Curve Finance is an automated market maker DEX much like Uniswap. However, they differ in their offerings, with Curves’ focus being on stablecoins.

Overview

-

What is Curve Finance?

-

How Does Curve Work?

-

The Role of CRV

-

Stablecoin Liquidity Pools

-

Combining Curve and Convex

-

Summary

What is Curve Finance?

Launched in 2020, Curve’s goal was to simplify the trading process by getting rid of the traditional central order book system. Curve quickly rose to the top of the ranks with a TVL of $4.28b, proving there was a market for this type of exchange.

Their popularity is derived from the fact they have incredibly low slippage, almost no impermanent loss risks, and high-yield opportunities on stablecoins. It’s also important to note anyone can earn their native token, CRV, and a portion of the trading fees by depositing into lending pools on the application.

At the time of writing, Curve currently has support for 11 blockchains (TVL included):

-

Ethereum — $3.98b

-

Arbitrum — $88.92m

-

Polygon — $67.08m

-

Optimism — $39.99m

-

Fantom — $25.02m

-

Gnosis — $23.69m

-

Celo — $22.44m

-

Avalanche — $16.67m

-

Kava — $12.5m

-

Moonbeam — $877k

-

Aurora — $17k

How Does Curve Work?

Curve uses the AMM protocol to handle trades, which utilizes algorithms to price assets. Their unique feature is its liquidity pool model that lets you trade between different stablecoins without having to first convert to ETH. This helps to reduce volatility and increase the efficiency of trading. Curve is governed by a group of validators who are responsible for ensuring that the platform operates smoothly and that all trades are executed accurately. It operates on a trustless, transparent, and open-source framework.

Curve also has the ability to create new tokens that are supported by its liquidity pool. This means that other projects can launch their own stablecoins that are linked to assets like the US dollar. If you want to trade one stablecoin for another, the platform will use the pool to find a match for your trade, and the smart contract will carry out the trade automatically.

When first using Curve, you must deposit your stablecoins into the platform’s pool of available funds, the same as you would on other DEXes. Those who do provide liquidity to Curve get CRV tokens as a reward which can then be locked for a set period of time. Doing so will give you veCRV, which acts like a voting token to give you a say in the platform’s governance and changes to its pool parameters. You can also choose to stake your CRV on the platform if you want to earn a share of the trading fees collected by Curve.

The Role of CRV

The value of CRV comes from its role as both the governance and revenue-sharing token of the Curve protocol. Participants are empowered to participate in the governance process by casting votes on proposals for updates and modifications to the platform. This enables CRV holders to have an active say in the direction and development of Curve.

To acquire these CRV tokens. you can buy them on the open market or yield farm. By providing liquidity to a Curve pool, anyone can receive both CRV tokens and interest or fees. For those CRV token holders with a sufficient amount of vote-locked tokens (veCRV), you can propose updates to the Curve protocol. These updates may encompass a range of changes, such as redirecting fees, establishing new liquidity pools, or adjusting yield farming rewards. Additionally, CRV is also used as a trading pair, which provides liquidity for stablecoin trading and helps to maintain stable pricing for these coins.

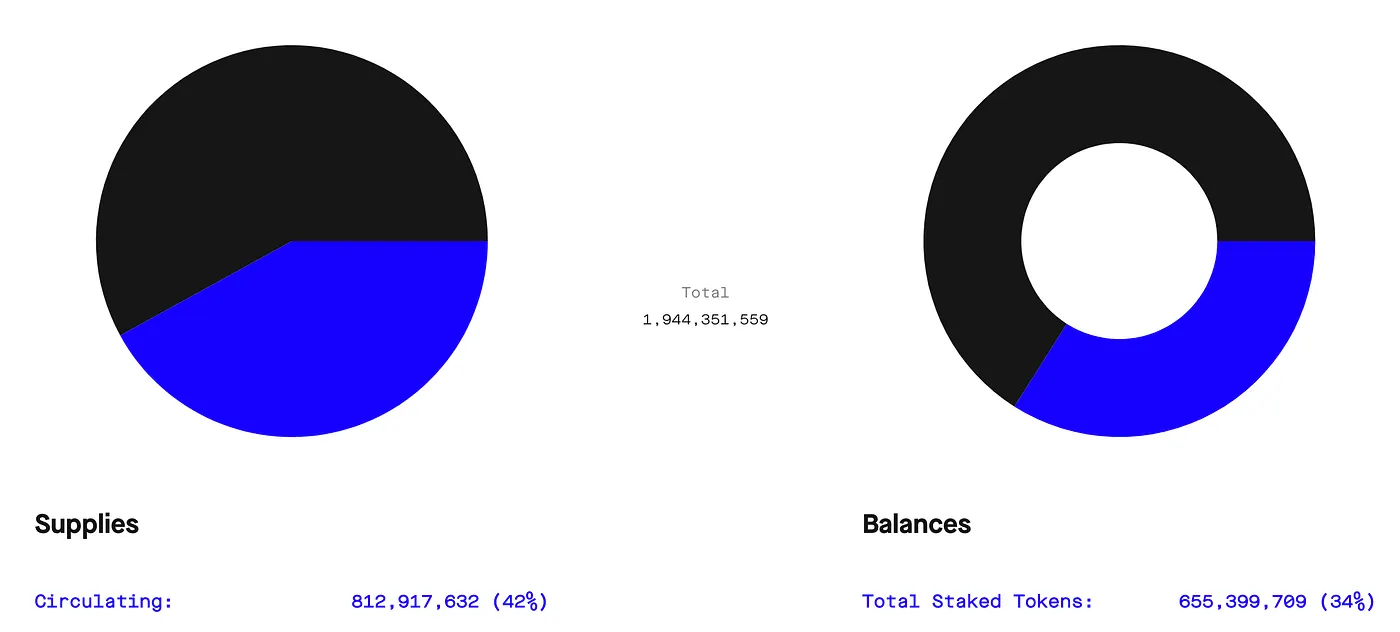

Due to the constant minting of new tokens to incentivize liquidity providers, CRV currently has 1.9 billion of their total 3.3 billion tokens available with 655 million locked up in staking. Curve’s strategy has so far been using inflation to attract user growth, which will no doubt continue far into the future.

Stablecoin Liquidity Pools

Curve’s AMM liquidity pools have fewer price fluctuations due to the limiting of assets which helps keep pricing stable between them. Uniswap and other AMMs on the other hand have more volatility as their pools contain a wider variety of tokens. By reducing the risk of impermanent losses, Curve appeals to liquidity providers who want to earn rewards while balancing the potential risks and rewards of volatility. This also enables you to use your funds invested on Curve to earn rewards from other applications.

Additionally, Curve uses a unique approach to managing assets by grouping those with similar prices together in a 1:1 ratio, rather than maintaining their equal or proportional value. This strategy aims to optimize liquidity in areas where it’s most needed and enables Curve to effectively leverage its liquidity, distinguishing it from other methods.

Combining Curve and Convex

In 2021, Convex launched its yield optimizer to help Curve LPs maximize their CRV earnings. This nifty system lets Curve LPs quickly earn CVX and additional CRV tokens for their yield farming activities. To get the best possible returns, many crypto enthusiasts stake their Curve LP tokens, as well as CRV (cvxCRV) and CVX, to qualify for all the CRV rewards Convex generates and participate in Curve’s governance. There are three main ways users can get involved:

Curve LP Staking through Convex enables you to deposit your Curve LP tokens and earn more rewards. By using its veCRV holdings, Convex helps you maximize your earnings as a Curve LP holder. You’ll not only receive rewards from Curve, but also earn additional rewards in the form of CVX and bonus CRV from Convex. What’s even better is that LPs are entitled to a share of CRV earnings generated by Convex. This means you can earn more rewards just by depositing your Curve LP tokens into Convex.

CVX Staking on Convex means you’re also eligible to receive CVX rewards, which are assessed based on the amount of CRV earned. If you lock in your CVX tokens for at least 16 weeks, you’ll be allocated a share of 5% of all CRV generated by Convex, along with an additional 1% fee on top of the normal staking rewards, and vlCVX (vote-locked CVX) tokens. These vlCVX tokens can be used to vote on platform decisions related to CRV emissions for Curve gauges. By staking your CVX, you can also vote to increase your own CRV rewards allocations, all while earning additional cvxCRV tokens to further boost your returns. This means you can help shape the platform’s future while simultaneously increasing your own earning potential.

CRV (cvxCRV) Staking is the process of converting CRV tokens for cvxCRV at a 1:1 ratio. Keep in mind that this process is irreversible, so make sure you’re certain before confirming. Once you stake your CRV tokens, they are locked into Curve for veCRV. However, you can still enjoy the same benefits as holding veCRV on Curve by staking your newly acquired cvxCRV. That’s not all — in addition to these benefits, you’ll also receive 10% of all CRV generated by Convex and bonus CVX reward emissions.

Summary

Although it may look complicated at first, Curve Finance once conquered provider’s users with a mirage of advantages and opportunities to increase yield farming gains safely, and when combined with Convex can be an unstoppable machine. Curve has rightly earned its place as one of the most prevalent DEXes to date with its composability and stable first approach. Their large list of supported blockchains show they have no plans of slowing down when it comes to providing users with the best options in the space. On top of that, being able to earn CRV tokens and then participate in its governance process is a huge advantage for anyone looking to hang around long-term and make a meaningful impact on its future.