Since all of us are born too early to explore the galaxy or too late to discover planet Earth, we are destined to migrate into the Metaverse economy. Notably since the pandemic, many friends & families have been asking, learning, & investing in crypto, NFTs, and the Metaverse for the first time. Unfortunately, they cannot tell what’s good & what’s bad; what’s real & what’s scam; what’s ETH & what’s ADA. To make things worse, the amount of information asymmetry and deleterious shills are growing at the same rate, if not more, than the growth of Metaverse itself. If left unchecked, this might lead to the demise of what could have been the most important socioeconomic transformation since the industrial revolution. To ensure prosperity for all in the Metaverse, we need “less shilling, more education; less maximalism, more collaboration”.

By combining cryptoeconomics with peer predictions & Natural Language Processing algorithms, we are proud to introduce KnoxEdge Market (KnoxMarket): a Community-Driven Learning Platform, where weekly peer-prediction knowledge markets are hosted to allow anyone to contribute-to-earn and put money where their mouths are, at the same time learning and educating themselves. We are re-thinking the way the world shares knowledge and our mission is to transform vast bytes of information consumed in today’s world and tomorrow’s Metaverse into easy bits of knowledge, making it seamlessly accessible to everyone.

1. What is Knowledge Market?

Information (prediction) markets can be thought of as belonging to the more general concept of crowdsourcing which is specially designed to aggregate information on particular topics of interest.

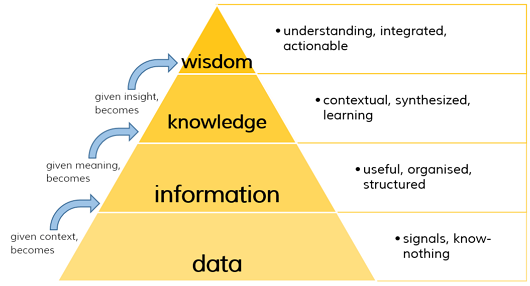

KnoxMarket is the next frontier of information market, representing the next logical step in realizing the data-information-knowledge-wisdom (DIKW) pyramid. Some of the existing information markets include Polymarket, Augur, Lithium Finance, Upshot, Erasure Bay and several others.

2. Empowering You to Contribute-To-Earn with Your Knowledge

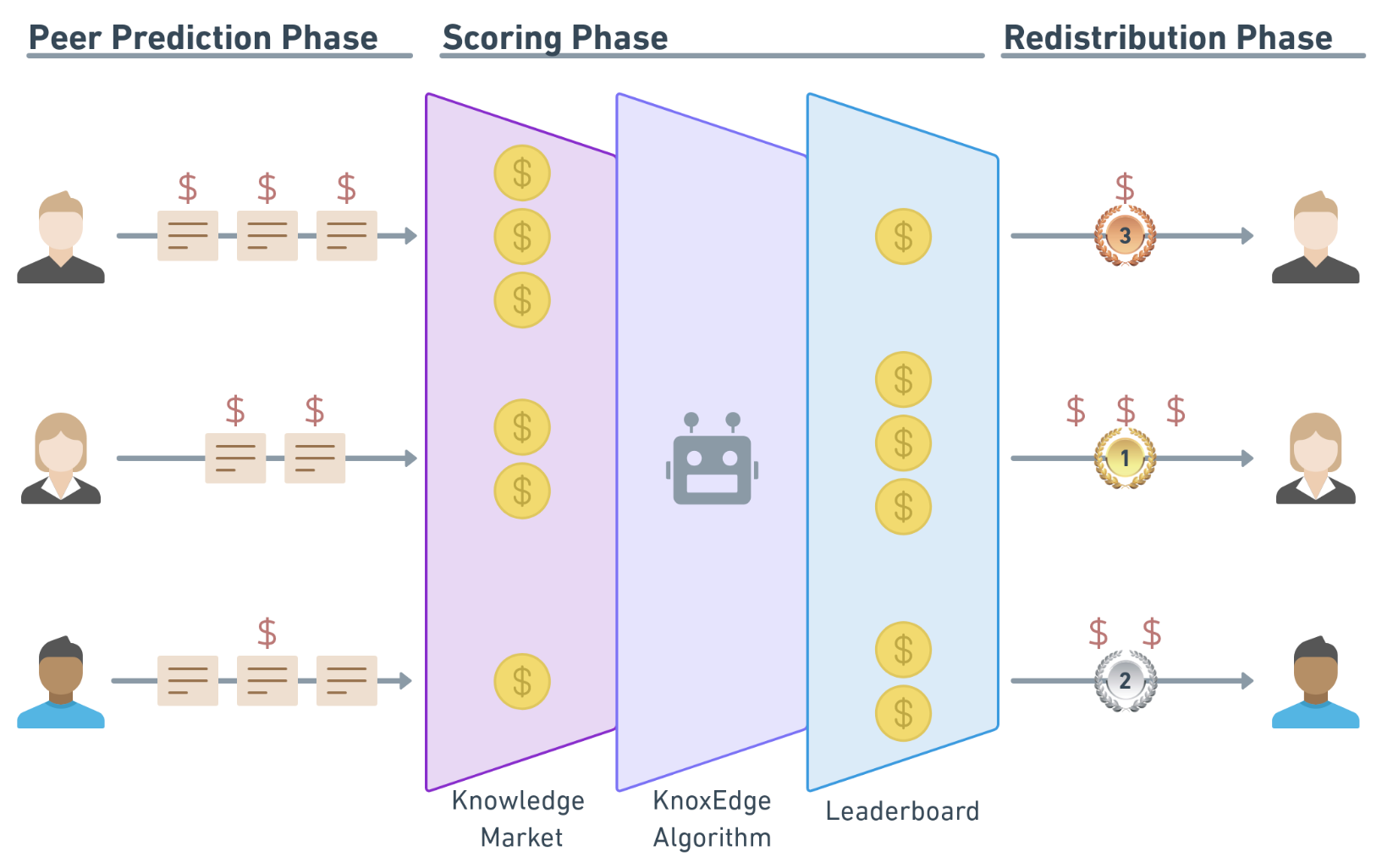

Users can participate in a knowledge market topic by submitting their thoughts and bidding $ on them. When an active topic ends, a leaderboard is released and users are ranked according to their scores. This score represents the contribution and alignment of the user to the wisdom of the crowd. It is calculated by scoring the submissions from each user against all other submissions using the KnoxEdge natural language processing algorithm. The bidding payout depends on their scores on the leaderboard: users who submit better peer predictions win money from losers.

Example

Alice and Bob are participating in the topic “What is Axie Infinity?”. Alice submits an answer of “a play-to-earn blockchain NFT game on Ethereum” and bids $5 on her answer. On the other hand, Bob submits an answer of “a PlayStation 5 new release” and bids $5 on his answer.

Their answers are scored by KnoxEdge NLP algorithm in reference to the pool of answers submitted by other users, and their $5s go into the KnoxMarket smart contract. After the topic ends, Alice is correct and receives a topic score of 100, whereas Bob is wrong and receives a topic score of 0. As a result, Alice wins a few dollars from Bob.

3. Platform Roles

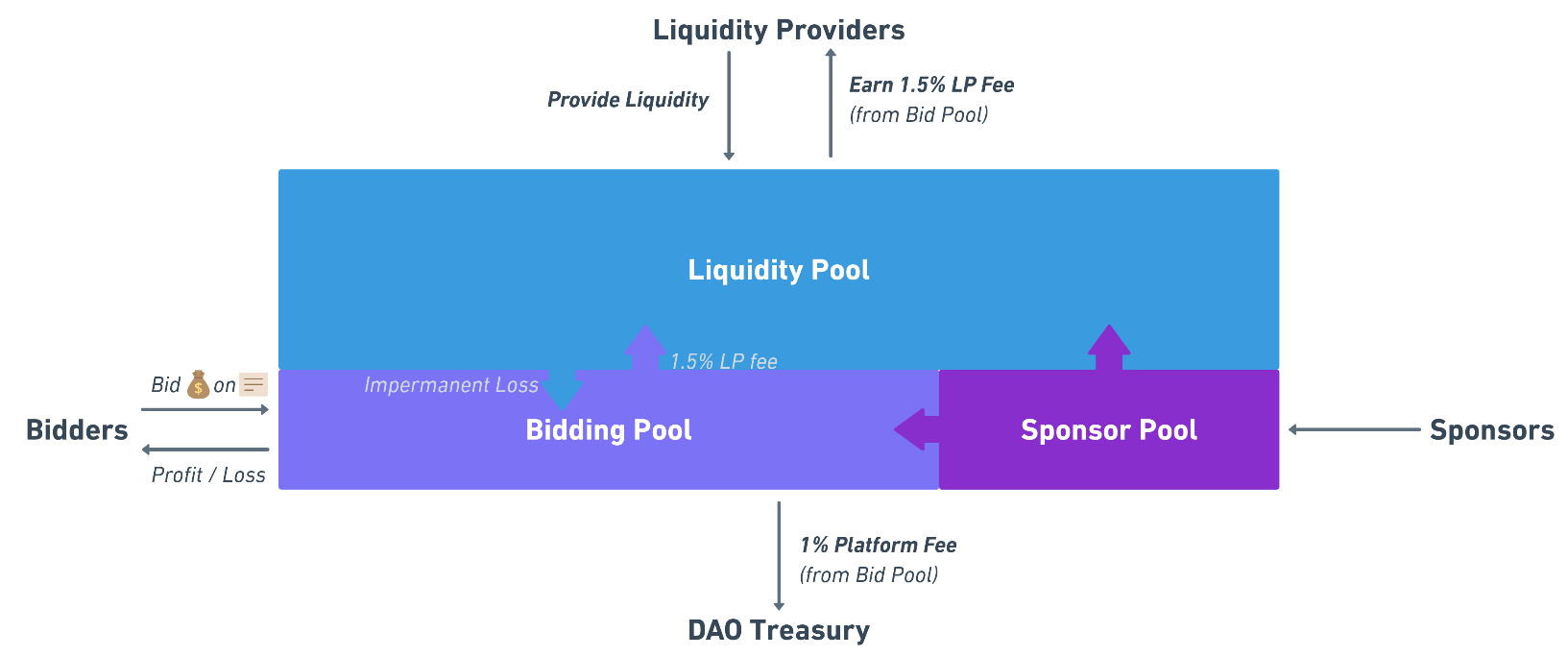

There are 3 roles on KnoxMarket with different risk-reward ratios: Bidders, LPs and Sponsors. Bidders put money where their mouths are, while LPs put their assets at work by providing liquidity to a topic. Sponsors are likely to be foundations/protocols/users who are interested in seeding a topic.

Bidders

Bidders are users who do the hard work: do your own research (DYOR), submit answers, and bid $ on their answers. By contributing high-quality answers, bidders are able to earn peer prediction profits from the bidding pool.

Liquidity Providers (LPs)

LPs are passive users who want to provide liquidity only by committing their assets to a given topic’s liquidity pool and earn 1.5% fee from each bid.

Sponsors

Sponsors are foundations/protocols/users who want to sponsor a topic that they are interested in by directly funding bidders & LPs.

4. Use Cases

Current Use Case: Community-Driven Learning

Less shilling, more education — Santiago Santos

Don’t ape, research — CZ Binance

If newcomers are still buying Cardano, we have lot of work to do on education — Stani

This will be the first use case of KnoxMarket to bootstrap peer predictions & learning at the community-level. Every week, KnoxMarket will host topics on trending projects, e.g. new projects on Celo, Avalaunch’s upcoming IDOs or new NFTs on Opensea. This will address information asymmetry and even out the playing field between new users and crypto natives, empowering users to educate and protect themselves for any potential risks & malicious CT shilling.

In the past few weeks, we hosted a series of testnet topics, including Axie Infinity, Yield Guild Games, Moola Market, Mobius Money, to name a few. We are humbled by what Axie Infinity co-founder Jiho commented on our very first topic:

what is this? it’s beautiful — Axie Infinity Co-founder Jiho

Other Use Cases

Furthermore, KnoxMarket’s Layer-0 coordination solution could be used for other applications, such as DAO governance & dispute resolution, which could be the answer to Vitalik’s vision of “non-coin-driven governance”. In fact, the same peer-prediction “bid-to-talk” format on KnoxMarket will be used to run KnoxEdgeDAO governance.

5. Knowledge Mining: Rewarding Bidders & LPs with KNX Tokens

KNX tokens are rewarded to top 20 bidders who submit high-quality answers. KNX tokens are also rewarded to LPs according to their pool share to incentivize them to provide liquidity to each topic.

KnoxMarket knowledge mining emission will reduce once KnoxFund goes live on Enzyme Finance. In order to boost AUM, KnoxFund depositors will be rewarded with KNX tokens by staking their KnoxFund tokens.

Bidding pool: 40,000 KNX per topic*

Liquidity pool: 20,000 KNX per topic*Shared among top 20 bidders who submitted ≥ 5 thoughts only

6. Roadmap

Q4 2021: Expansion to Ethereum’s Layer 2 & Cross-chain Topics

Less maximalism, more collaboration

Much like the Olympics, we hope to see crosschain communities competing on the same topic & leaderboard. We strongly believe in the ethos of “Prosperity for All” by breaking down boundaries and bringing together communities. Once KnoxMarket is deployed on Optimism, we will explore cross-chain peer-prediction topics.

Q4 2021: KNX Token Generation Event

1 billion KNX token will be minted and used as the governance token to govern the DAO & KnoxMarket parameters. KNX tokenomics and details on bootstrapping DAO-owned liquidity through Balancer LBP will be released in mid-late October.

Q1 2022: Knoxer Status

Empowering the right community members as opposed to having a governance circus where everyone voices unqualified opinions and nothing gets done — Santiago Santos

In V2, top users will be accredited with Knoxer status NFTs. Knoxers have the opportunity to make governance proposals. Moreover, Knoxer status will be crucial to unlock other use cases that are more dependent on expert insights than crowd wisdom.

2022 & Beyond: Progressive Decentralization

Following the progressive decentralization approach, the goal of KnoxDAO is to become entirely community-driven and decentralized. This is to ensure fair governance of the DAO.