DePIN is hottest crypto sector in 2024

If anyone in the space is asked to list narratives to watch out for in 2024, DePIN is undoubtedly going to be mentioned as one of the growing areas to be looked out for. In comparison to other self-explanatory narratives like artificial intelligence or gaming, DePIN does not immediately reveal its meaning upon first observation.

The role of the IoTeX network in the growing DePiN sector

The IoTeX Network has seen exponential growth over the years and 2022 was described as “one of the most productive times” in IoTeX five-year history according to IoTeX year review report for 2022.

DePIN, regarded as a narrative for the 2024 Bullrun, is proving to be highly favored within the industry. Despite gaming often being touted as the catalyst for mass adoption in Web3, DePIN arguably has a greater likelihood of achieving this.

Positive forecasts are also being made for the growth and development of the DePIN ecosystem. According to Messari, the DePIN market has the potential to exceed $3.5 trillion by 2028, making it one of the most promising sectors in the years to come.

Loxodrome: the Protocols built for Protocols on IoTeX

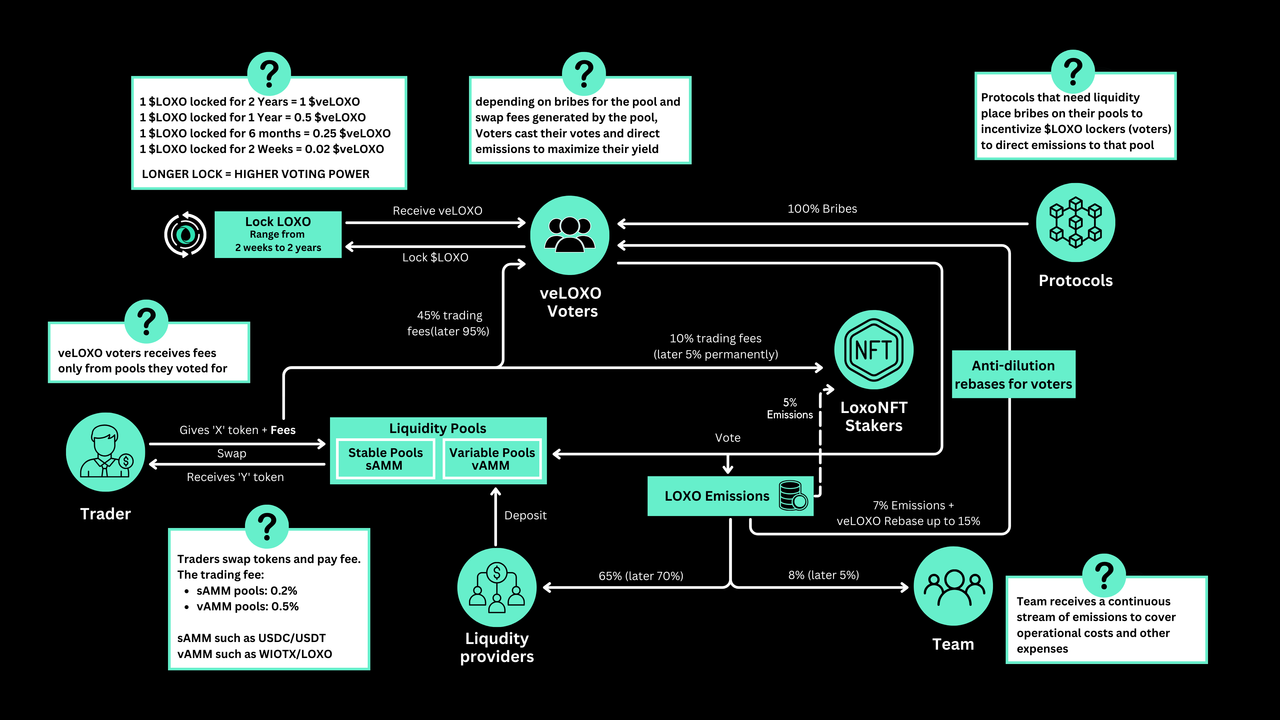

Loxodrome is a next generation liquidity layer on IoTeX network that was created as a protocol for protocols. The main stakeholders of Loxodrome —veLOXO holders, LPs, users, and protocols — are all aligned by the ve(3,3) dynamics that determine $LOXO emissions. $LOXO emissions, along with the bribes deposited by protocols and the fees generated by each pools, are the main pillars of Loxodrome's economy — designed to incentivize the best behavior out of each stakeholder.

The objective of this article is to examine the ways protocols can leverage the different strategies for their benefit. Prior to launch, certain stakeholders on the IoTeX ecosystem have been airdropped a share of veLOXO in order to engage them for the long-term success of Loxodrome. Each one of them has been identified and onboarded with mutual value creation in mind.

Current DePIN protocols dilemma: Centralized vs. Decentralized Emissions

In the current DeFi industry, DEXs emissions can be centralized (e.g. PancakeSwap), decentralized (e.g. Loxodrome) .

Centralized emissions are allocated by the core team of a DEX according to their own strategy and third party protocols can seek agreement to secure some emissions on their pools. This model is efficient to provide direct incentives for Liquidity Providers (“LPs”) and benefit from the exposure of a protocol that has already scaled its operations. However, this model suffers from multiple inefficiencies:

-

Emissions are not permissionless since the final allocation only depends on the good will of the DEX’s core team.

-

The price of incentives is not driven by free market forces and tends to be artificially high. The core team can set the incentives in order to maximize the revenue generated by the DEX.

-

This model is lacking flexibility. Emissions are usually scheduled for a given number of weeks and does not allow protocol to adapt in the circumstance of an unforeseen event.

How Loxodrome can solve the dilemma

On Loxodrome, emissions distribution is based on a free market and third party protocols have the flexibility to secure incentives for their liquidity through two different options:

-

Bribing: Protocols can deposit extra rewards on their gauge in Loxodrome's bribing interface in order to incentivize veLOXO holder to vote for their pool.

-

Gauges weight votes: Protocols can acquire veLOXO tokens and vote to allocate $LOXO emissions on their pool.

These two options are:

-

Permissionless: The bribing interface and the voting interface are permissionless. There are no barriers to entry

-

Flexible: Protocols can adjust their bribes/vote on a weekly basis depending on their operating needs.

-

Capital efficient: The market price of bribes is driven by free market forces and Loxodrome's top-up incentive. On the other hand, voting on gauges requires an initial investment that can produce net positive emissions once the initial outlay has been amortized.

The main difference between the bribing and the gauges weight vote option are:

-

Protocol owned liquidity (POL) deposits: Protocols with veLOXO can deploy their own liquidity on Loxodrome in order to farm $LOXO emissions, lock the proceeds as veLOXO and increase their share of the veLOXO total supply.

-

Market buy and lock: Protocols can market buy $LOXO and lock it to increase their share in the veLOXO total supply, and in return receive a greater amount of emissions over the coming months and years, trading fees and bribes.

For example: Given a hypothetical equilibrium $LOXO price at $0.01, any market buy & lock amount at week #1 would be amortized and start producing net positive $LOXO emissions at week #19.

-

Bribe deposits: In order to benefit from a positive return on investment, third parties can deposit custom amounts of rewards (“Bribes”) for any pool. Those rewards are claimed by veLOXO holders that vote and allocate $LOXO emissions to these pools. In this way, protocols can influence and increase emissions for their native tokens. This has typically been the cheapest way to incentivize liquidity, and protocols would in this scenario benefit from a net positive return on investment. Rationale: The indirect effect of protocols being incentivized to increase their bribes to benefit from this subsidy. veLOXO locking rate will increase, resulting in a strong buy & lock pressure on $LOXO resulting in higher APRs per $ of TVL on the liquidity pools. A deeper liquidity is incentivized and better trading conditions are enabled on the DEX.

-

Protocol revenue deposited as bribes: Protocols can utilize a portion of the revenue generated thanks to Loxodrome's pools to bribe and/or market buy and lock LOXO. Some protocols’ revenue depends directly on the global demand and liquidity of their tokens. As a result, and under certain conditions, staking some tokens in Loxodrome's pool are equivalent to generating revenue for the protocol issuer. For example: Liquid Stacking protocols are generating revenue from each $IOTX being staked through their platform. User deposits $IOTX → The protocol stakes the $IOTX and issues a receipt token that represents the staked position. It earns the staking rewards and can be traded on a secondary market. In exchange for the service, a fee is applied on the staking gains. In that particular case, the number of liquid staked tokens in Loxodrome's pool can serve as a proxy to estimate the number of IOTX being staked thanks to Loxodrome's and the associated revenue. A portion of this revenue can then be used to bribe veLOXO holders and/or market buy and lock $LOXO in order to increase the emissions received by the pool.

-

Revenue generation: Protocols also have the flexibility to sell their voting power on any given period of time in order to generate revenue with it. It also provides a discounted exit option through an OTC deal or NFT marketplace.

This cross-strategy can be applied to maximize the benefits for each of Loxodrome's stakeholders. It combines the provision of protocol owned liquidity (“POL”) with bribes deposits (“Bribes”). These two actions have been identified as the most value creative for Loxodrome and its stakeholders.

Here is how it works:

-

(0,0): Protocols that do not bribe or deposit POL (Protocol Owned Liquidity) do not foster the creation of value in Loxodrome. They are losing influence over $LOXO emissions due to the partial anti-dilution protection set at 15%.

-

(0,2): Protocols that deposit their own liquidity are able to farm & lock $LOXO in order to increase their governance power over time. This also increases liquidity for pools which improves the trading conditions for Loxodrome's users, drives more volume and generates more fees to incentivize veLOXO holders to vote for their pool.

-

(2,0): Protocols that bribe benefit from the top-up incentive program from Loxodrome that consists of increasing the bribes deposited. Protocols benefit from a net positive return on their expenses and deeper liquidity for their pools. Additionally, Loxodrome's participants are incentivized to lock their tokens in order to generate a higher yield out of their weekly-votes.

-

(2,2): Protocols depositing bribes and protocol owned liquidity is what benefits Loxodrome's stakeholders the most. This translates to deeper liquidity and higher $LOXO emissions for the pools.

What does it mean for stakeholders?

-

Traders: The deeper the liquidity, the better the user trading experience.

-

LPs: The bribes deposited incentivize higher $LOXO emissions for the pool, as well as a higher locking rate that leads to a buying pressure on $LOXO and higher APR.

-

Protocols: First, their bribe expense allows capital efficient $LOXO emissions that can be farmed and captured thanks to their protocol owned liquidity deposited. Secondly, the POL deposited enables better trading conditions for users which drives more volume and generates more fees that can, again, be captured by the protocol. Therefore, this strategy can be leveraged to increase protocols governance power over Loxodrome.

-

veLOXO holders: The bribes deposited will be directly captured and equally distributed. The optimal trading conditions lead to more liquidity being routed through Loxodrome, and therefore more fees being captured for the following emission epochs.

-

LoxoNFT stakers: More trades would mean more fees generated which would mean that there will be higher revenue for stakers.

The Loxodrome Flywheel: A Self-Sustaining Engine of Growth

-

Liquidity providers deposit tokens into pools and receive $LOXO emissions as rewards (incentives)

-

Traders use the available liquidity to swap assets, and they pay a fee for doing the swap

-

Participants/Protocols Lock $LOXO for governance power over $LOXO emissions, swap fees and rebases

-

External projects place bribes to incentivize liquidity provision for their pools

-

Based on bribes, $LOXO lockers (voters) direct $LOXO emissions to the respective pool for their share of the bribes + Trading fees

-

Emissions directed by voters to pools incentivize further liquidity provisions due to higher yields

A Winning Formula

Loxodrome is by design a decentralized protocol that seeks to promote the best sustainable DeFi practices on IoTeX. Protocols can tailor their own strategies in order to maximize the value extracted out of the DEX, and incentivize long-term sticky liquidity for their native tokens.

The bribing program, the initial veLOXO distribution protocols, and the modest anti-dilution protection guarantee a dynamic and decentralized governance over the protocol. When combined together, POL and Bribes can be leveraged as a strong tool by protocols to increase their power over Loxodrome emissions over the long run. Moreover, this strategy promotes a virtuous cycle of value creation for each Loxodrome stakeholders — LPs, traders, protocols, LoxoNFT stakers, and veLOXO holders.

Follow us to stay updated with everything on Loxodrome!

Website | Mainnet | Testnet | Twitter | Telegram | Discord | Link3