Introduction

At StaFi, we’ve been pioneering Liquid Staking as a Service (LSaaS) to bring liquidity to PoS tokens. Today, we want to introduce a brand new idea which is the new infrastructure module designed specifically for non-PoS tokens, dApps, and appchains:

Liquid Staking Vault (LSV) = Staking Vault + Liquid Staking Token

Unlike traditional LST protocols designed around PoS consensus mechanisms, the LSV framework is built entirely at the contract layer — enabling any project, including non-consensus tokens, to tap into the power of staking rewards, liquidity, and composability.

Our mission remains the same: Unlock staked value, maximize yield opportunities, and enable seamless participation across DeFi and on-chain AI economies.

A Brand New Infrastructure Layer in LSaaS

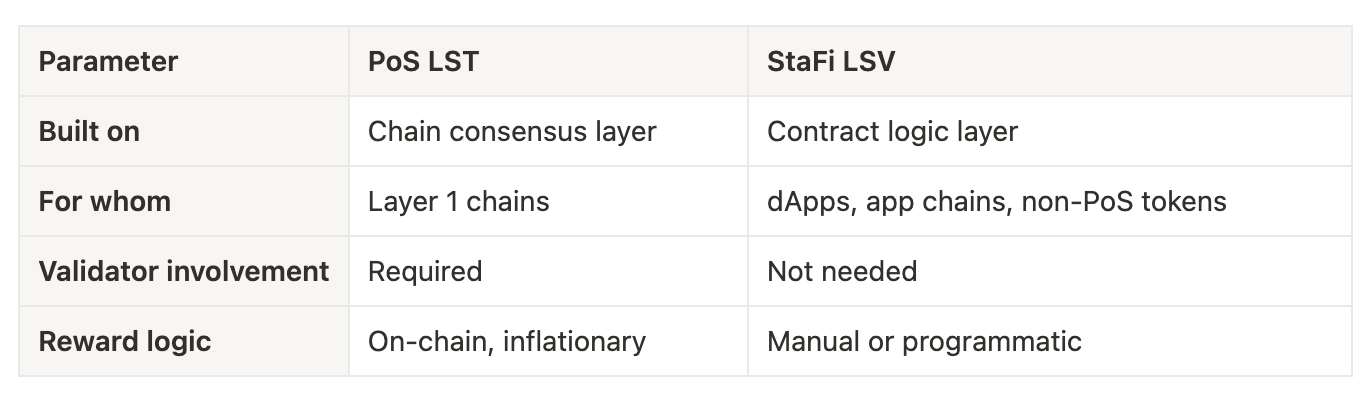

Liquid Staking Tokens (LSTs) in the traditional PoS world rely on chain-native consensus parameters — like inflation rates, validator performance, slashing, and unbonding. These are tightly coupled with Layer 1 blockchains.

In contrast, StaFi’s Liquid Staking Vault (LSV) is tailored for non-PoS environments — dApps, appchains, and protocols that do not have validators or built-in staking logic.

Instead, each Vault operates with customisable, off-chain defined parameters, including:

-

Manually set APR or reward pools

-

Lock-up and penalty configurations

-

No reliance on validators or consensus modules

To put it simply:

This shift is essential because not all valuable crypto economies are PoS-based. As DeFi, RWA, and AI-native assets rise, more protocols require a flexible staking solution — that’s exactly what LSV delivers.

What Can LSVs Unlock?

By introducing this new vault architecture, StaFi unlocks new possibilities:

-

Token teams can enable staking utilities with minimal tech lift

-

Protocols can bootstrap community loyalty through time-based incentives

-

Users can earn yield and retain liquidity via cTOKENs (Liquid Staking Tokens)

-

StaFi generates new LSaaS revenue streams, further strengthening the protocol and rewarding $FIS holders

Whether you're an AI-native protocol, DeFi application, or emerging appchain — you can now plug into StaFi’s LSV framework and launch fully-featured, customizable staking vaults.

How It Works

The LSV system includes several key components:

1. Vault Factory (V0)

A permissionless smart contract hub for deploying new staking vaults. It manages:

-

Vault contract deployment using templates

-

Metadata registration (token info, reward structure, rules)

-

Optional Liquid Staking Token (LST) setup (cTOKEN mint/burn)

-

Interface and security compliance

2. Staking Vault (V1)

Each vault holds unique parameters chosen by the token team:

-

Fixed or dynamic APR reward models

-

Unbonding penalties or early-exit fees

-

Optional time-based reward boosts

-

Deposit/withdraw logic and cTOKEN accounting

-

Modular reward engine integration

3. Liquid Staking Token (LST)

If enabled, the vault mints a cTOKEN representing the user’s staked position. These tokens:

-

Are minted 1:1 or via dynamic exchange rates

-

Can be used across DeFi (LP, lending, strategies)

-

Auto-adjust via sync or reward tracking logic

Together, these components create a full-stack staking infrastructure that is secure, customisable, and scalable.

Roadmap

StaFi’s LSV infrastructure is already powering real-world use cases and will soon expand across ecosystems.

SVM Deployment — Live Now

-

ChaosFinance is the first live example of a project built fully on StaFi's LSV stack.

-

Running on the SonicVM (SVM) layer, Chaos allows token teams to deploy LSVs without coding and instantly offer yield and liquidity.

EVM Compatibility— Coming Soon

-

EVM vault factory is already in plan, designed to follow the SVM deployment.

-

Our test partner on EVM will be GimoFinance, a yield protocol within the 0G AI chain.

Move Ecosystem Exploration

- We’re actively researching how to bring the LSV stack to Move-based ecosystems (e.g., Sui, Aptos) and support new modular Layer 1s and appchains.

Conclusion: LSV Is the Future of Modular Staking

StaFi’s Liquid Staking Vaults redefine what it means to stake.

By decoupling staking logic from consensus and placing it at the contract level, we make staking:

-

More accessible to non-PoS projects

-

More flexible for custom economic design

-

More composable for a growing DeFi + AI future

And most importantly, more valuable for users and $FIS holders.

We invite builders, protocols, and DAOs to try the StaFi LSV framework and help us expand LSaaS across the industry.

Let’s build a liquid future — not just for PoS chains, but for the entire crypto stack.

About StaFi

StaFi is a leading Liquid Staking infrastructure provider and protocol for PoS chains. Its Liquid Staking as a Service (LSaaS) framework enables developers to create Liquid Staking Tokens (LSTs) and Liquid Re-staking Tokens (LRTs) across ecosystems like ETH, EVM, BTC, CosmWasm, and SOL. By issuing rTokens (e.g., rETH, rMATIC, rBNB), StaFi unlocks the liquidity of staked assets, allowing users to earn staking rewards while retaining the flexibility to engage in DeFi. With support for major blockchains such as Ethereum, Solana, Polygon, BNB Chain, and Cosmos, StaFi bridges liquidity and security in Proof-of-Stake networks.

Read more about StaFi 2.0.

About LSaaS

LSaaS is a paradigm shift offering developers a robust framework to build their own Liquid Staking Tokens (LSTs) and Liquid Re-staking Tokens (LRTs). Compared to Rollup as a Service(RaaS), RaaS projects, like Altlayer, Dymension and Conduit, are primarily concerned with improving blockchain scalability and efficiency through layer 2 solutions.

For a deeper comparison and analysis, you can check out the full article: Read here.