In last month’s post, I looked at the obstacles and uncertainties we face as we make our way through the second stage of the crypto market cycle.

In this issue, I talk about predictions, price models, cycle theories, and what to think about conflicting visions of the future.

We all agree: the legacy financial system can’t give enough people the lifestyle they want. Cryptocurrency can solve this problem.

If that’s right, why do we spend so much time talking about predictions, models, and what narratives will bring new money into the market?

If this technology does what we think it will, the money will come.

Storytellers

So many people want an alternative to the legacy financial system. Why are we so obsessed with making money off of that?

We already have access to the protocols that will power finance and commerce in the decades to come. We’re already in a position to benefit from the transition of money from an instrument of control to an instrument of freedom.

We’re the first in line to stake our claims to the financial networks of the future — at a discount to their future prices.

Isn’t that good enough?

No.

That’s an abstraction. Its inevitability seems vague, foreign, and distant from our present reality. Financial progress takes too long. There’s no comfort in the whims of a dynamic, turbulent market.

So we create data models. We come up with narratives. We publish predictions.

For good reason! We need benchmarks and expectations. We need stories to make sense of facts. Otherwise, we lose perspective. It’s impossible to know what’s considered extreme or normal, realistic or absurd.

Some people choose to dismiss this as a fool’s errand. “Astrology for grownups.” “Fairy tales.”

These are the same people who will leap from their seats the moment somebody flashes a dot plot, CPI projection, or FRED chart that confirms whatever they already believe.

Other people put so much faith in a single metric that they enter an alternate reality. They tell you that Bitcoin’s price will hit $288,000 in 2021, $8,000 in 2022, and $1 million in 2023.

Now that the market’s boring, thinkers have a chance to come up with new models, predictions, and narratives. Might as well give people something else to argue about!

PlanB published the stock-to-flow model in similar market conditions in 2019. Willy Woo floated the Coindays concept during the doldrums, too. Glassnode just unveiled its Cointime economics. I think Ben Cowan has a new one, too.

Don’t forget the four-year cycle, logarithmic growth curves, rainbow charts, and such.

’Tis the season.

All of these models seem reasonable. They use data and math. They fit nicely with history and human behavior.

And they all disagree with each other.

It’s right, but does it get you what you want?

Worse, you can still lose money or underperform the market by following them.

For example, the four-year cycle. Buy in December every four years, right?

-

In 2010, 2018, and 2022, you’d do great. Only up.

-

In 2014, you’d suffer a 50% crash. You’d end up buying twice as high as the bottom and not get back to even until 2016. You’d miss all of 2015. You’d be “right” and still end up down 50% compared to somebody who bought all through 2015.

Should we assume 2014 was an aberration and the market will bottom in December of 2026 and 2030?

Or, should we assume the other three Decembers are coincidences drawn from a small sample size? Can we expect the bottom will come at a different time, as it did in 2014?

You don’t know. Nobody does.

Likewise for selling in December every four years.

Only in 2013 did it work out the way you would have expected.

In 2017, you would have missed a raging altseason. In 2021, you might have sold at a lower price than you bought during that summer — even though the four-cycle worked.

One of those three times, you were the smartest person on earth. Two of those three times, you missed out on a lot of money.

All three times, you were “right.”

Shift the timing to January and you’d sell after every peak, sometimes 40% lower. Twice, you might buy just before a 50% drop.

Know what you’re getting into

These models and concepts give you a general sense of the market. As for optimizing your returns or avoiding danger, they’re not so precise.

Don’t plan around these things. Market conditions change all the time.

In April, Bitcoin’s price approached $32,000. Conditions were rife for a short squeeze to pump the market as high as $57,000, for reasons I explained in several updates at that time (most recently the May 10 update).

When Bitcoin’s price approached $32,000 again in July, conditions had changed. A short-squeeze super-pump was no longer a realistic outcome, for reasons I explained in the July 6 update.

Both times, Bitcoin’s price could have easily gone higher than $32,000. It didn’t even get that high!

Somebody’s going to say, what’s the point of even doing that analysis? You don’t know what’s going to happen. Why even bother?

Point taken.

There is no reason to analyze anything, ever. People spend lifetimes studying all sorts of things and they still can’t predict the future.

Have you ever met a doctor who can tell when their patients will have heart attacks or how long they’ll take to recover from ACL surgery?

No! No doctor can do that!

They get years of training at the most rigorous programs and access to reams of data about their patients, and they still can’t tell you what will happen and when it will happen.

That doesn’t mean we can get something from trying.

Sometimes, it’s good to know whether a pump comes from a simple short squeeze or some stablecoin shenanigans, so you know whether to rush money into the market or go slow (or not buy at all).

Other times, it’s enough to anticipate realistic scenarios so you can prepare mentally and financially, even if you don’t necessarily change your decisions.

In March 2022, when today’s bears called for altseason and the ETH flippening, my analysis would’ve led you to allocate slowly, stop on March 24, and look out for a potential disaster from the lending platforms.

In April, when the market melted down, you got a little more crypto for your money.

Did the lending platforms *have to *collapse?

No. The conditions were rife for that outcome. That didn’t mean it had to happen.

Sometimes, risks pop up, never play out, and we go our merry way. Sometimes, risks play out.

Isn’t it nice to have somebody who can point those risks out to you? Who’s been in the market for a while and has some perspective and insight that you don’t?

Who can explain what to look for and give you strategies to navigate the market? Who can tell you what’s realistic and what’s not?

My Plan

You’re probably getting pitches from people promising 100x altcoins, foolproof trading strategies, or massive returns.

I only have my analysis and my plan.

My plan beats most traders and everybody who uses dollar-cost averaging.

At the extremes, you’re up almost 400% or down almost 50% on your investment. On average, you’re up about 12% with cash to spare.

In 2023, Bitcoin’s average price is $26,400. With my plan, you bought at an average price of $24,300. That’s an extra 8% on your investment with no extra work or effort.

As the market goes up, the difference will get larger.

From inception, my plan’s average price is roughly $23,400. Dollar-cost averagers bought at an average price of $29,800. That’s almost 30% improvement with no trading or timing the market.

While I have specific signals for selling, we’ll know when the market’s too hot. You’ll see that in my updates and analysis.

At that time, what you do depends on what you want to get out of this market. I set a high threshold for entry and exit. You may not want to do that.

What risks are you willing to take and what opportunities are you willing to sacrifice for the outcome you want?

Hopefully, you’ve already figured that out. If you need some help sorting through your thoughts or reflecting on your portfolio, feel free to schedule a call for a simple consultation or portfolio review on Superpeer or Tealfeed.

What do I want to get out of this market?

You should know from reading my portfolio strategy.

Consider the alternatives

Mark, that’s stupid! You’re a Bitmoji writing a newsletter, you’re supposed to give us certainty!

Ok.

PlanB says to buy 6 months before the halving and sell 18 months after it.

Free strategy:

-

Buy as much Bitcoin as you can next month.

-

Sell all of it in October 2025.

That’s almost certainly a profitable approach.

So’s buying Bitcoin when it goes above the 21-week moving average and selling when it goes below the 21-week moving average.

Also, buying Bitcoin one day after the TradingView NVT signal turns black and selling one day after the same signal turns red.

Do you know what’s also a profitable approach?

Buying Bitcoin at any time. You’ll get a CAGR of 34%, better than any other asset that doesn’t have maintenance or carrying costs.

Those approaches have nothing to do with data models, theories, or predictions. They work!

They’re also not guaranteed to beat somebody who follows my plan.

Model expectations

Mark, you don’t follow the data models?

No, I do. I love models. While I don’t spend much time discussing them, I take bits and pieces in my updates for premium subscribers.

I’ve given some predictions, too. After you’re finished with this post, come back and read these predictions:

The problem with predictions?

When you’re right, it’s a coincidence. When you’re wrong, people make fun of you. But you won’t know if you’re right or wrong until after it’s too late to do anything about it!

Still, they’re great thinking exercises and easy entertainment. As far as decisions go, I take the market as it comes.

Uninspiring, maybe. Dull, perhaps.

This newsletter will not be dull or uninspiring! Since you’re into models, I’ll give you my take on some of the more popular ones.

Halving cycle

Miners are always selling. If anything, they are forced to sell. Even if they’re in a strong financial position, they can’t resist the temptation to make money. That’s the whole point of mining.

As such, the more Bitcoins the miners have, the more they’ll sell. They’re a drag on Bitcoin’s price.

Fear not! Every four years, miner rewards get cut in half. The halving, as they say. This reduces selling pressure from miners.

We’ve had three of these cuts already, with a fourth expected around April 2024.

Some claim miner rewards have dropped so much already that these cuts won’t impact the market.

Others claim the halving is priced in, meaning people already made their buying or selling decision so the halving won’t change anything.

Neither of those things make sense to me.

At the halving, Bitcoin’s protocol will cut new issuance in half, the equivalent of roughly $4 billion per year at today’s prices.

That’s $350 million less selling pressure on the market each month (more as the price goes up) — enough to make up for three Mt. Gox settlements each year.

When you look at today’s market conditions, you don’t see a lot of buying and selling.

As a result, you don’t need a big shift in market dynamics. A little less selling goes a long way.

While $350 million each month is not a lot, it’s enough to make a difference in these conditions. We see persistent HODLing and accumulation combined with a general lack of sellers and no reason to think that will change (as of this post).

With the halving, less Bitcoin goes to people who sell all the time. That leaves more Bitcoin for people who only sell when the price goes up or down too much, too fast.

The vast majority of those people do not show any behaviors that suggest they plan to sell any time soon.

For those reasons, the halving is a spark for the wider market — not much on its own but enough to get a fire started. Everything else takes care of itself.

Also, it’s a nice fit for the aggregate movements of prices within each halving period. Take a look at how price patterns follow similar general paths (with different extremes):

Four-year cycle

What about the four-year cycle?

With this model, Bitcoin’s price reaches its bottom around December or January every four years, with the next bottom in late 2025.

That’s a valid pattern.

Do you know what’s crazy? Bitcoin’s price swings up and down 50% during those timeframes.

You can follow the four-year cycle and still do worse than somebody who took one of the other approaches. Depending on when you enter, you might even lose money.

What about the peaks? When’s the best time to sell?

Nobody knows. Four-year cycles can be left- or right-translated.

In other words, Bitcoin’s peak can come at any time during the four-year cycle.

Plan accordingly.

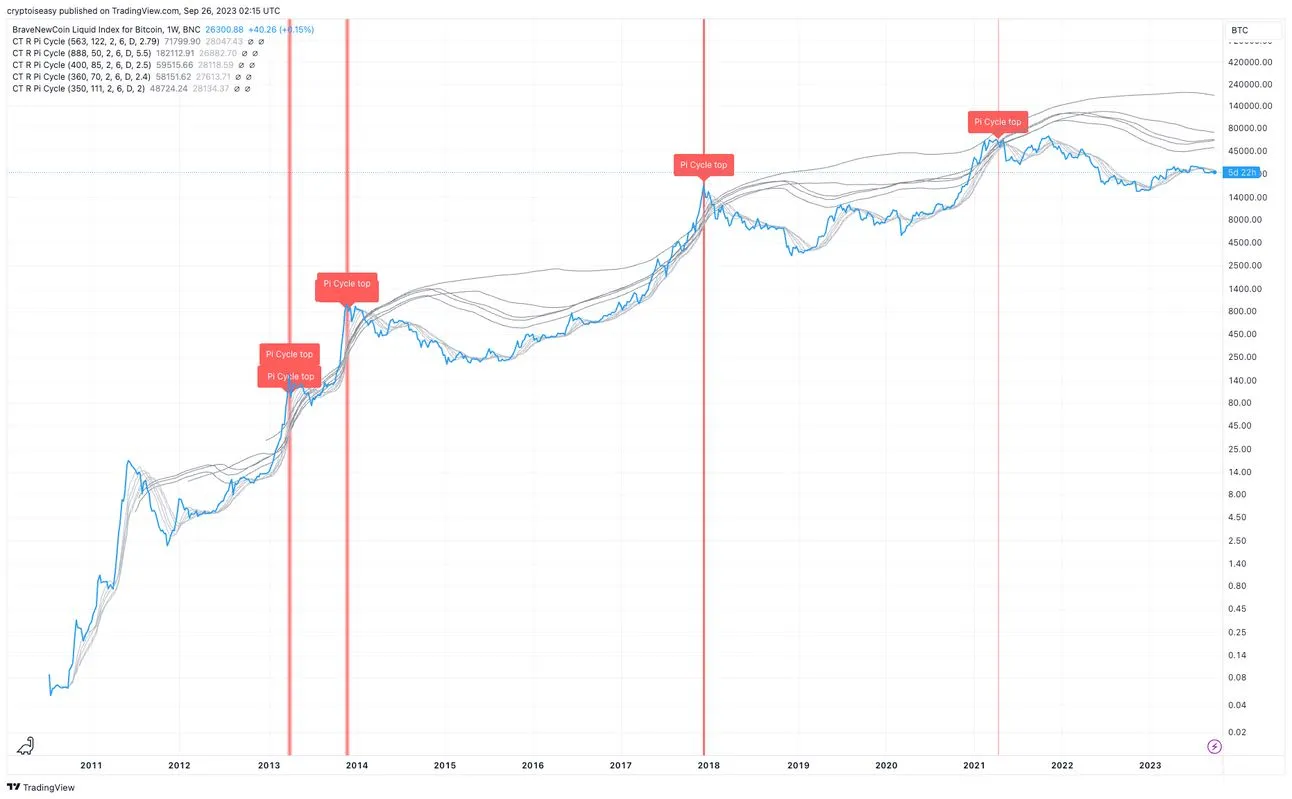

Pi cycle

The Pi Cycle is an extrapolation of two moving averages plotted as lines on a price chart. When those lines cross, they mark the big, long-term peaks and bottoms — or so the thinking goes.

You can put these lines together in lots of ways.

The classic Pi Cycle top is a formula based on the 350-day and 111-day moving averages, but you can see some other Pi Cycle configurations on this chart. The crosses are marked with vertical red lines.

As you can see, the lines crossed four times, twice at market cycle peaks and twice during smaller upswings.

The classic Pi Cycle bottom is a formula based on the 471-day and 150-day moving averages. Same idea but the lines cross at the bottoms instead of the tops.

This metric caught two of the four market cycle bottoms.

Pi cycles have 50% success rates, on par with most trading signals. Not very accurate.

Should we throw them out?

No! The Pi Cycles tell you when the market’s too hot or too cold. The market always goes in the opposite direction after the Pi Cycles flash.

You can confidently sell when you see the Pi Cycle top and confidently buy when you see the Pi Cycle bottom. Just remember, you might miss a lot of upside and downside.

The real problem comes on the other end.

When you sell fake peaks, when do you buy in again? When you buy fake bottoms, what do you do when the market keeps going lower? Strictly speaking, you can’t enter or exit for years at a time.

Free tip: split the difference! Sell 50% of your Bitcoin when the Pi Cycle peaks. Buy 50% of your allocation when the Pi Cycle bottoms. For the rest of the time, follow my plan.

You can get the basic Pi Cycle indicators for free on TradingView:

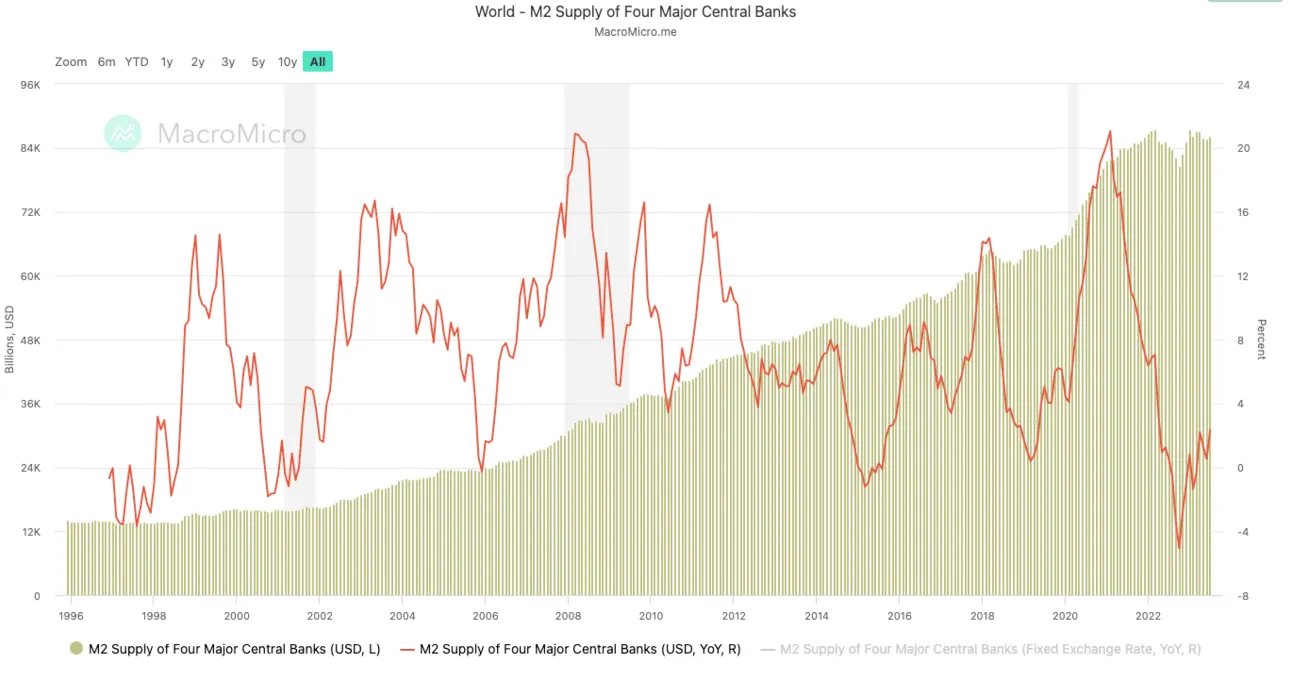

Liquidity cycle

Some on-chain analysts and contrarians dismiss the halving cycle, four-year cycle, and Pi cycles.

They say global liquidity drives the market. It’s just a coincidence that this liquidity cycle happens to match up with those other cycle timeframes.

What’s “global liquidity?”

The world’s supply of government money.

Ok.

How do you define liquidity? Do you use the old M2 or new M2? What about M3, the “broad” money supply? Central bank balance sheets? Some other measure?

Do we also assume that global liquidity has four-year cycles? Can we plan around that?

Can we even assume we know which measure of money matters now that the global financial system runs on debt and derivatives rather than actual money in the real economy?

What about currency swaps and repurchase agreements? These activities provide plenty of liquidity but aren’t calculated in conventional measures of money supply. You can find them on central bank balance sheets but they’re always changing.

Anyway, how do make decisions from this model? The world’s M2 hardly ever falls.

How do you account for wealth transfers from old people to young people? What about all of the other nuances and conditions that don’t get captured in this model?

And why can’t it tell you what the world’s “liquidity” will be in six months?

“Institutions” cycle

You may hear people say these models don’t matter, once institutions come, everything will change.

Ah, institutions. Our saviors! Just like in 2019.

Blackrock and EDX are the new Facebook and Bakkt.

People are getting excited about a spot Bitcoin ETF and the expectation of Wall Street firms bidding up Bitcoin’s price.

If you’ve read Bitcoin or Bust: Wall Street’s Entry Into Cryptocurrency, you know my thoughts about “institutions.” No point rehashing here.

A spot Bitcoin ETF is simply a way for Wall Street to make money off of people who don’t want to take five minutes to learn how to set up a Bitcoin wallet.

Fortunately for Wall Street, there are a lot of people who don’t want to take five minutes to learn how to set up a Bitcoin wallet. They’ll gladly pay a small fee or premium for somebody to do that on their behalf.

One note about the ETF, though.

ETFs don’t create demand. We already have plenty of Bitcoin funds and they’re not exactly lighting the world on fire. According to Coinshares, net flows into investment funds total $40 million so far this year.

Why do ETFs matter?

Because they give legacy financial firms a reason to sell, market, and offer incentives to financial advisors and brokers, who will then get their clients to put some money into the ETFs.

Grayscale, Proshares, and Bitwise fill a lucrative niche. They don’t yet have the network, brand awareness, or longevity of Fidelity, BNY Mellon, and other established Wall Street entities.

A spot ETF will attach Bitcoin to household names.

That’s good for Bitcoin’s image and legitimacy.

As far as boosting its price? We’ll see.

ETFs make it easy for people to put money into the market and take money out of the market.

Most people who use the ETF will sell after a 50% or 100% pump because their financial advisors will rebalance their portfolios back to their target allocations.

That might tamp down on some of the speculative excesses that have plagued the market for a long time. Healthy for the long-term growth of this asset class, but one step further from that supernova moonshot “we’re all going to be rich” outcome that the bull market champions want you to believe.

If we get the crazy bull market that so many people expect, it won’t be because of an ETF. It’ll be because crypto just does that sometimes.

Price theories

What about price projections? Can we get any closer than the cycle models?

Let’s see.

5.3 Theory. This theory says Bitcoin’s price peaks on average at 5.3x the most recent major bottom.

It’ll be years before we know if $15,600 was the most recent major bottom. It’s the lowest price since Bitcoin’s 2021 all-time high. Since we don’t have anything better to use, we’ll plug that into the equation.

That puts the next peak at $83,000.

When?

The theory doesn’t say. Plan accordingly!

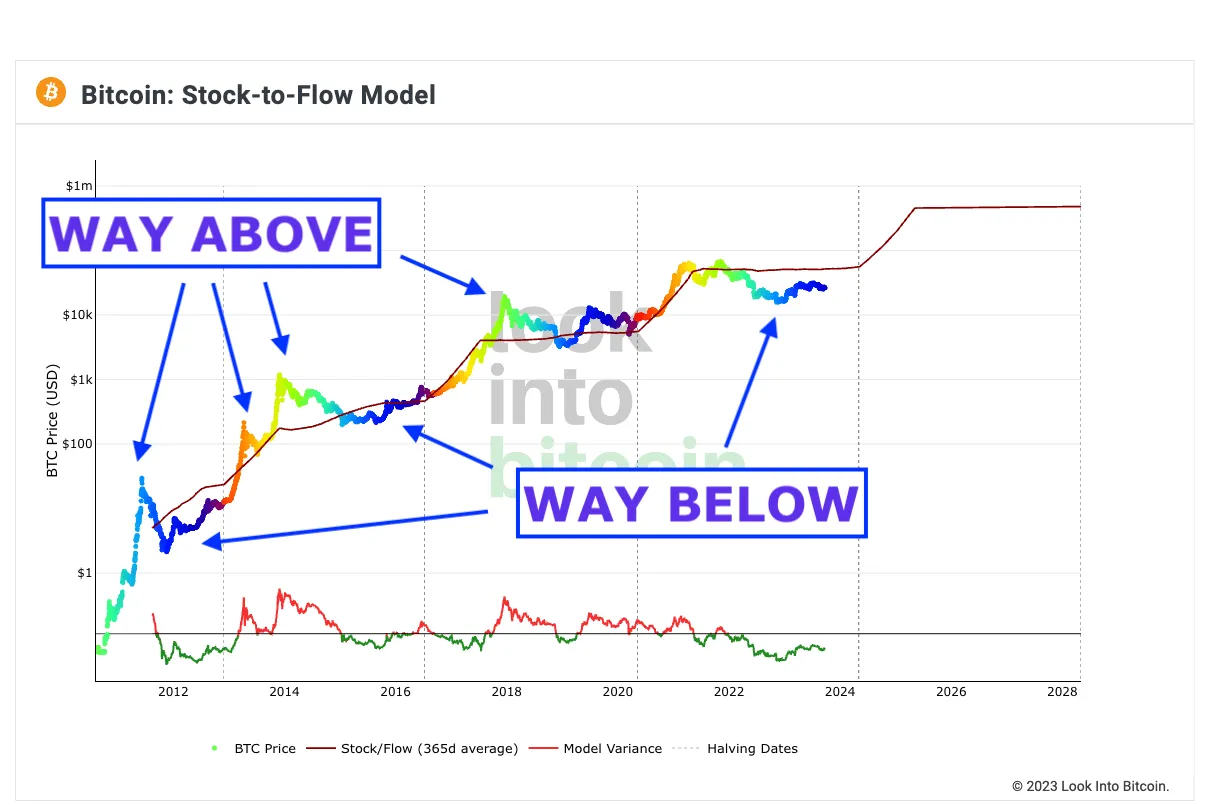

Stock to flow model. This model is too sophisticated to explain. It’s a bunch of maths rolled into a chart.

Bitcoin’s price has gone 400% higher and 80% lower than S2F predicts for months at a time.

That’s a wide range.

Using the chart from LookIntoBitcoin, the next peak could come as high as $400,000 (unless we already hit our peak at $31,800, also within the model’s range of accuracy).

U2R. At one time, I had my own version of S2F called “Mock to Flow” or M2F. It was like stock-to-flow except with more bullshit. M2Fers know the deal.

U2R is its successor. I stripped out all of the data and analysis and drew a line on a chart. That line goes up.

At any time, Bitcoin’s price will be above, below, or at that line.

This model has never failed. You can see it for yourself:

People say U2R is useless. They’re wrong. It’s more accurate than any other model. Bitcoin’s price is always above, below, or at the U2R price.

None of those other predictions, theories, or data models tell you what Bitcoin’s price will be on any given day, when its price will peak, or what price will mark the bottom.

As such, U2R is as valid as any other model.

2022 and 2023 — not so different after all

Are you skeptical?

Ok. That’s fair. Don’t feel like you have to pick one model! You can accept them for what they are and not stress too much.

In general, you might find this market is easier when you do that with everything. Facts never seem to square with sentiment and the social media algorithms don’t help. When you play things out, you might get surprising results.

For example, the internet tells you 2022 was a terrible year for crypto and 2023 is a great year for crypto.

In 2022, Bitcoin’s average price was $28,100. In 2023, Bitcoin’s average price is $26,400.

That’s a 6% difference.

Does it feel like 2022 was only 6% worse than 2023?

Is that 6% savings worth the stress and aggravation of waiting for perfect conditions in a market as volatile as crypto, where 6% swings happen all the time?

They say you shouldn’t buy crypto during a bear market, but is it worth waiting for “confirmation of a bull market” or “a final capitulation” at the risk of missing Bitcoin at $15,600, $17,600, or $19,600?

That is a very hard way to approach the market. You have to get your timing just right. You’ll get stressed out, aggravated, and anxious.

And you still might end up worse off than somebody who buys at fixed times without regard to price or circumstances.

Doom from the macro

Priya in the Park still shouts “The End is Near” and as always, she’s right.

The problem is, “near” keeps getting pushed further and further into the future.

On many financial and economic metrics, year-over-year changes still look abysmal. In some cases, the closest comparisons come after financial catastrophes.

Common measures like the 2-year/10-year yield curve inversion say we’re overdue for a recession. Should’ve had one this summer.

When that didn’t happen, analysts moved to the 3-year/10-year inversion. On this metric, the US has never had it so bad for so long.

From that perspective, we should expect a recession any day now.

Or not, because those analysts now say recessions don’t come until the inversion disappears, not when it appears.

Are they so different from the rainmakers of last month’s issue?

When everything has a long and variable lead and the goalposts always move, you can’t get too precise with your plans.

Don’t forget about your government’s magic wand!

A few months ago, experts said next month’s resumption of US student loan repayments would crash the US economy. Then, last month, the White House rolled out a new program to reduce and delay student loan payments.

Medicare has been going bankrupt “within 10 years” since the 1980s. Over that time, laws changed. Medicine changed. Private concierge services popped up. New drugs and treatments reduced costs and improved outcomes.

Medicare may be going bankrupt within 10 years forever.

China’s economy is still held together with gum wads and rubber bands, as it’s been for a long time. Now it’s pumping its economy with stimulus and engineering a controlled unwinding of troubled entities. Maybe it’ll work?

If a few more US banks fail, the Fed might stage another intervention.

When your government can wave its magic wand and create or destroy your financial opportunities at will, you can only plan so much.

Embrace uncertainty

Doomsbergers and naysayers will try anyway. They’ll feed your fears and stoke your anger. All to shill your government’s money.

Are they much different than the “up only” crypto bros?

Markets are more complicated and unpredictable than anybody can decipher.

Leading indicators can’t account for changes that happen from now until the event they predict.

Lagging indicators can’t tell you anything about what to expect in the future.

I could give you a dozen charts that make the future seem hopeless.

Despite all the gloom, Bitcoin’s price is up more than 50% this year. The S&P 500 is up about 17%. SHY, a fund that tracks 1- to 3-year US bonds, is about even. The US dollar is up about 2%.

Measured as Bitcoin, your stocks are down more than 20%, your cash has lost almost 36% of its value, and your bond ETF did even worse.

How much more will you lose waiting for the crypto market to “capitulate” and “collapse?”

Traders deal with this uncertainty with “strong convictions loosely held.” They’ll make a prediction and take it back whenever the market does something different than what they expect.

Why can’t we have loose convictions strongly held?

No predictions. Take the market as it comes. Understand and anticipate risks and opportunities. Get a strong sense of what’s going on at this moment, trends and behaviors, and what they suggest about the risks and opportunities to come. Project a range of outcomes, not a defined result.

Don’t fight uncertainty. Embrace it! That is the reason we have this opportunity.

Once everybody is certain about a bull market, you will have missed the best chance to buy. Once everybody is certain about a bear market, you will have missed the best chance to sell.

You have this opportunity because the rest of the world looks at Bitcoin’s price and thinks it will never go up.

They look at an altcoin chart without taking into account:

-

Staking rewards

-

Rewards for operating a node or contributing to the network

-

Emissions schedule

-

Lock-ups and kickbacks for insiders

-

Various measures of utility and function

-

Rewards from depositing into liquidity pools

-

Other factors that change the returns you can expect from your investment but never appear on a price chart.

They buy into bizarre and exotic projections that are unrealistically high or absurdly low. They get so wrapped up in the future that they miss what’s going on today.

As a result, they can’t reconcile their feelings with reality.

Normal for Act 2

This dissonance is typical of Act 2 in the market cycle.

During Act 2 of any good story, the hero has to confront and overcome challenges, suffer setbacks, and often lose something. Act 2 brings sacrifice, struggle, and doubt. So it does with the crypto market, too.

Everybody knows the hero will win. They just don’t know how. The audience hopes but doesn’t believe. Maybe the hero will fail? Maybe the villain will win?

You can see that in the general consensus that crypto is in a bear market even though it’s gone up for 10 months. Analysts dismiss the halving and claim Tether and Binance will collapse or a global recession will destroy everything.

Victory seems far out of reach.

If you entered the market in 2021, you might feel that way. Trust that the hero will win and focus on today, not tomorrow.

Don’t worry about the models. You will always have models, but you won’t always have this opportunity.

I’ll continue giving you the insights and analysis you need to stay calm, levelheaded, and aware of our circumstances and what expectations we should have for the coming weeks, months, and years.

If my only contribution to the space is the U2R model, I’ll be content with that. I would argue it’s as useful or more useful than any other data model, price, model, or market theory. It’s accurate 100% of the time.

All of those models and theories can play out as expected and still let you down.

As such, we have to take the market as it comes — the ups, downs, and sideways.

In this story, the hero always wins. You are the hero!

Relax and enjoy the ride!