Bitcoin’s price is up 35% in two months.

Now, I’m hearing people talking about an “echo bubble,” a big crypto pump that peaks sooner and higher than everybody expects, then plummets the entire market to new lows.

Are you hearing that, too?

Seems a little odd to make such proclamations. Crypto is a series of bubbles, one after the next, big and small, over short and long timeframes, forever.

Some bubbles last a few months. Some last a few years. Some last a few days or hours.

In June’s issue, I delved more deeply into this idea.

I’ll revisit the theme in this post.

Bubble is as bubble does

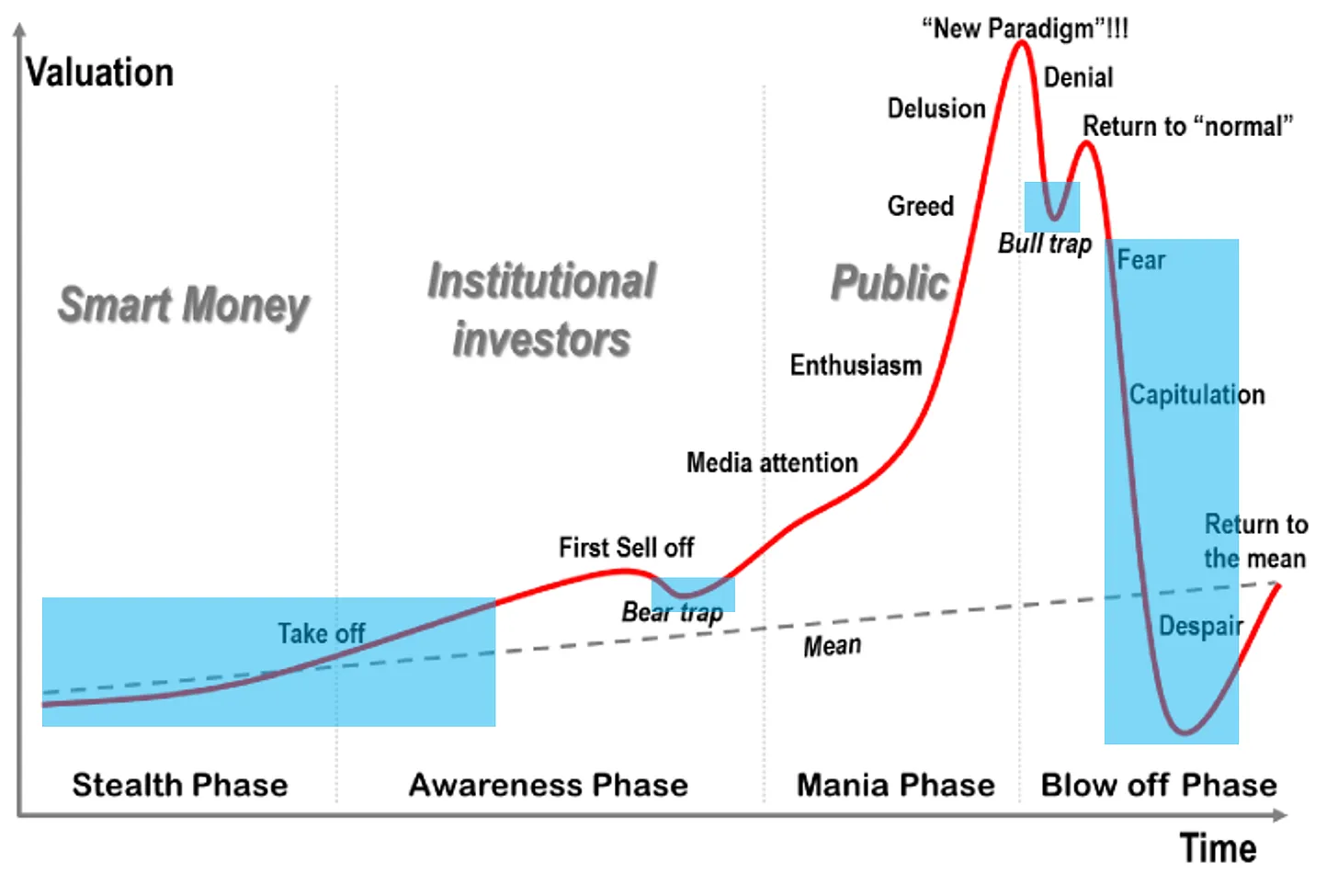

Look at this chart, which lays out the anatomy of a bubble:

This is not a price pattern, but a psychological one. You can apply this model to any asset, whether or not it has intrinsic value.

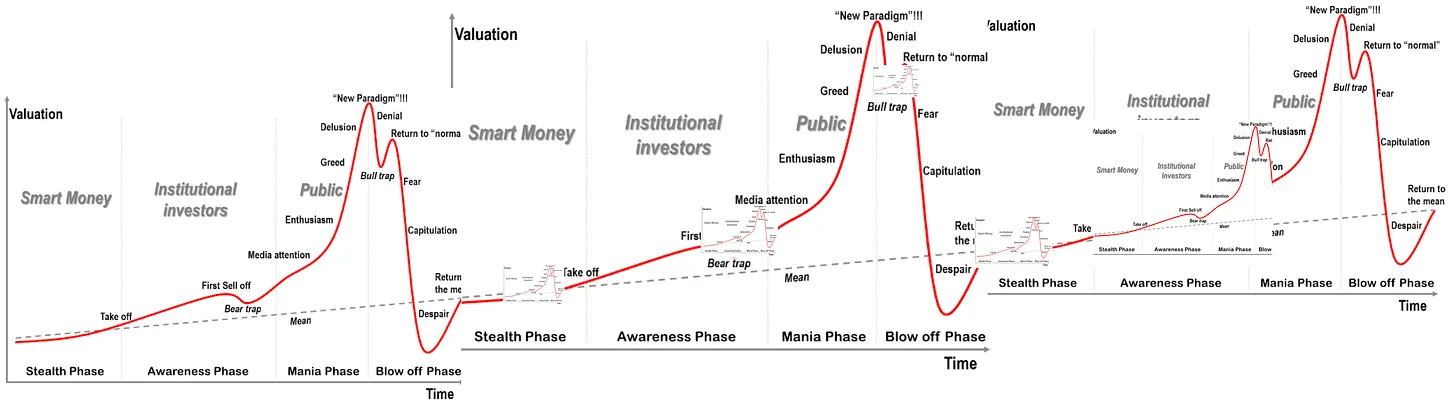

It’s the same pattern we saw during the six-month pump of 2019, the three-month DeFi summer of 2020, the altseason of early 2021, the overall swings of 2021-2022, and the larger 2018-2022 bottom-to-top cycle.

This model has defined all the peaks and valleys of the crypto market since its beginning, from brief gyrations to years-long expansions and contractions.

At any moment, you will never know where you are in the bubble.

Sometimes, you’re in the bear trap of one bubble and the stealth phase of another, depending on the timeframe and scale you’re looking at. Other times, you hit a “new paradigm” within a small subset of the market, while the rest of the market hasn’t even hit the awareness phase.

Perpetual bubble machine

If you’re not already familiar with the “Anatomy of a Bubble” chart, prepare to see a lot of it in the coming weeks and months.

Crypto markets move in rhythm with humanity—a perpetual bubble machine, repeated over and over on the shortest timeframes and longest time frames, in two-day cycles, altseasons, two-year cycles, four-year cycles, and ten-year cycles.

Like this:

Each bubble can last far longer and go way higher than you think possible or end far more quickly and way lower than you could ever expect.

The hard thing about having so many bubbles over such varying timeframes and price ranges?

You can get a good sense of tops and bottoms, but you never know where you are in the cycle.

Priya in the park will always tell you the market will crash. How many opportunities will you lose while you wait for her to be right?

Tony on the TV will always tell you the market will go up. How many opportunities will you lose while you wait for him to be right?

For that reason, I follow my plan.

With this plan, you catch all of the bottoms and avoid all of the peaks.

Timing isn’t everything

That doesn’t mean you catch only the exact bottom. You will buy higher, before, and after, but always with the opportunity to buy in that range of prices.

On average, my plan gives you 30% more bitcoin than dollar-cost averaging and better results than most traders. For the most part, you buy during these parts of bubble cycle:

You’ll still get the pumps, dumps, and everything in between, simply because you can’t get so precise. What happened in 2022 could’ve happened in 2021, the year before that, two years from now, or four years from now.

Even the best predictors need luck on their side.

For example, Michael Burry got famous for betting against the US housing market in the mid-2000s. He made a fortune for himself and his clients.

Supposedly, he was months away from running out of money to fund his position. If the housing market had taken an extra six months to burst—or deflated on its own—he’d have lost his bet bigly.

Also, his warnings first came in 2005, several years before the financial crisis, when you could still buy a house for a normal price with a reasonable down payment and terms that made sense for your income, goals, and lifestyle.

After the housing market collapsed, average prices fell about 7% lower than 2005 levels—not very far below the price you got when Burry started calling for a collapse.

Yes, if you bought a house in 2005, when Burry started calling for the bubble to burst, you would have done ok.

-

If he got it wrong, your house would keep going up in value.

-

If he got it right, you’d take a hit on paper but get through it. Depending on how you structured your finances, you may have even had a great chance to acquire more real estate at a discount in 2008, 2009, and 2010. You got 3-5 years to build equity in your primary residence, then the US government gave you a once-in-a-lifetime deal on low rates, depressed market conditions, and big subsidies to buy a new house or get a second one.

You’d win either way.

With crypto, we’ve dealt with the same problems time after time. Tether, rehypothecation, Ponzi schemes, vaporware, unfulfilled roadmaps, scammers, undisclosed shills, regulatory threats, bans, the list goes on.

Why do people assume these problems couldn’t have gone on for a few more years? What makes people so certain that these problems would ever come to light? That those risks would ever come true? Why did they have to come out now, not two or three years from now?

Appreciate the circumstances

While it’s fairly clear when the market reaches its peaks and bottoms, those things take time to play out. Prices can go up and down 50% during those times.

Just buy when opportunities present themselves and sell only when the market forces you to sell. At all other times, set aside cash until the next opportunity comes.

Does that mean you’ll buy into the echo bubble?

No, but you might buy the tail end of it, on the way down.

Ideally, we’ll have our allocation before each bubble begins, then come back when the market’s on the downtrend and collecting itself for the next move up.

Not as good as that exclusive secret signal group or trading subscription you already bought, but close enough that you can navigate the market without any more stress than absolutely necessary.

That way, you don’t have to worry about bubbles, echo bubbles, or anatomies of bubbles.

You can enjoy your good fortune, prepare for the inevitable downswings, and take advantage of the opportunities that arise when they come.

Mark Helfman publishes the Crypto is Easy newsletter. He is also the author of three books and a top bitcoin writer on Medium and Hacker Noon. Learn more about him in his bio.