Stablecoin trilemma is a tough problem to solve for builders in the ecosystem. Achieving scalability, capital efficiency, and decentralization at the same time is almost impossible. There have been several attempts to solve the stablecoin trilemma, and we believe that the CDP model, tailored by Liquity is one of the best solutions until now.

At Stable Jack, we are developing a new model that opens a new chapter in the future of CDP stablecoins. We are improving the CDP model in several ways to make it more scalable and capital-efficient while not giving up decentralization. As a result, there can be confusion for anyone who just learned about aUSD and Stable Jack.

This article will serve as a guide that explains the reasons why we improve the existing CDP model and how Stable Jack differs from it.The Problems in the CDP Models

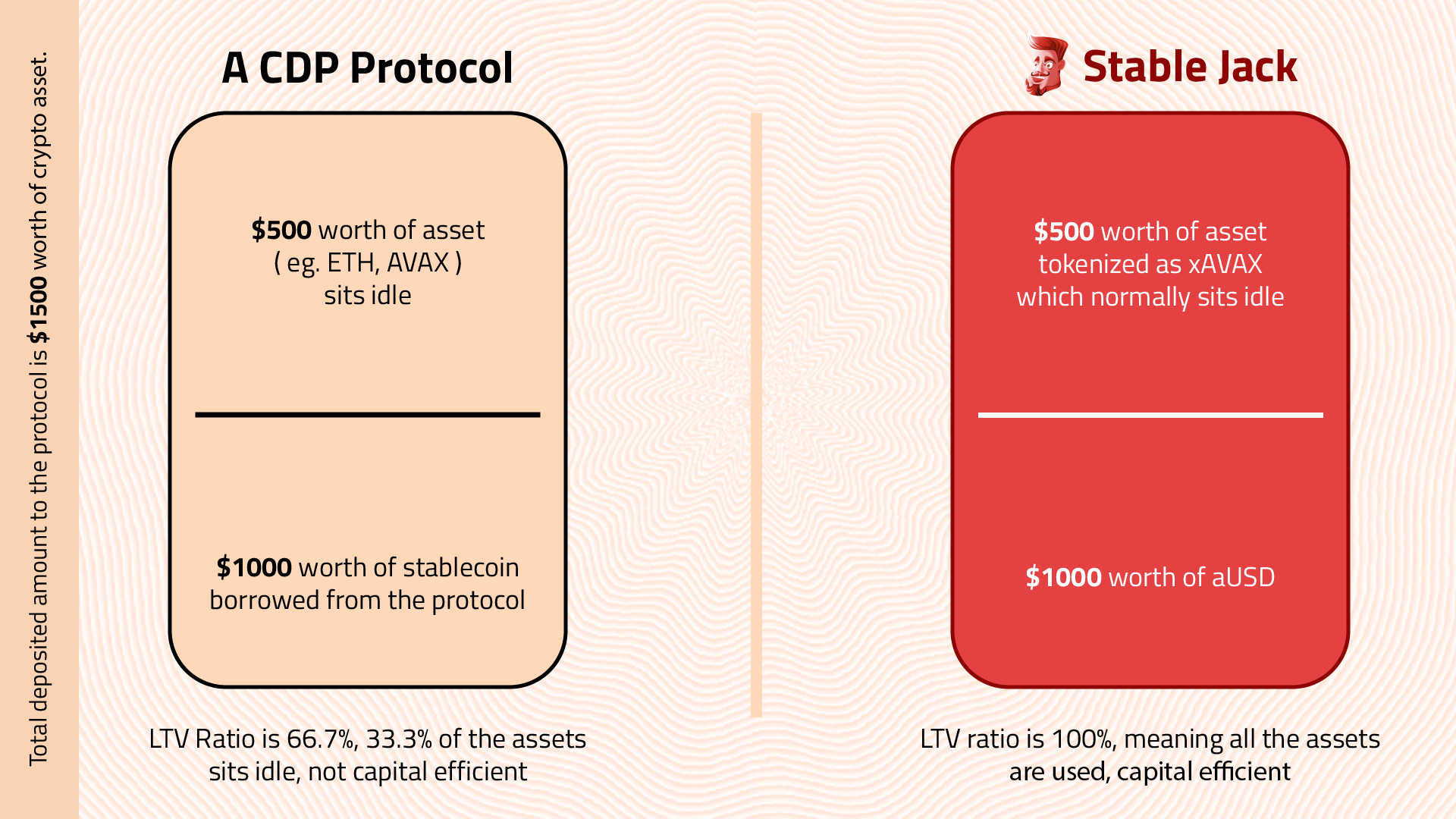

CDP models are over-collateralized debt positions that require users to deposit a certain asset eg. ETH or AVAX to borrow a stablecoin such as LUSD. As a borrowing position, there is a one-time fee or interest fee to manage the position and there is always a liquidation risk.

CDP models are mostly used for looping so that the borrower can increase his/her exposure to the main asset such as ETH or AVAX. This creates sell pressure on the stablecoin because there is no use case that can support the stablecoin such as yield. As a result, we can see CDP models as lending platforms.

Considering these, the major limitations of CDP models are as follows:

-

over-collateralization

-

borrowing costs

-

liquidation risks

-

lack of demand for the stablecoin

-

lack of use cases for the stablecoin

Stable Jack emerges as a solution to tackle these problems.

Conceptualizing Stable Jack as the next generation of CDP stablecoin

Stable Jack consists of two tokens, aUSD and xAVAX. While aUSD is a yield-bearing stablecoin, xAVAX is a volatile token that mirrors the price action of sAVAX exponentially. aUSD and xAVAX are dependent on each other to maintain protocol stability.

The creation of two separate tokens is an innovative idea that also serves two types of users with different risk and portfolio management, which was not possible with CDP models. This two-token model can be considered as a structured product with junior and senior tranches, where xAVAX represents the junior tranche, exposed to upside and downside volatility while aUSD is a senior tranche suited to more conservative investors looking for steady yields. Another way to look at this model is that xAVAX holders insure the aUSD holders and in exchange are exposed to the risks and rewards of being an insurer.

Before delving into the details, to make things simpler, we should consider the entire system as one big CDP in which:

-

the total sAVAX reserve represents the total CDP collateral

-

the total aUSD supply represents the borrowed amount

-

the xAVAX supply represents the difference between supplied collateral and the total borrowed amount

Our new model provides 3 main improvements to the CDP model:

1. Taking the responsibility from the user to the protocol

Compared to CDP models, where the borrower has to manage the collateralized debt position, at Stable Jack, the protocol manages the collateralized debt position. This is done by managing all the collateral as a pool which allows 1:1 minting of both tokens instead of having every borrower open several troves. To effectively execute this model, the protocol interferes with the market dynamics of aUSD and xAVAX supply. These methods are as follows:

a) Stability Mode engages when the collateral ratio drops below a certain point, in which the staked aUSD on the Rebalance pool is converted to sAVAX, which increases the collateralization ratio. This can be understood as closing your debt on the CDP model. It also works similarly to Liquity redemptions. However, unlike Liquity, in which the protocol forces to close the troves with the lowest health, in Stable Jack, the protocol liquidates the Rebalance Pool.

b) xAVAX incentivization via tokenomics is always implemented so that there is always enough xAVAX supply that can bear the aUSD supply. Increasing the supply of xAVAX means that the collateralization ratio of the protocol increases. This allows the supply of aUSD to increase further.

This optimization improves the CDP models in terms of scalability and capital efficiency. While users can mint the stablecoin and volatile AVAX token at a 1:1 collateralization, which is more capital efficient than over-collateralized models, it is more scalable than CDP models as it diversifies the user preferences into two separate products instead of merging them without any other option like a CDP model.

2. No selling pressure for stablecoin

In a CDP model, the only reason for the user to engage with the protocol is looping, and in that scenario, the stablecoin is a by-product and immediately gets sold for looping. As a result, the stablecoin gets depegged, which limits its adoption.

However, to prevent this, next to the stablecoin, aUSD, we are creating a by-product, called xAVAX. As stated, it is a volatile AVAX token that acts like a leveraged token, so it has the same function as looping with limited transactions required. As a result, in our model, there won’t be any selling pressure for the stablecoin.

3. Simplifying the user experience

CDP models require deep DeFi experience and strong financial sophistication as you need to create and manage the collateralized debt position. However, by dividing the CDP collateral into two tokens, we are simplifying the process.

Instead of creating and managing the collateralized debt position while considering the borrowing costs and transaction costs, the user needs to decide whether to mint aUSD and earn a yield or xAVAX and have exponential exposure to the main asset as you have while looping.

Conclusion

It is safe to say that Stable Jack is the next step in the journey of decentralized stablecoins. This new attempt aim to increase the scalability and capital efficiency of decentralized stablecoins so that we can solve the stablecoin trilemma.

To learn more about Stable Jack and ask your questions, follow our socials!