Our Network: Issue #85

August 20th, 2021

All funds raised via NFT sales go directly back to our contributors each week. Thank you for supporting community-driven crypto analytics! 🤝

About the editor: Spencer Noon is General Partner at Variant, a first-check crypto VC fund. DMs always open for entrepreneurs.

Click here to apply to the Our Network Talent Agency

Click here to subscribe to the newsletter and get issues delivered straight to your inbox each week.

① UMA

👥 Kinjal Shah

📈 UMA has minted $45M in value for over 60 projects

Community Discord Job Board Dashboard

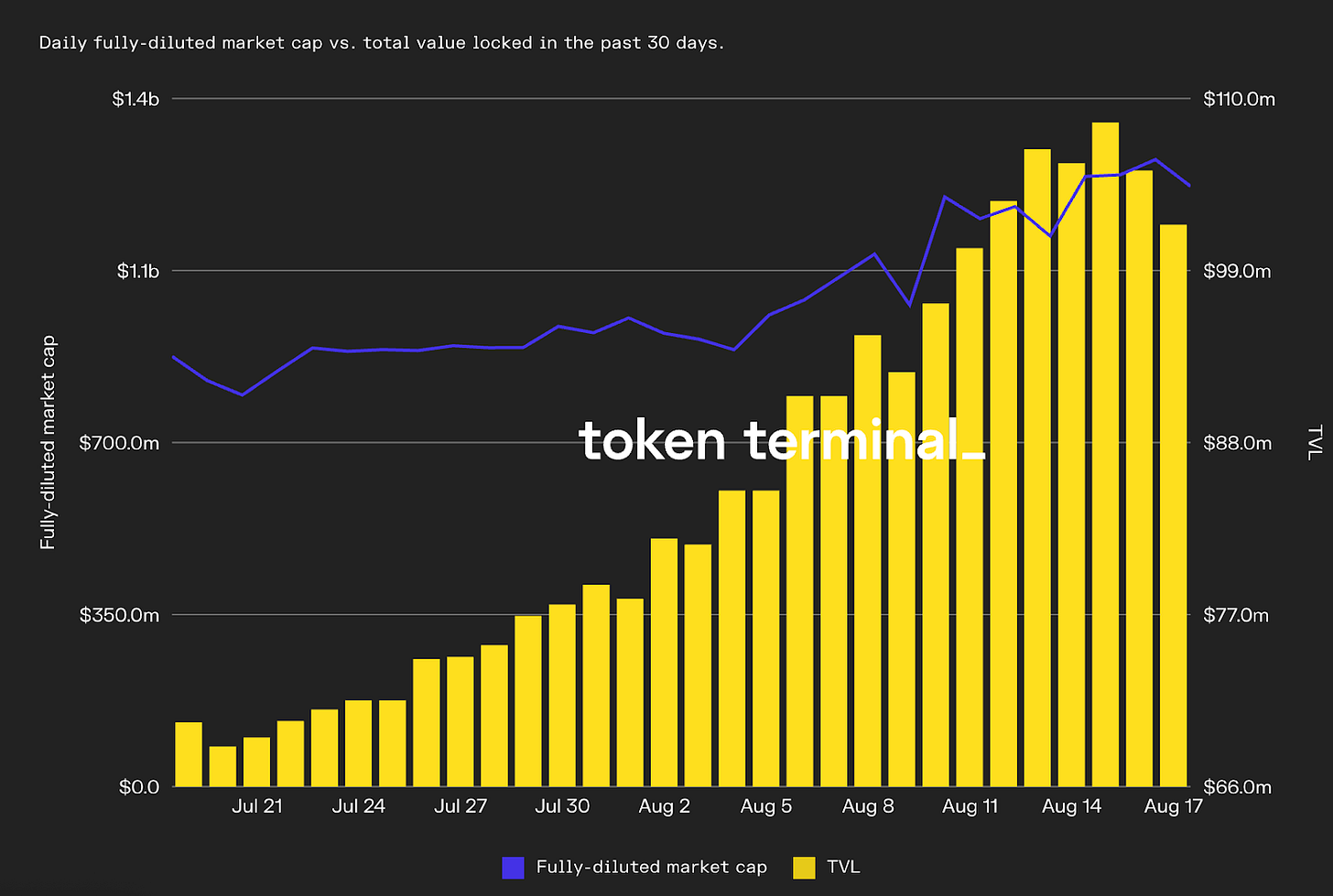

- UMA’s TVL grew 44% in the past 30 days as the team rolled out a number of new products, including range tokens and success tokens. Range tokens can be incredible tools for treasury diversification as it is an on-chain option that is customizable for DAO needs. Success tokens are a new incentive-aligned way for VC funds to effectively invest in a “Series B” for DAOS. UMA is working closely with teams, and is also organizing leads from VCs interested in taking the other side of these deals.

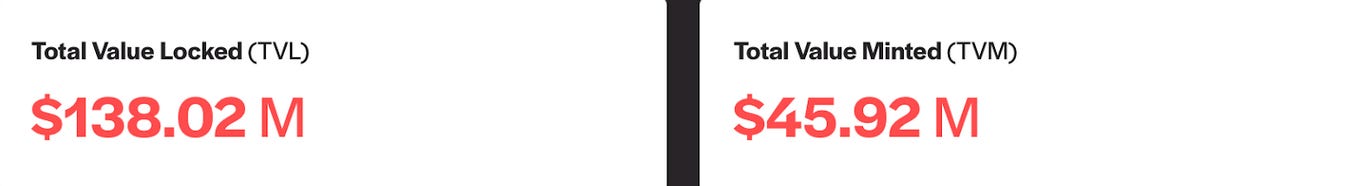

- UMA has $45M in total minted value, which represents assets created against collateral. In the newly launched UMAverse, investors can view the range of projects utilizing UMA’s product suite of options, range tokens, success tokens, and beyond. Over 60 projects have launched using UMA.

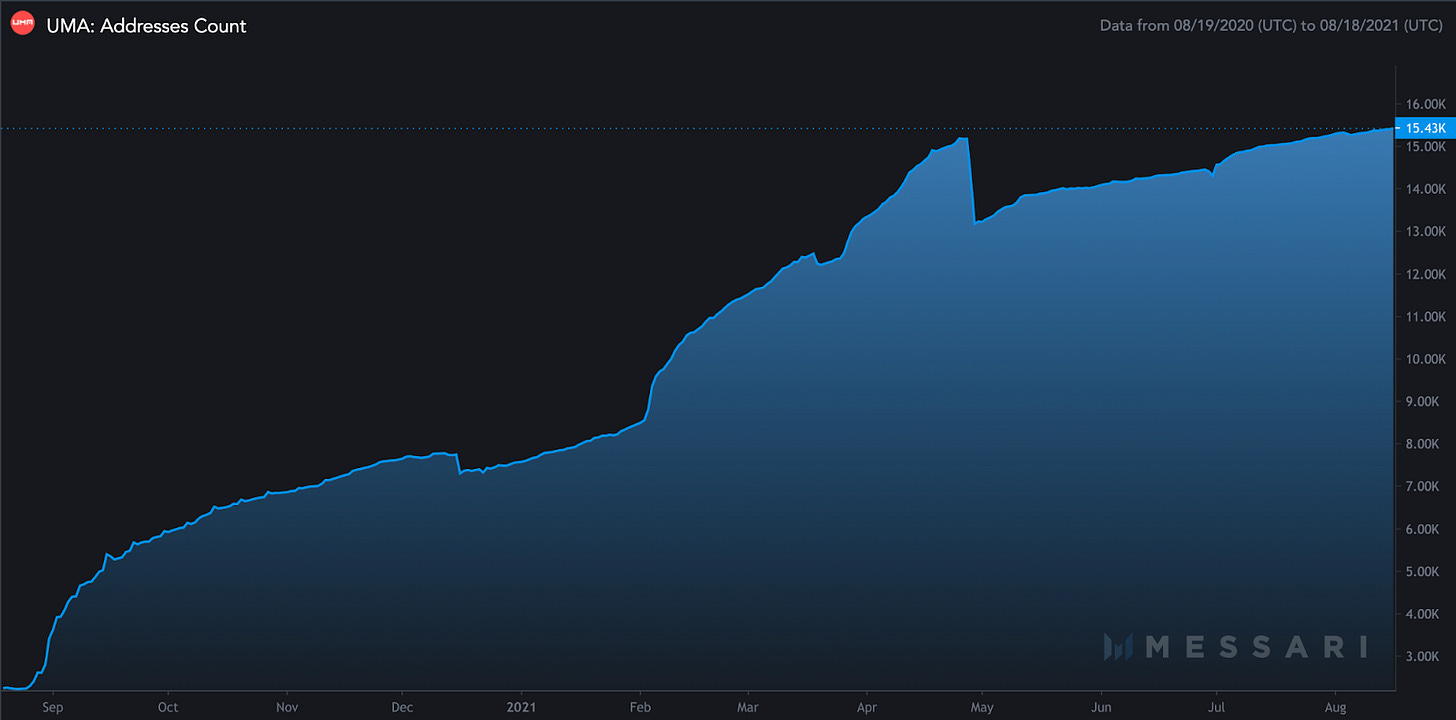

- The number of UMA tokenholder addresses surpassed 12K, reaching all time highs. UMA provides infrastructure for enforcing financial contracts, which is a broad application and token holders are taking notice.

② Balancer

👥 Markus Koch & Jeremy Musighi

📈 Balancer V2 TVL Surpasses V1

Community Discord Job Board Dashboard

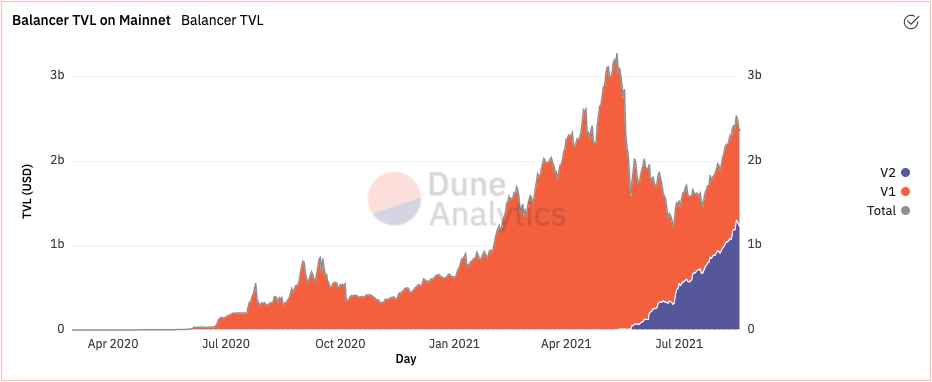

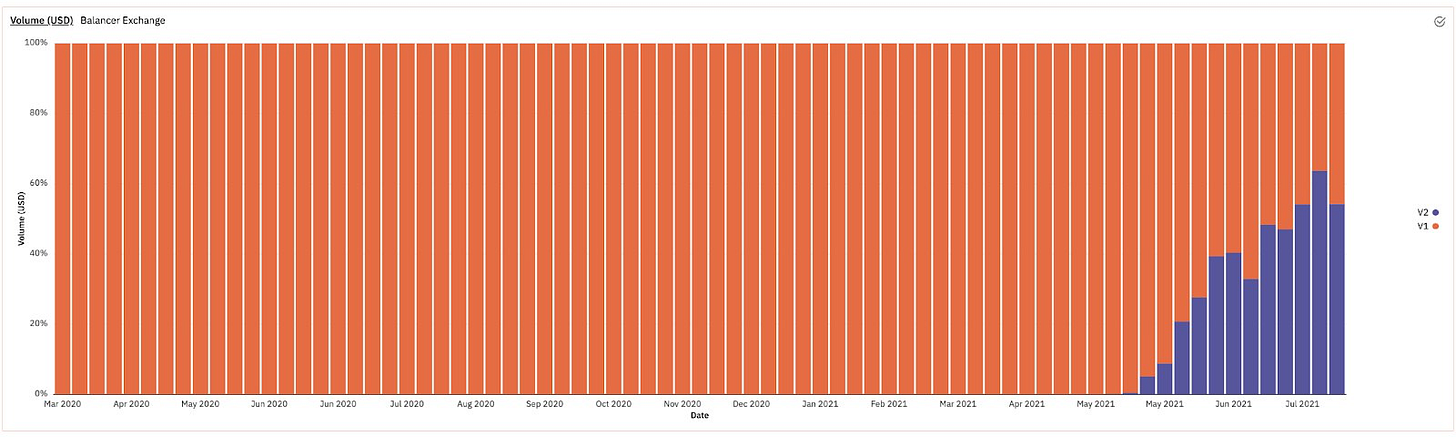

- Total Value Locked in Balancer V2 continues to grow. Virtually all liquidity expected to migrate from V1 to V2 has moved over, the exception being V1 pools that are deeply integrated with other protocols. Balancer pools on Ethereum mainnet currently hold ~$2.5B, roughly equally split between V1 and V2. In addition to that, the V2 deployment on Polygon holds ~$240M in assets.

- Balancer V2 has also achieved a higher utilization ratio than V1. While V2 TVL only just surpassed V1, weekly volume has been consistently higher on V2 since late July. This can be explained by the fact that liquidity on Balancer V2 is less fragmented than in V1, and also lowers gas fees.

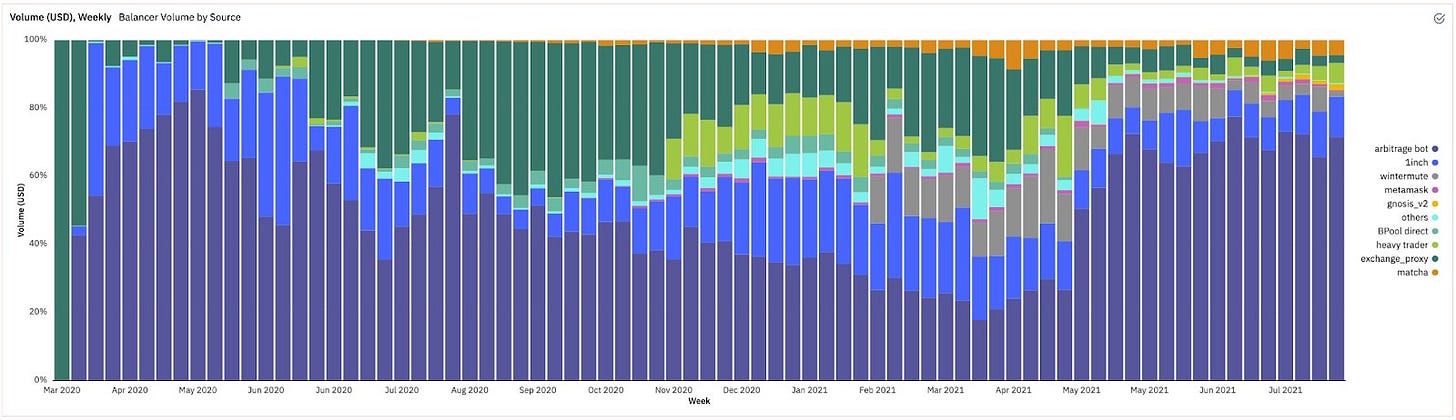

- Data also indicates that arbitrage bots might be missing out on opportunities on Balancer V2. While on V1 bots account for ~65% of volume, on V2 that number is closer to 30%. Developers interested in these opportunities should visit docs.balancer.fi and use the SOR package for increased efficiency.

③ Curve

👥 Juan Pellicer

📈 Curve celebrates 1 year with TVL at $11.6B

Community Discord Job Board Dashboard

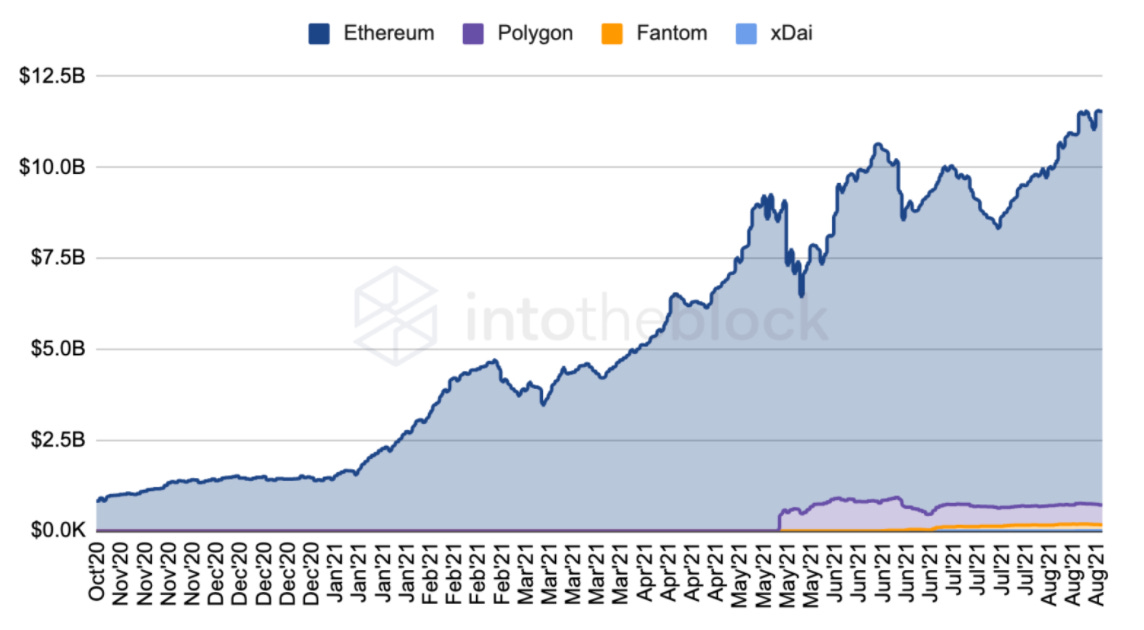

- On the 13th of August, Curve Finance celebrated their first anniversary with TVL at all-time-highs of $11.60B. The majority of the liquidity, or 93%, is represented by Ethereum. Polygon ranks in the second place with an amount of $542M, a 5% of the volume on Ethereum.

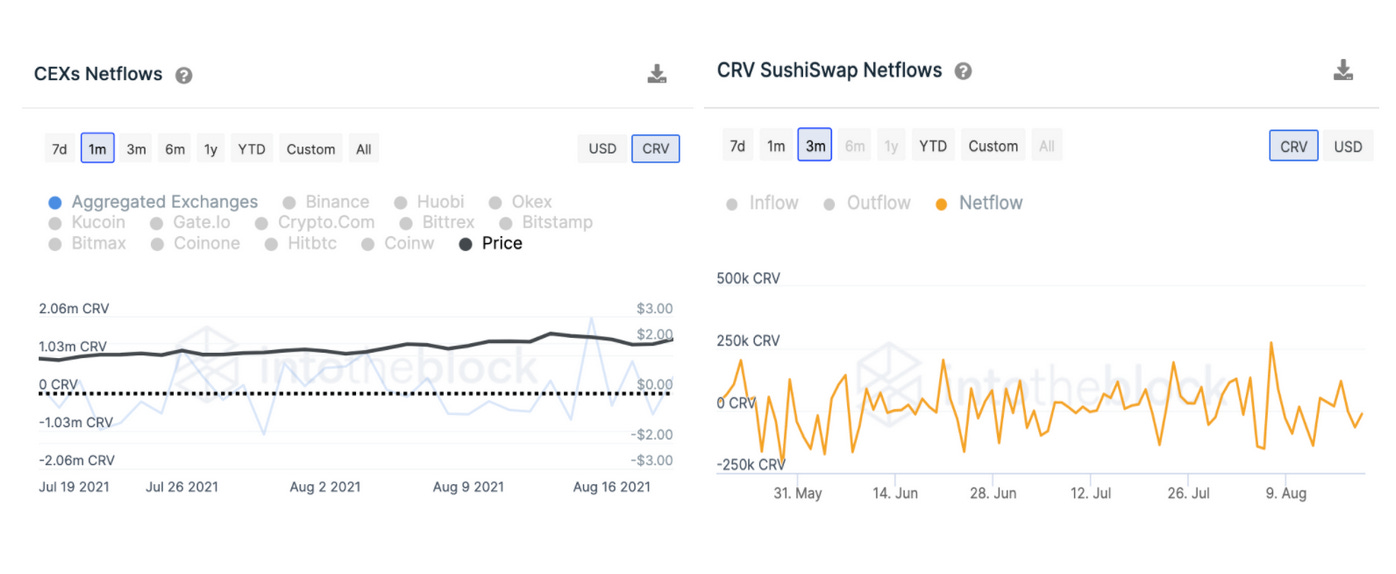

- The birthday resulted in a 30% cut on CRV emissions, hence a dip in the staking rewards for most pools. Despite this, Curve’s liquidity has continued to grow by $600M since, showcasing the ‘stickiness’ of Curve’s liquidity. No major inflow of CRV and thus sell pressure was found on its pairs:

- The Tricrypto2 hype continues: it is currently the pool with the biggest staking rewards ranging from 9.9% to 24.76% APY. Andre’s “bribing” veCRV protocol is heating up the gauge weight votes, but Tricrypto2 continues unfazed, consistently achieving the biggest gauge allocations:

④ Stablecoin Coverage

👥 Joel John & Alex Svanevik

📈 Binance Holds ~63% of All Stablecoins on Exchanges

Community Discord Job Board Dashboard

- Combined stable-coin market-cap has reached close to $60B. A large portion of that is held in exchanges. Binance’s BUSD balance sheet of close to $11B means over 60% of all stablecoin exchanges are held on the exchange. Even if BUSD is excluded, close to 35% of stablecoins held in exchanges are on Binance. What is interesting to note is that players like Uniswap and Curve currently hold as many stablecoins as traditional peers like Huobi and Coinbase.

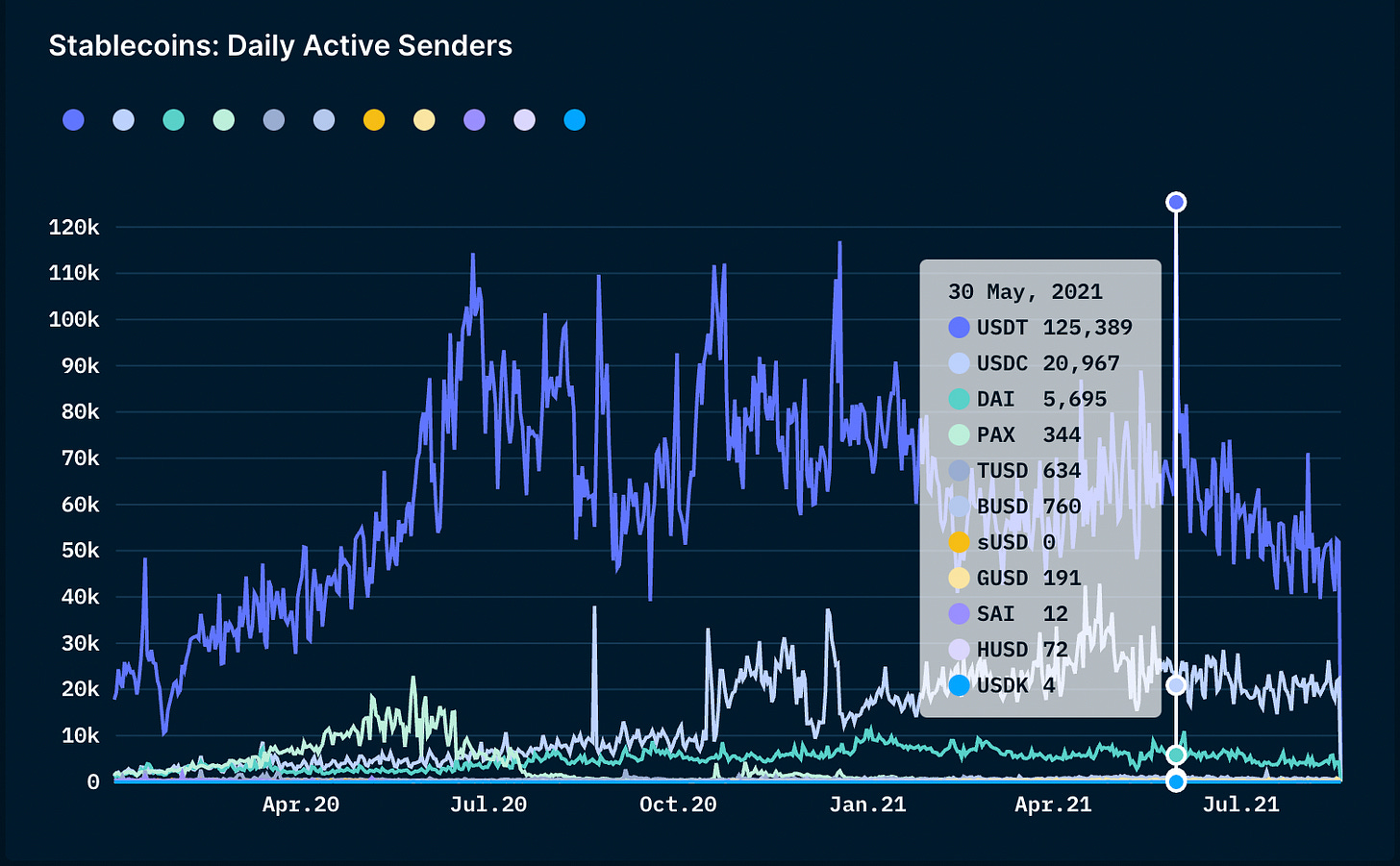

- Activity is still concentrated around USDT. At its recent peak in May, Tether had close to 125K wallets sending transactions in comparison to USDC having around 23K.

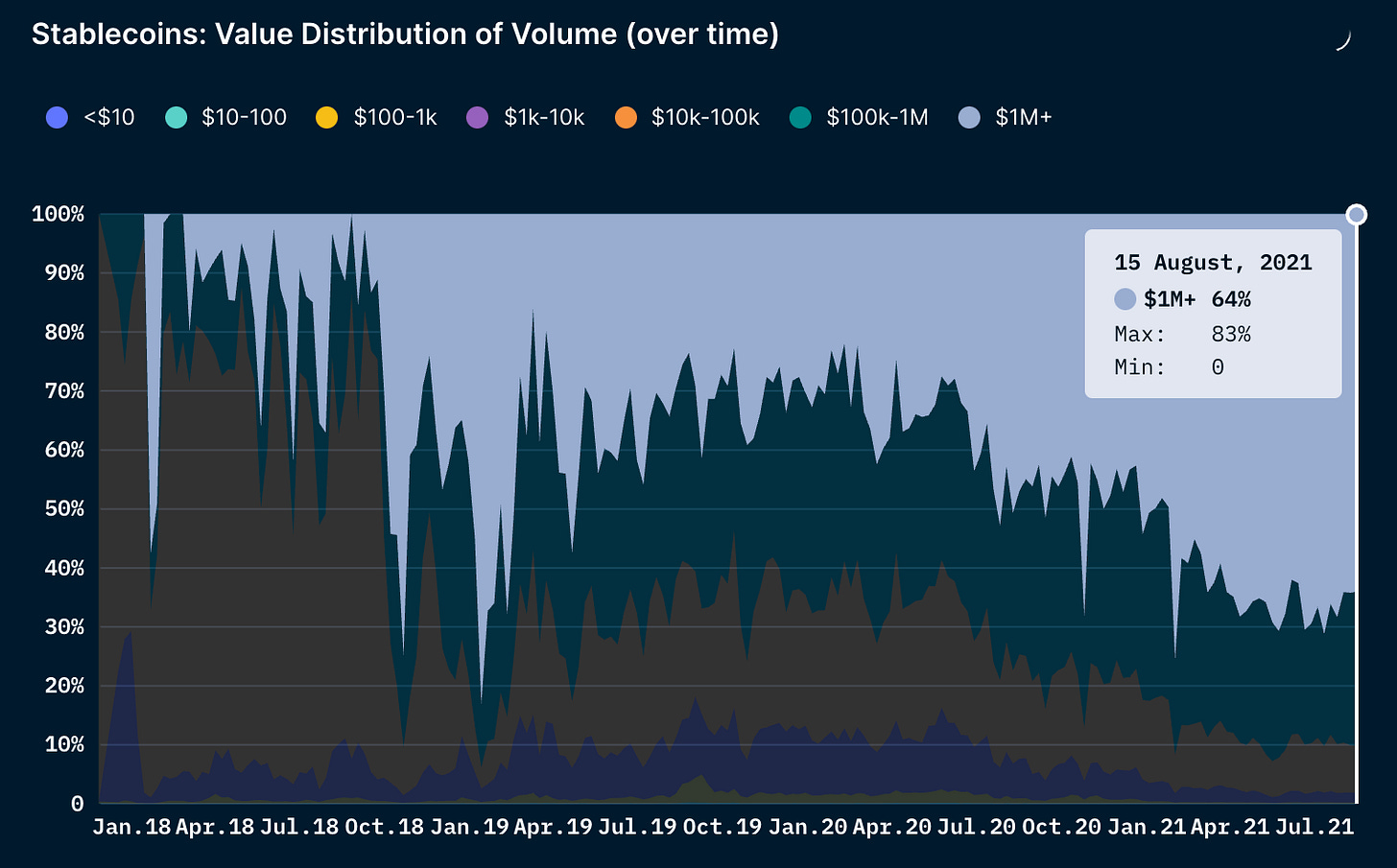

- If we break down capital moved on-chain to categories, transactions about $1 million account for 64% of all capital moved on-chain. In comparison, transactions accounting for between $1k-$10K account only for ~2% of transactions in a given day, down from a peak of 29%.

Subscribe to OurNetwork

Receive the latest updates directly to your inbox.

Verification

This entry has been permanently stored onchain and signed by its creator.

Arweave Transaction

27I2K_TfnP2IfNM…cLyLkwAWTmXC0Xw

Author Address

0x9C159121CEEBF93…0c895d7f6038bd4

Content Digest

beZ4RIwc-iX3C2c…8tC4H4_89sCKYcw

More from OurNetwork