ETF

An exchange-traded fund (ETF) is a type of investment fund whose shares are traded on exchanges, similar to regular stocks. An ETF holds assets such as stocks, commodities or bonds, and usually operates with an arbitrage mechanism designed to keep its trading value close to the net asset value.

Bitcoin or Ethereum ETF is a special kind of ETF that tracks the value of Bitcoin & Ethereum. It allows people to invest in BTC,ETH without owning the actual cryptocurrency. Because ETFs exist within the traditional financial system, ETFs open the door to a wider range of investors, including those who prefer traditional investment vehicles or want to include Bitcoin in their retirement plans. However, it is important to note that holders of ETF shares do not actually hold the underlying Bitcoin or Ethereum.

VanEck

VanEck is an American investment management firm headquartered in New York City. The firm is primarily engaged in issuing exchange-traded fund products although it also deals with mutual funds and separately managed accounts for institutional investors.

VanEck Crypto and Blockchain Innovators UCITS ETF provides investors with a unique opportunity to participate in the transformation of finance and other industries through blockchain technology. Long-term growth potential, diversified exposure and dynamic composition make this fund an attractive choice for those who believe in the future of digital assets and blockchain.

In recent years, cryptocurrency has transcended its niche status to become a mainstream investment. Bitcoin and Ethereum, the two largest cryptocurrencies by market capitalization, have been at the forefront of this revolution. Among the financial institutions that have embraced this trend, VanEck stands out with its Bitcoin and Ethereum Exchange-Traded Funds (ETFs). These ETFs represent a significant step in the integration of digital assets into traditional finance. This article explores the importance of VanEck's Bitcoin and Ethereum ETFs, their impact on the market, and what they mean for the future of crypto investing.

Bitcoin ETF

VanEck's Bitcoin ETF is designed to provide investors with exposure to Bitcoin without the need to directly purchase, store, or manage the cryptocurrency. The ETF aims to track the performance of Bitcoin as closely as possible, providing a simple and secure way for investors to gain exposure to the leading cryptocurrency.

VanEck Bitcoin ETF performance from January through July. The number of BTC started around 2,000 and grew steadily, reaching 11,000 by June 2024.

![VanEck Bitcoin ETF [ total BTC ] ( source: @obchakevich on Dune Analytics )](https://images.mirror-media.xyz/publication-images/mfB_mffEVzk2mywvfT68s.png)

Ethereum ETF

Similar to its Bitcoin counterpart, VanEck's Ethereum ETF provides investors with exposure to Ethereum, the second-largest cryptocurrency. The ETF seeks to replicate the performance of Ethereum, enabling investors to benefit from its price movements without dealing with the technical aspects of holding Ethereum directly.

VanEck Ethereum ETF performance from June through July. The number of ETH started around 2,929 by June 26 and grew steadily, reaching 8,056 by July 25.

![VanEck Ethereum ETF [ total ETH ] ( source: @obchakevich on Dune Analytics )](https://images.mirror-media.xyz/publication-images/tXDp8hgYNrjk7UQ3ecu_v.png)

Crypto ETF

VanEck partners with esteemed market makers to ensure the availability of our products for trading on the mentioned stock exchanges. Our Capital Markets team is committed to continuously monitoring and assessing spreads, sizes, and prices to ensure optimal trading conditions for our clients. Furthermore, VanEck ETFs are available on various trading platforms, and we collaborate with a wider range of reputable Authorized Participants (APs) to promote an efficient and fair trading environment.

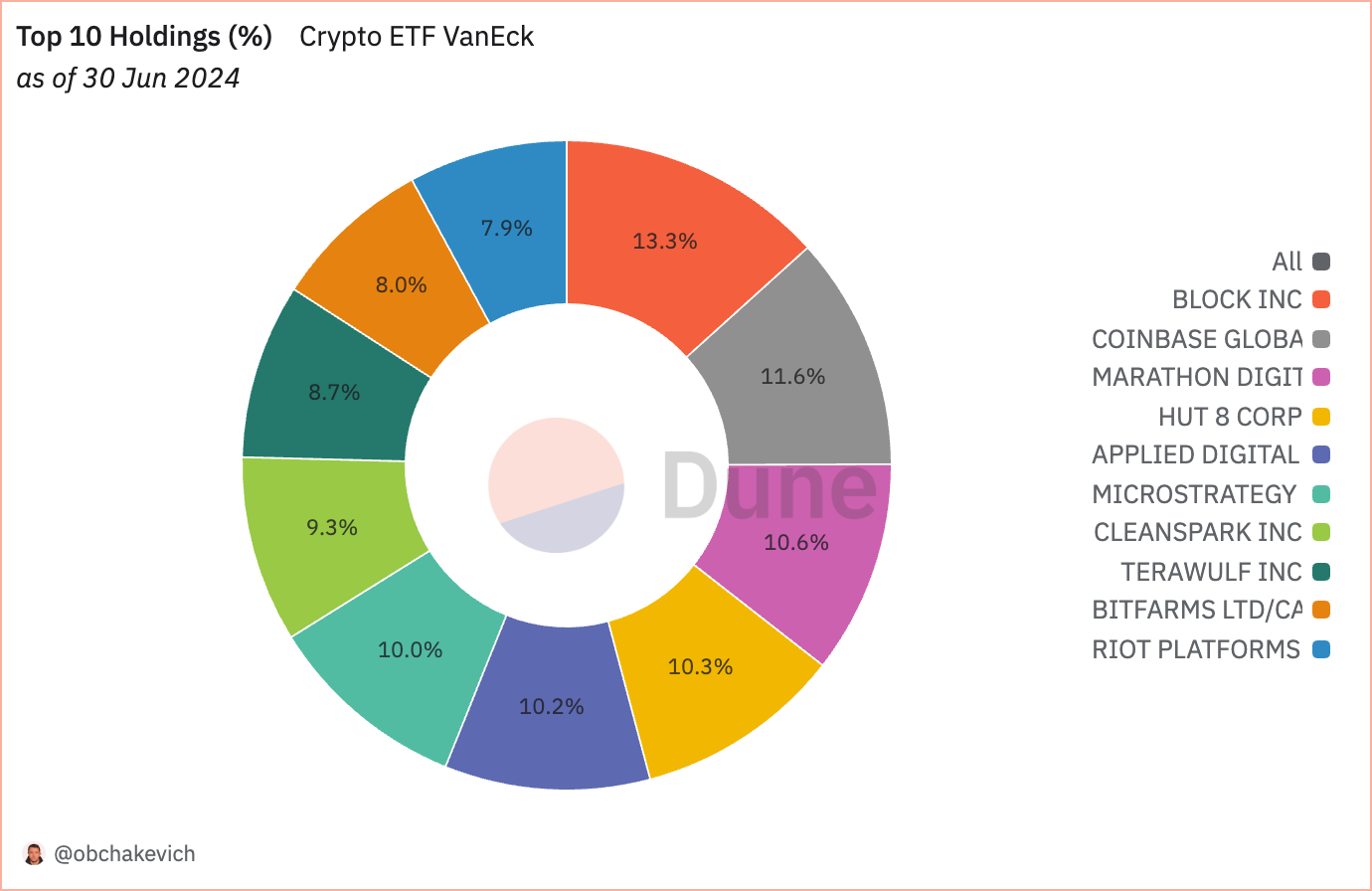

This data provides insight into the diversification and allocation strategy of the VanEck Crypto ETF. Each holding represents a significant player in the cryptocurrency and blockchain industry, showcasing a blend of cryptocurrency mining companies, trading platforms, and digital asset technology firms.

Reflections

The emergence of Crypto ETFs is more likely to increase trading activity, which in turn will increase liquidity in the crypto market. This should make it easier to buy and sell crypto and may stabilize their prices. The introduction of Crypto ETFs will also simplify access to cryptocurrencies for a wider range of investors, including even those who have not previously been able or willing to deal with crypto directly.

The most important thing that the BTC & ETH ETF is doing for the crypto market right now is providing institutional investors with a convenient and regulated way to invest in crypto. This will lead to a significant influx of capital into the crypto market.

The successful future of Crypto ETFs will depend on regulation, investor confidence and market adaptation to new financial instruments. This will take a lot of time and more than one year. Therefore, investors need to learn iron patience to accept all the changes that are currently taking place in the market.

Track VanEck Bitcoin & Ethereum ETF in real time:

Thanks for reading!