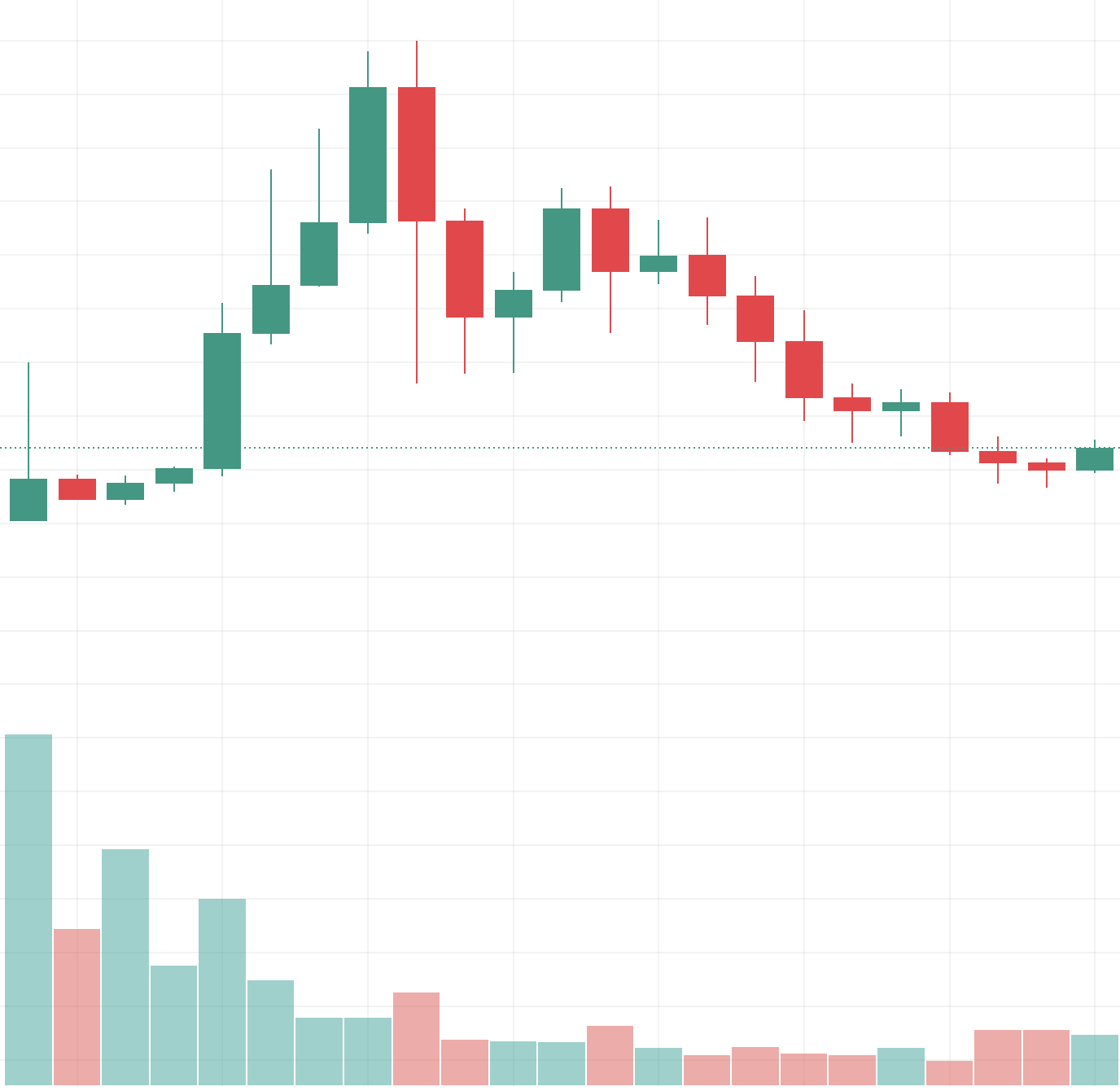

Let’s play a game. Look at the chart below, and guess what the token in question is (pair is against USDT).

Whatever you may have guessed, you’re probably right. Basically every DeFi chart, especially older DeFi, looks like this. Nice little speculative pump followed by unlocks, position unwinds and dumping that brings the token right back to 0, followed by months of anemic volumes and little price action. Although the entire market is starting to look like the above reference chart, DeFi tokens had been doing this for months before Joe even took office. You simply can’t blame the failing broader economy for the sad performance of a lot of DeFi names recently. The simple reason why you see this chart on every chain across crypto is because there was an intentional lack of tokenomic soundness in place across the early waves of DeFi. Projects raised cash from investors, bootstrapped a treasury, got users, and went to market, but left the question of what to do about these tokens they minted to the future.

While normies spent their paychecks aping into lazy lions and Solana monkes, “Future of France” middle curve investoooors slowly bled out as their favorite platform tokens took an express train to 0. That is not to suggest that ‘DeFi’ itself is a failure; to the contrary, I would argue that it is stronger than ever. The recent Voyager, Celsius, 3AC, BlockFi, Genesis, et. al debacle is the icing on top for the DeFi thesis. We need DeFi more than ever. Transparent, visible, auditable systems that allow parties to interact with some degree of community oversight may have mitigated some of the problems we have seen in the space in the last three months. But that doesn’t mean that DeFi has had some negative outcomes for certain ecosystem participants in the last few years of its existence.

In 2020 there was the concept of ‘blue chip DeFi’. These were the projects with the most reputable and intelligent teams, the most TVL, and the biggest user counts. Everybody knew, even then, that these were the truly lindy protocols - in 20, 30, even 50 years our descendants are likely to be interacting with them. The ‘blue chips’ often were the first to introduce some new economic primitive. And they did so in such a way that their systems were not grossly vulnerable to malfunction, which could jeopardize billions of dollars of user funds. Upstarts typically would either 1) rip off one of the blue chips or 2) combine different aspects of multiple blue chips into one. Ultimately, this relatively small set of primitives would come to underpin the entire market.

Typically it is a good thing to own ‘blue chip’ anything. If you owned a basket of FAANG stocks in the early 2000s, you’d be a rich man now (and probably not reading this due to being retired on a beach in Bali). But if you were early to ‘blue chip’ DeFi in 2019 and 2020, and didn’t sell the top of each when it was most opportune (within 6 months typically), then I would assume you still work a day job (like me). The multi-year LindyHold strategy simply failed. Why? If these protocols are going to be around forever, and will have a network effect flywheel that keeps in them at the top that whole time, why not have a piece of the action? Because you got sold a dream, not a reality.

In 2020 money printers were at capacity. The United States printed more money in 2020-21 than in the entire history of its having a coherent monetary policy in order to ‘fight the virus’. People were sitting at home, speculating on whatever, with the checks the government mailed them from the treasury. This was a weird time in world history that, assuming we don’t encounter a second world-halting pandemic in the near future, will never be seen again in our lifetimes. At that time, because everyone spent their days speculating, it became incredibly fashionable to use investment as a way to signal your affiliation with something. GME and AMC mooned because it was a way for zoomers to dunk on a hedge fund. SHIB and DOGE went parabolic because, uh, dogs. DeFi went crazy both because of liquidity mining incentives and also because public liquidity mining on one platform or another was a means to signal your alignment with the future of france. We all got to live through a speed run of the 1920s gilded age without leaving the couch. But those times are long gone.

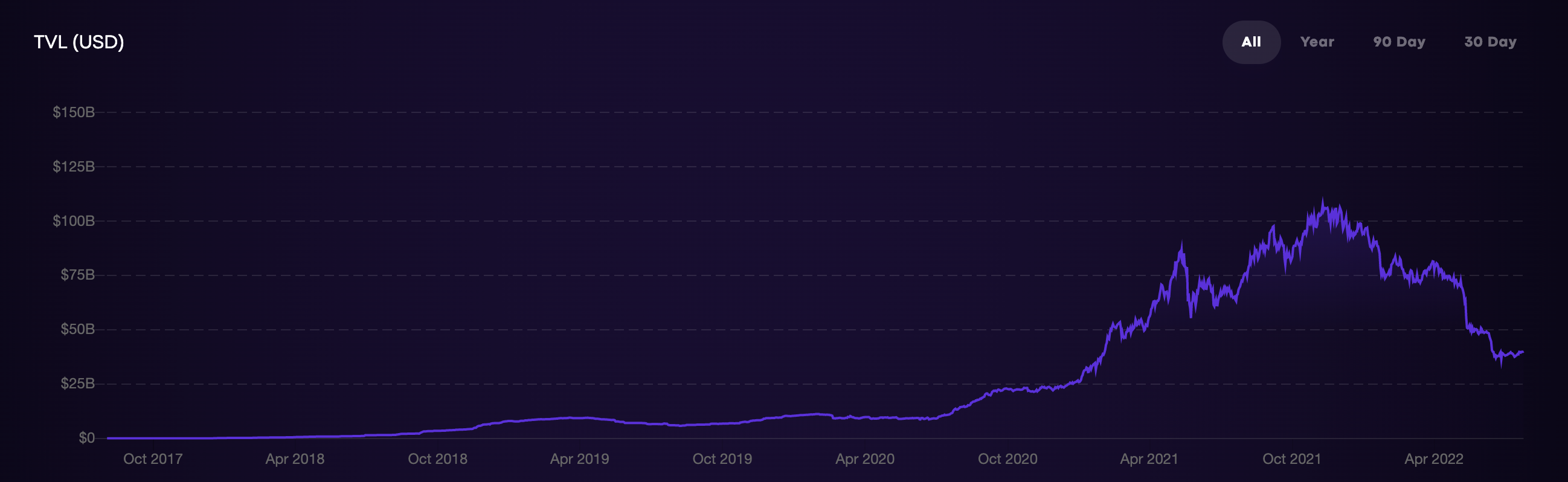

The absolute state of DeFi today is that while TVL is up 4x from 2020 levels (10b to 40b according to DeFi Pulse) most of the tokens that represent them have cratered to 0. Despite tens of thousands, if not hundreds of thousands, interacting with DeFi protocols every day, there is scant hope for a number of DeFi tokens (not the protocols they represent) that are sitting at negative $0.

That said, DeFi innovation did not end in 2020. Alongside the numerous improvements to capital efficiency, featureset, and user experience has come the realization that tokenomics can and should be fixed. The new generation of DeFi, call it DeFi 2.0, 3.0, 2.5, whatever, is comprised of a cohort of realists, who understand the key factors behind why we even have cryptocurrencies in the first place. Rather than make excuses, they practice realtokenomik. The basic principle of all tokenomics, in my opinion, is that tokenomics is not an open question. There is an obvious answer to ‘what are the best tokenomics’ for the vast majority of DeFi protocols (especially those that subsist off of a fee model). If a project has a token, then the revenue of the protocol should directly enrich the holders of that token. Many projects do this already, which can be easily discovered via research.

A system of realtokenomik is a system in which the tokenomics of a dApp or protocol reflect the reality of the wider situation. The wider situation is that individuals and even institutions will not ‘ape’ for no reason at all - there is no longer a speculative bid. When this bid exists, we see the entire market move upwards at the same time as capital attempts to find places to park itself. Today, however, capital is very obviously drawn to particular locales that are believed to be the most robust. Those locations are the enclaves of realtokenomik practitioners; where tokenomics reflect the real adoption and real cashflow of a smart contract platform. As more users onboard to DeFi over time this will become the primary governing principle.

Ultimately, we must come to terms with the fact that crypto is coming to fruition in a decaying world. Europe is once again at war, food and gasoline prices are rising rapidly, and shortages of all kinds are proliferating worldwide. These things are unpleasant, but Satoshi’s vision (forgive me for evoking BTC fork imagery) was that crypto would be a system resilient to these things. The content of the genesis block, “The Times 03/01/2009 Chancellor on brink of second bailout for banks” and its implicit cynicism underscores the fact that he expected the wider world to fail. Crypto (and DeFi as a subset) is meant to help us avoid the many human fallibilities that pollute the traditional systems. In order to achieve this two things are required: radical transparency, and radical community ownership. Despite the setbacks we frequently encounter in the space, I think the overwhelming trend is in this direction. WHITEPILLED.

Vive le realtokenomik

Opinions are my own and do not represent those of my associates, employers or anyone else.