Explore these cutting-edge, high-risk, high-reward strategies to earn yield and create a self-sustaining asset environment.

Overview:

-

Leverage Yield Farming

-

Looping Collateral with Synthetics

-

Crop Rotation

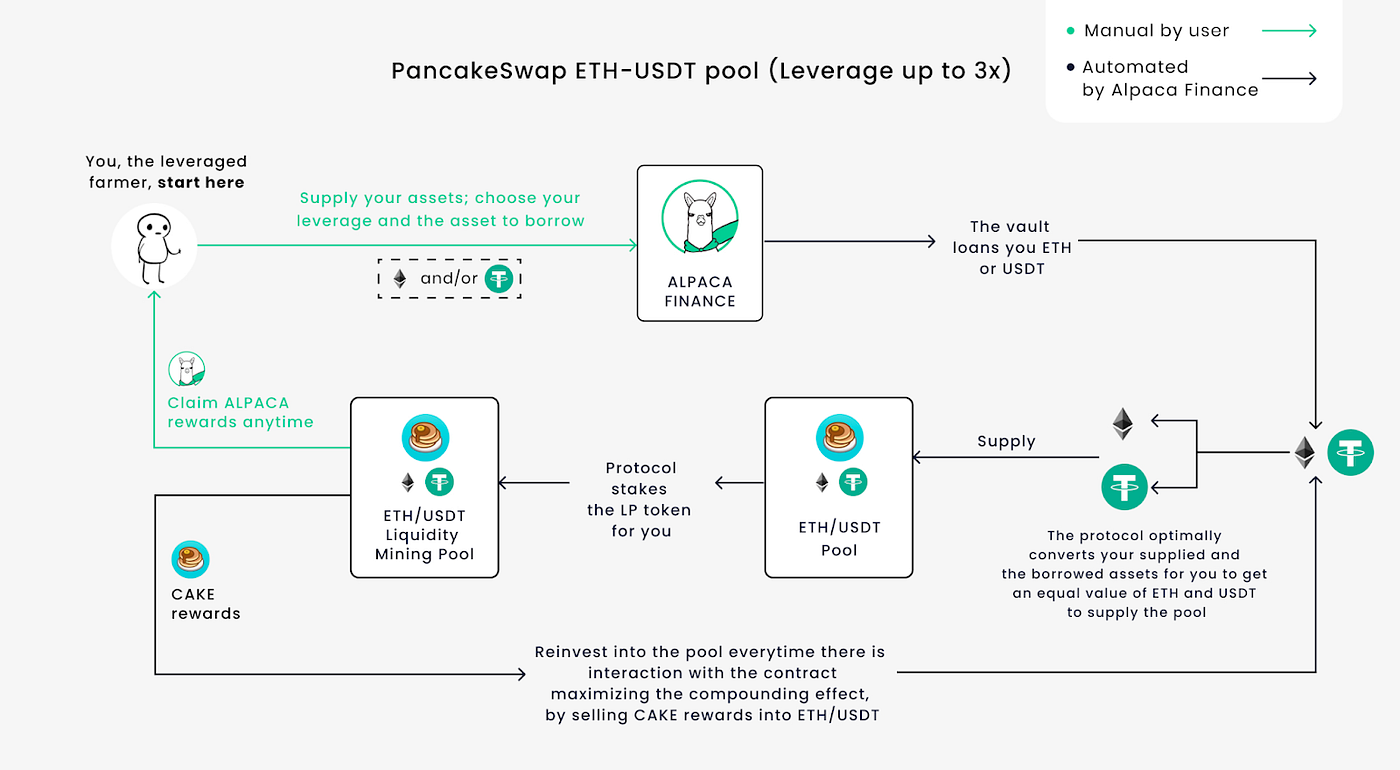

Leverage Yield Farming

Leverage Yield Farming is a widespread technique where users borrow additional liquidity in order to farm more yield. In doing so, users have the potential to increase their returns quite significantly, but it comes at the cost of a much higher risk of liquidation.

As leveraged yield farming is under-collateralized, the borrowing fees are relatively high (5–15% on average). However, if the strategy is correctly assessed, you can take home much bigger profits to offset these fees.

Unfortunately, it is almost impossible to predict what returns you can get due to the volatile nature of the space. Therefore, depending on your specific outlook and risk tolerance, the advantages of additional yield may outweigh the volatility. These include:

-

For advanced DeFi enthusiasts, the ability to long and short positions by deploying directional strategies

-

Additional incentives such as native airdrops or lockup programs from the platform utilized

-

As mentioned above, the opportunity to receive much higher returns versus a traditional borrow-lend strategy

-

A rise in the number of automated farming positions resulting in compounding rewards

Leverage Yield Farming sounds great, right? But there are always going to be risks when borrowing assets.

Liquidation bots or other users keep track of leveraged positions in order to capitalize on situations where collateral is insufficient and liquidate them for profit. Depending on the size of your position, this could be catastrophic. However, most applications allow for open positions to be customized and more collateral to be deposited.

Impermanent loss can also be crucial in reducing profits or incurring costs due to the automatic rebalancing of liquidity pools. However, as liquidity pools must be kept at an even ratio at all times, impermanent loss can vary based on how volatile the token is. IL can be further reduced by leveraging stable tokens or with delta-neutral strategies.

Looping Collateral with Synthetics

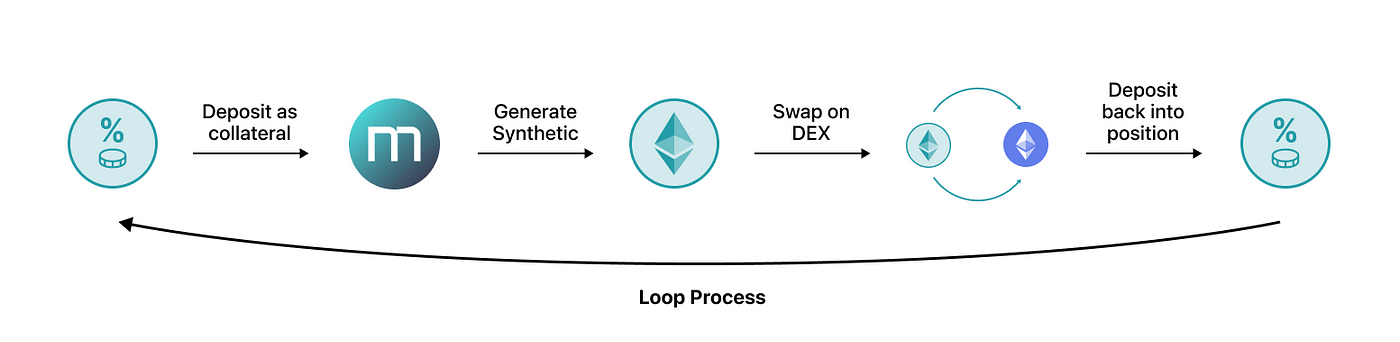

Combining strategies is a common theme in DeFi with enthusiasts doing everything they can to maximize profits. Whether you’re bullish or bearish, diving into synthetic assets can be a highly profitable way to optimize your capital efficiency. The process may seem intimidating at first, but once understood can create opportunities like no other.

When you deposit assets into yield-earning pools like Vesper Grow Pools, you gain a distinct advantage as you are issued pool share tokens that reflect your position’s weight. These can be utilized further and deployed to synthetic protocols to maximize their potential and increase exposure. Generating synthetics to swap on the open market can be put back into the original position to increase APY potential.

Taking advantage of this looping mechanism maximizes capital efficiency as your yield doesn’t have to end with a single deposit into a pool. For example, Metronome Synth can increase APY potential by utilizing Vesper Grow Pools as collateral; here you can see how to implement these strategies:

-

The yield-bearing position is deposited as collateral, and the synth of choice is generated

-

The synth is then swapped on a DEX for the originally deposited asset

-

The asset is then deposited into the original yield-farming pool, receiving more of the yield-bearing asset

-

Loop until satisfied — the final effect is a long position on the underlying deposited token

Monitoring Health Factor is a must when dealing with synthetic assets. The liquidation risk can be high depending on how much you loop your collateral and what assets are deposited. This is because the more synthetics that are generated, the higher risk for the collateral value to drop below the value of minted synthetic assets. To address this issue, additional collateral must be added to lower the synth to collateral ratio (borrow limit) and potentially decrease the number of minted synthetic assets.

Oracle de-pegging, although less common, can be a real threat. Disruptions and hacks to the oracle could cause inaccurate price feeds and unwarranted liquidations. It’s best to stick to protocols that utilize leaders in the space, such as Chainlink, to help avoid these issues.

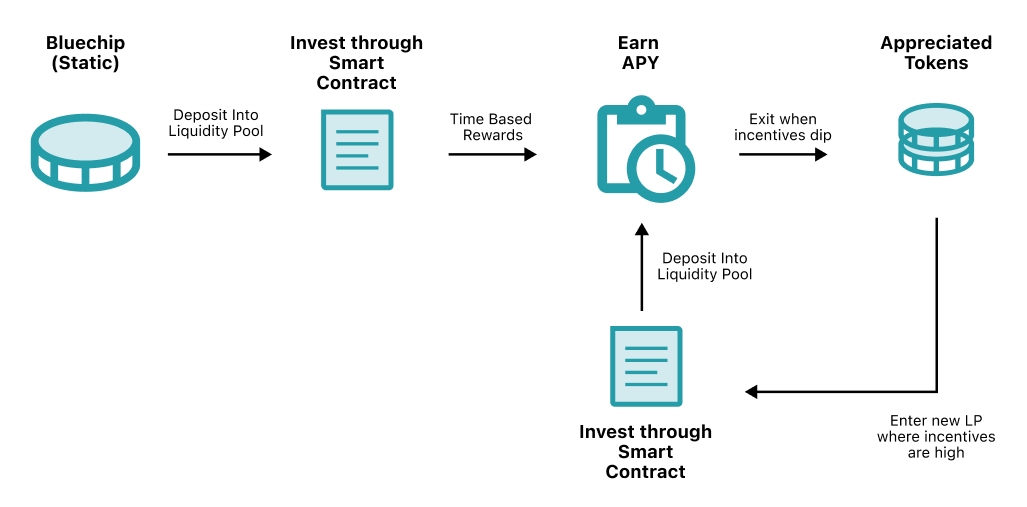

Crop Rotation

The idea behind crop rotation is similar to how applications such as Vesper work. However, some DeFi users prefer doing the process manually instead of aggregators doing the work for them. This involves constantly monitoring the space and swapping tokens around to provide liquidity in pools that offer better rewards. Essentially, you will always be chasing the best returns and rewards, rotating or “crop swapping” as often as required to realize their potential.

It can be a highly profitable strategy but requires a lot of time and effort; therefore, it is not for everyone. Some users create bots and alerts to inform them when they should be rotating. However, you will still need to physically execute the trades to move in and out of pools. If you don’t want to pay the yield aggregator fees and have the time, this is considered a reasonable method to gain a high yield.

Summary

In short, DeFi can offer many strategies to earn yield, such as leverage yield farming, looping collateral, and crop rotation. There are many applications out there to help ease you into optimizing yields, such as Vesper Finance which handles the heavy lifting, and Metronome Synth to generate synthetic assets, increasing potential APY. Some may be riskier than others, but without high risk, you cannot expect to reap the benefits of high rewards. It is up to you to determine whether that is worth it.

Community

Follow our Twitter for updates and join the Telegram or Discord channels to engage with other DeFi evangelists and get started with Metronome.