Crypto has long been a speculation-based game with actual utility far and few between. Is the tokenization of real-world assets the answer to mainstream adoption?

Overview

-

What are Tokenized RWAs?

-

The Advantages of Tokenizing RWAs

-

Stablecoins

What are Tokenized RWAs?

Over the years, the popularity of DeFi has continued to grow, resulting in the emergence of new on-chain assets that cater to a wider audience and enhance the utility of blockchain technology. These new assets are essentially tokenized derivatives of traditional financial assets, including commodities such as gold, and different currencies, such as the US Dollar.

Synthetic assets enable the tokenization of virtually any off-chain asset that can be connected to a live pricing feed. This is made possible by leveraging an oracle, a tool that brings off-chain data onto the blockchain. As long as the security of the data is maintained, the accuracy of asset prices can be ensured. These derivatives are becoming increasingly more desirable because they enable investors to adapt to market conditions quickly and effectively without the need for a third-party intermediary, such as a centralized exchange. This ensures that traders have the option to maintain their anonymity if they so choose, while also providing a secure environment for their transactions, thanks to distributed ledgers.

Additionally, when discussing real-world assets (RWAs) in the context of blockchain and cryptocurrency, there are two methods for tokenizing them. The first involves creating non-native tokens, which are produced on-chain but have their underlying assets managed off-chain by a custodian. Non-native tokens are the most common type of token for RWAs because it’s easier to use existing financial systems to manage assets. For example, most stablecoins that are backed by US Dollars use this method to create their tokens. This allows the stablecoin to maintain a 1-to-1 peg with the US dollar, while the actual dollars are held in reserve by a trusted custodian. The second way is through native tokens, where the token represents the RWA, and there is no need for an off-chain asset to back it up.

So knowing this, it poses the question, are tokenized assets the propeller to push crypto mainstream?

The Advantages of Tokenizing RWAs

Conventional finance has long been criticized for its inefficiency, and the absence of interoperability has limited opportunities for users, causing them to explore alternative options. Tokenizing real-world assets resolves these issues and offers several advantages over traditional finance, such as:

Transparency: As all transactions are meticulously recorded on a transparent and publicly accessible ledger, anyone can scrutinize the transaction history and confirm the legitimacy of assets being traded at any time. The inherent transparency of the system enables potential investors to conduct thorough due diligence and assess the risk factors associated with their investments.

Liquidity: Gone are the days when markets like real estate were illiquid and out of reach for many. Thanks to synthetic protocols, these markets have undergone a transformation, becoming more accessible and within reach of a wider audience.

Frictionless Movement: By participating, traders can seamlessly switch between different equity options, such as synthetic gold, without the need to own the physical underlying asset. This feature enables greater flexibility and efficiency in trading, eliminating the need for the time-consuming processes involved in the physical ownership of assets.

Anonymity: Opting to trade synthetic RWAs means individuals who prioritize anonymity can find peace of mind in the added privacy this option provides. As many protocols operate in a non-custodial, trustless, and permissionless manner, individuals can engage in trading activities without relying on third-party intermediaries.

Stablecoins

Stablecoins are one of the most popular types of tokenized derivatives. They are assets designed to maintain a fixed price that is tied to a particular currency or commodity. The first and most well-known of these is Tether, often referred to as USDT. Originally introduced on the Bitcoin blockchain as a way for CEXes to bring in banking partners, Tether’s success led to increased market liquidity and greater accessibility to cryptocurrency. However, once Ethereum was launched in 2015, it quickly became the superior chain, prompting Tether to make the switch in 2019 because of its continued success.

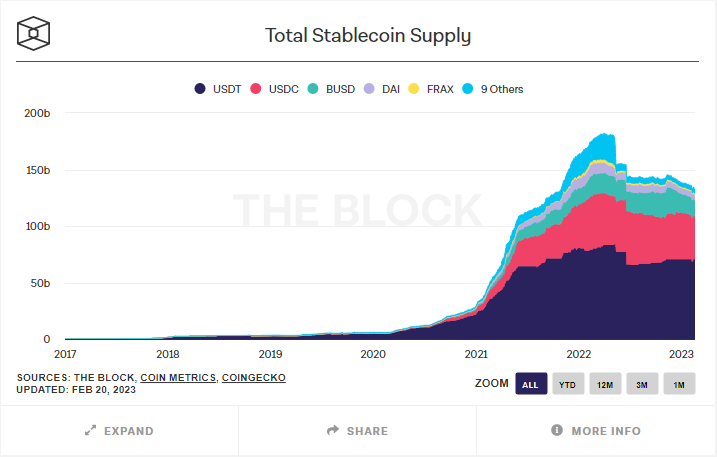

Since then, the total supply of stablecoins has surged dramatically, reaching over $133 billion as of 2023. This represents a substantial increase from the $5.84 billion that was available at the beginning of 2020.

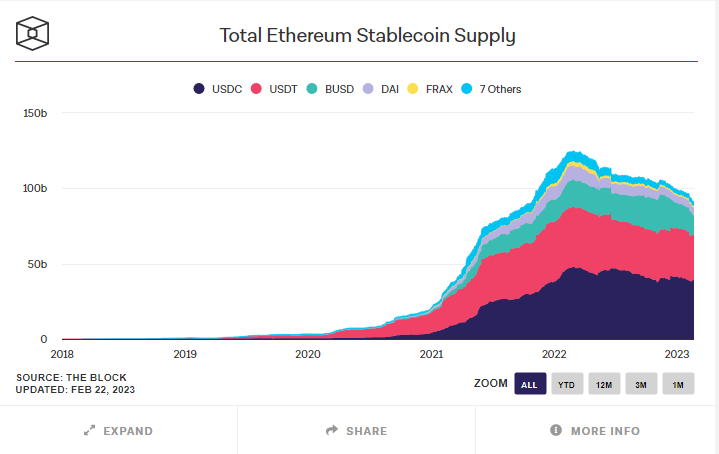

Most stablecoins offer a digital version of the US Dollar that can be much easier to obtain and use globally. Unlike traditional dollars, these stablecoins don’t need constant investment or speculation to keep their value stable. They can be redeemed directly and are fully backed by USD, so their supply can be adjusted as needed to meet market demands. Consequently, the launch of Ethereum, which has dominated the market due to its efficiency in tokenizing and managing assets, has played a key role in the success of stablecoins. In fact, $91 billion of the current stablecoin market supply has been issued on the Ethereum blockchain.

As you can see from the images above, stablecoins gained significant traction during the DeFi boom, thanks to their increased utilization in on-chain applications such as lending platforms and yield farming activities. While this yield is often generated through crypto leverage traders and rewards, the integration of stablecoins has significantly expanded the value proposition of DeFi. This is especially noteworthy with the introduction of applications such as Curve offering yield through liquidity pools made of similarly behaving assets like stablecoins.

And, although there have been attempts to create decentralized stablecoins, they have proven to be challenging. For example, the undercollateralized algorithmic stablecoin TerraUSD collapsed, highlighting the difficulties of deviating from the traditional USD collateralized stablecoin model. Despite these challenges, stablecoins have gained traction within DeFi, indicating a growing interest in tokenized RWAs. This trend may even signal the beginning of a larger shift towards RWAs in DeFi.

Summary

In summary, the emergence of tokenized derivatives has brought many advantages to the financial world. The use of synthetic assets enables the tokenization of traditional financial assets, while stablecoins offer a digital version of traditional currencies and commodities that is easier to obtain and use globally. These tokenized assets offer transparency, liquidity, frictionless movement, and anonymity. Furthermore, with the increasing popularity of DeFi, tokenized assets and stablecoins have gained significant traction in the market, providing greater accessibility to a wider range of participants. The trend towards tokenized real-world assets may even signal a larger shift towards RWAs in DeFi, leading to a potential push for mainstream adoption of cryptocurrencies. Keep an eye on this space.