Here are 8 key questions to quickly familiarize yourself with what we build:

1. What is SODA?

SODA is a no-code builder for Tokenized Telegram Mini-Apps Games (TTMAG). With SODA you can launch your own game and a token in less than a minute!

2. TL;DR: Can you pitch it to me in 5 min?

Sure, here you go:

3. What is a Tokenized Telegram Mini-App Game?

A tokenized Telegram Mini-App game is a game with a token that can be instantly traded on a bonding curve or farmed by playing a game.

4. What kind of games can I launch?

Currently, SODA supports tap-idle games. New game types will be added by the core team first (e.g. infinite craft).

Next, an SDK will be released that would allow anyone to add new games.

Finally, our ultimate goal: AI code-gen game builder for any game a user might want!

5. How does trading work?

Users can buy and sell tokens on a bonding curve anytime. When somebody buys the token, the price goes up, when somebody sells the token the price goes down.

6. How does token farming work?

Playing the game grants your experience points XP. The more experience points you farm, the larger

7. How are tokens allocated between trading and farming?

Each token has 1 billion total supply:

-

700 million tokens are available for sale on a bonding curve

-

100 million tokens are reserved for the airdrop

-

200 million tokens are reserved for the liquidity

Token needs to raise 300 SOL (~70k USD) to be listed on Raydium DEX on Solana. The initial market cap of the token is 350k USD. The airdrop event is triggered when the market cap reaches 700k USD. A user is airdropped the amount of tokens proportional to the amount of XP they farmed.

8. How do token trading and farming contribute to the token’s liquidity?

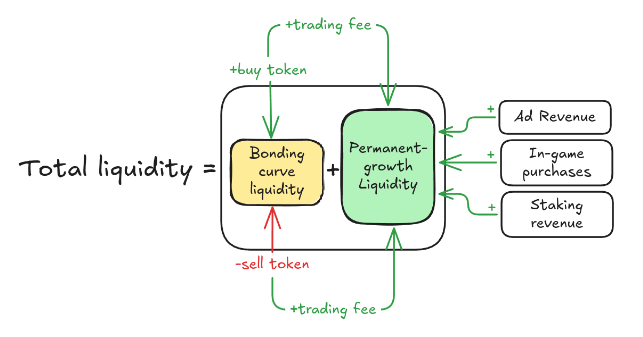

Token’s liquidity is the sum of the liquidity in two pools:

-

Bonding curve pool

-

Permanent-growth pool

Buying and selling tokens increases and decreases the amount of liquidity in the Bonding curve pool. Prices of tokens determined solely based on Bonding curve pool’s liquidity. Trading can happen only against the liquidity Bonding curve pool. Each trade, whether it’s a buy or sell, has a trading fee that goes to the Permanent-growth pool.

As the name suggests, the Permanent-growth pool is a pool holding liquidity that can never be decreased. This pool accumulates trading fees and all revenue generated by the game, including ads, microtransactions, staking, sponsored quests, etc.

Permanent-growth pool is a unique distinguishing feature of SODA. Unlike PumpFun and its clones, SODA keeps already accumulated PvE token liquidity untouched by PvP trades. In other words, players can never become “exit liquidity” for traders. In other words, one cannot sell tokens against the liquidity gathered through in-game purchases or any other fees.

A token is listed on a Radyum DEX when the combined Bonding curve liquidity and Permanent growth liquidity reach the threshold of 300 SOL.

Any unsold tokens allocated to the bonding curve are burned when a token graduates to the Radyum DEX.

We promised to be real quick!

… and that’s it! We’ve highlighted the main things that makes SODA unique. SODA is simple, elegant and efficient!

Stay tuned for details on our unique tokenomics!

Our socials: MINI-APP │ X │ Telegram │ Telegram-CIS │ Chat │ Chat-CIS