AMM Incentives: From Trader Frenzy to LP Loyalty

The AMM landscape has undergone a metamorphosis, evolving from a trader-centric playground to a haven for loyal liquidity providers. Initially, AMMs lured traders with fee rebates and token rewards, but these incentives proved fleeting and failed to foster long-term commitment.

AMMs have grown in complexity and utility. Central to the AMM ecosystem are the liquidity providers (LPs). These LPs face challenges such as impermanent loss (IL) and loss versus rebalancing (LVR), but their role is pivotal to enable automated trading without a third party.

Recognizing the critical role of LPs, AMMs shifted their focus, showering them with rewards in the form of protocol tokens and trading fees. This strategic move ensured ample liquidity, improved trade efficiency, and fostered a sustainable ecosystem.

But the evolution didn't stop there. Innovative models like ve(3,3) emerged, incentivizing long-term LP commitment by rewarding those who lock their tokens for extended periods. This approach aligns the interests of LPs, traders, and the AMM itself, creating a win-win situation for all.

The Ve(3,3) Flywheel: A Game of Incentives and Loyalty

ve(3,3) is an ingenious concept designed to address the challenges faced by traditional decentralized exchanges (Dex) in attracting liquidity to their platforms. Its core objective is to actively incentivize users to deposit liquidity into their preferred pools, rewarding them with protocol tokens that can be staked to compound interest, generating profits for all stakeholders - the protocol, liquidity providers (LPs), and users.

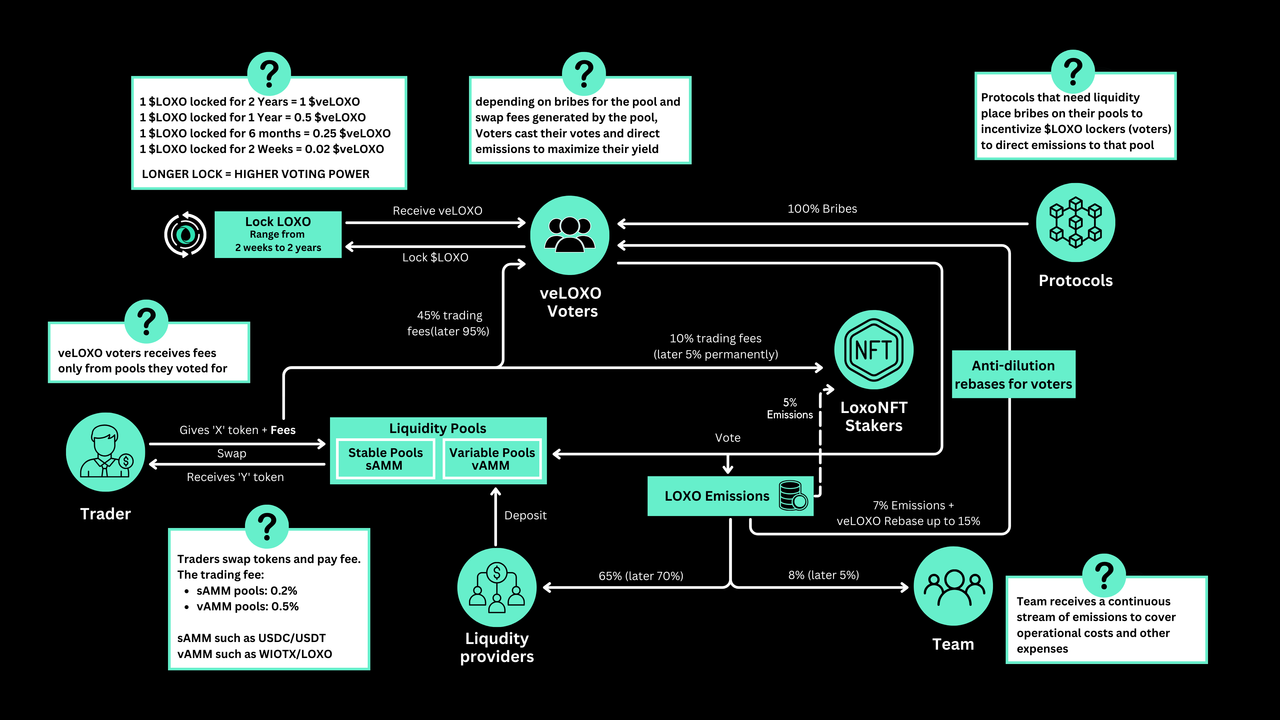

The Ve(3,3) mechanism originally stemmed from the Solidly protocol by Andre Cronje, the co-founder of Fantom. Now, Loxodrome, the native depin-focused liquidity layer on IoTeX, has improved upon the deficiencies of the Solidly protocol. The core Ve(3,3) mechanism of Loxodrome can be broken down into two parts: Ve&(3,3). ‘Ve’ is derived from Curve’s veCRV model (vote-escrowed), and ‘(3,3)’ is inspired by OlympusDAO’s 3v3 game (the win-win staking method). The combination of these two parts aims to balance the holder and trader in the supply, bringing more protocol revenue to projects that join the Loxodrome, especially initial projects. This also enhances the efficiency of rewarding when leasing liquidity.

veNFT's Evolution: Dual token system - $LOXO and $veLOXO

The concept of veNFTs, an evolution of the veCRV mechanism (vote-escrowed), brings an innovative approach to the world of decentralized finance.

Loxodrome introduces two protocol tokens: $LOXO and $veLOXO. $LOXO serves as the primary token within the Loxodrome ecosystem, rewarding liquidity providers who contribute to the platform's stability and efficiency, and adheres to the ERC20 standard.

By locking $LOXO, participants can acquire $veLOXO, which is encapsulated within a unique veNFT, following the ERC721 standard. This innovative combination of liquidity provision and non-fungible tokens creates an exciting dynamic within the Loxodrome protocol. The quantity of $veLOXO obtained through locking $LOXO depends on the duration of the lockup period, following a linear relationship.

For those committed to a long-term approach, locking $LOXO for the maximum period of 2 years yields a 1:1 ratio of $veLOXO. In contrast, a one-year lockup grants 1/2 the amount of $veLOXO compared to the initially locked $LOXO. For shorter lockup periods, such as 2 weeks, the acquired $veLOXO amounts to merely 1/50 of the locked $LOXO. It's important to note that once the lockup period expires, users regain full access to their locked $LOXO.

To ensure a fair and decentralized governance process, Loxodrome’s Ve(3,3) system rewards active user participation through voting, fees, bribes, and decisions to lock or unlock the governance token by implements a weekly emission of $LOXO tokens [Per Epoch: 7 days, Total emissions per epoch: 1.6M $LOXO, Every emission decay: 1%]. Here, $veLOXO holders play a crucial role in the decision-making process by actively participating in voting. Through their votes, they determine which liquidity pool will receive the newly emitted $LOXO tokens, thereby influencing the platform's growth and development.

Incentives and Outcomes in Loxodrome Protocol

The (3,3) Game, inspired by OlympusDAO's game theory, lies at the heart of the Loxodrome protocol. This concept explores the strategic interplay between participants in a game, where each player aims to maximize their individual payoff. In Loxodrome, the game revolves around the $LOXO token, and participants have three options:

-

Provide Liquidity: Contribute $LOXO to liquidity pools, earning rewards through trading fees and $LOXO emissions.

-

Lock $LOXO: Stake $LOXO to earn $veLOXO, granting governance rights and boosted rewards.

-

Sell $LOXO: Exchange $LOXO for other assets, exiting the protocol.

The Loxodrome Flywheel: A Self-Sustaining Engine of Growth

The Loxodrome protocol operates on a unique flywheel mechanism, where the protocol's fundamentals (TVL, trading volume, fees, and external protocol bribes) and the protocol token $LOXO are intertwined in a self-sustaining cycle of growth. This dynamic system resembles a powerful engine, continuously propelling the protocol's value upwards.

Imagine a scenario where the price of $LOXO starts to rise. This increase incentivizes liquidity providers, who are rewarded with higher income (Emissions). As they inject more liquidity into the system, the trading volume experiences a surge, leading to increased protocol revenue. This surge in revenue attracts more participants, who choose to lock their $LOXO to earn a share of the protocol's income.

The growing popularity of Loxodrome attracts external protocols seeking to participate in its success. These external protocols contribute bribes to incentivize liquidity provision and trading activity, further boosting the protocol's fundamentals. This positive feedback loop creates an upward spiral, where each element reinforces the growth of the others.

The diagram below illustrates this flywheel effect:

LoxoNFT: Unveiling the Utility Behind the Collectible

LoxoNFT transcends the realm of a mere digital collectible. It serves as a keycard to exclusive benefits within the Loxodrome ecosystem. Owning a LoxoNFT grants you access to a treasure trove of advantages:

-

Passive Income Stream: Enjoy a 10% airdrop of $LOXO tokens, the native token of Loxodrome, providing a steady flow of passive income.

-

Long-Term Rewards: Hold onto your LoxoNFT and benefit from a 5% share of $LOXO token emissions for 24 epochs (defined periods). This translates to ongoing rewards for simply holding your LoxoNFT.

-

Trading Fee Share: Become a part of the Loxodrome platform's success. Earn a 10% share of the trading fees generated on the platform, allowing you to profit from the protocol's growth.

-

Secondary Market Royalties: Not only do you benefit when you hold, but you also earn a 3% royalty on every subsequent sale of your LoxoNFT on marketplaces. This incentivizes holding onto your NFT while potentially generating additional income through appreciation in value.

-

Governance Rights: LoxoNFT empowers you to actively participate in shaping the future of Loxodrome. As a holder, you gain voting rights within the protocol, allowing you to influence important decisions.

Differentiation

Unlike traditional AMMs, Loxodrome’s model incorporates mechanisms that address the challenges faced by new projects trying to launch a token. Protocols are able to create a liquidity pool for their asset and incentivize liquidity more effectively through veLOXO gauge voting and providing bribes for other ve-voters to direct incentives to their liquidity pool, attracting liquidity while earning the trading fees resulting from trader activity for their assets. As long as the ratio between the cost of direct LP incentives vs the cost of incentives directed to LPs in the flywheel through bribes and ve-voters remains greater than 1, the system will be effective for protocols launching and incentivizing tokens.

Conclusion: Loxodrome - A DeFi Powerhouse for DePINs

Loxodrome stands out as a groundbreaking DeFi protocol with a laser focus on DePINs. It offers a comprehensive solution, acting as the primary liquidity hub while fostering long-term commitment through its innovative ve(3,3) model. LoxoNFTs further incentivize participation and reward holders with a stake in the ecosystem's success. The upcoming Mainnet launch airdrop and liquidity minting competition demonstrate Loxodrome's commitment to building a vibrant community around DePINs. With its unique approach, Loxodrome is well-positioned to become a DeFi powerhouse, acting as a catalyst for the widespread adoption and success of Decentralized Physical Infrastructure Networks.

Follow us to stay updated with everything on Loxodrome!

Website | Beta Mainnet | Testnet | Twitter | Telegram | Discord | Link3