This is issue #80 of the on-chain analytics newsletter that reaches nearly 12k crypto investors every week 📈

About the editor: Spencer Noon is General Partner at Variant, a first-check crypto VC fund. DMs always open for entrepreneurs.

Our Community Is Hiring

-

Phantom is hiring a Senior iOS / React Native Engineer (Link)

-

Goldfinch is hiring a Senior Software Engineer (Link)

-

Yield Protocol is hiring for a Go To Market Lead (Link)

-

Don’t see your ideal role? Fill out my talent form and I’ll personally do my best to connect the dots with top projects in our community.

This week our contributor analysts cover DeFi: Yearn, 0x, 1inch, and Opyn.

① Yearn

📈 Yearn Surpasses $30M In Protocol Revenue

👉 Participate in Yearn Governance

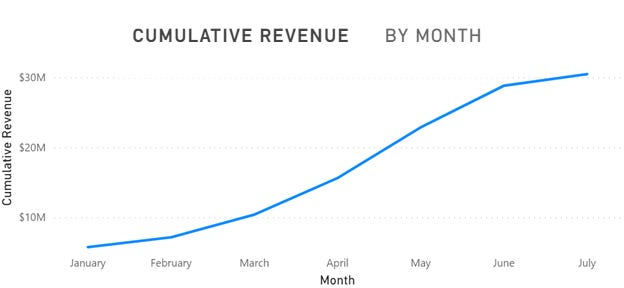

- Yearn has surpassed $30m in protocol revenue since launch on the back of strong growth in the first half of 2021. Yearn earned more than $23.9m in protocol revenue in H1’21, ~5x greater than all of 2020’s protocol revenue combined. (Source: yfistats)

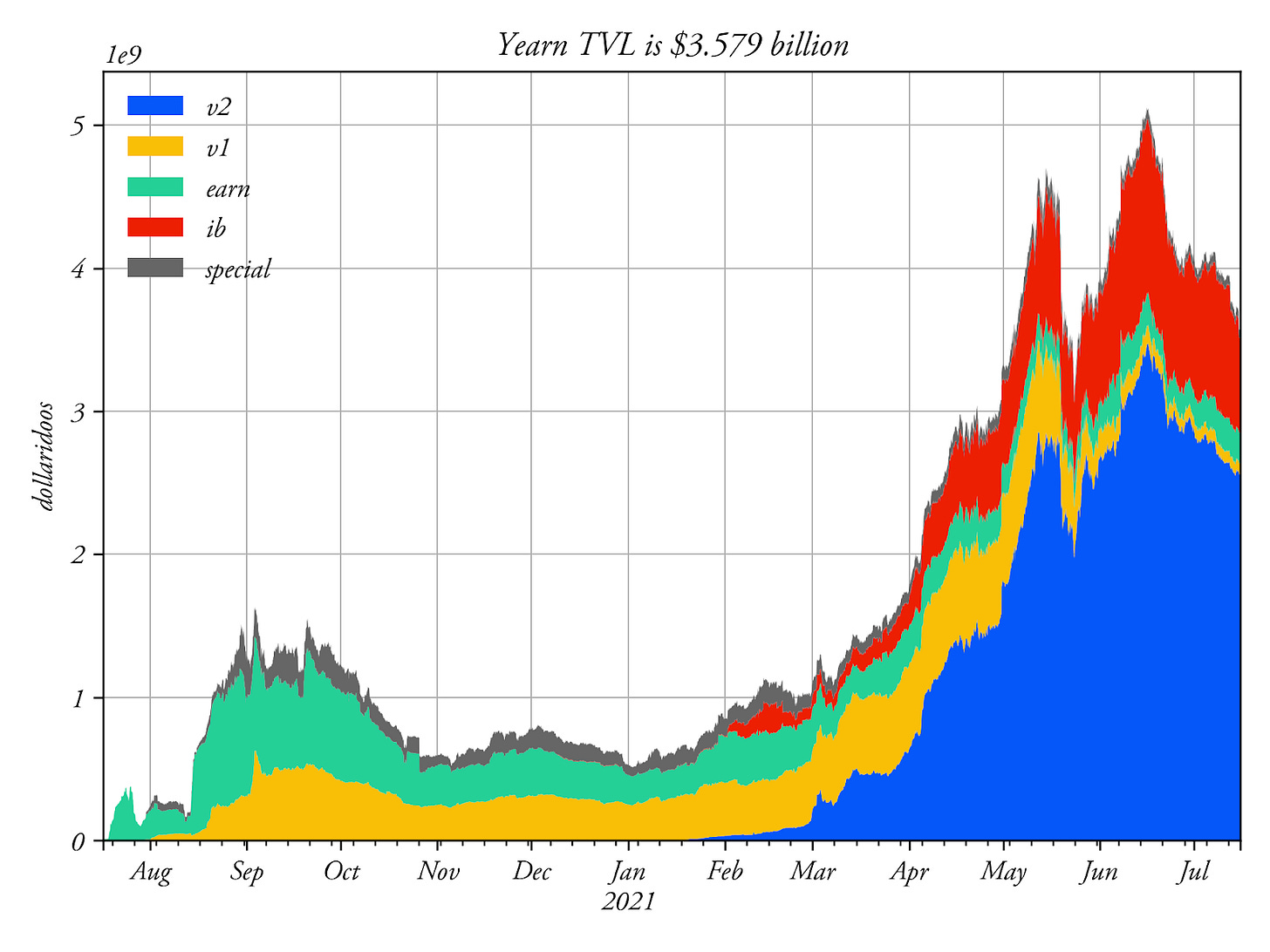

- Protocol revenue growth mirrors the growth of Yearn’s TVL. In the first half of 2021, Yearn’s TVL grew 671% from $531m to $4.1b. TVL growth can largely be attributed to the launch and subsequent growth of v2 yVaults. (Source: yearn.science)

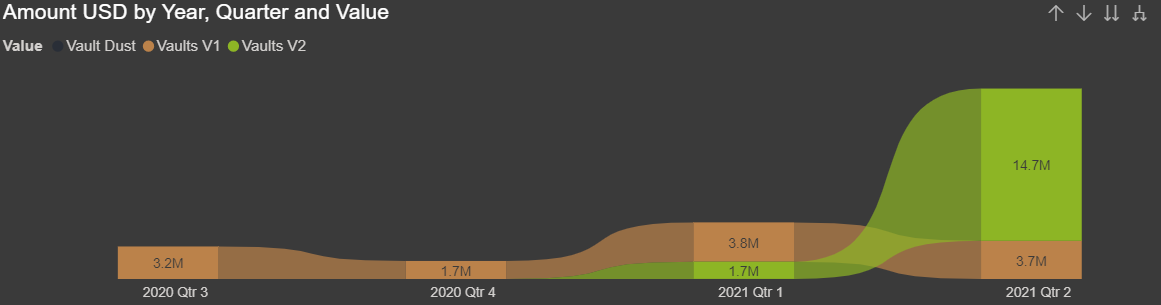

- QoQ protocol revenue growth has continued to accelerate. In Q2 2021, Yearn’s protocol revenue grew 236% to $18.4m, up from $5.5m in Q1 2021. V2 yVaults contributed $14.7m of the total $18.4m in quarterly revenue. Quarterly protocol revenue has grown more than 3x QoQ in 2021. (Source: yfistats)

[

② 0x

📈 $1B 24h Volume, 200k Monthly Traders

👉 Join the 0x community on Discord & Join the 0x team

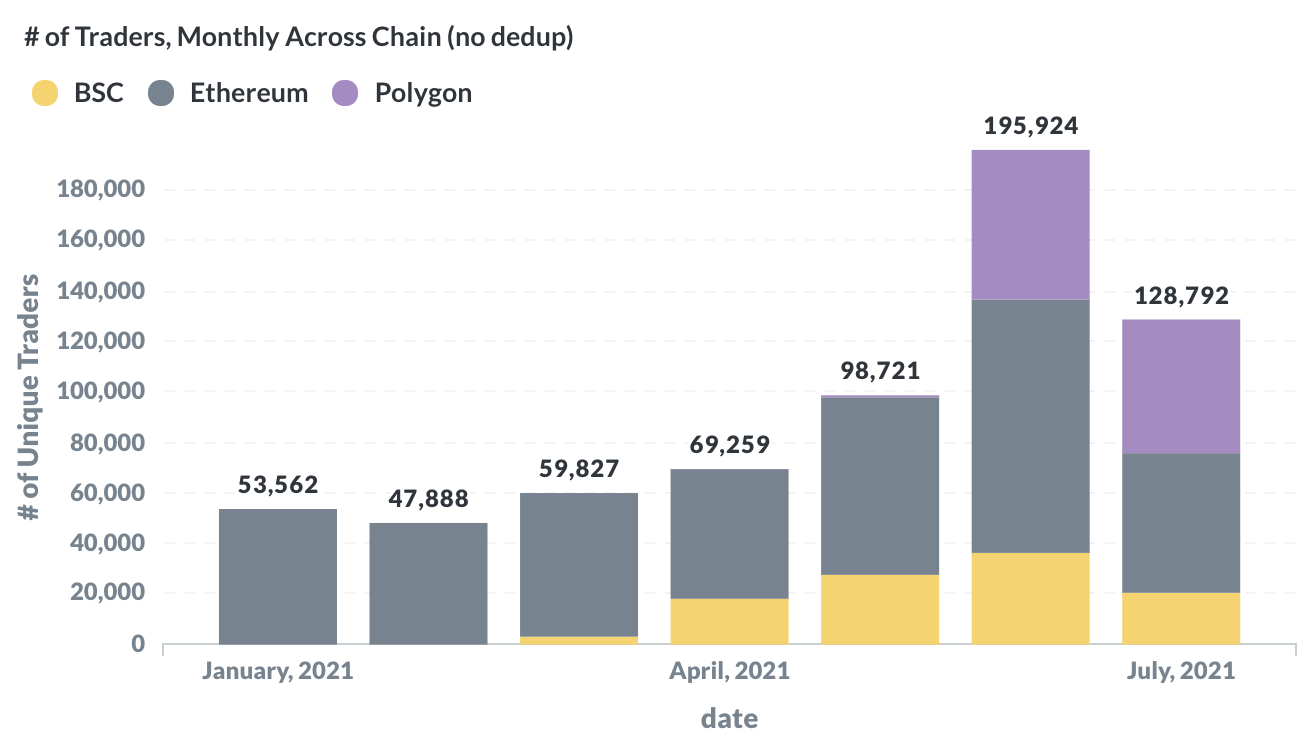

- 0x API user base in June peaked at ~196k, which has doubled compared with May. It totals up to ~200k when 0x native contracts traffic combined. Among them, 100k are Ethereum traders through various applications. New user growth was mainly contributed by the Polygon community -- since the launch on Polygon, over 70k users have traded via 0x API, ~90% of whom are brought by Zapper. First 2 weeks of July show that the scale of Polygon active users is relatively same as Ethereum on 0x API already.

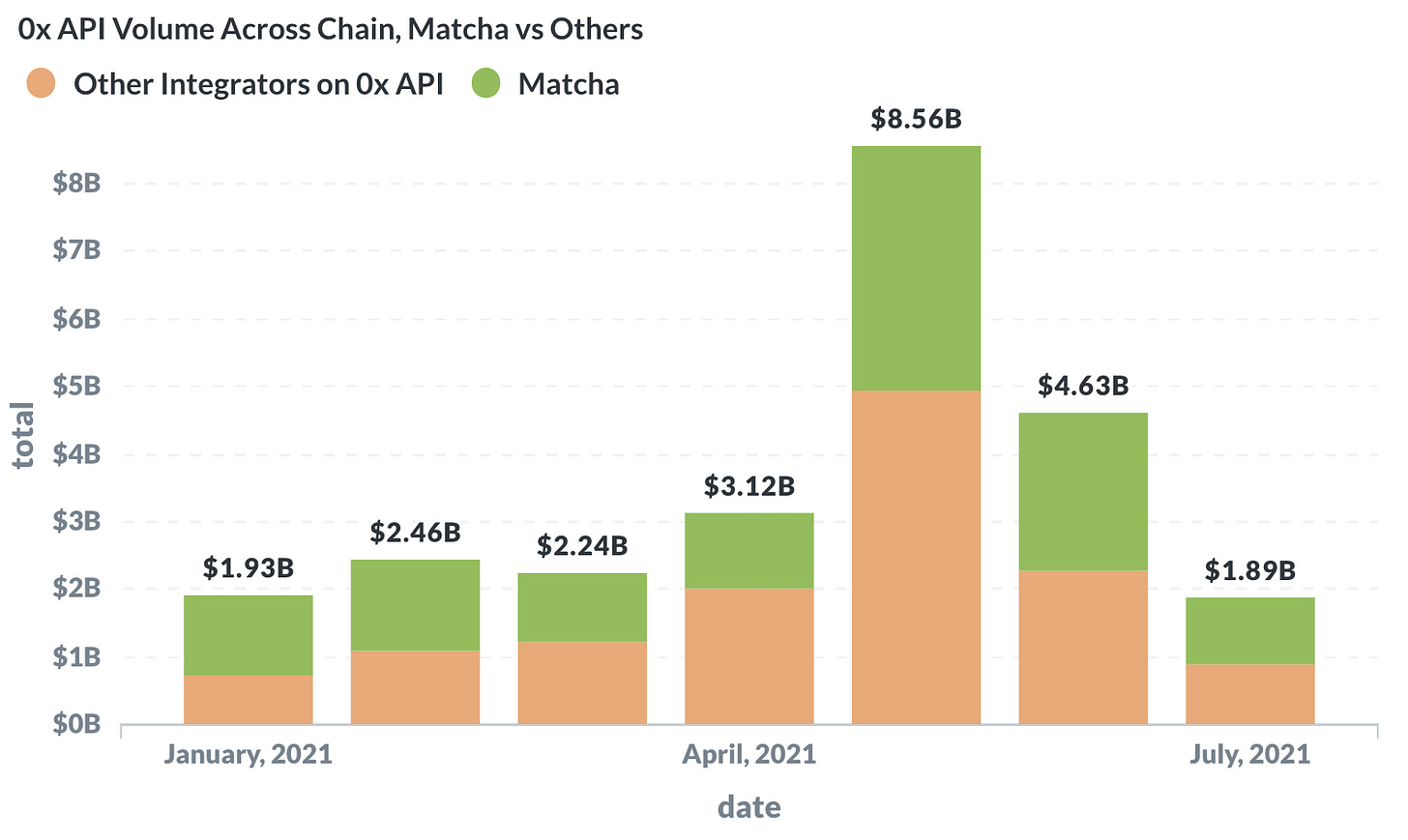

- Under extremely volatile market condition in May, 0x API volume rocketed to ~3X monthly, with a total of $8.56B across chain ($17.8b when combined with native contracts). Around May 19th, rolling-24h volume hit $1b all-time-highs. Matcha attributes to ~50% of the volume steadily over the past months.

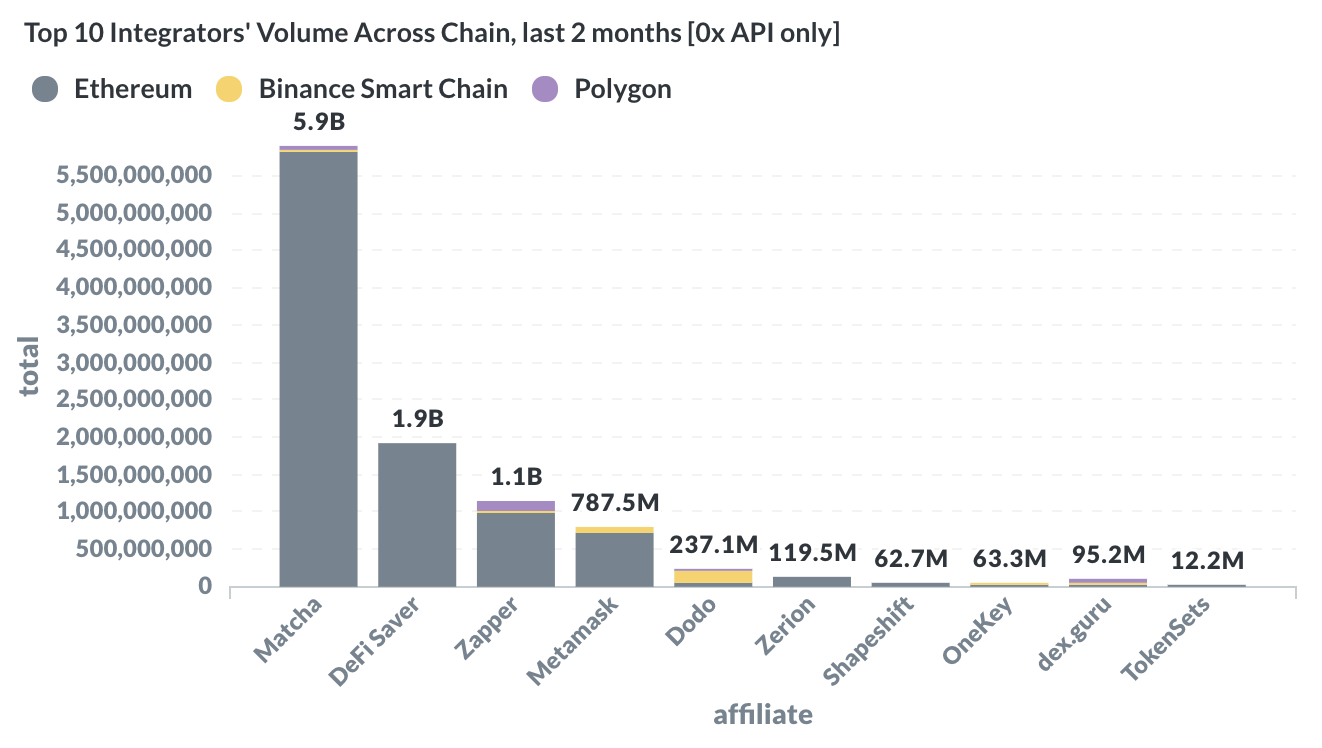

- In June, Matcha 2.0 launched with a series of feature releases including fiat-on-ramp, multi-chain trading, OTC trading, dark mode, and asset and portfolio tracking. Its volume dominated across integrators in the past 2 months with a total of ~$6b. DeFiSaver took 2nd place with a total of $2b.

③ 1inch Network

👥 Nikita Ovchinnik & Valeriya Minaeva

📈 1inch is the 2nd biggest App in DeFi

👉 Join The 1inch Community On Twitter & Become a 1inch contributor

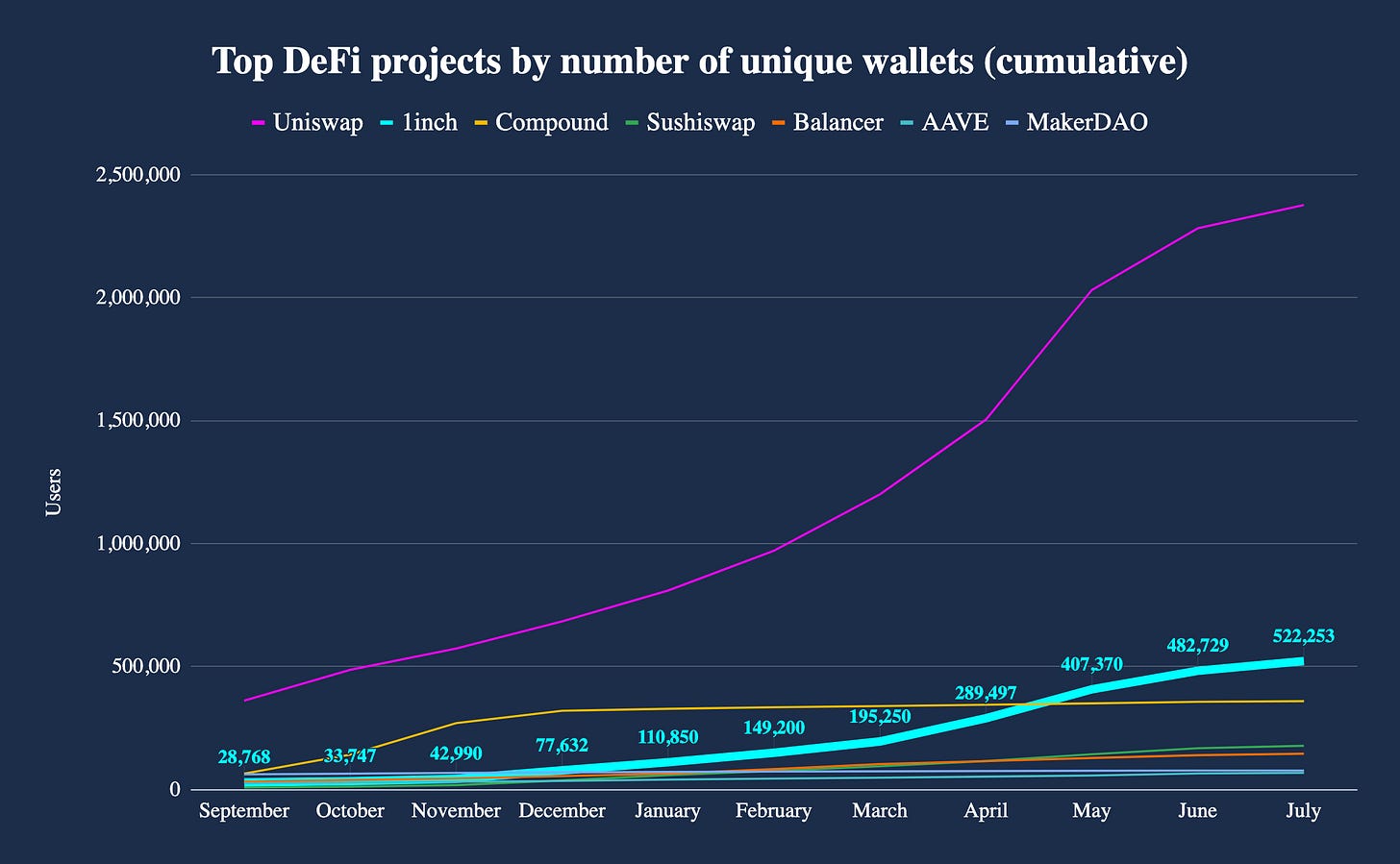

- The 1inch Network has taken a leading position on the current landscape of DeFi protocols by user numbers, currently ranked №2. The 1inch DEX aggregator’s numbers have increased by notable rates since January 2021 and have surpassed the majority of applications that were previously further ahead, reaching over 520,000 active users on the Ethereum network alone. (Source: Dune Analytics)

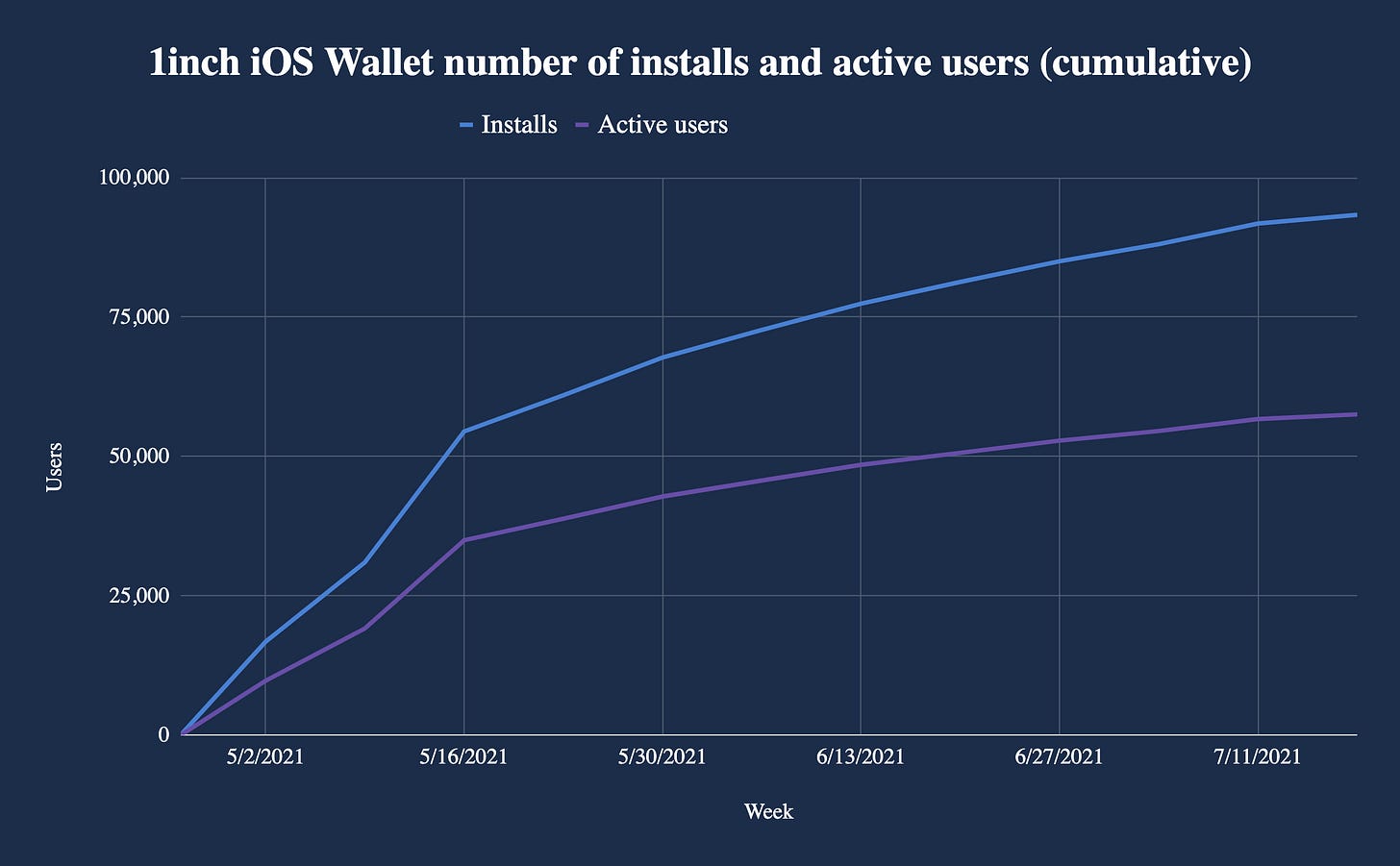

- 1inch iOS Wallet numbers: 100k+ downloads. Shortening the path between DeFi and retail users brings growth to the 1inch Wallet for iOS with a native DeFi trading experience. 1inch was able to successfully capitalize on a well-established market of wallets and demonstrate large trading activity.

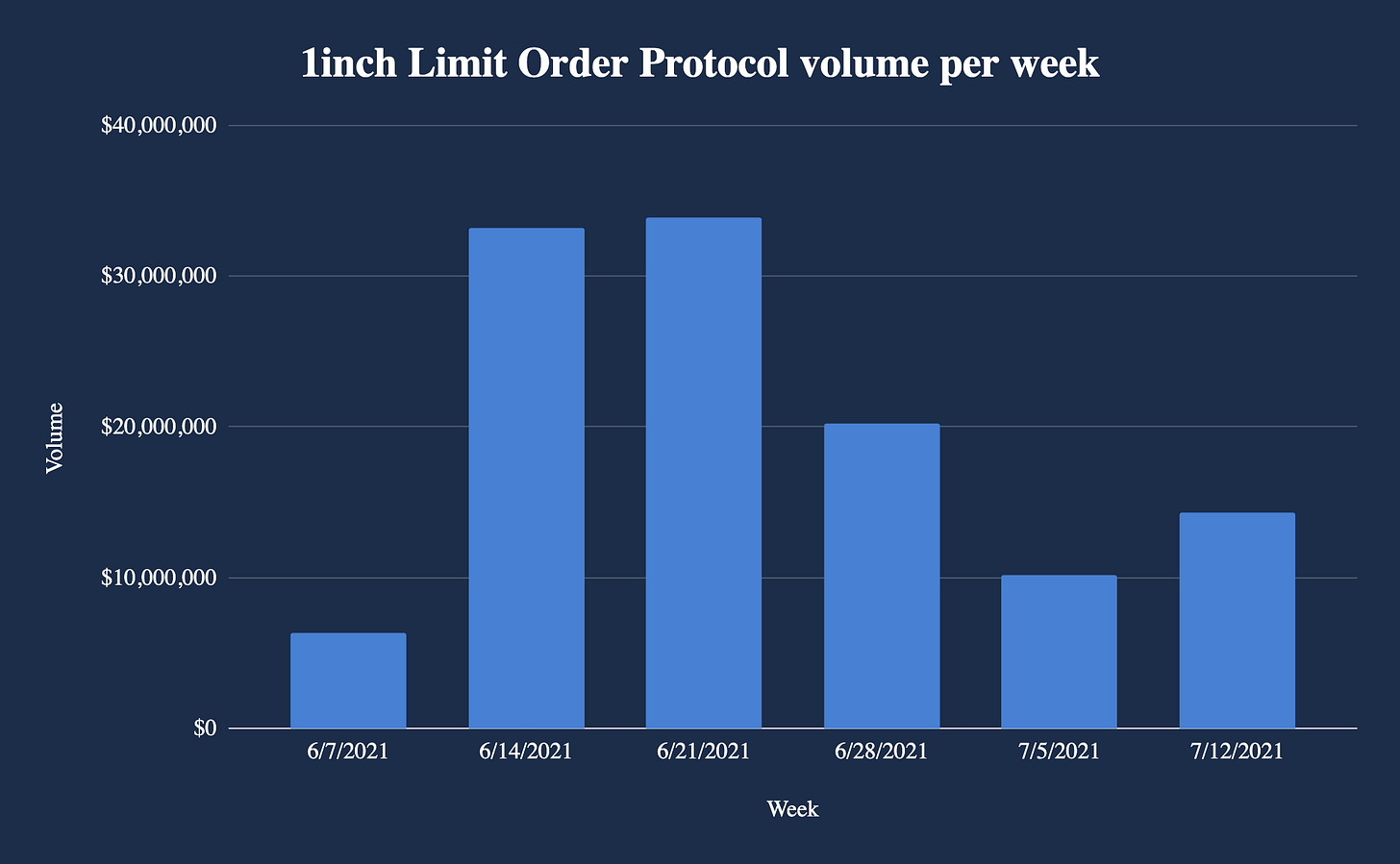

- The 1inch Limit Order Protocol is released, $120m+ volume achieved. It replaces a legacy solution from 0x in the 1inch dApp, offering users much more efficient and flexible limit order swaps and access to features that generate significant cash on-chain. (Source: Dune Analytics)

④ Opyn

📈 Opyn Reaches All Time High TVL And Volume Traded

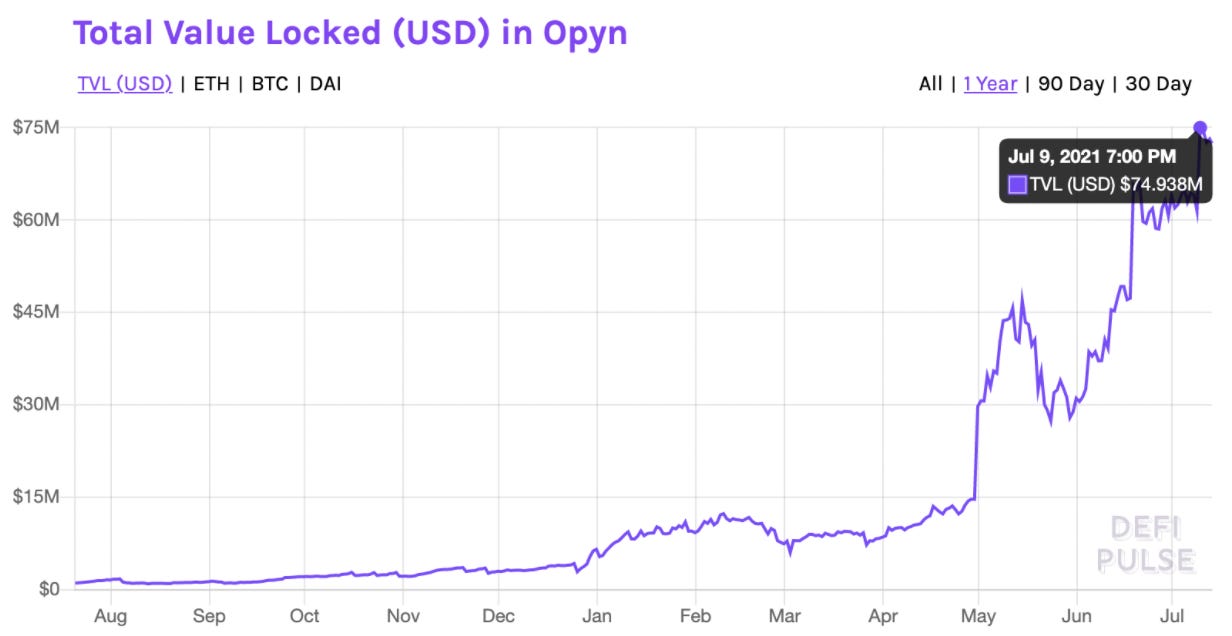

- Opyn is a capital-efficient DeFi options trading protocol that allows users to buy, sell, and create options on ERC20s. At time of writing, there is currently an all- time-high of $74.93m of collateral locked in Opyn option contracts. The 601% increase in TVL since April 12 is due to Ribbon Finance bringing structured products to DeFi. Structured products take options and other complex derivatives and turn them into simple, automated positions that are easy for users to understand. (Source: DeFi Pulse)

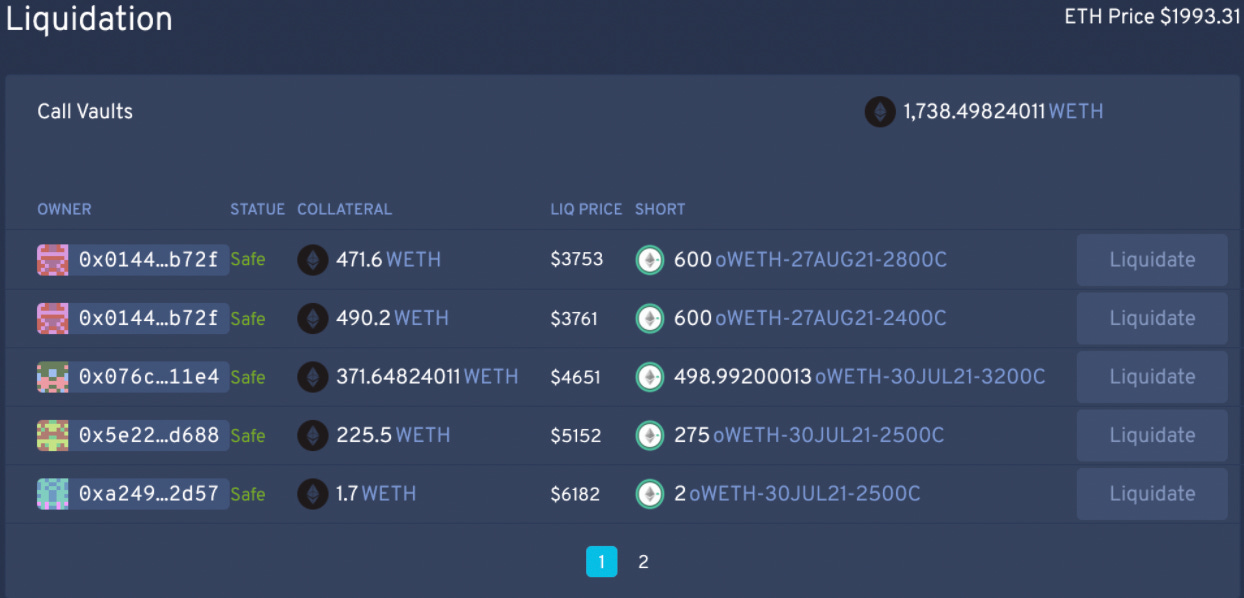

- Opyn launched the first-ever partially collateralized options in DeFi on June 29, and after 1 week, 20% of short vaults on Opyn are partially collateralized. There are currently 2k WETH and $1m USDC held in partially collateralized vaults, with an average collateralization ratio of 87.53%. (Source: Opyn KPI Dashboard)

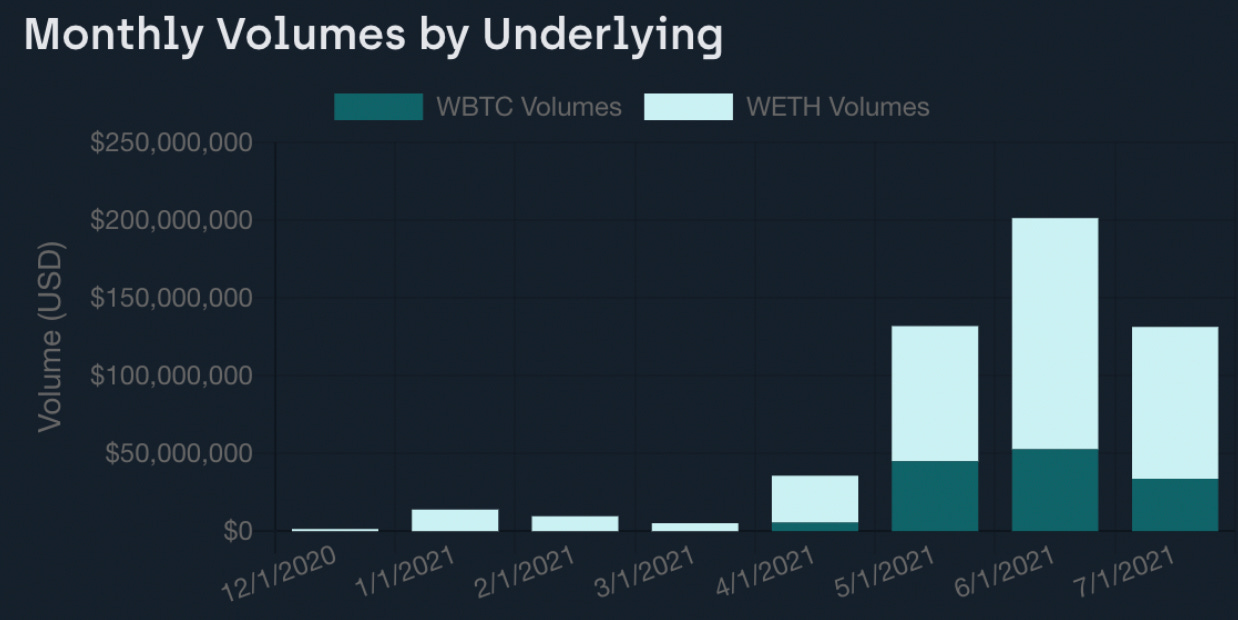

- Opyn’s total notional volume grew to its highest level in June with $202mm in notional volume, $148m of which coming from ETH put and call options, $53mm from WBTC call options, and around $613k from UNI call and put options. Notional = option * price of asset at time of trade. (Source: Opyn KPI Dashboard)

About the editor: Spencer Noon is General Partner at Variant, a first-check crypto VC fund.