What’s up?

Interest rates. Prices. Stress.

In the US, job listings just fell to pandemic lows, property values started to collapse, earnings are down across the board, and unsold goods are piling up in many stores.

Elsewhere, pension funds are on the verge of insolvency and governments are on the brink of default. Plus war, food shortages, chip shortages, dollar shortages, energy shortages, inflation, starvation, and general human suffering.

Yet, you still make money. You earn an income. You have some wealth, even if it’s just spare cash from your paycheck, a pension, or savings you’ve accumulated over the years.

Less with each passing day, but money nonetheless.

What will you do with that money?

Not buy bitcoin or any other crypto.

Wait until the price goes up

“Macro” conditions suck. You’re worried about food, heat, shelter, and your job. Maybe once things stabilize, you’ll put some money into speculative financial assets like crypto.

Maybe not.

At the same time, bitcoin’s price sits at historic lows with lots of room to move up, even if just for a temporary relief rally or one of its outrageous pumps.

What will you do if its price goes up 25% this month? If some altcoins double in price — while your government’s money keeps crashing, as all major currencies except the US dollar have done this year?

Nothing will change about bitcoin, cryptocurrency markets, or their future prospects, but you’ll feel an itch to buy. You just lost 25% of your purchasing power by holding cash instead of crypto. How much more are you willing to risk losing?

Your mind will tell you you’re getting a better deal because “the bottom’s in” or “it’s decoupling from the stock market” or “it’s finally going up.”

A fleeting temptation

It won’t be a better deal, but it will feel like one.

When financial assets go up, you can’t help but want to put money in — even if you don’t have money to spare. When they go down, you can’t help but want to keep money out — even if you have money to spare.

This is an odd phenomenon but well-established among behavioral economists.

For real things like houses, cars, gas, and toiletries, you get excited when prices go down. For fake things like stocks, bonds, and crypto, you get worried when prices go down.

I guess how you feel depends on whether you want to buy or sell.

A strange thing, innit?

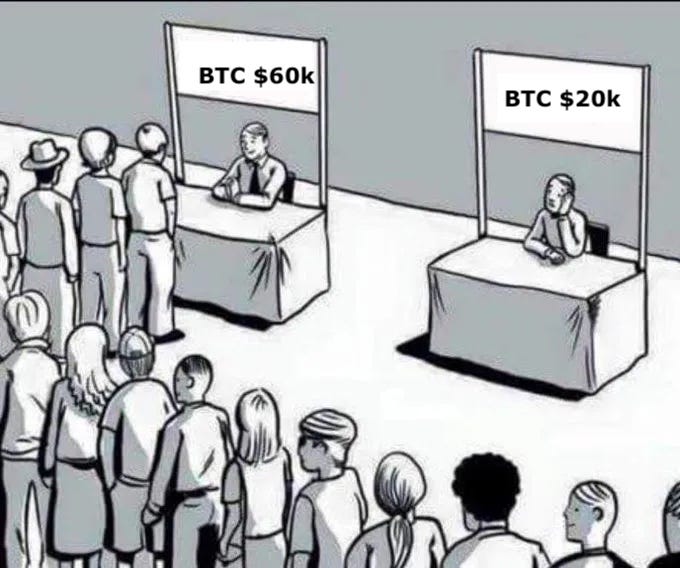

Do you think it’s funny that some people bought bitcoin at $60,000 but won’t buy it at $20,000? A handful gave up everything to buy at the peak. Some of them sold at $40,000 or $30,000. Others still hold today but haven’t bought any more since then.

Why?

Because they never wanted to buy bitcoin in the first place. They wanted to sell it for more than they bought it for.

Buying was a necessary first step.

When bitcoin’s price hit $60,000 on an upswing, they thought they could make money. When its price hit $30,000 on a downswing, they thought they couldn’t.

Now, at $20,000, they think it’s dead. In any event, they have bigger things to worry about.

Immutability, censorship-resistance, permissionless innovation, open finance, anti-fragility, yada yada?

Whatever. To paraphrase 2PAC, “Helfman cares, if don’t nobody else care.”

Then again, you can’t eat bitcoin (though you can mine it for heat).

Recency bias

With crypto, the market moves in a specific pattern:

-

Crypto flows into the hands of people who want it more than their government’s money. Eventually, the market runs out of sellers. Prices go up.

-

Once prices go up long enough that people think prices will keep going up, new buyers come into the market. Prices go up higher.

-

Once prices go high enough that people decide they want to trade it for more of their government’s money, they sell. Prices go down.

-

Once prices go down long enough for people to think prices will keep going down, new sellers come into the market. Prices go down more until enough crypto flows into the hands of people who want it more than their government’s money.

Then, the cycle continues.

As I covered at length earlier this year in my newsletter, *Crypto is Easy, *the historical “market bottom” signals flashed in May and June.

During previous market bottoms, bitcoin’s price went up and down 25% to 75% after those signals flashed. While that means a drop to $14,000 would make sense, what if that never happens, despite the horrible “macro” conditions or potential 2008-style financial catastrophe?

What if so many people have already sold that it’s impossible for buyers to find sellers at June’s $17,600 low or any lower price? What if the worst does happen, but crypto only drops a little while equities and other assets drop a lot?

Doesn’t matter. You’ll wait until the price goes up long enough for people to think it will keep going up. Once inflation’s done, world peace breaks out, your job’s secure, gas flows again, and the coast is clear.

Except, the coast will never be clear.

Crypto prices have dropped 50% in bull and bear markets, whether there’s a global crisis or not, in good times like 2019 and 2021, and in bad times like 2020 and 2022.

You are the money that you seek

For your mental health, sense of safety, and near-term financial security, maybe it does make sense to wait for a higher price.

That’s ok. You don’t need to buy crypto to make money. You have skills and a mindset that people will pay for. You can make money off of your time, talent, energy, and all the things that make you an incredible person.

If you do that, you won’t have to think about the prices of financial assets. It won’t matter whether your pension fund is solvent, your currency collapses, the value of your house drops, or your government screws everything up.

Trust in yourself. Hope for the best. Keep working.

Bitcoin and other cryptocurrencies sit at historic lows and they will function when your government doesn’t.

As you have money, put a little into this market, even if it feels risky and uncomfortable. Today, you’re paying less for that risk and discomfort than you have in years, with more upside than ever.

Learn how to custody your bitcoin in your self-hosted wallet. Stake or delegate your altcoins. Deposit crypto into liquidity pools. Try out new dapps and wallets. Discover opportunities to enrich your life with NFTs, Web3 technology, and new communities.

Own a source of wealth that doesn’t depend on what your central bank does with your money.

Grow with this asset class.

You may want to follow my plan.

If you do that, you’ll get better results than most traders and people who dollar-cost average.

(Some traders will do much better.)

If you don’t follow my plan, you’ll do ok, too. Buy now and you won’t need to buy later.

You may not end up with Lambos, 100x moonshots, and eternal wealth, but you’ll get a stake in the financial networks of the future.

The legacy financial system is held together with gum wads and rubber bands. Everything sucks.

If you wait for everything to get better, you could be waiting forever.

Mark Helfman publishes the Crypto is Easy newsletter. He is also the author of three books and a top bitcoin writer on Medium and Hacker Noon. Learn more about him in his bio.