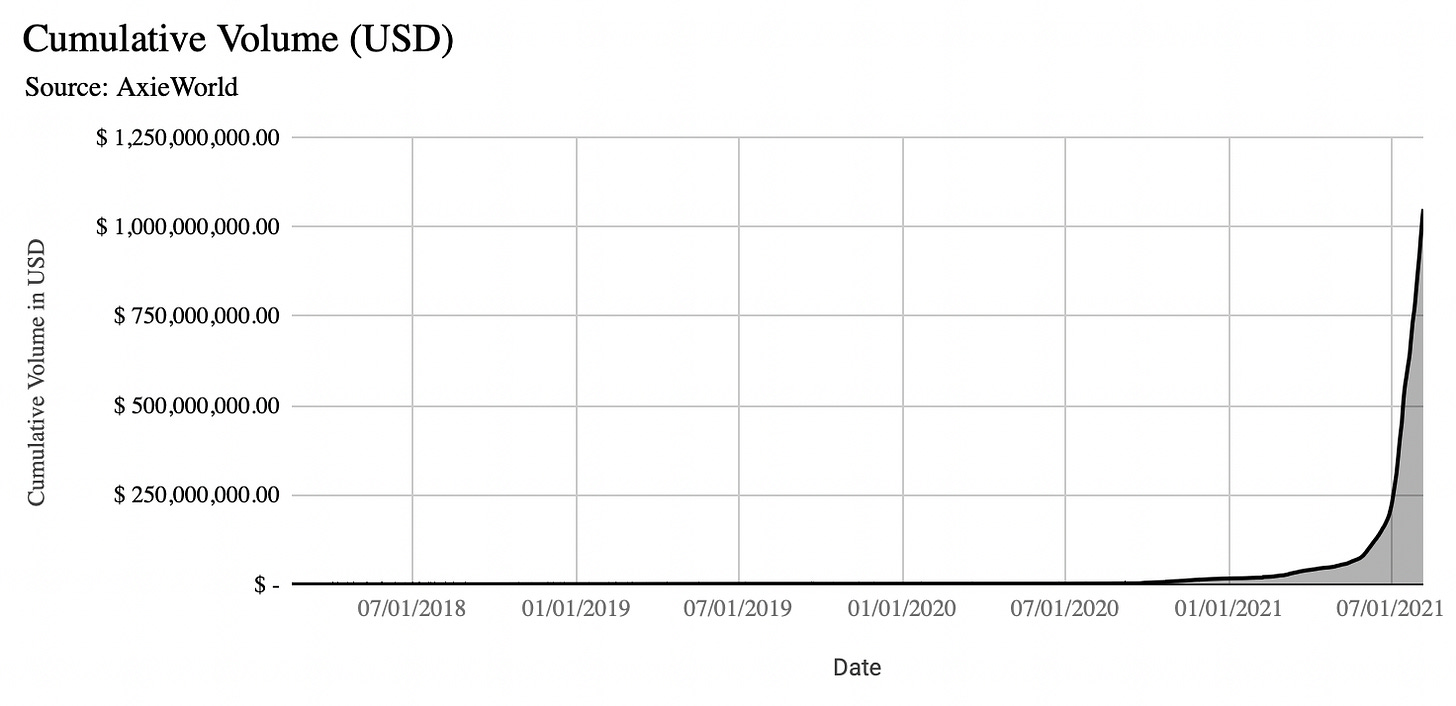

- This rapid rising interest has translated to exponential growth in on-chain volume. According to Axie Infinity’s data, the cumulative volume of assets transacted in Axie crossed north of $1 billion in the past month. While much of it has been in the recent past, the chart is a testament to the perseverance and grit of the team over the years. Axie Infinity is proof that product market fit kicking in can lead to exponential growth. (Source: AxieWorld)

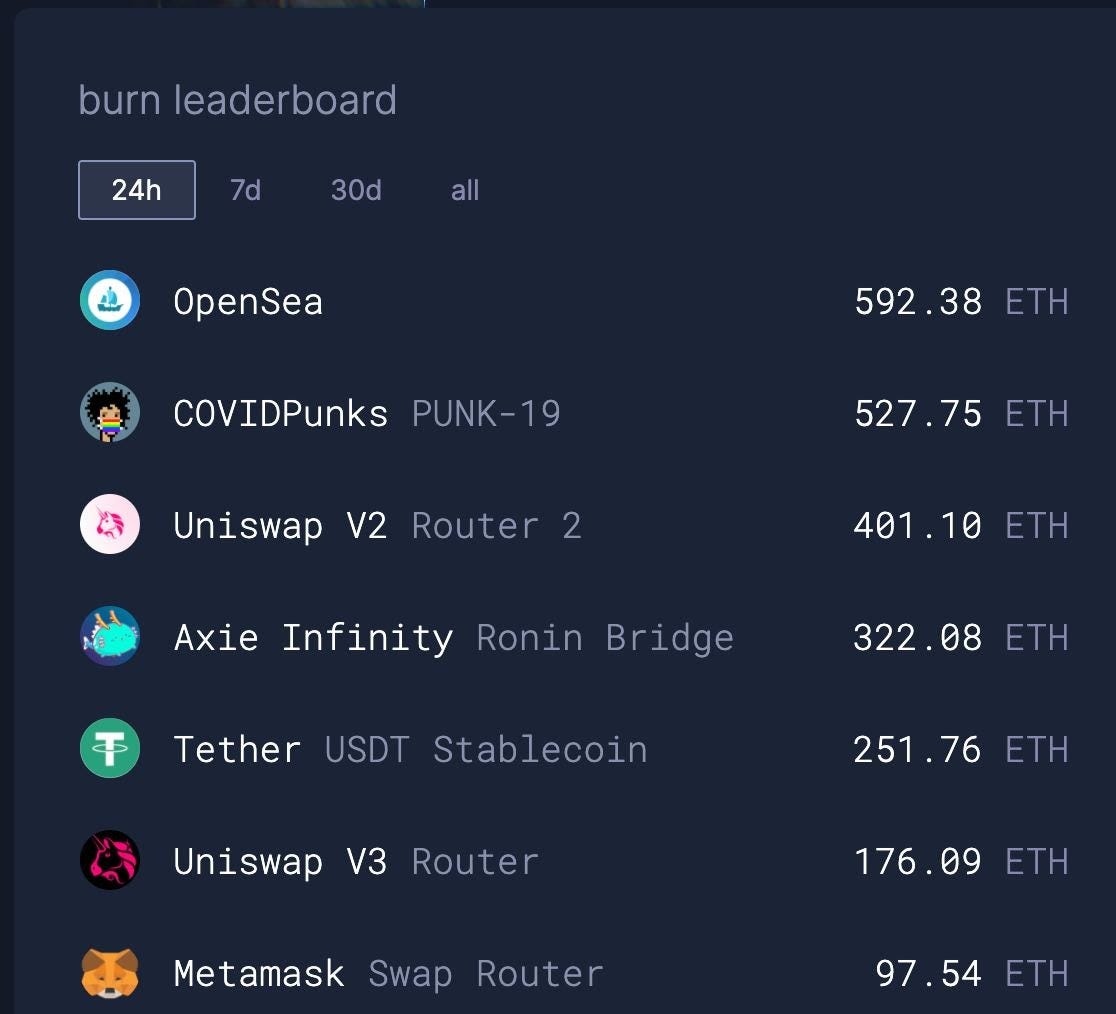

- The traction Axie Infinity has achieved also benefits Ethereum as a network. According to Nansen’s gas tracker, Axie Infinity alone accounted for ~9% of all gas consumed in the last seven days. (Source: Nansen)

-

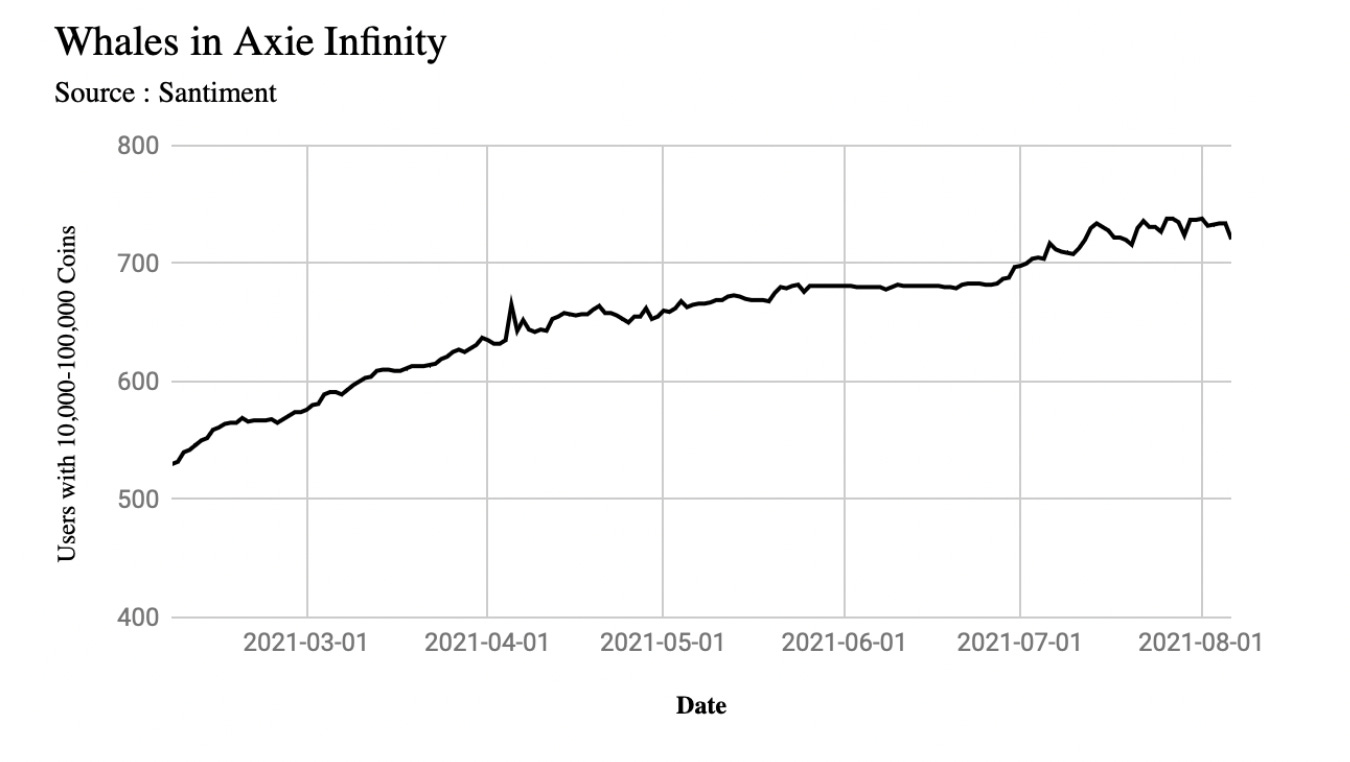

Finally, when examining the activity of large wallets, the number of addresses exiting Axie Infinity over the past few months was quite low. Close to ~200 wallets have accumulated north of 10,000 tokens over the past six months. The recent price rise has not translated to a sell-off among the large wallets.

Part of the reason for this may be due to the fact that creating cash flow out of Axie Infinity tokens is possible through programs like those offered by YGG, standing as a proof-point that individuals building a position in Axie still believe there is long-term upside despite the recent massive rally. (Source: Santiment)

② Mirror

👥 Andrew Hong

📈 1850+ ETH Raised by Creators and Communities

🏁 Join the Write Race

🔎 Check out the dashboard

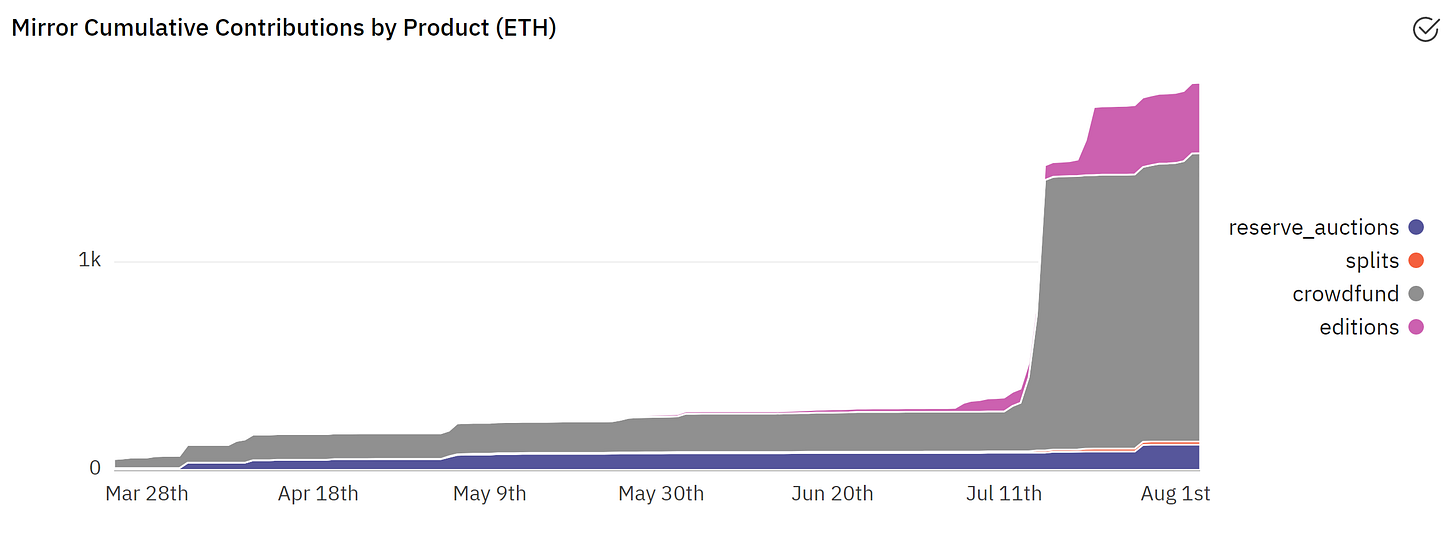

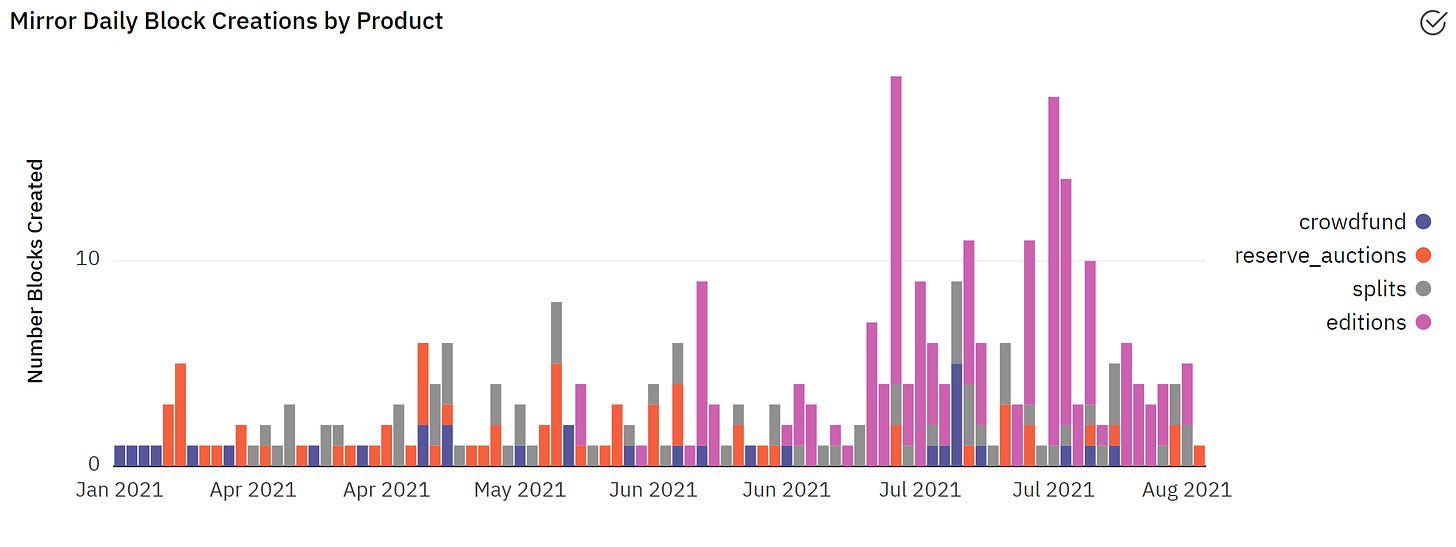

- Mirror is a crypto-based publishing platform that aims to connect creators directly with their audience using a combination of Web2 and Web3 native tooling. Writers gain access to the platform by entering the $WRITE race, which occurs every Wednesday at 3pm - 5pm EST. Mirror's current main products for allowing creators to raise funds are editions, crowdfunds, reserve auctions, and splits. Each of these are smart contracts, with multiple iterations of each to date. (Source: Dune Analytics)

- Editions have become the most popular product that Mirror creators use, due to the product’s flexibility in creating tiered NFT editions (i.e. with rarities) as well as linking editions directly to crowdfund blocks. (Source: Dune Analytics)

-

Mirror links users data across governance ($WRITE race), Ethereum interactions (across various creator blocks), and Twitter conversation threads. Aggregating this data allows the use of "Betweenness Centrality" to create a community-specific reputation score (highest ranked are the red dots below).

Click here to learn more about community-specific reputation scoring on Mirror.

③ NFT Bots

👥 Drake Danner

📈 NFT Purchasing Bots Are Producing 50+ ETH Profits

🔎 Check out the dashboard

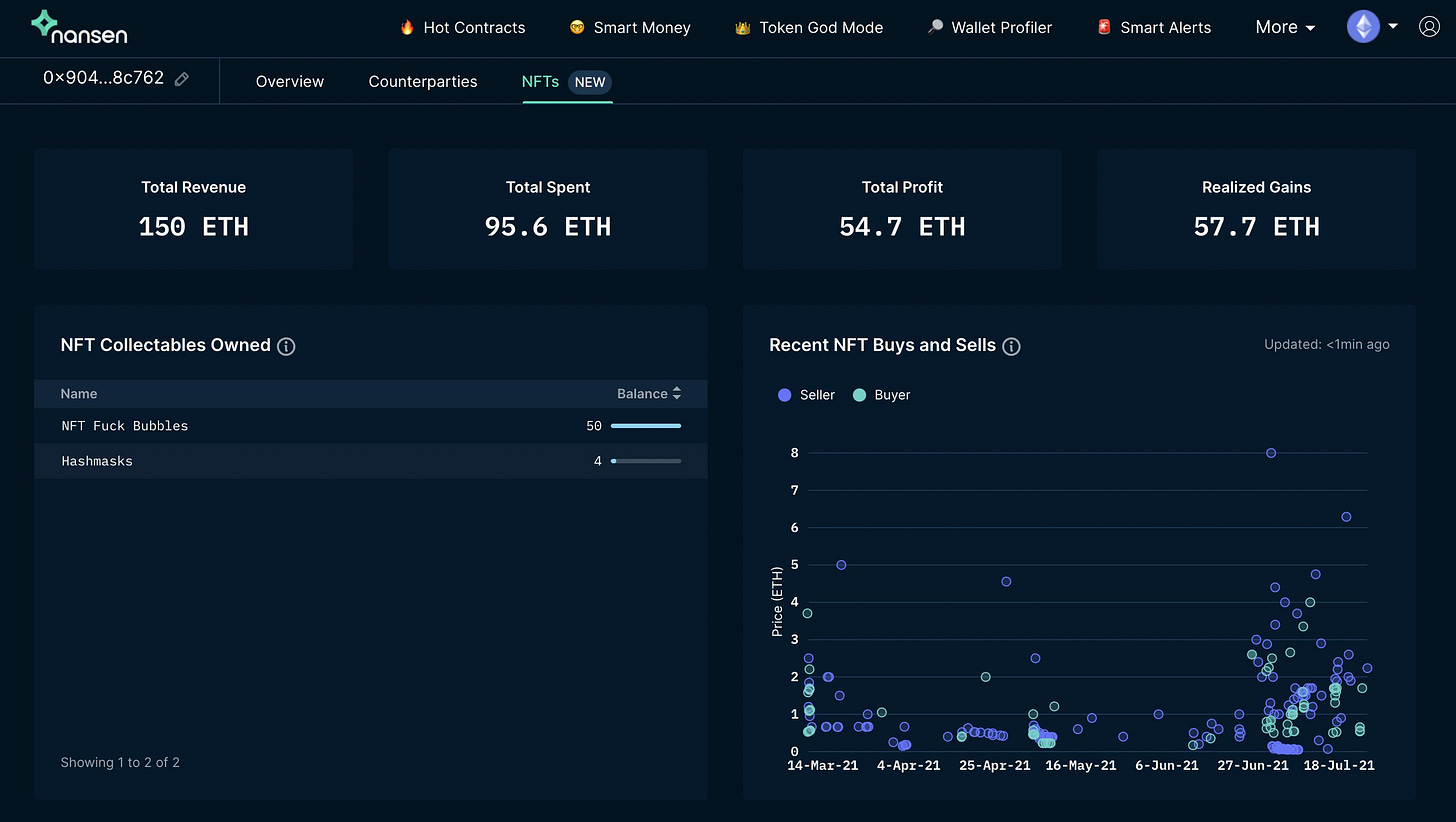

- On OpenSea, it is not hard to notice that nearly all items in popular collections have bids far below the floor price. After observing behavior and speaking to community members, it becomes clear that these bids are placed by bots and that the bots relist these items at the lowest current ask. Some bots have cleared over 50 ETH in profit. While I have not identified all known bots, purchases made by a number of bots compared to other purchases show how bots are able to turn profits over 600 ETH. (Source: Nansen)

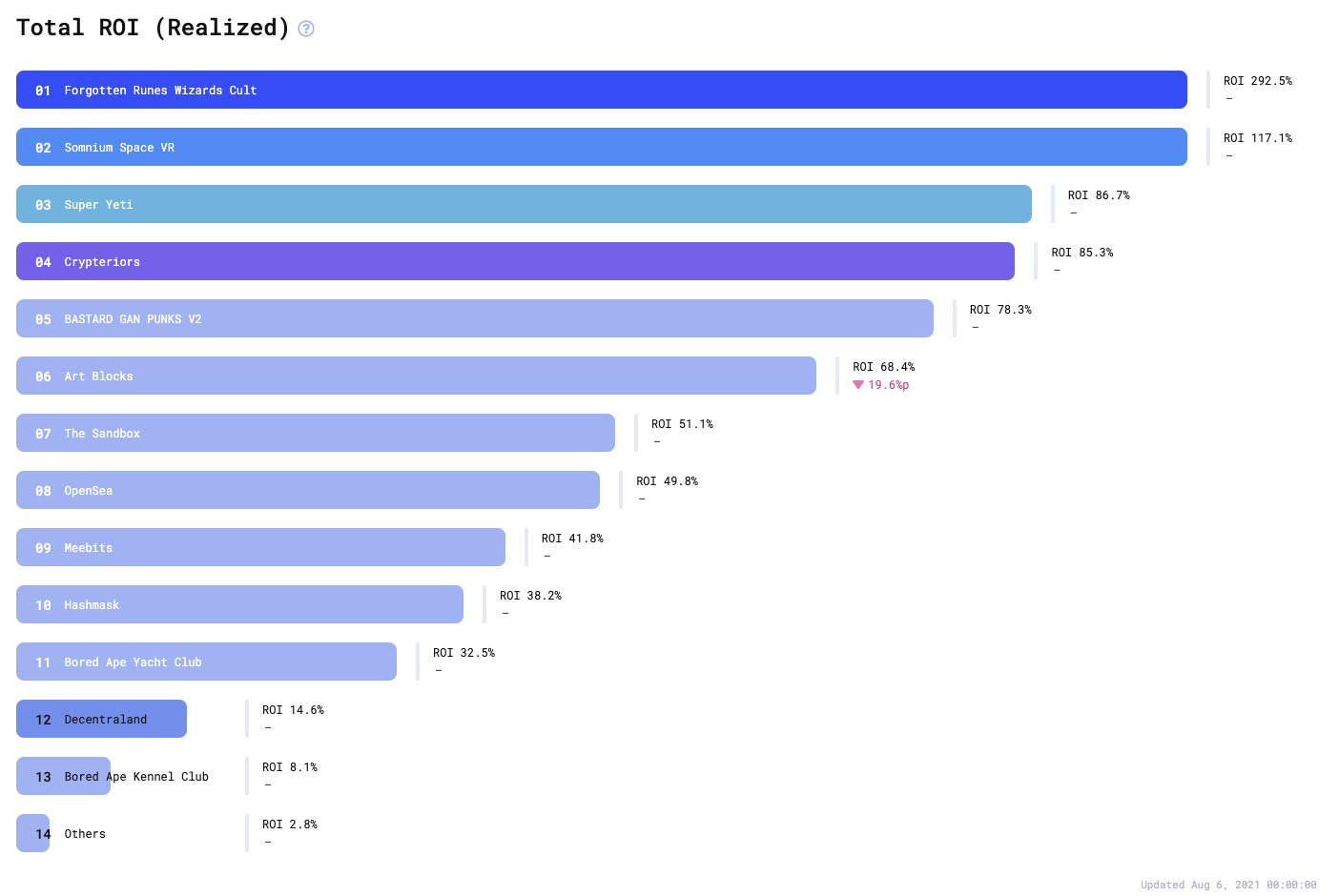

- Dr_Burry1, a well known NFT bot, has produced over 60 ETH in profit and has realized ROIs in the triple digits. The top ROI by project for this bot is the Forgotten Runes Wizards Cult, at 292.5%. Dr_Burry1 is accompanied by Dr_Burry and Dr_Burry2, and their accounts can be analyzed on NFTBank.ai. (Source: NFTBank.ai)

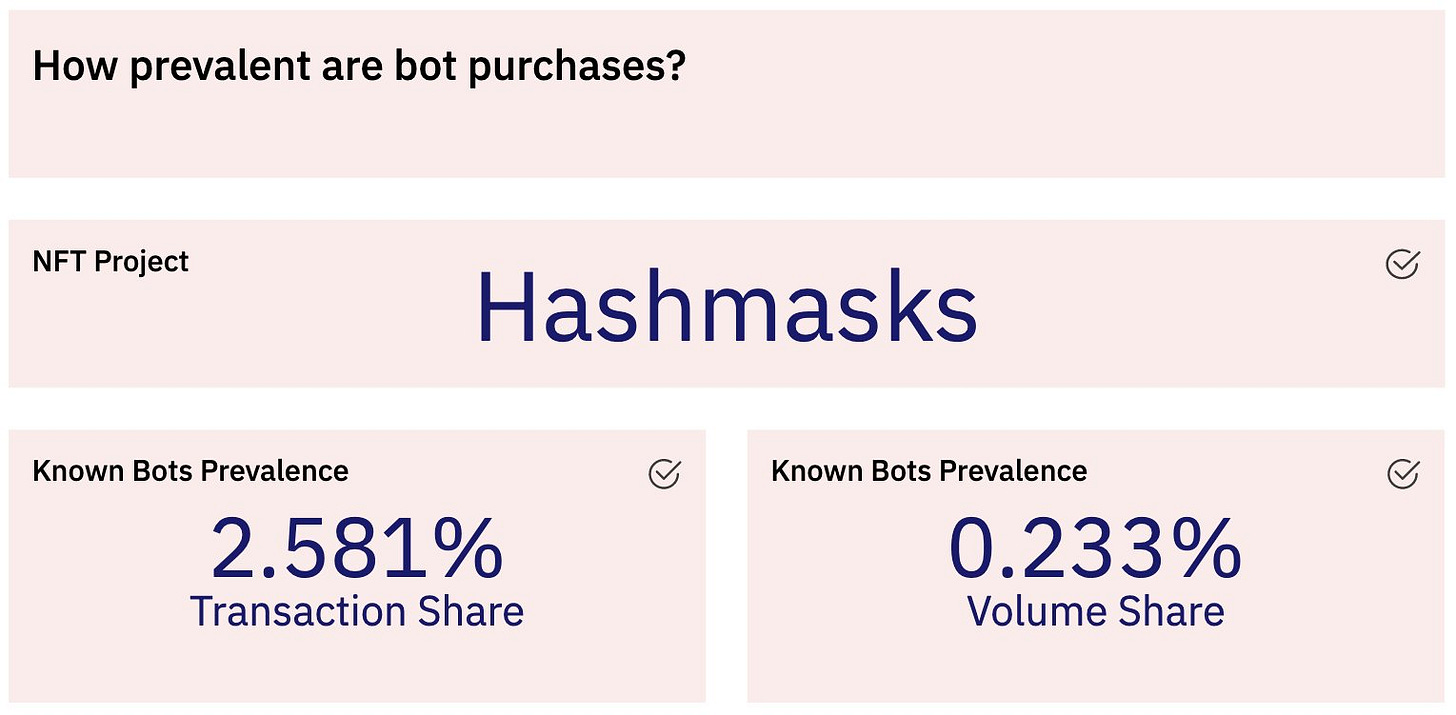

- Bot bids are pervasive throughout OpenSea, but the purchase transaction share from identified bots is small and concentrated. The highest involvement on a per project basis is Hashmasks, with identified known bots accounting for 2.6% of secondary market purchases and 0.23% of total ETH volume. (Source: Dune Analytics)

About the editor: Spencer Noon is General Partner at Variant, a first-check crypto VC fund.