The RWA Trend

Real World Asset (RWA) tokenization is rapidly becoming one of the most compelling trends in blockchain. As of mid-2025, over $8 billion worth of RWAs—ranging from U.S. Treasury bonds, gold, to real estate—have already been tokenized and deployed across major chains like Ethereum, Polygon, and Solana (source: rwa.xyz, 2025 Q2 report).

This growth is not just speculative; it reflects a structural shift. By putting RWAs on-chain, blockchain infrastructure enables greater liquidity, lower transaction costs, and improved access. Financial institutions such as BlackRock, Franklin Templeton, and HSBC have all launched or piloted tokenized RWA products in recent months.

Why Tokenize RWAs On-Chain?

Benefits for Asset Owners and Users:

-

24/7 global access and trading

-

Increased liquidity for traditionally illiquid assets

-

Fractional ownership and easier diversification

-

Transparent, auditable settlement systems

Benefits of Blockchain Infrastructure:

-

Smart contract automation reduces operational costs

-

Borderless infrastructure removes friction for global investors

-

Composability with DeFi unlocks new financial use cases

-

Immutable, real-time proof of ownership

At StaFi, we see the momentum building—and we are ready to take part in the transformation. With deeper exploration into the mechanics of RWA tokenization, we believe Liquid Staking Token (LST) infrastructure is uniquely positioned to become a foundational layer for RWAs.

Similarities Between LST and RWA Tokenization

The value proposition of Liquid Staking—efficiency, composability, and yield—aligns perfectly with what RWA tokenization aims to deliver. Here’s how:

1. Fixing Capital Inefficiency

LSTs unlock the value of staked assets by issuing a liquid representative token. Similarly, RWA tokenization removes barriers to using traditionally illiquid assets like:

-

Gold — hard to store or transfer physically

-

Stocks — restricted by brokers, banking systems, or regulation

-

Fine art — impossible to fractionally own and trade in real-time

Both approaches fix inefficiencies in asset access, storage, and mobility.

2. Yield Generation

LSTs don’t just represent staked tokens—they amplify them via:

-

Staking yield

-

DeFi participation

-

MEV/re-staking yield

RWA tokens can follow the same model:

-

Used as collateral in lending markets (e.g. tokenized T-Bills in MakerDAO)

-

Backing yield-bearing stablecoins (e.g. USDM, sDAI)

-

Building structured products or ETF-style wrappers

This shared yield capability is key—it’s what drives institutional and DeFi capital to flow toward tokenized assets.

3. Composability and Innovation

Liquid staking started with ETH and quickly expanded to Polkadot, Cosmos, Avalanche, etc.—each with a modular architecture and DeFi integrations. We’re now seeing the same playbook being used for RWA:

-

Modular issuance

-

Plug-and-play DeFi use

-

Institutional-grade asset management layers

The result? Just like LSTs have become DeFi-native building blocks, RWAs will evolve into programmable financial primitives—especially as institutions seek to bridge TradFi and on-chain liquidity.

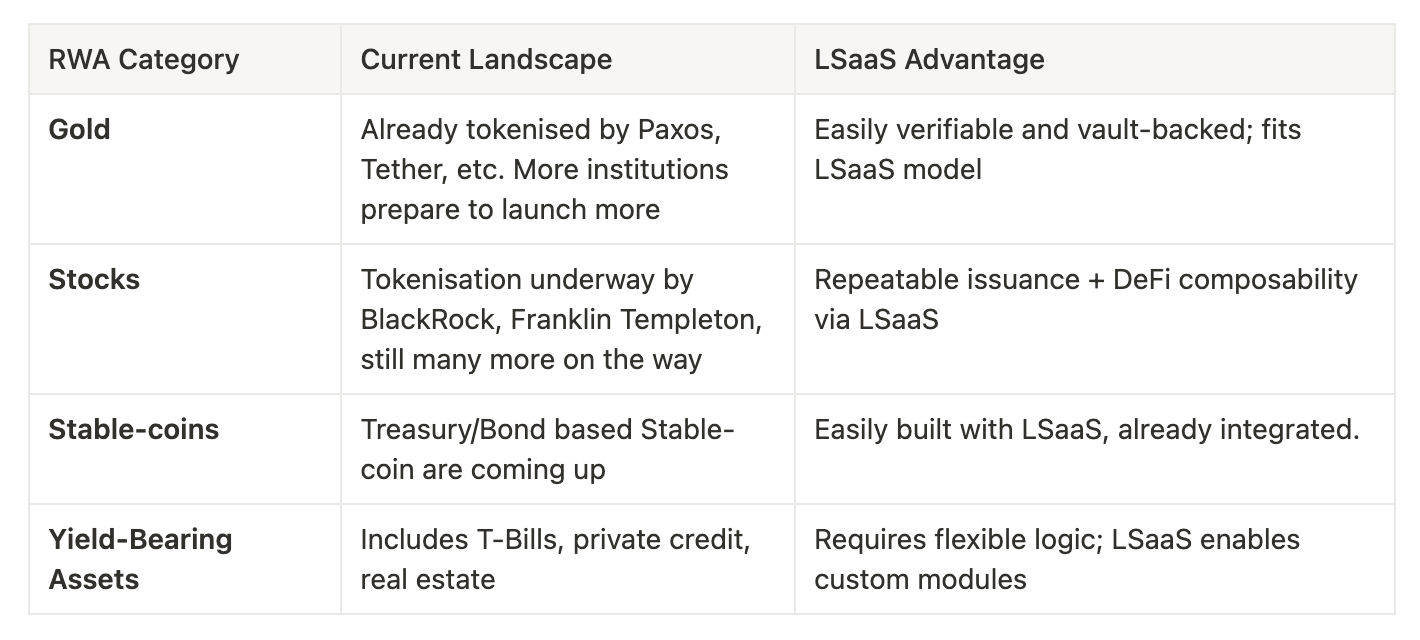

RWA Tokenization in StaFi LSaaS

With this strategic overlap, StaFi LSaaS (Liquid Staking as a Service) is naturally equipped to support tokenized RWA issuance.

Our vision is to extend the modular LSaaS stack—designed for LSTs—to enable:

-

Custom modules for legal verification, asset management, and price feeds

-

Permissioned wrappers for regulated institutions

-

DeFi-ready integration post-tokenization

Tokenized Stock Example

Traditional equity markets are limited in several ways. They operate within fixed hours, rely on complex settlement layers, and are often constrained by regional regulatory barriers. These limitations restrict access and liquidity for global investors.

By tokenizing stocks on blockchain, these barriers are removed. Tokenized equities can be traded 24/7, accessed globally, and held directly through a permissionless wallet—no broker or bank account required.

Within the StaFi LSaaS framework, this process mirrors how liquid staking works. Off-chain stock acquisition is handled by a regulated custodian or third-party operator. Once proof of ownership is submitted and verified, StaFi’s contracts issue an on-chain tokenized representation of the asset—just like rETH or rDOT. These could take the form of rAAPL, rTSLA, or even rS&P500, unlocking liquidity and enabling composability across DeFi.

What makes this powerful is that it all runs on the same LSaaS infrastructure already battle-tested in staking. With only minor adjustments in modules—such as legal verification and custodial integration—the system becomes fully adaptable for real-world assets like stocks.

A Big Opportunity for StaFi

The tokenization of real-world assets is accelerating, and the onboarding process closely resembles how Liquid Staking Tokens are integrated into StaFi LSaaS. With its modular, customizable framework, StaFi is uniquely positioned to support a wide range of RWA categories. Whether it’s vault-backed gold, tokenized stocks, or complex yield-generating instruments, LSaaS provides the tools to issue, verify, and integrate these assets on-chain—seamlessly and securely.

What’s Big?

StaFi is excited to be part of the growing RWA movement, actively collaborating with select Web2 companies to explore real-world asset tokenization. This marks a significant milestone—not just for StaFi, but for the broader adoption of the LSaaS framework. While details will be revealed soon, this development is something worth keeping a close eye on.

What’s Next?

StaFi LSaaS will continue to abstract and modularize the tokenization process, creating an RWA-focused stack to serve institutions and innovators alike.

By offering:

-

Plug-and-play issuance contracts

-

Off-chain proof verification modules

-

One-click DeFi integration tools

We aim to become a core enabler of RWA tokenization on-chain.

The future of staking is more than crypto—it’s a universal capital layer. StaFi LSaaS is here to power it.

About StaFi

StaFi is a leading Liquid Staking infrastructure provider and protocol for PoS chains. Its Liquid Staking as a Service (LSaaS) framework enables developers to create Liquid Staking Tokens (LSTs) and Liquid Re-staking Tokens (LRTs) across ecosystems like ETH, EVM, BTC, CosmWasm, and SOL. By issuing rTokens (e.g., rETH, rMATIC, rBNB), StaFi unlocks the liquidity of staked assets, allowing users to earn staking rewards while retaining the flexibility to engage in DeFi. With support for major blockchains such as Ethereum, Solana, Polygon, BNB Chain, and Cosmos, StaFi bridges liquidity and security in Proof-of-Stake networks.

Read more about StaFi 2.0.

About LSaaS

LSaaS is a paradigm shift offering developers a robust framework to build their own Liquid Staking Tokens (LSTs) and Liquid Re-staking Tokens (LRTs). Compared to Rollup as a Service(RaaS), RaaS projects, like Altlayer, Dymension and Conduit, are primarily concerned with improving blockchain scalability and efficiency through layer 2 solutions.

For a deeper comparison and analysis, you can check out the full article: Read here.