Introduction

September brought a softer market, yet Metronome still reached new highs in TVL, protocol revenue, and token-holder income, helped in part by Odyssey’s continued usage. To meet demand, mint caps for msUSD and msETH were raised ahead of October, so growth can continue if activity accelerates.

This report walks through the changes in MET price and esMET, TVL by chain, protocol revenue and token-holder income, msAsset liquidity and peg quality over the month, liquidity incentives on Aerodrome and Velodrome, and the current treasury allocations.

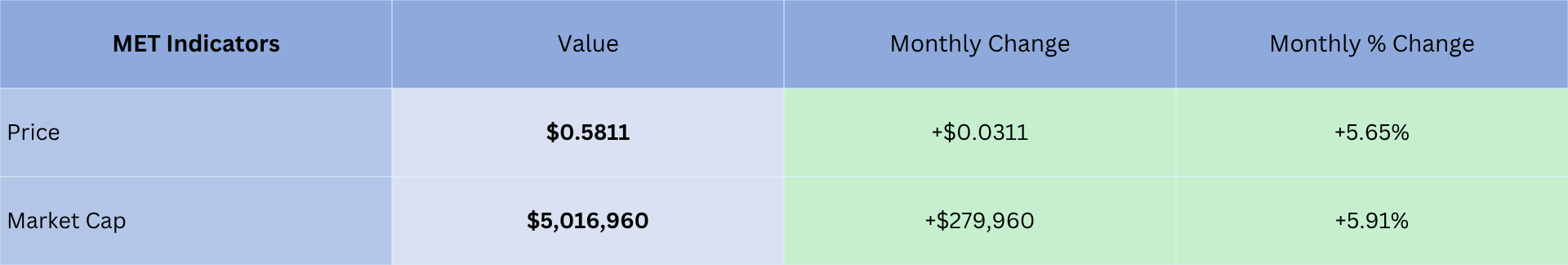

MET Price and esMET

Supported by growth in protocol revenue and TVL, MET finished the month stronger, rising over 5%. This good performance is particularly notable in a month when Ethereum fell about 5% and broader crypto sentiment was bearish.

Locked MET (esMET) slightly increased, from 1.27 million MET tokens at the end of August to 1.29 million at the end of September (around 9% of the total supply).

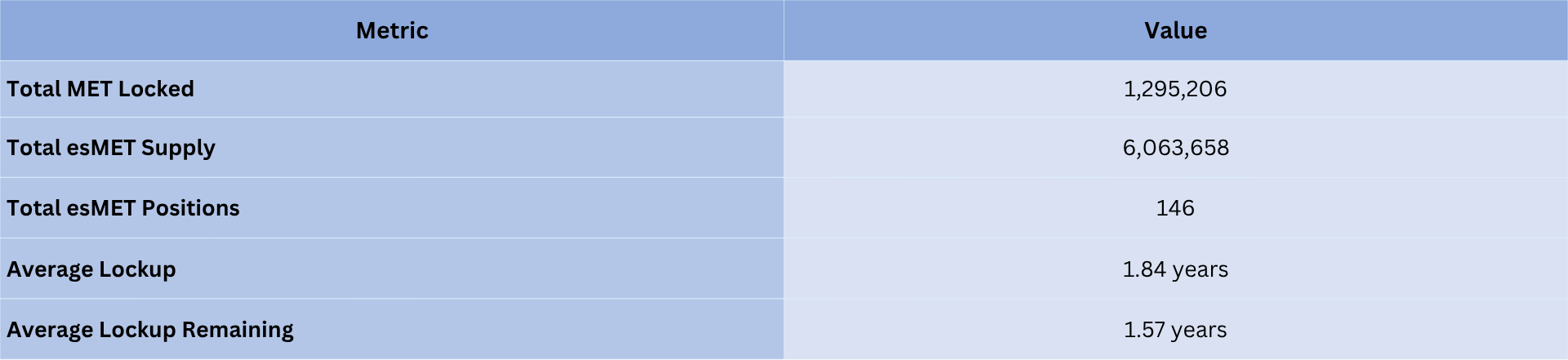

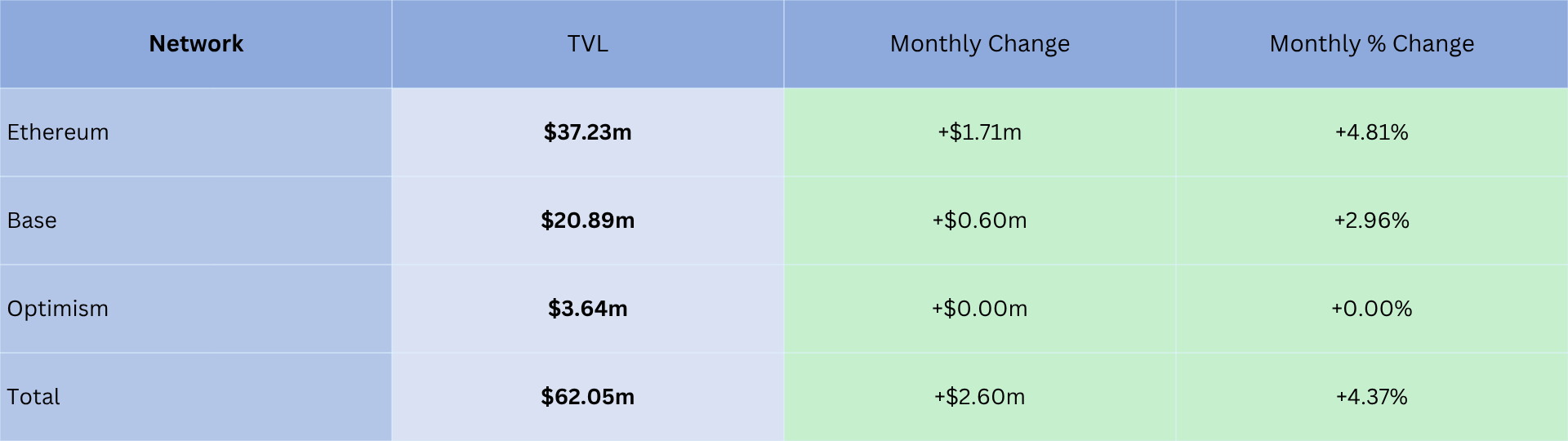

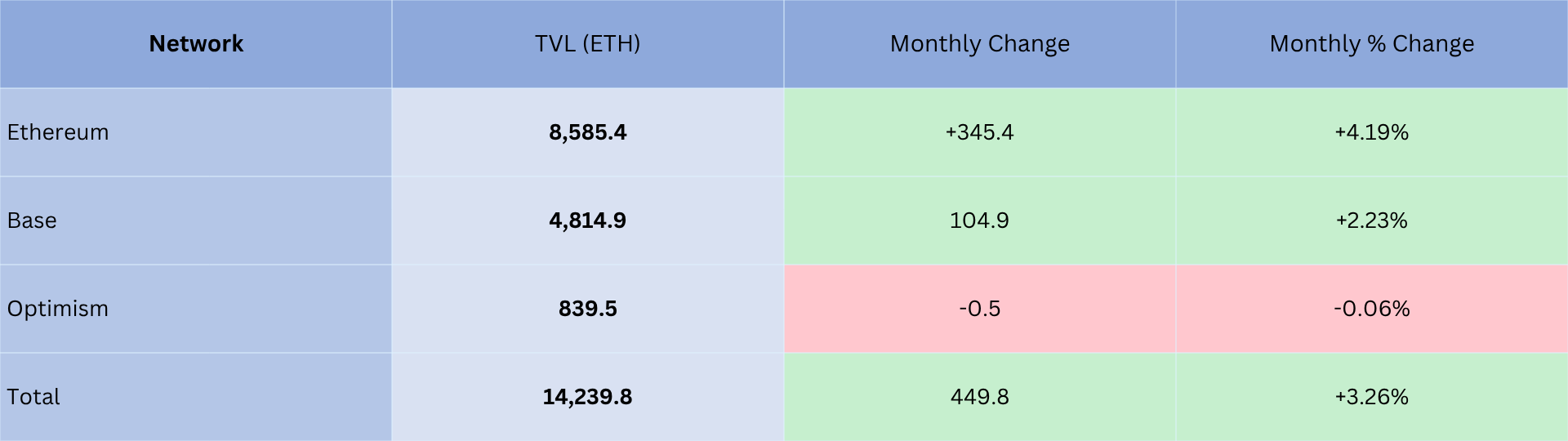

Total TVL (USD)

Protocol TVL advanced to a new high, led by Ethereum mainnet. On Base, TVL also grew, though more modestly, and on Optimism it was essentially flat. With TVL at these high levels, protocol revenue should continue to rise, strengthening Metronome’s treasury and its capacity to fund liquidity provision and MET buybacks.

Because ETH was roughly flat in September, Metronome’s TVL looks similar when expressed in ETH. Small differences reflect the precise pricing timestamps used for the snapshots.

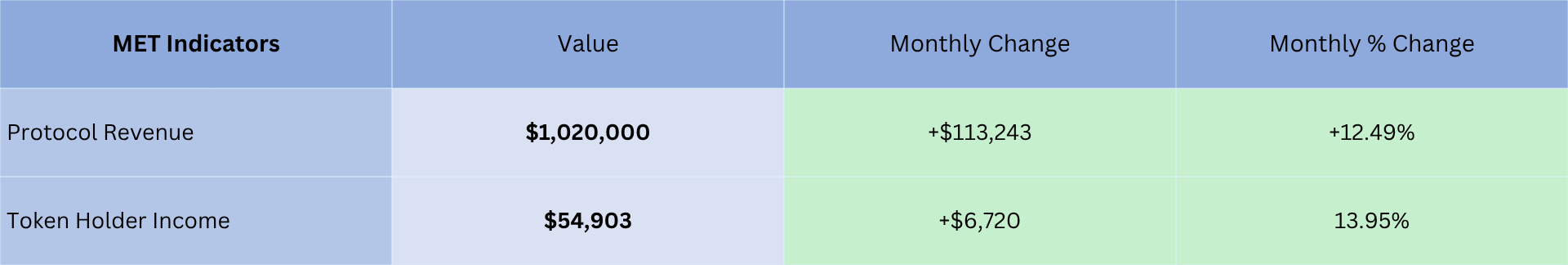

Protocol Revenue & Token-holder Income

Protocol revenue increased substantially month over month, with token-holder income (buy and stream to esMET) rising at a similar pace. Although more protocol fees were collected in September, the main source of revenue growth were rewards from the interest accrued from AMO markets (Morpho), which was about $275k, and around $100k of regular LP rewards (CRV, AERO, VELO, KITE, OETH).

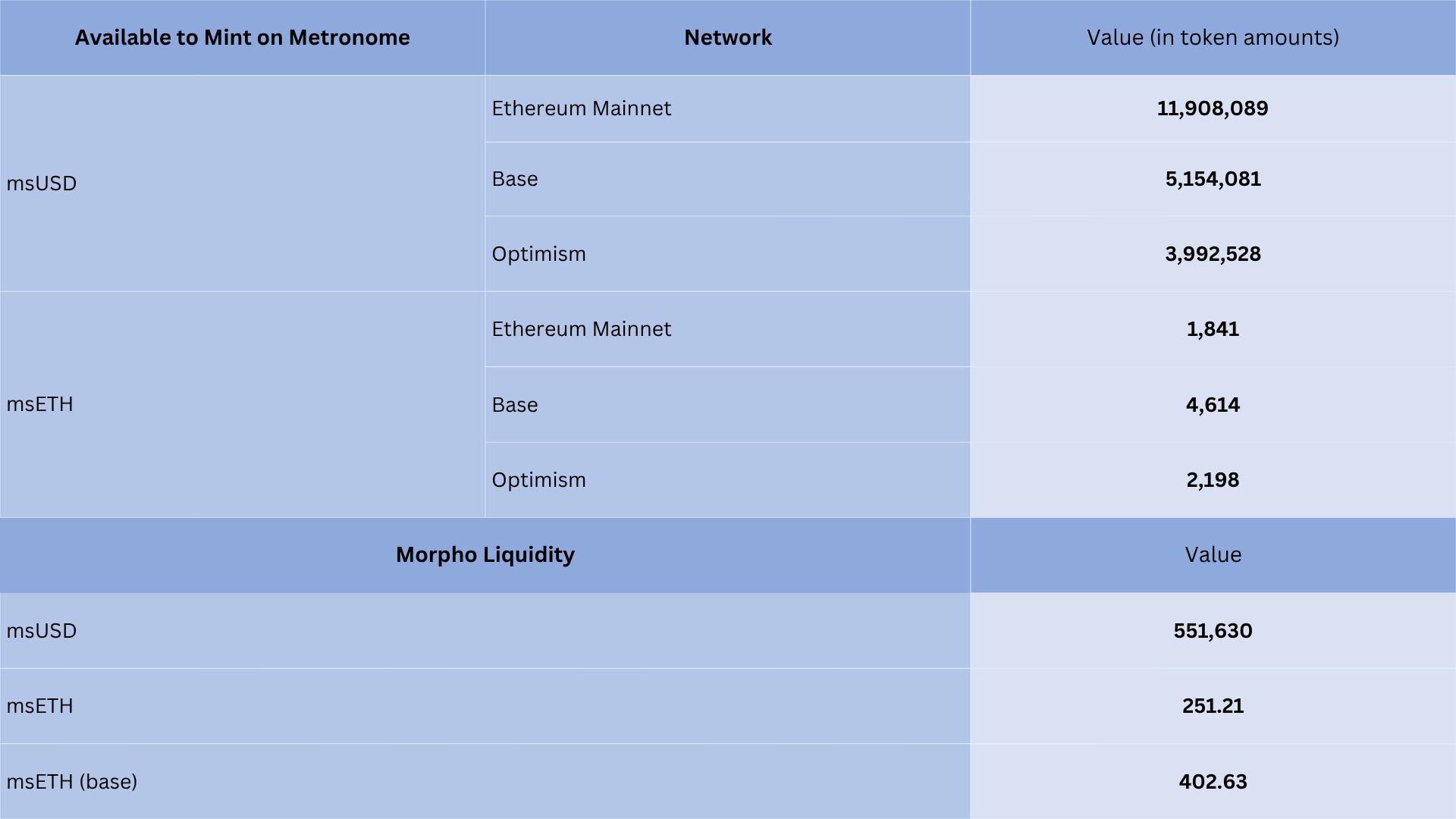

Mint Headroom & Morpho Liquidity

Mint caps for msUSD and msETH were significantly increased in September. With this, Metronome is ready to accommodate additional growth in October as new Odyssey strategies roll out and other market opportunities open up. Morpho liquidity remained tight. Strong demand for msAssets from Odyssey kept utilization on Morpho pools near the 90% target for most of the month.

Peg Quality

Both assets stayed close to target for most of the month. msETH was tighter on Base, spending almost the entire window inside the 50-bp band. On Ethereum, the Curve msETH pair hovered a touch below 1.0 on average but still sat inside 50 bps nearly all the time. For msUSD, the Ethereum Curve pool was the firmest of the three. The two Base pools were generally close to target, although they showed a few deeper downside wicks, which is why the worst-drawdown figures are larger there.

MET Incentives

Aerodrome (Base) and Velodrome (Optimism) supported msETH and msUSD liquidity through native emissions to staked LPs. In addition, Metronome paid USDC vote incentives to veAERO and veVELO holders so a larger share of weekly emissions flowed to the msETH and msUSD pools. The table shows native emissions in AERO or VELO and the USDC amounts paid as voter incentives.

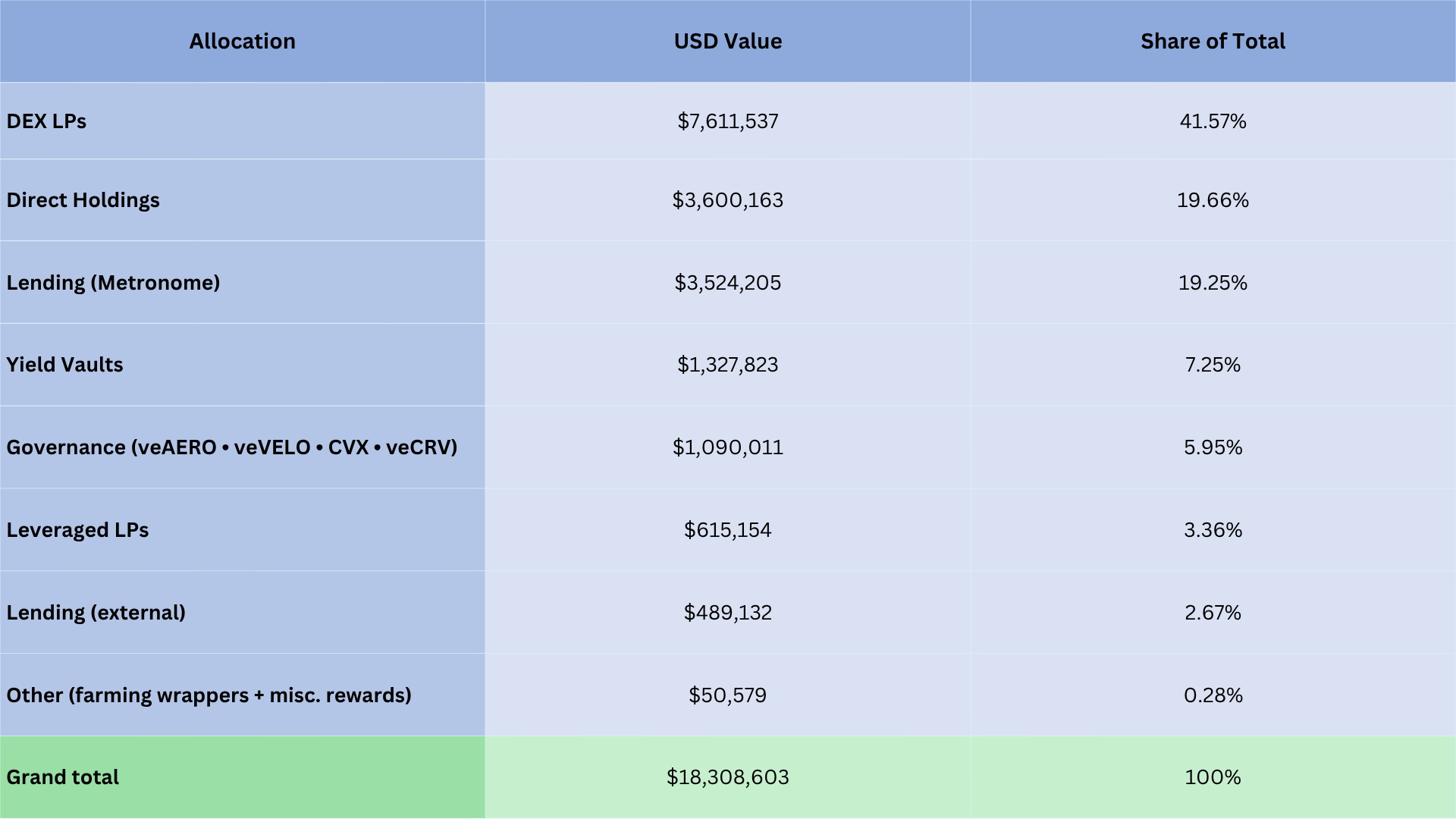

Treasury Allocations

Metronome maintains a sizable, protocol-owned treasury that supplies liquidity for msAssets and earns yield. This capital provides trading depth and generates a steady revenue stream to fund ongoing incentives, MET buybacks, and other initiatives approved by governance.By far the largest allocation is liquidity positions on the venues that matter most for msAssets and MET. These include pools on Aerodrome and Velodrome, plus concentrated-range positions on Uniswap and several pairs on Curve, Sushi, and Lithos. Together, these pools handle most trading in msETH, msUSD, and MET.

The treasury also maintains direct holdings in its wallets. About seventy percent of this sleeve is held in MET, with smaller balances in msETH, WETH, USDC, and others. These balances provide price exposure to MET and, secondarily, to ETH.

Another important allocation is lending on Metronome Markets. The treasury supplies WETH, wstETH, and at times USDC or OP as collateral, and borrows msAssets such as msETH and msUSD. The borrowed assets are then paired with WETH or stablecoins in liquidity pools. This approach expands liquidity in key msAsset pools on Ethereum mainnet, Base, and Optimism.

Further down the stack are positions in yield vaults. These are token deposits, such as msETH, wstETH, OETH, or WETH, in vaults that automatically claim and reinvest rewards. The treasury also holds a few deposit-only positions on lending platforms, where tokens are lent to earn interest without borrowing or LP exposure.

The governance block consists of locked protocol tokens such as AERO, VELO, and CVX that confer voting power. Voting directs emissions toward targeted liquidity pools and helps attract outside liquidity. The locks also earn voter rewards: primarily vote incentives and, on some venues, a small share of protocol fees.

Finally, a small allocation sits in third-party lending markets. Examples include HAI on Optimism and Ionic on Ethereum. Everything else in the table falls under Other. This covers small farming wrappers, claimable rewards, and the occasional dust balance. These items are included for completeness and are not material drivers of the overall profile compared with the core allocations above.

Key Takeaways

Despite the weak crypto markets, September was a good month for Metronome. TVL set a new high while protocol revenue greatly accelerated, helped by a strong round of rewards captured by the treasury. MET held up well in a soft market, and the esMET balance inched higher.

msETH and msUSD traded with tight spreads for most of the month, with a few deeper msUSD wicks. Liquidity remained the core allocation in the treasury, supported by lending on Metronome Markets, a small set of yield vaults, and governance locks that help direct emissions to key pools.