In the fast-moving world of decentralized finance (DeFi), one name stands out above the rest: Uniswap. Since its launch, this decentralized exchange (DEX) has transformed the way users trade Ethereum and ERC-20 tokens. By 2025, Uniswap remains the leading platform for crypto swaps, liquidity pools, and decentralized governance.

Unlike centralized platforms, Uniswap doesn’t require users to trust a third party. Instead, all trades are powered by smart contracts. This makes it one of the most secure, transparent, and permissionless tools in the entire blockchain ecosystem. 🔐

🌐 Why Uniswap Matters

Uniswap has become more than just a decentralized exchange Ethereum traders trust — it is now the backbone of the DeFi economy. Millions of people around the world use Uniswap DEX to swap crypto, provide liquidity, and earn fees. The platform’s user-friendly interface makes it possible for beginners and professionals to start trading in seconds.

In 2025, Uniswap v4 introduces new features like customizable hooks, cross-chain support, and lower gas fees. Whether you want to make a simple Uniswap swap or manage an advanced liquidity pool, the platform gives you all the tools you need.

🔑 How to Use Uniswap

The process is simple:

-

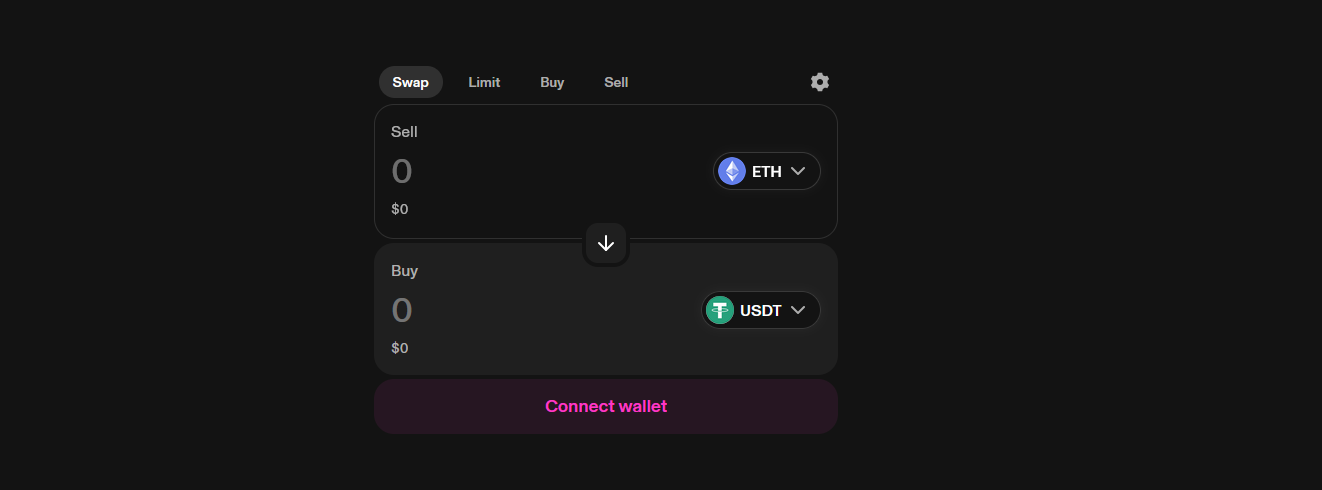

Go to the official Uniswap app

-

Connect wallet Uniswap — choose MetaMask, WalletConnect, or another Ethereum wallet.

-

Select the token you want to trade from and the token you want to receive.

-

Enter the amount and check your Uniswap trading fees.

-

Confirm the swap and wait for the transaction to finalize.

Within a few seconds, your tokens appear in your wallet. That’s it — fast, simple, decentralized. ⚡

💧 Liquidity and Earning on Uniswap

One of the most powerful features is the ability to become a liquidity provider. By depositing pairs of tokens into Uniswap liquidity pools, you enable other users to trade. In return, you earn a share of the fees every time someone swaps tokens.

For example, providing ETH and USDC into a pool allows you to collect rewards whenever other traders swap between these tokens. This creates opportunities to generate passive income while supporting the ecosystem. 💸

Of course, liquidity providers should be aware of impermanent loss, which happens when token prices move. Still, many users find the rewards worth it.

⚡ Uniswap vs. Centralized Exchanges

Centralized exchanges may feel familiar, but they come with risks: they hold custody of your funds, face regulation, and can be hacked. On the other hand, Uniswap exchange is non-custodial, transparent, and powered entirely by Ethereum smart contracts.

This makes it one of the most trusted options for people who want complete control over their assets. By 2025, Uniswap has processed billions in daily volume, proving that decentralized systems are not only safer but also more efficient.

🪙 The UNI Token

The UNI token is the heart of Uniswap governance. Holders of UNI can vote on proposals, shape protocol upgrades, and decide how treasury funds are used. This gives the community real power over the future of the platform.

UNI is more than just a token — it’s a symbol of decentralization, a stake in the future of DeFi, and a way to ensure the protocol evolves fairly.

🔮 The Future of Uniswap

Looking ahead, Uniswap is set to grow even further:

-

Integration with Ethereum Layer 2 solutions like Arbitrum and Optimism reduces gas costs.

-

Uniswap v4 expands the flexibility of liquidity pools.

-

Multi-chain support connects assets across different blockchains.

-

Institutional adoption brings even more liquidity to the ecosystem.

Uniswap isn’t just a DEX anymore — it’s becoming a global financial hub for Web3. 🌍

✅ Conclusion

By 2025, Uniswap stands as the most important decentralized exchange Ethereum has ever seen. From fast and secure Uniswap swaps, to earning fees through liquidity pools, to shaping the future with the UNI token, the platform remains unmatched in the DeFi space.

Whether you’re here to trade tokens, earn passive income, or participate in governance, Uniswap DEX is the ultimate gateway to decentralized finance. Connect your wallet, explore opportunities, and take control of your financial future today. 🚀