Binance USD (BUSD) is a stablecoin released by the Binance exchange in collaboration with Paxos. BUSD was intended to provide users with a stable digital asset pegged to the US dollar. However, despite its initial popularity, over time BUSD faced a number of problems and challenges that led to its gradual decline.

In this research, we will review the major milestones that led to the decline of BUSD and analyze the key factors that contributed to its demise.

BUSD formation

Binance launched BUSD in September 2019. The token was approved by the New York State Department of Financial Services (NYDFS), giving it additional legitimacy. BUSD has quickly become popular due to its high liquidity and reliable support from Binance.

Binance actively promoted BUSD through numerous partnerships and integrations with various platforms and services. This helped accelerate the growth and spread of the token in the cryptocurrency community.

Factors contributing to the decline of BUSD

The rise of alternative stablecoins

Competition from other stablecoins such as USDT (Tether) and USDC (USD Coin) was one of the key reasons for BUSD decline. These tokens oered similar benets and enjoyed a higher level of trust among users.

Development of Decentralized Stablecoins

The rise in popularity of decentralized stablecoins such as DAI also put pressure on BUSD. Decentralized stablecoins oer a higher level of transparency and stability, which has attracted many users.

Increased regulation

Over time, regulators around the world have increased their scrutiny of stablecoins due to their potential impact on nancial stability. In 2022 and 2023, regulators began to strengthen disclosure and reserve requirements, which created additional burdens for stablecoin issuers.

Litigation with the SEC

In 2023, the U.S. Securities and Exchange Commission (SEC) initiated an investigation into Binance and its BUSD stablecoin. The main purpose of the investigation was to determine whether BUSD complied with securities laws. The SEC argued that the stablecoin could have been classied as a security under the Securities Act of 1933, which would have resulted in the need to comply with strict regulatory requirements.

SEC's main claims

Misclassication of the asset

One of the SEC's main arguments was that BUSD should be treated as an investment contract. Under the criteria set forth in Howey v. SEC, if an asset involves an investment of money in a common enterprise with the expectation of a return dependent on the eorts of a third party, it can be classied as a security. The SEC argued that BUSD, issued and managed by Paxos, fell within this classication.

Lack of required registration

The SEC stated that BUSD was not registered as a security, which violates the requirements of the securities laws. Registration includes disclosure of detailed information about the reserve assets, the nancial condition of the issuer, and the mechanisms for maintaining the U.S. dollar peg. The lack of registration and related documentation raised concerns about the transparency and reliability of BUSD.

Marketing Practices

The SEC also turned its attention to Binance's marketing practices, alleging that the exchange misled users about the safety and stability of BUSD. According to the SEC, claims that BUSD was fully backed by real assets and complied with all regulatory requirements were untrue.

Binance and Paxos response

Legal Defense

Binance and Paxos strongly denied the SEC's allegations, stating that BUSD is not a security and that the company has always acted in accordance with the law. In legal documents, they argued that BUSD is a simple medium of exchange and does not involve investment expectations.

Strengthening Compliance Practices

In response to the investigation, Binance and Paxos announced measures to strengthen compliance practices, including improved disclosure procedures and regular audits. These measures were aimed at increasing transparency and restoring user trust.

Development of the court case

Interim Measures

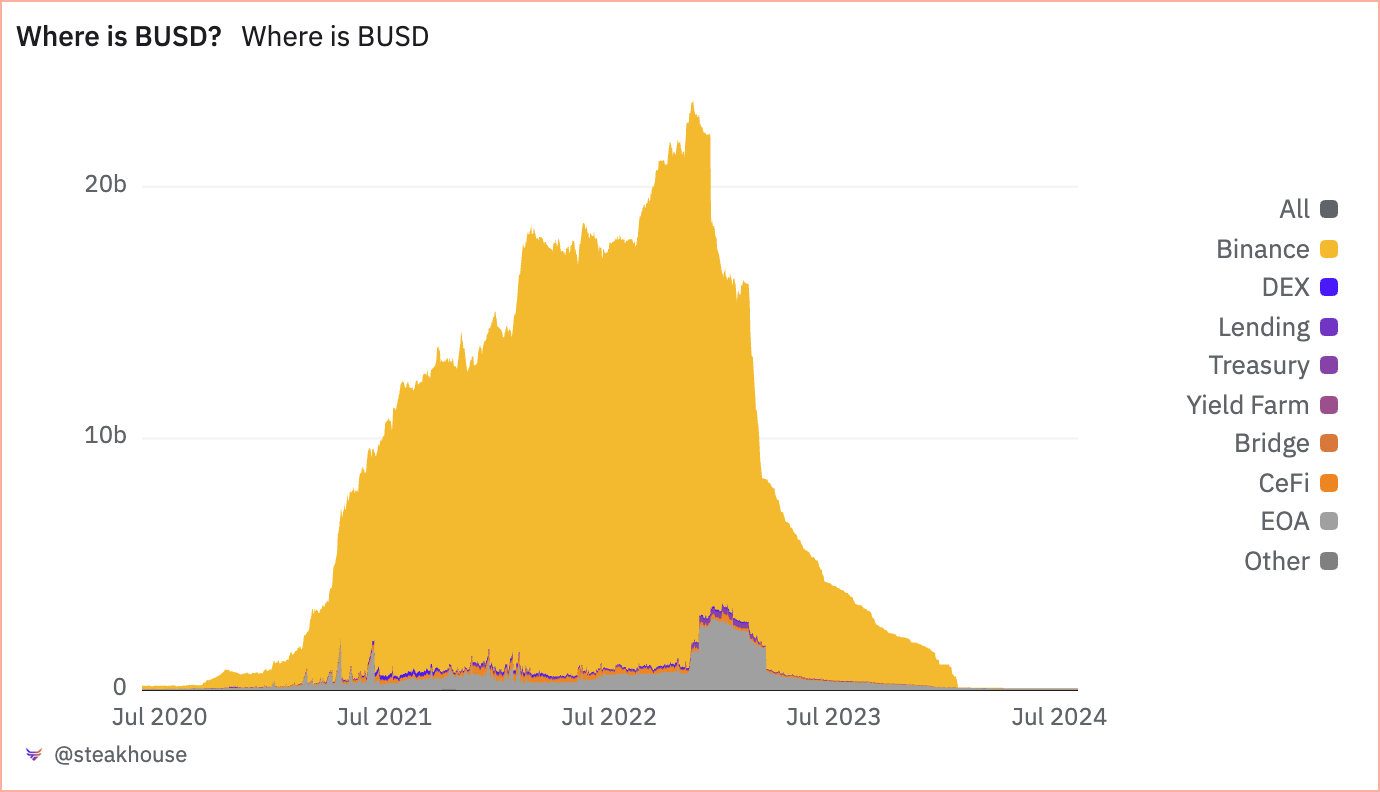

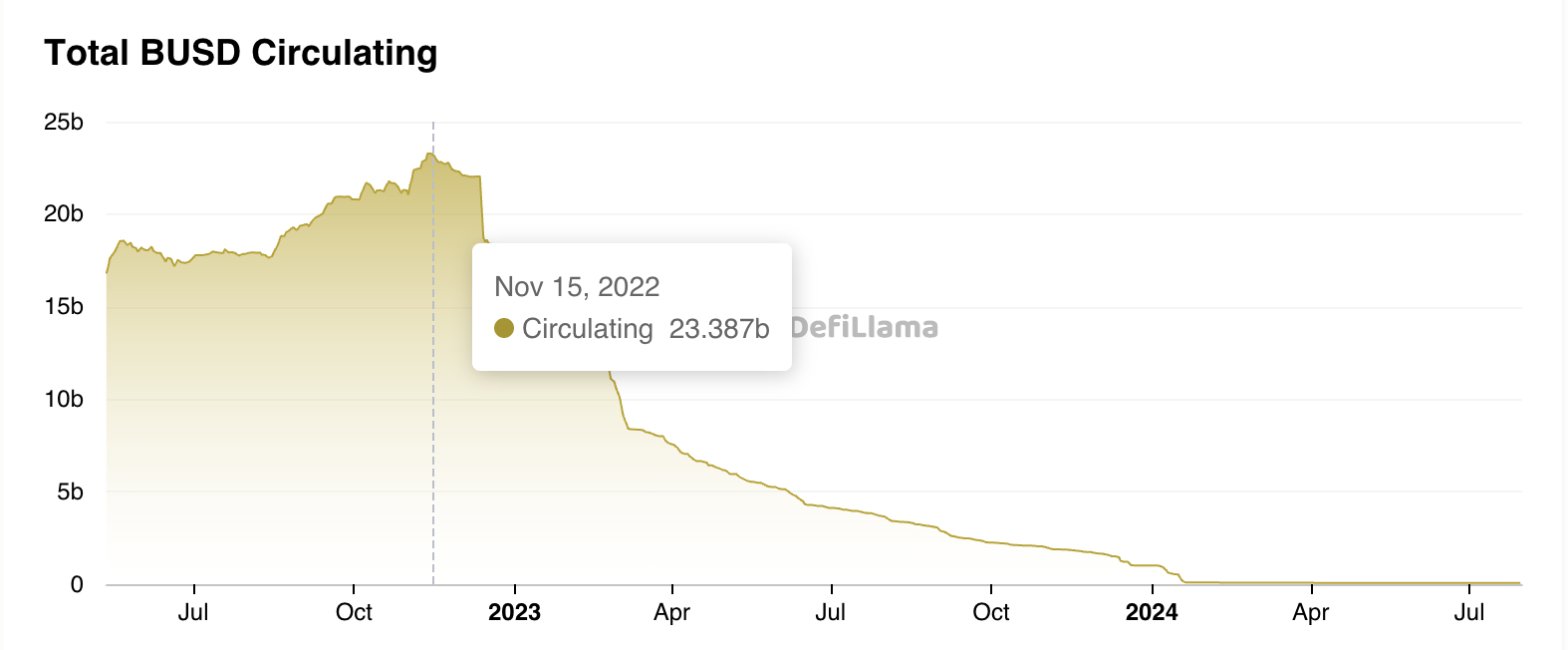

The SEC has requested interim measures, including an asset freeze and suspension of new BUSD tokens pending the outcome of the investigation. These measures caused signicant market disruption and resulted in an outow of funds from BUSD.

Court Hearings

The court hearings began in mid-2023 and lasted several months. Both sides presented their arguments and evidence, including expert testimony and testimony from key sta members.

Outcome and consequences

Conict Resolution

In early 2024, Binance and the SEC reached a settlement. Under the terms of the settlement, Binance agreed to pay a signicant ne and implement additional measures to strengthen compliance practices. Paxos also committed to strengthen disclosure procedures and conduct regular audits of reserve assets.

Formal conclusion of the investigation

Later in 2024, the SEC formally concluded its investigation into stablecoin issuer Paxos, declaring that BUSD was not a security. This was an important development as it conrmed the validity of classifying BUSD as a stablecoin and relieved some of the regulatory pressure on Paxos and Binance.

Market Impact

The trial and its outcome had a signicant impact on the stablecoin market. Increased regulation and increased focus on compliance has led to increased condence in other stablecoins such as USDC and DAI, which were already compliant with most regulatory requirements.

Conclusion

Litigation with the SEC was one of the key factors that led to the decline of BUSD. Despite the eorts of Binance and Paxos to defend their position, increased regulation and heightened transparency requirements have put signicant pressure on the stablecoin. However, the formal conclusion of the investigation and the recognition that BUSD is not a security relieved some of the regulatory pressure and conrmed the validity of BUSD's classification. This case underscores the importance of compliance with the law.